Attached files

Building on the

Future

Building on the

Future

June 6, 2011

June 6, 2011

Exhibit 99.2 |

2

Forward-Looking Statements

Forward-Looking Statements

All statements included or incorporated by reference in these slides other than

statements or characterizations of historical fact, are forward-looking

statements. These statements reflect management's current views and are

subject to risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in these statements. Factors

which could cause actual results to differ relate to: (i) The failure to

realize

synergies

and

cost

savings

from

the

transaction

or

delay

in

realization

thereof;

(ii)

increases in interest rates; (iii) industry conditions, including but not limited

to changes in the cost or availability of raw materials, energy and

transportation costs, competition we face, cyclicality and changes in

consumer preferences, demand and pricing for our products;

(iv)

global

economic

conditions

and

political

changes,

including

but

not

limited

to

the impairment of financial institutions, changes in currency exchange rates,

credit ratings issued by recognized credit rating organizations, the amount

of our future pension funding obligation, changes in tax laws and pension

and health care costs; (v) unanticipated expenditures

related

to

the

cost

of

compliance

with

existing

and

new

environmental

and

other governmental regulations and to actual or potential litigation; and (vi)

whether we experience a material disruption at one of our manufacturing

facilities and risks inherent in conducting business through a joint

venture. We undertake no obligation to publicly update any statements or

information relating to these slides or the potential offer, whether as a

result

of

new

information,

future

events

or

otherwise.

These

and

other

factors

that

could

cause or contribute to actual results differing materially from such forward

looking statements are discussed in greater detail in the company's SEC

filings. |

3

Statements Relating to Non-GAAP

Financial Measures

Statements Relating to Non-GAAP

Financial Measures

During the course of this presentation, certain

non-U.S. GAAP financial information will be

presented.

A reconciliation of those numbers to U.S. GAAP

financial measures is available on the

company’s

website

at

internationalpaper.com

under Investors. |

4

Consistent with IP’s transformation plan and focus on achieving and

sustaining cost of capital returns

Makes a very good business an excellent one

-

Compelling strategic and industrial logic

-

Shared focus on low-cost mills; complementary converting systems; high level

of box integration

-

Powerful cash flow engine

Delivers near and long term value for both IP and TIN shareholders

driven by significant synergies

-

Substantial and immediate premium for TIN shareholders represents unique

opportunity to realize compelling and certain value, in cash today

-

By

end

of

year

one,

strongly

earnings

accretive

to

IP,

continues

to

drive

FCF

and

ROI

improvement while maintaining Debt / EBITDA below 3x

IP is a proven outstanding operator with demonstrated track record

of success integrating acquisitions

Building on the Future

The Temple-Inland Opportunity

Building on the Future

The Temple-Inland Opportunity |

5

•

Exited non-strategic businesses

•

Reduced structural capacity & fixed costs

•

Significant reduction of overhead costs

•

Industry-leading margins

•

Increased dividend to a sustainable level

•

Generate strong, sustainable FCF

•

Expand margins & earnings in all businesses

•

Achieve cycle-average ROI above cost-of-capital

•

Balance cash allocation

•

Recovering from industry demand declines

•

Managing our supply to meet customer demand

•

Improving liquidity

•

Capitalizing on global demand growth

Transformation to the “New IP”

2006-2011

Transformation to the “New IP”

2006-2011

What

We’ve

Done

What

We’re

Doing

What

We’ll

Do |

6

Transformation Accomplishments

Transformation Accomplishments

Significant improvement in margins

Replaced land sales earnings by strengthening core businesses

Achieved Cost of Capital returns

Balanced Use of Cash

-

Cash to Shareholders -

$1.05 dividend, $460MM (~30% FCF)

-

Reinvestment in Base Business -

CAPEX $1B/year

-

Debt Repayment

EBITDA coverage from 5.1x to <3.0x

-

Investment in Core North America Businesses to enhance FCF

WY PKG

-

Investment

Internationally

for

Profitable

Growth

and

Future

Cash

Generation

ILIM JV

Sun JV coated paperboard

SCA Packaging Asia

APPM India (pending) |

7

Streamlined Business Portfolio

Improved Positions in more Profitable Segments

Streamlined Business Portfolio

Improved Positions in more Profitable Segments

Segment Position

Market Segment

2004

2010

U.S. Industrial Packaging

#3

#1

U.S. Uncoated Papers

#1

#2

U.S. Coated Paperboard

#1

#1

Global Market Pulp

Secondary

#4

U.S. Coated Papers

Secondary

Exited

U.S. Wood Products

Secondary

Exited

U.S. Forestland

#2

Exited

U.S. Kraft Paper

Secondary

Exited

U.S. Chemicals

Secondary

Exited

U.S. Beverage Packaging

Secondary

Exited |

8

Step-Change

Improvement

in

Free

Cash

Flow

Step-Change

Improvement

in

Free

Cash

Flow

Free cash flow, based on data in the 10-K for each year at the time of

filing. Excludes net cash pension contributions impacting 2006, 2010 &

2011 cash flows under European accounts receivable securitization beginning

in 2009 and ending in 1Q 2011, and cash received from AFMTC & CBTC in

2009 and 2010. 1Q RR

2000 –

2004 Average

$0.9 Billion

Transformation

2008 –

2011 Average

$1.8 Billion |

9

Improving Returns on Invested Capital

Transformation Driving ROI

Improving Returns on Invested Capital

Transformation Driving ROI |

10

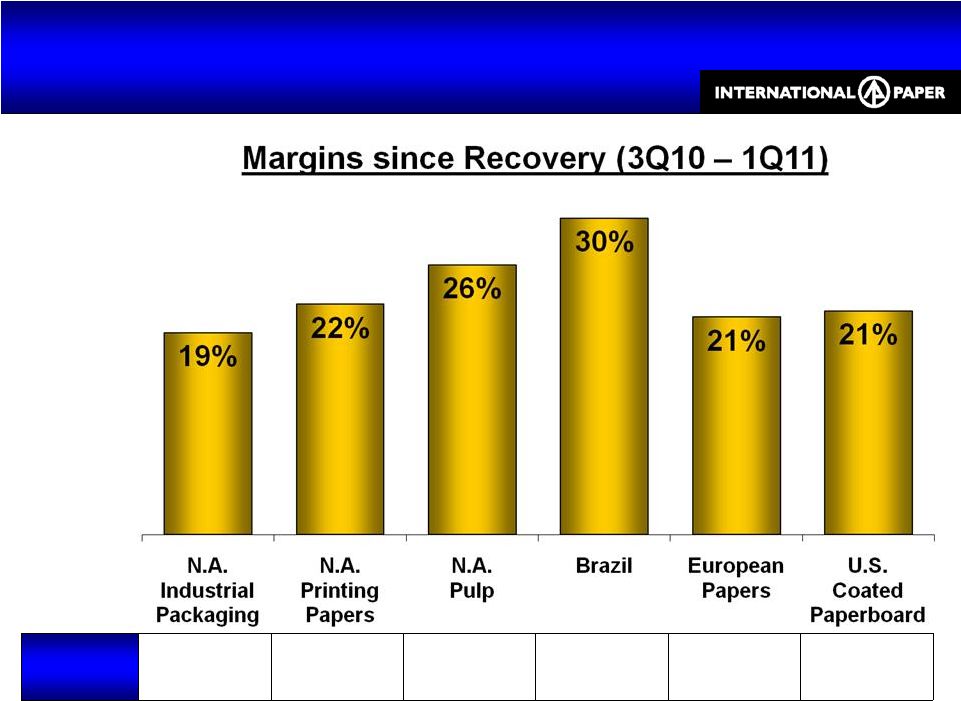

1H10

Margin

12%

17%

14%

24%

22%

11%

Significantly Improved EBITDA Margins

Significantly Improved EBITDA Margins |

11

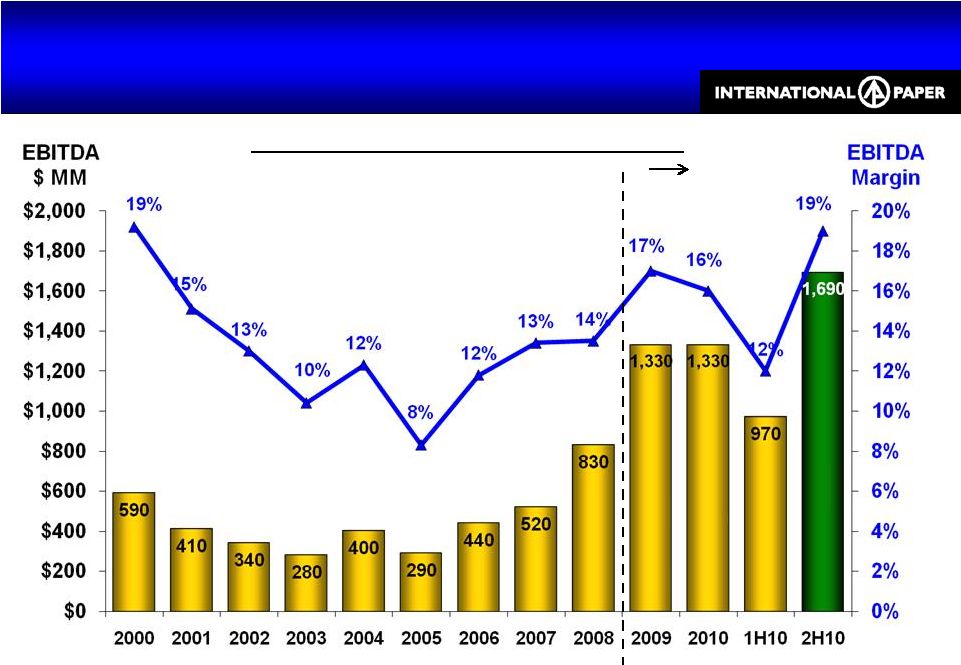

Step Change in Level of Performance

Post-WY PKG Acquisition

Step Change in Level of Performance

Post-WY PKG Acquisition

Post-WY PKG

Note: Corporate allocations for 2000 –

2004 held constant at 2005 allocation level, EBITDA % margins calculated per

external reporting

with

trades

included

in

revenue.

2000

–

2006

also

excludes

discontinued

operations

–

Kraft

and

Specialty

IP Industrial Packaging EBITDA Trend |

12

Demonstrated Ability to Deliver Synergies

Demonstrated Ability to Deliver Synergies

Synergies generated from the WY PKG acquisition have

exceeded expectations

Targeted $400MM of synergies on a sales base of

$5.2B

Generated over $500MM of run rate synergies ahead

of plan

Synergies strongly contributed to the better than cost

of capital returns generated within 18 months of the

acquisition |

13

Strengthening North American Industrial Packaging

Strengthening North American Industrial Packaging

($ Billion)

North American

Industrial Packaging

Pre-WY PKG

2007

3Q’10-1Q’11

Annualized

Sales

$3.9

$8.6

EBITDA (before special items)

$0.5

$1.6

EBITDA Margin

IPG = 13%

Comp. A = 20%

Comp. B = 11%

Comp. C = 9%

IPG = 19%

Comp. A = 20%

Comp. B = 15%

Comp. C = 13%

ROI (before special items)

7%

10%

Industry Box Volume (BSF)

390

357 |

14

Strengthening International Paper

Strengthening International Paper

($ Billion, except per share)

IP Total

Excl. Forest Products

Pre-WY PKG

2007

3Q’10-1Q’11

Annualized

Sales

$21.4

$25.9

EBITDA (before special items)

$2.3

$3.7

EBITDA Margin

11%

14%

Free Cash Flow

(Includes special items;

excludes pension contribution & AFMTC)

$0.3

$2.2

ROI (before special items)

4%

8%

EPS (before special items)

$1.48

$3.00 |

15

Current State Summary

Current State Summary

Focused Business Portfolio

Higher, More Sustainable Earnings

Reduced Costs

Reduced Debt

Increased Earnings, Free Cash Flow & Returns

Commitment to Balanced use of Cash to Generate

Increased Shareholder Value |

16

Offer to Acquire Temple-Inland

Transaction Highlights

Offer to Acquire Temple-Inland

Transaction Highlights

Consideration

All-cash offer for all TIN shares at $30.60 per share

Premium

Premium of 44% to TIN price as of noon, 6 June 2011 ($21.21)

Accretion

Substantially accretive to IP EPS in first year

Synergies

Expect to generate significant synergies

Financing

IP has obtained committed financing in an amount sufficient to

consummate this transaction

IP is committed to remaining investment grade and expects the

acquisition would not result in a rating or outlook change

Regulatory

Approval

IP has thoroughly considered potential regulatory issues of this

combination and believes all approvals can be obtained

|

17

Financing Overview

Financing Overview |

18

Synergy Opportunities

Synergy Opportunities

S G & A

Business Overhead Reduction

Corporate Overhead Reduction

Mills

Machine / Product Optimization

Efficiency Improvements

Market Access

Mix Improvement

Supply Chain

Freight Optimization

Purchasing

Box Plants

System Streamlining |

19

2011 Sales¹

of $4 Billion

2011 EBITDA¹

of $510 Million

4 Million Tons of

Containerboard Capacity

7 Containerboard Mills

59 Box Plants

14 Building Products Plants

Corrugated

82%

Building

Products

18%

2010 Segment Assets

Temple-Inland at a Glance

Predominately a Corrugated Packaging Company

Temple-Inland at a Glance

Predominately a Corrugated Packaging Company

1

First Call TIN estimates (without synergies) |

20

N. A. Industrial Packaging

Producer Positions

N. A. Industrial Packaging

Producer Positions

Source:

RISI

N.A.

Paper

Packaging

Capacity

Reports,

SEC

filings,

IP

analysis,

RKT/

SSCC

announcements

to

public

in

2011

2010

Post RKT / SSCC Acquisition

2010

With IP + TIN

IP

12%

SSCC

18%

GP

11%

TIN

10%

PCA

6%

WY

16%

Other

27%

(35 companies)

IP

27%

RKT/ SSCC

19%

GP

11%

TIN

10%

PCA

6%

Other

27%

(30 companies)

2007

Prior to IP / WY PKG Acquisition

IP

37%

RKT

19%

GP

11%

PCA

6%

Other

27%

(30 companies) |

21

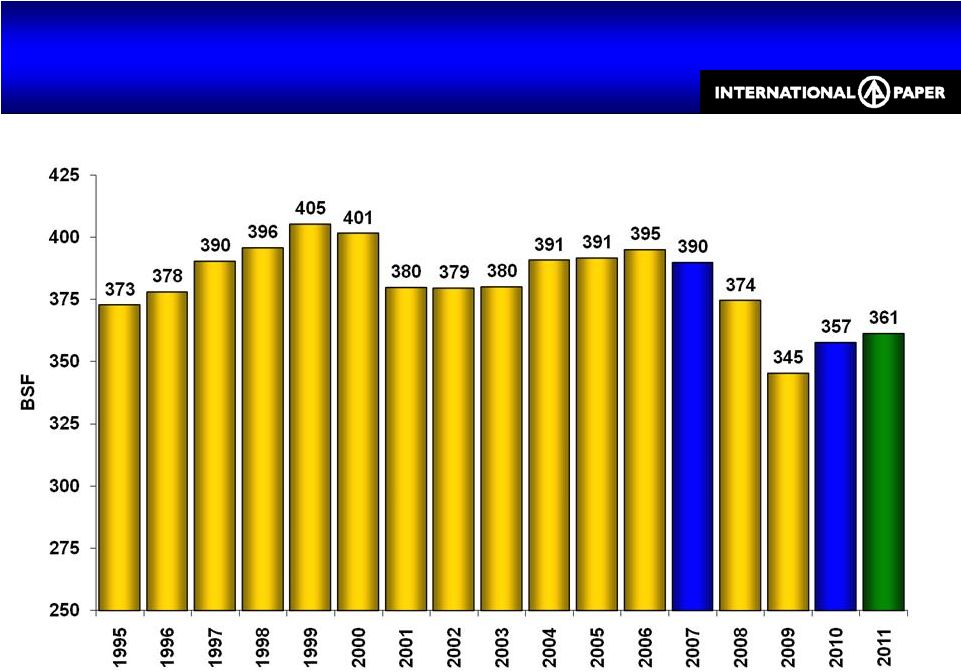

External Environment

External Environment

U.S. economy is recovering

U.S. box demand grew 3% in 2010 and is

expected to grow with the economy

Strong demand for containerboard exports

U.S. supply and demand balanced |

22

2011 -

Demand Still Recovering

2011 -

Demand Still Recovering

Source: Fibre Box Association

2011 Q1 Run Rate

U.S. Box Shipments |

23

Acquisition Assessment

Acquisition Assessment

Creates Shareholder Value

Consistent with Strategy

Improves Core Business

Cost of Capital Returns

Significant Synergies

Greater Cash Flow Generation

Low Integration Risk |

24

The ‘New IP’

Repositioned and well positioned

The ‘New IP’

Repositioned and well positioned

IP + TIN

EBITDA¹

1

Combined (IP + TIN) 2010 EBITDA excluding special items

North

America

75%

Rest of

World

25%

North America

Stronger free cash flow

Leading core segment positions

ROI greater than cost of capital

EMEA,

Brazil,

Asia,

Russia

JV,

India

•

Growing margins

•

Revenue + profit growth runway

•

Leading emerging market positions |

25

Asia

India

Eastern Europe

Brazil

North America

Russia

Western Europe

TIME

Today

2011-2012

Near Term

Next 3-5 Years

Medium Term

Next 5+ Years

Earnings Growth Horizon

Temple-Inland “an investment for today”

Earnings Growth Horizon

Temple-Inland “an investment for today” |

26

Path Forward

Path Forward

IP Board of Directors is serious and committed

Given TIN’s Board outright rejection and lack of interest

to engage, IP has decided to take the offer directly to

shareholders

A negotiated transaction represents the best path

forward for all shareholders

All reasonable options are on the table with respect to

next steps |

27

Acquisition Summary

Acquisition Summary

Consistent with strategy

Financially attractive

-

Accretive in year one

-

Returns exceed cost of capital

Strengthens IP’s portfolio

Makes a good Industrial Packaging business an

excellent one

Significant synergy opportunities

Creates shareholder value |

28

Other Information

Additional Information

Other Information

Additional Information

This communication does not constitute an offer to buy or solicitation of an offer

to sell any securities. No tender offer for the shares of Temple-Inland

Inc. (“Temple-Inland”) has commenced at this time. In

connection with the proposed transaction, International Paper Company (the

“Company”) may file tender offer documents with the U.S. Securities and

Exchange Commission (“SEC”). Any definitive tender offer documents

will be mailed to stockholders of Temple-Inland. INVESTORS AND SECURITY

HOLDERS OF TEMPLE- INLAND ARE URGED TO READ THESE AND OTHER DOCUMENTS

FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. Investors and security holders will be able to obtain free copies of

these documents

(if

and

when

available)

and

other

documents

filed

with

the

SEC

by

the

Company

through

the

web

site

maintained

by

the

SEC

at

http://www.sec.gov.

In

connection

with

the

proposed

transaction,

the

Company

may

file

a

proxy

statement

with

the SEC. Any definitive proxy statement will be mailed to stockholders of

Temple-Inland. INVESTORS AND SECURITY HOLDERS OF TEMPLE-INLAND

ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT

INFORMATION

ABOUT

THE

PROPOSED

TRANSACTION.

Investors

and

security holders will be able to obtain free copies of these documents (if and when

available)

and

other

documents

filed

with

the

SEC

by

the

Company

through

the

web

site

maintained by the SEC at http://www.sec.gov. |

29

Other Information

Certain Information Regarding Participants

Other Information

Certain Information Regarding Participants

The Company and certain of its respective directors and executive officers

may be deemed to be participants in the proposed transaction under the rules

of the SEC. Security holders may obtain information regarding the names,

affiliations and interests of the Company’s directors and executive officers

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2010 which was filed with the SEC on February 25, 2011, and its

proxy statement for the 2011 Annual Meeting, which was filed with the SEC on

April 8, 2011.

These

documents

can

be

obtained

free

of

charge

from

the

sources

indicated

above.

Additional

information

regarding

the

interests

of

these

participants in the proxy solicitation and a description of their direct and

indirect

interests,

by

security

holdings

or

otherwise,

will

also

be

included

in

any proxy statement and other relevant materials to be filed with the SEC

when they become available. |

30

Investor Relations Contacts

Glenn R. Landau

901-419-1731

Emily Nix

901-419-4987

Media Contact

Tom Ryan

901-419-4333

Contacts

Contacts |