Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEUSTAR INC | d432658d8k.htm |

| EX-99.1 - EARNINGS RELEASE - NEUSTAR INC | d432658dex991.htm |

Earnings Report

November 5, 2012

Neustar, Inc.

Supplemental Information

Exhibit 99.2 |

2

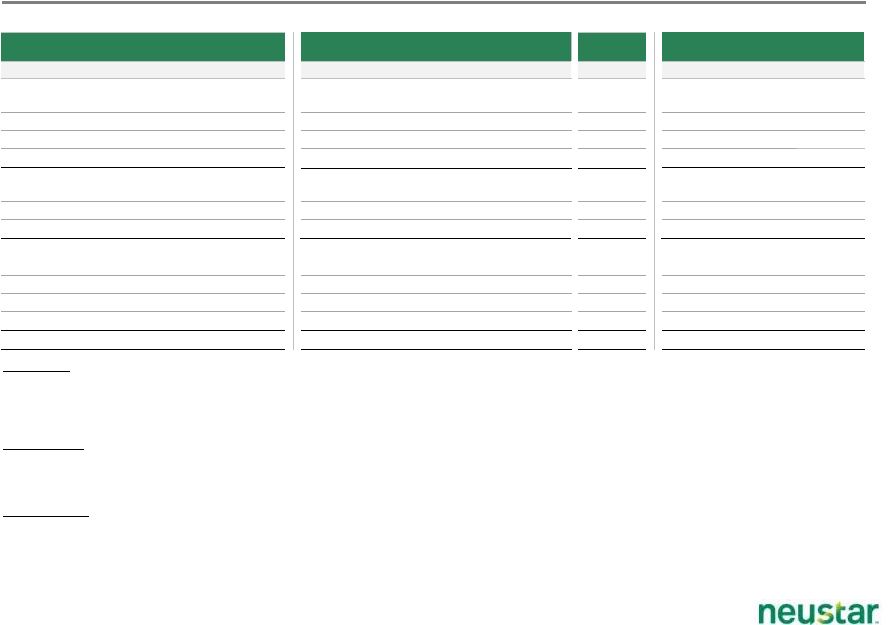

Revenue by Segment

Segment Revenu ($ in 000s)

Full-Year

Mar

31,

Jun

30,

Sep

30,

Dec

31,

2011

Mar

31,

Jun

30,

Sep

30,

Carrier Services

Numbering Services

99,426

98,813

99,924

99,810

397,973

110,489

110,896

111,726

Order Management Services

7,144

8,481

10,236

9,943

35,804

10,910

10,541

10,104

IP Services

3,045

3,540

3,995

3,537

14,117

2,974

4,910

3,372

Total Carrier Services revenue

109,615

110,834

114,155

113,290

447,894

124,373

126,347

125,202

Enterprise Services

Internet Infrastructure Services (IIS)

20,404

20,117

20,484

21,982

82,987

21,723

22,455

22,856

Registry Services

16,076

16,732

17,858

17,737

68,403

17,762

19,634

20,774

Total Enterprise Services revenue

36,480

36,849

38,342

39,719

151,390

39,485

42,089

43,630

Information Services

Identification Services

-

-

-

13,873

13,873

22,719

22,957

24,212

Verification & Analytics Services

-

-

-

4,465

4,465

8,236

9,821

13,078

Local Search & Licensed Data Services

-

-

-

2,833

2,833

4,769

5,248

5,050

Total Information Services revenue

-

-

-

21,171

21,171

35,724

38,026

42,340

Total consolidated revenue

146,095

147,683

152,497

174,180

620,455

199,582

206,462

211,172

2012 Qtr Ended,

2011 Quarter Ended,

Carrier

Services:

Numbering

Services

–

We

operate

and

maintain

authoritative

databases

for

telephone

number

resources

utilized

by

our

carrier

customers

and

manage

the

telephone

number

lifecycle.

The

services

utilizing

these

databases

are:

NPAC

Services

in

the

United

States

and

Canada,

International

LNP

Services

and

Number

Administration.

Order

Management

Services

–

Our

Order

Management

Services

(OMS)

permit

carrier

customers,

through

a

single

interface,

to

exchange

essential

operating

data

with

multiple

carriers

in

order

to

provision

services.

IP

Services

–

We

provide

scalable

IP

services

to

carriers

which

allow

them

to

manage

access

for

the

routing

of

IP

communications.

Enterprise

Services:

Internet

Infrastructure

Services

–

We

provide

a

suite

of

domain

name

systems

(DNS)

services

to

our

enterprise

customers

built

on

a

global

directory

platform.

These

services

include

Managed

DNS,

Monitoring

and

Load

Testing,

and

IP

Geolocation.

Registry

Services

–

We

operate

the

authoritative

registries

for

certain

Internet

domain

names

and

operate

the

authoritative

U.S.

Common

Short

Code

(CSC)

registry

on

behalf

of

wireless

carriers

in

the

United

States.

These

services

include

the

registry

services

for

.biz,

.us,

.co,

.tel

and

.travel

domain

names,

as

well

as

the

registry

for

U.S.

Common

Short

Codes.

Information

Services:

Identification

Services

–

Our

real-time

identification

services

include

the

provision

of

caller-name

and

related

information

to

telephony

providers,

delivery

of

identity

and

other

attribute

data

for

use

in

call

centers

or

in

remarketing

efforts,

and

geographic-based

solutions

for

intelligent

call

routing,

Web-based

location

lookup,

and

site

planning.

Verification

&

Analytics

Services

–

We

provide

verification

services

that

allow

clients

to

validate

customer-provided

information,

enhance

sales

leads

and

assign

quality

ratings

to

maximize

a

prospect’s

“reachability.”

Our

broad-based

analytic

capabilities

also

utilize

real-time

predictive

scoring

to

determine

which

prospects

are

most

likely

to

purchase,

become

a

high-value

customer

or

respond

to

a

particular

marketing

campaign.

We

also

provide

an

intelligent,

privacy-friendly

mechanism

for

delivering

targeted,

real-time

advertising

on

the

Internet.

Local

Search

&

Licensed

Data

Services

–

We

provide

an

online

listing

identity

management

solution

that

provides

the

essential

tools

to

verify,

enhance

and

manage

the

identity

of

local

listings

across

the

Web.

We

also

maintain

an

expansive

data

repository

that

provides

a

more

current

alternative

to

Directory

Listing

and

White

Page

compilations. |

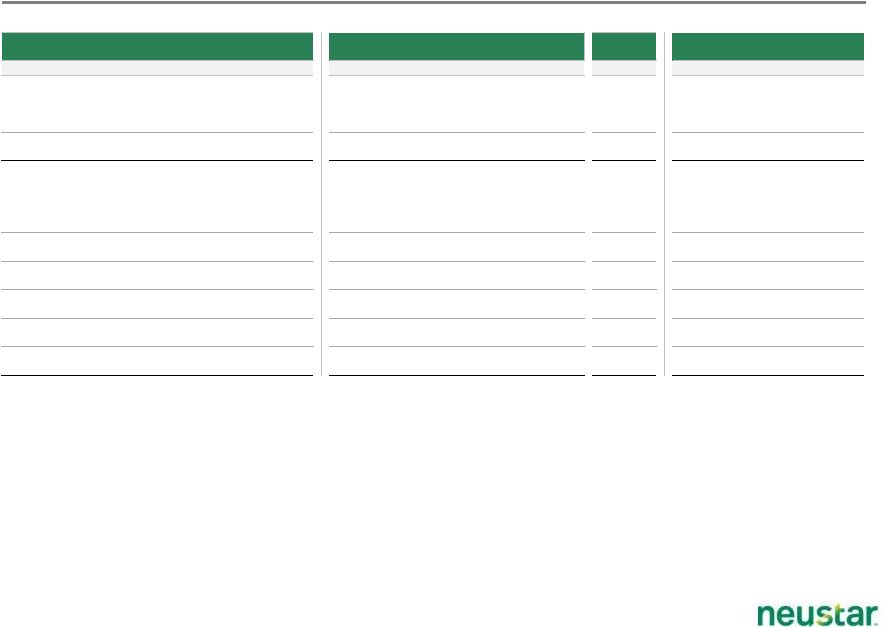

3

Key Performance Metrics

Metrics

Full-Year

Revenue category

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Mar 31,

Jun 30,

Sep 30,

Carrier Services

NPAC Services transactions (in thousands)

131,278

130,121

117,792

89,746

468,937

113,243

125,479

138,297

Functionality enhancements NPAC SOWs (in thousands)

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

Enterprise Services

Functionality enhancements SOWs (in thousands)

966

$

161

$

-

$

-

$

1,127

$

42

$

1,104

$

1,893

$

IIS queries (in billions)

1,090

881

962

1,029

3,962

982

986

1,051

IIS new customers

287

306

242

258

1,093

253

222

237

IIS upgrades

321

311

318

311

1,261

381

367

282

Registry - domain names under management (in thousands)

5,143

5,310

5,403

5,451

5,451

5,736

5,787

5,821

CSC - codes under management

4,103

4,256

4,370

4,565

4,565

4,667

4,681

4,895

2011 Quarter Ended,

2012 Qtr Ended, |

4

Expense by Type

by Quarter and as a Percentage of Revenue

$ in 000s

Full-Year

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Mar 31,

Jun 30,

Sep 30,

Revenue

146,095

147,683

152,497

174,180

620,455

199,582

206,462

211,172

Expense by type

Cost of revenue (excl. depreciation & amortization)

31,052

31,417

34,194

41,329

137,992

44,898

46,127

46,339

% of Revenue

21%

21%

22%

24%

22%

22%

22%

22%

Sales and marketing

24,939

26,267

25,069

33,580

109,855

38,353

41,073

38,040

% of Revenue

17%

18%

16%

19%

18%

19%

20%

18%

Research and development

3,996

3,441

3,746

6,326

17,509

7,724

8,096

7,663

% of Revenue

3%

2%

2%

4%

3%

4%

4%

4%

General and administrative

20,215

21,949

20,960

33,193

96,317

20,993

20,091

20,915

% of Revenue

14%

15%

14%

19%

16%

11%

10%

10%

Depreciation & amortization

9,146

9,386

10,486

17,191

46,209

22,706

22,713

23,622

% of Revenue

6%

6%

7%

10%

7%

11%

11%

11%

Restructuring charges (recoveries)

432

(12)

(33)

3,162

3,549

522

2

(32)

% of Revenue

0%

0%

0%

2%

1%

0%

0%

0%

Total operating expense

89,780

92,448

94,422

134,781

411,431

135,196

138,102

136,547

2011 Quarter Ended,

2012 Qtr Ended, |

5

Expense Details

Other Details and Headcount

Stock-based compensation by type ($ in 000s)

Full-Year

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Mar 31,

Jun 30,

Sep 30,

Cost of revenue

476

616

780

940

2,812

555

1,158

1,461

Sales and marketing

1,726

1,989

1,907

2,378

8,000

1,736

3,004

3,734

Research and development

335

312

345

381

1,373

359

561

589

General and administrative

3,479

3,083

3,428

5,316

15,306

1,251

2,326

3,253

Total stock-based compensation expense

6,016

6,000

6,460

9,015

27,491

3,901

7,049

9,037

Amortization of intangibles ($ in 000s)

1,129

1,110

1,716

8,152

12,107

12,572

12,571

12,569

Headcount by type

Year-End

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Mar 31,

Jun 30,

Sep 30,

Cost of revenue

385

390

430

658

658

659

674

673

Sales and marketing

300

306

327

461

461

461

470

470

Research and development

83

78

77

137

137

141

158

154

General and administrative

199

200

200

232

232

228

230

232

Total headcount

967

974

1,034

1,488

1,488

1,489

1,532

1,529

2012 Qtr Ended,

2012 Qtr Ended,

2011 Quarter Ended,

2011 Quarter Ended, |

Non-GAAP Financial

Measures

RECONCILIATION OF NON-GAAP FINANCIAL MEASURE

Neustar reports its results in accordance with generally accepted accounting

principles in the United States (GAAP). In this section, Neustar

is

also

providing

certain

non-GAAP

financial

measures

and

reconciliations

to

the

most

directly

comparable

GAAP

measure.

Neustar

cautions investors that the non-GAAP financial measures presented are intended

to supplement Neustar’s GAAP results and are not a substitute

for,

or

superior

to,

financial

measures

calculated

in

accordance

with

GAAP,

and

the

financial

results

calculated

in

accordance

with

GAAP and reconciliations from these results should be carefully evaluated. In

addition, these non-GAAP financial measures may not be comparable with

similar non-GAAP financial measures used by other companies. Management believes that these measures enhance

investors’

understanding of the company’s financial performance and the comparability of

the company’s operating results to prior periods, as well as against

the performance of other companies. |

7

Reconciliation of Segment Contribution

($ in 000s)

Full-Year

Mar 31,

Jun 30,

Sep 30,

Dec 31,

2011

Mar 31,

Jun 30,

Sep 30,

Segment contribution

Carrier Services

96,579

97,570

99,302

97,549

391,000

108,446

110,438

109,359

Enterprise Services

15,651

15,418

16,551

17,460

65,080

16,731

18,866

20,314

Information Services

-

-

-

12,583

12,583

18,014

16,991

24,064

Total segment contribution

112,230

112,988

115,853

127,592

468,663

143,191

146,295

153,737

Indirect operating expense:

Cost of revenue (excl. depreciation & amortization)

19,627

19,742

20,424

24,197

83,990

24,269

24,741

24,989

Sales and marketing

3,825

4,617

3,584

5,314

17,340

5,730

6,635

6,050

Research and development

3,598

2,912

3,575

6,149

16,234

4,860

4,431

4,270

General and administrative

19,287

21,108

19,742

32,180

92,317

20,718

19,413

20,213

Depreciation and amortization

9,146

9,386

10,486

17,191

46,209

22,706

22,713

23,622

Restructuring charges (recoveries)

432

(12)

(33)

3,162

3,549

522

2

(32)

Consolidated income from operations

56,315

55,235

58,075

39,399

209,024

64,386

68,360

74,625

2011 Quarter Ended,

2012 Qtr Ended, |

8

Adjusted Net Income from Continuing Operations

$ in 000s, except per share amounts

Full-Year

2012 YTD

2011

Mar 31,

Jun 30,

Sep 30,

Sep 30,

Revenue

620,455

199,582

206,462

211,172

617,216

Income from operations

209,024

64,386

68,360

74,625

207,371

Add: Other (expense) income

(4,313)

(7,964)

(8,294)

(8,377)

(24,635)

Income from continuing operations before income taxes

204,711

56,422

60,066

66,248

182,736

Less: Provision for income taxes, continuing operations

81,137

22,460

21,474

20,495

64,429

Income from continuing operations

123,574

33,962

38,592

45,753

118,307

Add: Stock-based compensation

27,491

3,901

7,049

9,037

19,987

Add: Amortization of acquired intangible assets

12,107

12,572

12,571

12,569

37,712

Add: TARGUSinfo acquisition-related costs

(1)

11,602

-

-

-

-

Add: Tender offer costs

(2)

2,413

-

-

-

-

Less: Adjustment for provision for income taxes

(3)(4)

(18,173)

(6,557)

(7,014)

(6,684)

(20,344)

Adjusted net income from continuing operations

159,014

43,878

51,198

60,675

155,662

Adjusted net income margin from continuing operations

(5)

26%

22%

25%

29%

25%

Adjusted net income from continuing operations per diluted share

(6)

$2.13

$0.64

$0.75

$0.90

$2.29

Weighted average diluted common shares outstanding

74,496

68,478

67,887

67,623

67,961

Quarter Ended 2012,

(1)

Amounts represent costs incurred by the Company in connection with its acquisition of Targus

Information Corporation (TARGUSinfo). (2)

Amounts represent costs incurred by the Company to repurchase 7.2 million shares of its Class A common

stock through a modified “Dutch auction” tender offer which closed on December 8,

2011. These costs were not deductible for income tax purposes. (3)

Adjustment reflects the estimated tax effect of adjustments for stock-based compensation expense,

amortization of acquired intangible assets and approximately $6.3 million of tax

deductible TARGUSinfo acquisition-related costs based on the effective tax rate for income from continuing operations for the applicable period.

(4)

Quarterly amounts for the adjustment for provision for income taxes do not add to the full year amount

due to differences in the effective tax rate for income from continuing operations for the

applicable quarters compared to effective annual tax rate. (5)

Adjusted net income margin is a measure of adjusted net income from continuing operations as a

percentage of revenue. (6)

Quarterly amounts for adjusted net income from continuing operations per diluted share may not add to

the full year amount due to differences in the adjustment for provision for income taxes

discussed in (4) above. |