Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_3-20121025.htm |

| EX-99.1 - EXHIBIT 99.1 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_1-20121025.htm |

| EX-99.2 - EXHIBIT 99.2 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_2-20121025.htm |

| 8-K - FORM 8-K - OCCIDENTAL PETROLEUM CORP /DE/ | form8k-20121025.htm |

| EX-99.5 - EXHIBIT 99.5 - OCCIDENTAL PETROLEUM CORP /DE/ | ex99_5-20121025.htm |

EXHIBIT 99.4

Occidental Petroleum Corporation

Third Quarter 2012 Earnings Conference Call

October 25, 2012

Third Quarter 2012 Earnings Conference Call

October 25, 2012

1

2

• Income from continuing operations — $1.4 Billion in

3Q12 vs. $1.8 Billion in 3Q11 or $1.3 Billion in 2Q12.

3Q12 vs. $1.8 Billion in 3Q11 or $1.3 Billion in 2Q12.

– EPS $1.70 (diluted) vs. $2.18 (diluted) in 3Q11 or $1.64 (diluted)

in 2Q12.

in 2Q12.

• 3Q12 income from continuing operations improved

$0.06 per diluted share from 2Q12:

$0.06 per diluted share from 2Q12:

– Higher margins in marketing and trading businesses;

– partially offset by lower earnings in the chemical segment.

– In the oil and gas segment, the effect of higher liquids

production and domestic gas prices was partially offset by the

impact of a 3% decline in realized worldwide crude oil prices.

production and domestic gas prices was partially offset by the

impact of a 3% decline in realized worldwide crude oil prices.

Third Quarter 2012 Earnings - Highlights

Third Quarter 2012 Earnings - Highlights

2

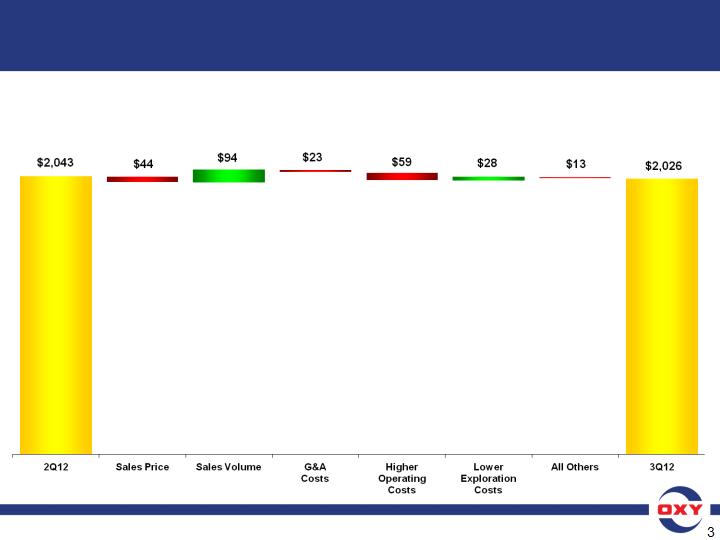

Third Quarter 2012 Earnings - Oil & Gas

Segment Variance Analysis - 3Q12 vs. 2Q12

Segment Variance Analysis - 3Q12 vs. 2Q12

Third Quarter 2012 Earnings - Oil & Gas

Segment Variance Analysis - 3Q12 vs. 2Q12

Segment Variance Analysis - 3Q12 vs. 2Q12

• Core Results for 3Q12 of $2.0 B vs. $2.0 B in 2Q12

($ in millions)

3

4

3Q12 3Q11

Oil and Gas Production Volumes (mboe/d) 766 739

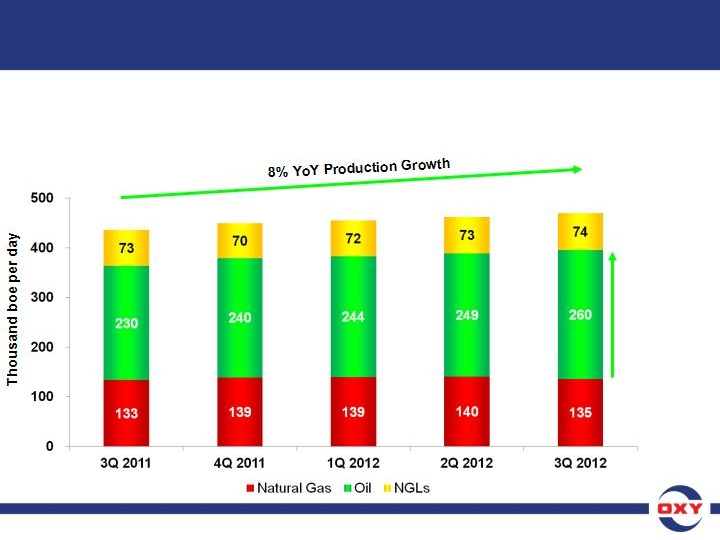

• 3Q12 production of 766 mboe/d increased 4% from 3Q11;

• Domestic production was 469 mboe/d, an increase of

7 mboe/d from 2Q12 and the eighth consecutive quarterly

domestic volume record for the company;

7 mboe/d from 2Q12 and the eighth consecutive quarterly

domestic volume record for the company;

• Domestic production was 8% higher than 3Q11.

– Almost all of the sequential quarterly increase came from the

Permian and Williston basins;

Permian and Williston basins;

– CA production was higher in liquids but flat on a BOE basis with

2Q12, mainly due to lower gas volumes associated with initial

start-up issues of the new gas plant. These issues were resolved

mid-quarter although the positive effect of the plant on 3Q12 was

limited;

2Q12, mainly due to lower gas volumes associated with initial

start-up issues of the new gas plant. These issues were resolved

mid-quarter although the positive effect of the plant on 3Q12 was

limited;

– CA’s current production run rate is ~150 mboe/d.

Third Quarter 2012 Earnings - Oil & Gas Production

Details regarding other country-specific production levels available in the IR Supplemental Schedules

4

5

• Latin America volumes were 32 mboe/d;

• In the Middle East region, volumes were 265 mboe/d:

– Dolphin’s production was 13 mboe/d lower than 2Q12 resulting

from the full cost recovery of pre-startup capital, as we noted last

quarter;

from the full cost recovery of pre-startup capital, as we noted last

quarter;

– Qatar’s production was also impacted by a facility outage in

August, which reduced production by 5 mboe/d. The outage

was subsequently resolved;

August, which reduced production by 5 mboe/d. The outage

was subsequently resolved;

– The rest of the Middle East partially offset these decreases in

part due to higher spending levels.

part due to higher spending levels.

• Factors affecting production sharing and similar contracts,

including oil prices, did not significantly impact this quarter’s

production volumes compared to 3Q11 or 2Q12.

including oil prices, did not significantly impact this quarter’s

production volumes compared to 3Q11 or 2Q12.

Third Quarter 2012 Earnings - Oil & Gas Production

Third Quarter 2012 Earnings - Oil & Gas Production

Details regarding country specific production levels available in the IR Supplemental Schedules

5

6

• 3Q12 realized prices were mixed for our products compared

to 2Q12.

to 2Q12.

− Our worldwide crude oil realized price was $96.62 per bbl,

a decrease of about 3%;

a decrease of about 3%;

− worldwide NGLs were $40.65 per barrel, also a decrease of

about 3%;

about 3%;

− domestic natural gas prices were $2.48 per mcf, an improvement

of 19%.

of 19%.

• The change in worldwide crude oil realized price was

primarily due to the mix of sales volumes in 3Q12

primarily due to the mix of sales volumes in 3Q12

• 3Q12 realized prices were lower than 3Q11 prices for all

our products.

our products.

– On a year-over-year basis, price decreases were 1% for worldwide

crude oil;

crude oil;

– 27% for worldwide NGLs, and;

– 41% percent for domestic natural gas.

Third Quarter 2012 Earnings - Oil & Gas Segment

Realized Prices

Realized Prices

Third Quarter 2012 Earnings - Oil & Gas Segment

Realized Prices

Realized Prices

6

7

• Realized oil prices for the quarter represented 105%

of the average WTI and 88% of the average Brent price.

of the average WTI and 88% of the average Brent price.

• Realized NGL prices were 44% of the average WTI and

realized domestic gas prices were 90% of the average

NYMEX price.

realized domestic gas prices were 90% of the average

NYMEX price.

• Price changes at current global prices affect our quarterly

earnings before income taxes by $36 mm for a $1 per bbl

change in oil prices and $8 mm for a $1 per bbl change in

NGL prices.

earnings before income taxes by $36 mm for a $1 per bbl

change in oil prices and $8 mm for a $1 per bbl change in

NGL prices.

• A swing of 50 cents per mm BTUs in domestic gas prices

affects quarterly pre-tax earnings by about $35 mm.

affects quarterly pre-tax earnings by about $35 mm.

• These price change sensitivities include the impact of

production-sharing and similar contract volume changes

on income.

production-sharing and similar contract volume changes

on income.

Third Quarter 2012 Earnings - Oil & Gas Segment

Realized Prices

Realized Prices

Third Quarter 2012 Earnings - Oil & Gas Segment

Realized Prices

Realized Prices

7

8

Third Quarter 2012 Earnings - Oil & Gas Segment

3Q12 3Q11

Reported Segment Earnings ($mm) $2,026 $2,612

WTI Oil Price ($/bbl) $92.22 $89.76

Brent Oil Price ($/bbl) $109.48 $112.22

NYMEX Gas Price ($/mcf) $2.76 $4.28

Oxy’s Realized Prices

Worldwide Oil ($/bbl) $96.62 $97.24

- 1% year-over-year

Worldwide NGLs ($/bbl) $40.65 $56.06

- 27% year-over-year

US Natural Gas ($/mcf) $2.48 $4.23

- 41% year-over-year

8

9

• Oil and gas cash production costs were $15.00 per boe

for the first nine months of 2012, compared with $12.84

per boe for the full year 2011.

for the first nine months of 2012, compared with $12.84

per boe for the full year 2011.

– The cost increase reflects higher well maintenance activity, in part

reflecting our higher well count, higher workover activity and higher

support and injection costs.

reflecting our higher well count, higher workover activity and higher

support and injection costs.

• Taxes other than on income, which are generally related

to product prices, were $2.43 per boe for the first nine

months of 2012, compared with $2.21 per boe for the

full year of 2011.

to product prices, were $2.43 per boe for the first nine

months of 2012, compared with $2.21 per boe for the

full year of 2011.

• 3Q12 exploration expense was $69 million.

Third Quarter 2012 Earnings - Oil & Gas

Segment - Production Costs and Taxes

Segment - Production Costs and Taxes

Third Quarter 2012 Earnings - Oil & Gas

Segment - Production Costs and Taxes

Segment - Production Costs and Taxes

9

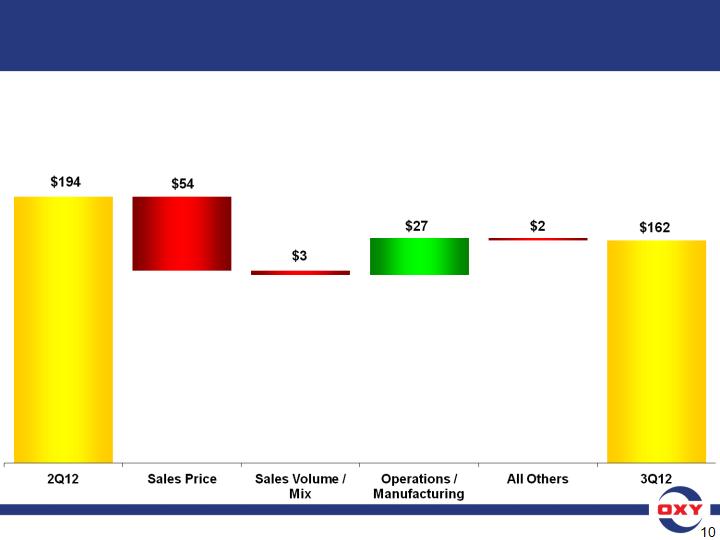

Third Quarter 2012 Earnings - Chemical

Segment Variance Analysis - 3Q12 vs. 2Q12

Segment Variance Analysis - 3Q12 vs. 2Q12

Third Quarter 2012 Earnings - Chemical

Segment Variance Analysis - 3Q12 vs. 2Q12

Segment Variance Analysis - 3Q12 vs. 2Q12

• Core Results for 3Q12 were $162 mm vs. $194 mm in 2Q12

– The sequential quarterly and year-over-year decline were due to lower Asian market demand

that drove export prices lower, partially offset by lower ethylene costs.

that drove export prices lower, partially offset by lower ethylene costs.

($ in millions)

10

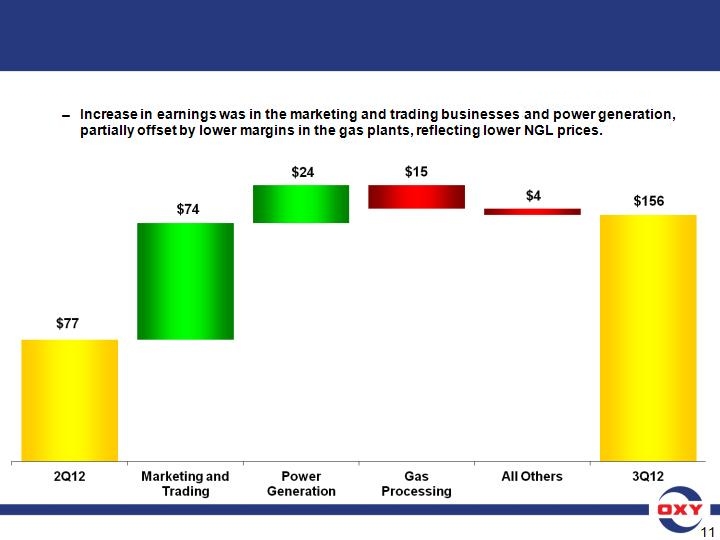

Third Quarter 2012 Earnings - Midstream

Segment Variance Analysis - 3Q12 vs. 2Q12

Segment Variance Analysis - 3Q12 vs. 2Q12

Third Quarter 2012 Earnings - Midstream

Segment Variance Analysis - 3Q12 vs. 2Q12

Segment Variance Analysis - 3Q12 vs. 2Q12

• Core Results for 3Q12 were $156 mm vs. $77 mm in 2Q12

($ in millions)

11

12

• The worldwide effective tax rate was 38% for 3Q12. The

lower rate compared to our guidance was attributable to

a shift in the mix of income toward domestic.

lower rate compared to our guidance was attributable to

a shift in the mix of income toward domestic.

• Our 3Q12 US and foreign tax rates are included in

the Investor Relations Supplemental Schedules.

the Investor Relations Supplemental Schedules.

Third Quarter 2012 Earnings - Taxes

12

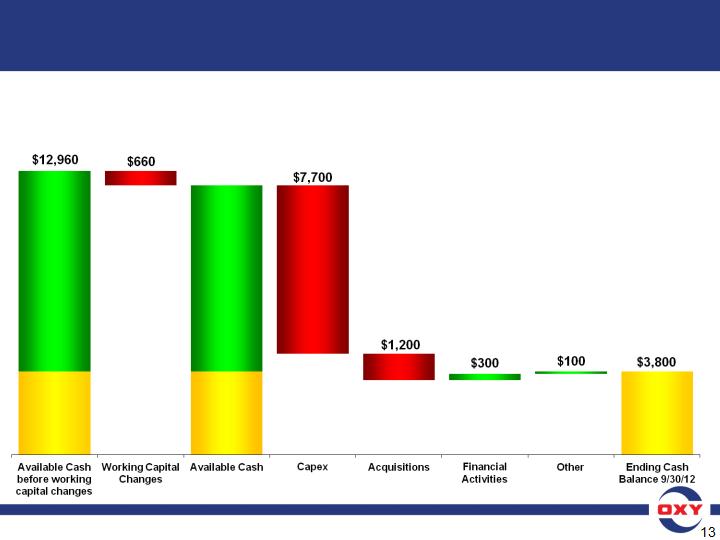

Third Quarter 2012 Earnings -

2012 YTD Cash Flow

2012 YTD Cash Flow

Third Quarter 2012 Earnings -

2012 YTD Cash Flow

2012 YTD Cash Flow

– Working capital reduced our nine-month cash flow from operations of $9.2 billion by ~$660 mm to $8.5 billion.

~$510 mm of working capital use occurred in 3Q12. Capex was $7.7 billion for the first nine months, of which

$2.6 billion was spent in 3Q12; YTD capex was 82% in oil and gas, 14% in midstream and remainder in chemicals.

Financial activities, which included dividends paid, stock buybacks and a $1.74 billion borrowing earlier this year,

provided a net $300 mm of cash flow.

~$510 mm of working capital use occurred in 3Q12. Capex was $7.7 billion for the first nine months, of which

$2.6 billion was spent in 3Q12; YTD capex was 82% in oil and gas, 14% in midstream and remainder in chemicals.

Financial activities, which included dividends paid, stock buybacks and a $1.74 billion borrowing earlier this year,

provided a net $300 mm of cash flow.

($ in millions)

Cash Flow

From

Operations

before

Working

Capital

changes

From

Operations

before

Working

Capital

changes

$9,160

Beginning

Cash

$3,800

12/31/11

Cash

$3,800

12/31/11

Beginning

Cash

$3,800

12/31/11

Cash

$3,800

12/31/11

Cash Flow

From

Operations

$8,500

From

Operations

$8,500

$12,300

13

14

Third Quarter 2012 Earnings -

Shares Outstanding & Debt/Capital

Shares Outstanding & Debt/Capital

Shares Outstanding (mm) YTD12 9/30/12

Weighted Average Basic 810.1

Weighted Average Diluted 810.8

Basic Shares Outstanding 809.3

Diluted Shares Outstanding 810.1

9/30/12 12/31/11

Debt/Capital 16% 13%

14

15

Third Quarter 2012 Earnings - Key Performance Metrics

Third Quarter 2012 Earnings - Key Performance Metrics

• Occidental’s domestic oil and gas segment produced record

volumes for the eighth consecutive quarter and continued to

execute on our liquids production growth strategy.

volumes for the eighth consecutive quarter and continued to

execute on our liquids production growth strategy.

• 3Q12 domestic production of 469 mboe/d, consisting of 334 mboe/d

of liquids and 812 mmcf/d of gas, was an increase of 7 mboe/d

compared to 2Q12.

of liquids and 812 mmcf/d of gas, was an increase of 7 mboe/d

compared to 2Q12.

• The increase in the domestic production over 2Q12 was almost

entirely in oil, which grew from 249 mb/d to 260 mb/d.

entirely in oil, which grew from 249 mb/d to 260 mb/d.

− Gas production declined 28 mmcf/d on a sequential quarterly basis, mainly

in CA, some of which was due to the initial start-up issues of the new gas plant.

in CA, some of which was due to the initial start-up issues of the new gas plant.

• Compared to 3Q11, domestic production grew by 8%, or 33 mboe/d,

of which 30 mb/d was oil production growth.

of which 30 mb/d was oil production growth.

• Our annualized return on equity for the first nine months of 2012

was 15% and return on capital employed was 13%.

was 15% and return on capital employed was 13%.

Note: See attached GAAP reconciliation

15

16

436

449

455

462

469

• Compared to 3Q11, our domestic production grew by 8%, or 33

mboe/d, of which 30 mb/d was oil production growth.

mboe/d, of which 30 mb/d was oil production growth.

+30 mb/d oil

production

growth

production

growth

Third Quarter 2012 Earnings - Key Performance Metrics

Third Quarter 2012 Earnings - Key Performance Metrics

16

17

Third Quarter 2012 Earnings - Oxy’s Strategy

Third Quarter 2012 Earnings - Oxy’s Strategy

• Three main objectives:

− Generate rates of return on invested capital

significantly in excess of our cost of capital;

significantly in excess of our cost of capital;

− Achieve moderate growth of the business;

− Deliver continued dividend growth.

• With regard to returns, we don't believe that a depleting or

shrinking business can maintain high rates of return. One can

reduce spending to achieve short term higher returns,

but these returns would not be sustainable as the Company

would deplete.

shrinking business can maintain high rates of return. One can

reduce spending to achieve short term higher returns,

but these returns would not be sustainable as the Company

would deplete.

• Our business model is to balance the need for growth of

the business while maintaining attractive returns.

the business while maintaining attractive returns.

• We are currently in an investing phase in many of our

businesses where higher than normal portion of our

capital is spent on longer-term projects.

businesses where higher than normal portion of our

capital is spent on longer-term projects.

17

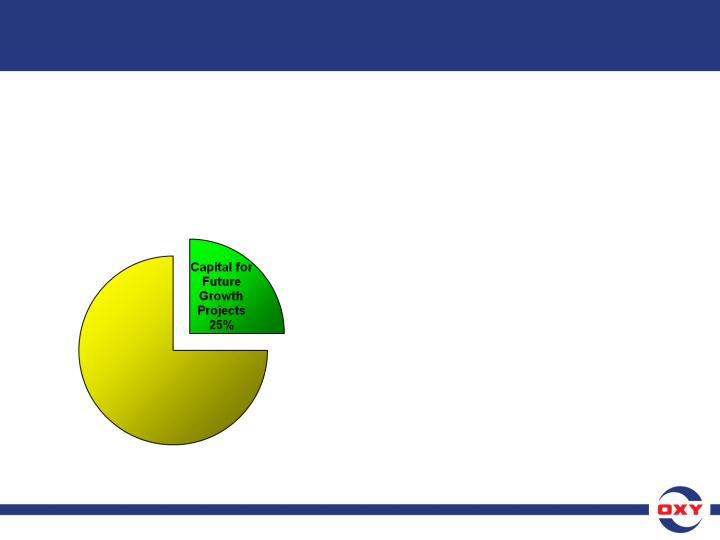

2012 YTD Total Capital - $7.7 Billion

• These expenditures include

capital for:

capital for:

• the Al Hosn Shah gas project

which is expected to start

production in late 2014;

which is expected to start

production in late 2014;

• gas and CO2 processing

plants and pipelines to

maintain or expand the

capacity of these facilities to

handle future production

increases;

plants and pipelines to

maintain or expand the

capacity of these facilities to

handle future production

increases;

• the chemical segment, and

other items.

other items.

18

Third Quarter 2012 Earnings - Oxy’s Strategy

Third Quarter 2012 Earnings - Oxy’s Strategy

• This year, we expect to spend

~25% of our total capital

expenditures on future growth

projects that will contribute to

our operations over the next

several years.

~25% of our total capital

expenditures on future growth

projects that will contribute to

our operations over the next

several years.

18

19

• Domestically and internationally, we have a mix of both

higher return assets and higher growth assets.

higher return assets and higher growth assets.

• Importantly, many of our higher growth assets are

relatively early in their development, although we have

already experienced meaningful success.

relatively early in their development, although we have

already experienced meaningful success.

• Our Permian CO2 operation continues to be our most

profitable business generating the highest free cash

flow after capital among all of our assets.

profitable business generating the highest free cash

flow after capital among all of our assets.

• The Permian non-CO2 business is one of the fastest

growing assets in our entire portfolio.

growing assets in our entire portfolio.

− Since we began significant delineation and development efforts

in 2010, we have grown production by over 25%.

in 2010, we have grown production by over 25%.

Third Quarter 2012 Earnings - Permian

Third Quarter 2012 Earnings - Permian

19

20

Third Quarter 2012 Earnings - Permian

Third Quarter 2012 Earnings - Permian

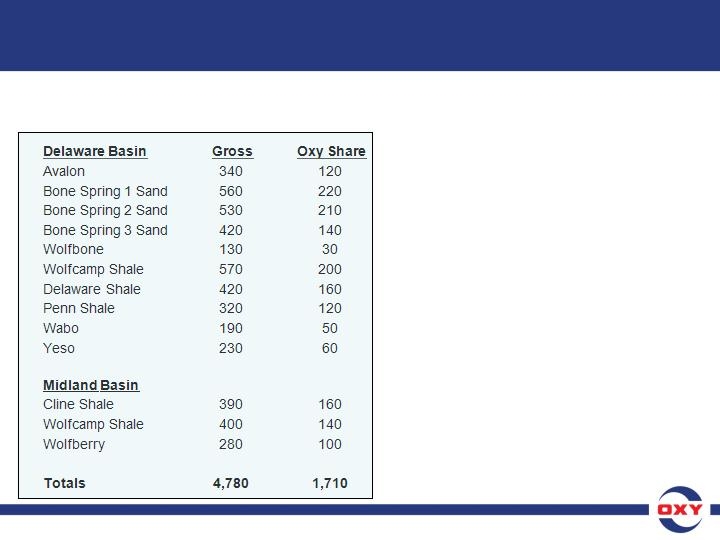

Oxy Acreage in Select Permian Basin Plays

(Thousands of Acres)

• As a result of the significant

activity by us and our partners,

our Permian acreage where we

believe resource development is

likely, has grown from our

estimate of about 3 mm gross

acres earlier in the year to about

4.8 mm acres in October.

activity by us and our partners,

our Permian acreage where we

believe resource development is

likely, has grown from our

estimate of about 3 mm gross

acres earlier in the year to about

4.8 mm acres in October.

• Oxy's net share of this acreage

grew from about 1 mm acres to

about 1.7 mm acres during the

same period.

grew from about 1 mm acres to

about 1.7 mm acres during the

same period.

20

21

• In CA, we have a very large acreage position with diverse

geologic characteristics and numerous reservoir targets.

geologic characteristics and numerous reservoir targets.

• Development opportunities range from conventional to

steam floods, water floods and shales.

steam floods, water floods and shales.

• The drilling costs and expected ultimate recoveries

(EURs) also vary for each.

(EURs) also vary for each.

Third Quarter 2012 Earnings - California

Third Quarter 2012 Earnings - California

21

22

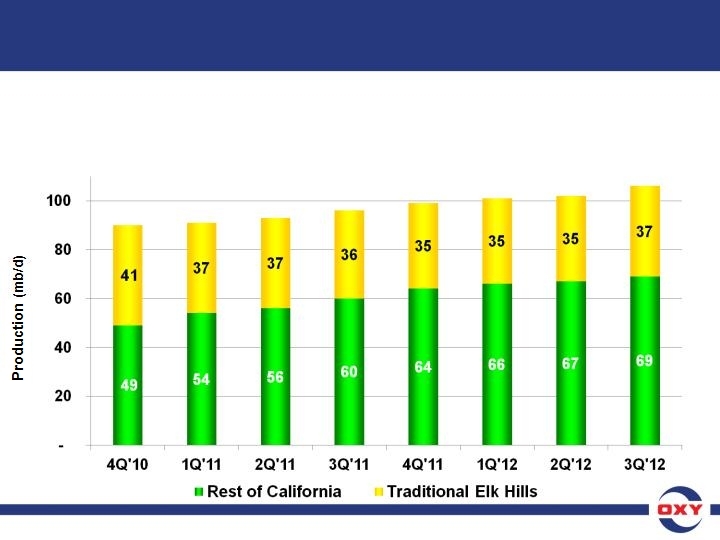

• In mid-2010, we shifted our development program to conventional

and unconventional opportunities outside of the traditional and

more mature Elk Hills areas.

and unconventional opportunities outside of the traditional and

more mature Elk Hills areas.

90

91

93

96

99

101

Third Quarter 2012 Earnings -

California Liquids Production Volumes

California Liquids Production Volumes

Third Quarter 2012 Earnings -

California Liquids Production Volumes

California Liquids Production Volumes

102

106

Liquids Production Volumes

22

23

• Recently, we further modified our programs to emphasize oil production

in light of depressed gas and associated liquids prices. As a result, gas

production in all of CA declined in 3Q12.

in light of depressed gas and associated liquids prices. As a result, gas

production in all of CA declined in 3Q12.

43

40

42

45

46

45

Third Quarter 2012 Earnings -

California Gas Production Volumes

California Gas Production Volumes

Third Quarter 2012 Earnings -

California Gas Production Volumes

California Gas Production Volumes

45

42

Gas Production Volumes

23

24

• Total CA production growth on a BOE basis is slower

than we thought it would be, in part due to the Elk Hills

decline, permitting issues and more recently low gas prices.

than we thought it would be, in part due to the Elk Hills

decline, permitting issues and more recently low gas prices.

• On a positive note, overall performance of the new

resources has been consistent with expectations,

including our unconventional opportunities for which

well performance is similar to the type curves we showed

you a couple of years ago.

resources has been consistent with expectations,

including our unconventional opportunities for which

well performance is similar to the type curves we showed

you a couple of years ago.

Third Quarter 2012 Earnings - California

Third Quarter 2012 Earnings - California

24

25

• Over the last several years we

have spent $370 mm on the

new Elk Hills gas plant.

have spent $370 mm on the

new Elk Hills gas plant.

• The plant went into operation in

early July and, notwithstanding

initial startup issues, is

positively affecting our

operational efficiency and

production including higher

liquids yields.

early July and, notwithstanding

initial startup issues, is

positively affecting our

operational efficiency and

production including higher

liquids yields.

• The plant operated optimally

for about one month last

quarter and has been operating

as expected since.

for about one month last

quarter and has been operating

as expected since.

Third Quarter 2012 Earnings - California

Third Quarter 2012 Earnings - California

Elk Hills Cryogenic Gas Processing Plant

25

26

• We will continue our focus on higher return, low cost

opportunities in CA, and this is a very diverse opportunity set.

opportunities in CA, and this is a very diverse opportunity set.

• For example, Lost Hills - a major steam flood project

– We expect to achieve significant production growth to

about 15 mb/d in several years from the current 4 mb/d;

about 15 mb/d in several years from the current 4 mb/d;

– Total oil in place in Lost Hills is estimated to be about

500 million barrels;

500 million barrels;

– Using reasonable assumptions, we expect to recover

over 50 million barrels net to Oxy;

over 50 million barrels net to Oxy;

– Our drilling costs in this area average in the low

$200,000's per well and we expect to bring this average

cost down over time.

$200,000's per well and we expect to bring this average

cost down over time.

Third Quarter 2012 Earnings - California

Third Quarter 2012 Earnings - California

26

27

• In the Williston basin in North Dakota, we currently have over

310,000 net acres with significant resource potential, which we

estimate to be about 250 million net barrels.

310,000 net acres with significant resource potential, which we

estimate to be about 250 million net barrels.

• Our production in the basin has tripled since we entered the

area over a year and a half ago.

area over a year and a half ago.

• We have recently slowed our drilling activity in the basin and

significantly reduced our rig count.

significantly reduced our rig count.

• While well costs have declined modestly, we will only increase

our rig count when costs come down enough to make returns

competitive with the rest of our portfolio.

our rig count when costs come down enough to make returns

competitive with the rest of our portfolio.

• We believe over the long-term, the total resource base in the

Williston basin represents a significant opportunity for the Company.

Williston basin represents a significant opportunity for the Company.

• In the Mid-Continent, including our assets in South Texas, we have

significantly reduced our gas directed drilling.

significantly reduced our gas directed drilling.

• However, we could ramp up our gas production rapidly and

meaningfully if prices for gas and associated liquids improved from

their current levels on a sustained basis.

meaningfully if prices for gas and associated liquids improved from

their current levels on a sustained basis.

Third Quarter 2012 Earnings -

Williston / Mid-Continent

Williston / Mid-Continent

Third Quarter 2012 Earnings -

Williston / Mid-Continent

Williston / Mid-Continent

27

Third Quarter 2012 Earnings - International

Third Quarter 2012 Earnings - International

28

29

Third Quarter 2012 Earnings - International

Third Quarter 2012 Earnings - International

Al Hosn Gas Project

29

30

Third Quarter 2012 Earnings - International

Third Quarter 2012 Earnings - International

30

31

Third Quarter 2012 Earnings - Operating Costs &

Capital

Capital

Third Quarter 2012 Earnings - Operating Costs &

Capital

Capital

31

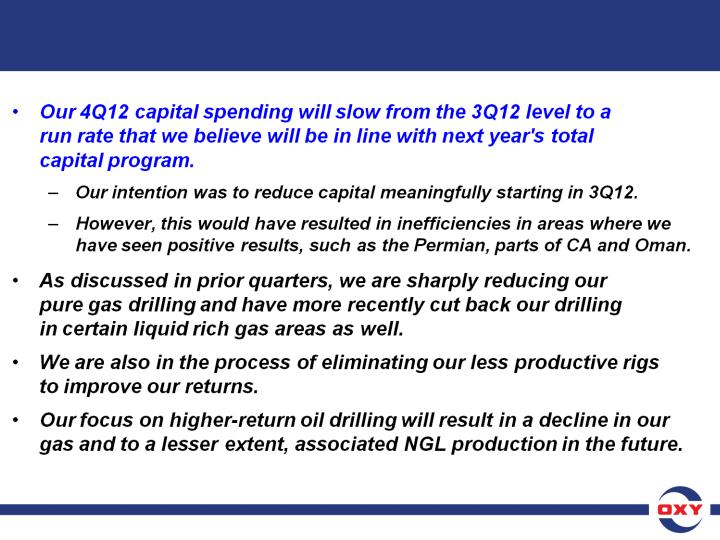

32

Third Quarter 2012 Earnings -

Operating Costs & Capital

Operating Costs & Capital

Third Quarter 2012 Earnings -

Operating Costs & Capital

Operating Costs & Capital

32

33

Third Quarter 2012 Earnings - 4Q12 Outlook

Capital Program

Capital Program

Third Quarter 2012 Earnings - 4Q12 Outlook

Capital Program

Capital Program

33

34

• Over the past year, we have achieved our goal of

increasing domestic production by 6 to 8 mboe/d

quarter-over-quarter.

increasing domestic production by 6 to 8 mboe/d

quarter-over-quarter.

– We expect our 4Q12 oil production to grow by about this much.

– However, the expected decline in gas production resulting from

the change in our capital program focus may offset some of the

increased oil production on an equivalent basis.

the change in our capital program focus may offset some of the

increased oil production on an equivalent basis.

• Internationally, at current prices we expect production

to be approximately flat with 3Q12, while sales volumes

increase slightly.

to be approximately flat with 3Q12, while sales volumes

increase slightly.

• We expect 4Q12 exploration expense to be about

$100 mm for seismic and drilling in our exploration

programs.

$100 mm for seismic and drilling in our exploration

programs.

Third Quarter 2012 Earnings - 4Q12 Outlook

Oil and Gas Production

Oil and Gas Production

34

35

• The fourth quarter is typically the chemical segment’s

weakest quarter.

weakest quarter.

• We estimate 4Q12 earnings will be about $140 mm,

or slightly lower than 3Q12.

or slightly lower than 3Q12.

– Along with seasonal factors, weak global demand from the

European and Asian economies and rising natural gas costs

will keep pressure on margins.

European and Asian economies and rising natural gas costs

will keep pressure on margins.

• We expect our combined worldwide tax rate in 4Q12

to increase to about 40% to 41%.

to increase to about 40% to 41%.

Third Quarter 2012 Earnings - 4Q12 Outlook

Chemicals & Taxes

Chemicals & Taxes

35

36

Third Quarter 2012 Earnings - Summary

Third Quarter 2012 Earnings - Summary

• We believe we have a deep portfolio of development opportunities

that will allow us to continue to deliver returns that are 5 to 6

percentage points above our cost of capital.

that will allow us to continue to deliver returns that are 5 to 6

percentage points above our cost of capital.

• Total return to our shareholders is the combination of

appreciation in stock price and dividends.

appreciation in stock price and dividends.

• As I have mentioned before, if we are unable to generate

value to our stockholders as measured by relative stock

performance over a reasonable period of time, the Company's

policy would then be to retain a smaller portion of its earnings

and return a larger portion to its stockholders.

value to our stockholders as measured by relative stock

performance over a reasonable period of time, the Company's

policy would then be to retain a smaller portion of its earnings

and return a larger portion to its stockholders.

• We have increased our dividends at a compounded annual rate of

15.8% over the last 10 years through 11 dividend increases.

15.8% over the last 10 years through 11 dividend increases.

• We expect to increase our dividends again next year and in the

future at a rate that would maximize returns to our stockholders.

future at a rate that would maximize returns to our stockholders.

36

37

Third Quarter 2012 Earnings - Q&A

Third Quarter 2012 Earnings - Q&A

37

|

Occidental Petroleum Corporation

|

||

|

Return on Capital Employed (ROCE)

|

||

|

Reconciliation to Generally Accepted Accounting Principles (GAAP)

|

||

|

2012

|

||

|

RETURN ON CAPITAL EMPLOYED (%)

|

12.6

|

|

|

GAAP measure - net income

|

4,262

|

|

|

Interest expense

|

87

|

|

|

Tax effect of interest expense

|

(30

|

)

|

|

Earnings before tax-effected interest expense

|

4,319

|

|

|

GAAP stockholders' equity

|

40,474

|

|

|

Debt

|

7,622

|

|

|

Total capital employed

|

48,096

|

|

|

ROCE - Annualized for the nine months of September 30, 2012

|

12.6

|

|

ROCE-ROE