Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - INTERSECTIONS INC | intersections-8k_052311.htm |

Stephens Spring Investor Conference

May 25, 2011

May 25, 2011

Industry Leadership through Innovation,

Experience, and Execution

Experience, and Execution

2

Safe Harbor Statement

Statements in this presentation relating to future plans, results, performance,

expectations, achievements and the like are considered “forward-looking

statements.” Those forward-looking statements involve known and unknown

risks and are subject to change based on various factors and uncertainties that

may cause actual results to differ materially from those expressed or implied by

those statements. Factors and uncertainties that may cause actual results to

differ include, but are not limited to, the risks disclosed in the company’s filings

with the U.S. Securities and Exchange Commission. The company undertakes no

obligation to revise or update any forward-looking statements.

expectations, achievements and the like are considered “forward-looking

statements.” Those forward-looking statements involve known and unknown

risks and are subject to change based on various factors and uncertainties that

may cause actual results to differ materially from those expressed or implied by

those statements. Factors and uncertainties that may cause actual results to

differ include, but are not limited to, the risks disclosed in the company’s filings

with the U.S. Securities and Exchange Commission. The company undertakes no

obligation to revise or update any forward-looking statements.

2

3

Agenda

3

Corporate Overview

Industry Overview

Q1 Results

4

Corporate Overview

About Us

► A leading provider in the ~ $2.2 billion and growing market for consumer subscription

identity theft protection services

identity theft protection services

► Co-founded in 1996 by our current Chairman & CEO, Michael Stanfield

► NASDAQ listed (Ticker: INTX) since 2004

► Currently protecting approximately 8 million consumers from the dangers of identity

theft, and have safeguarded the identities of 32 million since our inception

theft, and have safeguarded the identities of 32 million since our inception

► Recognized as the preferred and trusted partner of major financial institutions in North

America, providing cross-selling opportunities with custom-branded identity

management solutions

America, providing cross-selling opportunities with custom-branded identity

management solutions

► Trailing 12 month revenue of $358 million as of March 31, 2011

4

5

Leadership, Experience, Stability, Passion

5

6

What Is an Identity Theft Protection Product?

► Consumer Benefits Include:

o Credit Reports

o Credit Scores

o Credit Monitoring

o Additional Data & Monitoring

o Software Tools

– Desktop

– Mobile

o Customer Education

o Victim Assistance

o Insurance

o More

6

Product Example:

IDENTITY GUARD® TOTAL PROTECTIONSM

7

Recognized for Best In Class Products and Service

7

8

Strategic Update

Focus on Endorsed Marketing of Identity Theft Protection

► Sold Screening International (pre-employment background screening segment) for

approximately 15x EBITDA in July 2010

approximately 15x EBITDA in July 2010

► Reduced emphasis on insurance services products to focus resources on more

differentiated identity theft protection services

differentiated identity theft protection services

► Growing our own IDENTITY GUARD® brand first quarter 2011 top line growth 42% YoY as

both a standalone business and a showcase for new endorsed business

both a standalone business and a showcase for new endorsed business

► Driving endorsed marketing growth through:

o Existing large clients

o New large client wins

o Product/channel partnerships to address smaller FIs

o Reformulated products to succeed in new industry verticals

► Returning capital to shareholders via dividends and share repurchases due to strong EBITDA

generation and access to capital

generation and access to capital

8

9

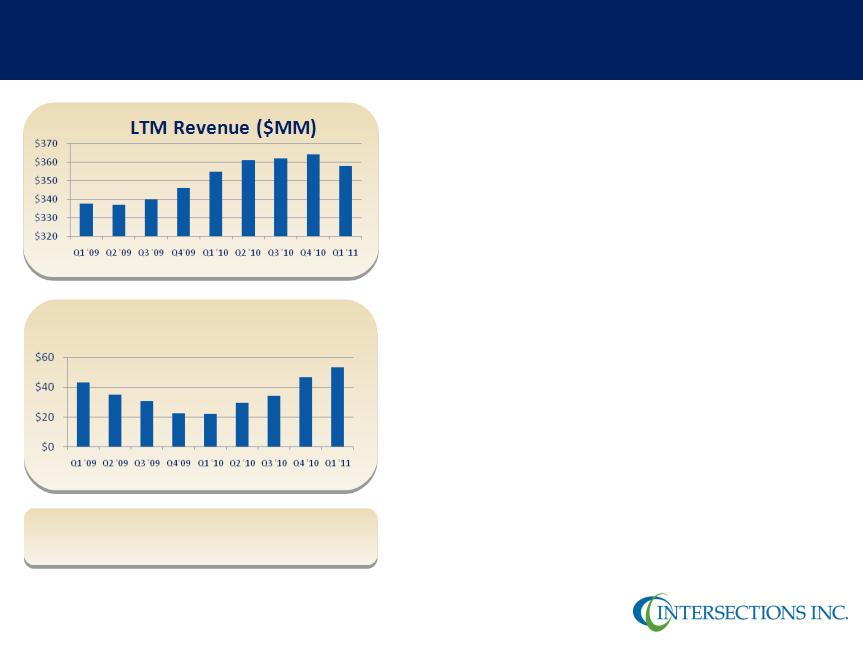

Attractive Economic Profile

► Flexible economic arrangements with clients

o High margin fee for service “indirect”

arrangements

arrangements

o High return on marketing investment

“direct” arrangements

“direct” arrangements

► Detailed financial modeling at the client,

product and marketing channel level based

cumulative knowledge from 32 million

customers served

product and marketing channel level based

cumulative knowledge from 32 million

customers served

► High visibility recurring revenue and cash

flow business model

flow business model

► Returning capital to shareholders via share

repurchases and dividends

repurchases and dividends

9

Dividend Yield @ 4.1%

LTM Adjusted EBITDA ($MM)

Dividend Yield is based on 5/18/11 closing price of $14.72

Adjusted EBITDA is a non-GAAP financial measure. Our consolidated financial statements, other data and reconciliations of these non-GAPP financial measures to the most directly comparable GAAP

financial measures and related notes can be found in the “GAAP and Non-GAAP Measures” link under the “Investor & Media "page on our website at “www.intersections.com.”

financial measures and related notes can be found in the “GAAP and Non-GAAP Measures” link under the “Investor & Media "page on our website at “www.intersections.com.”

Consolidated results adjusted for sale of SI. EBITDA adjusted for share related compensation and non-cash impairment charges.

10

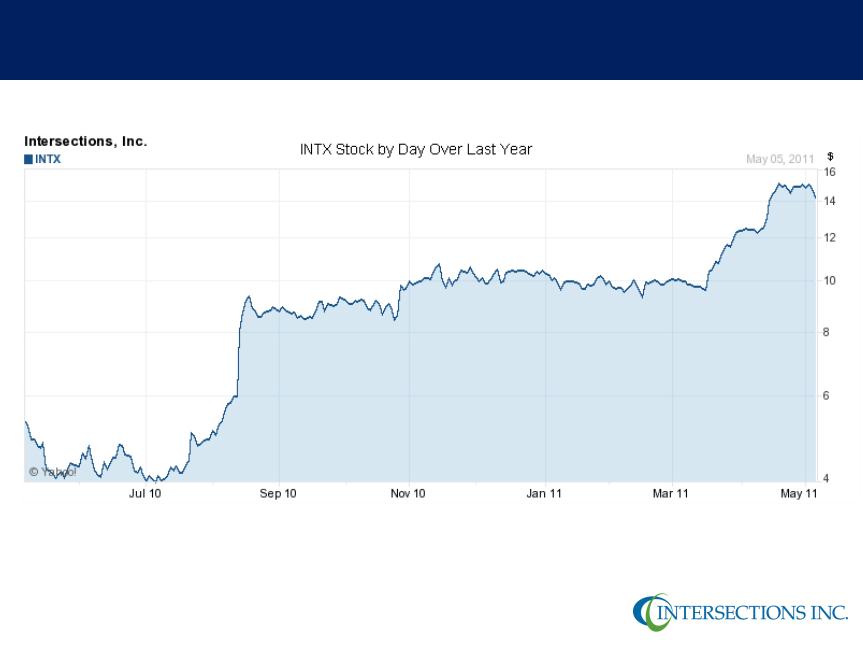

Intersections Stock Price by Day Over Last 12 Months

Source: Yahoo Finance

11

Agenda

11

Corporate Overview

Industry Overview

Q1 Results

12

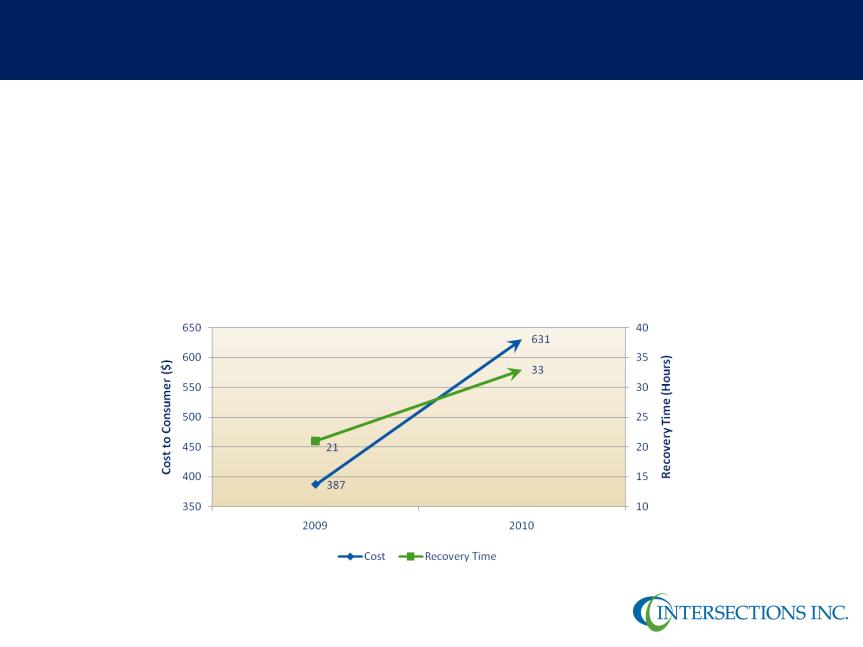

Identity Theft’s Impact Continues to Escalate

According to the most recent Identity Fraud Survey Report*:

► More than 8 million U.S. consumers were victims of identity theft in 2010

► The mean cost to consumers jumped sharply to $631 (2010) from $387 (2009)

► Recovery time increased from 21 hours (2009) to 33 hours (2010)

► “Friendly Fraud” was the most prevalent source of identity theft

*Source: Javelin, 2011 Javelin Identity Fraud Survey Report

12

13

Consumers are Paying Attention

1Gallup, October 2009

2bankrate.com, “Consumers take steps to thwart ID thieves”, April 21, 2008.

14

Yet There is Still A Tremendous, Untapped Market

14

Identity Theft:

Identity Theft:

~ $2.2 Billion

Market &

Growing

Market &

Growing

~ $2.2 Billion

Market &

Growing

Market &

Growing

Endorsed

Direct to

Consumer

Only 15% of consumers subscribe to identity theft services;

indicating a huge, untapped market

indicating a huge, untapped market

Market Size based on internal estimates only. Subject to revision.

15

My bank or credit card company

An independent provider, such as

LifeLock, Debix, Identity Guard, etc.

Experian

Equifax

Other

TransUnion

Consumers Trust Their Banks for Their Identity Protection

15

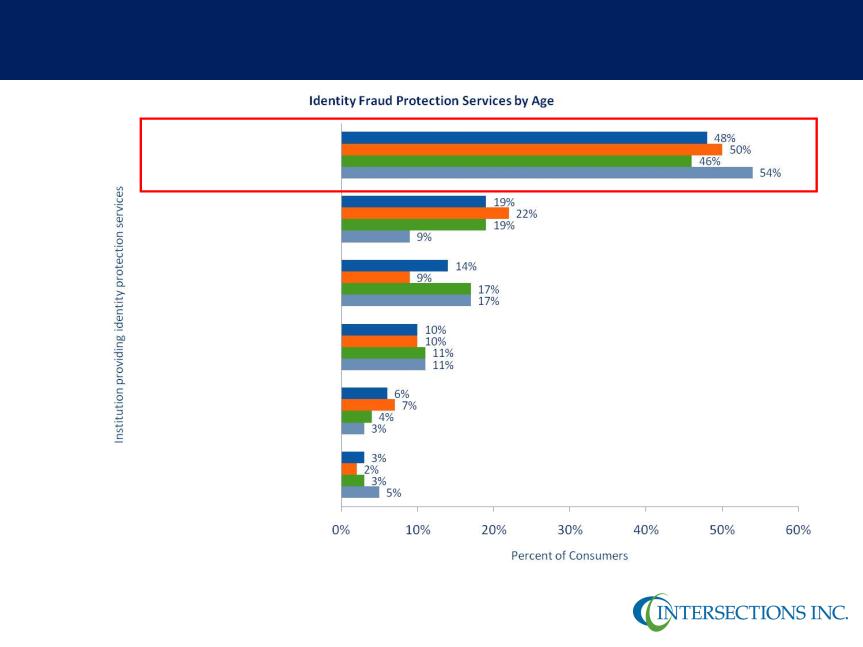

Source: Javelin 2010 Annual Identity Protection Services Scorecard, Identity Fraud Protection Services by Age.

<Gen Y

<Gen X

<Baby boomers

<All Consumers

16

Banks Want More Than Clever Advertising

16

17

Example: Industry Leading Information & Physical Security

► PCI Level 1 compliant (Audited by ControlCase)

► Participate in the Financial Services

Roundtable/BITS Financial Institution Shared

Assessment Plan with annual audit by AS Tech

Consulting

Roundtable/BITS Financial Institution Shared

Assessment Plan with annual audit by AS Tech

Consulting

► EI3PA Compliance (Experian PCI- ControlCase)

► Successfully Audited Annually by Financial

Institution Clients

Institution Clients

► Comprehensive Disaster Recovery Plan

► Compliant for both Gramm-Leach-Bliley Act

(GLBA) and Sarbanes-Oxley Act (SOX)

(GLBA) and Sarbanes-Oxley Act (SOX)

► Sensitive Data and Servers Guarded 24x7 with

Biometric Access Required

Biometric Access Required

18

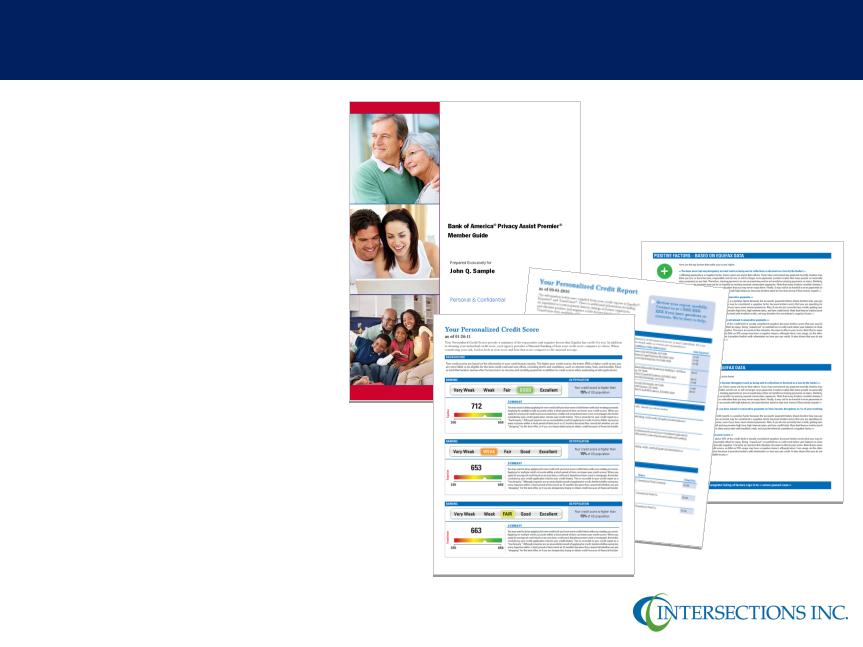

Example: In-house High Integrity Fulfillment Advantage

► Our high quality, fully

personalized fulfillment

materials are delivered

directly to your customers

personalized fulfillment

materials are delivered

directly to your customers

► Full color print capabilities as

well as black and white

presses

well as black and white

presses

► Approximately 3.5 million

pieces mailed each month

pieces mailed each month

► Image and page level tracking

to ensure the right documents

are delivered to the right

customer

to ensure the right documents

are delivered to the right

customer

19

Banks Trust Intersections for Their Customer’s Identity Protection

Intersections is the most successful player in this high profile, private label partnerships

► 4 of the top 5 U.S. banks

► 6 of the top 7 Canadian banks

► Retailers, Internet companies, and others

Note: Marketing Penetration defined as partnership with Financial Institutions’ to offer ID Theft Protection services through

various online/offline marketing channels.

various online/offline marketing channels.

“There is a strong trust relationship between consumers and their financial institutions,

making Intersections 'Best in Class' solution and its partnerships with financial institutions

exceptionally significant in the identity theft protection market.”

making Intersections 'Best in Class' solution and its partnerships with financial institutions

exceptionally significant in the identity theft protection market.”

- James Van Dyke

President and Founder, Javelin Strategy & Research

President and Founder, Javelin Strategy & Research

20

Agenda

20

Corporate Overview

Industry Overview

Q1 Results

21

1st Quarter 2011 Update

Consolidated Highlights

► Revenue for the first quarter of 2011 was $90.4 million, a slight decrease of

approximately 1 percent compared to the same quarter last year.

approximately 1 percent compared to the same quarter last year.

► For the first quarter of 2011 consolidated adjusted EBITDA before share related

compensation was $13.0 million, an increase of 100 percent compared to the first

quarter of 2010.

compensation was $13.0 million, an increase of 100 percent compared to the first

quarter of 2010.

► Income from continuing operations was $4.6 million or $0.23 per diluted share,

compared to a loss from continuing operations of $258 thousand or ($.01) per diluted

share for the first quarter of 2010.

compared to a loss from continuing operations of $258 thousand or ($.01) per diluted

share for the first quarter of 2010.

► In the first quarter of 2011 Intersections generated $12.7 million from cash flow

provided by operating activities.

provided by operating activities.

Please see the company’s release and website at www.intersections.com for additional details on quarterly results.

22

1st Quarter 2011 Update

Shareholder Initiatives

► On March 31, 2011 Intersections repurchased 1,742,463 shares of common stock

owned by CCP Equity Partners, approximately 9.7 percent of the outstanding shares at

that time. The purchase price was approximately $19.6 million, based on the

negotiated purchase price of $11.25 per share.

owned by CCP Equity Partners, approximately 9.7 percent of the outstanding shares at

that time. The purchase price was approximately $19.6 million, based on the

negotiated purchase price of $11.25 per share.

► We currently have $20 million authorized by our Board of Directors for future stock

purchases.

purchases.

► On April 21, 2011 Intersections’ Board of Directors declared a regular quarterly cash

dividend on its common stock of $0.15 per share. The dividend will be paid on June

10, 2011 to stockholders of record at the close of business on May 31, 2011. This is

the fourth consecutive quarter Intersections has paid a dividend. Intersections’ annual

dividend yield would be 4.1% percent based on the closing price of $14.72 on

Wednesday May 18, 2011.

dividend on its common stock of $0.15 per share. The dividend will be paid on June

10, 2011 to stockholders of record at the close of business on May 31, 2011. This is

the fourth consecutive quarter Intersections has paid a dividend. Intersections’ annual

dividend yield would be 4.1% percent based on the closing price of $14.72 on

Wednesday May 18, 2011.

Please see the company’s release and website at www.intersections.com for additional details on quarterly results.

23

1st Quarter 2011 Update

Year End 2011 Guidance*

► Low single digit revenue growth, driven by:

o The full year affect of reduced marketing leads from a direct client that started in 2Q 2010.

o A reduction in insurance services marketing.

o Offset by incremental revenue from new business and organic growth with other clients and direct to consumer.

► UPDATED GUIDANCE: Mid single digit Adjusted EBITDA before share related compensation growth due to:

o Revenue growth mentioned above, lower subscriber acquisition costs (e.g., Marketing and Bounty) and diligent cost

management.

management.

o Offset by:

– Higher data costs from one of the credit bureaus.

– Higher payments under an agreement for non-credit data.

– Higher costs related to our new Call Center and new color printing capabilities.

– Ongoing investments related to launching new clients, before their incremental revenue begins.

– Ongoing investments to complete the roll-out of our eCommerce platform.

► 2011 is expected to be a year of absorbing new relationships, continuing profitability from existing business

and positioning our company for further growth in 2012.

and positioning our company for further growth in 2012.

* Guidance as of May 25, 2011

24

LTM Revenue and Adjusted EBITDA Growth

24

LTM Adjusted EBITDA

LTM Revenue

25

Well-positioned to Capitalize on Industry Trends and Leverage Our

Unique Advantages

Unique Advantages

25

• 8 million adults were victims of identity theft in

2010; with an average recovery time of 33 hours

2010; with an average recovery time of 33 hours

• Growing consumer awareness of identity theft and

credit breaches

credit breaches

• Increasing trends in non-card frauds, computer-

based crimes, and counterfeit software

based crimes, and counterfeit software

Favorable Industry Dynamics

• 8 million customers currently protected; 32 million

since inception

since inception

• Recognized as the innovator and product leader in

the identity protection industry

the identity protection industry

• Most comprehensive identity protection product

suite available

suite available

• Proven subscription model creates strong,

predictable cash flow

predictable cash flow

• Manages all program aspects on-site, allowing for

scalability among products and clients

scalability among products and clients

Attractive Financial

Characteristics

Characteristics

• Long-standing relationships and reputation with

clients, credit bureaus and service providers

clients, credit bureaus and service providers

• Proprietary processes and technology leveraged to

serve the needs of both clients and subscribers

serve the needs of both clients and subscribers

Source: Javelin, 2011 Javelin Identity Fraud Survey Report