Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE ISSUED JANUARY 9, 2010 - BLUCORA, INC. | d278620dex991.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - BLUCORA, INC. | d278620dex21.htm |

| 8-K - CURRRENT REPORT ON FORM 8-K - BLUCORA, INC. | d278620d8k.htm |

Acquisition

Overview January 9, 2011

1

Exhibit 99.2 |

Safe Harbor

During the course

of this presentation, we may provide projections or

other forward-looking statements regarding future events and/or

future financial performance.

We wish to caution you that you should

not place undue reliance on such forward-looking statements because

they are just projections. Actual events or results may differ

materially due to risks, uncertainties, and other factors, including, but

not limited to: the successful execution of the Company’s strategic

initiatives, business integration and operating plans, and marketing

strategies; the timing and extent of market acceptance of products

and services; and general economic, industry, and market sector

conditions.

We refer you to the documents

InfoSpace files from time

to time with the Securities and Exchange Commission, and in

particular

the

risk

factors

identified

in

InfoSpace's most recent

Quarterly Report on Form 10-Q.

2 |

Introducing…

3 |

Transaction

Overview •

InfoSpace has agreed to acquire TaxACT for $287.5M in cash

•

Transaction represents an attractive return on shareholder capital

•

Anticipating debt financing of roughly $95M at the TaxACT subsidiary level,

leaving InfoSpace with an estimated excess of $90M of cash at closing

•

Expected to close in the first quarter of 2012

TaxACT

(millions)

Implied

Multiple

Enterprise Value /

Revenues

$78.1

3.7x

Enterprise Value /

Adjusted EBITDA

$37.8

7.6x

Enterprise Value /

Unlevered Free Cash

Flow

$37.3

7.7x

Deal Summary

(Twelve months ending Sept. 30, 2011)

Sources

Cash from Parent

$200.0

Senior Secured Subsidiary Debt

90.0

Revolver (drawn at close)

3.0

$293.0

Uses

Cash Consideration

$287.5

Transaction Expenses

5.5

$ 293.0

Sources and Uses

($ in millions)

4 |

Investment

Highlights 5

Significant, Positive Step Forward for InfoSpace Shareholders

Large,

Growing

Market

TaxACT Well

Positioned

Track Record

of Execution

Financial

Return |

Investment

Highlights •

Enduring category

•

Digital shift in its early stages

•

Evolving consumer needs and preferences

•

Shifting provider landscape

•

Enduring category

•

Digital shift in its early stages

•

Evolving consumer needs and preferences

•

Shifting provider landscape

6

Large,

Growing

Market

TaxACT Well

Positioned

Track Record of

Execution

Financial Return |

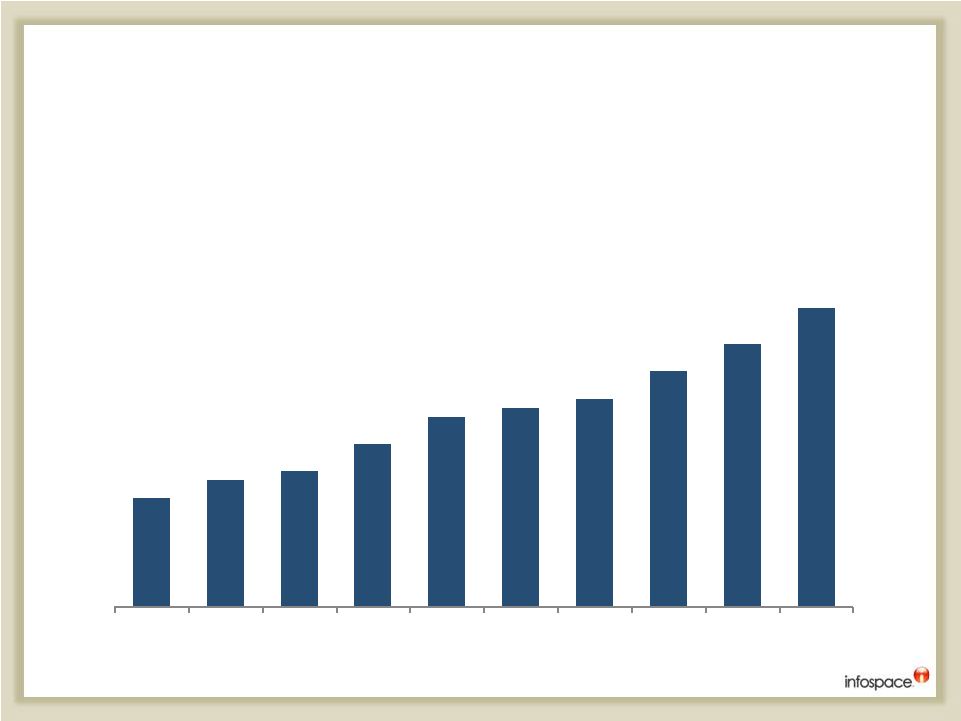

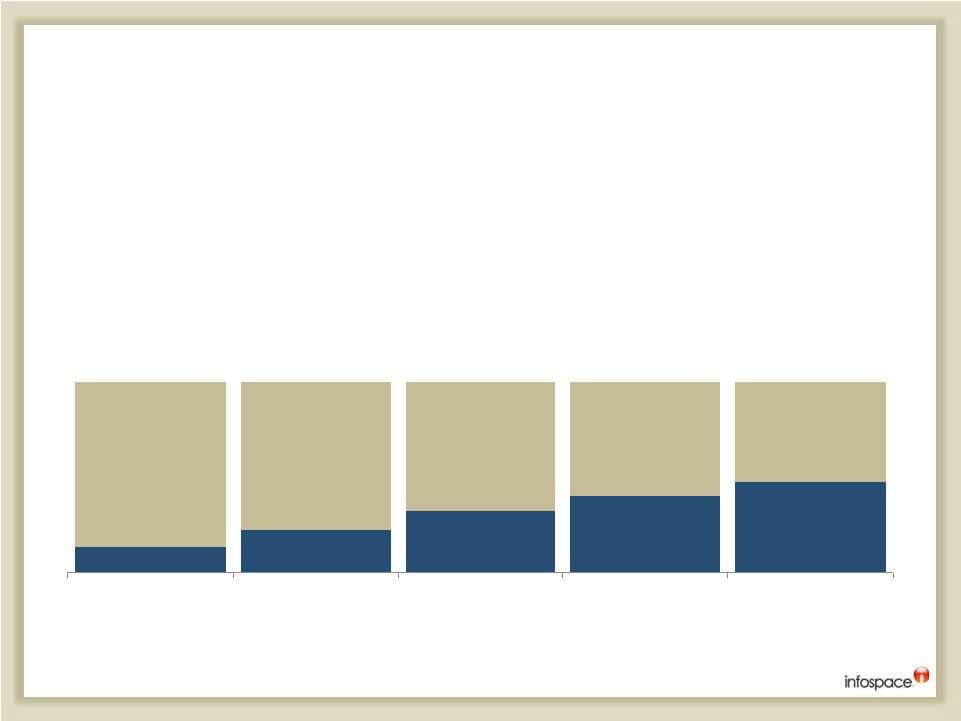

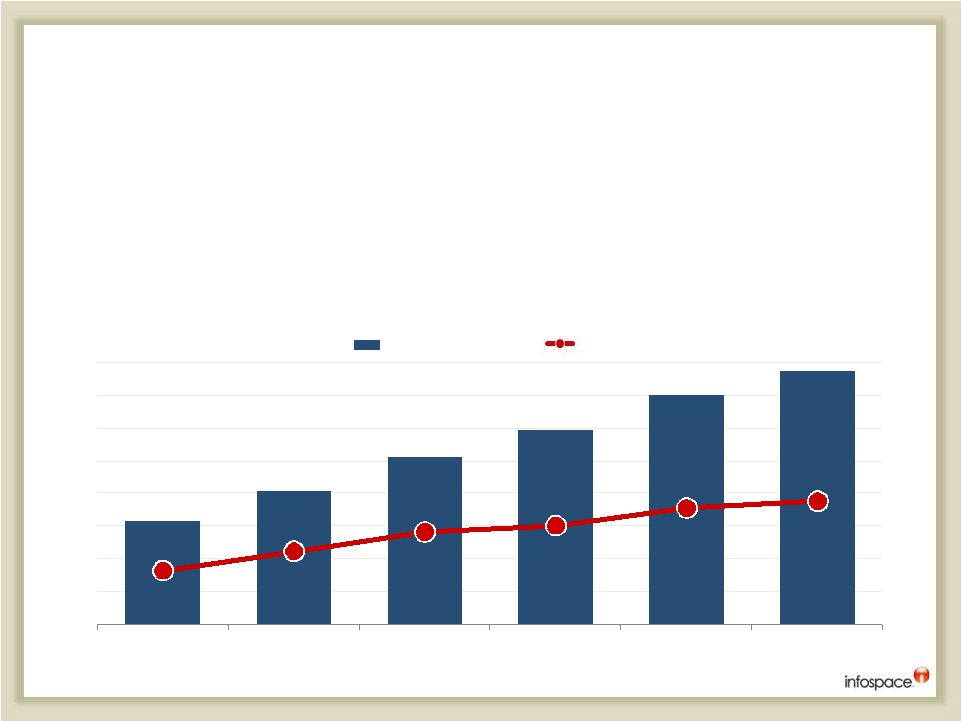

•

Total

tax

year

2010

U.S.

individual

federal

tax

returns

of

~

140

million;

expected to grow at roughly 1%-2% per year

•

Digital do-it-yourself (‘DDIY’) tax preparation supplementing ‘paper

& pencil’ and professional preparation

•

Internet has increasingly become the preferred DIY platform

•

Approximately 30 million filers prepared taxes using an online solution in

2010, up from 17 million in 2007

7

Digital Shift Underway in Tax Preparation

“DDIY”

Proportion of Total IRS Returns

(12% -

9 Year CAGR)

12%

14%

15%

18%

21%

22%

23%

26%

29%

33%

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011 |

Market Supported

by Demographic Trends •

Online tax preparation market expected to grow at ~10% + annually over

the next few years, fueled by demographic shifts in the base of taxpayers

•

Online tax preparation providers are best positioned to meet evolving

consumer needs and preferences

8

*Data sourced from a proprietary survey conducted by a professional, third party market

research firm; Digital age defined by people born after 1971 Growth of “Digital

Age” as % of Filing Population* in US (1995-2015)

% of US “Filing Age”

Population (18+ Years)

= = Estimated = =

Digital Age 13%

Digital Age 22%

Digital Age 32%

Digital Age 40%

Digital Age 47%

Other Filing Age

87%

Other Filing Age

78%

Other Filing Age

68%

Other Filing Age

60%

Other Filing Age

53%

1995

2000

2005

2010

2015 |

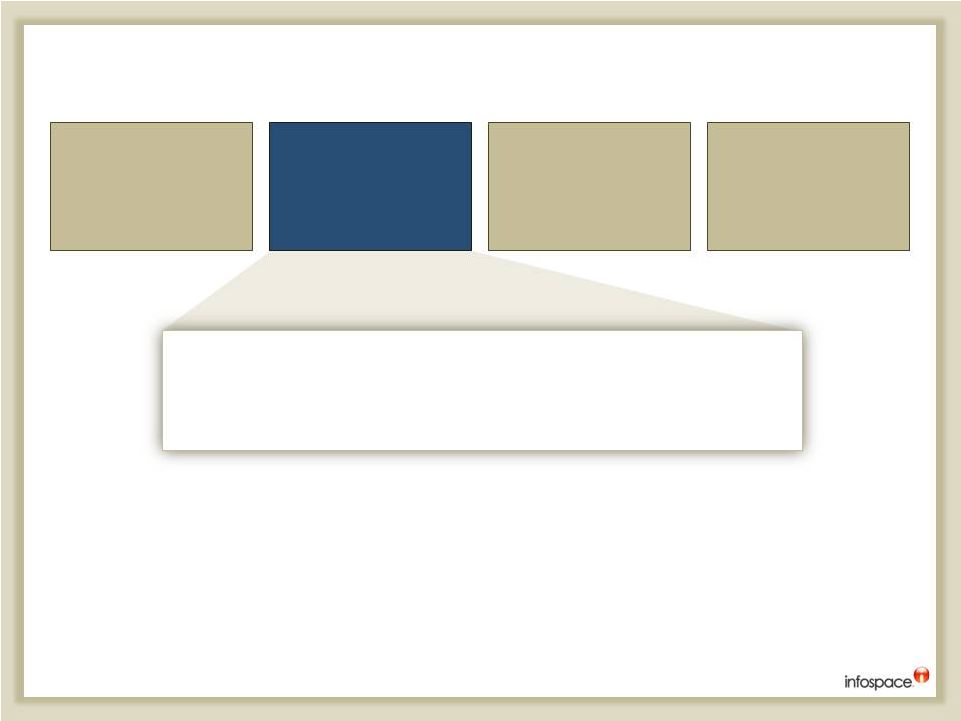

Investment

Highlights •

Competitive market position

•

Leading brand and value based-positioning

•

Loyal growing customer base

•

Competitive market position

•

Leading brand and value based-positioning

•

Loyal growing customer base

9

Large, Growing

Market

TaxACT Well

Positioned

Track Record of

Execution

Financial Return |

Consumer Value

Proposition 10

•

Net promoter score that compares favorably with

leading global consumer brands

•

Recognized for ease of use, accessibility & reliability

•

Over 90% of taxpayers are paying more to file their

taxes than TaxAct charges

•

Compare TaxAct’s average $13/filing with:

o

H&R Block online: ~ $33

o

TurboTax: ~ $54

o

Tax Stores: ~ $180

o

Professional Accountant: ~ $225

•

TaxACT is solidly profitable

•

Advantageously positioned for future investment

(product enhancements, customer acquisition)

Well established brand, favorably positioned against

identified market trends.

Brand

Acceptance

Superior

Value

Financial

Strength |

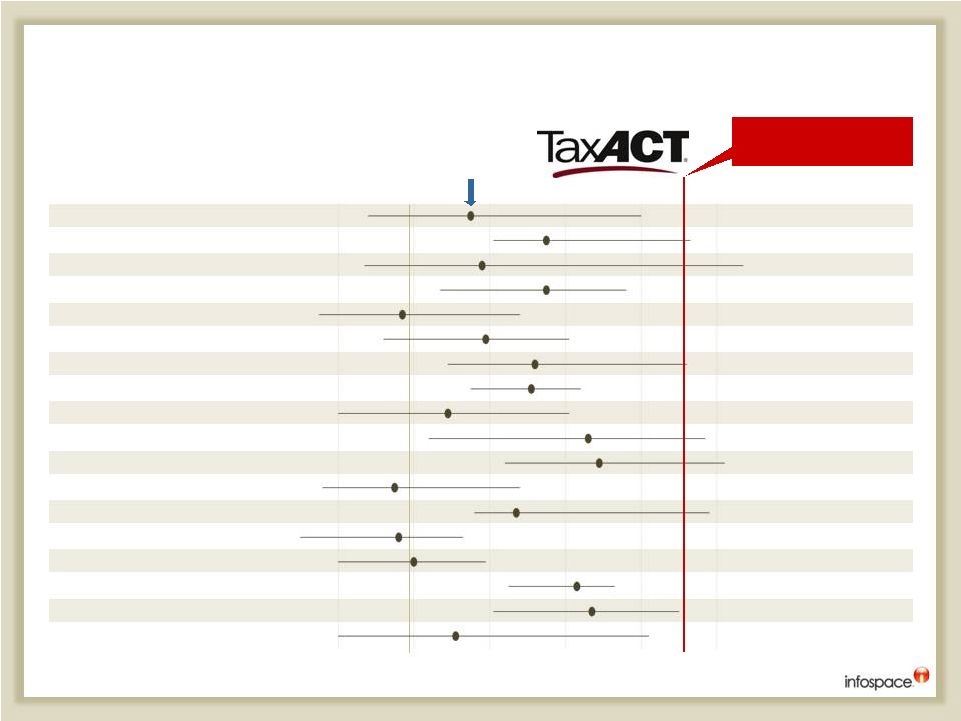

TaxACT NPS in

Context Net Promoter Score Ranges and Leaders by Industry (US)

Source: Satmetrix 2011 Net Promoter Benchmark Study of

U.S. Consumers; Bain analysis

11

-20%

0

20%

40%

60%

80%

Industry

Airlines

Auto Insurance

Banking

Brokerage and investments

Cable and satellite TV

Cellular phone service

Computer hardware

Consumer software

Credit cards

Dept., wholesale, specialty stores

Grocery and supermarkets

Health insurance

Homeowners insurance

Internet service

Life insurance

Online search and information

Online shopping

Quick-service restaurants

Leader

JetBlue/SWA

USAA

USAA

Vanguard

Verizon

MetroPCS

Apple

Symantec

AMEX

Costco

Trader Joe’s

Kaiser Permanente

USAA

Verizon

State Farm

Google/Facebook

Amazon.com

Chick-fil-A

TaxACT NPS

Among the Highest

Average

Score |

Product

Leadership “Deluxe”

-

$9.95; Enhanced feature set, including

additional reports, “life event”

interviews and in depth help

content

“State”

-

$14.95 for Free Federal customers; $8 for Deluxe

Consumer Paid

“Professional”

-

$119 to $619

•

•

Professional

“Free Federal for Everyone”

•

Full-featured, individual federal tax preparation

•

No-risk, no obligation solution

Consumer Free

Offerings

12

Toolkit for professional tax preparers includes client

organizers, invoicing, client letters, client manager, and

tax planning tools

Individual, partnership and corporate returns

“Other”

-

includes bundles , data archive services, refund

payment transfers, stored value card solutions, phone

support |

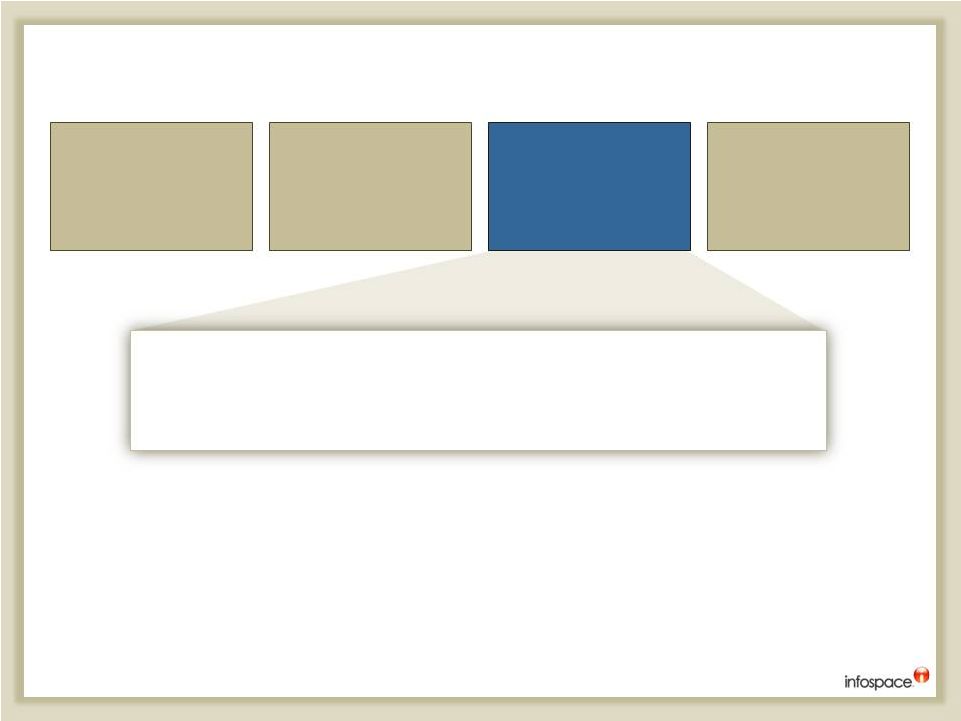

Investment

Highlights •

In-market expertise & leadership in tax preparation

•

Dedicated, industry leading management team

•

Legacy of growth and profitability

•

In-market expertise & leadership in tax preparation

•

Dedicated, industry leading management team

•

Legacy of growth and profitability

13

Large, Growing

Market

TaxACT Well

Positioned

Track Record

of Execution

Financial Return |

Sustained

Execution TaxACT Financial Performance

($ in millions)

14

•

Experienced management team lead by industry veterans

•

Proven online direct marketing capabilities

•

Consistent revenue growth and bottom line performance

$31.5

$40.6

$51.2

$59.6

$70.0

$77.6

$16.4

$22.3

$28.2

$30.1

$35.5

$37.6

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

Revenue

EBITDA |

Investment

Highlights •

Strong, near-term return on shareholder capital

•

Pro-forma non-GAAP earnings per share of $1.21

•

Positioned for future growth and investment

•

Strong, near-term return on shareholder capital

•

Pro-forma non-GAAP earnings per share of $1.21

•

Positioned for future growth and investment

15

Large, Growing

Market

TaxACT Well

Positioned

Track Record of

Execution

Financial

Return |

Superior Return

on Shareholder Capital 16

Adjusted EBITDA

$37,809

Less –

Cash Interest Expense

(4,500)

(a)

Less –

Cash Taxes

(650)

(b)

Less –

Capital Expenditures

(500)

Levered Free Cash Flow

$32,159

Cash from Parent

$200,000

ROE

16.1%

(a)

Interest expense estimated at $90.0 million of debt at a 5.0% interest rate

(b)

Cash taxes estimated at 2.0% of earnings before income taxes excluding non-recurring

income and expense ($ in thousands; financial figures represent twelve months ending

September 30, 2011) •

Transaction contemplates modest leverage (~ 2.5x LTM EBITDA); shareholders

realize superior return on capital

•

Infospace NOL meaningfully enhances ROE to shareholders (~ 50% on a pro

forma basis) |

Pro

Forma Combined

Revenue

$211,882

$78,093

$289,975

Adj. EBITDA

$34,721

$37,809

$72,530

% Margin

16.4%

48.4%

25.0%

Non-GAAP Net Income

$13,796

$31,798

$45,594

Non-GAAP EPS -

Diluted

$0.36

$0.85

$1.21

Diluted Avg Shares

37,812

37,812

37,812

Compelling Pro Forma Financial Profile

17

Twelve months ending Sept. 30, 2011 ($ in Thousands)

|

Future Growth

and Investment Potential Future Steps for Value Creation

18

Revenue $290M

Adjusted EBITDA $73M

Search

Revenue: $212M

EBITDA $35M

TaxACT

Revenue: $78M

EBITDA: $38M

Estimated Cash at Close in Excess of $90M

1

2

3

Optimize and grow existing businesses

Identify areas for future investment

Disciplined consideration of follow-on M&A opportunities

|

Non-GAAP

Financial Measures Some

measures

presented

for

InfoSpace,

Inc.

("InfoSpace")

and

2

nd

Story Software, Inc. ("TaxACT") in this presentation are non-GAAP

financial measures within the meaning of the SEC's Regulation

G.

InfoSpace believes that presenting non-GAAP financial measures

is useful to financial statement users because it describes InfoSpace

and TaxAct operating performance, excluding some recurring and

non-recurring charges that are included in the most directly

comparable measures calculated and presented in accordance with

GAAP.

InfoSpace management uses these non-GAAP measures as

important indicators of the Company's historical performance and

in

planning and forecasting future performance.

The non-GAAP financial

measures that InfoSpace presents may not be comparable to

similarly-named financial measures used by other companies, and

financial statement users should not consider non-GAAP financial

measures in isolation from, or a substitute for, financial information

presented in compliance with GAAP.

You are encouraged to review

the reconciliation of non-GAAP financial measures to GAAP financial

measures included in the following pages of this presentation and in

InfoSpace's filings with the SEC.

19 |

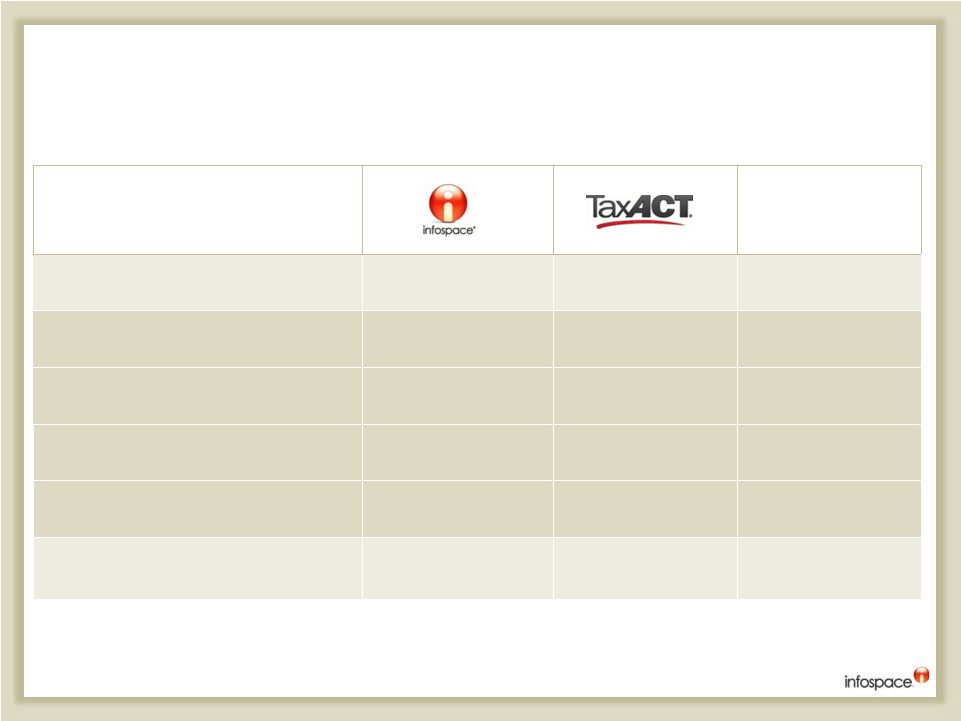

20

INSP

TaxACT

Pro Forma

Combined

GAAP pro forma net income, including pro forma interest on debt and pro forma income taxes

13,798

$

16,487

$

30,285

$

Discontinued operations

11,579

-

11,579

Depreciation and amortization of intangible assets

9,480

752

10,232

Stock-based compensation

11,560

35

11,595

Other loss (income), net, includes INSP's $19.0 million litigation settlement and TaxACT's $7.1

million in expenses related to the H&R Block failed transaction process

(19,125)

7,158

(11,967)

Pro forma adjustment for interest on debt

-

4,500

4,500

Pro forma income tax expense, calculated at 35% of pre-tax pro forma income

7,429

8,877

16,306

Adjusted pro forma EBITDA

34,721

$

37,809

$

72,530

$

InfoSpace, Inc.

Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measure

Adjusted Pro Forma EBITDA Reconciliation

(Unaudited)

(Amounts in thousands)

12 Months Ended September 30, 2011 |

21

INSP

TaxACT

Pro Forma

Combined

GAAP pro forma net income, including pro forma interest on debt and pro forma income taxes

13,798

$

16,487

$

30,285

$

Discontinued operations

11,579

-

11,579

Pro forma adjustment for legal settlement

(18,965)

-

(18,965)

Pro forma adjustment for expenses incurred related to the H&R Block failed transaction

process -

7,083

7,083

Pro forma income from continuing operations net of non-recurring items

6,412

23,570

29,982

Pro forma non-cash income tax expense from pro forma income from continuing operations net of

non- recurring items, calculated at 35% of pre-tax pro forma income from continuing

operations less 2% alternative minimum tax

7,384

8,228

15,612

Pro forma non-GAAP net income

13,796

$

31,798

$

45,594

$

Income from continuing operations net of non-recurring items - diluted

0.17

$

0.62

$

0.79

$

Non-cash income tax expense from continuing operations net of non-recurring items -

diluted 0.19

$

0.23

$

0.42

$

Pro forma non-GAAP net income per share - diluted

0.36

$

0.85

$

1.21

$

37,812

37,812

37,812

12 Months Ended September 30, 2011

InfoSpace, Inc.

Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measure

Pro Forma Non-GAAP Net Income Reconciliation

(Unaudited)

(Amounts in thousands, except per share amounts) |