Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCLARO, INC. | d340407d8k.htm |

| EX-99.1 - PRESS RELEASE - OCLARO, INC. | d340407dex991.htm |

Alain

Couder Chairman & CEO

Jerry Turin

CFO

Shining light on photonic innovation ™

Exhibit 99.2

Q3 Fiscal Year 2012 Summary |

©

Oclaro ™

2

Forward Looking Statements

Safe Harbor Statement This

presentation, including the statements made by management, contain statements about management’s future

expectations, plans or prospects of Oclaro, Inc. and its business, and together with

the assumptions underlying these statements, constitute forward-looking

statements for the purposes of the safe harbor provisions of The Private Securities Litigation Reform Act

of 1995. These forward-looking statements include statements concerning (i)

financial targets and expectations, and progress toward our targeted business

model, including financial guidance for the fiscal quarter ending March 31, 2012 regarding revenue,

non-GAAP gross margin and Adjusted EBITDA, (ii) the impact to our operations and

financial condition attributable to the flooding in Thailand, and our recovery

efforts related to the flooding, (iii) sources for improvement of gross margin and operating

expenses, (iv) the progress on our strategic initiatives, including our merger with

Opnext, (v) our cash position and financial resources, and (vi) our position

with respect to our product roadmap and our ability to introduce new products. Such statements

can be identified by the fact that they do not relate strictly to historical or current

facts and may contain words such as “anticipate,”

“estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “should,” “outlook,” “could,” “target,” and other

words and terms of similar meaning in connection the any discussion of future

operations or financial performance. There are a number of important

factors that could cause actual results or events to differ materially from those indicated by such forward-

looking statements, including (i) the impact to our operations and financial condition

attributable to the flooding in Thailand, (ii) the impact of continued

uncertainty in world financial markets and any resulting reduction in demand for our products, (iii) our

ability to maintain our gross margin, (iv) the effects of fluctuating product mix on

our results, (v) our ability to timely develop and commercialize new products,

(vi) our ability to respond to evolving technologies and customer requirements, (vii) our

dependence on a limited number of customers for a significant percentage of our

revenues, (viii) our ability to effectively compete with companies that have

greater name recognition, broader customer relationships and substantially greater financial,

technical and marketing resources than we do, (ix) the future performance of Oclaro,

Inc. following the closing of acquisitions and mergers, (x) our ability to

efficiently and effectively transition to an outsourced back-end assembly and test model over the

next three years, (xi) the potential inability to realize the expected benefits and

synergies of acquisitions and mergers, (xii) increased costs related to

downsizing and compliance with regulatory compliance in connection with such downsizing,

competition and pricing pressure, (xiii) the potential lack of availability of credit

or opportunity for equity based financing, (xiv) the risks associated with our

international operations, (xv)the outcome of tax audits or similar proceedings, (xvi) the outcome of

pending litigation against the company, (xvii) our ability to increase our cash

reserves and obtain financing on terms acceptable to us, and (xviii) other

factors described in Oclaro's most recent annual report on Form 10-K, most recent quarterly reports on Form

10-Q and other documents we periodically file with the SEC. The

forward-looking statements included in this presentation represent Oclaro's

view as of the date of this announcement. Oclaro anticipates that subsequent events and developments may

cause Oclaro’s views and expectations to change. Oclaro specifically

disclaims any intention or obligation to update any forward-looking

statements as a result of developments occurring after the date of this presentation. |

©

Oclaro 2011

3

FY12 Q3 Result |

©

Oclaro ™

4

Summary of Q3 FY 2012

•

Revenues of $88.7 million; $4 million negative impact due to short-term work

stoppage in Shenzhen.

•

Non-GAAP gross margins: 16% compared to guidance range of 14% to 19%.

•

Adjusted EBITDA ($9.9M) compared to guidance range of ($13.5M) to ($9M).

•

Cash position at $51.1M on March 31, 2012 (includes additional $6 million

drawn under line of credit) compared to $54.2 million end of December

2011.

•

Progress on strategic initiatives continues for long-term scalability and to

maximize our long term return on invested capital:

Thailand flood recovery largely complete. Final products (WSS,

modulators) to return to full capacity by end June.

Cost reduction and margin improvement progressing, demonstrated

by on-target Q3 2012 non-GAAP gross margin and adjusted EBITDA

results.

Back end assembly and test to be outsourced completely within

three years, through Fabrinet agreement and transition to Venture.

Merger announced with Opnext

to establish new industry leader with

broad product portfolio, technology innovation, engineering

resources, cost structure and strategic customer relationships

expected to expand growth and long-term shareholder value.

Financial Summary

Financial Summary

for March Quarter

for March Quarter

Progress on

Progress on

Strategic Initiatives

Strategic Initiatives |

©

Oclaro ™

New Telecom

Product

Momentum

•

Joint

collaboration

with

Huawei

–

Oclaro

optimized

performance of tunable InP laser to deliver ultra-fast switching

capability.

•

New tunable 100G DWDM CFP transceiver that utilizes 4x28G

wavelengths to deliver a 2.5x improvement in spectral

efficiency.

•

New family of intra-node amplifiers offsets losses inside 100G,

400G, and 1T channel ROADM network architectures

•

Oclaro MI8000XM 100G coherent transponder module now

fully integrated with Oclaro components.

•

Industry’s first 1x23 WSS with 10X faster switching speeds.

•

40G and 100G coherent portfolio strengthened:

•

New micro-ITLA delivers 3x reduction in size

•

100G coherent receiver reduces form factor by 50%

•

New 40G and 100G modulators now in volume

production

New Product Momentum

5 |

©

Oclaro ™

6

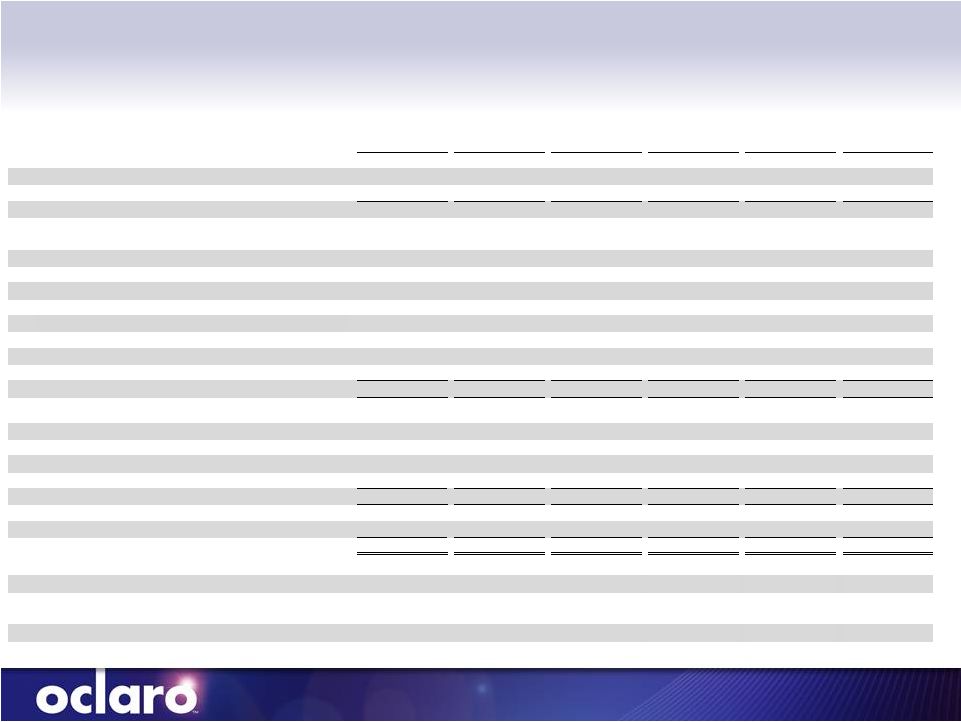

Financial Results

(1)

Telecom Components include lasers, modulators, laser pumps, receivers and integrated

lasers and modulators. (2)

Transmission Modules include 10G and 40G transponders and transceivers.

(3)

Amplification, Filtering & Optical Routing includes amplifiers, micro-optics,

dispersion compensation, wavelength select switching (WSS) modules, and

subsystems and ROADM line cards. (4)

Industrial & Consumer includes high power lasers and VCSELs.

(5)

See tabular reconciliation to comparable GAAP numbers on page 15.

$ millions

FQ2-11

DEC-10

FQ3-11

MAR-11

FQ4-11

JUN-11

FQ1-12

SEP-11

FQ2-12

DEC-11

FQ3-12

Mar-12

Telecom Components

1

$ 35.8

$ 33.9

$ 31.1

$ 24.8

$ 22.3

$ 23.5

Transmission Modules

2

24.9

24.2

22.2

24.0

31.4

28.3

Amplification, Filtering & Optical

Routing

3

47.4

44.2

41.2

40.0

20.6

23.6

Industrial & Consumer

4

12.3

13.4

14.6

17.1

12.2

13.3

Total Revenues

120.3

115.7

109.2

105.8

86.5

88.7

Gross Profit (non-GAAP)

36.1

28.8

25.0

24.3

11.3

14.1

Gross Margin %

30%

25%

23%

23%

13%

16%

R&D (non-GAAP)

5

15.3

16.9

18.5

17.3

16.7

14.7

SG&A (non-GAAP)

5

14.2

15.2

15.8

16.6

13.5

14.0

Non-GAAP Operating Income

$ 6.6

$ (3.3)

$ (9.4)

$ (9.6)

$

(18.9)

$

(14.6)

Adjusted EBITDA

$ 10.1

$ 0.7

$ (4.7)

$ (4.5)

$ (14.3)

$ (9.9) |

©

Oclaro ™

7

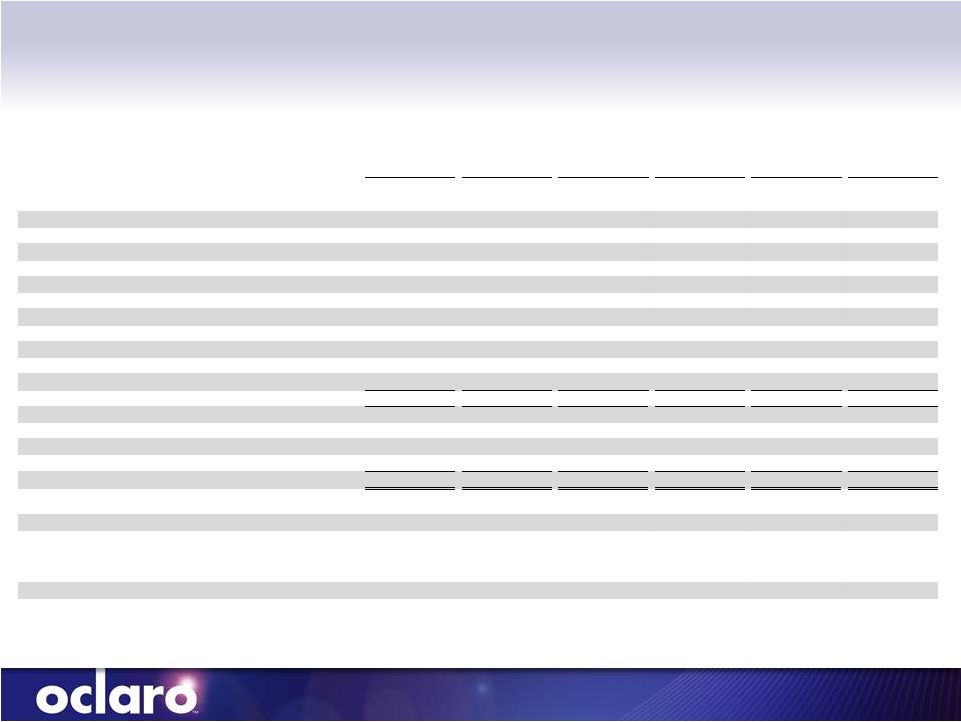

Q3 FY2012 Financial Summary and Q4 Outlook

(G) –

Guidance Range as of April 26, 2012

Gross Margin %

Revenue ($M)

Adjusted EBITDA ($M)

Outlook FY Q4 2012

Revenue (G)

Gross Margin (G)

(Non-GAAP)

Adj. EBITDA (G)

$100M to 109M

19% to 23%

($6.5M) to ($1M)

(Non-GAAP) |

©

Oclaro ™

8

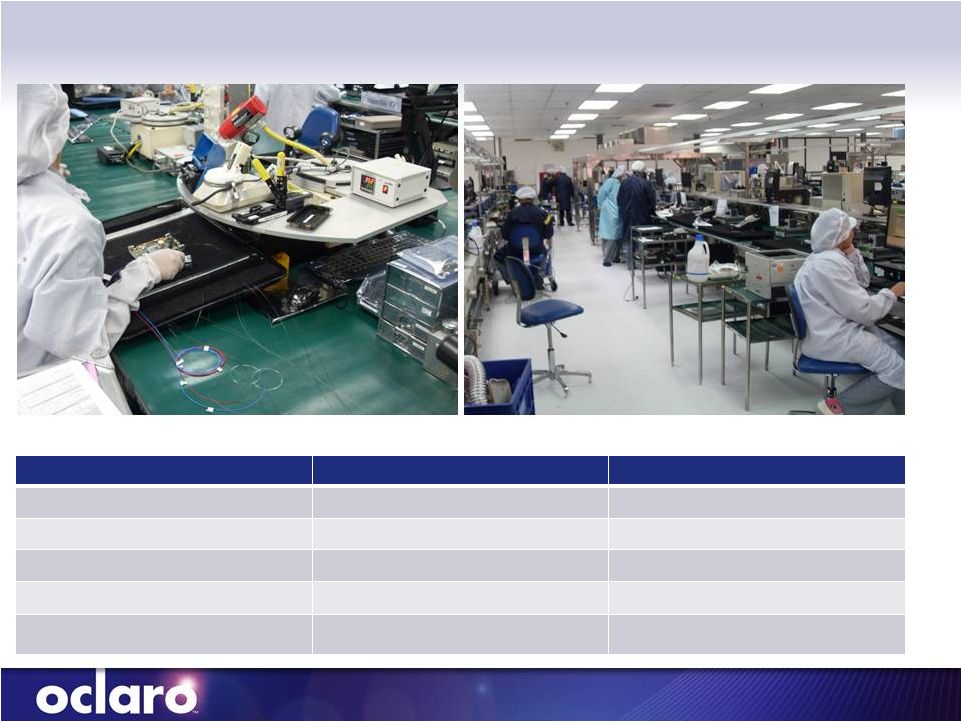

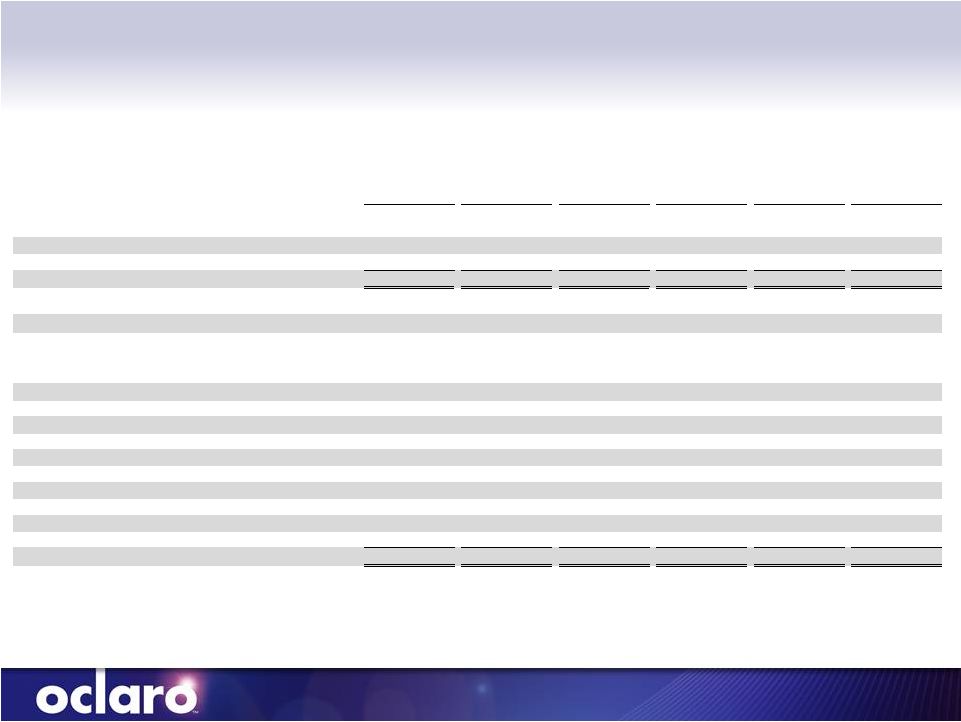

Thailand Flood Recovery Efforts

Fabrinet Pinehurst Restart*

Commercial Shipments

Pre-Flood Production Capacity Expected

High Powered Lasers

November 2011

Achieved

Tunable Dispersion Compensators

End January

February

Amplifiers

December

March

Lithium Niobate External Modulators

January

June

WSS (shipments continue from other Western

sites)

May

June |

©

Oclaro ™

Q3 FY2012 Summary

•

Revenue impacted by flood and short-term work stoppage in

Shenzhen

•

Our focus on execution resulted in gross margin and Adjusted

EBITDA within guidance ranges

•

Making progress on strategic initiatives for long-term scalability of

our business and to maximize long-term return on invested

capital:

9

-

Through the Fabrinet agreement and transition to Venture,

back-end assembly and test expected to be outsourced

completely within three years

-

Proposed merger with Opnext expected to put us in the #2

position in the optical components and modules market.

Integration planning progressing with close targeted for July

-

Working to have plans in place to be non-GAAP operating

margin positive in the December 2012 quarter and to realize

$35M to $45M of annualized synergies by the December 2013

quarter |

©

Oclaro ™

10

Trended Financial Slides |

©

Oclaro ™

11

Non-GAAP Financial Measures

Oclaro provides certain supplemental non-GAAP financial measures to its investors

as a complement to the most comparable GAAP measures. The GAAP measure most

directly comparable to non-GAAP gross margin rate is gross margin rate. The GAAP

measure most directly comparable to non-GAAP operating income/loss is operating

income/loss. The GAAP measure most directly comparable to non-GAAP net

income/loss and Adjusted EBITDA is net income/loss. An explanation and reconciliation

of each of these non-GAAP financial measures to GAAP information is set forth

below.

Oclaro believes that providing these non-GAAP measures to its investors, in

addition to corresponding income statement measures, provides investors the

benefit of viewing Oclaro’s performance using the same financial metrics that the

management team uses in making many key decisions and evaluating how Oclaro’s

“core operating performance” and its results of operations may look in

the future. Oclaro defines “core operating performance” as its on-going performance in the

ordinary course of its operations. Items that are non-recurring or do not

involve cash expenditures, such as impairment charges, income taxes,

restructuring and severance programs, costs relating to specific major projects, such as acquisitions,

non-cash compensation related to stock and options and certain expenses related to

flooding in Thailand, including impairment of fixed assets and inventory, are

not included in Oclaro’s view of “core operating performance.” Management

does not believe these items are reflective of Oclaro’s ongoing core operations

and accordingly excludes those items from non-GAAP gross margin rate,

non-GAAP operating income/loss, non-GAAP net income/loss and Adjusted EBITDA.

Additionally, each non-GAAP measure has historically been presented by Oclaro as a

complement to its most comparable GAAP measure, and Oclaro believes that the

continuation of this practice increases the consistency and comparability of

Oclaro’s earnings releases.

Non-GAAP financial measures are not in accordance with, or an alternative for,

generally accepted accounting principles in the United States of America.

Non-GAAP measures should not be considered in isolation from or as a substitute for financial

information presented in accordance with generally accepted accounting principles, and

may be different from non-GAAP measures used by other companies. |

©

Oclaro ™

12

Non-GAAP Financial Measures

Non-GAAP Gross Margin Rate

Non-GAAP gross margin rate is calculated as gross margin rate as determined in

accordance with GAAP (gross profit as a percentage of revenues) excluding

non-cash compensation related to stock and options. Oclaro evaluates its performance using non-GAAP gross

margin rate to assess Oclaro’s historical and prospective operating financial

performance, as well as its operating performance relative to its competitors.

Non-GAAP Operating Income/Loss

Non-GAAP operating income/loss is calculated as operating income/loss as determined

in accordance with GAAP excluding the impact of amortization of intangible

assets, restructuring, acquisition and related costs, non-cash compensation related to stock and options

granted to employees and directors, certain other one-time charges and credits and

excluding any flood related impairment of fixed assets and inventory and related

income (expenses) specifically identified in the non-GAAP reconciliation schedules set forth below.

Oclaro evaluates its performance using, among other things, non-GAAP operating

income/loss in evaluating Oclaro’s historical and prospective operating

financial performance, as well as its operating performance relative to its competitors.

Non-GAAP Net Income/Loss Non-GAAP net

income/loss is calculated as net income/loss excluding the impact of restructuring, acquisition and related costs, Thailand

flood-related expenses, non-cash compensation related to stock and options

granted to employees and directors, net foreign currency translation

gains/losses, the impact of amortization of intangible assets and certain other one-time charges and credits specifically

identified in the non-GAAP reconciliation schedules set forth below. Oclaro uses

non-GAAP net income/loss in evaluating Oclaro’s historical and

prospective operating financial performance, as well as its operating performance relative to its competitors.

Adjusted EBITDA Adjusted EBITDA

is calculated as net income/loss excluding the impact of income taxes, net interest income/expense, depreciation and

amortization, net foreign currency translation gains/losses, as well as restructuring,

acquisition and related costs, non-cash compensation related to stock and

options and certain other one-time charges and credits, including flood related impairment of fixed assets and

inventory and related income (expenses), specifically identified in the non-GAAP

reconciliation schedules set forth below. Oclaro uses Adjusted EBITDA in

evaluating Oclaro’s historical and prospective cash usage, as well as its cash usage relative to its competitors.

Specifically, management uses this non-GAAP measure to further understand and

analyze the cash used in/generated from Oclaro’s core operations. Oclaro

believes that by excluding these non-cash and non-recurring charges, more accurate expectations of its future cash

needs can be assessed in addition to providing a better understanding of the actual

cash used in or generated from core operations for the periods presented.

Oclaro further believes that providing this information allows Oclaro’s investors greater transparency and a better

understanding of Oclaro’s core cash position.

|

©

Oclaro ™

13

Income Statement (unaudited, in thousands, except per share

amounts) (Millions, except per share amounts)

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

120.3

$

115.7

$

109.2

$

105.8

$

86.5

$

88.7

$

84.6

87.3

84.5

81.8

75.6

75.0

35.7

28.4

24.7

24.0

10.9

13.7

GAAP gross margin rate

29.7%

24.6%

22.6%

22.7%

12.6%

15.4%

Operating expenses:

Research and development

15.7

17.2

18.9

17.7

17.0

15.0

Selling, general and administrative

15.1

16.1

16.7

17.5

14.4

14.9

Amortization of intangible assets

0.7

0.7

0.7

0.7

0.7

0.8

Restructuring, acquisition and related costs

0.9

1.0

1.9

(1.8)

3.2

2.2

Flood-related income (expense),net

-

-

-

-

9.1

(3.3)

Legal settlements

1.7

-

-

-

-

-

Impairment of goodwill

-

-

20.0

-

-

-

(Gain) loss on sale of property and equipment

(0.0)

0.0

0.1

0.1

0.0

(0.0)

Total operating expenses

34.1

35.1

58.3

34.2

44.5

29.6

Operating income (loss)

1.6

(6.6)

(33.6)

(10.2)

(33.6)

(15.9)

Interest income (expense), net

(0.5)

(0.5)

(0.5)

(0.2)

(0.2)

(0.3)

Gain (loss) on foreign currency translation

(1.1)

(2.0)

(2.4)

1.4

1.3

(0.3)

Other income (expense)

-

-

-

-

2.2

-

(1.6)

(2.5)

(2.9)

1.2

3.3

(0.6)

0.0

(9.2)

(36.5)

(9.0)

(30.4)

(16.5)

0.3

0.7

0.2

5.6

0.5

0.7

Net loss

(0.2)

$

(9.8)

$

(36.7)

$

(14.6)

$

(30.8)

$

(17.2)

$

Net loss per share:

Basic

(0.00)

$

(0.20)

$

(0.75)

$

(0.29)

$

(0.61)

$

(0.34)

$

Diluted

(0.00)

$

(0.20)

$

(0.75)

$

(0.29)

$

(0.61)

$

(0.34)

$

Shares used in computing net loss per share:

Basic

48.3

48.6

48.8

49.4

50.5

50.8 Diluted

48.3

48.6

48.8

49.4

50.5

50.8 OCLARO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Revenues

Cost of revenues

Gross profit

Other income (expense):

Total other income (expense)

Income (loss) before taxes

Income tax provision |

©

Oclaro ™

14

RECONCILIATION OF GAAP FINANCIAL MEASURES

TO NON-GAAP FINANCIAL MEASURES

(Millions, except per share amounts)

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

GAAP net loss

(0.2)

$

(9.8)

$

(36.7)

$

(14.6)

$

(30.8)

$

(17.2)

$

Stock-based compensation included in:

Cost of revenues

0.4

0.4

0.4

0.3

0.4

0.5

Research and development

0.4

0.3

0.4

0.4

0.4

0.3

Selling, general and administrative

0.9

0.9

0.9

0.9

0.9

0.9

Amortization expense

0.7

0.7

0.7

0.7

0.7

0.8

Restructuring, acquisition and related costs

0.9

1.0

1.9

(1.8)

3.2

2.2

Flood-related income (expense), net

-

-

-

-

9.1

(3.3)

Legal Settlements

1.7

-

-

-

-

-

Impairment of goodwill

-

-

20.0

-

-

-

(Gain) loss on foreign currency translation

1.1

2.0

2.4

(1.4)

(1.3)

0.3

5.9

(4.5)

(10.0)

(15.4)

(17.4)

(15.5)

Income tax provision

0.3

0.7

0.2

5.6

0.5

0.7

Depreciation expense

3.5

4.0

4.6

5.1

4.6

4.6

Other (income) expense items, net

-

-

-

-

(2.2)

-

Interest (income) expense, net

0.5

0.5

0.5

0.2

0.2

0.3

Adjusted EBITDA

10.1

$

0.7

$

(4.7)

$

(4.5)

$

(14.3)

$

(9.9)

$

Non-GAAP net income (loss) per share:

Basic

0.12

$

(0.09)

$

(0.21)

$

(0.31)

$

(0.35)

$

(0.31)

$

Diluted

0.12

$

(0.09)

$

(0.21)

$

(0.31)

$

(0.35)

$

(0.31)

$

Basic

48.3

48.6

48.8

49.4

50.5

50.8

Diluted

51.2

48.6

48.8

49.4

50.5

50.8

OCLARO, INC.

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES

Reconciliation of GAAP net loss to

non-GAAP net income (loss) and adjusted EBITDA:

Non-GAAP net income (loss)

Shares used in computing Non-GAAP net income

(loss) per share: |

©

Oclaro ™

15

RECONCILIATION OF GAAP FINANCIAL MEASURES

TO NON-GAAP FINANCIAL MEASURES

(Millions, except per share amounts)

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

GAAP gross profit

35.7

$

28.4

$

24.7

$

24.0

$

10.9

$

13.7

$

Stock-based compensation in cost of revenues

0.4

0.4

0.4

0.3

0.4

0.5

Non-GAAP gross profit

36.1

$

28.8

$

25.0

$

24.3

$

11.3

$

14.1

$

GAAP gross margin rate

29.7%

24.6%

22.6%

22.7%

12.6%

15.4%

Non-GAAP gross margin rate

30.0%

24.9%

22.9%

23.0%

13.0%

15.9%

GAAP operating income (loss)

1.6

$

(6.6)

$

(33.6)

$

(10.2)

$

(33.6)

$

(15.9)

$

Stock-based compensation included in:

Cost of revenues

0.4

0.4

0.4

0.3

0.4

0.5

Research and development

0.4

0.3

0.4

0.4

0.4

0.3

Selling, general and administrative

0.9

0.9

0.9

0.9

0.9

0.9

Amortization of intangible assets

0.7

0.7

0.7

0.7

0.7

0.8

Restructuring, acquisition and related costs

0.9

1.0

1.9

(1.8)

3.2

2.2

Flood-related income (expense), net

-

-

-

-

9.1

(3.3)

Legal Settlements

1.7

-

-

-

-

-

Impairment of goodwill

-

-

20.0

-

-

-

Non-GAAP operating income (loss)

6.6

$

(3.3)

$

(9.4)

$

(9.6)

$

(18.9)

$

(14.6)

$

OCLARO, INC.

Reconciliation of GAAP operating income (loss) to

non-GAAP operating income (loss):

Reconciliation of GAAP gross margin rate to

non-GAAP gross margin rate:

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES

|

©

Oclaro ™

16

RECONCILIATION OF GAAP FINANCIAL MEASURES

TO NON-GAAP FINANCIAL MEASURES

(Millions)

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

GAAP R&D expense

15.7

$

17.2

$

18.9

$

17.7

$

17.0

$

15.0

$

Stock-based compensation in R&D expense

(0.4)

(0.3)

(0.4)

(0.4)

(0.4)

(0.3)

Non-GAAP R&D Expense

15.3

$

16.9

$

18.5

$

17.3

$

16.7

$

14.7

$

GAAP SG&A expense

15.1

$

16.1

$

16.7

$

17.5

$

14.4

$

14.9

$

Stock-based compensation in SG&A expense

(0.9)

(0.9)

(0.9)

(0.9)

(0.9)

(0.9)

Non-GAAP SG&A Expense

14.2

$

15.2

$

15.8

$

16.6

$

13.5

$

14.0

$

OCLARO, INC.

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES

|

©

Oclaro ™

17

CONDENSED CONSOLIDATED BALANCE SHEETS

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Dec-10

Mar-11

Jun-11

Sep-11

Dec-11

Mar-12

Current assets:

Cash, cash equivalents and short-term

investments

77.3

$

74.9

$

62.8

$

51.1

$

53.6

$

50.5

$

Restricted cash

0.8

0.9

0.6

0.6

0.6

0.6

Accounts receivable, net

105.7

96.4

82.9

81.2

59.7

61.7

Inventories

82.8

87.5

102.2

100.5

83.3

72.7

Prepaid expenses and other current assets

15.9

17.1

16.5

12.2

11.9

11.7

Assets held for sale

-

-

-

-

-

20.3

Total current assets

282.5

276.8

264.9

245.7

209.2

217.5

Property and equipment, net

54.1

64.8

69.4

69.5

63.8

59.5

Other intangible assets, net

21.1

20.4

19.7

18.9

18.2

17.5

Goodwill

30.9

30.9

10.9

10.9

10.9

10.9

Other non-current assets

10.1

10.0

10.3

14.0

12.5

12.5

Total assets

398.7

$

403.0

$

375.2

$

358.9

$

314.6

$

317.9

$

Current liabilities:

Accounts payable

61.8

$

65.0

$

66.2

$

51.3

$

38.7

$

48.7

$

Accrued expenses and other liabilities

45.5

$

47.0

$

60.7

$

50.6

$

48.5

$

48.6

$

Credit line payable

-

-

-

19.5

19.5

25.5

Total current liabilities

107.3

112.0

126.9

121.4

106.7

122.9

Deferred gain on sale-leaseback

12.9

13.2

12.9

12.3

12.0

12.1

Other long-term liabilities

14.6

15.9

6.3

6.2

6.1

6.4

Total liabilities

134.8

141.1

146.1

140.0

124.7

141.3

Stockholders' equity:

Common stock

0.5

0.5

0.5

0.5

0.5

0.5

Additional paid-in capital

1,308.5

1,312.2

1,313.9

1,322.7

1,327.1

1,328.7

Accumulated other comprehensive income

34.3

38.5

40.7

36.4

33.7

36.1

Accumulated deficit

(1,079.5)

(1,089.3)

(1,126.1)

(1,140.7)

(1,171.5)

(1,188.6)

Total stockholders' equity

263.9

261.9

229.1

219.0

189.9

176.6

Total liabilities and stockholders’ equity

398.7

$

403.0

$

375.2

$

358.9

$

314.6

$

317.9

$

LIABILITIES AND STOCKHOLDERS’ EQUITY

ASSETS

OCLARO, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS |