Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Tower Group International, Ltd. | d491391d8k.htm |

1.

Presentation

Exhibit 99.1 |

1

Forward-Looking Statements

This document contains certain forward-looking information about Tower

Group, Inc. (“Tower”) and Canopius Holdings Bermuda Limited

(“Canopius Bermuda”), which will be renamed Tower Group International, Ltd. (“Tower Ltd.”) following the merger transaction

described herein . Forward-looking information about Tower or Tower Ltd. is

intended to be covered by the safe harbor for “forward- looking

statements” provided by the Private Securities Litigation Reform Act

of 1995. Forward-looking statements may be made directly in this

document and may include statements for the period after the completion of the merger. Representatives of Tower

and Canopius Bermuda may also make forward-looking statements.

Forward-looking statements are statements that are not

historical

facts.

Words

such

as

“expect,”

“believe,”

“will,”

“may,”

“anticipate,”

“plan,”

“estimate,”

“intend,”

“should,”

“can,”

“likely,”

“could”

and similar expressions are intended to identify forward-looking

statements. These statements include statements about the expected

benefits

of

the

merger,

pro

forma

financial

information

and

financial

information

for

future

periods,

the

expected

ownership of Tower Ltd., information about the combined company’s

objectives, plans and expectations, the likelihood of satisfaction of

certain conditions to the completion of the merger and whether and when the merger will be completed. Forward-

looking statements are not guarantees of performance. These statements are

based upon the current beliefs and expectations of the management of

Tower and / or Canopius Bermuda, as applicable, and are subject to risks and uncertainties that could cause

actual results to differ materially from those expressed in, or implied or

projected by, the forward-looking information and statements. For a

more complete discussion of the risks and uncertainties relating to Tower, the merger and this private placement,

investors are urged to read the information under the caption and in

Tower’s Annual Report on Form 10-K to be filed after the date

hereof.

In

light

of

these

risks,

uncertainties,

assumptions

and

factors,

the

results

anticipated

by

the

forward-looking

statements

discussed

in

this document or made by representatives of Tower or Canopius Bermuda may not

occur. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof or, in the case of statements made by

representatives of Tower or Canopius Bermuda, on the date those statements are

made. All subsequent written and oral forward- looking

statements

concerning

the

merger

or

the

combined

company

or

other

matters

addressed

in

this

document

and

attributable

to Tower or Canopius Bermuda or any person acting on their behalf are expressly

qualified in their entirety by the cautionary statements contained or

referred to in this section. Except to the extent required by applicable law or regulation, neither Tower nor

Canopius Bermuda undertakes any obligation to update or publish revised

forward-looking statements to reflect events or circumstances after

the date hereof or the date of the forward-looking statements or to reflect the occurrence of unanticipated

events.

Notes on Non-GAAP Financial Measures

(1)

(2)

Operating income excludes realized gains and losses, acquisition-related

transaction costs and the results of the reciprocal business, net of

tax. Operating income is a common measurement for property and casualty insurance companies. We

believe this presentation enhances the understanding of our results of

operations by highlighting the underlying profitability of our

insurance business. Additionally, these measures are a key internal management performance standard. Operating

earnings per share is operating income divided by diluted weighted average

shares outstanding. Operating return on equity is annualized operating

income divided by average common stockholders' equity.

Gross premiums written and managed include gross premiums written through

Tower’s insurance subsidiaries and produced as managing general

agent on behalf of other insurance companies, including the reciprocal business. |

2

High Level Pro Forma Corporate Chart

Tower Group

Delaware Holding Company

*CP Re used solely to reinsure US Pool

Tower

Stockholders

100%

US Pool*

Castle Point Re*

(“CP Re”)

CURRENT STRUCTURE

New

Shareholders

Tower

Shareholders

Tower Ltd.

Bermuda Holding Company

Bermuda Operations

and CP Re business

Tower and its

Subsidiaries

U.S. Operations

EXPECTED POST MERGER STRUCTURE |

3

Investment Highlights

Tower’s demonstrated track record of growth and profitability

•

169% total return since IPO in 2004

•

•

Strong operating performance (19.9% ROE) from 2005 to 2008

•

Began deploying capital from CastlePoint acquisition in 2009

•

Implemented

five

year

plan

(2010

to

2014)

to

build

a

diversified

international

specialty

insurance

company

•

Gain access to Bermuda platform to provide efficient source of capital

•

Final key step to completing five year plan (2010 to 2014)

Attractive entry point for new investors

•

0.78x P/B and 1.2x P/TB, based on 2012 year end book value

•

3.8%

dividend

yield

vs.

1.2%

yield

of

the

SNL

U.S.

Insurance

P&C

Index

Significant insider ownership

•

$89 MM (approximately 9% pro forma ownership)

Source: SNL Financial. Market data as of February 22, 2013;

*Excludes catastrophic storm losses and reserve development

Since 2010, Tower’s core domestic franchise has generated a stable 10%

- 12% ROE* (15% - 17%

ROTE)*

Canopius transaction expected in 2014 to result in 13% - 15% Pro Forma

ROE

(forecasted 18% - 20% ROTE)

Outperformed S&P 500 by 2.6x and SNL U.S. Insurance P&C Index by

1.6x |

4

Overview of Tower

Diversified international specialty P&C insurance company

•

Rated “A-”

by A.M. Best

•

Top 50 P&C insurance company

•

20 offices nationwide with over 1,400 employees

Diversified product offering in U.S.

•

Commercial General: 34%*

»

Comprehensive product offering to small business owners

•

Commercial Specialty: 28%*

»

Narrowly focused specialty insurance and reinsurance products

•

Personal Lines: 38%*

»

Home and auto

Canopius transaction enables further growth in international markets

•

Expands existing relationships with Lloyd’s syndicates

•

Bermuda platform provides capital to support Tower and third parties

* Percentage of total premium for the year ended 12/31/12

|

5

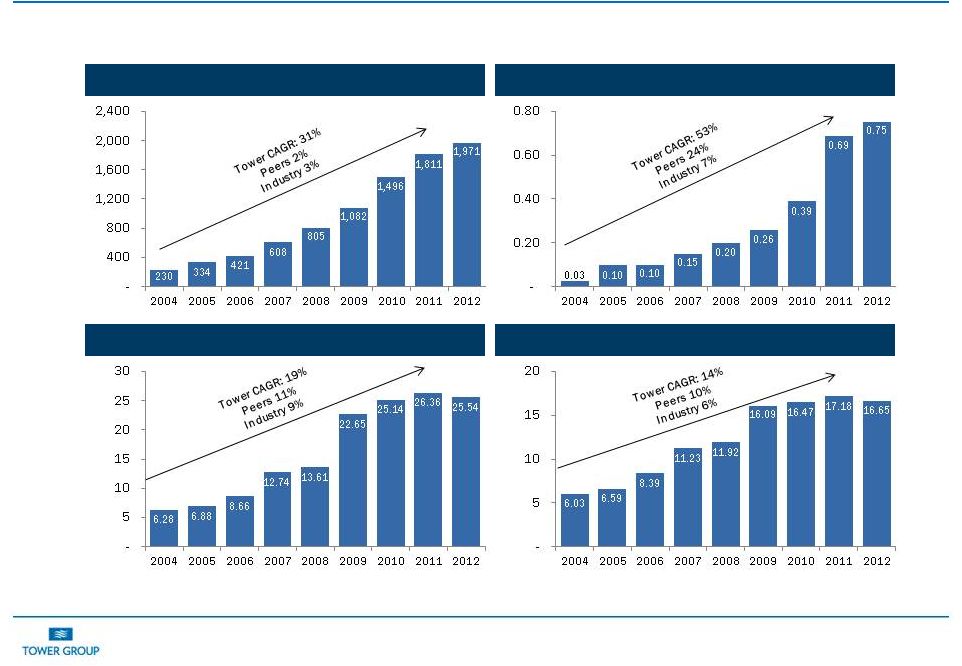

Strong and Consistent Track Record of Profitable Growth

Source: SNL Financial. Industry data based upon SNL U.S. Insurance P&C

Index. Component companies and weighting based on SNL U.S. Insurance P&C Index as of 2/22/2013. CAGR TWGP period

through 12/31/12, industry CAGR through 12/31/11

Book Value per Share

Tangible Book Value per Share

Gross Written Premiums ($MM)

Dividends Per Share

Peers consist of AFG, AFSI, HCC, MKL, NAVG, RLI, SIGI, THG, UFCS, WRB.

|

6

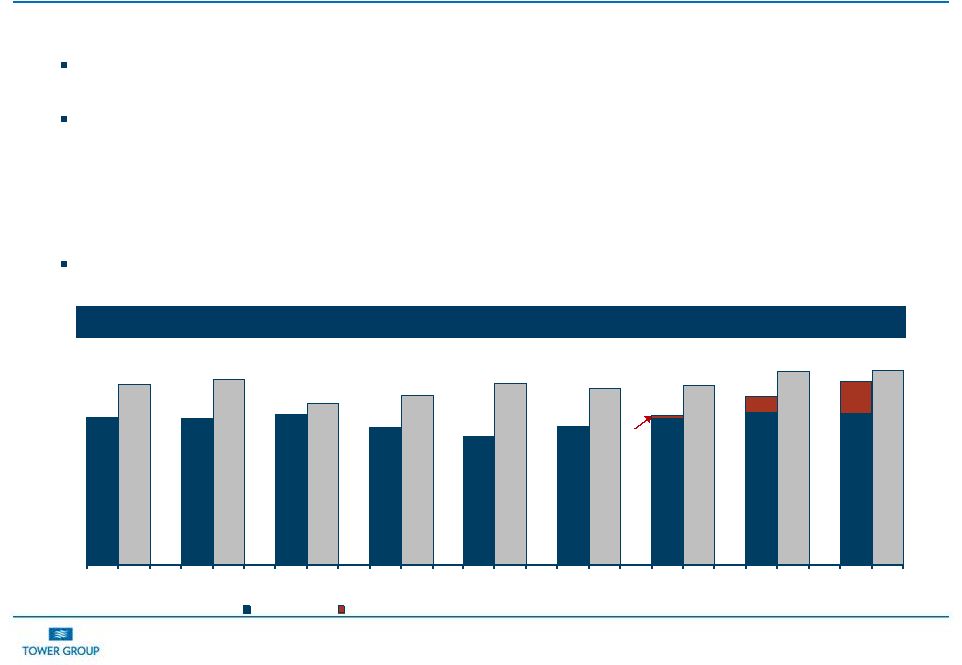

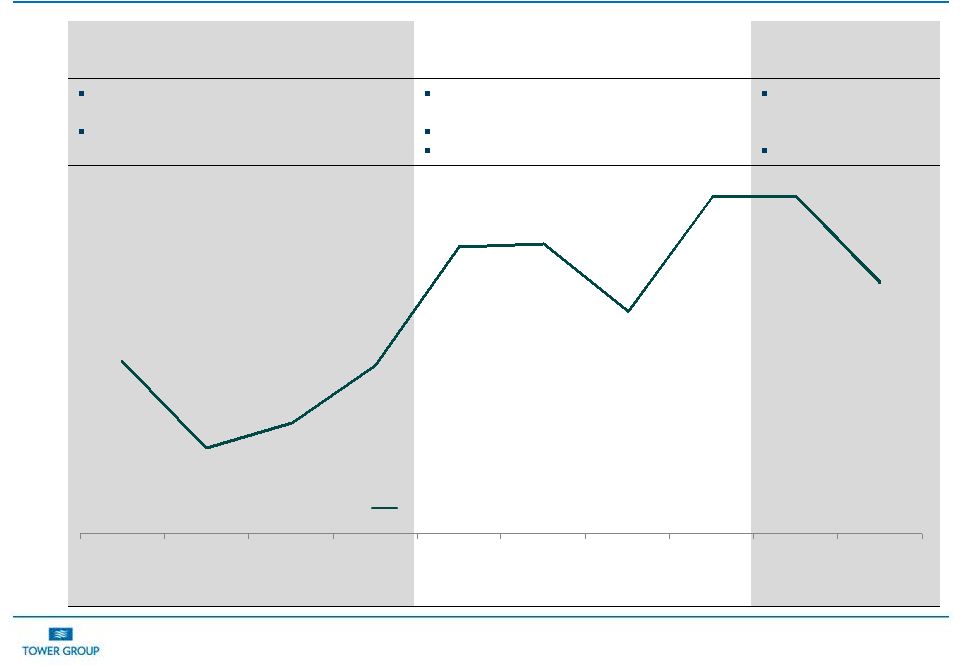

Superior Underwriting Track Record

Tower has outperformed the P&C industry loss ratio by approximately 10

points Positive loss ratio trends

•

Changes to business mix

•

Corrective underwriting actions

•

Claims cost reduction

•

Improving pricing environment

2Q12 reserve charge solidifies balance sheet

•

No adverse development expected

Note: P&C Industry Data source A.M. Best; 2012 P&C industry data

A.M. Best estimate Loss Ratio

59.4%

72.7%

58.8%

74.4%

60.3%

65.2%

55.2%

68.0%

51.7%

73.1%

55.6%

70.8%

58.7%

72.1%

61.1%

77.9%

60.9%

78.0%

1.5%

6.5%

12.6%

60.2%

67.6%

73.5%

2004

2005

2006

2007

2008

2009

2010

2011

2012

Core Tower

Tower Catastrophe & Reserve Development

P&C Industry |

7

Tower Phase I (2005 -

2008)

Strong operating performance

•

Average ROE 19.9%

•

Average combined ratio 86.6%

•

Gross premiums written & produced CAGR of 34%

Efficient use of capital

•

$805 MM in premiums written and managed with $319 MM of capital

•

Generated significant fee income through management fees and ceding

commissions Geographic and product specialization

•

Heavily concentrated in Northeast

•

Primarily focused on small commercial products

Note: Average combined ratio and average ROE metrics are premium weighted |

8

Tower Phase II (2009 -

2012)

Challenging market conditions

•

Financial crisis and prolonged economic downturn

•

Competitive market conditions

•

Low interest rate environment

•

Unprecedented catastrophic events for Tower (e.g., Irene and Sandy)

CastlePoint merger in 2009 and successful deployment of capital

•

Changes to the business model used in phase I

Tower acquired CastlePoint, a Bermuda reinsurer

Significant increase in capital and share count

Capital increased from $319 MM to $819 MM ($1B by year-end 2009)

Share count increased from 23M to 45M shares by year end 2009

•

Deployed excess capital through organic growth and acquisitions

Premiums written and managed increased from $805MM in 2008 to $2B in

2012 Since 2010, Tower’s ROE met 10 to 12% ROE near term ROE target

excluding reserve charges and catastrophe losses (Irene and Sandy)

|

9

Strategic Five-Year Plan (2010 to 2014)

In 2010 Tower began a five year plan to create a diversified international

specialty insurance company

Expand geographically

Tower expanded geographically from the Northeast to U.S and internationally

with expansion into Lloyds’ market

Broaden product platform in U.S. to add personal and specialty lines

Implemented organic growth initiative to expand products, improve existing and

create new businesses Enhance business model

Increase fee income from managing other insurance companies

(reciprocals) Gain access to Bermuda platform

Improve systems infrastructure

Recent infrastructure investments should allow Tower to achieve greater scale

and grow profitably and efficiently without significant future capital

expenditures Improve ROE

10 to 12% historical ROE in U.S. since 2010*

13 to 15% expected within 18 months of merger closing*

Merger with CHBL is final key step in executing five-year plan

*Excluding reserve charges and catastrophe losses

|

10

Canopius Merger Background

CHBL’s parent company, Canopius Group Limited (“CGL”), is a

privately owned (re)insurance group with operations at Lloyd’s and

Bermuda •

2011 GPW of approximately $1 billion

•

Quota share relationship with Tower since July 2011

Tower invested $75 MM in CGL in August 2012

•

10.7% ownership stake

•

Option to merge with subsidiary of CHBL

•

Increased

existing

quota

share

of

CGL’s

Lloyd’s

business

for

2013

–

2015

•

CGL assistance in creating Tower’s Lloyd’s platform

Strategic benefits:

•

Bermuda platform

•

Access to profitable specialty and international business

•

Reduce acquisition or start-up related execution risk of creating a

Lloyd’s syndicate •

Take advantage of the leverage opportunities offered by Lloyd’s through

quota share arrangements Bermuda operations

•

Quota share Lloyd’s business from CGL and third parties

•

CHBL acquired for tangible book value plus the value of retained

business (currently estimated to be ~$8 MM)

»

Tower determines CHBL tangible book value and retained business as part of

pre-closing restructuring |

11

Tower Phase III (2013 -

2014)

Merger is final key step in executing five-year plan

•

EPS accretion expected to be *~8% in 2013 and projected to be ~21% in 2014

•

Expected to increase ROE to 13% -

15% within 18 months

•

Creates a global specialty insurance company

U.S.

Bermuda

Lloyd’s

•

Continue expansion of commercial,

personal and specialty businesses

•

Establish more efficient platform to

support U.S. and international

business

•

Expand existing relationships with

Lloyd’s syndicates to access $38B

market

•

Expect to create Tower Lloyd’s

managing agency

* Assumes transaction closes in March 2013

** Percentage of total 2012 premiums

Existing Tower**

2013 Pro Forma

Assumed Re 2012 and 2013 Pro Forma Premiums contain 71% and 87% of quota share of

Lloyds’ business respectively |

12

Organic Growth Strategy

Transitioning from acquisitions to organic growth

•

Completed deployment of excess capital by making accretive acquisitions

•

Implemented organic growth initiative in 2011

»

Develop and customize products for different industries and customer groups as

well as key clients »

Improve existing business units and create new business units

»

Improve technical expertise in functions related to generating organic growth

(ex. Product and business development)

Organic growth is working

•

Newly created business units are driving organic growth

»

Assumed reinsurance and customized solutions generated $158 MM of new written

premiums in 2011 and $195 MM in 2012

•

Talent depth

»

Recently hired highly experienced underwriting managers with national markets

and product experience to provide leadership for personal and

commercial lines businesses –

Expected expansion into affluent personal lines market and various commercial

niche markets expected in 2013 •

Currently developing a pipeline of customized products for select agents

•

Recently formed strategic alliances with Lloyd’s syndicates and key

business partners to significantly improve product and analytical

expertise in specialty markets |

13

Improving Market Conditions

Positive commercial U.S. pricing beginning in mid 2011

Sandy expected to serve as a catalyst for further pricing improvements in the

Northeast P&C Pricing Trends

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

4Q06

2Q07

4Q07

2Q08

4Q08

2Q09

4Q09

2Q10

4Q10

2Q11

4Q11

2Q12

4Q12

Commercial insurance

Tenants' and household insurance

Source: The Council of Insurance Agents & Brokers for commercial lines;

Bureau of Labor Statistics for Tenants’ and household insurance. |

14

Sandy Losses Limited by Reinsurance and Underwriting

•

Tower’s share of industry losses is expected to be less than half of its

1.8% market share of insured homes and businesses affected

»

Irene 1% of industry loss despite 3.9% market share

»

After tax loss includes $2.7 million investment loss from Canopius

•

Through February 24, 2013, Tower has closed 93.7% of the 30,511 claims that

its stock companies and reciprocal exchanges received as a result of

Superstorm Sandy.

•

Irene and Sandy were two of the four major windstorms to make landfall in the

Tri-state area in last 100 years

•

Losses from Sandy and Irene represent the two single largest loss events in

Tower’s history

»

Prior to Irene and Sandy, Tower’s total aggregate historical catastrophe

losses were less than Irene losses

•

Continued geographical diversification

•

Utilization of reciprocals to reduce Tower’s earnings volatility

•

Further strengthen reinsurance program

100% Tower

100% Reinsured

30% Tower

70% Reinsured

$925 MM

$225 MM

$150 MM

$75 MM

$0 MM

100% Reinsured

Limited catastrophe activity in the Northeast prior to Irene and

Sandy

Sandy’s pre-tax net loss estimated to be $119.0 million,

after-tax net loss estimated to be $80.1

million

Expect future impact of catastrophe losses on Tower’s earnings

to be more limited |

15

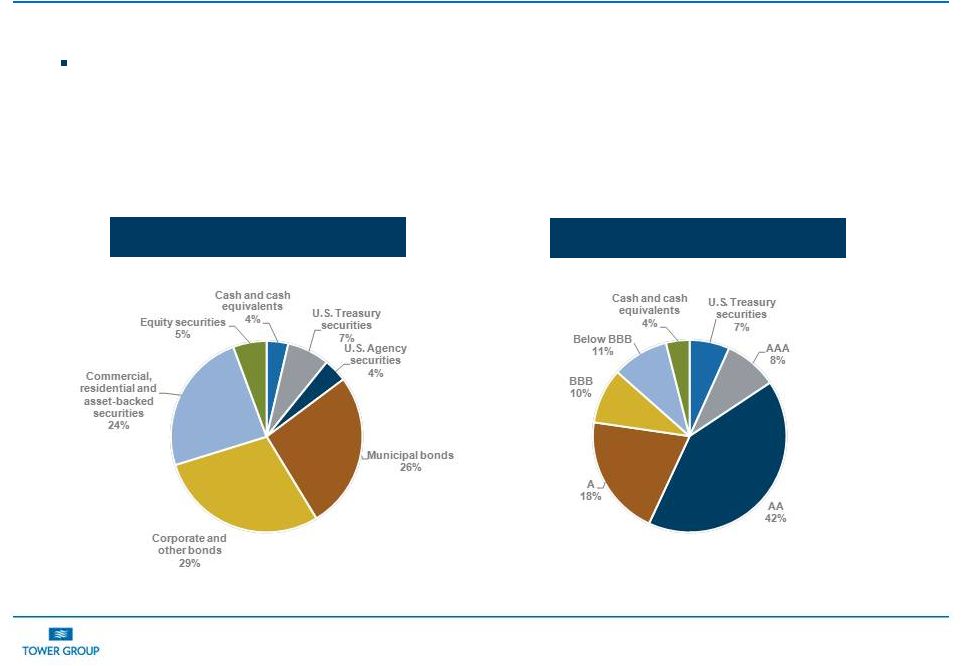

Our investment portfolio had net unrealized pre-tax gains of $135 MM at

December 31, 2012 attributable to Tower shareholders

•

Fixed income average quality of A+

•

Duration of 4.6 years

•

Tax equivalent book yield of 4.5%

Asset Allocation

Asset Quality

Note: All numbers exclude the reciprocal exchanges. Data as of December 31,

2012 Highly Rated Investments |

16

Phase I

Phase II

Phase III

Achieve scale for predominately commercial

business

Fee income

Significant investments in infrastructure to

support two additional businesses

Acquisition integration

Shift in claims expense to underwriting

Leverage

infrastructure through

organic growth

Increasing fee income

Leveraging Existing Infrastructure

Premium

($MM)

335

421

608

805

1,082

1,496

1,811

1,971

2,270

2,577

Premium is gross written premium and produced, expense ratios are adjusted to

reflect 1/1/2011 adoption of new guidance for DAC reporting 32%

29%

30%

32%

35%

35%

33%

36%

36%

34%

2005

2006

2007

2008

2009

2010

2011

2012

2013 E

2014 E

Expense Ratio Excluding Reciprocals |

17

Earnings Outlook

Merger is expected to be ~8% accretive to 2013 EPS

Projected to be ~21% accretive in 2014

Capital Fully

Deployed

13 -

15% ROE

12.0% ROE

Pro Forma EPS on a Tower equivalent basis. Assumes merger transaction closes in

March 2013 $2.63

($0.50)

$0.49

$0.14

$0.09

$2.85

$3.75

Base 2013

Dilution

Bermuda

Platform

Efficiency

Additional

Investment

Income

Additional

Underwriting

Earnings

Pro Forma 2013

Pro Forma 2014 |

18

ROE Drivers

Note: 2013 and 2014 forecast assumes merger transaction closes in March

2013 2012

2013

2014

Operating Combined Ratio

109.0%

97.8%

95.5% - 97.5%

Operating Leverage

1.5x

1.4x

1.5x

Underwriting ROE

-13.7%

3.3%

3.8% - 6.8%

Investment Leverage

2.3x

2.3x

2.3x

Investment Yield

4.7%

4.6%

4.6%

Investment ROE

10.9%

10.8%

10.9%

Contribution from Fee Income

1.0%

1.8%

1.7%

Contribution from Corporate Overhead & Debt

-3.7%

-2.3%

-2.4%

Pre-Tax ROE

-5.5%

13.6%

14% - 17%

Tax Rate

N/A

11.5%

7.3%

Adjusted Operating ROE

10.1%

12.0%

13% - 15%

Impact of Storms and Adverse Development

-12.8%

Operating Return on Equity

-2.7%

12.0%

13% - 15%

Adjusted Return on Tangible Equity

15.0%

17.3%

18% - 20%

Pro Forma Estimates

2014 forecasted ROTE is expected to be 18% - 20%

|

19

Summary

Completed investment in infrastructure to build diversified commercial, specialty

and personal lines platform

•

Since

2010,

domestic

franchise

has

generated

a

stable

10%

-

12%

ROE

(15%

to

17%

ROTE)*

Merger is a key final step to creating a diversified international specialty

insurance company •

Further expands international and specialty business

•

Gains access to Bermuda platform to provide efficient source of capital

•

Completed business platform expected to yield 13% -

15% ROE in 2014 (forecasted 18% to 20% ROTE)

Attractive entry point for new investors

•

0.78x P/B and 1.2x P/TB

•

3.8% dividend yield vs. 1.2% yield of the SNL U.S. Insurance P&C

Index

Significant insider ownership

•

$89 MM (approximately 9%

pro forma ownership)

Source: SNL Financial. Market data as of February 22, 2012; Tower financial

data as of 12/31/2012 *Excludes catastrophic storm losses and adverse

development. |