Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CVR ENERGY INC | d299909d8k.htm |

| EX-99.1 - PRESS RELEASE, DATED FEBRUARY 13, 2012 - CVR ENERGY INC | d299909dex991.htm |

Returning Capital to Shareholders

February 13, 2012

Exhibit 99.2 |

1

1

1

1

1

We are taking action to prudently return

cash to shareholders

CVR Energy announced today its Board of Directors approved a regular quarterly cash

dividend of $0.08 per common share

–

Dividend will be payable following the end of the first quarter

–

Decision to initiate a regular quarterly dividend was reached after an extensive

review of the company’s financial performance and confidence in its

future prospects –

CVR Energy’s Board believes a regular dividend is consistent with its continuing

commitment to deliver long term value for shareholders

CVR Energy intends to sell a portion of its investment in CVR Partners

–

The net proceeds will be used to pay a special dividend to CVR Energy’s

shareholders and to strengthen the company’s balance sheet

–

Sizing broadly consistent with MLP offering precedent so that it

can provide the greatest cash return to

shareholders without significant negative impact on the market for CVR Partners

–

The size, time and manner of the sale will be disclosed when the

transaction is implemented

CVR Energy’s Board has evaluated various financial and structural alternatives

and believes these actions offer the best opportunity to enhance returns for

shareholders in a reasonable time frame with minimal execution risk or

structural impediments CVR Energy Declares Regular Quarterly Dividend and

Intends to Monetize a Portion of its Investment in CVR Partners

|

2

2

2

2

2

This plan is focused on shareholder value

Institutes a regular quarterly dividend to benefit shareholders

Monetizes a portion of the CVR Partners stake after strong post-IPO

performance Returns a majority of the after-tax sale proceeds to CVR

Energy shareholders via special dividend

Strengthens the balance sheet to better weather refining business cycles

Increases

the

float

and

liquidity

of

CVR

Partners

without

introducing

an

unproven

new

equity security to the market

Our plan provides transparency and certainty of execution and will deliver additional

immediate and long-term value to CVR Energy shareholders

|

3

3

3

3

3

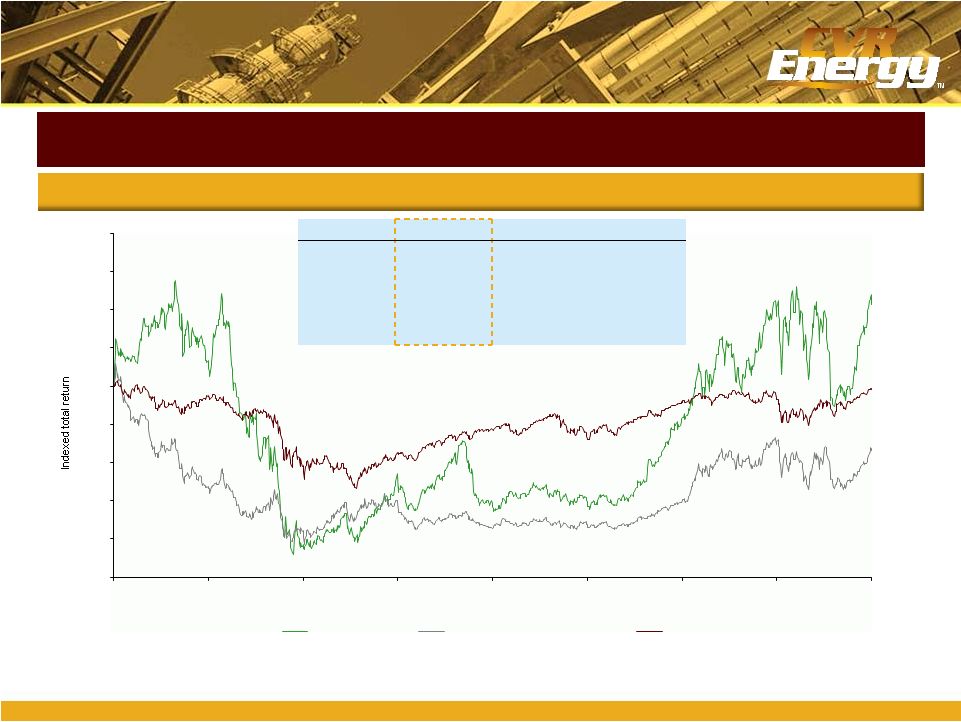

Delivering value to CVR Energy

shareholders

Note:

Total return based on period from October 22, 2007 to February 10, 2012. CVI

initial value based on IPO price of $19.00 per share. CVI total return compared to total return of

refining peers: ALJ, DK, HFC, TSO and WNR. Peer index equal weighted.

Source: Capital IQ

Refiners relative total return performance

CVI

Refining peers

S&P 500

Since IPO

43%

(34%)

(2%)

3-year

357%

77%

73%

2-year

243%

160%

31%

1-year

44%

27%

4%

1-month

29%

23%

4%

Since

IPO,

CVR

Energy

is

#1

in

total

return

among

refining

peers

and

remains focused on creating value for shareholders

0

20

40

60

80

100

120

140

160

180

Oct-07

May-08

Nov

-08

Jun

-09

Dec-09

Jun

-10

Jan

-11

Jul

-11

Feb-12

CVI

Refining Peers Index

S&P 500

(2%)

(34%)

43% |

4

4

4

4

4

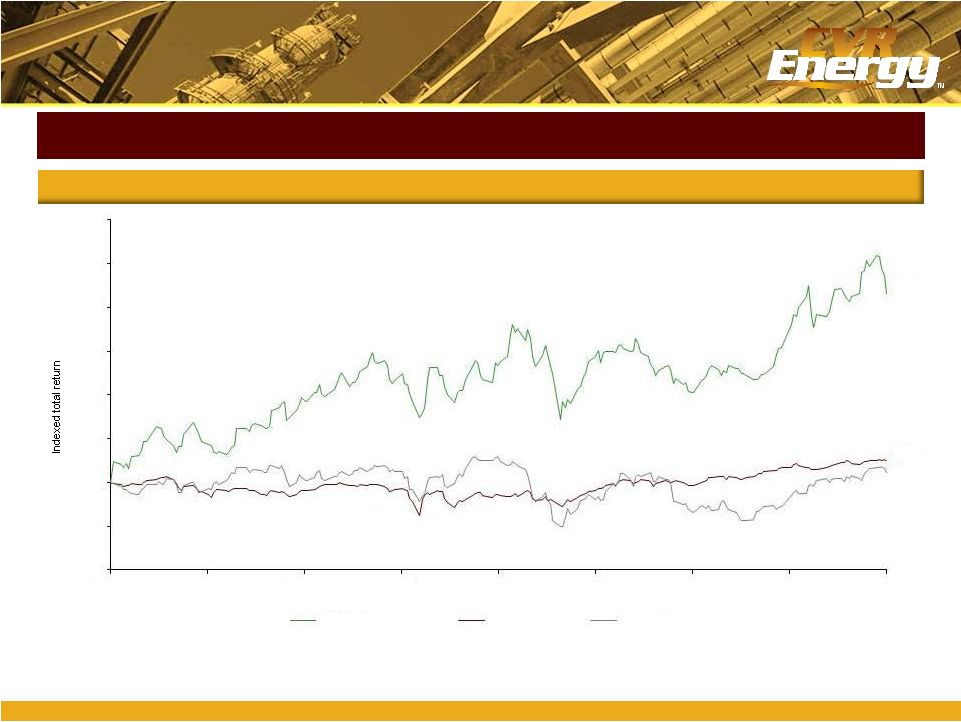

CVR Partners has outperformed the Alerian

MLP index and fertilizer corporations

Note:

Total return based on period from April 7, 2011 to February 10, 2012. CVR Partners

initial value based on IPO price of $16.00 per unit. AMZX is based on the total return of the

Alerian

MLP

index.

Corporate

fertilizer

index

equal

weighted

and

includes

AGU,

CF

and

YAR.

Performance

calculated

using

local

currency

returns.

Source: Bloomberg, Capital IQ, Alerian

Total return of UAN vs. Alerian MLP index and fertilizer corporations

CVR Partners has provided a total return of 86% since IPO

60

80

100

120

140

160

180

200

220

Apr-11

May-11

Jun

-11

Jul

-11

Sep-11

Oct-11

Nov

-11

Jan

-12

Feb-12

CVR Partners

AMZX

Corporate Fertilizer Index

86 %

10 %

4 % |

5

5

5

5

5

Your Board’s commitment to shareholders

Commitment to operational excellence

Commitment to building shareholder value in accordance with prudent capital

allocation Continuously evaluating opportunities and alternatives to enhance

value for or return cash to shareholders Transparency regarding our

objectives Identifying outcomes that deliver value to our shareholders on

a risk-adjusted basis within reasonable

timeframes

Meaningful return of capital within definitive time frame

Dividend signals our commitment to regularly return capital

Our decision came following a review of other alternatives, including a full

spin-off of CVR Partners, but our plan:

–

Provides greater certainty of shareholder return

–

Rapidly delivers cash to our shareholders

–

Maintains our ability to retain future cash and appreciation from CVR Partners

distributions –

Does not create the uncertainties related to introducing a new security without true

comparables Our principles

Our announcement today is consistent with those principles

|

6

6

6

6

6

Separating Refining and Fertilizer at this

time is not an optimal strategy

Tax-free separation is complex and requires corporate holding company for UAN

units (UAN Holdco) UAN Holdco would pay cash taxes on UAN distributions

received, with an effective tax rate in excess of 40% Separation is time

consuming and exposes shareholders to more market risk May require refinancing

of existing CVR Energy’s debt at significant premiums over par A

Fertilizer separation has significant structural, execution and valuation

risks compared with our plan Structural and execution risks

Valuation risks

UAN Holdco’s valuation would be subject to significant uncertainty

–

No true comparable companies

–

UAN’s variable distribution policy makes valuation inherently more volatile

than other corporate GP holding companies

–

Unlike other corporate GP holding companies, there are no incentive distribution

rights associated with CVR Energy’s GP interest and no associated

incremental cash flows CVR Energy and its shareholders would receive no cash

proceeds today and forego future cash and appreciation from UAN distributions

and unit sales –

Potential impact on financial flexibility, ratings and cost of debt at CVR

Energy To create value for shareholders, post-spin entities must trade at

multiples above current levels and closest peers

|

7

7

7

7

7

We have a demonstrated track record of

creating shareholder value

Operational excellence and enhancements

–

Increased total refining capacity and crude gathering

–

Expanding UAN capacity

Improving financial strength

–

Conservative leverage metrics led to Ba3 rating upgrade

–

Tactical hedging and risk management

Willing to take action

–

IPO of CVR Partners

–

Accretive and synergistic acquisition of GWEC

–

Instituting a regular quarterly dividend

–

Selling a portion of CVR Partners interest

Our plan is consistent with our commitment to creating value through operating

improvements, focused growth initiatives, conservative

capital management and structural actions |