Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEUSTAR INC | d256698d8k.htm |

Neustar’s Acquisition

of TARGUSinfo

©

Neustar Inc. / All Rights Reserved

November 15, 2011

This document is an update to Exhibit 99.3 of Form 8-K filed with the

Securities and Exchange Commission on October 11, 2011

Exhibit 99.1 |

2

Forward Looking Statements

©

Neustar Inc. / All Rights Reserved

Statements in this document regarding Neustar, Inc.'s acquisition of TARGUSinfo, including, without

limitation, benefits of the transaction and Neustar's expectations regarding the transaction's

effects on its GAAP and non--GAAP results, and any other statements regarding future

expectations, beliefs, goals or business prospects constitute forward-looking statements made

pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995.

We cannot assure you that our expectations will be achieved or that any deviations will not be

material. Forward-looking statements are subject to many assumptions, risks and

uncertainties that may cause future results to differ materially from those anticipated. Among the

important factors that could cause future events or results to vary from those addressed in the

forward-looking statements include, without limitation, risks and uncertainties arising

from difficulties with the integration process or the realization of the benefits of the

transaction; general economic conditions in the regions and industries in which Neustar and TARGUSinfo

operate; the reaction of the users of TARGUSinfo's services; and the reaction of competitors to the

transaction. More information about potential factors that could affect our business and

financial results is included in our filings with the Securities and Exchange Commission,

including, without limitation, our Annual Report on Form 10-K for the year ended December

31, 2010 and subsequent periodic reports. All forward-looking statements are based on information available to us

on the date of this press release, and we undertake no obligation to update any of the

forward-looking statements after the date of this press release.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURE

Neustar reports its results in accordance with generally accepted accounting principles in the United

States (GAAP). Throughout this document, Neustar is providing certain non-GAAP

financial measures. Neustar cautions investors that the non-GAAP financial measures

presented are intended to supplement Neustar’s GAAP results and are not a substitute for

such results. Additionally, the non-GAAP financial measures used by Neustar may differ from

the non-GAAP financial measures used by other companies.

|

3

Why TARGUSinfo?

©

Neustar Inc. / All Rights Reserved

Creates a leader in information and analytics services

•

Provides value-added decision-making data and analytical tools for

customers •

Leverages patented processes and predictive analytics assets

Strong strategic fit

•

Near-adjacency with similar business model and financial profile

•

Low execution / integration risk

Creates multiple opportunities for incremental growth

•

Expanded distribution channels

•

Cross-selling / up-selling opportunities

•

Deeper service portfolio for all types of carriers

•

Combination of assets enables broader predictive analytics capabilities

Diversifies

revenue

while

maintaining

high

margins

and

continued

growth

•

Combined LTM revenue of $732M and adjusted EBITDA of $327M

Adds experienced management team with a demonstrated record of

innovation |

4

TARGUSinfo at a Glance

©

Neustar Inc. / All Rights Reserved

A leading provider of on-demand identification, verification, scoring, and

local search solutions

•

Access to over 200 sources of data, creating the most reliable, trusted and

comprehensive data repository

•

Processes over 100 billion real-time queries annually

•

Extensive portfolio of patents

Operates in large, growing markets

•

U.S.

online

display

advertising

market

estimated

to

reach

$12.3

billion

in

2011

(1)

•

U.S.

online

local

directories

and

search

market

estimated

at

$2.6

billion

in

2010

(2)

•

U.S.

online

lead

generation

market

estimated

at

$1.3

billion

in

2010

(3)

Broad, diverse customer base

•

Recurring revenues provide strong visibility

•

Over

800

customers

in

diversified

customer

segments

–

cable,

telecom,

financial

services, e-commerce, retail, education, and government

•

Strategic

partnerships

–

search

engines,

ad

networks,

and

clearinghouses

Founded in 1993 and headquartered in Northern Virginia

•

Approximately 460 employees

(1)

Source: eMarketer

(2)

Source: Industry Survey conducted by PricewaterhouseCoopers and sponsored by

Interactive Advertising Bureau (3)

Source: Industry Survey conducted by PricewaterhouseCoopers and sponsored by

Interactive Advertising Bureau |

5

What is the most

efficient network path?

Who is TARGUSinfo?

Just Like Neustar…. TARGUSinfo Provides Real

Intelligence For Better Business Decisions

©

Neustar Inc. / All Rights Reserved

Who is on the other end

of my transaction?

How do I get someone to the

correct store location?

Is the information provided

from the consumer accurate?

How do I interact with

customers and sell more

effectively?

N

On what network does this

phone number terminate?

Is my website providing

relevant information?

Is my on-line storefront

performing optimally? |

6

Who is TARGUSinfo?

Overview of Services

©

Neustar Inc. / All Rights Reserved

Solutions

(% LTM Revenues

(1)

)

Services

Customer Segments

Largest independent provider of Caller ID

•

Cable companies

•

Telecom operators

•

Wireless

providers

Identification

and Location

(64%)

Identification

and Location

(64%)

Link phone number to name and address in real-time

Real-time geographic call routing based on address identifier

Links phone number to name /address for direct mail

•

Call centers

•

Direct response marketers

•

Call centers

•

Direct response marketers

•

Telecom companies

•

Call centers

•

Utilities

Lead Verification,

Authentication

and Scoring

(19%)

Lead Verification,

Authentication

and Scoring

(19%)

Qualifies and scores online leads

Enables businesses to manage and enhance their online identity

Provides online audience information

•

Marketing companies

•

Education

•

Insurance companies

•

Enhancement to “On-

Demand Verification”

•

Ad agencies

•

Ad networks

•

Publishers

•

Local/national businesses

•

Local search engines

Directory

Services

(17%)

Directory

Services

(17%)

Enhanced Directory Assistance and White Pages listings

•

White

pages

/

yellow pages

providers

•

Marketing companies

Description

Caller Name:

On-Demand

Identification:

On-Demand Location:

Second Approach:

On-Demand Verification:

On-Demand Scoring:

AdAdvisor:

Localeze:

Amacai:

(1)

As of September 30, 2011

Verifies

and supplements prospective leads’

name and

address |

7

Neustar and TARGUSinfo Value Proposition

©

Neustar Inc. / All Rights Reserved

•

2.9B global telephone numbers

•

2.8B global IP addresses

•

5.3M global domain names

200 data sources

14M business listings

400M household listings

Creates

unmatched scale

Enables predictive

analytics

•

11,000 customers

•

5,700 carrier customers

•

4,300 global customers

•

1,400 brand marketers

800 customers

200 distribution channel

partners

150+ search engines

Major social networks

Enhances cross-selling

and up-selling

Expands distribution

channels

•

Numbering

•

Order management

•

IP services

Caller name

Enhanced caller ID

Directory assistance

Deepens service

portfolio for all types

of carriers

•

DNS and monitoring

•

Domain name registries

•

Common short codes

•

IP Geolocation

AdAdvisor

Lead Verification

Directory Services

Accelerates

development of

services in large, high

growth markets

Assets

Customers

Carrier

Services

Enterprise

Services |

8

Combined Company Overview

Strong margins, more efficient capital structure

©

Neustar Inc. / All Rights Reserved

LTM September 30, 2011 Metrics

Neustar

TARGUSinfo

Combined

(1)

LTM Revenue (millions)

$583

$149

$732

LTM Adjusted EBITDA (millions)

$260

$67

$327

% Adjusted EBITDA Margin

45%

45%

45%

Cash and investments (millions)

$410

$23

$319

(2)

Total Debt (millions)

$6

(3)

$165

$606

(4)

Total Debt / LTM Adjusted EBITDA

0.0x

2.4x

1.9x

Net Debt / LTM Adjusted EBITDA

NM

2.1x

0.9x

(4)

(1)

Combined financial statements exclude pro forma purchase accounting adjustments

including the purchase price allocation which is based

on

the

fair

value

of

assets

and

liabilities

as

of

the

date

of

acquisition

(November

8,

2011).

(2)

Reflects the $600M Term Loan, use of cash for this acquisition, and payment of

estimated financing and transaction costs of approximately

$40.8

million.

Cash

and

investments

have

not

been

adjusted

to

reflect

the

additional

$250M

share

repurchase

program.

(3)

Consists of capital leases of $6M.

(4)

Reflects post-close debt position (including $600M Term Loan and undrawn

Revolving Credit Facility) plus a portion of existing cash. •

Adjusted EBITDA margins of combined entity consistent with Neustar’s historical

performance •

More efficient capital structure, resulting in increased shareholder value

•

Maintains flexibility with leverage capacity

©

Neustar Inc. / All Rights Reserved |

9

0

50

100

150

200

2006

2007

2008

2009

2010

LTM

0

200

400

600

800

2006

2007

2008

2009

2010

LTM

0

100

200

300

400

2006

2007

2008

2009

2010

LTM

0

200

400

600

800

2006

2007

2008

2009

2010

LTM

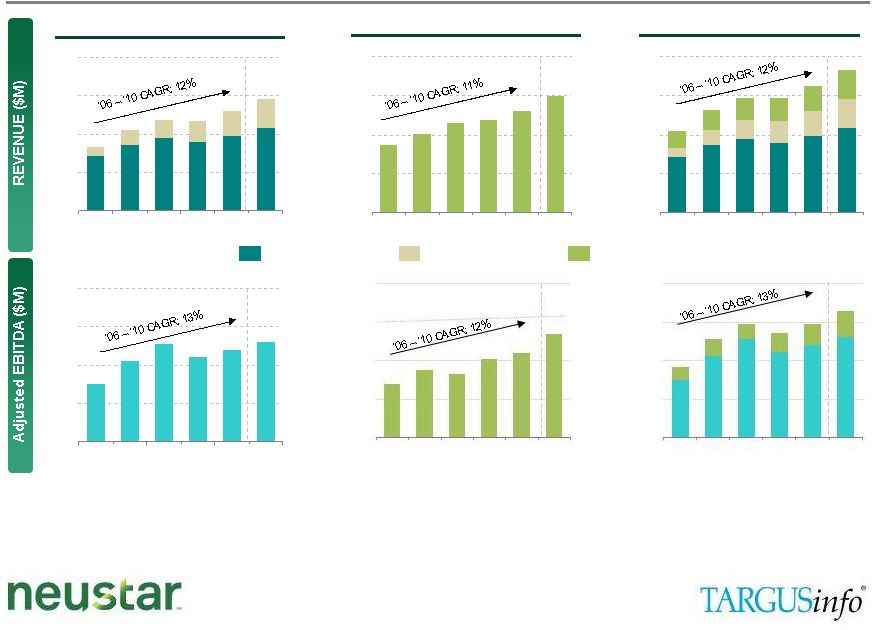

Combined Company Overview

Enhanced Scale and Strong Growth

©

Neustar Inc. / All Rights Reserved

Neustar

TARGUSinfo

Combined Company

(1)

Neustar Carrier Services

Neustar Enterprise Services

TARGUSinfo

+

+

=

=

(1)

Combined

Company

financial

statements

exclude

pro

forma

purchase

accounting

adjustments

including

the

purchase

price

allocation

which

is based on the fair value of assets and liabilities as of the date of acquisition (November 8, 2011).

(2)

Adjusted for a legal contingency favorably resolved in 2008.

(3)

Adjusted for discretionary compensation associated with a 2010 recapitalization event.

YoY:

20%

YoY:

28%

YoY:

9%

YoY:

15%

YoY:

12%

YoY:

13%

©

Neustar Inc. / All Rights Reserved

2006

2007

2008

2009

2010

LTM

(2)

(2)

(3)

(3)

0

25

50

75

100

2006

(3)

0

25

50

75

100

2007

2009

2010

2011

LTM

(2)

(2)

(3) |

10

Takeaways

Compelling Strategic and Financial Benefits

©

Neustar Inc. / All Rights Reserved

Immediately accretive on

a Non-GAAP basis

Maintains strong revenue growth

and high margins

Recurring revenues

Enhanced scale and diversification

More efficient capital structure

Creates a leading information

and analytics services provider

New services in large high

growth markets

Cross-selling and up-selling

opportunities

Expanded distribution

Track record of innovation

Minimal execution risk

Strategic Benefits

Financial Benefits |

11

Additional Historical and Pro Forma Financial Data

©

Neustar Inc. / All Rights Reserved |

12

Preparation of Pro Forma Financial Data

©

Neustar Inc. / All Rights Reserved

The selected pro forma financial information reflects the results of the combined

company as if the transaction occurred as of September 30, 2011 for purposes

of the balance sheet data and as of the beginning of each respective period

presented for the income statement data and reflects payment of the merger

consideration through a combination of cash on hand and borrowings of $600

million under Neustar's new credit facility. The selected pro forma financial information

should be read together with (1) the respective historical financial information of

each company included with this presentation

and,

with

respect

to

Neustar,

included

in

Neustar's

filings

with

the

SEC

and

(2)

the

full

pro

forma

financial

information and TARGUSinfo's audited and unaudited historical financial statements,

including the notes thereto, when available, which Neustar will file with

the SEC as soon as practicable, but no later than 71 days after November 15, 2011.

For purposes of this unaudited pro forma selected information, we have made

preliminary allocations of the estimated merger consideration to

TARGUSinfo's tangible and intangible assets acquired and liabilities assumed based on

preliminary estimates of their fair values as of September 30, 2011. These

preliminary allocations are based on preliminary estimates and assumptions,

which are subject to change. A final determination of the fair values of

TARGUSinfo’s assets and liabilities will be made based on the net tangible and

intangible assets of TARGUSinfo as of the

closing

date.

Amounts

allocated

to

goodwill

and

intangible

assets

in

the

final

purchase

price

allocation

could

change

significantly from those used in this pro forma information and could result in a

material change from the pro forma financial information presented

herein. The following pro forma information is provided for informational

purposes only. Pro forma information does not purport to represent

what the combined company's results of operation and financial position would have been had the merger been

completed as of the dates indicated or be indicative of the results of operation or

financial position that the combined company may achieve in the

future. |

13

Pro

Forma

Selected

Financial

Data

-

Balance

Sheets

©

Neustar Inc. / All Rights Reserved

(1)

The amounts expressed in this column are derived from Neustar’s unaudited

consolidated financial statements for the nine months ended September 30, 2011.

(2)

The amounts expressed in this column are derived from TARGUSinfo’s unaudited

consolidated financial statements for the nine months ended September 30,

2011.

(3)

The amounts expressed in this column reflect preliminary pro forma purchase

accounting adjustments required to present the acquisition as of September 30,

2011.

(4)

Reflects the $600M Term Loan, use of cash for this acquisition, and payment of

estimated financing and transaction costs of approximately $40.8 million.

Cash and investments have not been adjusted to reflect the additional $250M share

repurchase program. (5)

Pro forma amounts reflect estimated acquired intangible assets of $309.8 million

and goodwill of $447.1 million. (6)

Pro forma amounts reflect the long-term portion of borrowings of $585.4 million

used to partially fund the Merger and payment of TARGUSinfo’s debt in

connection with the Merger.

September 30, 2011

Neustar

(1)

TARGUSinfo

(2)

Pro Forma

(3)

(in thousands)

(unaudited)

Cash, cash equivalents and short-term investments

$

391,825

$

22,605

$

293,478 (4)

Working capital

$

423,675

$

24,354

$

343,993 (4)

Goodwill and intangible assets

$

181,973

$

3,955

$

938,847 (5)

Total assets

$

843,371

$

74,571

$

1,553,552 Deferred revenue, excluding current portion

$

10,733

$

---

$

10,733 Long-term debt and

capital lease obligations, excluding current portion

$

2,459

$

148,750

$

587,888 (6)

Total stockholders’

equity (deficit)

$

709,900

$

(109,163)

$

703,035 |

14

Pro

Forma

Selected

Financial

Data

–

Income

Statements

©

Neustar Inc. / All Rights Reserved

Year Ended December 31, 2010

Nine Months Ended September 30, 2011

Neustar

(1)

TARGUSinfo

(2)

Pro Forma

(3)

Neustar

(4)

TARGUSinfo

(5)

Pro Forma

(3)

(in thousands)

(unaudited)

Revenue

$ 520,866

$

130,431 $ 650,250

$ 446,275

$ 113,225

$ 557,120

Total operating expenses, excluding depreciation and

amortization

282,282

86,820

368,266

247,632

60,904

305,046

Depreciation

and

amortization

(6)

32,861

4,039

79,701

29,018

2,885

64,003

Income from operations

205,723

39,572

202,283

169,625

49,436

188,071

Other income

(expense)

(7)

587

117

(34,603)

289

(10,449)

(26,344)

Provision for income

taxes,

continuing

operations

(8)

82,282

15,120

66,630

65,060

16,348

62,720

Income from continuing operations

$ 124,028

$

24,569 $ 101,050

$ 104,854

$

22,639 $

99,007 (1)

The amounts expressed in this column are derived from Neustar’s audited consolidated financial

statements for the year ended December 31, 2010.

(2)

The amounts expressed in this column are derived from TARGUSinfo’s audited consolidated financial

statements for the year ended December 31, 2010.

(3)

The amounts expressed in this column reflect pro forma purchase accounting adjustments required to

present the acquisition as of the beginning of each respective period.

(4)

The amounts expressed in this column are derived from Neustar’s unaudited consolidated financial

statements for the nine months ended September 30, 2011.

(5)

The amounts expressed in this column are derived from TARGUSinfo’s unaudited consolidated

financial statements for the nine months ended September 30, 2011.

(6)

Pro forma amounts reflect acquired intangible asset amortization expense of $43.6 million and $32.7

million for the year ended December 31, 2010 and for the nine months ended September 30, 2011,

respectively.

(7)

Pro forma amounts reflect interest expense of $35.4 million and $26.5 million for the year ended

December 31, 2010 and for the nine months ended September 30, 2011, respectively, related to

debt used to partially fund the Merger.

(8)

Pro forma income taxes reflect Neustar’s estimated consolidated effective tax rate of 39.7% and

38.8% for the year ended December 31, 2010 and for the nine months ended September 30, 2011,

respectively. |

15

TARGUSinfo

Selected

Financial

Data

–

Balance

Sheets

©

Neustar Inc. / All Rights Reserved

(1)

The amounts expressed in this column are derived from TARGUSinfo’s audited

consolidated financial statements for the years ended December 31, 2008,

2009, and 2010. (2)

The amounts expressed in this column are derived from TARGUSinfo’s unaudited

consolidated financial statements for the nine months ended September 30,

2011. December 31,

September 30,

2008

(1)

2009

(1)

2010

(1)

2011

(2)

(in thousands)

(unaudited)

Cash, cash equivalents and short-term investments

$

33,954

$

64,065

$

9,839

$

22,605 Working capital

$

41,409

$

73,715

$ 10,930

$

24,354 Intangible assets

$

6,285

$

5,438

$

4,590

$

3,955 Total assets

$

80,421

$

107,276 $

60,695

$

74,571 Long-term debt, excluding current portion

$

---

$

---

$ 161,875

$ 148,750

Total stockholders’

equity (deficit)

$

55,845

$

86,633 $ (133,875)

$ (109,163)

|

16

TARGUSinfo

Selected

Financial

Data

–

Income

Statements

©

Neustar Inc. / All Rights Reserved

(1)

The amounts expressed in this column are derived from TARGUSinfo’s audited

consolidated financial statements for the years ended December 31, 2008, 2009

and 2010.

(2)

The amounts expressed in this column are derived from TARGUSinfo’s unaudited

consolidated financial statements for the nine months ended September 30,

2011.

(3)

Total operating expenses reflects a reversal of $49.0 million related to a legal

contingency favorably resolved in 2008. Year Ended December 31,

Nine Months Ended

September 30,

2008

(1)

2009

(1)

2010

(1)

2011

(2)

(in thousands)

(unaudited)

Revenue

$ 114,625

$

118,367

$

130,431

$

113,225 Total operating expenses, excluding depreciation and

amortization 24,827

(3)

67,759

86,820

60,904

Depreciation and amortization

4,069

4,003

4,039

2,885

Income from operations

85,729

46,605

39,572

49,436

Other income (expense)

444

2,645

117

(10,449)

Provision for income taxes

34,903

19,501

15,120

16,348

Income from continuing operations

$

51,270

$

29,749

$

24,569

$

22,639 |

17

Appendix

©

Neustar Inc. / All Rights Reserved |

18

Non-GAAP Reconciliation

©

Neustar Inc. / All Rights Reserved

Reconciliation to combined adjusted EBITDA from continuing operations

Year Ended December 31, 2010

Last Twelve Months Ended September 30, 2011

Neustar

(1)

TARGUSinfo

(2)

Combined

Company

(3)

Neustar

TARGUSinfo

Combined

Company

(3)

(dollars in thousands)

(unaudited)

Revenue

$ 520,866

$

130,431 $ 651,297

$ 583,137

$

149,302 $ 732,439

Income from continuing operations

$ 124,028

$

24,569 $

148,597 $

136,212

$

25,115 $

161,327 Add:

Depreciation and amortization

32,861

4,039

36,900

38,054

3,894

41,948

Add:

Other expense (income)

(587)

(117)

(704)

(230)

10,527

10,297

Add:

Provision for income taxes, continuing

operations

82,282

15,120

97,402

85,772

16,742

102,514

EBITDA from continuing operations

238,584

43,611

282,195

259,808

56,278

316,086

Add:

Discretionary compensation

---

10,747

10,747

---

10,747

10,747

Adjusted EBITDA from continuing operations

$ 238,584

(4)

$

54,358 $ 292,942

$ 259,808

(4)

$

67,025 $ 326,833

Adjusted EBITDA margin

46%

42%

45%

45%

45%

45%

(1)

The amounts expressed in this column are derived from Neustar’s audited

consolidated financial statements for the year ended December 31, 2010.

(2)

The amounts expressed in this column are derived from Targus Information

Corporation’s audited consolidated financial statements for the year ended December 31, 2010.

(3)

The amounts expressed in this column do not reflect pro forma purchase accounting

adjustments required to present the acquisition as of the beginning of each respective period.

(4)

Includes management transition costs of $6.0 million for restructuring and

severance costs. (5)

EBITDA margin is a measure of EBITDA from continuing operations as a percentage of

total revenue. (5) |