Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEW JERSEY RESOURCES CORP | d281426d8k.htm |

| EX-99.2 - EXHIBIT 99.2 - NEW JERSEY RESOURCES CORP | d281426dex992.htm |

New

Jersey Resources New York Financial

Community Luncheon

January 12, 2012

Exhibit 99.1 |

Regarding Forward-Looking Statements

2

Certain statements contained in this presentation are forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements can also be identified by the use of forward-looking terminology such as “may,” “intend,” “expect,” or “continue” or comparable

terminology and are made based upon management’s current expectations and beliefs as of this date

concerning future developments and their potential effect upon New Jersey Resources (NJR or the

Company). There can be no assurance that future developments will be in accordance with management’s expectations

or that the effect of future developments on the Company will be those anticipated by management. NJR

cautions persons reading or hearing this presentation that the assumptions that form the basis

for forward-looking statements regarding expected contribution by new customers of New Jersey Natural Gas Company

(NJNG) to utility gross margin, expected number of new customers of NJNG, the completion of NJRCEV's

planned solar projects in fiscal 2012, the approval of NJNG’s natural gas refueling station filing, approval of the proposed extension of The SAVEGREEN Project®,

estimated capital expenditures in fiscal 2012 by NJNG and NJRCEV, and NJ’s Energy Master Plan include many factors that are beyond the Company’s ability to control or estimate precisely.

The factors that could cause actual results to differ materially from NJR’s expectations include,

but are not limited to, weather and economic conditions; demographic changes in the NJNG service

territory and their effect on NJNG's customer growth; volatility of natural gas and other

commodity prices and their impact on NJNG customer usage, NJNG's incentive programs, NJRES' operations

and on the Company's risk management efforts; changes in rating agency requirements and/or credit

ratings and their effect on availability and cost of capital to the Company; the impact of

volatility in the credit markets; the ability to comply with debt covenants; the impact to the asset

values and resulting higher costs and funding obligations of NJR's pension and postemployment

benefit plans as a result of downturns in the financial markets, a lower discount rate, and impacts

associated with the Patient Protection and Affordable Care Act; accounting effects and other risks

associated with hedging activities and use of derivatives contracts; commercial and wholesale

credit risks, including the availability of creditworthy customers and counterparties, liquidity in the

wholesale energy trading market and the Company’s ability to recover all of NJRES’ funds in

the MF Global liquidation proceedings; the ability to obtain governmental approvals and/or

financing for the construction, development and operation of certain non-regulated energy investments; risks

associated with the management of the Company's joint ventures and partnerships; risks associated with

our investments in solar energy projects, including the availability of regulatory and tax

incentives, logistical risks and potential delays related to construction, permitting, regulatory approvals

and electric grid interconnection, the availability of viable projects and NJR's eligibility for federal

investment tax credits (ITC), the future market for Solar Renewable Energy Certificates and

operational risks related to projects in service; timing of qualifying for ITCs due to delays or failures to

complete planned solar energy projects and the resulting effect on our effective tax rate and earnings;

the level and rate at which NJNG's costs and expenses are incurred and the extent to which

they are allowed to be recovered from customers through the regulatory process; access to adequate

supplies of natural gas and dependence on third-party storage and transportation facilities for

natural gas supply; operating risks incidental to handling, storing, transporting and providing

customers with natural gas; risks related to our employee workforce; the regulatory and pricing policies

of federal and state regulatory agencies; the costs of compliance with the proposed regulatory framework

for over-the-counter derivatives; the costs of compliance with present and future

environmental laws, including potential climate change-related legislation; risks related to changes in accounting

standards; the disallowance of recovery of environmental-related expenditures and other regulatory

changes; environmental-related and other litigation and other uncertainties; and the

impact of natural disasters, terrorist activities, and other extreme events. The aforementioned factors are

detailed in the “Risk Factors” sections of our Annual Report on Form 10-K to be filed on November 23, 2011, as filed with the Securities and Exchange

Commission (SEC) and which is available on the SEC’s website at sec.gov. NJR disclaims any obligation to update and revise statements contained in

these materials based on new information or otherwise. |

Disclaimer Regarding

Non-GAAP Financial Measures

This presentation includes the non-GAAP measures net financial earnings

(losses) and utility gross margin. As an indicator of the

company’s

operating

performance,

these

measures

should

not

be

considered

an

alternative

to,

or

more

meaningful

than,

GAAP

measures

such

as

cash

flow,

net

income,

operating

income

or

earnings

per

share.

Net

financial

earnings

(losses)

exclude unrealized gains or losses on derivative instruments related to the

company’s unregulated subsidiaries and certain realized gains and

losses on derivative instruments related to natural gas that has been placed into storage at NJRES. Volatility

associated with the change in value of these financial and physical commodity

contracts is reported in the income statement in the current period. In

order to manage its business, NJR views its results without the impacts of the unrealized gains and losses,

and certain realized gains and losses, caused by changes in value of these

financial instruments and physical commodity contracts prior to the

completion of the planned transaction because it shows changes in value currently as opposed to when

the planned transaction ultimately is settled. NJNG’s utility gross margin

represents the results of revenues less natural gas costs, sales and other

taxes and regulatory rider expenses, which are key components of the company’s operations that move

in relation to each other.

Management uses net financial earnings and utility gross margin as supplemental

measures to other GAAP results to provide a more complete understanding of

the company’s performance. Management believes these non-GAAP measures are more

reflective of the company’s business model, provide transparency to investors

and enable period-to-period comparability of financial performance.

For a full discussion of our non-GAAP financial measures, please see Item 7 of our Annual Report on

Form 10-K for the fiscal year ended September 30, 2011, filed on November 23,

2011. 3 |

Key

Industry Issues 4

Desire for

Yield

Macro

Economic

Environment

Interest Rates

Supply

Commodity

Prices

Organic

Customer

Growth

Financial

Profile

Environmental

Policy |

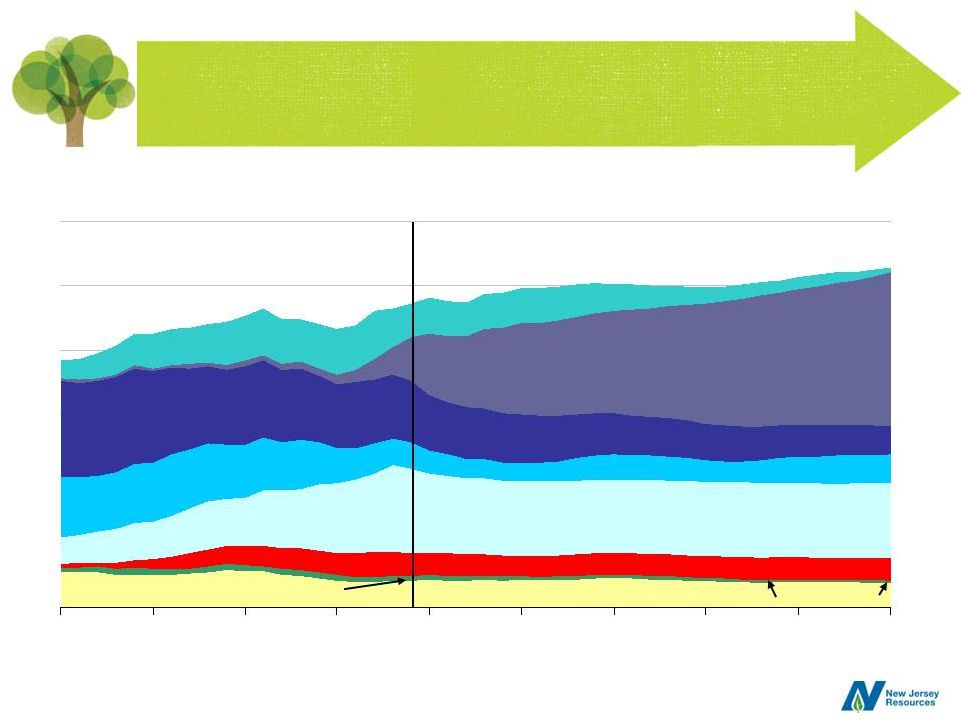

U.S. Natural Gas Reserves

5

Unproved

shale gas

Unproved

other gas

Proved

reserves

Tcf

245

1,481

827

2,552

0

500

1,000

1,500

2,000

2,500

3,000

2000

2005

2006

2007

2008

2009

2010

2011

Source: EIA,

Annual Energy Outlook 2011 |

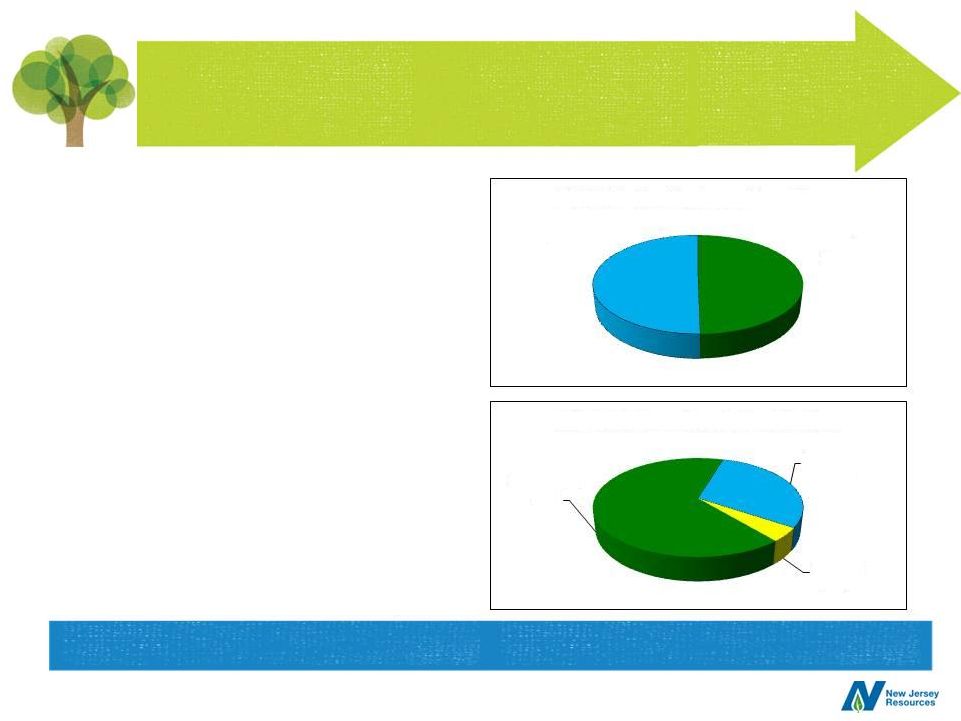

Sources of Supply

6

Alaska

Non-associated offshore

Projections

History

Associated with oil

Coalbed methane

Net imports

Non-associated onshore

Shale gas

2009

11%

1%

9%

7%

9%

8%

20%

14%

8%

2%

8%

7%

46%

1%

Tight gas

28%

22%

Source: EIA, Annual Energy Outlook 2011

30

25

20

15

10

5

0

1990

1995

2000

2005

2010

2015

2020

2052

2030

2035 |

Our

Business Model Steady customer growth

Rate base

investment opportunities

Regulatory incentives

Safety and reliability

Competitive pricing

Natural Gas Distribution

Clean Energy and Retail Services

Residential solar programs

Commercial rooftop solar

and ground-mounted projects

Service contracts, installations

and repair services

Wholesale Energy Services

Physical natural

gas marketer

Producer services

Storage and transportation

asset management

Midstream investments

Focus on the Fundamentals

•

Diverse Stakeholder Relationships

•

Strong Financial Profile

•

Disciplined Capital Allocation

•

Energy Infrastructure, Asset Mgmt. and Services

•

Consistent Earnings and Dividend Growth

7 |

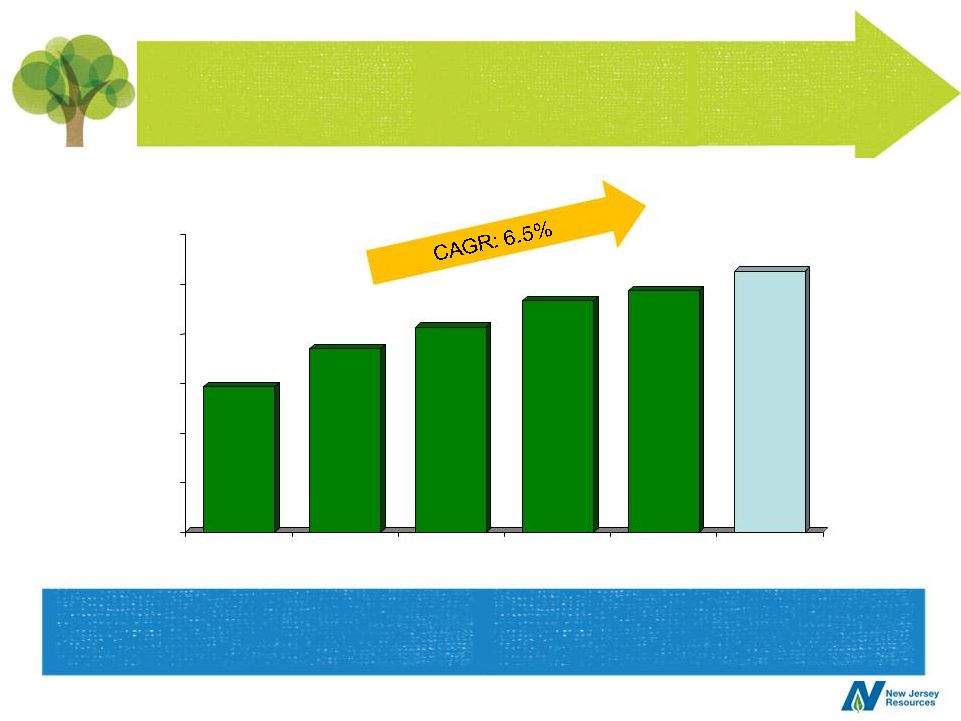

•

Achieved our 20th consecutive year of net financial earnings (NFE) per share growth

in fiscal 2011

–

$2.58 compared with $2.46 last year, a 4.9 percent increase

•

Implemented a 5.6 percent dividend increase effective January 3,

2012

–

New annual rate of $1.52 per share

–

17th consecutive annual increase

•

Strong results from New Jersey Natural Gas (NJNG)

–

Steady customer growth

–

Regulatory incentives

–

BGSS margins

•

Continued progress on clean energy strategy

–

Five commercial and 349 residential projects completed totaling over 9.8 megawatts

(MW) –

McGraw Hill and others completed in the first quarter of fiscal 2012

•

Positive earnings contribution from NJR Energy Services (NJRES),

NJR Home

Services (NJRHS) and Midstream Assets

Highlights

8 |

•

Approximately 496,000

customers

•

$943 million of rate base

•

100 percent residential and

commercial customers

•

Solid customer growth

Our Core Business

9

Favorable demographics to support customer growth |

Customer Growth

•

6,783 new customers in fiscal

2011, a 10 percent increase over

fiscal 2010

•

641 additional existing customer

heat conversions

•

New customers and existing

customer conversions are

expected to contribute

approximately $3.5 million of new

NJNG utility gross margin annually

•

Estimate 12,000 to 14,000 new

customers over the next two years

10

Steady customer growth of 1.4 percent

New

Construction

50%

Conversions

50%

FYE 2011 New Customer Breakdown

Residential

66%

Commercial

30%

Existing

4%

FYE 2011 Gross Margin Contribution |

$1.15

$3.03

$4.52

$4.98

$0.00

$1.25

$2.50

$3.75

$5.00

NJNG

Fuel Oil

Propane

Electricity

Fuel Price Comparison

Source: EIA

Data as of December 2011. Based on 100,000 comparable

BTUs

11

NJNG enjoys a distinct price advantage in its service area

|

Future Customer Growth

12

2017-Build Out

Potential New Customers = 90,000

2012-2016

Near Main

Potential Conversions = 127,800

Non Heat

On Main

Off Main

Long-term customer growth outlook is strong

Sources: Arthur D. Little , Harte Hanks and NJNG

38,723

7,555

29,445

52,077

75,500

14,500 |

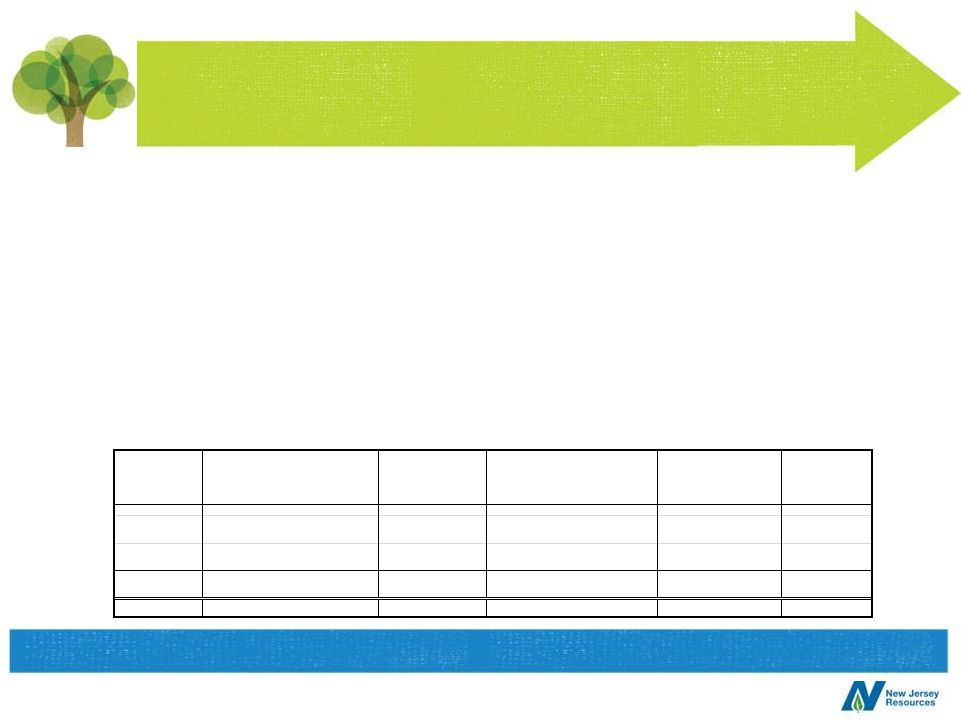

Regulatory Initiatives

Accelerated Infrastructure Programs (AIP)

•

Extended on March 30, 2011

•

Accelerated

capital

projects

help

create

jobs

and

support

system

reliability

•

Project spending:

13

Conservation Incentive Program

•

In place through September 30, 2013; encourages customer conservation

•

Customers have reduced usage and saved over $193 million since inception in

2006 •

Protects NJNG from declining usage and weather; realized $9.1 million in gross

margin in fiscal 2011 Program

Total Capital

Number of

Expected

Return

Name

Approved ($mm)

Projects

Completion Date

on Equity

WACC *

AIP I

$70.8

14

9/30/2011

10.3%

7.76%

AIP II

60.2

9

10/31/2012

10.3%

7.12%

Total

$131.0

23

Constructive regulatory environment allows for innovative programs

|

2011 Energy Master Plan

•

For NJNG, overall positive for natural gas:

–

Supports natural gas electric generation

–

Supports renewable fuel vehicles (NGVs)

–

Supports natural gas over oil in conversion

markets

14 |

Pending Regulatory Initiatives

Natural Gas Refueling Stations

•

Filing submitted to the BPU on June 16, 2011

•

Potential investment of up to $15 million to fund seven to 10 stations in service

area –

$1.60 per gallon of gasoline equivalent based on current prices

–

If approved by the BPU, NJNG would begin construction immediately but no later

than December 31, 2012

–

Proposed annual rate recovery of program spending at WACC of 7.76 percent (10.3%

ROE) 15

The SAVEGREEN Project

®

•

Seeking

program

extension

through

December

31,

2012

to

invest

an

additional

$25.8

million

–

Existing program has resulted in over $73 million of economic activity in the

state •

Over $20 million invested; currently recoverable through rider at WACC of 7.76

percent New regulatory opportunities that benefit

both NJNG and customers |

•

Off-system sales and capacity release

–

In place since 1992

–

Optimization of capacity and supply contracts

–

Sharing formula of 85 percent customer;

15 percent NJNG

•

Storage Incentive (SI)

–

In place since 2004

–

Promotes long-term price stability

–

Promotes efficient utilization

–

Sharing formula of 80 percent customer;

20 percent NJNG

•

Financial Risk Management (FRM)

–

In place since 1997

–

Promote application of risk management

tools

–

Sharing formula of 85 percent customer;

15 percent NJNG

BGSS Incentives

16

Total earnings since inception:

$1.76 per share, an average

of $.08 annually

Incentive programs in place through October 2015 |

Clean Energy Strategic Rationale

•

Consistent with our core energy strategy

•

Reduced energy usage and lower prices for customers

•

Promotes economic development and job creation

•

Supports New Jersey’s environmental goals

17

Clean energy investments contributed $6.8 million to NFE

in its first year of operations |

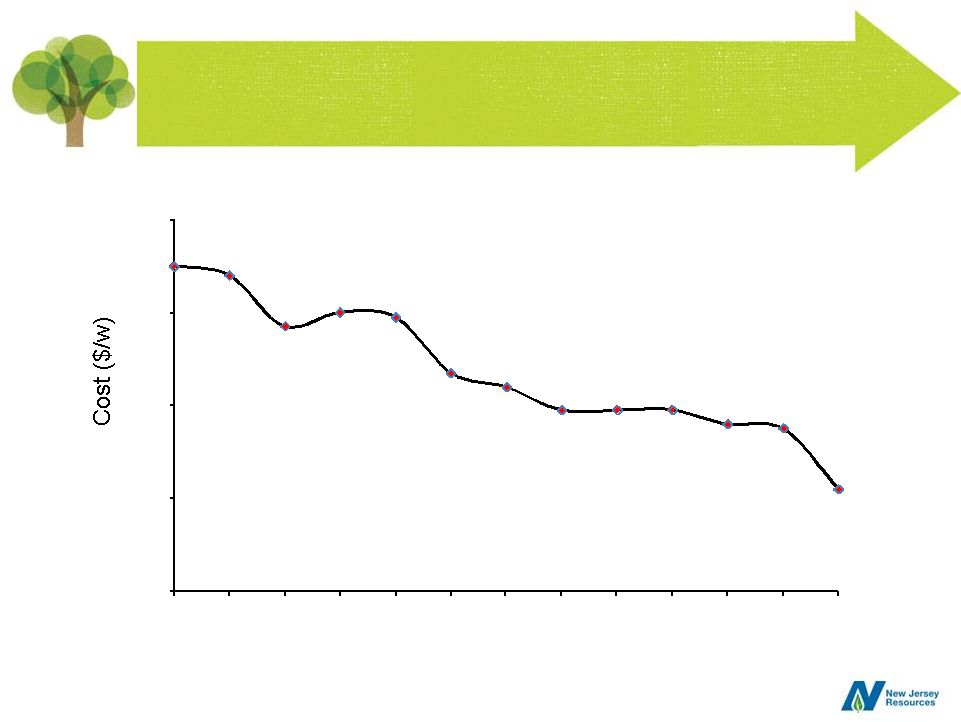

Declining Solar Material Costs

18

Source: Lawrence Berkeley National Laboratory (Behind the meter weighted average installed cost)

$11.00

$10.80

$9.70

$10.00

$9.90

$8.70

$8.40

$7.90

$7.90

$7.90

$7.60

$7.50

$6.20

$4.00

$6.00

$8.00

$10.00

$12.00

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

National Average -

Installed Cost by Year |

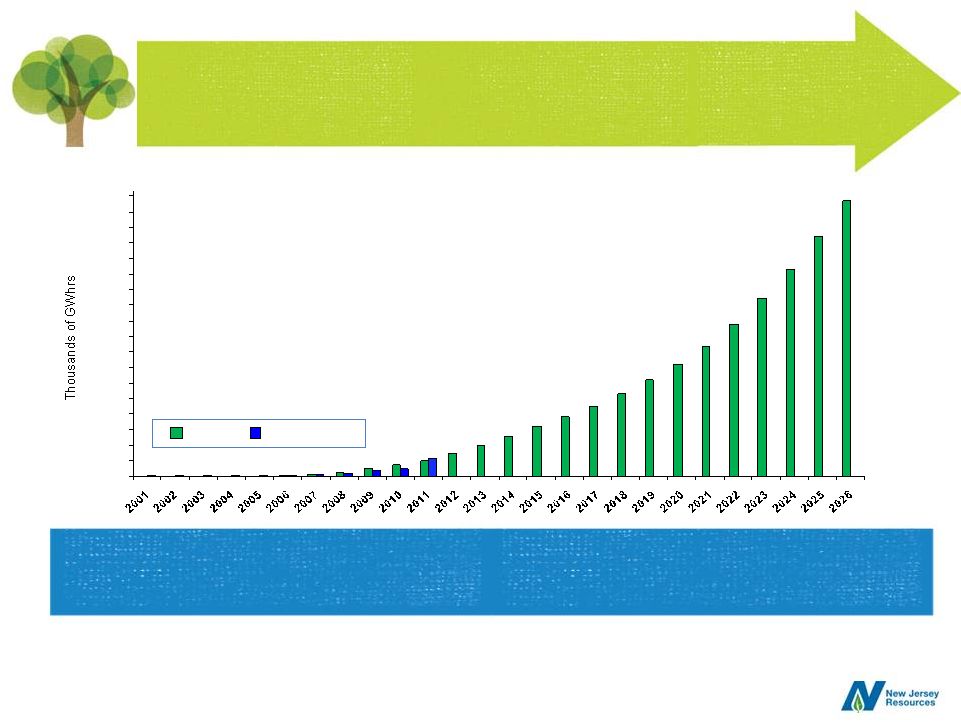

Legislative Renewable Portfolio Standard

12

37

78

156

218

306

442

596

772

965

1,150

1,357

1,591

1,858

2,164

2,518

2,928

3,433

3,989

4,610

5,316

0

300

600

900

1,200

1,500

1,800

2,100

2,400

2,700

3,000

3,300

3,600

3,900

4,200

4,500

4,800

5,100

5,400

RPS

Installed

Source: NJCEP solar installation report as of May 31, 2011

19

Robust Renewable Portfolio Standard (RPS) provides

for long-term solar project opportunities |

The Sunlight Advantage™

Program

•

Fiscal 2011 results:

–

Over 700 leases signed

–

349 operational in FY 2011

–

Average size: 6.9 kilowatts

–

$9.7 million of capital deployed

in FY 2011

•

Supply chain cost efficiency

–

Construction cost reductions

–

Equipment cost reductions

20

Strong residential solar demand |

Commercial Solar Project Update

Project

Map Ref.

Type

Capital (mm)

MW

Adler 1-4

1

Rooftop

$18.0

3.9

75% Vineland

2

Ground

15.1

3.5

Sub Total

$33.1

7.4

Adler 5-6

1

Rooftop

$6.4

1.3

25% Vineland

2

Ground

7.2

1.2

Manalapan

3

Ground

17.2

3.6

McGraw Hill

4

Ground

59.5

14.1

Sub Total

$90.3

20.2

Grand Total

$123.4

27.6

In Service - Fiscal 2011

In Service - Fiscal 2012

1

2

3

4

21

Seeking additional opportunities in fiscal 2012 and beyond

|

22

Solar Project Update -

SREC Pricing

•

New Jersey’s commercial solar market surpassed

California last year to become the largest in the United

States

•

Tax credits, cash grants and bonus depreciation

incentives create an attractive solar market

•

Energy year 2012 SREC prices have been volatile

•

The New Jersey Energy Master Plan and pending

legislation support the solar industry |

23

Solar Program Update –

Legislative Update

•

Administration’s Energy Master Plan supports a sustainable solar

business model that will create jobs, economic growth and

environmental mandates in New Jersey

•

Pending legislation supports the needs of the solar industry while

balancing the cost to customers

-

Accelerates the RPS targets

-

Reduces the Solar Alternative Compliance Payment (SACP) to

reflect the industry’s cost reductions

-

Reduces cost to customers

•

We currently anticipate legislative action in the first quarter of 2012

|

Clean Energy Summary

•

Energy Master Plan and pending legislation provides

clear direction that solar will play an important role in New

Jersey’s energy future

–

Provides clean energy

–

Reduces costs to customers

–

Stimulates economic development

–

Uses new technologies

•

The solar industry is aggressively reducing costs, and

improving efficiencies in order to have less reliance on

incentives in the long term

–

Material prices should continue to fall

24 |

Midstream Investments

•

Overall, Midstream Assets contributed $6.8 million to FY 2011 NFE vs.

$6.4 million last year

–

Iroquois contributed $2.7 million

•

Approximately 30 percent of Steckman Ridge capacity under

long-term contracts

NJRES and Midstream Investment Updates

25

NJRES

•

Value of capacity and storage has been affected by changing markets

and additional supplies

–

Resulted in lower margins

–

Continued focus on a long-option strategy

–

Disciplined risk management

•

Contributed $18.6 million to FY 2011 NFE vs. $24.8 million last year

|

•

Serves nearly 150,000 customers

with Premier Service Plans and

equipment installations

•

Fiscal 2011 revenue of more than

$36 million, an 18 percent increase

over last year

•

Contributed over 2 percent of fiscal

2011 NFE

NJR Home Services

26

Consistently delivers high-quality products and service levels

|

Financial Performance

September 30

Infrastructure-based businesses provided

83 percent of fiscal 2011 NFE

27

$1.88

$2.11

$2.24

$2.40

$2.46

$2.58

$1.00

$1.30

$1.60

$1.90

$2.20

$2.50

$2.80

2006

2007

2008

2009

2010

2011

Net Financial Earnings |

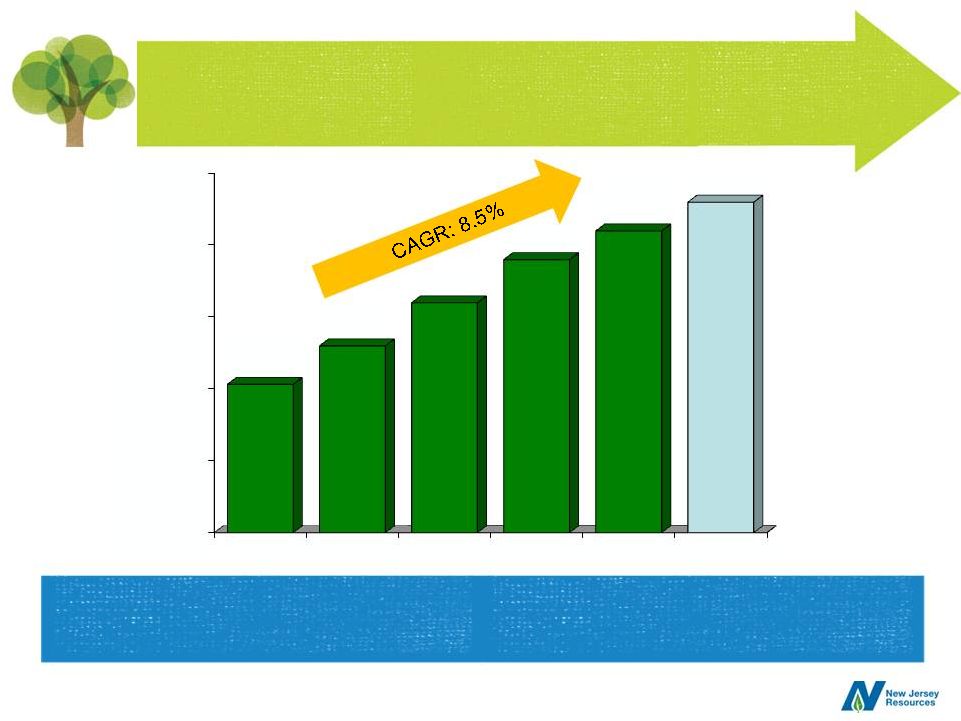

17 consecutive year of dividend growth;

Five-year CAGR: 8.5% vs. 3.5%** for peers

Dividend Growth

* Effective January 3, 2012

** Based on current indicated dividend rates

28

th

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

2007

2008

2009

2010

2011

2012*

$1.01

$1.12

$1.24

$1.36

$1.44

$1.52 |

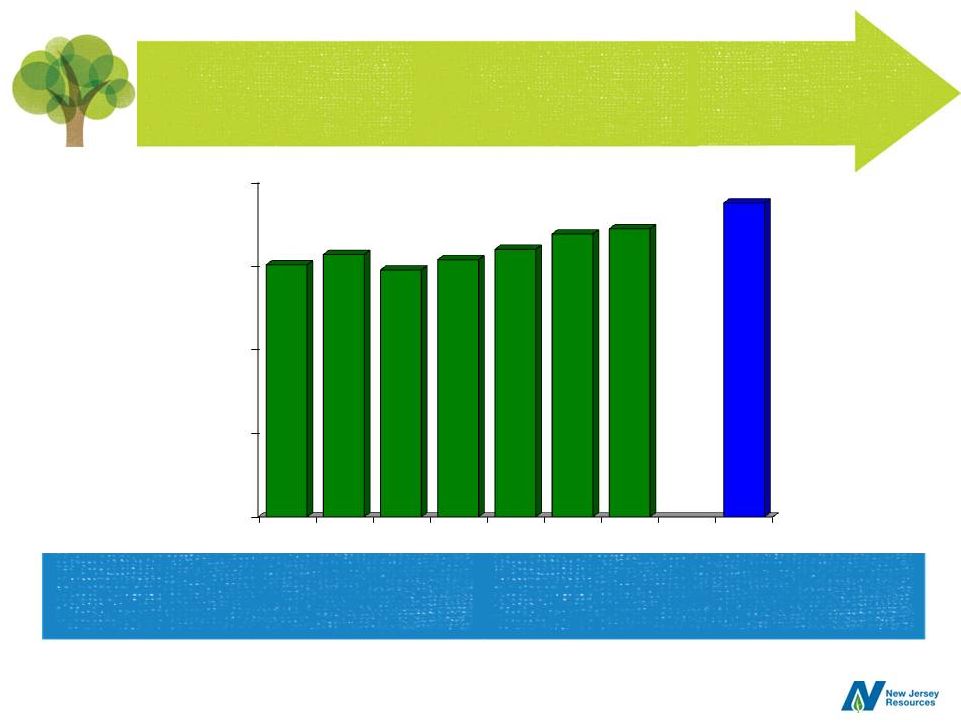

Payout Ratio

Based on Net Financial Earnings

Relatively low payout ratio provides

continued dividend growth opportunities

29

* Peer group average based on 2011 earnings estimates and

indicated dividend from Bloomberg. Peer group: ATO, GAS,

LG, NWN, PNY, SJI, SWX, VVC and WGL

0%

16%

33%

49%

65%

2005

2006

2007

2008

2009

2010

2011

Peer

Group*

49%

51%

48%

50%

52%

55%

56%

61% |

($ millions)

September 30,

September 30,

2011

2010

Cash Flow from Operations

$250.1

$139.4

Capital Expenditures:

Utility Plant

(93.6)

(86.6)

Solar Equipment and Other

(75.5)

(3.5)

Cost of Removal, Investments and Other

(6.0)

(11.2)

Subtotal Capital Expenditures

(175.1)

(101.3)

Financing Activitites

Common Stock Issued

15.7

7.2

Common Stock Repurchased

(10.2)

(29.7)

Dividends

(58.7)

(53.1)

Debt (Payments) Proceeds, net

(15.3)

2.3

Subtotal Financing Activities

(68.5)

(73.3)

Change in Cash

$6.5

($35.2)

Cash Flow Summary

30

Strong cash flow supports future capital expenditure plans

Strong cash flow supports future capital expenditure plans

|

•

NJNG capital expenditures totaling $121.2 million

–

Includes $49.9 million for AIP

•

Continued steady customer growth

–

About 6,500 new customers

–

Gross margin of $3.5 million annually

•

ITC-eligible clean energy capital expenditures estimated

at $104.3 million

–

Commercial -

$90.1 million

–

Residential -

$14.2 million

Key Fiscal 2012 Assumptions

31

Fiscal 2012 guidance will be issued on February 7 |

32

•

We have:

–

A track record of growth and consistent results

–

The fundamentals in place to deliver consistent long-term NFE growth

•

Solid customer growth

•

Progressive regulation

•

Disciplined solar investments

–

A collaborative relationship with key stakeholders

–

A strong financial profile

–

A commitment to dividend growth

•

17-year growth history

Why NJR?

A record of consistent performance; positioned for long-term growth

|

New

Jersey Resources New York Financial

Community Luncheon

January 12, 2012 |