Attached files

1

2011 First-Quarter

Earnings Results

April 21, 2011

Exhibit 99.3 |

2

Introduction

Unless otherwise stated, we will be talking about results for the first-

quarter 2011 and comparing them with the same period in 2010

References to PMI volumes refer to PMI shipment data, unless

otherwise stated

Industry volume and market shares are the latest data available from

a number of internal and external sources

Acquisitions, for the purposes of this presentation, also include our

business combination with Fortune Tobacco Corporation in the

Philippines

Organic volume refers to volume excluding acquisitions

Net revenues exclude excise taxes

OCI stands for Operating Companies Income, which is defined as

operating income before general corporate expenses and the

amortization

of

intangibles.

OCI

growth

rates

are

on

an

adjusted

basis

which excludes asset impairment, exit and other costs

Data tables showing adjustments to net revenues and OCI for

currency, acquisitions, asset impairment, exit and other costs, free

cash flow calculations, adjustments to EPS, and reconciliations to

U.S. GAAP measures are at the end of today’s web cast slides and

are posted on our web site |

3

Forward-Looking and Cautionary Statements

This presentation and related discussion contain statements that, to

the extent they do not relate strictly to historical or current facts,

constitute

“forward-looking

statements”

within

the

meaning

of

the

Private Securities Litigation Reform Act of 1995. Such forward-looking

statements are based on current plans, estimates and expectations,

and are not guarantees of future performance. They are based on

management’s expectations that involve a number of business risks

and uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the forward-looking

statements. PMI undertakes no obligation to publicly update or revise

any forward-looking statements, except in the normal course of its

public disclosure obligations. The risks and uncertainties relating to

the forward-looking statements in this presentation include those

described

under

Item

1A.

“Risk

Factors”

in

PMI’s

Form

10-K

for

the

year ended December 31, 2010, filed with the Securities and

Exchange Commission |

4

First-Quarter 2011 Results

Very strong financial performance:

The events in Japan and North Africa only caused

temporary disruptions that were not material to our

financial results

Q1, 2011 Results

(a)

Net Revenues

+2.7%

Adjusted OCI

+8.0%

Adjusted Diluted EPS

+14.4%

(a)

All financial growth rates exclude currency. Net revenues and OCI growth rates also

exclude acquisitions Source: PMI Financials |

5

First-Quarter 2011 Results

Volume performance:

Lower organic volume driven by Japan, Mexico, Pakistan,

Spain and Ukraine, as well as events in North Africa

All other markets, representing over 80% of our volume

base, grew at an organic rate of 1.0%

Q1, 2011 Results

Cigarette Volume

+1.6%

Organic Cigarette Volume

-3.3%

Source: PMI Financials |

6

2011 EPS Guidance

Reported diluted EPS guidance for 2011 is being raised

by 20 cents to $4.55 to $4.65

Compared to an adjusted diluted EPS of $3.87 in 2010,

this corresponds to a growth rate of approximately 17.5%

to 20% at prevailing exchange rates, and approximately

12.5% to 15% excluding currency

Ten cents of the increased guidance are attributable to

more favorable prevailing exchange rates

Ten cents of the increased guidance are attributable to an

improved business outlook, partly offset by investments in

marketing and sales and slightly more conservative

pricing assumptions

Source: PMI forecasts |

7

Japan

Japan Tobacco facing significant supply disruptions

in its home market

PMI has sufficient in-market inventories

Difficult to determine extent of likely uplift in PMI

sales

Second quarter will allow us to have better read on

total consumption levels and extent to which

consumers return to prior brand of choice

Source: PMI estimates |

8

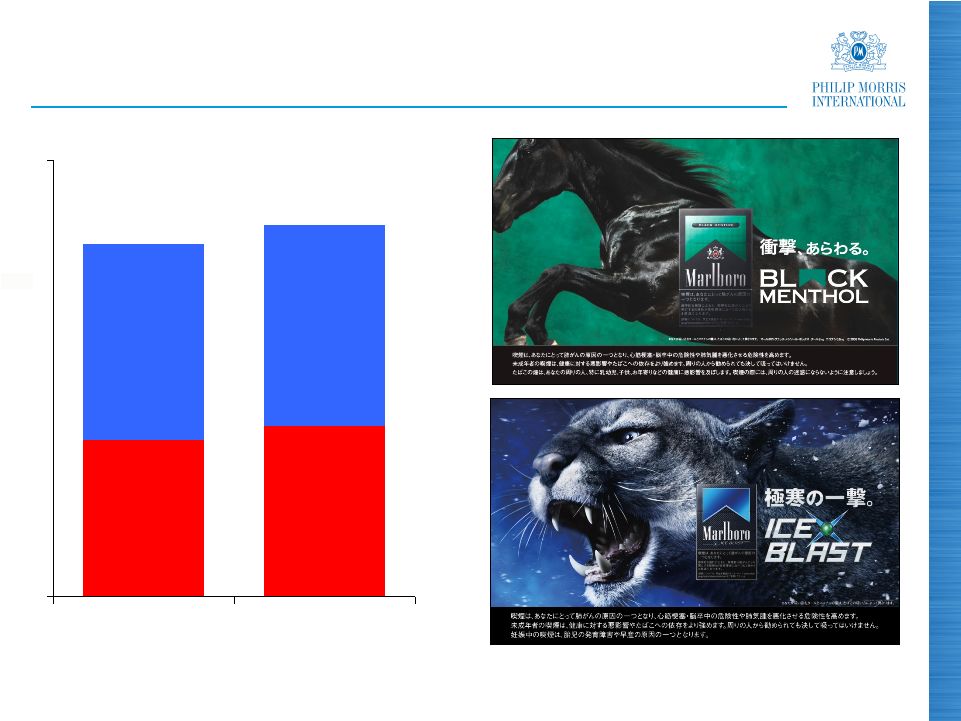

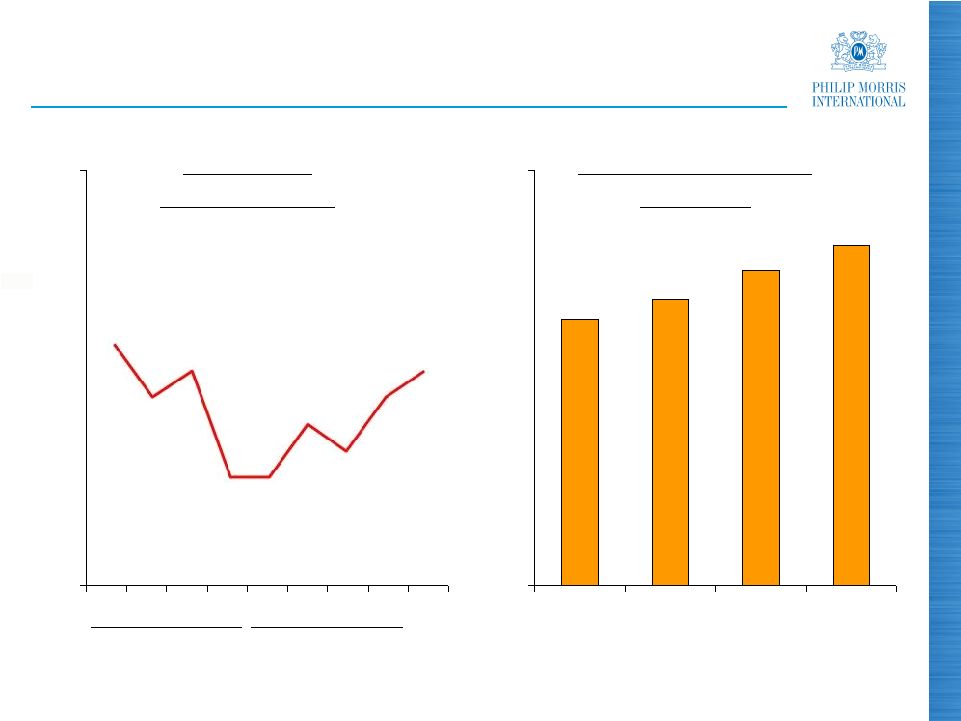

Japan -

PMI Market Shares

Source: Tobacco Institute of Japan

(%)

Total PMI

Marlboro

2010

2011

Other

PMI

Brands

10.8

11.7

25.6

24.2

0

30

Q1

Q1 |

9

Pricing Assumptions

Continued economic difficulties and consumer

affordability issues in certain markets, such as Greece,

Spain and Ukraine

Reaction to competitive price moves, such as selective

tax absorption, brand repositioning, discounting and

delays in the implementation of tax-driven price increases

Pricing will nevertheless remain the key driver of PMI

profitability growth and our 2011 pricing variance is

expected to surpass the level achieved last year |

10

Asia Region

PMI regional volume increased by 14.0% in Q1, driven by

the business combination in the Philippines, though down

1.7% on an organic basis

Marlboro

volume in Asia increased by 0.7% overall and by

5.5% excluding Japan

Strong volume and share performance in Indonesia,

Korea and the Philippines

Excellent regional financial results with net revenues up

by 11.6% and adjusted OCI 34.0% higher, both excluding

currency and acquisitions

Source: PMI Financials, PMI estimates and Hankook

Research |

11

Australia -

Plain Packaging

The Australian Government has released an exposure

draft of the bill, which would mandate plain packaging in

2012

There is a public consultation through June 6

PMI is firmly opposed to such a measure because:

-

there is no credible evidence that it will reduce smoking rates

-

it may undermine public health objectives by lowering prices and

increasing illicit trade

-

it will violate intellectual property protections and breach

international trade obligations

PMI will consider all appropriate options, including legal

action, to oppose the plain packaging proposal and

protect its valuable brands |

12

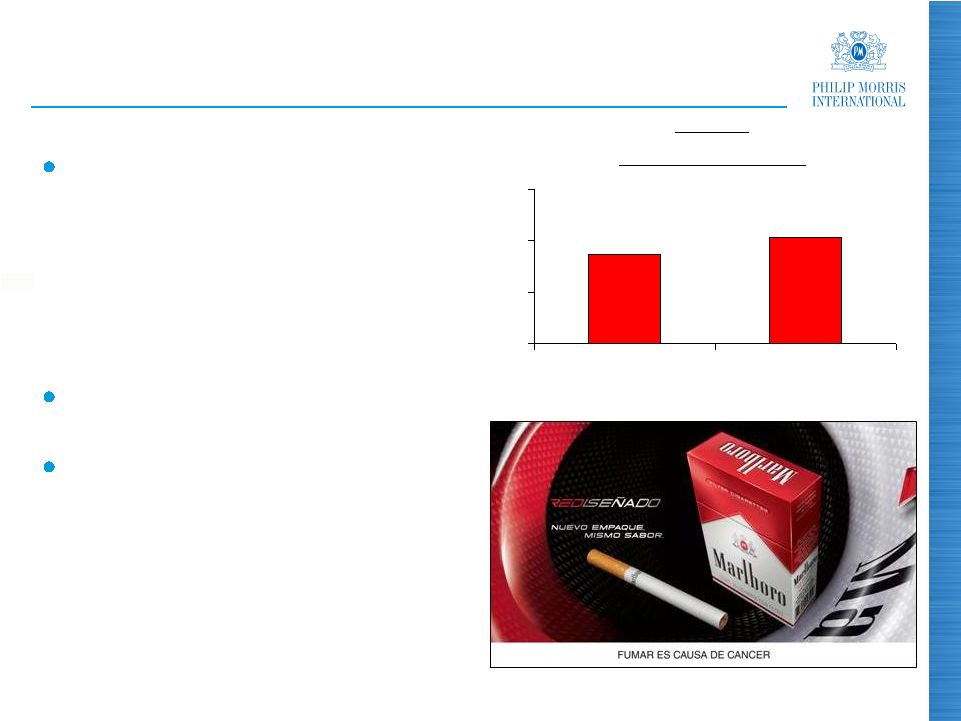

Latin America & Canada Region

Impact of disruptively large

tax/price increase in Mexico

(+8 Pesos/pack of 20):

-

Underlying industry volume

decline estimated at 14%

-

Resilience of Marlboro

and

Benson & Hedges

Marlboro

market share up in all

key markets in the Region

Adjusted regional OCI up 15.7%

and adjusted OCI margin 1.9

points higher in the first quarter,

both excluding currency

Source: PMI Financials and PMI estimates

(%)

2010

2011

Marlboro

Mexico -

Market Share

48.7

50.3

40

45

50

55

Q1

Q1 |

13

EU Region

Weak economies in Southern Europe driving industry

volume decline and consumer downtrading

Situation exacerbated in Spain by the introduction of a

total indoor smoking ban, higher prices, a reduction in

trade inventories and an increase in contraband. Full-year

decline forecast at around 15%

Greece continued to be a drag on PMI results in Q1,

though comparables will be easier as of Q2

Industry volume in EU Region was down by 2.5%,

excluding Spain

Source: PMI Financials and PMI estimates |

14

EU Region

PMI regional net revenues down 3.5% and adjusted OCI

2.3% lower in Q1, excluding currency, due to lower

industry volume and a Regional share decline

Structural excise tax improvements in 2011 in France,

Greece, the Netherlands, Sweden and the UK

Multi-year excise tax programs in Germany and the

Czech Republic

PMI has announced a 20 Euro cents per pack of 19

cigarettes price increase in Germany across its portfolio

PMI cigarette market share in Germany up 0.5 points in

Q1 and fine cut market share up 0.9 points

Source: PMI Financials and PMI estimates |

15

EU Region

(a) Young Adult Smokers: Legal Age (minimum 18)-24 years old; 12 mm: 12 months

moving average (b) Through end February

Source: PMI estimates and PMI Market Research

(%)

2008

(%)

2009

2010

2011

France

–

Philip

Morris

brand

Market Share

2009

2010

2011

Italy –

Marlboro

YAS 12 mm Share

(a)

6.4

6.9

7.6

8.2

0

10

Q1

Q1

Q1

Q1

34

29

33

25

40

1

2

3

4

1

2

3

4

Q1

(b) |

16

EEMA Region

PMI volume decreased by 0.8% driven by Ukraine and

North Africa, partly offset by favorable comparisons in

Romania and Turkey

Strong premium portfolio performance with higher

Marlboro

and Parliament volumes

Russian market impacted by rampant food price inflation

and cigarette price increases. Moderate industry volume

decline now expected in 2011 and only modest consumer

uptrading

PMI’s slight volume and share decline in Russia in Q1,

2011, attributable to the timing of price increases and

increased price gaps at the bottom of the market

Source: PMI Financials and A.C. Nielsen |

17

EEMA Region

Market contraction and polarization in Ukraine with

premium and super-low segments growing

PMI share loss of 3.6 points in Ukraine through end

February, driven by under-representation at the bottom

end of the market

PMI volume increased by 10.4% in Turkey during the first

quarter, driven by Parliament, Muratti

and L&M

Regional net revenues and adjusted OCI, both excluding

currency, were down 1.7% and 4.4% respectively, in the

quarter

Excluding impact of tax/price windfalls in Q1, 2010,

Regional adjusted OCI would have been up at double

digit rate

Source: PMI Financials and A.C. Nielsen |

18

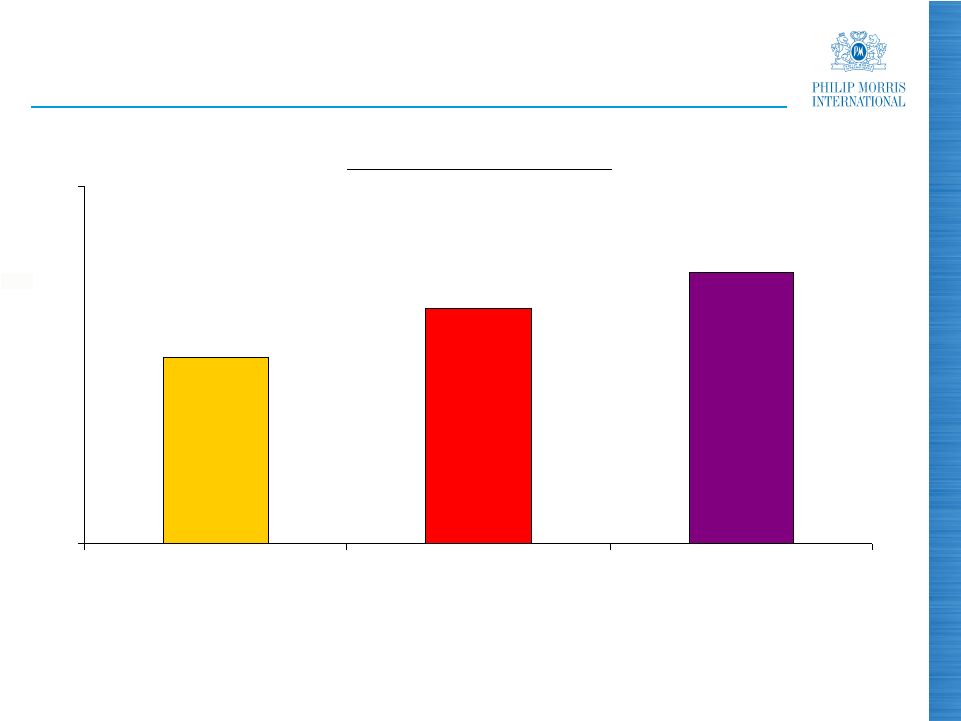

PMI Market Share Developments

(%)

Top 30 PMI OCI Markets

Note: Historical data adjusted for pro-forma inclusion of business combination

with Fortune Tobacco in the Philippines Source: PMI estimates

34.6

35.3

35.8

32

37

Q1, 2009

Q1, 2010

Q1, 2011 |

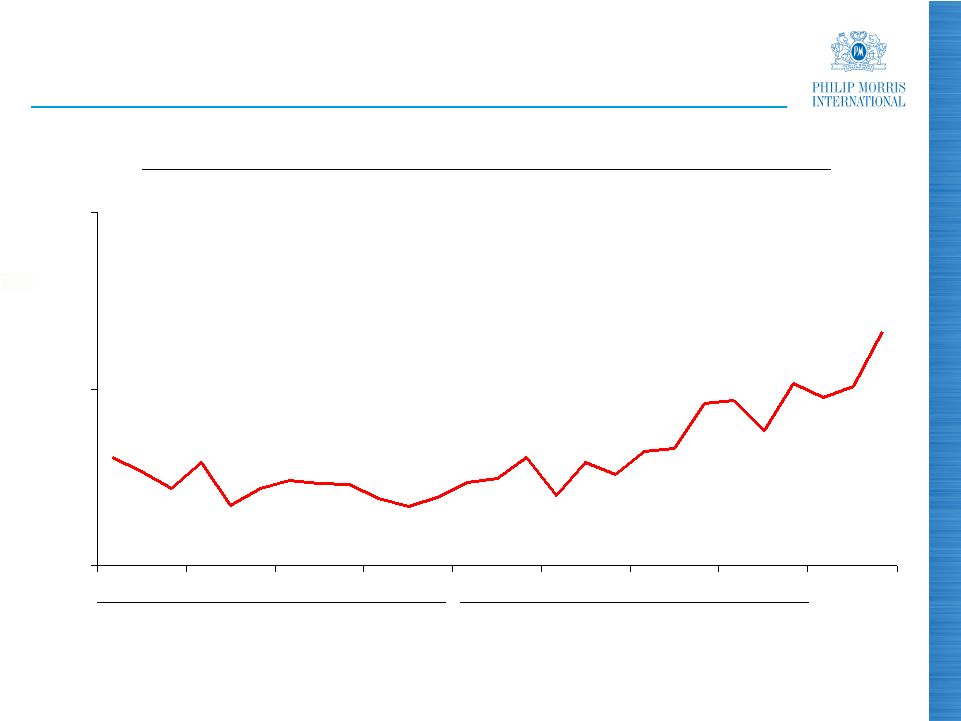

19

9.0

9.1

9.2

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Marlboro

–

Market Share

2009

2010

Marlboro

Global

Share

of

Market

(a)

–

12

Months

Moving

Average

(%)

(a)

Excluding China and USA

Source: PMI estimates

2011

Q1 |

20

Tobacco Leaf and Direct Materials

Stable tobacco leaf prices expected in 2011, mainly due

to a larger crop in Brazil

Direct material costs stable

Manufacturing costs expected to increase in line with

inflation this year, partly offset by our $250 million annual

productivity and cost reduction target, which we are fully

on track to achieve |

21

Adjusted OCI Margins

2.2

42.7

44.9

Total

1.9

31.3

33.2

LA&C

7.7

38.7

46.4

Asia

(1.2)

44.1

42.9

EEMA

0.7 pp

48.6 %

49.3 %

EU

Variance

2010

2011

(a)

First-Quarter

(a)

Excluding currency and acquisitions

Source: PMI Financials |

22

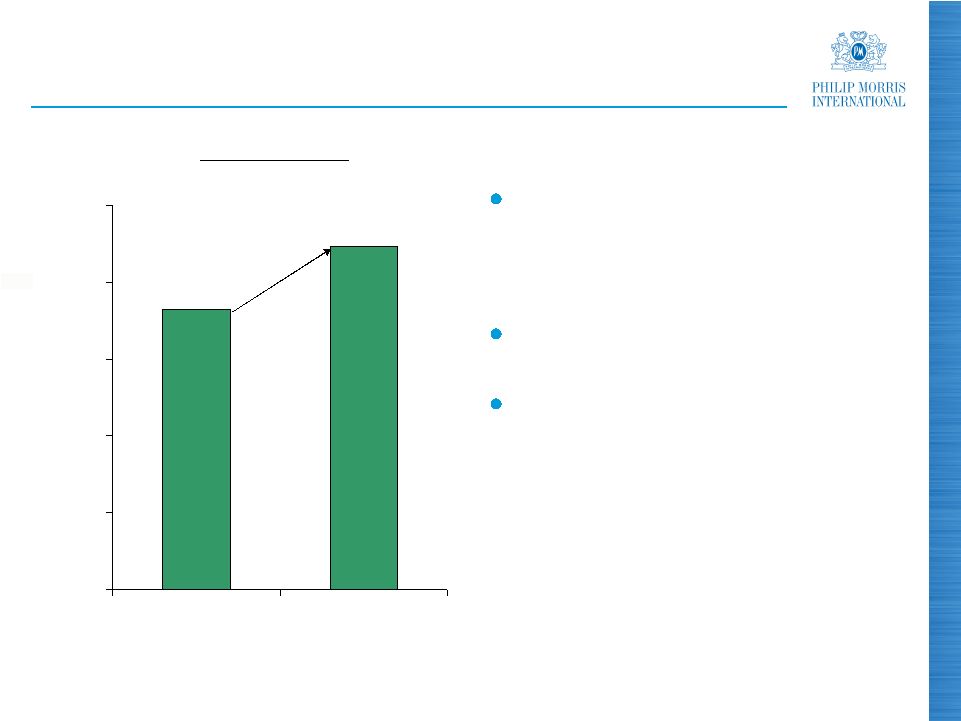

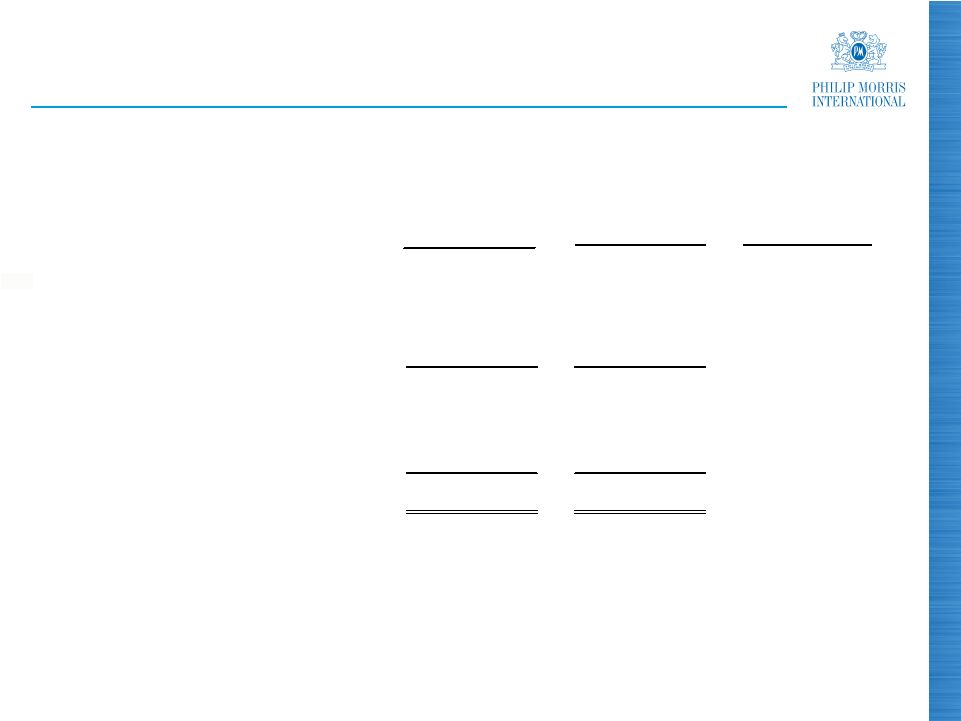

Free Cash Flow

(a)

Free cash flow equals net cash provided by operating activities less capital

expenditures Source: PMI Financials

Free Cash Flow

(a)

($ million)

+22.6%

Increase driven by higher

net earnings, lower

pension contributions and

lower cash exit costs

We continue to focus on

reducing inventory levels

Year-end working capital

requirements remain

subject to tax/price

increases and forestalling

regulations

1,824

2,236

0

500

1,000

1,500

2,000

2,500

Q1, 2010

Q1, 2011 |

23

Share Repurchase Program

During the first quarter, PMI spent some $1.36 billion to

purchase 22.2 million shares at an average of $61.21

Full-year 2011 share repurchases expected to total

around $5 billion |

24

Conclusions

Strong first-quarter results

Business outlook is favorable

Positive impact of Japan difficult to measure

Increased investment behind our portfolio of leading

brands

Slightly more conservative pricing assumptions

2011 reported diluted EPS guidance raised by 20 cents to

$4.55 to $4.65:

-

Ten cents to reflect our positive business momentum

-

Ten cents to reflect more favorable exchange rates

We will continue to use our strong cash flow to generously

reward our shareholders |

25

Questions & Answers

2011 First-Quarter Results |

26

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Adjustments for the Impact of Currency and Acquisitions

For the Quarters Ended March 31,

($ in millions)

(Unaudited)

(1)

Represents the business combination in the Philippines

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Less

Currency

Reported Net

Revenues

excluding

Excise Taxes &

Currency

Less

Acquisi-

tions

Reported Net

Revenues

excluding

Excise Taxes,

Currency &

Acquisitions

Reported Net

Revenues

Less

Excise

Taxes

Reported Net

Revenues

excluding

Excise Taxes

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

6,415

$

4,414

$

2,001

$

(106)

$

2,107

$

-

$

2,107

$

European Union

6,748

$

4,564

$

2,184

$

(8.4)%

(3.5)%

(3.5)%

3,671

1,984

1,687

(29)

1,716

-

1,716

EEMA

3,356

1,610

1,746

(3.4)%

(1.7)%

(1.7)%

4,288

1,965

2,323

128

2,195

105

(1)

2,090

Asia

3,562

1,689

1,873

24.0%

17.2%

11.6%

2,156

1,376

780

24

756

-

756

Latin America & Canada

1,921

1,228

693

12.6%

9.1%

9.1%

16,530

$

9,739

$

6,791

$

17

$

6,774

$

105

$

6,669

$

PMI Total

15,587

$

9,091

$

6,496

$

4.5%

4.3%

2.7%

Reported

Operating

Companies

Income

Less

Currency

Reported

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Reported

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Reported

Reported

excluding

Currency

Reported

excluding

Currency &

Acquisitions

1,006

$

(21)

$

1,027

$

-

$

1,027

$

European Union

1,062

$

(5.3)%

(3.3)%

(3.3)%

722

(12)

734

-

734

EEMA

770

(6.2)%

(4.7)%

(4.7)%

1,093

102

991

23

(1)

968

Asia

724

51.0%

36.9%

33.7%

251

1

250

-

250

Latin America & Canada

217

15.7%

15.2%

15.2%

3,072

$

70

$

3,002

$

23

$

2,979

$

PMI Total

2,773

$

10.8%

8.3%

7.4%

% Change in Reported Net Revenues

excluding Excise Taxes

2011

2010

% Change in Reported Operating

Companies Income

2011

2010 |

27

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Operating Companies Income to Adjusted Operating

Companies Income & Reconciliation of Adjusted Operating Companies Income

Margin, excluding Currency and Acquisitions For the Quarters Ended March

31, ($ in millions)

(Unaudited)

(1)

Represents the business combination in the Philippines

(2)

For the calculation of net revenues excluding excise taxes, currency and

acquisitions refer to previous slide Reported

Operating

Companies

Income

Less

Asset Impairment

& Exit Costs

Adjusted

Operating

Companies

Income

Less

Currency

Adjusted

Operating

Companies

Income

excluding

Currency

Less

Acquisi-

tions

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Reported

Operating

Companies

Income

Less

Asset

Impairment &

Exit Costs

Adjusted

Operating

Companies

Income

Adjusted

Adjusted

excluding

Currency

Adjusted

excluding

Currency &

Acquisitions

1,006

$

(11)

$

1,017

$

(21)

$

1,038

$

-

$

1,038

$

European Union

1,062

$

-

$

1,062

$

(4.2)%

(2.3)%

(2.3)%

722

(2)

724

(12)

736

-

736

EEMA

770

-

770

(6.0)%

(4.4)%

(4.4)%

1,093

(2)

1,095

102

993

23

(1)

970

Asia

724

-

724

51.2%

37.2%

34.0%

251

(1)

252

1

251

-

251

Latin America & Canada

217

-

217

16.1%

15.7%

15.7%

3,072

$

(16)

$

3,088

$

70

$

3,018

$

23

$

2,995

$

PMI Total

2,773

$

-

$

2,773

$

11.4%

8.8%

8.0%

% Points Change

Adjusted

Operating

Companies

Income

excluding

Currency

Net Revenues

excluding Excise

Taxes &

Currency

(2)

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income

excluding

Currency &

Acquisitions

Net Revenues

excluding Excise

Taxes, Currency

& Acquisitions

(2)

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

Adjusted

Operating

Companies

Income

Net Revenues

excluding Excise

Taxes

(2)

Adjusted

Operating

Companies

Income

Margin

Adjusted

Operating

Companies

Income

Margin

excluding

Currency

Adjusted

Operating

Companies

Income Margin

excluding

Currency &

Acquisitions

1,038

$

2,107

$

49.3%

1,038

$

2,107

$

49.3%

European Union

1,062

$

2,184

$

48.6%

0.7

0.7

736

1,716

42.9%

736

1,716

42.9%

EEMA

770

1,746

44.1%

(1.2)

(1.2)

993

2,195

45.2%

970

2,090

46.4%

Asia

724

1,873

38.7%

6.5

7.7

251

756

33.2%

251

756

33.2%

Latin America & Canada

217

693

31.3%

1.9

1.9

3,018

$

6,774

$

44.6%

2,995

$

6,669

$

44.9%

PMI Total

2,773

$

6,496

$

42.7%

1.9

2.2

2010

2011

2010

2011

% Change in Adjusted Operating

Companies Income |

28

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS and Adjusted

Diluted EPS, excluding Currency For the Quarters Ended March 31,

(Unaudited)

2011

2010

% Change

Reported Diluted EPS

1.06

$

0.90

$

17.8%

Adjustments:

Tax items

(0.01)

-

Asset impairment and exit costs

0.01

-

Adjusted Diluted EPS

1.06

$

0.90

$

17.8%

Less:

Currency impact

0.03

Adjusted Diluted EPS, excluding Currency

1.03

$

0.90

$

14.4% |

29

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries

Reconciliation of Non-GAAP Measures

Reconciliation

of

Operating

Cash

Flow

to

Free

Cash

Flow

and

Free

Cash

Flow,

excluding

Currency

For the Quarters Ended March 31,

($ in millions)

(Unaudited)

(a) Operating Cash Flow

2011

2010

% Change

Net

cash

provided

by

operating

activities

(a)

2,395

$

1,974

$

21.3%

Less:

Capital expenditures

159

150

Free cash flow

2,236

$

1,824

$

22.6%

Less:

Currency impact

28

Free cash flow, excluding currency

2,208

$

1,824

$

21.1% |

30

2011 First-Quarter Results

April 21, 2011 |