Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - People's United Financial, Inc. | d308302dex991.htm |

| 8-K - FORM 8-K - People's United Financial, Inc. | d308302d8k.htm |

Acquisition of Select Citizens Bank Branches

February 28, 2012

Exhibit 99.2 |

1

Certain statements contained in this release are forward-looking in nature. These include all

statements about People's United Financial's plans, objectives, expectations and other

statements that are not historical facts, and usually use words such as "expect,"

"anticipate," "believe" and similar expressions. Such statements represent

management's current beliefs, based upon information available at the time the statements are

made, with regard to the matters addressed. All forward-looking statements are subject to

risks and uncertainties that could cause People's United Financial's actual results or financial condition

to differ materially from those expressed in or implied by such statements. Factors of particular

importance to People’s United Financial include, but are not limited to: (1) changes in

general, national or regional economic conditions; (2) changes in interest rates; (3) changes

in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels

of income and expense in non-interest income and expense related activities; (6)

residential mortgage and secondary market activity; (7) changes in accounting and regulatory

guidance applicable to banks; (8) price levels and conditions in the public securities markets

generally; (9) competition and its effect on pricing, spending, third-party relationships

and revenues; (10) the successful integration of acquired companies; and (11) changes in regulation

resulting from or relating to financial reform legislation. People's United Financial does not

undertake any obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

Forward-Looking Statement |

2

Price & Structure

•

$3.25MM

•

100% cash

Deal value:

Consideration:

Pricing Multiples

Deposit premium:

•

1.0%

Closing & Other

Due diligence:

Approvals:

Expected close:

•

Completed

•

Regulatory approvals

•

2

nd

quarter 2012

Summary of Key Terms

Acquisition Assets

•

Citizens Bank

•

$325MM

•

--

•

56

•

52 ($213MM deposits, 66% of deposits)

•

4 ($112MM deposits, 34% of deposits)

Seller:

Deposits:

Loans:

Total branches:

In-store branches:

Traditional branches:

Note: Financial data as of 12/31/2011 |

3

Unique opportunity based on People’s United’s excellent in-store

branch banking track record, longstanding relationship with Stop & Shop

and strong traditional branch network in the market

–

In each of the past 14 years, People’s United has ranked as the #1

in-store branch operator in the U.S.

*

–

Becomes the exclusive provider of banking services to Stop & Shop on Long

Island, Southern New York and Connecticut

–

Pro forma for this transaction, we will operate 139 in-store Stop & Shop

branches Strong traditional branch network is crucial for successful

in-store branch banking –

37 traditional branches on Long Island and Westchester County

–

Our traditional branches offer the full suite of services

–

Provides a lift to traffic in both in-store and traditional branches

–

Opportunity to bring average acquired in-store deposit balances up from $4MM to

our average in- store deposit balances of $29MM

Adds additional source of core deposit funding

–

Expected core deposit growth within acquired in-store branches and surrounding

traditional branches will help fund continued strong loan growth

* Source: SNL Financial. As measured by average deposits per in-store branch

among active banks with at least $500MM of in-store deposits Transaction

Rationale Transaction deepens People’s United’s presence on Long Island and in

Westchester County |

4

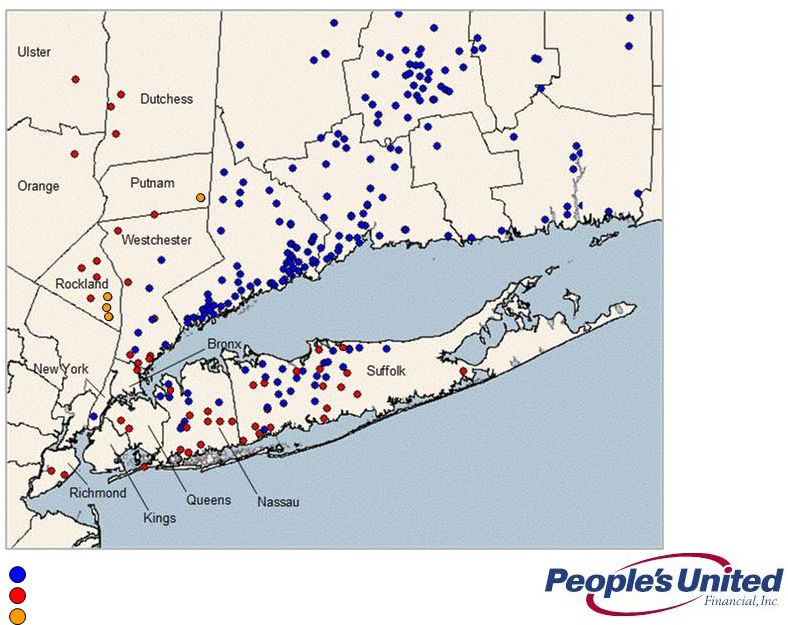

People’s United Bank branches (includes 38 traditional branches in NY)

Citizens, in-store branches (52)

Source: SNL Financial

Citizens, traditional branches (4)

Expanding Long Island, NY and Hudson Valley Footprint

Branch Map |

5

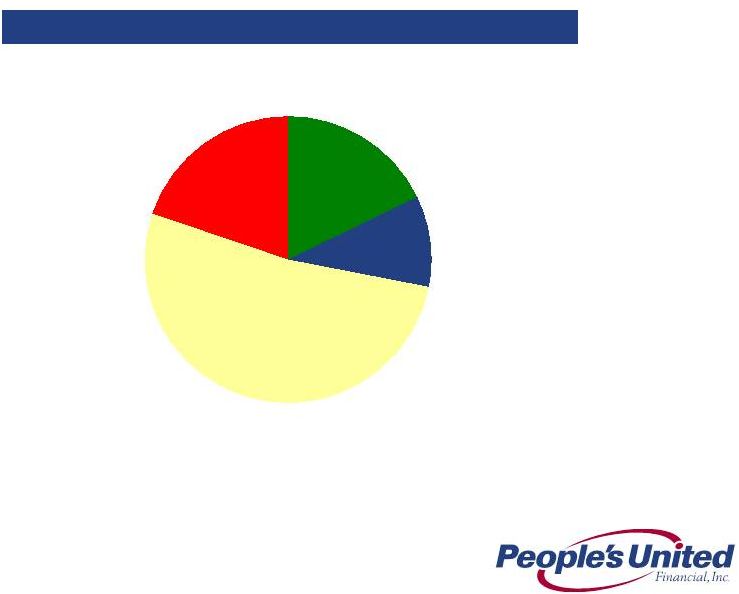

Deposits Acquired

Source: Company financials; financial data as of 12/31/2011

Cost of Deposits: 0.42%

Total Deposits: $325MM

CD

$64MM

20%

Demand

$58MM

18%

Savings

$33MM

10%

Money Market

$170MM

52%

Attractive Deposit Base |