Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAPITAL ONE FINANCIAL CORP | d425528d8k.htm |

| EX-99.2 - FINANCIAL SUPPLEMENT - CAPITAL ONE FINANCIAL CORP | d425528dex992.htm |

| EX-99.1 - PRESS RELEASE - CAPITAL ONE FINANCIAL CORP | d425528dex991.htm |

Third Quarter 2012

Results October 18, 2012

Exhibit 99.3 |

| Forward-Looking Statements

Please note that the following materials containing information regarding Capital One's financial

performance speak only as of the particular date or dates indicated in these materials. Capital

One does not undertake any obligation to update or revise any of the information contained herein whether as a result of new information,

future events or otherwise.

Certain statements in this presentation and other oral and written statements made by Capital One from

time to time are forward-looking statements, including those that discuss, among other

things: strategies, goals, outlook or other non-historical matters; projections, revenues, income, returns, expenses, capital measures,

accruals for claims in litigation and for other claims against Capital One, earnings per share or other

financial measures for Capital One; future financial and operating results; Capital One's plans,

objectives, expectations and intentions; the projected impact and benefits of the acquisitions of

ING Direct and HSBC's U.S. credit card business (the "Transactions"); and the assumptions

that underlie these matters. To the extent that any such information is

forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private

Securities Litigation Reform Act of 1995. Numerous factors could

cause Capital One's actual results to differ materially from those described in such forward-

looking statements, including, among other things: general economic and business conditions in the U.S.,

the U.K., Canada and Capital One’s local markets, including conditions affecting employment

levels, interest rates, consumer income and confidence, spending and savings that may affect consumer bankruptcies,

defaults, charge-offs and deposit activity; an increase or decrease in credit losses (including

increases due to a worsening of general economic conditions in the credit environment);

financial, legal, regulatory, tax or accounting changes or actions, including the impact of the Dodd-Frank Wall Street Reform and Consumer

Protection Act and the regulations promulgated thereunder and regulations governing bank capital and

liquidity standards, including Basel-related initiatives; the possibility

that

Capital

One

may

not

fully

realize

the

projected

cost

savings

and

other

projected

benefits

of

the

Transactions;

difficulties

and

delays

in

integrating

the

assets

and

businesses

acquired

in

the

Transactions;

business

disruption

following

the

Transactions;

diversion

of

management

time

on

issues

related

to

the

Transactions,

including

integration

of

the

assets

and

businesses

acquired;

reputational

risks

and

the

reaction

of

customers

and

counterparties

to

the

Transactions;

disruptions relating to the Transactions negatively impacting Capital One’s ability to maintain

relationships with customers, employees and suppliers; changes in asset quality and credit risk

as a result of the Transactions; the accuracy of estimates and assumptions Capital One uses to determine the fair value of assets

acquired

and

liabilities

assumed

in

the

Transactions,

and

the

potential

for

its

estimates

or

assumptions

to

change

as

additional

information

becomes

available

and

Capital One completes the accounting analysis of the Transactions; developments, changes or actions

relating to any litigation matter involving Capital One; the inability to sustain revenue and

earnings growth; increases or decreases in interest rates; Capital One’s ability to access the capital markets at attractive rates and

terms to capitalize and fund its operations and future growth; the success of Capital One’s

marketing efforts in attracting and retaining customers; increases or decreases in Capital

One’s aggregate loan balances or the number of customers and the growth rate and composition thereof, including increases or decreases

resulting from factors such as shifting product mix, amount of actual marketing expenses Capital One

incurs and attrition of loan balances; the level of future repurchase or indemnification requests

Capital One may receive, the actual future performance of mortgage loans relating to such

requests, the success rates of

claimants against it, any developments in litigation and the actual recoveries Capital One may make on

any collateral relating to claims against it; the amount and rate of deposit growth; changes in

the reputation of or expectations regarding the financial services industry or Capital One with respect to practices, products or

financial condition; any significant disruption in Capital One’s operations or technology platform;

Capital One’s ability to maintain a compliance infrastructure suitable for the nature of its

business; Capital One’s ability to control costs; the amount of, and rate of growth in, its expenses as its business develops or changes

or

as

it

expands

into

new

market

areas;

Capital

One’s

ability

to

execute

on

its

strategic

and

operational

plans;

any

significant

disruption

of,

or

loss

of

public

confidence in, the United States Mail service affecting Capital One’s response rates and consumer

payments; Capital One’s ability to recruit and retain experienced personnel to assist in the

management and operations of new products and services; changes in the labor and employment markets; fraud or misconduct by Capital

One’s customers, employees or business partners; competition from providers of products and

services that compete with Capital One’s businesses; and other risk factors set forth from

time to time in reports that Capital One files with the Securities and Exchange Commission, including, but not limited to, the Annual Report on

Form 10-K for the year ended December 31, 2011.

You should carefully consider the factors discussed above in evaluating these forward-looking

statements. All information in these slides is based on the consolidated results of Capital One

Financial Corporation, unless otherwise noted. A reconciliation of any non-GAAP financial measures included in this

presentation can be found in Capital One's most recent Current Report on Form 8-K filed October 18,

2012, available on its website at www.capitalone.com under "Investors."

|

| 3

October 18, 2012

Third quarter net income was $1.18B, or $2.01 per common share,

including a full quarter of acquisitions and reduced credit impacts

•

Continued strong results evident in all three business segments

•

Relatively less impact from acquisition-related credit accounting

–

HSBC-related allowance build of $0.1B in Q3 vs. $1.2B in Q2

–

Other credit accounting impacts partially offsetting

•

Principal losses absorbed by HSBC mark of $176MM in Q3 vs. $251MM in Q2

•

Deal-related non-principal reserve build of $17MM in Q3 vs. $173MM in Q2

•

Ongoing impact from acquisition-related accounting on Q3’12 pre-

provision earnings; will decline gradually

–

Premium amortization on both deals of $133MM decreased revenue

–

PCCR amortization of $127MM included in operating expenses

–

Amortization on other intangibles and other assets related to acquisitions of $42MM

included in operating expenses |

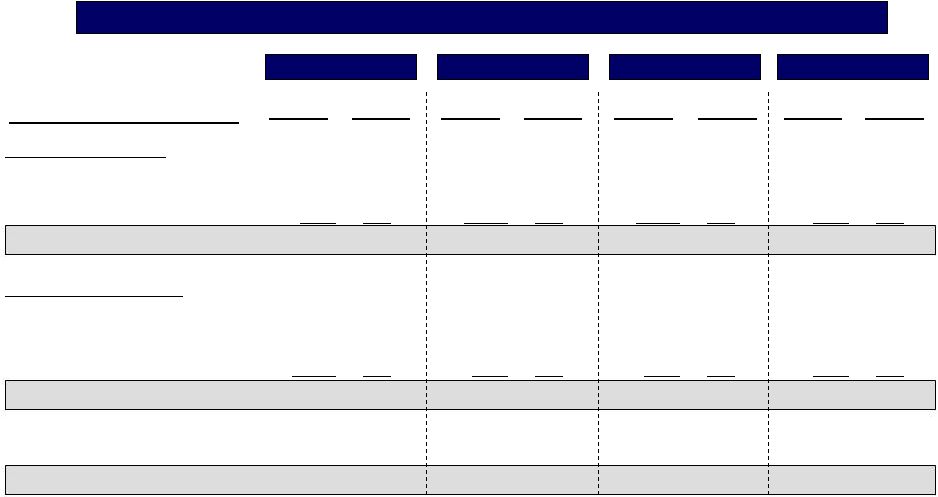

4

October 18, 2012

Third quarter results reflect continued solid business performance

Net interest income

Non-interest income

Total net revenue

Q3’12

Q2’12

Q1’12

Marketing

Operating expense

Non-interest expense

Net charge-offs

Allowance build/(release)

Provision for credit losses

Other

Pretax income from continuing operations

Income tax provision

Operating earnings, net of tax

Discontinued operations, net of tax

Pre-provision earnings

Net income

Diluted earnings per common share

4,646

1,136

5,782

316

2,729

3,045

2,737

887

156

(29)

1,014

1,723

535

1,188

(10)

1,178

$2.01

4,001

1,054

5,055

334

2,808

3,142

1,913

738

938

1

1,677

236

43

193

(100)

93

$0.16

3,414

1,521

4,935

321

2,183

2,504

2,431

780

(190)

(17)

573

1,858

353

1,505

(102)

1,403

$2.72

$MM

Q3 vs. Q2 highlights

A.

Increase in pre-

provision earnings

driven largely by full

quarter of HSBC, lower

charges on legal and

regulatory matters and

unique items

B.

Lower provision driven

largely by significantly

lower HSBC allowance

build

A

B

Wtd avg common shares outstanding

584.1

582.8

513.1

Net income avail to common stockholders

1,173

92

1,396

2

1

1

HSBC closed on 5/1/2012; includes partial quarter impacts of acquisition

2

ING Direct closed on 2/17/2012; includes partial quarter impacts of acquisition

and bargain purchase gain of $594MM recognized in non-interest

income |

5

October 18, 2012

The impact of acquisitions on NIM has largely played through

Yield/

Rate

Yield/

Rate

Average

Balance

Yield/

Rate

Average

Balance

Average

Balance

Average

Balance

Yield/

Rate

Q3’12

Average Balances & Margin Highlights

(Dollars in millions)

Interest-earning assets:

Loans held for investment

$

202,856

9.66

%

Investment securities

57,928

2.31

Cash equivalents and other

6,019

1.20

Total interest-earning assets

$

266,803

7.88

%

Interest-bearing liabilities:

Total interest-bearing deposits

$

193,700

0.77

%

Securitized debt obligations

13,331

1.92

Senior and subordinated notes

3.08

Other borrowings

2.91

Total interest-bearing liabilities

$

1.06

%

Impact of non-interest bearing funding

0.15

%

Net interest margin

6.97

%

11,035

12,085

230,151

Q2’12

$

192,632

8.84

%

56,972

2.35

15,415

0.67

$

265,019

6.97

%

$

195,597

0.76

%

14,948

1.85

3.10

3.72

$

1.06

%

0.13

%

6.04

%

11,213

9,257

231,015

Q1’12

$

152,900

9.56

%

50,543

2.36

16,803

0.62

$

220,246

7.23

%

$

151,625

0.82

%

16,185

1.98

3.43

3.61

$

1.20

%

0.17

%

6.20

%

10,268

9,541

187,619

Q4’11

$

131,581

10.46

%

39,005

2.50

5,685

1.20

$

176,271

8.40

%

$

109,914

0.96

%

16,780

1.91

3.48

4.41

$

1.43

%

0.25

%

7.22

%

10,237

7,794

144,725 |

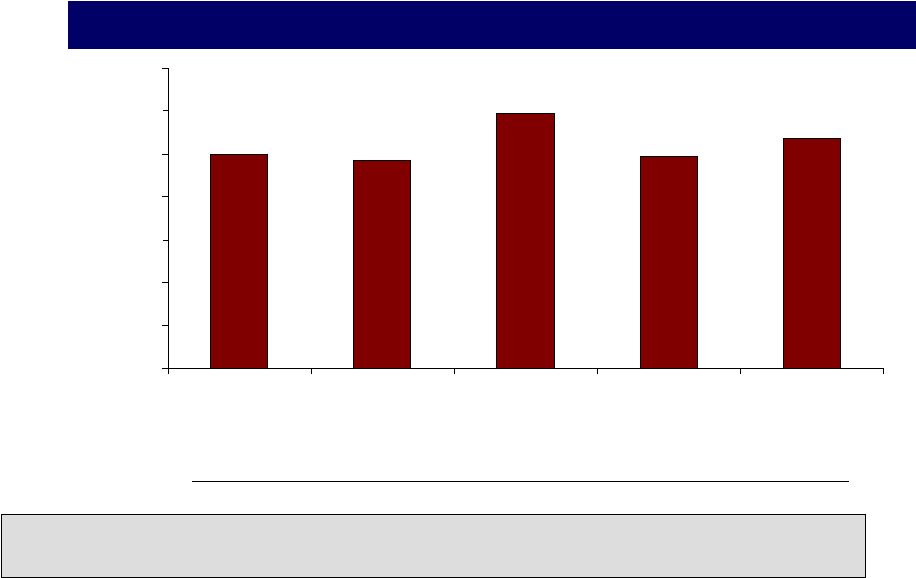

6

October 18, 2012

Our capacity to generate capital is strong

Tier 1 Common Ratio (Basel I)

10.0%

9.7%

11.9%

9.9%

10.7%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

Q3'11

Q4'11

Q1'12

Q2'12

Q3'12

Disallowed DTA

RWA

EOP Loans

Tier 1 common capital

excluding disallowed DTA

($B)

Tier 1 common capital

(0.2)

149

130

15.1

14.9

(0.5)

156

15.6

15.1

136

(0.9)

183

22.6

21.7

174

216

22.3

21.5

203

(0.8)

1

Tier 1 common ratio is a regulatory capital measure calculated based on Tier 1 common capital divided

by risk-weighted assets. See "Exhibit 99.2—Table 13: Reconciliation of

Non-GAAP Measures and Calculation of Regulatory Capital Measures" for the calculation of this ratio.

218

23.5

23.3

203

(0.2)

1 |

| 7

October 18, 2012

We expect to meet an assumed Basel III capital target of 8% in 2013

•

We expect the Basel II rules will apply to us no earlier than January of 2016 but are

assumed to be fully implemented in our Basel III estimates

–

We expect to trigger Basel II status at the end of 2012

–

We will enter parallel run in 2015

•

Our Q3’12 estimated Basel III equivalent for Tier 1 common ratio is in the high 7%

range

–

Includes preliminary analysis of RWA (denominator) impacts of Basel II, and capital (numerator)

impacts of Basel II and Basel III

–

Is

adjusted

for

scheduled

amortization

of

PCCR

and

capital

punitive

securities

by

2016

•

We expect to be above an assumed target of 8% (Basel III Tier 1 common ratio) in

2013

1

2

1

Estimated based on our current interpretation, expectations and understanding of

the Basel III capital rules and other capital regulations proposed by

U.S. regulators and the application of such rules to our businesses as currently

conducted. Basel III calculations are necessarily subject to change

based on, among other things, the scope and terms of the final rules and

regulations, model calibration and other implementation guidance, changes

in our businesses and certain actions of management, including those affecting

the composition of our balance sheet. We believe this ratio provides

useful information to investors and others by measuring our progress against

expected future regulatory capital standards.

2

Our assumed 8% Basel III Tier 1 common ratio target assumes a SIFI buffer of 50

bps and a further buffer of 50 bps. Actual target will depend on

regulatory expectations and business judgments. See Note 1 above for more

information on Basel III calculations. |

8

October 18, 2012

Consumer Banking

Commercial Banking

Domestic Card

Our businesses continue to deliver solid results

•

Ending loans declined by 0.2%

in the quarter

–

Excluding expected HSBC

and IL run-off, card grew

0.4%, in line with normal

seasonal patterns

•

Purchase

volumes

grew

9.1%

year-over-year

•

Net revenue margin of 17.1%

•

Charge-offs were 3.04%

–

Charge-offs suppressed by

89bps from purchase

accounting

–

Seasonally low quarter for

charge-offs

•

Steady growth continued with

ending loans up 3% in the

quarter and 15% year-over-

year

•

Revenue was up 2% in the

quarter and 11% year-over-

year

•

Charge-offs for the quarter

were zero, as recoveries offset

charge-offs

•

Modest decline in ending loan

balances

–

$2.0B expected run-off of

Home Loans

–

$1.2B growth in Auto loans

•

Revenue increased by 5%

quarter-over-quarter

–

Valuation of retained

mortgage interests

–

Growth in average Auto

loans

•

Charge-offs were 0.83%, up

35bps quarter-over-quarter,

consistent with normal Auto

seasonality

1

Reported purchase volume growth of 40.6% year-over-year, including the impact of the HSBC

acquisition 1 |

9

October 18, 2012

Despite strong underlying growth, we expect significant run-off will

drive declining average loan balances in 2013

Underlying Growth

Portfolio Run-off

(expected 2013 run-off, ending loan balances)

•

Solid growth where we’re investing to grow:

–

Parts of Domestic Card

–

Auto Finance

–

Commercial Banking

•

Risks

–

Continued weak consumer demand

–

Increased competitive intensity

–

Uncertain economic, regulatory, and

rate environment

•

Increasing divergence between ending and

average loan balances

•

Consumer Banking (~$9 billion)

–

Home Loans inherited in acquisitions

•

Domestic Card (~$2 billion)

–

High-margin, high-loss portions of HSBC

U.S. credit card portfolio

–

Small amount of remaining run-off of

installment loans

•

Commercial Banking (~$140 million)

–

Small Ticket CRE inherited in acquisitions |

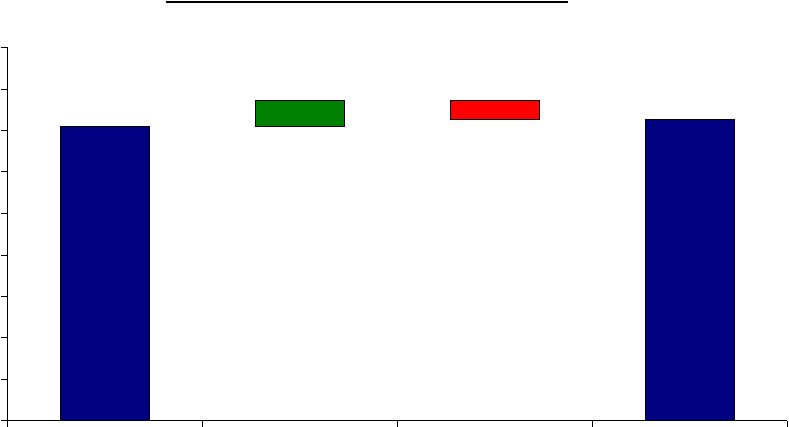

10

October 18, 2012

17.08%

17.26%

(0.45%)

0.63%

10%

11%

12%

13%

14%

15%

16%

17%

18%

19%

Q3'12

Removal of Purchase

Accounting Impacts

Removal of

Seasonality

Adjusted Q3'12

Third quarter Domestic Card revenue margin is seasonally high

Domestic Card Revenue Margin

Q3’12 |

11

October 18, 2012

We expect Domestic Card revenue margin to decline from Q3 levels

Estimated Quarterly Revenue Margin Impacts

(cumulative basis point impact from Q3’12)

Q4’12

Q1’13

Q2’13

Q3’13

Q4’13

(10)

(30)

(40)

(40)

(50)

(1)

(5)

(9)

(12)

(15)

?

?

?

?

?

Franchise Enhancements

Align HSBC practices, payment

protection runoff, other

Mix Shift / Runoff

Higher yielding HSBC branded

book assets running off

Other Factors

Competitive, credit, and

interest rate environment |

12

October 18, 2012

Expected 2013 trends for non-interest expense items are emerging in the

second half of 2012

Integration and

Purchase

Accounting

Synergies

Investments

Marketing

•

2013 marketing

expense of

approximately

$1.5B

•

Infrastructure and

customer

investments in 2013

similar to Q3’12

levels

•

Operating expense

investments to drive

Auto and

Commercial loan

growth similar to

Q3’12 levels

•

Majority of expected

synergies already

reflected in Q3’12

operating expense

•

Integration costs

and purchase

accounting

impacts in 2013

similar to Q3’12

levels

Operating Expense |

13

October 18, 2012

Solid Business Results

in a Challenging

Environment

Strong Returns and

Capital Generation

Sure-footed

Integrations

We remain focused on delivering sustained shareholder value |

14

October 18, 2012 |