Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Allison Transmission Holdings Inc | d488770dex991.htm |

| 8-K - 8-K - Allison Transmission Holdings Inc | d488770d8k.htm |

Q4

2012 Earnings Release February 19, 2013

1

Lawrence Dewey, Chairman, President & Chief Executive Officer

David Graziosi, Executive Vice President & Chief Financial Officer

Exhibit 99.2 |

Safe

Harbor Statement 2

The following information contains, or may be deemed to contain, “forward-looking

statements” (as defined in the U.S. Private Securities Litigation Reform Act of

1995). Most forward-looking statements contain words that identify them as

forward-looking, such as “may”, “plan”, “seek”, “will”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”, “project”,

“opportunity”, “target”, “goal”, “growing” and

“continue” or other words that relate to future events, as opposed to past or current

events. By their nature, forward-looking statements are not statements of historical facts and involve risks and

uncertainties because they relate to events and depend on circumstances that may or may not occur in

the future. These statements give Allison Transmission’s current expectation of

future events or its future performance and do not relate directly to historical or current

events or Allison Transmission’s historical or future performance. As such, Allison

Transmission’s future results may vary from any expectations or goals expressed in, or implied

by, the forward-looking statements included in this presentation, possibly to a material

degree. Factors which may cause the actual results to differ materially from those anticipated

at the time the forward-looking statements are made include, but are not limited to: risks

related to our substantial indebtedness; our participation in markets that are competitive; general economic and

industry conditions; our ability to prepare for, respond to and successfully achieve our objectives

relating to technological and market developments and changing customer needs; the failure of

markets outside North America to increase adoption of fully-automatic transmissions; the

discovery of defects in our products, resulting in delays in new model launches, recall

campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and

reputation; the concentration of our net sales in our top five customers and the loss of any one of

these; risks associated with our international operations; brand and reputational risks; our

intention to pay dividends; and labor strikes, work stoppages or similar labor disputes, which

could significantly disrupt our operations or those of our principal customers.

Allison Transmission cannot assure you that the assumptions made in preparing any of the

forward-looking statements will prove accurate or that any long-term financial goals

will be realized. All forward-looking statements included in this presentation speak only

as of the date made, and Allison Transmission undertakes no obligation to update or revise

publicly any such forward-looking statements, whether as a result of new information, future

events, or otherwise. In particular, Allison Transmission cautions you not to place undue

weight on certain forward-looking statements pertaining to potential growth opportunities,

long-term financial goals or the value we currently ascribe to certain tax attributes set forth

herein. Actual results may vary significantly from these statements. Allison Transmission’s

business is subject to numerous risks and uncertainties, which may cause future results of

operations to vary significantly from those presented herein. Important factors that could cause

actual results to differ materially are discussed in Allison Transmission’s prospectus

filed pursuant to Rule 424(b)(1) under the Securities Act of 1933, as amended, dated as of

March 15, 2012 and Quarterly Reports on Form 10-Q. |

Non-GAAP Financial Information

3

We use Adjusted net income, Adjusted EBITDA, Adjusted EBITDA excluding technology-related license

expenses, Adjusted EBITDA margin, Adjusted EBITDA margin excluding technology-related

license expenses, adjusted free cash flow and free cash flow to evaluate our performance

relative to that of our peers. In addition, the Senior Secured Credit Facility has certain covenants that

incorporate Adjusted EBITDA. However, Adjusted net income, Adjusted EBITDA, Adjusted EBITDA excluding

technology-related license expenses, Adjusted EBITDA margin, Adjusted EBITDA margin

excluding technology-related license expenses, adjusted free cash flow and free cash flow

are not measurements of financial performance under GAAP, and these metrics may not be comparable

to similarly titled measures of other companies. Adjusted net income is calculated as the sum of net

income (loss), interest expense, net, income tax expense, trade name impairment and

amortization of intangible assets, less cash interest, net and cash income taxes, and adjusted

for certain non-recurring items. Adjusted EBITDA is calculated as the sum of Adjusted net income, cash interest,

net, cash income taxes, depreciation of property, plant and equipment and other adjustments as defined

by the Senior Secured Credit Facility and as further described below. Adjusted EBITDA excluding

technology-related license expenses is calculated as Adjusted EBITDA less

technology-related license expenses. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by

net sales. Adjusted EBITDA margin excluding technology-related license expenses is calculated as

Adjusted EBITDA excluding technology-related license expenses divided by net sales. Free

cash flow is calculated as net cash provided by operating activities less capital expenditures.

Adjusted free cash flow is free cash flow adjusted for non-recurring items.

We use Adjusted net income to measure our overall profitability because it better reflects our cash

flow generation by capturing the actual cash interest paid and cash taxes paid rather than our

interest expense and tax expense as calculated under GAAP and excludes the impact of the

non-cash annual amortization of certain intangible assets that were created at the time of the Acquisition

Transaction. We use Adjusted EBITDA, Adjusted EBITDA excluding technology-related license

expenses, Adjusted EBITDA margin and Adjusted EBITDA margin excluding technology-related

license expenses to evaluate and control our cash operating costs and to measure our operating

profitability. We use adjusted free cash flow and free cash flow to evaluate the amount of cash generated by

the business that, after the capital investment needed to maintain and grow our business, can be used

for strategic opportunities, including investing in our business and strengthening our balance

sheet. We believe the presentation of Adjusted net income, Adjusted EBITDA, Adjusted EBITDA

excluding technology-related license expenses, Adjusted EBITDA margin, Adjusted EBITDA

margin excluding technology-related license expenses, adjusted free cash and free cash flow

enhances our investors' overall understanding of the financial performance and cash flow of our

business.

You should not consider Adjusted net income, Adjusted EBITDA, Adjusted EBITDA excluding

technology-related license expenses, Adjusted EBITDA margin, Adjusted EBITDA margin

excluding technology-related license expenses, adjusted free cash flow and free cash flow

as an alternative to net income (loss), determined in accordance with GAAP, as an indicator of operating performance, or

as an alternative to net cash provided by operating activities, determined in accordance with GAAP, as

an indicator of Allison’s cash flow.

|

Call

Agenda Q4 2012 Performance

2013 Guidance

4 |

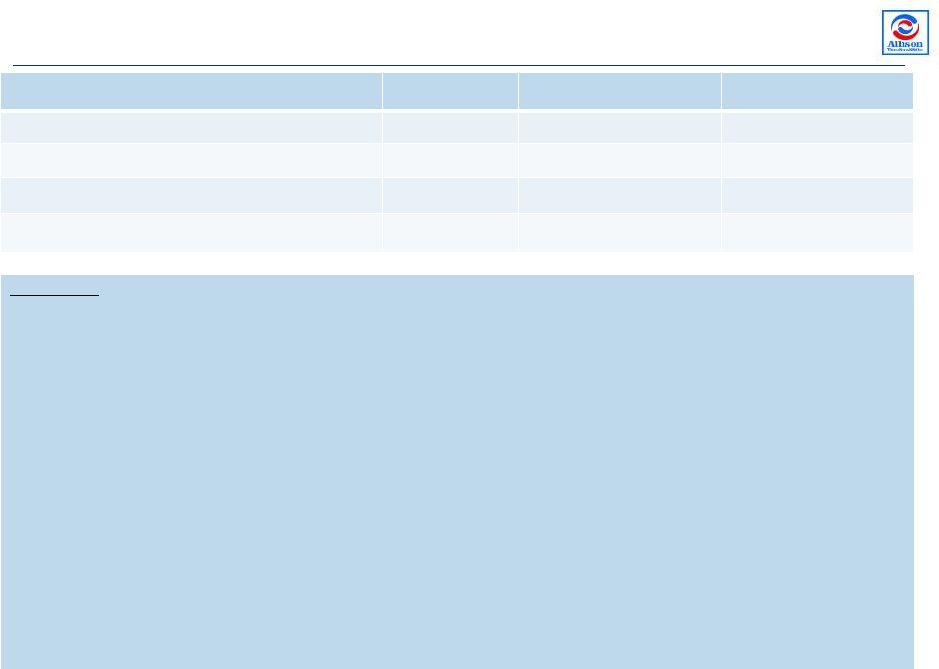

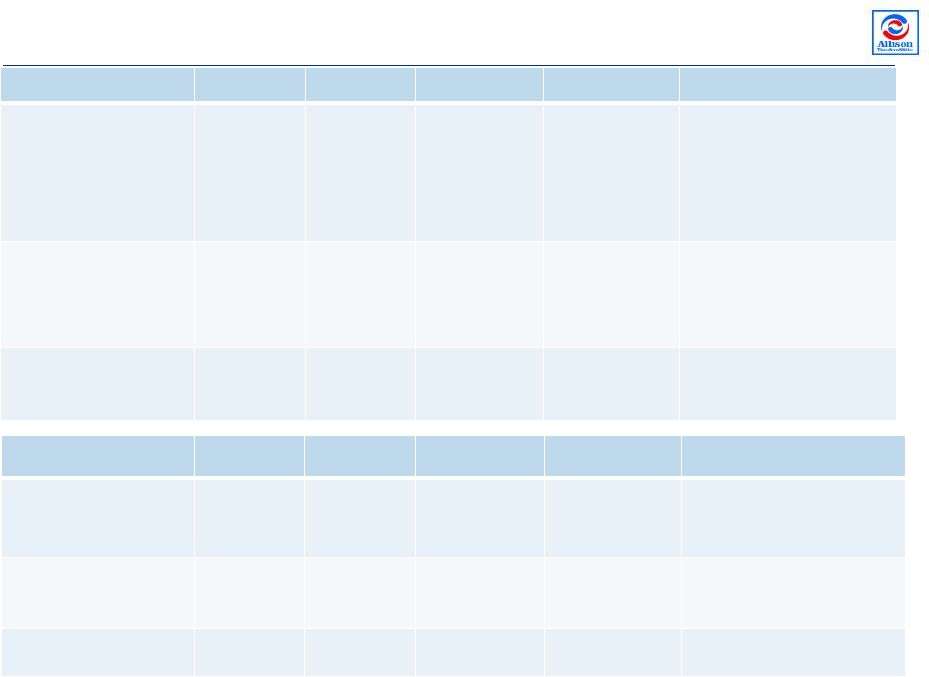

Q4

2012 Performance Summary 5

($ in millions)

Q4 2012

Q4 2011

% Variance

Net Sales

$487

$516

(5.6%)

Gross Margin %

39.9%

43.1%

(320 bps)

Adjusted Net Income

(1)

$46

$52

(12.6%)

Adjusted Free Cash Flow

(1)

$82

$30

171.0%

Commentary

Net

Sales:

the

decrease

was

principally

driven

by

reduced

demand

for

North

America

Off-Highway

transmission

products

and

service parts due to continued weakness in natural gas pricing.

Partially offsetting these declines were increased net sales

in the global On-Highway and Outside North America Off-Highway end markets

and price increases on certain products. Strength in the Outside North

America Off-Highway end market was principally driven by higher demand in the energy and

mining sectors.

Gross

Margin:

excluding

$15

million

of

costs

and

charges

to

conclude

a

new

five-year

labor

agreement

with

the

UAW

Local

933

the

gross

margin

decreased

30

bps.

Adjusted Net Income: the decrease was principally driven by decreased net sales, $16

million of costs and charges to conclude a new five-year labor agreement

with the UAW Local 933, a $9 million product warranty charge for specific product

issues and

higher

product

initiatives

spending

partially

offset

by

favorable

material

costs,

price

increases

on

certain

products,

reduced

global

commercial

spending

activities

and

decreased

cash

interest

expense

as

a

result

of

debt

refinancing

and

repayments.

Adjusted Free Cash Flow: the increase was principally driven by increased net cash

provided by operating activities and reduced capital expenditures. The

decrease in capital expenditures was principally driven by prior year spending for the India

expansion and the timing of investments in productivity and replacement programs

partially offset by increased product initiatives spending.

(1)

See Appendix for a reconciliation of Adjusted Net Income and Adjusted Free Cash

Flow. |

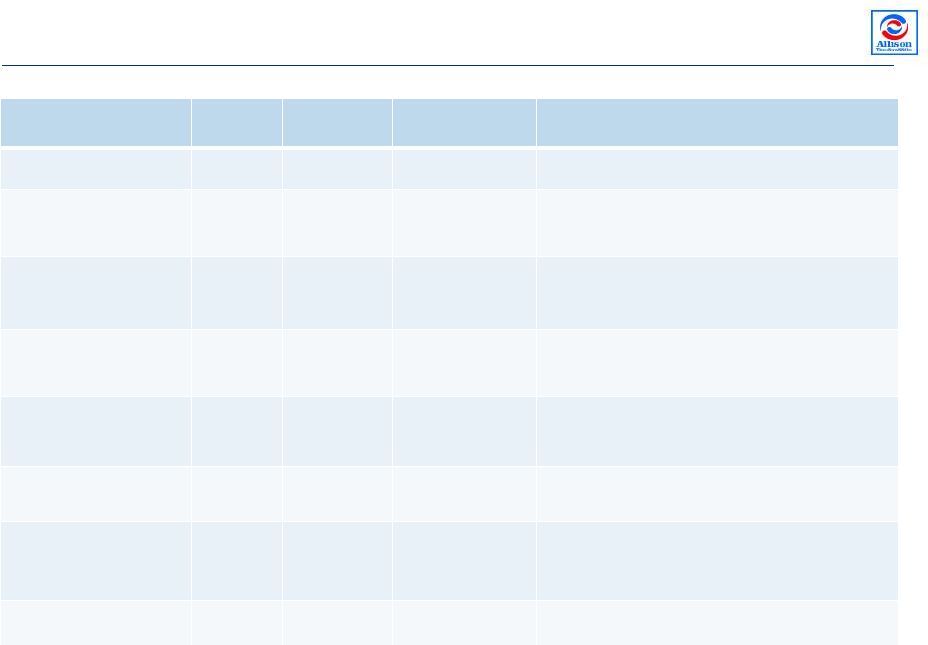

Q4

2012 Sales Performance End Markets

Q4 2012

Q4 2011

% Variance

Commentary

North America On-Hwy

$188

$175

7%

Increased commercial vehicle production

North America Hybrid-

Propulsion Systems for

Transit Bus

$32

$27

19%

Timing of orders

North America Off-Hwy

$17

$70

(76%)

Decreased demand from hydraulic fracturing

applications due to weakness in natural gas

pricing

Military

$74

$70

6%

Increased wheeled product requirements for

several programs partially offset by lower

tracked products demand

Outside North America

On-Hwy

$73

$70

4%

Strength in China partially offset by weakness in

Latin America while Europe was flat

Outside North America

Off-Hwy

$30

$19

58%

Stronger demand from the energy and mining

sectors

Service Parts, Support

Equipment & Other

$73

$85

(14%)

Reduced demand for North America Off-Hwy

and On-Hwy service parts partially offset by

price increases on certain products

Total

$487

$516

(6%)

6

($ in millions) |

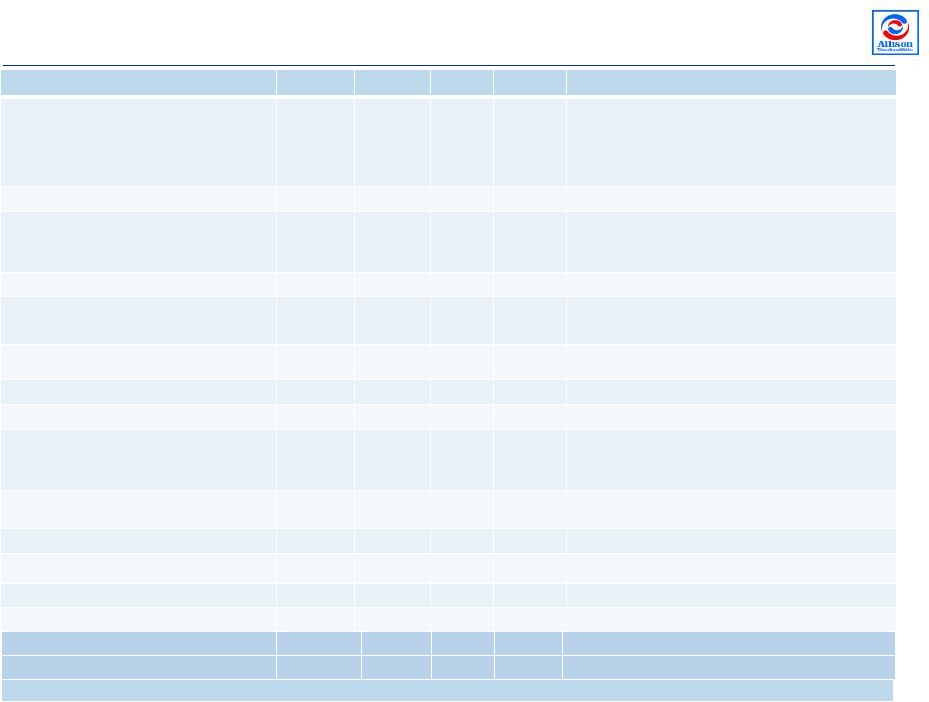

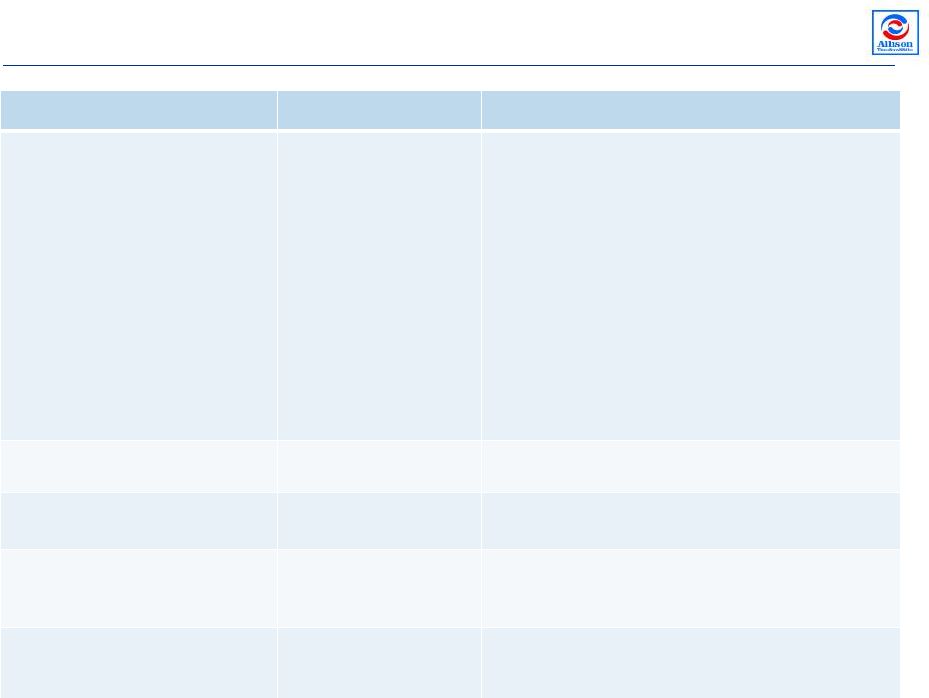

Q4

2012 Financial Performance 7

($ in millions)

Q4 2012

Q4 2011

$ Var

% Var

Commentary

Net Sales

$487.0

$516.1

($29.1)

(5.6%)

Decreased demand for North America Off-Highway and Service

Parts, Support Equipment & Other products partially offset by

increased demand for North America On-Highway, Outside North

America Off-Highway, North America Hybrid-Propulsion Systems

for Transit Bus, Military, Outside North America On-Highway

products and price increases on certain products

Cost of Sales

$292.8

$293.7

$0.9

0.3%

Gross Profit

$194.2

$222.4

($28.2)

(12.7%)

Decreased net sales and $15 million of costs and charges to

conclude a new five-

year labor agreement with the UAW Local

933 partially offset by favorable material costs and price

increases on certain products

Operating Expenses

Selling, general and administrative expenses

$112.0

$109.9

($2.1)

(1.9%)

Product warranty charge of $9 million and UAW Local 933

contract signing bonus charge of $1 million partially offset by

reduced global commercial spending activities

Engineering –

research and development

$28.1

$26.0

($2.1)

(8.1%)

Increased product initiatives spending

Total operating expenses

$140.1

$135.9

($4.2)

(3.1%)

Operating Income

$54.1

$86.5

($32.4)

(37.5%)

Interest Expense, net

($35.6)

($33.4)

($2.2)

(6.6%)

Lower favorable mark-to-market adjustments for interest rate

derivatives and increased Term B Loan margins due to

refinancing partially offset by the favorable impact of debt

repayments and repurchases

Other Income (Expense), net

$2.6

($3.3)

$5.9

178.8%

Increased grant income and reduction in loss associated with

debt redemptions

Income Before Income Taxes

$21.1

$49.8

($28.7)

(57.6%)

Higher U.S. taxable income

Income Tax Expense

($9.9)

($5.3)

($4.6)

(86.8%)

Net Income

$11.2

$44.5

($33.3)

(74.8%)

Diluted Earnings Per Share

$0.06

$0.24

($0.18)

(75.0%)

2012: 186.2M shares; 2011: 183.3M shares

(1)

See Appendix for a reconciliation from Net Income (Loss).

Adjusted EBITDA

(1)

$131.9

$156.2

($24.3)

(15.6%)

Adjusted Net Income

(1)

$45.8

$52.4

($6.6)

(12.6%) |

Q4

2012 Cash Flow Performance 8

($ in millions)

Q4 2012

Q4 2011

$ Variance

% Variance

Commentary

Net Cash Provided by

Operating Activities

$112

$72

$40

55.9%

Reduced Operating Working

Capital investment principally

driven by lower net sales,

conclusion of 2012 labor

negotiations, debt repayments

and accruals for labor

negotiations charges partially

offset by lower net income

CapEx

$30

$42

($12)

(27.9%)

Completion of India facility

expansion (Q4 2011) and timing

of investments in productivity and

replacement programs partially

offset by product initiatives

spending

Adjusted Free Cash

Flow

(1)

$82

$30

$52

171.0%

Increased net cash provided by

operating activities and reduced

capital expenditures

($ in millions)

Q4 2012

Q4 2011

$ Variance

% Variance

Commentary

Operating Working

Capital

(2)

Percentage of

LTM Sales

8.8%

8.7%

N/A

10 bps

Cash Paid for Interest

$47

$68

($21)

(31.3%)

Reduced Sr. Notes interest

partially offset by Sr. Secured

Credit Facility refinancing

Cash Paid for Income

Taxes

$2

$1

$1

149.3%

Increased taxable income

(1)

See Appendix for a reconciliation of Adjusted Free Cash Flow.

(2)

Operating

Working

Capital

=

A/R

+

Inventory

–

A/P. |

2013

Guidance - End Markets Commentary

9

Allison expects first quarter net sales to be significantly lower than the same period

in 2012 driven by considerably lower demand in the North America energy

sector’s hydraulic fracturing market, previously considered reductions in Military net sales and weaker Global On-

Highway

end

markets

entering

2013.

We

expect

that

the

majority

of

the

full

year

2013

net

sales

reduction

implied

by

the

midpoint

of

our

guidance will occur in the first quarter followed by growth in the Global

On-Highway end markets for the balance of the year. •

North America On-Highway

•

Moderated

market

recovery

rate:

somewhat

elevated

year

end

2012

vehicle

retail

inventory

levels,

November

2012

thru

January

2013

Allison

order

rates down year over year and OEMs reducing take rates/adding downtime in Q1

2013 •

2012 net sales $813 million; Expect 2013 net sales midpoint growth of 8

percent •

North America Hybrid-Propulsion Systems for Transit Bus

•

Municipal subsidy and spending constraints, engine emissions improvements and

non-hybrid alternative technologies that generally require a fully-

automatic transmission (e.g. xNG)

•

2012 net sales $115 million; Expect 2013 net sales midpoint reduction of 24

percent •

North America Off-Highway

•

Hydraulic fracturing market’s challenges continue for the first half of the

year given forecasts for low rig utilization rates and high levels of surplus

equipment attributable to weakness in natural gas pricing

•

2012 net sales $157 million; Expect 2013 net sales midpoint reduction of 68

percent •

Outside North America On-Highway

•

Growth in key developing markets through increased fully-automatic transmission

penetration and implementation of additional vehicle releases; limited

improvement in European end markets •

2012 net sales $290 million; Expect 2013 net sales midpoint growth of 5

percent •

Outside North America Off-Highway

•

2012 net sales $114 million; Expect 2013 net sales midpoint reduction of 11 percent

driven by weak mining sector capital spending forecasts •

Military

•

2012 net sales $305 million; Expect 2013 net sales midpoint reduction of 31 percent

driven by continued reductions in U.S. defense spending to longer term

averages experienced during periods without active conflicts •

Service Parts, Support Equipment & Other

•

2012 net sales $348 million; Expect 2013 net sales midpoint growth of 3 percent

driven by improved North America On-Highway service parts leveIs in the

second half of the year and increased support equipment sales commensurate with higher transmission unit volumes |

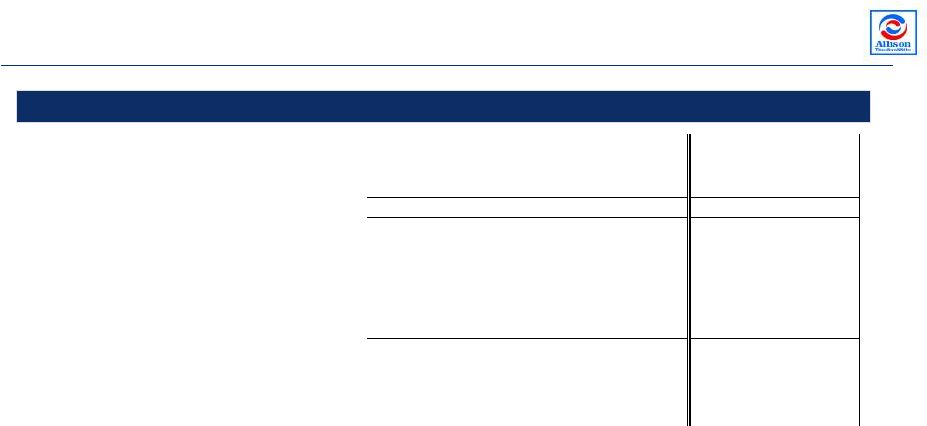

2013 Guidance -

Summary

10

Guidance

Commentary

Net Sales Growth from 2012

(6) to (8) percent

Reflects a cautious approach given the continued heightened

level of uncertainty in our end markets and the lack of near-

term visibility and confidence in certain of our end markets.

Allison’s 2013 net sales outlook also incorporates an

assumed continuation of cyclically low levels of demand in

the North America energy sector’s hydraulic fracturing

market, the previously considered reductions in U.S. defense

spending to longer term averages experienced during

periods without active conflicts and lower demand in the

North America Hybrid-Propulsion Systems for Transit Bus

end market demand due to municipal spending constraints.

Accordingly we assume year over year net sales reductions

in the Global Off-Highway, Military and North America Hybrid-

Propulsion Systems for Transit Bus end markets partially

offset by year over year net sales growth in the Global On-

Highway and Service Parts, Support Equipment & Other end

markets.

Adjusted EBITDA Margin

32 to 34 percent

Principally driven by sales mix and volume timing

Adjusted Free Cash Flow

($ in millions)

$325 to $375

$1.75 to $2.01 per diluted share

CapEx

($ in millions)

Maintenance

New Product Programs

$60 to $65

$20 to $25

New product programs subject to timely completion of

development and sourcing milestones

Cash Income Taxes

($ in millions)

$15 to $20

U.S. income tax shield and net operating loss utilization

|

11

APPENDIX

Non-GAAP Financial Information |

Non-GAAP Reconciliations

(1 of 2)

Adjusted Net Income and Adjusted EBITDA reconciliation

(1) Includes charges or income related to legacy employee

benefits, shared income with General Motors, benefit plan adjustments, transitional costs to establish Allison as a stand-alone

entity, pension curtailment adjustments, employee stock compensation expense,

service fees paid to Allison’s Sponsors and an adjustment for the settlement of litigation which

originated with the Predecessor but was assumed by the Company as part of the

Acquisition Transaction. 12

$ in millions, Unaudited

2009

2010

2011

2012

2011

2012

Net (loss) income

($323.9)

$29.6

$103.0

$514.2

$44.5

$11.2

plus:

Interest expense,

net

234.2

277.5

217.3

151.2

33.4

35.6

Cash interest expense

(242.5)

(239.1)

(208.6)

(167.3)

(68.0)

(46.7)

Income tax expense (benefit)

41.4

53.7

47.6

(298.0)

5.3

9.9

Cash income

taxes

(5.5)

(2.2)

(5.8)

(10.7)

(0.7)

(1.7)

Fee to terminate services agreement with Sponsors

—

—

—

16.0

—

—

Technology-related investment expense

—

—

—

14.4

—

—

Initial public offering expenses

—

—

—

6.1

—

—

Trade name

impairment

190.0

—

—

—

—

—

Amortization of intangible

assets

155.9

154.2

151.9

150.0

37.9

37.5

Adjusted net

income

$49.6

$273.7

$305.4

$375.9

$52.4

$45.8

Cash interest expense

242.5

239.1

208.6

167.3

68.0

46.7

Cash income

taxes

5.5

2.2

5.8

10.7

0.7

1.7

Depreciation of property, plant and equipment

105.9

99.6

103.8

102.5

26.8

26.5

(Gain)/Loss on repurchases of long-term debt

(8.9)

(3.3)

16.0

22.1

4.7

0.5

Dual power inverter module extended coverage

11.4

(1.9)

—

9.4

—

—

UAW Local 933 signing bonus

—

—

—

8.8

—

8.8

Benefit plan re-measurement

—

—

—

2.3

—

—

Unrealized (gain) loss on hedge contracts

(5.8)

0.1

6.8

(0.9)

1.7

0.2

Premiums and expenses on tender offer for long-term debt

—

—

56.9

0.0

—

—

Restructuring charges

47.9

—

—

—

—

—

Reduction of supply contract liability

—

(3.4)

—

—

—

—

Other, net

(1)

53.2

10.9

8.6

7.0

1.9

1.7

Adjusted

EBITDA

$501.3

$617.0

$711.9

$705.1

$156.2

$131.9

Adjusted EBITDA excluding technology-related license expense

$501.3

$617.0

$711.9

$717.1

$156.2

$131.9

Net Sales

$1,766.7

$1,926.3

$2,162.8

$2,141.8

$516.1

$487.0

Adjusted EBITDA

margin

28.4%

32.0%

32.9%

32.9%

30.3%

27.1%

Adjusted EBITDA margin excl technology-related license expense

28.4%

32.0%

32.9%

33.5%

30.3%

27.1%

Three months ended

December 31,

For the year ended December 31, |

$ in millions,

Unaudited 2009

2010

2011

2012

2011

2012

Net Cash Provided by Operating Activities

$168.7

$388.9

$469.2

$497.5

$71.9

$112.1

(Deductions) or Additions:

Long-lived assets

(88.2)

(73.8)

(96.9)

(123.9)

(41.6)

(30.0)

Fee to terminate services agreement with Sponsors

—

—

—

16.0

—

—

Technology-related license expense

—

—

—

12.0

—

—

2009 Non-Recurring Activity

(1)

61.0

—

—

—

—

—

Adjusted Free Cash Flow

$141.5

$315.1

$372.3

$401.6

$30.3

$82.1

Net

Sales

$1,766.7

$1,926.3

$2,162.8

$2,141.8

$516.1

$487.0

Adjusted Free Cash Flow (% to Net Sales)

8.0%

16.4%

17.2%

18.8%

5.9%

16.9%

Three months ended

December 31,

For the year ended December 31,

Adjusted Free Cash Flow reconciliation

(1)

Non-GAAP Reconciliations

(2 of 2)

13

2009 adjusted for certain non-recurring activity: (a) capitalized accrued interest on Senior

Toggle Notes ($29) million, (b) cash restructuring charge $51 million, (c) accounts payable

early payments $3 million, (d) delayed accounts receivable receipts $19 million and (e) Lehman

LIBOR swap settlement $17 million. |