Attached files

| file | filename |

|---|---|

| EX-99.3 - PRESS RELEASE - REX ENERGY CORP | d289363dex993.htm |

| 8-K - FORM 8-K - REX ENERGY CORP | d289363d8k.htm |

| EX-99.1 - INFORMATION REGARDING EXPECTED FINANCIAL RESULTS - REX ENERGY CORP | d289363dex991.htm |

Rex

Energy Corporation | 476 Rolling Ridge Drive | State College, PA 16801 P:

(814) 278-7267 | F: (814) 278-7286 E:

InvestorRelations@RexEnergyCorp.com www.rexenergy.com

Responsible Development of America’s Energy Resources

Rex Energy

Corporate Presentation

February 2012

Exhibit 99.2 |

2

Forward Looking Statements

Except for historical information, statements made in this presentation, including those

relating to significant potential opportunities, future earnings, resource

potential, cash flow, capital expenditures, production growth, planned number of wells

(as well as the timing of rig operations, natural gas processing plant

commissioning and operations, fracture stimulation activities and the completion of wells

and the expected dates that wells are producing hydrocarbons that are sold) and

potential ethane sales pipeline projects are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These

forward-looking statements are indicated by words such as “expected”, “expects”,

“assumes”, “anticipates” and similar words. These statements

are based on assumptions and estimates that management believes are reasonable based on

currently available information; however, management's assumptions and the company's

future performance are subject to a wide range of business risks and

uncertainties, and there is no assurance that these goals and projections can or will be

met. Any number of factors could cause actual results to differ materially from

those in the forward-looking statements, including (without limitation) the following:

adverse economic conditions in the United States and globally; the difficult and

adverse conditions in the domestic and global capital and credit markets; domestic

and global demand for oil and natural gas; sustained or further declines in the prices the company receives for oil and natural gas; the effects of

government regulation, permitting and other legal requirements; the geologic quality of

the company’s properties with regard to, among other things, the existence of

hydrocarbons in economic quantities; uncertainties about the estimates of the company’s oil and natural gas reserves; the company’s ability to

increase production and oil and natural gas income through exploration and development;

the company’s ability to successfully apply horizontal drilling techniques

and tertiary recovery methods; the number of well locations to be drilled, the cost to drill and the time frame within which they will be drilled; the

effects of adverse weather on operations; drilling and operating risks; the ability of

contractors to timely and adequately perform their drilling, construction, well

stimulation, completion and production services; the availability of equipment, such as drilling rigs and transportation pipelines; changes in the

company’s drilling plans and related budgets; the adequacy of capital resources and

liquidity including (without limitation) access to additional borrowing capacity;

and uncertainties associated with our legal proceedings and the outcome.

The company undertakes no obligation to publicly update or revise any forward-looking

statements. Further information on the company’s risks and uncertainties is

available in the company's filings with the Securities and Exchange Commission.

The company's internal estimates of reserves may be subject to revision and may be

different from estimates by the company's external reservoir engineers at year

end. Although the company believes the expectations and forecasts reflected in these and other forward-looking statements are reasonable, it can give no

assurance they will prove to have been correct. They can be affected by inaccurate

assumptions or by known or unknown risks and uncertainties. |

Estimates

Used in This Presentation 3

Hydrocarbon Volumes

The SEC permits publicly-reporting oil and gas companies to disclose “proved

reserves” in their filings with the SEC. “Proved reserves” are estimates that

geological and engineering data demonstrate with reasonable certainty to be recoverable

in future years from known reservoirs under existing economic and operating

conditions. SEC rules also permit the disclosure of “probable” and possible” reserves. Rex Energy discloses proved reserves but does not disclose

probable or possible reserves. We may use certain broader terms such as

“resource potential,” “EUR” (estimated ultimate recovery of resources, defined

below) and other descriptions of volumes of potentially recoverable hydrocarbon resources

throughout this presentation. These broader classifications do not constitute

“reserves” as defined by the SEC and we do not attempt to distinguish these classifications from probable or possible reserves as defined by SEC

guidelines.

The company defines EUR as the cumulative oil and gas production expected to be

economically recovered from a reservoir or individual well from initial production

until the end of its useful life. Our estimates of EURs and resource potential have been prepared internally by our engineers and management

without review by independent engineers. These estimates are by their nature more

speculative than estimates of proved, probable and possible reserves and

accordingly are subject to substantially greater risk of being actually realized. We

include these estimates to demonstrate what we believe to be the potential for

future drilling and production by the company. Ultimate recoveries will be dependent upon numerous factors including actual encountered geological

conditions, the impact of future oil and gas pricing, exploration and development costs,

and our future drilling decisions and budgets based upon our future evaluation of

risk, returns and the availability of capital and, in many areas, the outcome of negotiation of drilling arrangements with holders of adjacent or

fractional interest leases. Estimates of resource potential and other figures may

change significantly as development of our resource plays provide additional data

and therefore actual quantities that may ultimately be recovered will likely differ from these estimates.

Potential Drilling Locations

Our estimates of potential drilling locations are based upon our total acreage holdings

discounted by a factor derived from our historical drilling experiences and

practices. We use assumptions for well spacing based on the area of operations, i.e. 120-acre spacing for wells in the Ohio and Butler Area Utica, 84 acre

spacing for Marcellus wells and 76 acre spacing for Upper Devonian wells in the Butler

County, Pennsylvania operations. We believe these spacing assumptions are

consistent with our expected drilling operations and those used by other exploration and production companies operating in the areas in

which we operate, as well as in other unconventional shale plays. We divide our

discounted acreage holdings by the assumed acre spacing to arrive at an estimated

number of potential drilling locations. Management uses these estimates to, among other things, evaluate our acreage holdings and to formulate

plans for drilling. Any number of factors could cause the number of wells we

actually drill to vary significantly from these estimates, including: the availability

of capital, drilling and production costs, commodity prices, availability of drilling

services and equipment, lease expirations, regulatory approvals and other factors.

Potential ASP Units

Our estimates of potential target areas, which we sometimes refer to as

“units,” for which we may use an Alkali-Surfactant-Polymer (“ASP”) flood as a method

of tertiary recovery have been prepared internally by our engineers and management. These

estimates are based on our evaluation of the sand bodies underlying certain of our

properties in the Illinois Basin. We have identified certain characteristics which we believe are desirable for potential ASP projects,

including sand bodies with no less than 60 acres of areal extent and net reservoir

thickness no less than 15 feet. We have subdivided the sand bodies to determine

potential ASP target areas, which have been modeled such that no individual target area or unit would exceed 500 acres. We include these estimates

to demonstrate what we believe to be the future potential for ASP tertiary recovery for

the company. These estimates are highly speculative in nature and ultimate

recoveries will depend on a number of factors, including the ASP technology utilized, the characteristics of the sand bodies and the reservoirs,

geological conditions encountered, our decisions regarding capital, and the impact of

future oil prices. |

Rex Energy

Overview Market Data

•

NASDAQ: REXX

•

Common

shares

outstanding:

~44.9

million¹

•

~21% Ownership with corporate officers and directors

•

Share Price: $10.72²

•

Market

Capitalization:

$476

million²

•

52

Week

Price

Range:

$9.67

-

$18.00²

•

2011

December

Exit

Rate

of

54.6

Mmcfe/d³

•

Active operations in two basins:

•

Appalachia Basin

•

Illinois Basin

Balance

Sheet

&

Liquidity³

•

$10.7 million in cash

•

$225 million in debt

•

$80 million available on senior credit facility

•

Total bank commitments of $305 million

•

Senior Credit Facility of $255 million

•

Second Lien Facility initial commitment of $50 million

with ability to increase to $100 million

1. As of January 24, 2012, represents basic and diluted common shares outstanding

2. Data as of market close 1/27/2012

3. Unaudited financial data as of 12/31/2011

4 |

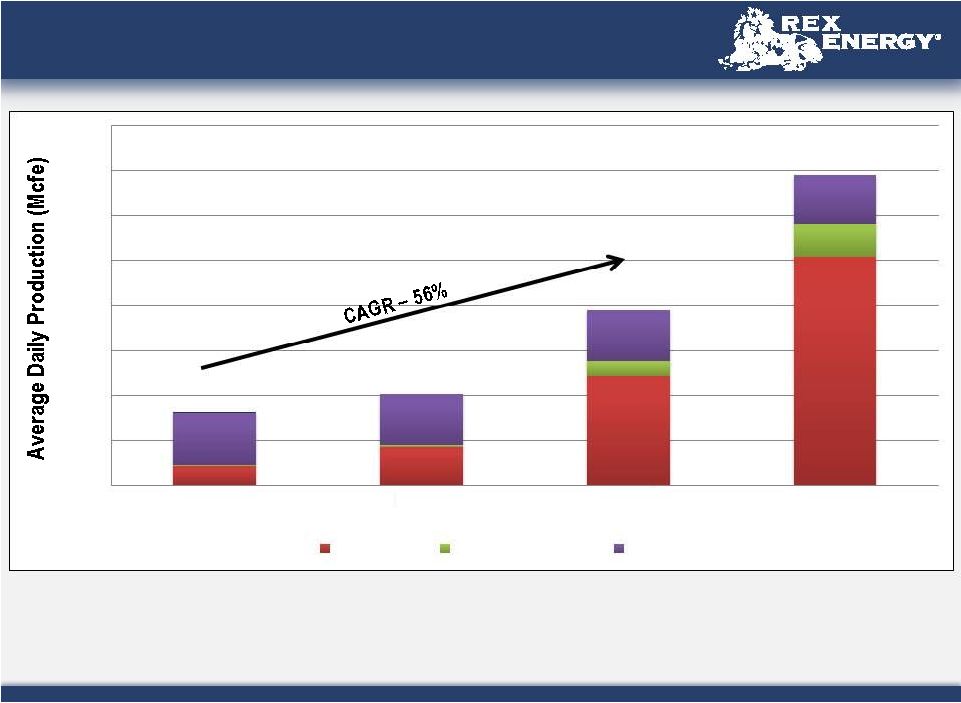

Annual

Consecutive Growth •

Compounded annual growth rate of 56% over last three years, 62% CAGR at midpoint of 2012

guidance •

Company has achieved five consecutive quarters of double digit growth since the third

quarter of 2010 5

4%

26%

92%

77%

1

1. Excludes production from discontinued operations

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

2009 (A)

2010 (A)

2011 (A)

2012 Midcase

Guidance (E)

Natural Gas

NGL & Condensate

Oil |

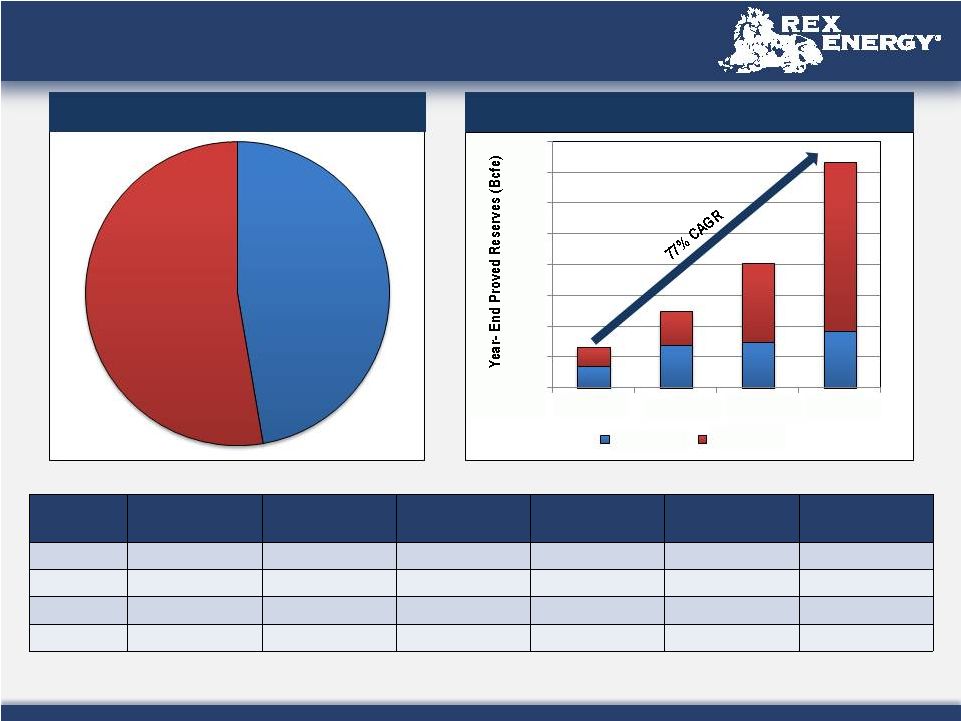

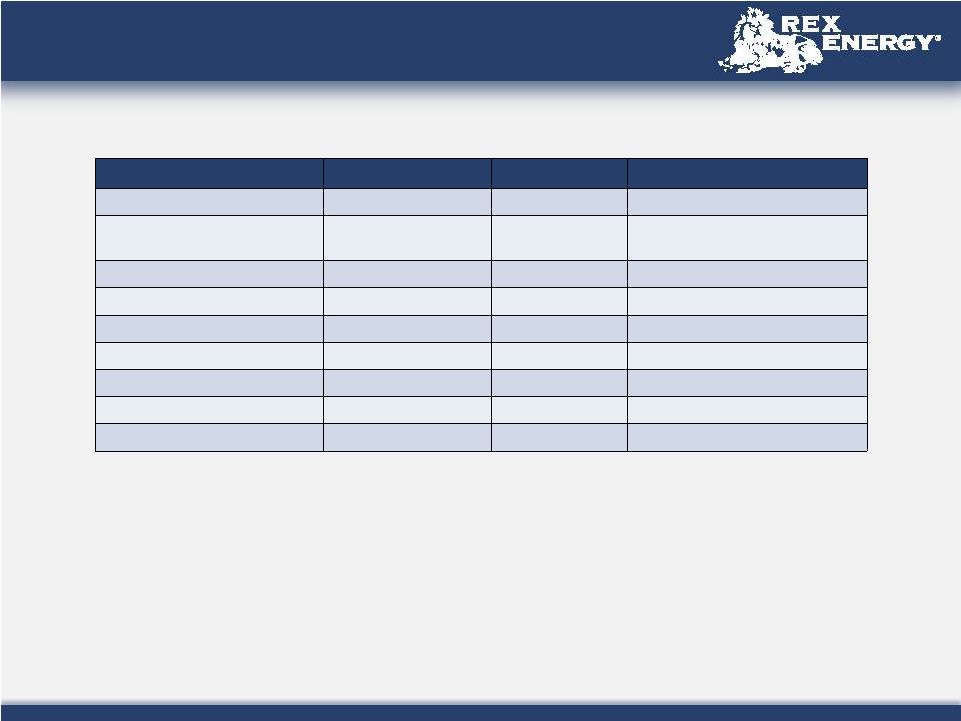

2011

Proved Reserves Year

Proved Reserves

(Bcfe)

PV-10

(Millions)

% Proved

Developed

Oil Price

Assumption

1

Natural Gas Price

Assumption

1

NGL Price

Assumption

1

2011

366.2

$ 539.6

47%

$ 92.45

$ 4.54

$ 46.34

2010

201.7

$ 269.4

42%

$ 76.03

$ 4.57

$ 31.71

2009

125.2

$ 190.5

54%

$ 57.73

$ 3.81

$ 30.27

2008

65.9

$ 84.0

62%

$ 40.50

$ 6.27

$ 19.95

6

•

Ratio of 1.27 PUD to 1 PDP in the Marcellus Shale

1. Commodity prices used were based on the 12-month unweighted arithmetic average

of the first-day-of-the-month price for 2011. For crude oil and NGL volumes, the average West Texas

Intermediate posted price of $92.71 per barrel was adjusted by lease for quality,

transportation fees and regional price differentials. For gas volumes, the average Henry Hub spot price of $4.118

per MMBTU was adjusted by lease for energy content, transportation fees and regional

price differentials. All prices were held constant throughout the life of the properties.

0

50

100

150

200

250

300

350

400

2008

2009

2010

2011

Oil & NGLs

Natural Gas

PDP

47%

PUD

53%

2011 PDP –

PUD Reserves

Proved Reserves Growth |

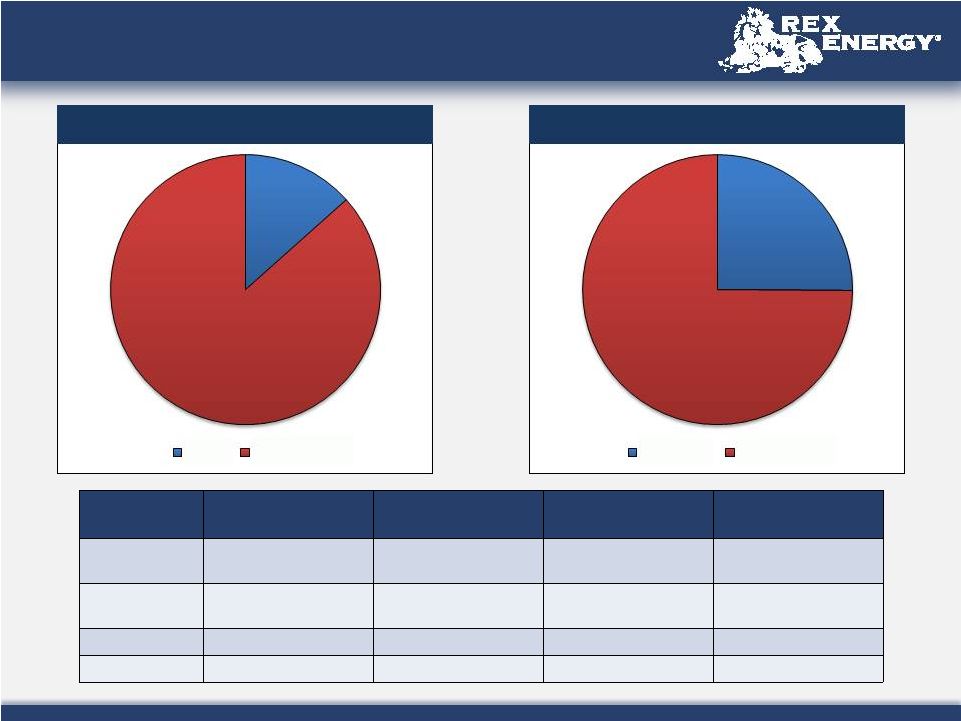

2011

Proved Reserves Area

PDP Reserves

(MMcfe)

PDNP Reserves

(MMcfe)

PUD Reserves

(MMcfe)

Total Proved

Reserves (MMcfe)

Appalachia

Conventional

4,703

-

-

4,703

Appalachia

Unconventional

111,152

8,309

192,936

312,399

Illinois Basin

48,442

646

-

49,088

Total

164,297

8,955

192,936

366,188

7

13%

87%

Illinois

Appalachia

25%

75%

Oil & NGLs

Natural Gas

2011 Reserves By Region

2011 Reserves By Commodity |

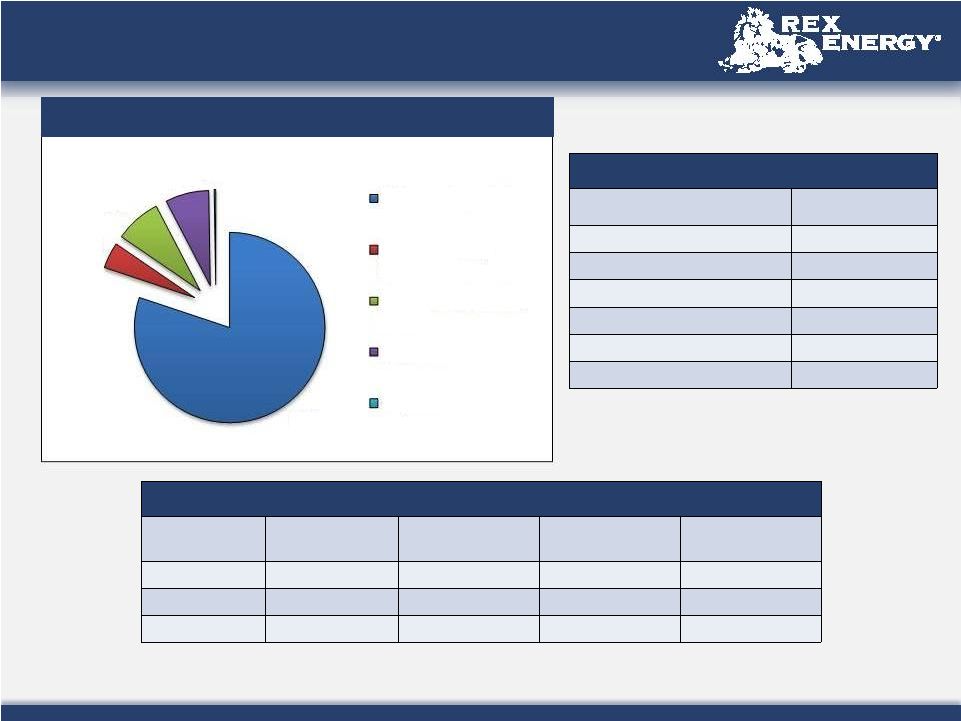

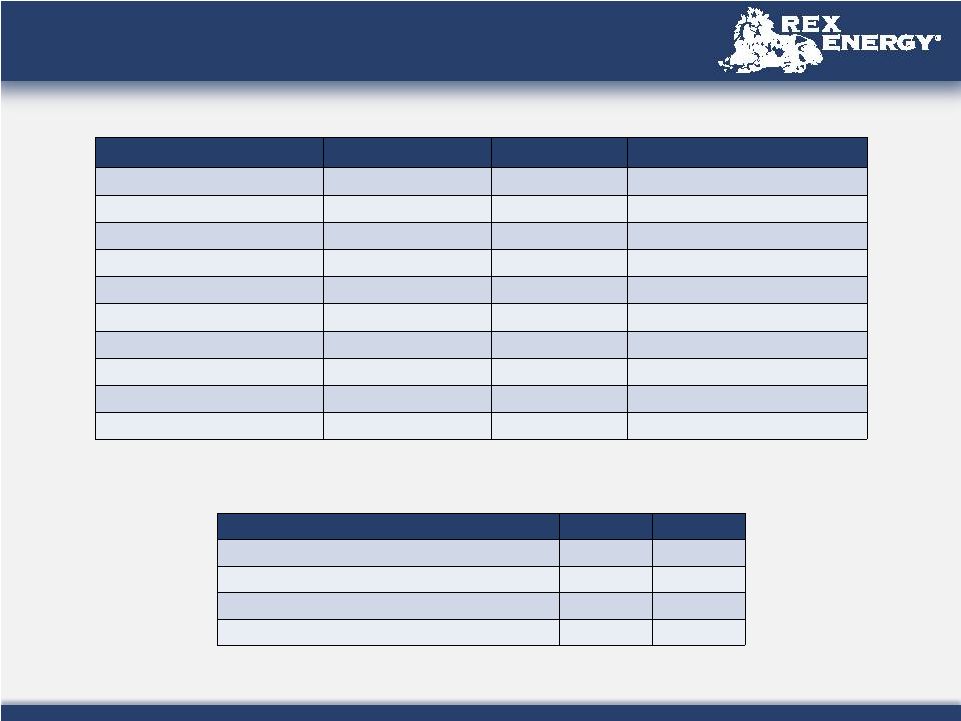

2012

Operating Capital Budget 8

Capital Budget Allocation by Activity

2012 Appalachia Drilling Program

Gross (Net)

Wells Drilled

Gross (Net) Wells

Fracture Stimulated

Gross (Net) Wells

Placed Into Service

Gross (Net) Wells

Awaiting Completion

Operated

18 (12.9)

24 (16.0)

26 (17.4)

13 (9.1)

Non-Operated

17 (6.8)

16 (6.4)

16 (6.4)

5 (2.0)

Total

35 (19.7)

40 (22.4)

42 (23.8)

18 (11.1)

2012 Capital Program Breakdown

Activity

Budget ($ in millions)

Drilling and Exploitation

152.0

Tertiary Recovery Projects

8.4

Facilities, Equipment, & HS&E

14.8

Midstream

14.0

Corporate

0.5

Total

189.7

¹

1. The company does not attempt to budget for future acquisitions of proved

and unproved oil and gas properties

80%

5%

8%

7%

0%

Drilling and Exploitation

Tertiary Recovery

Projects

Facilities, Equipment, &

HS&E

Midstream

Corporate |

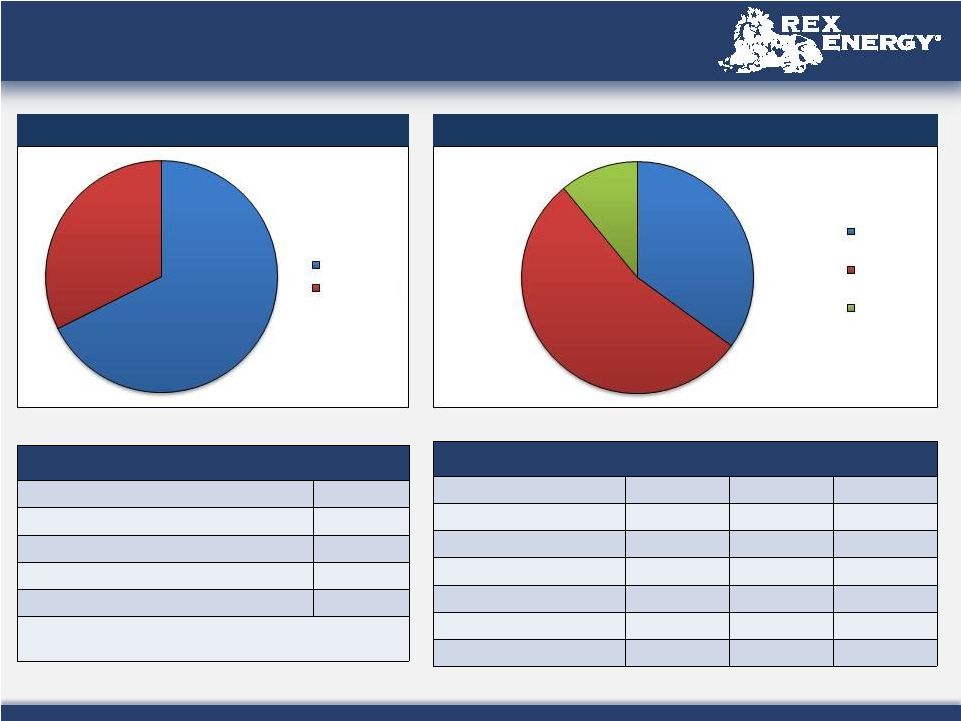

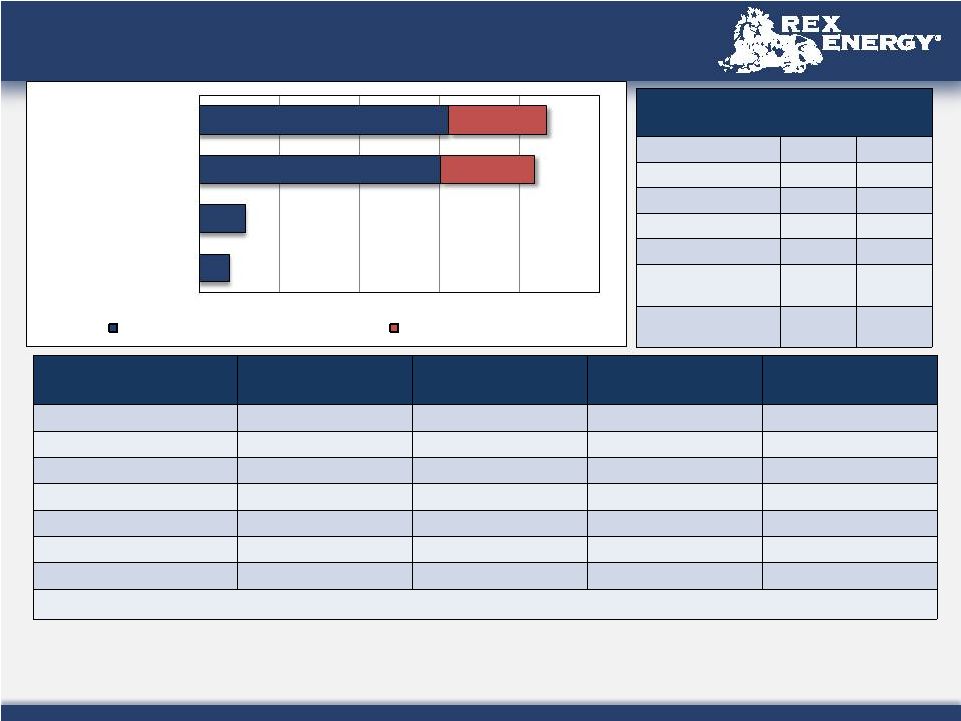

2012

Capital Program & Liquidity Analysis 2012 Capital Budget

Activity

Appalachia

Illinois

Total

Drilling and Exploitation

150.0

2.0

152.0

Tertiary Recovery Projects

-

8.4

8.4

Facilities, Equipment, & HS&E

4.1

10.7

14.8

Midstream

14.0

-

14.0

Corporate

-

-

0.5

Total

168.1

21.1

189.7

Liquidity Sources (Uses)

Cash and Cash Equivalents¹

$ 10.7

Existing Borrowing Base Debt Available¹

$ 80.0

Estimated Proceeds From Asset Divestitures

$ 100.0

Total Sources

$ 190.7

Capital Expenditures

(189.7)

*Future 2012 cash flows, borrowing base increases and

availability under second lien facility will add to liquidity position

Capital Expenditures by Commodity

Capital Expenditures by Operatorship

9

1. Unaudited financial results as of 12/31/2011

35%

54%

11%

Dry Gas

Wet Gas and

Gas Liquids

Oil

68%

32%

Operated

Non-Operated |

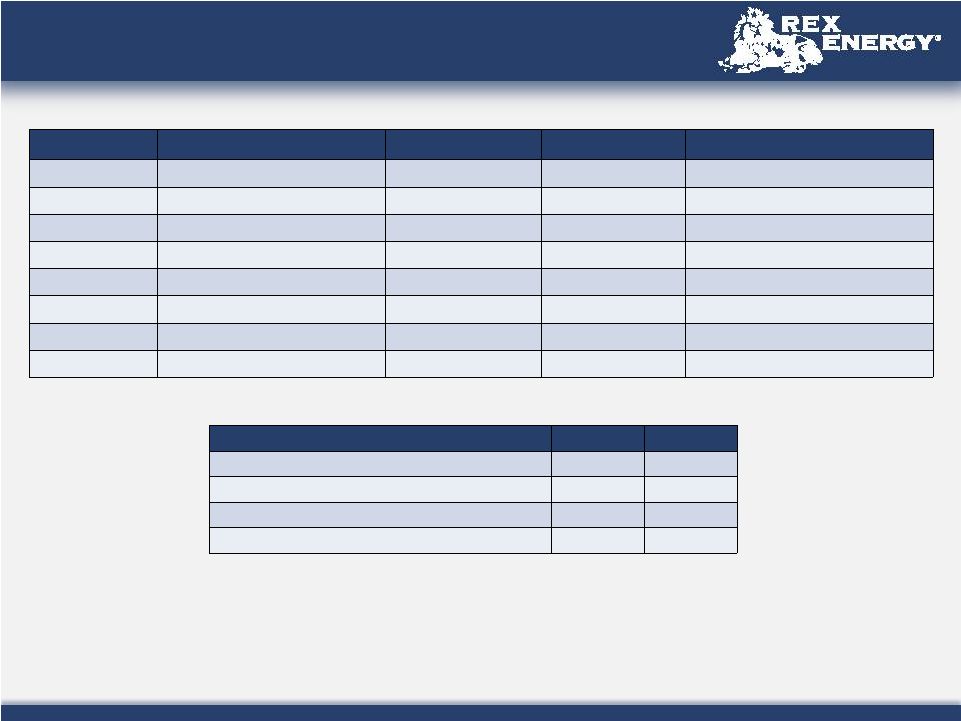

First

Quarter and Full Year 2012 Guidance First Quarter

2012

Full Year

2012

Average Daily Production

56.0 –

60.0 Mmcfe/d

66.0 –

72.0 Mmcfe/d

Lease Operating Expense

$11.0 –

12.0 million

$50.0 –

55.0 million

Cash G&A

$5.0 –

6.0 million

$20.0 –

24.0 million

Capital Expenditures

N/A

$189.7 million

10 |

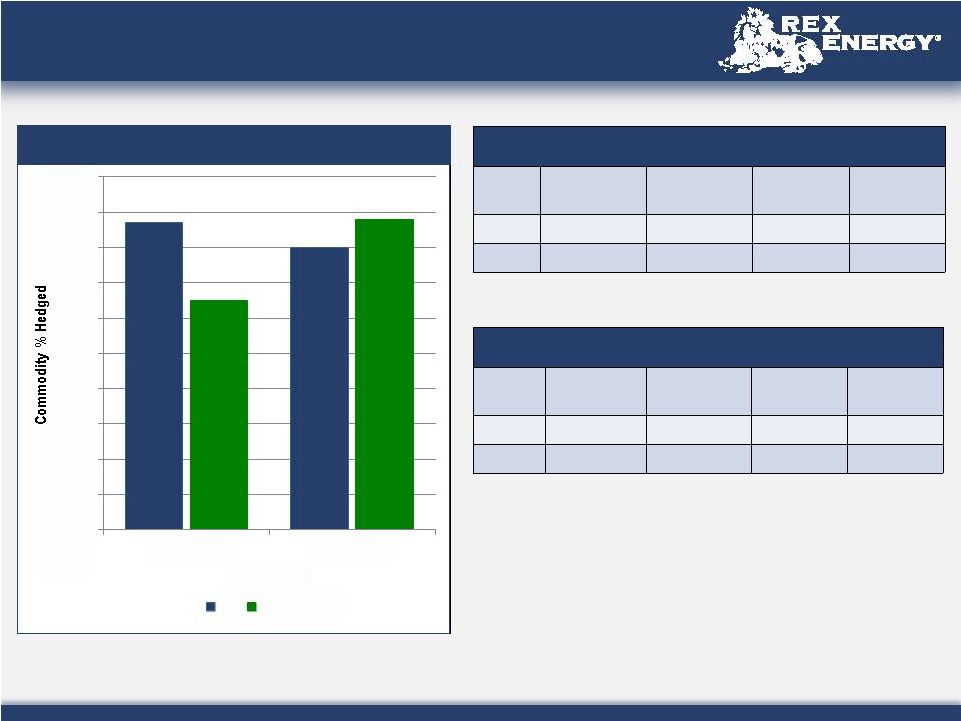

Current

Hedging Summary Natural Gas

% of Current

with Floor

% of Current

with Ceiling

Avg. Floor

Price

Avg. Ceiling

Price

2012

(1)

65%

65%

$ 4.52

$ 5.03

2013

(1)

88%

70%

$ 4.45

$ 4.74

Crude Oil

% of Current

with Floor

% of Current

with Ceiling

Avg. Floor

Price

Avg. Ceiling

Price

2012

87%

87%

$68.39

$111.08

2013

80%

80%

$72.44

$112.56

•

Percentage hedged based on 1

Quarter 2012 mid-case

guidance with standard decline

11

1. Portions of production hedged with put spreads and collar contracts with short

puts. See Appendix for more information 0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2012

2013

Commodity

Oil

Natural Gas

Current Production Hedged

st |

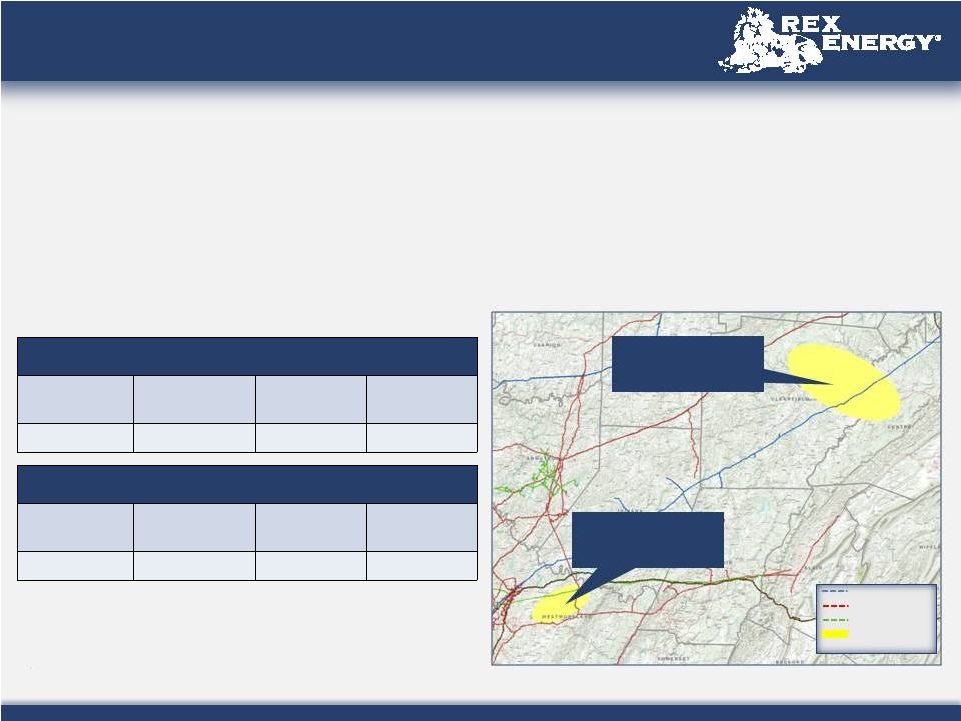

Acreage

Summary 12

•

Total

of

~90,800

gross

(~62,400

net)

acres

in

the

Utica

Shale³

•

Total of ~129,200 gross (~66,400 net) acres in the Marcellus Shale

1.

Closed

on

13,000

acres,

~2,000

acres

committed

pending

clearance

of

title

2.

Other Marcellus acreage located in Clearfield, Centre and Fayette Counties,

Pennsylvania 3.

~15,000 gross (~7,800 net) acres in areas of Warren County, Pennsylvania, which have

not been included in acreage totals Butler Operated Area

~67,200 gross

(~44,800 net) acres

Westmoreland, Centre, Clearfield

Non-Operated Area

~44,600 gross (~16,500 net) acres

Carroll County –

Warrior Prospect

~15,000 acres¹

Illinois Basin –

Lawrence Field

~13,100 gross (~13,000 net) acres

Other Marcellus

Acreage

~17,400 gross

(~5,100 net)

acres²

Other Operated Utica Acreage in

Mercer County Pennsylvania

~9,300 gross (~3,400 net) |

0

500

1,000

1,500

2,000

2,500

ASP:

Oil

Warrior Prospect:

Liquids Rich Utica

Butler Marcellus:

Liquids Rich

Butler Upper Devonian:

Liquids Rich

Estimated Resource Potential (Bcfe)

Additional Ethane Recoveries²

Rex Energy Liquids-Rich Resource Potential

1

13

Assumptions

Butler Operated Area:

Marcellus

Butler Operated Area:

Upper Devonian³

Warrior Prospect:

Liquids-rich Utica³

Illinois Basin: ASP

Unproved Prospective Acreage

4

~38,700

~44,700

~15,000

5

N/A

Assumed % Drilled

6

75%

75%

80%

N/A

Well Spacing

6

84 Acres

76 Acres

120 Acres

N/A

Net Potential Well Locations

6

347

443

100

N/A

EUR

7

5.3 Bcfe

4.3 Bcfe

600 MBOE

N/A

Royalty Burdens

8

18%

18%

20%

N/A

Resource Potential

1

1,508 Bcfe

1,562 Bcfe

48,000 MBOE

31,500 MBbls

MMBOE

Bcfe

Oil & Condensate

52.6

315.7

NGLs

110.8

664.5

Natural Gas

427.8

2,566.9

Total

591.2

3,547.1

Additional Ethane

Recoveries²

200.2

1,200.9

Total with Additional

Ethane Recoveries²

791.4

4,748.0

1

Total Liquids-Rich Operating Area Resource

Potential

1

Total Liquids-rich Resource Potential ~3.5 Tcfe / ~591 MMBOE (~4.7 Tcfe / ~791

MMBOE with full ethane recoveries²) 1. See notes on “Forward Looking

Statements” and “Hydrocarbon Volumes” on pages 2&3 2.

Represents potential ethane recoveries assuming a full ethane recovery scenario; see page 16 for

estimated yield for ethane recovery

3. As of 12/31/2011, the company has drilled 1 gross (0.7 net) Upper Devonian well and

has not begun development of its Warrior Prospect Utica acreage

4. Based on net acreage position excluding acreage from proved developed and

undeveloped reserves 5. Closed on 13,000 acres, ~2,000 acres pending clearance

of title 6. See note on “Potential Drilling Locations” on page 3

7. EURs based on internal estimates, see notes on “Forward Looking

Statements” and “Hydrocarbon Volumes” on pages 2&3

8. Represents the company’s average royalty burden assumption in each designated

area, does not necessarily reflect royalties paid to landowners |

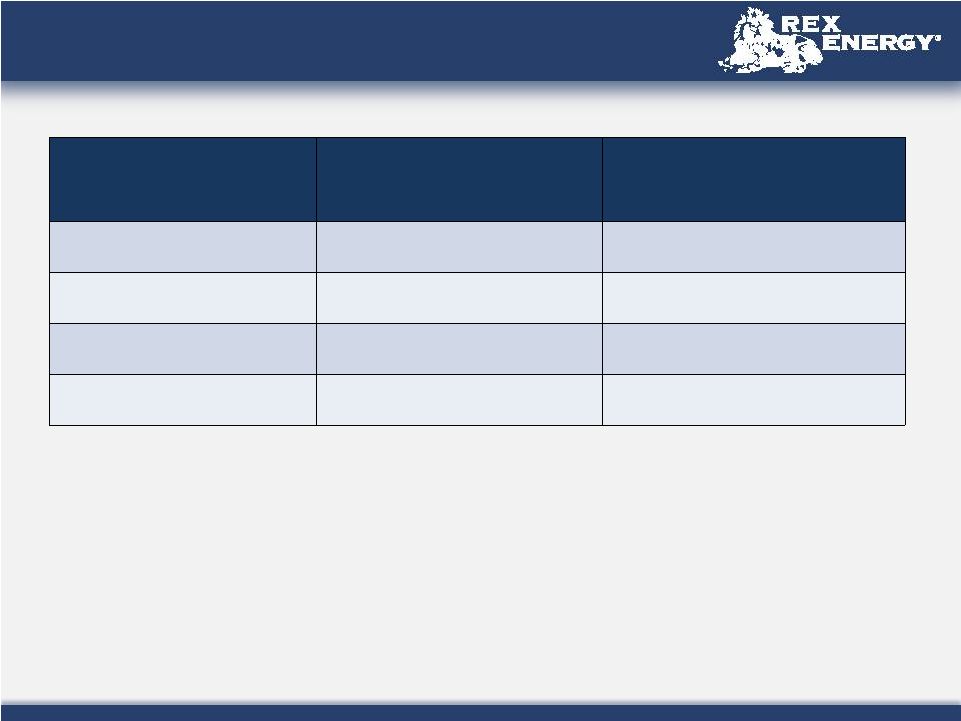

Leasing

Program Focused on Liquids-Rich Areas Year-End 2010

Year-End 2011

Change

Year-to-Year

Total Marcellus Acreage (Net)

~56,200

~66,400

+10,200

Marcellus

Liquids-Rich

Areas

(Net)

¹

~34,100

~44,800

+10,700

Percent of Marcellus Acreage

Liquids-Rich

60.7%

67.5%

+6.8%

14

Year-End 2010

Year-End 2011

Change

Year-to-Year

Total Utica Acreage (Net)

~37,500

2

~62,400

2

+24,900

Utica

Liquids-Rich

Areas

(Net)

¹

--

~15,000

3

+15,000

Percent of Utica Acreage

Liquids-Rich

0%

24.0%

+24.0%

1.

Based on the company’s internal estimates of resource potential; see notes on

“Forward Looking Statements” and “Hydrocarbon Volumes” on pages 2&3

2.

~3,400 net acres in Mercer County, Pennsylvania are undetermined as to liquids

content

3.

Closed on 13,000 acres, ~2,000 acres committed pending clearance of title |

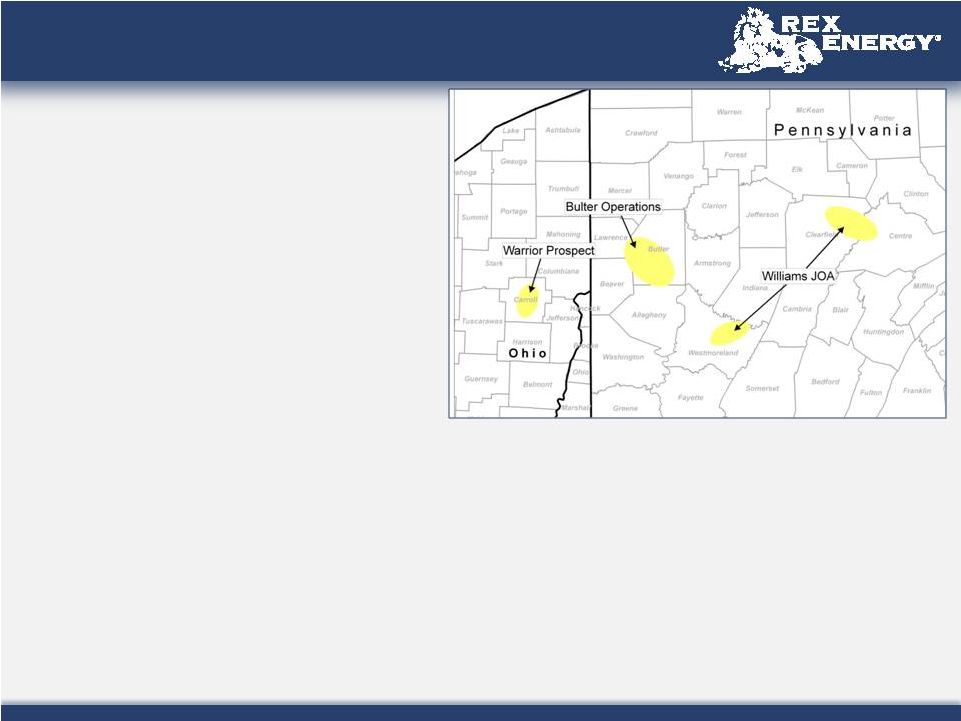

Appalachia Overview

Butler Area (Operated)

•

~67,200 gross (~44,800 net) acres

•

Joint Venture with Sumitomo in Butler County

•

70% Rex / 30% Sumitomo

•

Butler Midstream Joint Venture

•

•

15

Carroll County, Ohio –

Warrior Prospect

•

Commitments on ~15,000 acres in liquids rich

window of the Utica Shale

•

Actively leasing in the area

•

Drilling operations expected to begin in 2012

Other Appalachia Acreage

Westmoreland, Centre, and Clearfield Counties

(Non Operated)

•

~44,600 gross (~16,500 net) acres

•

Joint Venture among Williams, Rex, and Sumitomo

•

50% Williams / 40% Rex / 10% Sumitomo

•

JV includes interest in gathering and transportation

1.

Currently exploring options to monetize Butler midstream assets

2.

~44,100 acres believed to be prospective for all three drilling horizons

2

1

•

~26,700 gross (~8,600 net) acres in areas of

Clearfield, Centre, Mercer and Fayette counties

•

Marcellus Shale

•

Utica Shale

•

Upper Devonian Shale

•

60% Stonehenge / 28% Rex / 12% Sumitomo

50 MMcf/d Bluestone Cryogenic Plant expected to

be commissioned May 2012

Access to three drilling horizons |

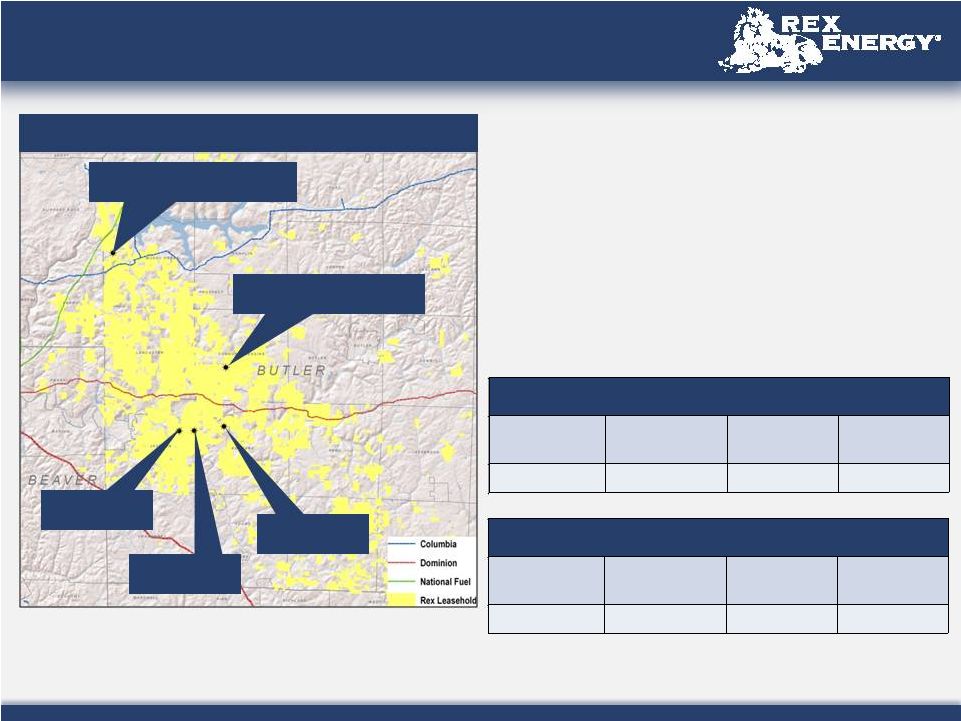

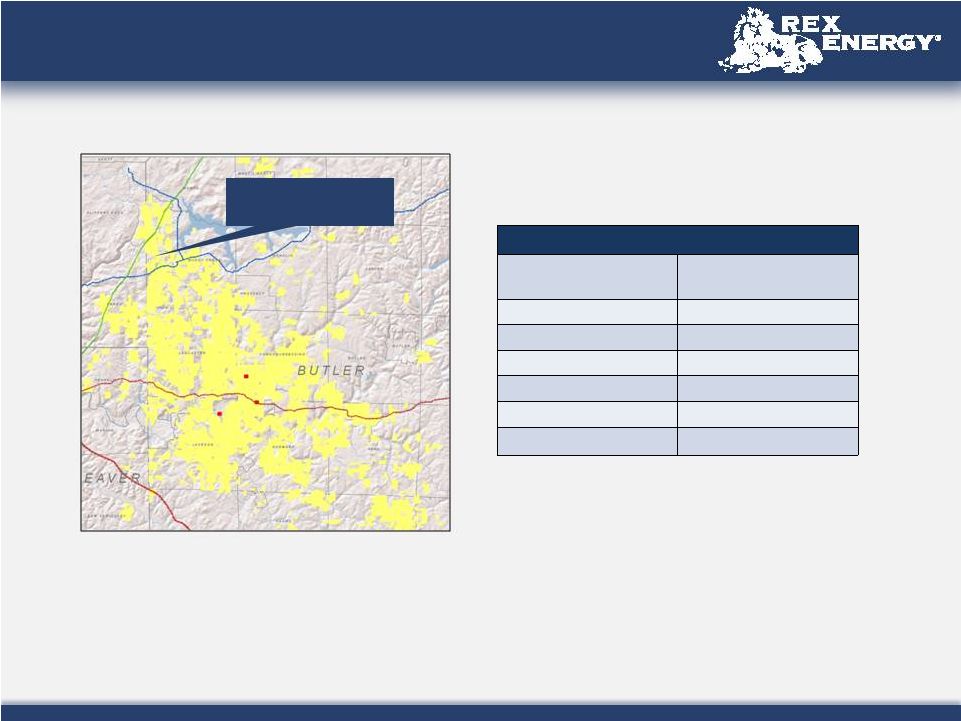

•

Consolidated acreage position of ~67,200 gross

(~44,800 net) acres

•

Allows for minimal rig movement

•

Decreases in drilling time

•

Maximizes unitized acreage

•

Marcellus Shale: increasing EUR from previous range

•

Upper Devonian / Burkett Shale: similar in composition to

Marcellus Shale

•

Utica Shale: encouraging test well results

Butler Operated Area

16

1.

~44,100

net

acres

believed

to

be

prospective

for

all

three

drilling

horizons

2.

Includes 2 wells completed and awaiting pipeline

3.

Includes 3 Utica Shale wells in Butler County

2011 Butler County Drilling Program Well Counts

Wells Drilled

Fracture

Stimulated

Placed in

Service

Awaiting

Completion

2

31

19

21

21

2012 Butler County Drilling Program Well Counts

Wells Drilled

Fracture

Stimulated

Placed in

Service

Awaiting

Completion

15

21

23

13

Cheeseman #1 –

Utica Shale Test

9.2 MMcf/d 24-Hour Test Rate

Gilliland #11HB –

Burkett Shale Test

3.1 Mmcfe/d 5-day test rate

Talarico Pad

Mmcfe/d

Drushel Pad

Butler Operated Area

•

Three potential drilling horizons

Behm Pad

5-day rate of 6.6

5-day rate of 4.4

Mmcfe/d

5-day rate of 3.8

Mmcfe/d

1

3 |

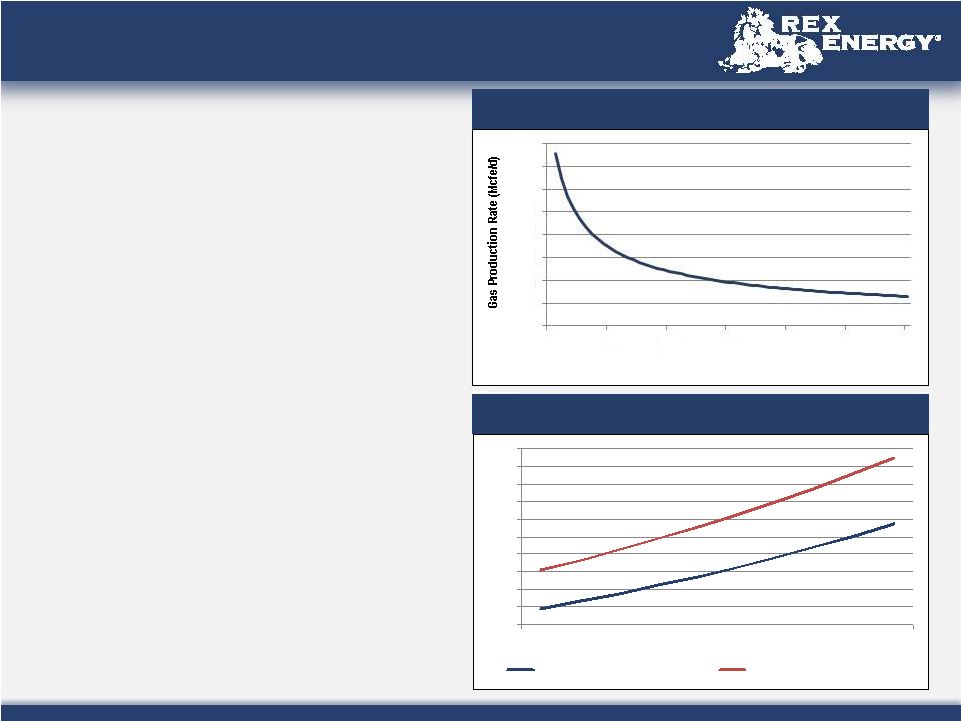

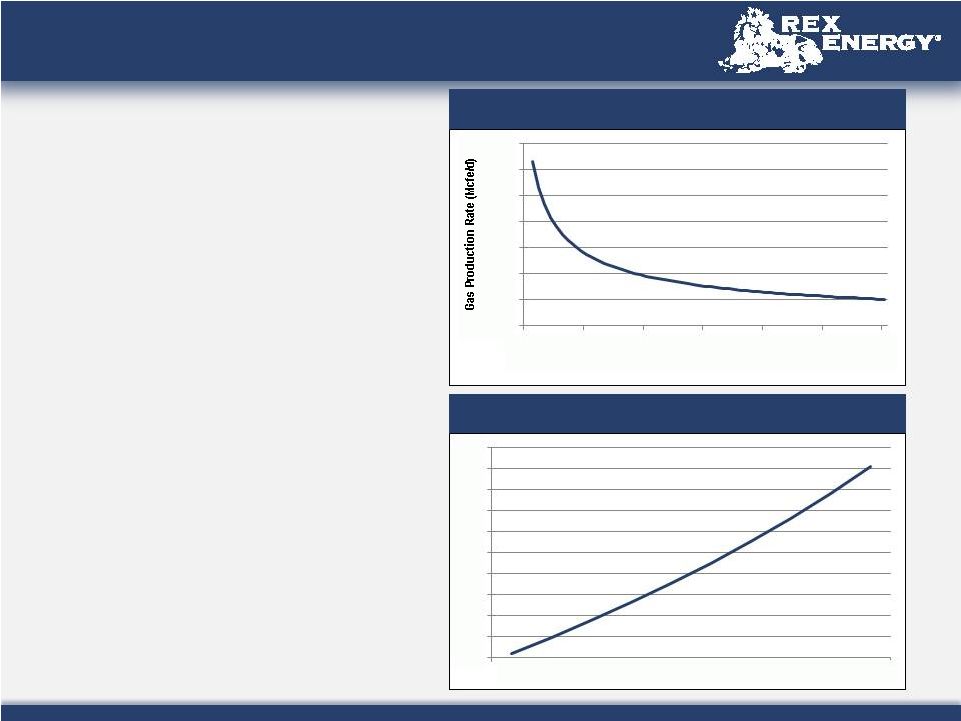

Butler

County Marcellus Economics 17

Before Tax IRR

Butler County Wet Gas Type Curve

Butler Area (Operated) Assumptions

•

Well costs of $5.3 million per well

•

Lateral length of 3,500 ft.

•

30-Day average rate of 3.8 MMcfe/d

•

Reference Oil Price: $90.00

•

EUR

of

5.3

Bcfe

per

well

•

EUR range increase 20% over 2010 EUR

with only 13% increase in well cost

•

NGL yield with current Ethane recovery of 1.64

gallons

per

Mcf

(39

Bbls

per

MMcf)

•

Butler Area type curve based on current ethane

recovery and NGL yield

•

NGL yield with full Ethane recovery of

approximately 4.5 gallons per Mcf (107 Bbls per

MMcf)

1.

See note on “Hydrocarbon Volumes”

on page 3

2.

Assumption

used

for

“Current

Ethane

Recovery”

projections

3.

Assumption

used

for

“Full

Ethane

Recovery”

projections

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

$5.50

$6.00

$6.50

$7.00

IRR: Current Ethane Recovery

IRR: Full Ethane Recovery

2

3

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

0

10

20

30

40

50

60

Production Month

1

2

3 |

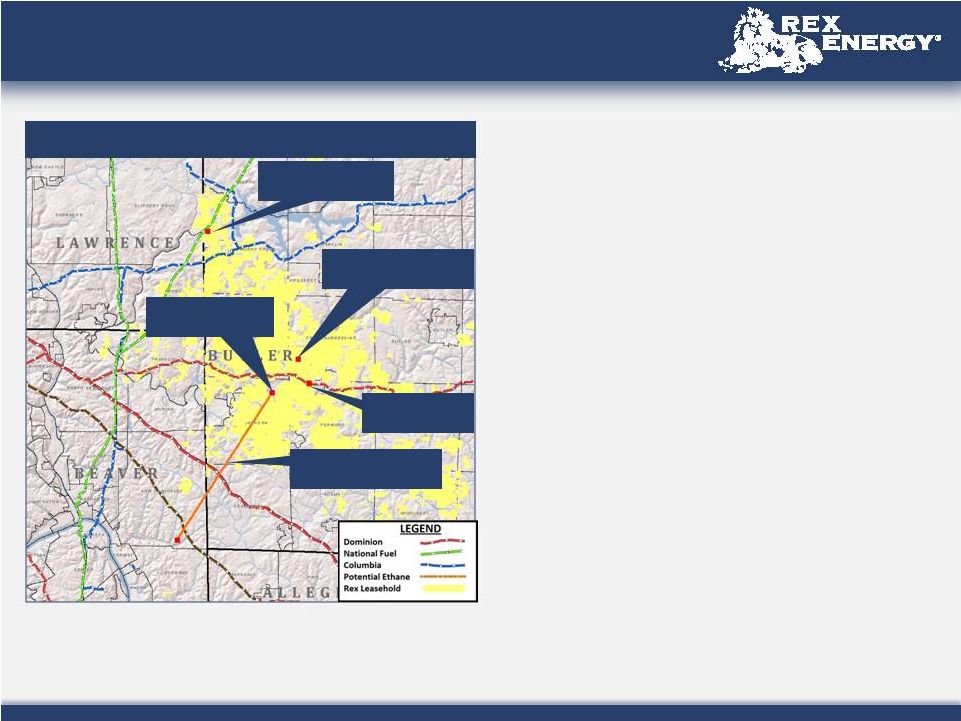

•

Firm transportation of 85.0 gross MMcf/d

•

25.0 gross MMcf/d available March 2012

•

Remaining 60.0 gross MMcf/d available January 2013

•

Sarsen Plant

•

Current processing capacity of 34 MMcf/d

•

Capacity increase to 40 MMcf/d with commissioning of

the Voll compressor station expected in February 2012

•

Bluestone Plant

•

50 MMcf/d processing capacity design

•

Expected commissioning in May 2012

•

Location for third cryogenic processing plant being

determined

•

Cheeseman #1H Utica Shale test well expected sales

February 2012

•

Currently exploring options to monetize Butler midstream

assets

•

Regional projects entering southwestern Pennsylvania

have been proposed to expand ethane alternatives¹

Butler Area Midstream & Infrastructure

18

Voll Compressor Station

Sarsen Cryogenic

Processing Plant

Bluestone Cryogenic

Processing Plant

Butler Operated Area

Cheeseman #1 –

Pipeline tap into NFG

Projected 12-Mile Ethane

Pipeline Connection ¹

1.

Pipeline route shown for illustrative purposes only. Actual pipeline route,

design, construction and capacity

may

vary

from

illustration

shown.

See

note

on

“Forward

Looking

Statements”

on

page 2.

The company can give no assurance that proposed ethane projects will be completed or

that ethane markets will expand as currently projected

1

•

Rex Energy targeting 2014 for potential expanded

ethane sales |

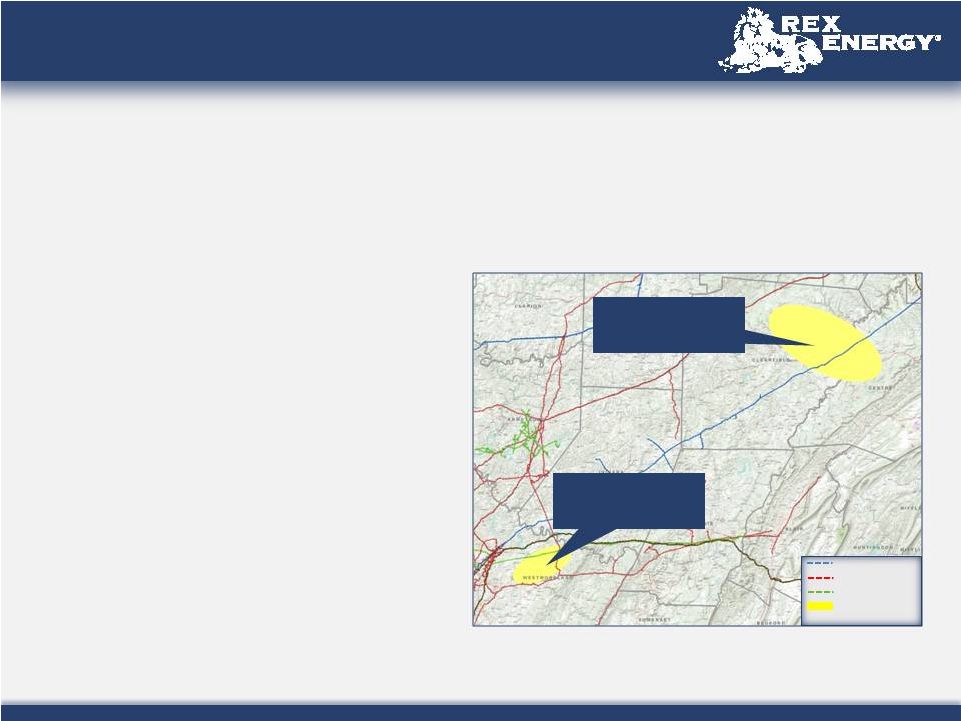

Marcellus

Non-Operated Overview Westmoreland, Clearfield and Centre Counties, PA

•

Sizeable acreage position with ~44,600 gross (~16,500 net) acres¹

•

34 Wells producing in Westmoreland County

•

4 Wells producing in Centre County

•

4 Wells producing in Clearfield County

•

47.0 gross (15.8 Net) MMcf/d 2011 December Exit Rate in Westmoreland County

•

13.3 gross (4.5 Net) MMcf/d 2011 December Exit Rate in Clearfield and Centre County

1.

Includes non-operated area acreage only

Columbia

Dominion

Equitrans

REX Leasehold

Areas

Clearfield –

Centre

County

Non-Operated Area

2011 Non-Operated Drilling Program Well Counts

Wells Drilled

Fracture

Stimulated

Placed in

Service

Awaiting

Completion

26

29

30

3

2012 Non-Operated Drilling Program Well Counts

Wells Drilled

Fracture

Stimulated

Placed in

Service

Awaiting

Completion

17

16

16

5

Westmoreland County

Non-Operated Area

19 |

Westmoreland County Marcellus Economics

20

Westmoreland County (Non-Operated)

Assumptions

•

Well costs of $5.8 million per well

•

Lateral length of 3,500 ft.

•

30-Day average rate of 3.2 MMcf/d

•

EUR of 4.2 Bcf per well

•

EUR increase 40% over 2010 EUR with only

23% increase in well cost

•

Seven recently completed laterals recorded an

unconstrained 30-day average rate of 4.3 MMcf/d

0

500

1,000

1,500

2,000

2,500

3,000

3,500

0

10

20

30

40

50

60

Production Month

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

$5.50

$6.00

$6.50

$7.00

Westmoreland County Dry Gas Type Curve

Before Tax IRR |

Non-Operated Midstream and Infrastructure

Westmoreland County, PA

•

17.0 gross MMcf/d capacity through Ecker Station tap

into Dominion line

•

35.0 gross MMcf/d capacity through high pressure

delivery system into Peoples line

•

29.0 gross MMcf/d capacity through Salem Beagle

Club station into Equitable gas line

Clearfield and Centre Counties, PA

•

7.0 gross MMcf/d firm capacity with interruptible

takeaway into Columbia gas line

21

Westmoreland County

Non-Operated Area

Clearfield –

Centre

County

Non-Operated Area

Columbia

Dominion

Equitrans

REX Leasehold

Areas |

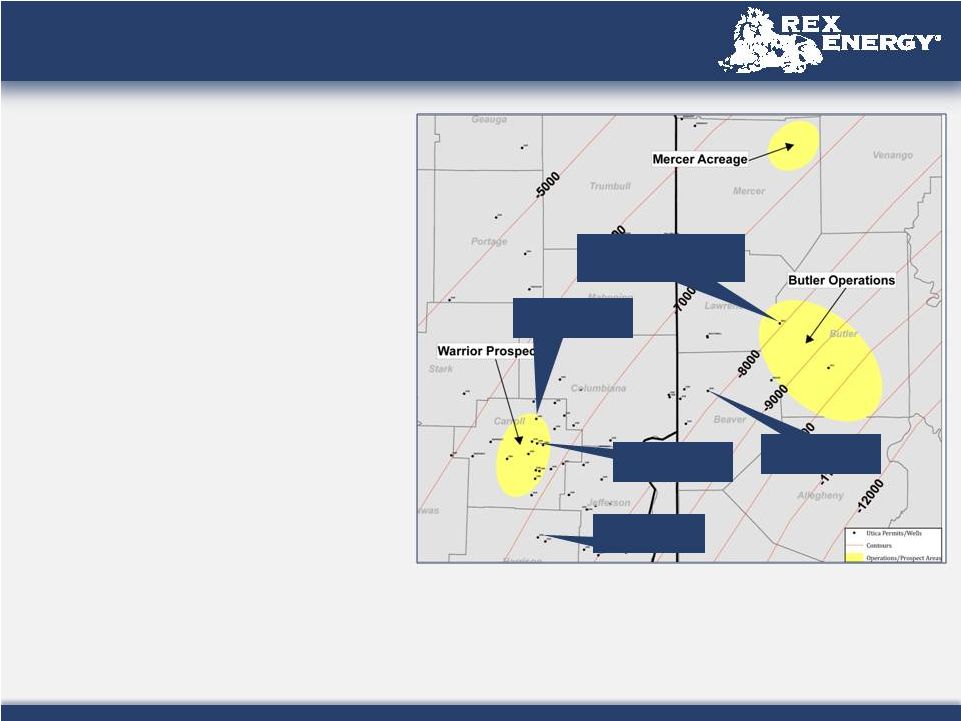

~ 90,800

gross (~62,400 net) acres in the Utica Shale¹

•

Butler County Operations ~66,400 gross

(~44,100 net) acres

•

Successful well test in 2011 in Butler

County

-

Cheeseman

#1H

-

9.2

MMcf/d

24 hour test rate (dry gas)

•

Ohio Warrior Prospect 15,000 acres²

•

Other operated Utica acreage 9,300 gross

(3,400 net) acres

•

Expecting to drill 6 Utica Shale wells in 2012

22

CHK Buell 10-11-5

8H -3.0 Mboe/d

CHK Mangun 22-15-5

8H -1.5 Mboe/d

CHK Neider 10-14-5

3H -1.6 Mboe/d

Rex Energy Cheeseman #1H –

9.2 MMcf/d Dry Gas

24-Hour Test Rate

CHK Thompson 3H –

6.4 MMcf/d Dry Gas

Utica Shale Overview

•

Drill and complete 3 wells in the Warrior

Prospect

•

Drill 3 wells in the Butler County

operated area (1 completed and placed

in service)

1.

~15,000 gross (~7,800 net) acres in areas of Warren County, Pennsylvania which have not

been included in acreage totals

2.

Closed on 13,000 acres, ~2,000 acres committed pending clearance of title |

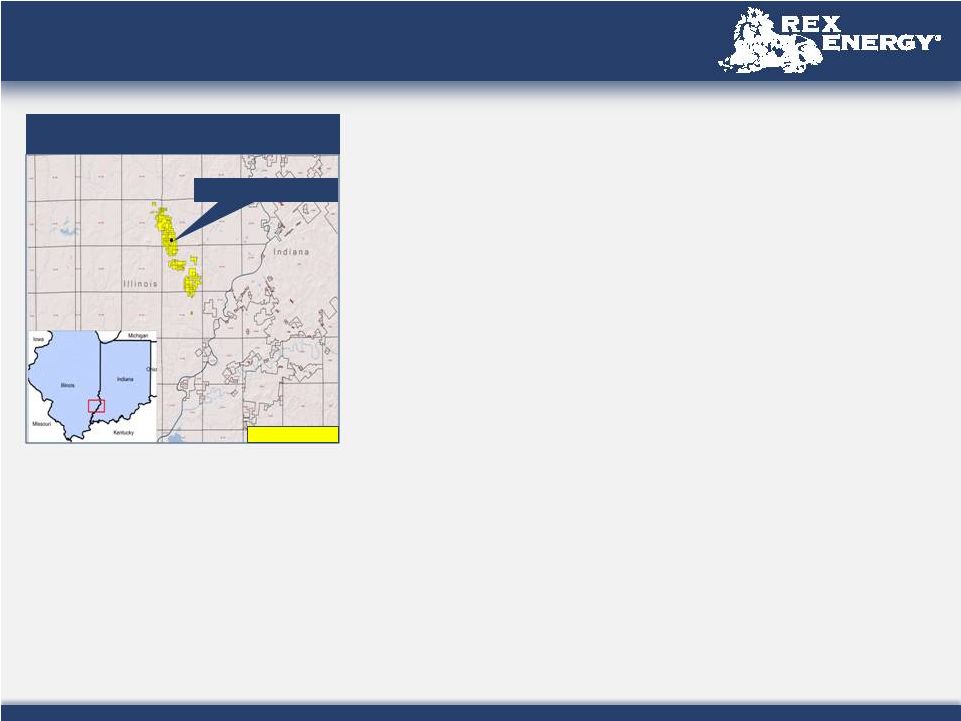

Ohio

Utica – Warrior Prospect

~ 15,000 acres in the Utica Shale¹

•

Close access to infrastructure and pipelines

•

Acreage within liquids rich window of the

Utica Shale

•

100 Potential drilling locations²

•

Drilling and development expected to begin in

2012

•

Secured 15 MMcf/d of firm wet gas processing

capacity for Ohio Utica development

•

Processing at Dominion Natrium Facility

after expected plant commissioning in

December 2012, interim processing at

Dominion Hastings Plant

•

Actively leasing in the area

23

CHK Buell 10-11-5

8H -3.0 Mboe/d

CHK Mangun 22-15-5

8H -1.5 Mboe/d

CHK Neider 10-14-5

3H -1.6 Mboe/d

1.

Closed

on

13,000

acres,

~2,000

acres

committed

pending

clearance

of

title;

the

company

refers

to

this

acreage

as

its

“Warrior

Prospect”

2.

See

note

on

“Potential

Drilling

Locations”

on

page

3 |

Butler

Area Utica Shale Resource Potential 1

24

Butler Operated Area: Utica Shale –

Dry Gas

Unproved Prospective

Acreage

²

~43,800

Assumed

%

Drilled³

30%

Well

Spacing³

120 Acres

Net Potential Well Locations³

110

EUR

4

4.5 Bcfe

Royalty Burdens

5

18%

Resource

Potential

¹

405.9 Bcfe

1. See notes on “Forward Looking Statements”

and “Hydrocarbon Volumes”

on pages 2&3

2. Based on net acreage position excluding acreage from proved developed and

undeveloped reserves that the company believes to be prospective for

Utica

Shale

development.

Actual

future

development

of

this

acreage

may

vary.

See

notes

on

“Forward

Looking

Statements”

and

“Hydrocarbon

Volumes”

on pages 2&3. Does not include ~3,400 net acres in Mercer County,

Pennsylvania 3. See

note

on

“Potential

Drilling

Locations”

on

page

3;

drilling

assumptions

based

on

what

the

company

believes

can

be

drilled

economically

under

the current commodity price environment

4. Current EUR assumption based on internal estimates using a 4.3 MMcf/d 30-day

estimated average production rate; see notes on “Forward Looking

Statements” and “Hydrocarbon Volumes”

on

pages

2&3

5.

Represents

the

company’s

average

royalty

burden

assumption

in

the

designated

area,

does

not

necessarily

reflect

royalties

paid

to

landowners

Rex Energy Cheeseman #1H –

9.2 MMcf/d Dry Gas

24-Hour Test Rate |

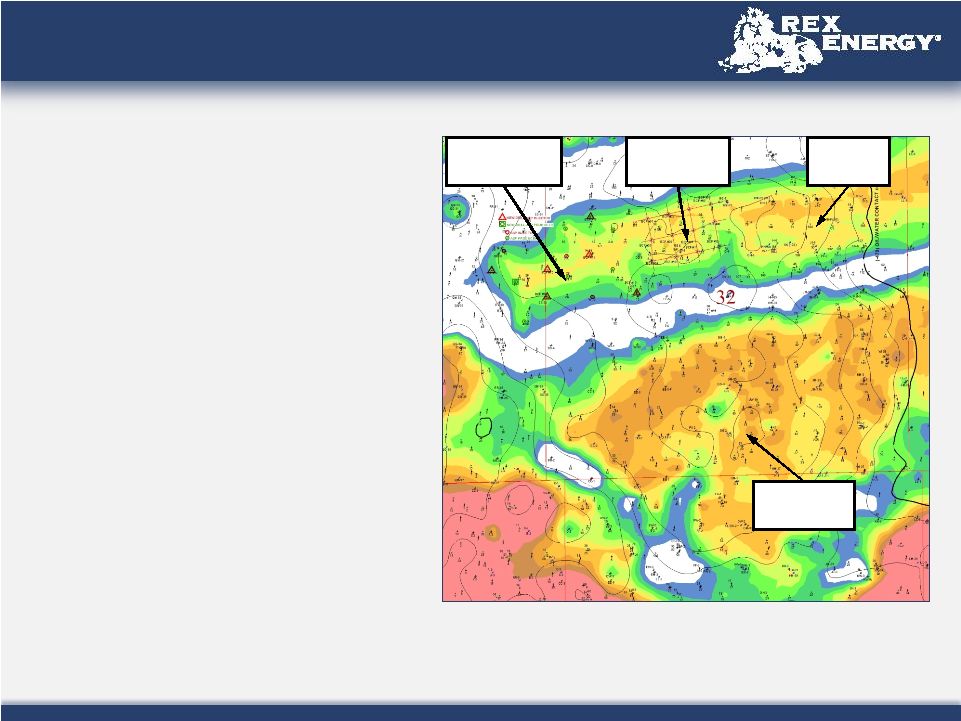

Lawrence

Field ASP Overview Illinois Basin

Middagh Unit, ASP Project

25

REX Acreage

~13,100 gross (13,000 net) acres in Lawrence Field

•

Estimated 1 billion barrels of original-oil-in-place (OOIP)

•

Field has produced 400 MMBbls since 1906

•

Waterflooded

since

the

1950’s

•

Two successful surfactant-polymer flood pilots completed by Marathon

with 15-20% of OOIP recovered

•

Field currently produces ~1,600 gross (1,250 net) barrels per day under

waterflood

ASP Project Summary

•

ASP stands for Alkali-Surfactant-Polymer flood

•

Alkali-Surfactant mix reduces interfacial tension allowing remaining oil to flow

easier through the formation

•

Polymer

improves

sweep

efficiency

by

forcing

fluid

into

parts

of

the

field

not

effectively swept by the waterflood

•

Field ASP injection plant constructed in 2008

•

Capacity design of 72,000 Bbls per day

•

15 Acre Middagh Unit Pilot used to confirm commerciality of ASP Tertiary

Recovery in the Lawrence Field:

•

Pilot flood initiated in August 2010

•

Initial oil response seen on March 2011

•

Peak production rates observed in September 2011

•

Proved reserves are booked as of 12/31/2011 at 13% of Pore Volume

|

ASP

Economics 26

Delta Unit ASP Economics

1.

Resource

potential

and

pore

volume

recovery

assumptions

based

on

full

development

program.

Individual

ASP

unit

results

may

vary

significantly.

See

note

on

“Hydrocarbon

Volumes”

on

page

3

2.

See

note

on

“Potential

ASP

Units”

on

page

3

3.

Based

on

company

estimates

and

projections

to

date.

See

note

on

“Hydrocarbon

Volumes”

on

page

3

Resource Potential Range Confirmed

•

Proved reserve bookings at 13% of pore volume

recovery confirming mid-point resource potential

range of ~31.5 MMBbls (net)

•

North and Central Lawrence Units reviewed for

ASP potential in Bridgeport and Cypress

formations by NSAI

•

27 ASP targets identified across both units

combined²

•

Estimated 76% of North and Central Lawrence

acreage prospective for ASP flooding, with a

further ~1,900 acres of South Lawrence unit to

undergo further review

Delta Unit Conceptual Economics³

•

$5MM of Capex in 2012 and $21MM in 2013

•

Proved reserve bookings at 13% of Pore Volume

equate to ~20% IRR at $100/Bbl NYMEX prices

•

All reserves recovered in first 5 years

•

Discounted Return on Investment: ~1.25

•

Full-cycle F&D Cost ~$30/Bbl

Resource

Potential: North & Central Lawrence Units¹

Low Case

High

Case

Bridgeport Sand Pore Volume

182.7 MMbbl

Cypress Sand Pore Volume

128.3 MMbbl

Royalties

22%

Recovery

Potential (%PV)

8%

20%

Total ASP Upside

Potential (Net)

19.4 MMbbl

48.5 MMbbl

0

5

10

15

20

25

30

35

40

45

50

9

10

11

12

13

14

15

16

17

18

19

20

Pore Volume Recovery % |

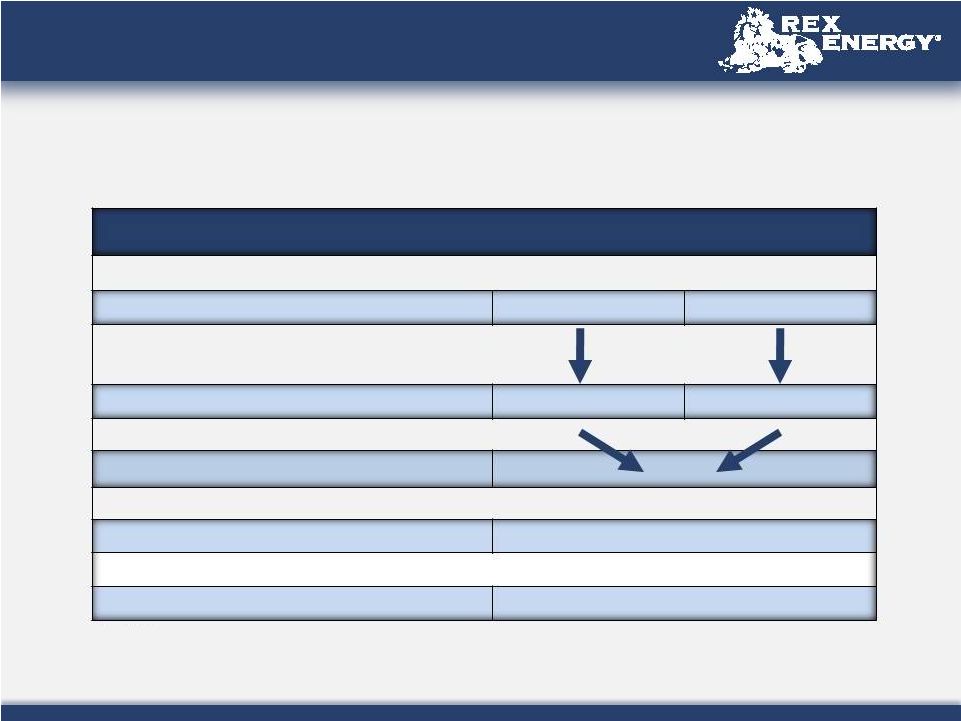

27

Middagh Pilot

15 Acres

Griggs

72 Acres

Perkins-Smith

58 Acres

Delta Unit

351 Acres

Lawrence Field ASP Update

•

Middagh Pilot:

•

Production increased from 16 BOPD and has maintained a

range of 65 –

75 gross BOPD over the last 90 days; peak

production was seen at 100+ BOPD

•

Oil cuts in the Pilot increased from

1.0% to ~12.0% in total unit, with individual wells

experiencing oil cuts above 20%

•

Third party engineer firm NSAI booked PDP reserves as of

12/31/2011

•

Perkins-Smith Unit Pilot Expansion:

•

Third party engineer firm NSAI booked PDNP reserves as of

12/31/2011

•

All drilling and infrastructure complete

•

Initial brine injection underway

•

Plan to commence ASP injection by 2

nd

quarter of 2012

•

Initial

project

response

expected

by

2

nd

quarter

of

2013;

expected

peak

response

of

175-250

gross

BOPD

by

4

th

quarter of 2013

•

Delta Unit Full Scale Expansion:

•

Core studies and geologic mapping underway

•

Drilling of additional pattern wells planned for 2Q & 3Q-2012

•

Injection line tie-in targeted for 3Q-2012

•

Expect to initiate tracer injection survey work in 3Q-2012

•

Planning to begin ASP injection in 2Q-2013

•

Initial production response anticipated in 2014

•

ASP Recovery Incremental Production Impact:

•

Potential to double current field production in 2015 |

Responsible Development of America’s Energy Resources

Appendix |

Assumed

Net Asset Value ($ in millions)

Description

Scenario A

Scenario B

2011 Year-End Proved Reserves

366.2 Bcfe

$536.5

(NYMEX PV-10¹)

$ 539.6

(SEC PV-10²)

Warrior Prospect (Liquids-rich Utica)

-

Net Acreage

15,000

Net

Acres³

$90.0

(@ $6,000 per acre

4

)

$225.0

(@ $15,000 per acre

4

)

Butler Marcellus -

Resource Potential

5

1,508.0 Bcfe Net

6

$452.4

(@ $0.30/Mcfe

7

)

$904.8

(@ $0.60/Mcfe

7

)

ASP -

Resource Potential

5

31.5 MMBbls Net

6

$31.5

(@ $1.00/Bbl

7

)

$94.5

(@ $3.00/Bbl

7

)

Other

Midstream and Rockies

Assets

8

$ 90.0

$ 110.0

Less Long-term Debt

9

As of 12/31/2011

($ 225.0)

($ 225.0)

Assumed Net Asset Value

$ 975.4

$ 1,648.9

29

1.

Based on Rex Energy internal estimates using NYMEX commodity strip prices as of

December 31, 2011. Estimates have not be updated to reflect current

market prices

2.

Estimated by Netherland, Sewell, & Associates, Inc. at $92.45 per Bbl and $4.54

per Mcf as of 12/31/2011

3.

Closed on 13,000 acres, ~2,000 acres pending clearance of title 4. Based on publicly available data for recent joint venture

transactions

5.

See note on “Forward Looking Statements” and “Hydrocarbon Volumes”

on pages 2&3

6.

Recoveries based on Rex Energy internal estimates, (see page 3); excludes

approximately 307.4 Bcfe of Marcellus proved reserves and 5.0 Bcfe of Utica

and Upper Devonian Shale proved reserves as of December 31, 2011 7. Assumptions based on analyst valuations 8. Based on Rex Energy internal estimates of the amount of

proceeds it expects to receive in connection with its previously announced divestiture of its

midstream assets in Butler County, Pennsylvania and its interests in the

Denver-Julesburg Basin

9.

Includes borrowings under the senior credit facility and second lien facility |

Wet Gas

Economic Yields $3.75 NYMEX equates to $3.95 per Mcf of net revenue

•

$3.75 NYMEX Henry Hub

•

$100.00 NYMEX WTI

Wellhead Production –

1 mcf of Natural Gas

Natural Gas

NGLs

Production by Product

.900 mcf

1.64 gallons/ mcf

(2)

Gross Realized by Product

$3.42 net

(1)

$2.03

(3)

Aggregate Realized Price per 1 mcf at wellhead

$5.45

Gathering, transportation and operating expenses

$1.50

Net Income Less Operating Expenses

$3.95

(4)

1.

$0.05 added to NYMEX Henry Hub for premium

2.

.85 gallon/ mcf is excluded since it is used as fuel for compressors at the

Sarsen cryogenic plant 3.

NGL Price assumption of 52% of $100.00 NYMEX WTI

4.

Does not include Rex’s 28% interest in cash flow from the cryogenic plant

partnership 30 |

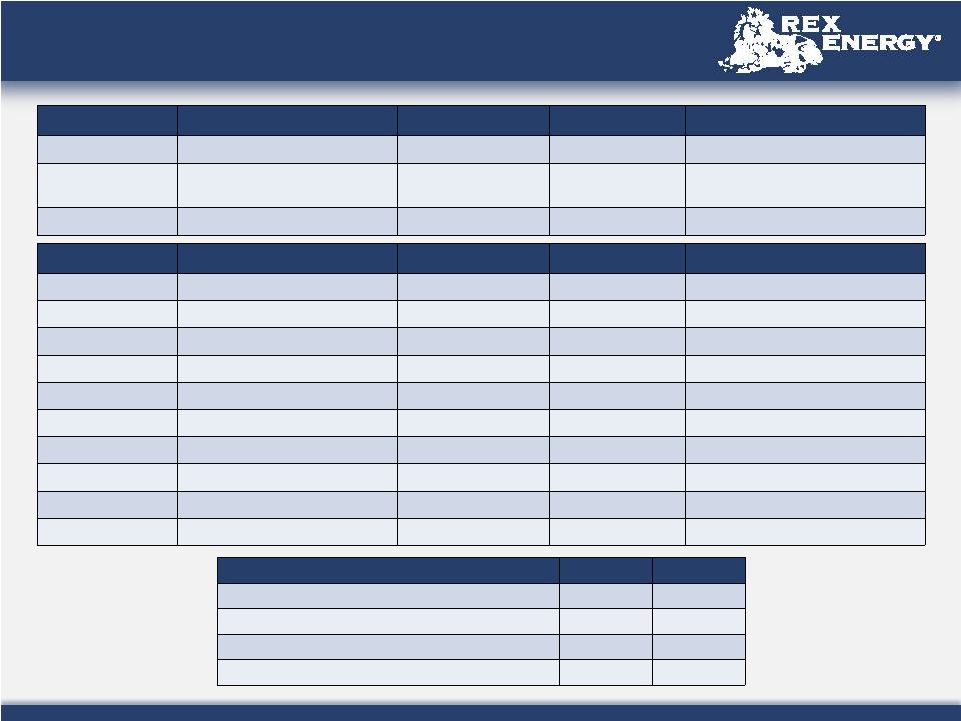

Butler

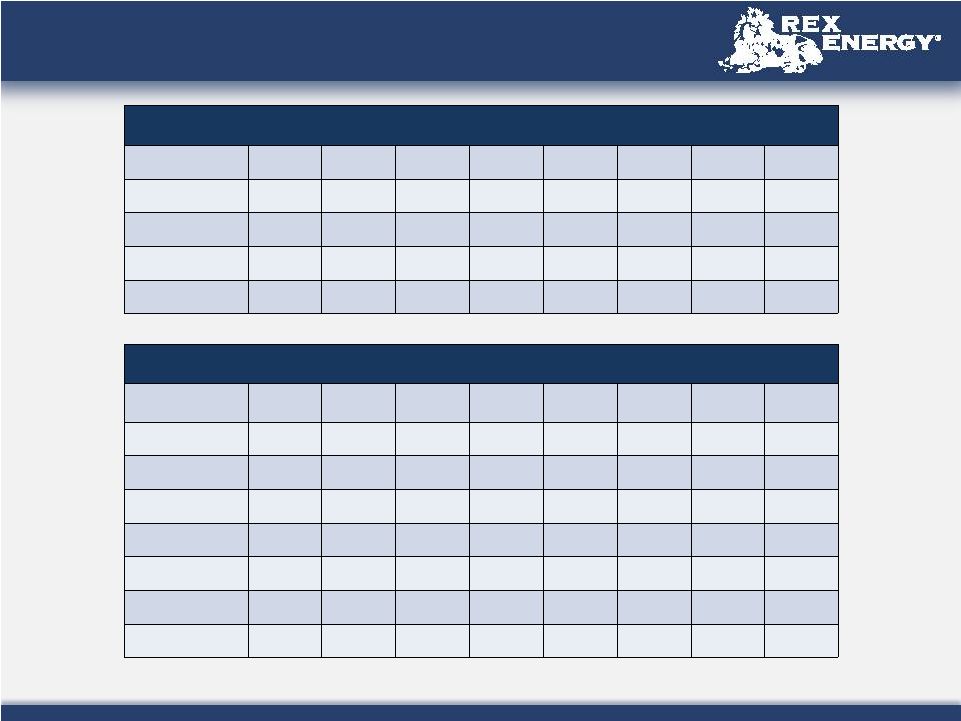

Marcellus Operated Wells In Inventory 31

Pad

Pad

Gross Well Count

Gross Well Count

Net Well Count

Net Well Count

Status

Status

Gilliland #11-HB

1.0

0.7

Completed awaiting pipeline

Grosick

(1)

4.0

1.7

Fracture stimulating remaining

four of seven Wells

Carson

3.0

2.1

Drilled awaiting completion

Bricker

1.0

0.7

Drilled awaiting completion

Graham

3.0

2.1

Drilled awaiting completion

Pallack

2.0

1.4

Drilled awaiting completion

Drushel

1.0

0.7

Drilled awaiting completion

Gilliland

-

Marcellus

Wells

5.0

3.5

Wells drilled awaiting completion

Total 2011 Wells in Inventory

20

12.9 |

Pad

Pad

Gross Well Count

Gross Well Count

Net Well Count

Net Well Count

Status

Status

Plesniak

2

1.4

Drilling first of two wells

Lynn N&S

2

1.4

Awaiting Drilling Rig

JRGL

1

0.7

Awaiting Drilling Rig

Stebbins

1

0.7

Awaiting Drilling Rig

Meyer

1

0.7

Awaiting Drilling Rig

Breakneck Beagle Club

1

0.7

Awaiting Drilling Rig

Wack

1

0.7

Awaiting Drilling Rig

Lamperski

1

0.7

Awaiting Drilling Rig

Rape

2

1.4

Awaiting Drilling Rig

Total 2012 Drilling Program

12

8.4

Butler Operated Drilling & Completion Schedule

2012 Butler County Operated Area Drilling Program

Gross

Net

Wells Drilled

12

8.4

Wells Fracture Stimulated

20

12.9

Wells Placed in Service

21

13.6

Wells Drilled Awaiting Completion

11

7.7

32 |

Area

Pad

Pad

Gross Well Count

Gross Well Count

Net Well Count

Net Well Count

Status

Status

Butler County, PA

Cheeseman #1H

1

0.7

Completed Awaiting Pipeline

Butler County, PA

Petro

1

0.7

Awaiting Drilling Rig

Butler County, PA

Grubbs

1

0.7

Awaiting Drilling Rig

Butler County, PA

Burgh

1

0.7

Awaiting Drilling Rig

Carroll County, OH

Brace

1

0.8

Awaiting Drilling Rig

Carroll County, OH

G. Graham

1

0.8

Awaiting Drilling Rig

Carroll County, OH

Troyer

1

0.8

Awaiting Drilling Rig

Total 2012 Utica Drilling Program

7

5.2

Utica Shale Drilling & Completion Schedule

2012 Utica Shale Drilling Program

Gross

Net

Wells Drilled

6

4.5

Wells Fracture Stimulated

4

3.1

Wells Placed in Service

5

3.8

Wells Drilled Awaiting Completion

2

1.4

33 |

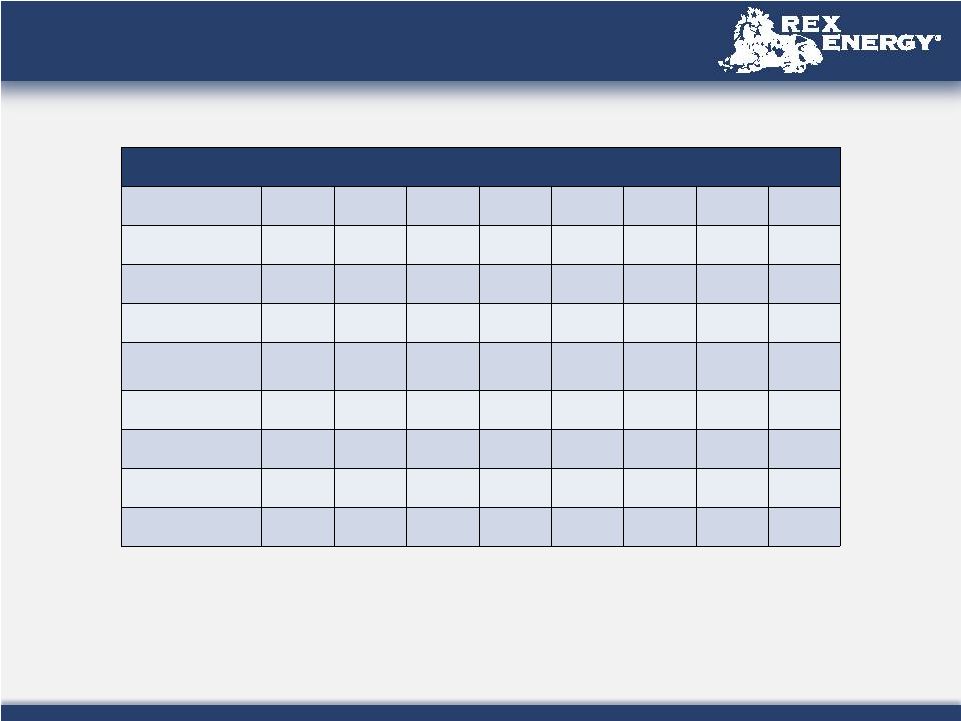

County

Pad

Pad

Gross Well Count

Gross Well Count

Net Well Count

Net Well Count

Status

Status

Westmoreland

Duralia

2.0

0.8

Wells Drilled Awaiting Completion

Westmoreland

McBroom

1.0

0.4

One of three wells on pad awaiting

completion

Total 2011 Wells in Inventory

3.0

1.2

Non Operated Drilling & Completion Schedule

34

County

Pad

Pad

Gross Well Count

Gross Well Count

Net Well Count

Net Well Count

Status

Status

Westmoreland

Corbett

2.0

0.8

Drilling Second of Two Wells

Westmoreland

Gera

2.0

0.8

Awaiting Drilling Rig

Westmoreland

Mehalic

2.0

0.8

Awaiting Drilling Rig

Clearfield/Centre

Hartle

2.0

0.8

Awaiting Drilling Rig

Clearfield/Centre

Billotte

2.0

0.8

Awaiting Drilling Rig

Clearfield/Centre

Lauver

2.0

0.8

Awaiting Drilling Rig

Clearfield/Centre

Smith

1.0

0.4

Awaiting Drilling Rig

Clearfield/Centre

Sankey

2.0

0.8

Awaiting Drilling Rig

Clearfield/Centre

Mignot

2.0

0.8

Awaiting Drilling Rig

Total 2012 Drilling Program

17.0

6.8

2012 Non-Operated Drilling Program

Gross

Net

Wells Drilled

17

6.8

Wells Fracture Stimulated

16

6.4

Wells Placed in Service

16

6.4

Wells Drilled Awaiting Completion

5

2.0 |

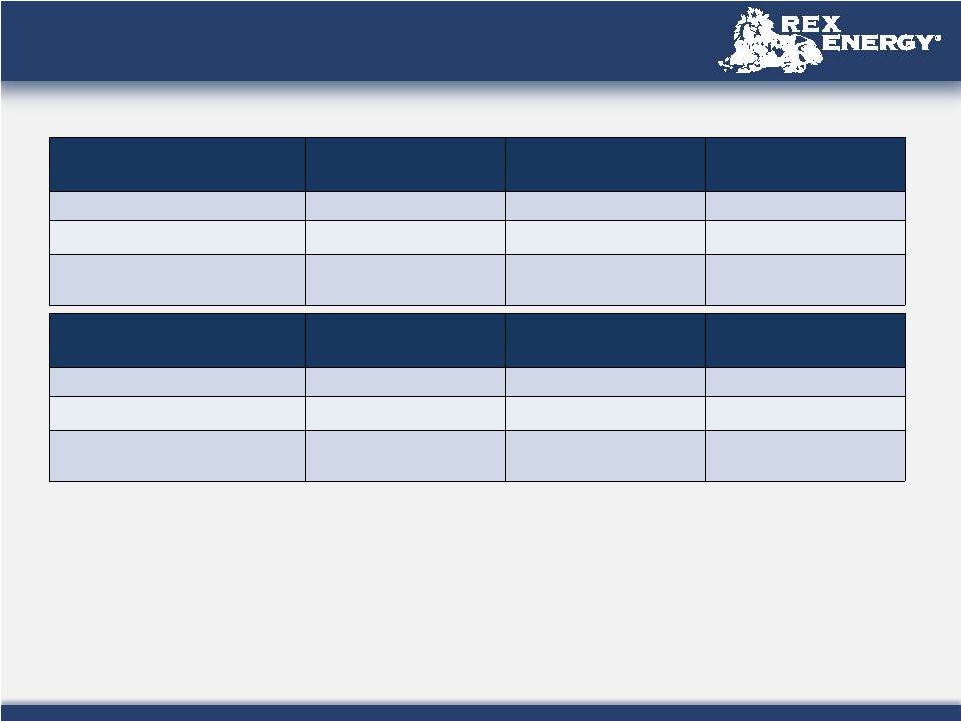

Current

Hedging Summary Crude Oil

(1)

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

Collar Contracts

Volume Hedged

150,000

150,000

150,000

150,000

135,000

135,000

135,000

135,000

Ceiling

$ 111.08

$ 111.08

$ 111.08

$ 111.08

$ 112.56

$ 112.56

$ 112.56

$ 112.56

Floor

$ 68.39

$ 68.39

$ 68.39

$ 68.39

$ 72.44

$ 72.44

$ 72.44

$ 72.44

35

Natural Gas Hedges

(1)

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

Swap Contracts

Volume

1,050,000

1,200,000

1,200,000

1,200,000

1,170,000

1,170,000

1,170,000

1,170,000

Price

$ 4.59

$ 4.43

$ 4.43

$ 4.43

$ 3.93

$ 3.93

$ 3.93

$ 3.93

Collar Contracts

Volume

750,000

750,000

750,000

750,000

840,000

840,000

840,000

840,000

Ceiling

$ 5.89

$ 5.89

$ 5.89

$ 5.89

$ 5.68

$ 5.68

$ 5.68

$ 5.68

Floor

$ 4.70

$ 4.70

$ 4.70

$ 4.70

$ 4.77

$ 4.77

$ 4.77

$ 4.77

1. Hedging position as of 1/24/2012 |

Current

Hedging Summary Cont’d Natural Gas Hedges Cont’d

(1)

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

Put Contracts

Volume

-

-

-

-

660,000

660,000

660,000

660,000

Floor

-

-

-

-

$ 5.00

$ 5.00

$ 5.00

$ 5.00

Collar Contracts

with Short Puts

Volume

660,000

660,000

660,000

660,000

480,000

480,000

480,000

480,000

Ceiling

$ 5.13

$ 5.13

$ 5.13

$ 5.13

$ 5.08

$ 5.08

$ 5.08

$ 5.08

Floor

$ 4.48

$ 4.48

$ 4.48

$ 4.48

$ 4.38

$ 4.38

$ 4.38

$ 4.38

Short Put

$3.66

$3.66

$3.66

$3.66

$ 3.53

$ 3.53

$ 3.53

$ 3.53

36

1. Hedging position as of 1/24/2012 |