Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMERISAFE INC | d8k.htm |

Exhibit 99.1

Sidoti & Company, LLC

15

th

Annual New York Conference

March 22, 2011

G. Janelle Frost

Chief Financial Officer

C. Allen Bradley

Chairman & Chief Executive Officer |

Forward Looking

Statements Statements made in this presentation that are not historical facts, including

statements accompanied by words such as “will,”

“believe,”

“anticipate,”

“expect,”

“estimate,”

“preliminary,”

or similar words are forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995 regarding

AMERISAFE’s plans and performance. These statements are based on

management’s estimates, assumptions, and projections as of the date of this

presentation and are not guarantees of future performance. Actual results may

differ materially from the results expressed or implied in these

statements as the

result of risks, uncertainties, and other factors, including the

factors set forth in the

Company’s filings with the Securities and Exchange Commission, including

in Item

1A “Risk Factors”

in AMERISAFE’s Annual Report on Form 10-K for the year ended

December 31, 2010. AMERISAFE cautions you not to place undue reliance on the

forward-looking statements contained in this presentation. AMERISAFE does not

undertake any obligation to publicly update or revise any forward-looking

statements to reflect future events, information, or circumstances that arise after

the date of this presentation.

2 |

3

Market data as of March 15, 2011; Financial data as of December 31, 2010

Nasdaq: AMSF

Market Statistics:

Stock Price

$21.82

52 week range

$15.50 - $22.19

Shares Outstanding

18.2 M

Market Cap

$397 M

Book Value per Share

$17.72

Price-to-Book

1.23 |

Overview

AMERISAFE has a 25-year operating history as a specialty

provider

of

workers’

compensation

insurance

for

small

to

mid-sized employers engaged in high hazard industries

4

2010 Highlights

GPW: $228.4 million

Combined ratio: 93.3%

Operating ROE: 9.9%

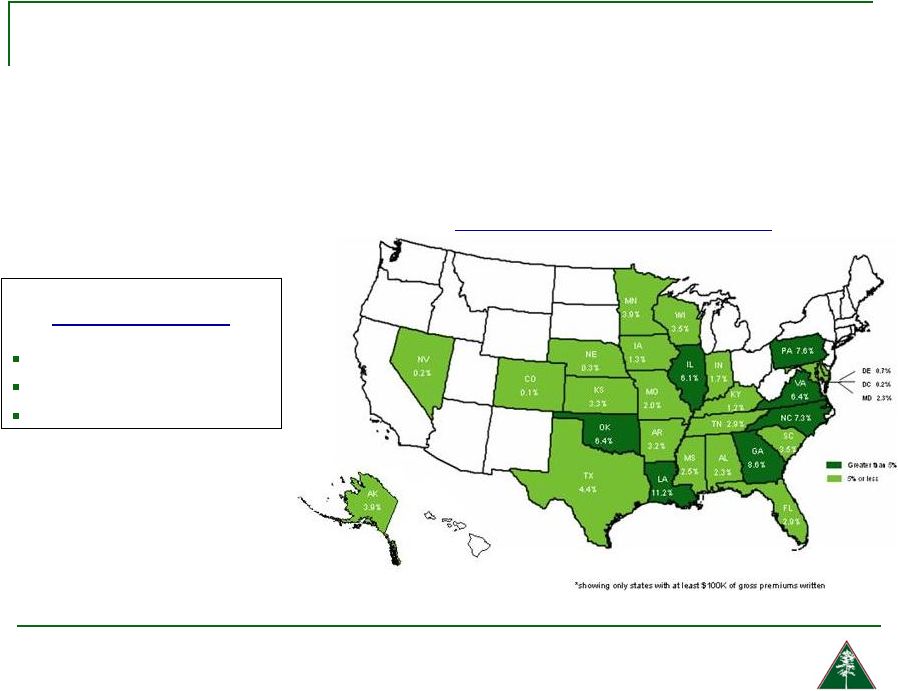

Premium Distribution by State

AMERISAFE

actively

markets

insurance

in

33

states

and

Washington

D.C. |

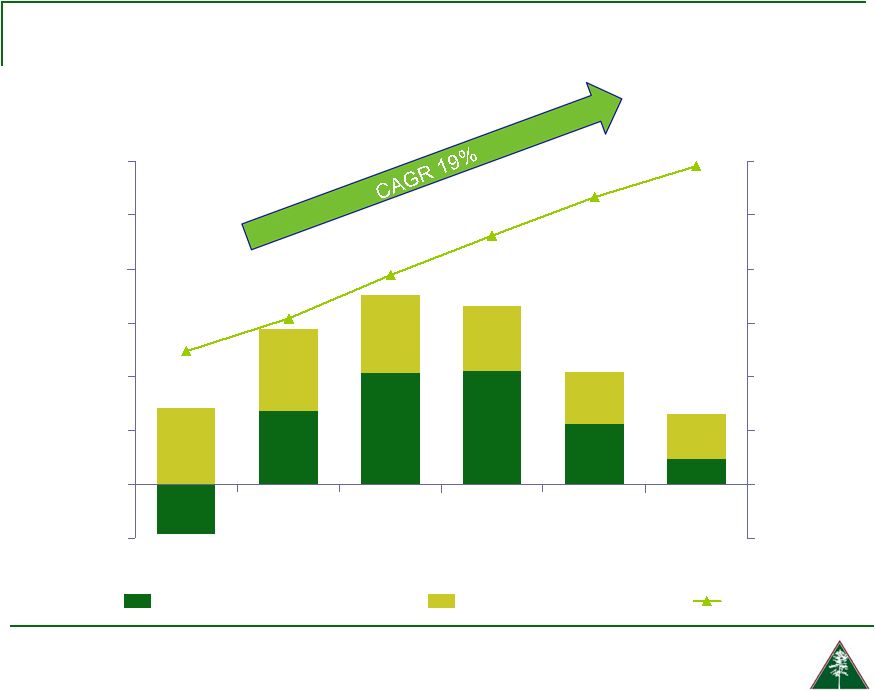

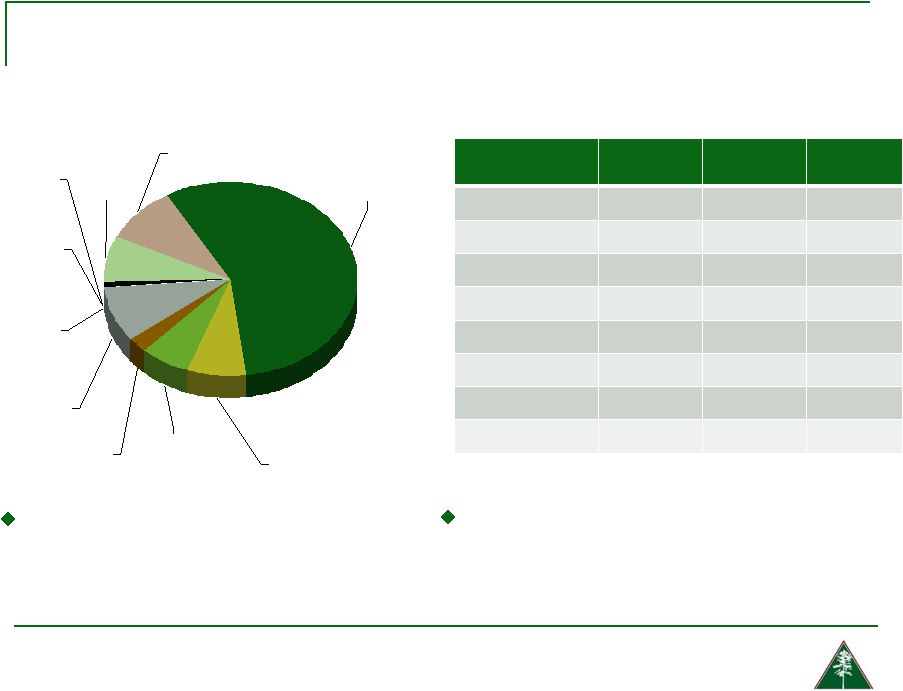

Premium

Distribution 5

Premium Distribution by Industry as of 12/31/10

Historical Premium Distribution

of Major Industry Groups

(in $ millions)

150

100

50

0

2008

Construction

2009

2010

Trucking

Agriculture

Oil and Gas

Construction

Trucking

Agriculture

24.1%

6.8%

Logging

4.2%

Other

26.9%

4.0%

34.0% |

AMERISAFE

Differentiators 6

Focus on High Hazard Industries Niche

Focus on Small to Mid-Sized Employers

Specialized Underwriting Expertise

Comprehensive Safety Services

Intensive Claims Management

Integrated High-Touch Service |

High Hazard Niche

Focus High hazard industry workers’

comp rates are more

than 3 times the national average

Difficult to serve industry sub-segments

Less impacted by soft market cycles

Represents a broad spectrum of risk quality; favors

expertise in risk selection and pricing

Higher severity losses require unique claims

handling skills and processes

7 |

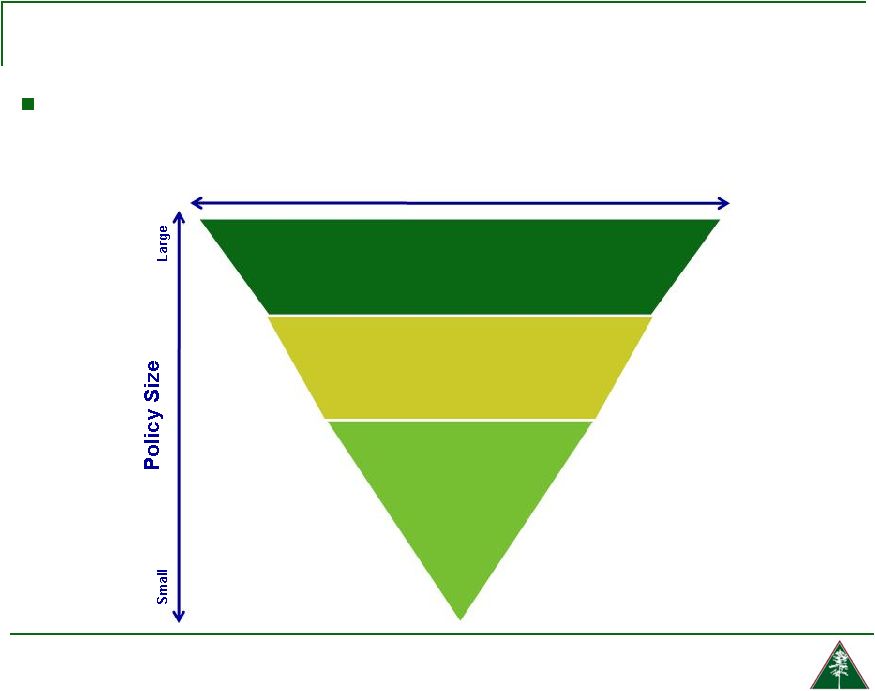

Small

to Mid-Sized Employers 1

Competition is fragmented, and favors multi-state writers

of small to mid-sized employers

8

Intensity of Competition

Annual

premium

> $100,000

Annual

premium

$35,000 to

$100,000

Annual

premium

< $35,000

Large Competitors (major national firms);

Represents 3% of AMSF policies;

22% of premiums

Mid-sized Competitors (regional and

smaller national firms);

Represents 19% of AMSF policies;

36% of premiums

Small Competitors (single-state

writers, self-insured funds);

Represents 78% of

AMSF policies;

42% of

Premiums

1

As of 12/31/2010 |

Specialized

Underwriting Expertise Industry-specific risk analysis and proprietary

rating tools developed over 25-year history Underwriters

have

in-depth

knowledge

of

insureds’

industry

practices

and

loss

exposures

No delegation of underwriting authority to agents or MGA’s

Track record of maintaining pricing discipline and low loss experience

9

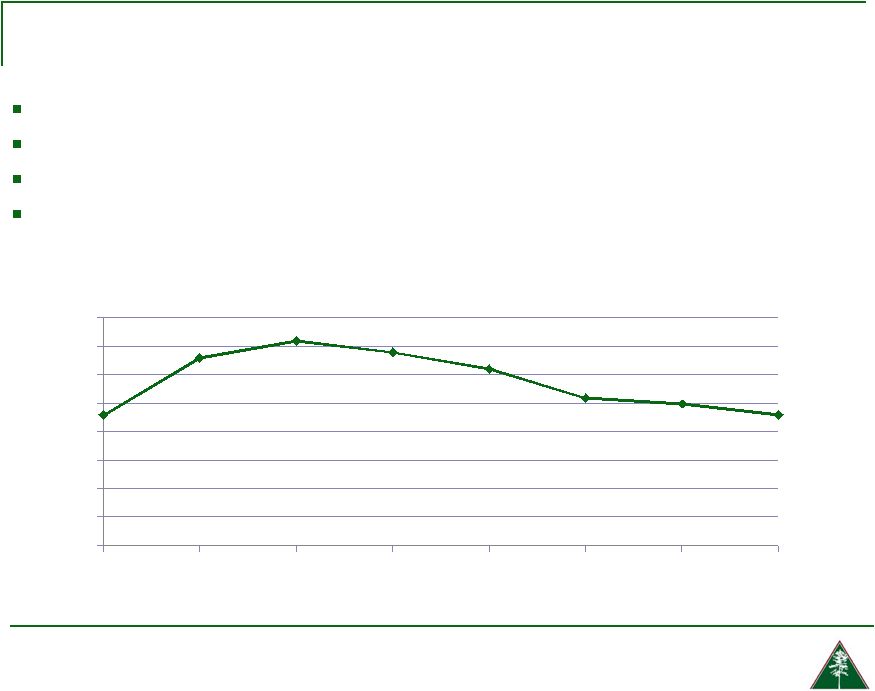

1.43

1.53

1.56

1.54

1.51

1.46

1.45

1.43

1.20

1.25

1.30

1.35

1.40

1.45

1.50

1.55

1.60

2003

2004

2005

2006

2007

2008

2009

2010

Policy Year ELCM |

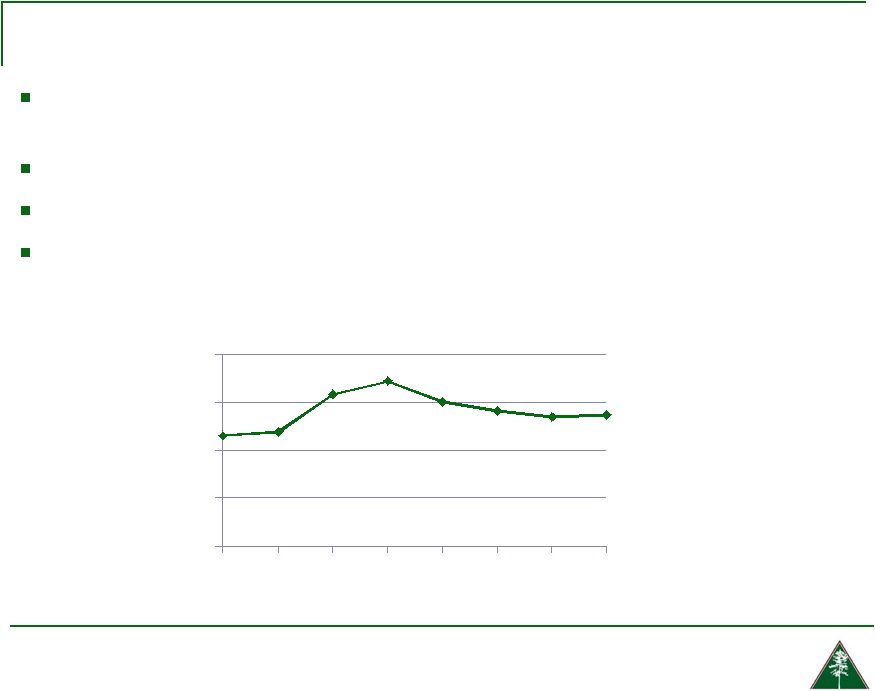

Comprehensive

Safety Services Pre-quotation, worksite safety inspections were performed

on approximately 90% of new voluntary policyholders in 2010

Voluntary policies inspected prior to renewal

Detailed safety reports provided to underwriters after safety visits

Field Safety Professionals have in-depth knowledge of our high hazard

industries

10

60%

70%

80%

90%

100%

2003

2004

2005

2006

2007

2008

2009

2010

Safety Inspection Ratio |

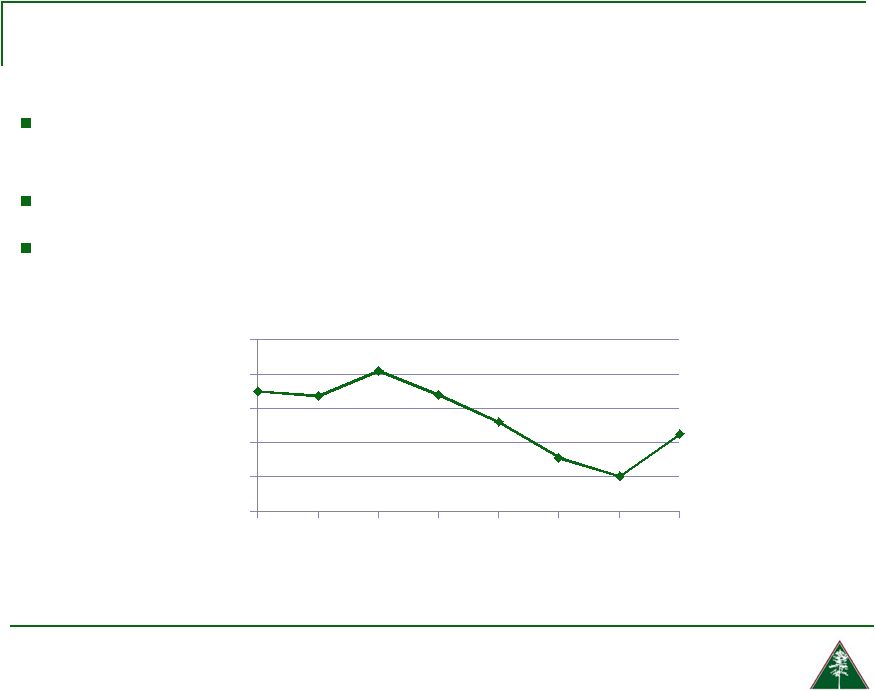

Intensive Claims

Management Field Case Managers (FCMs) located in service areas; visit

claimants personally

On average, only 56 indemnity claims per FCM as of 12/31/10

FCMs focus on timely resolution of claims

11

4,000

4,500

5,000

5,500

6,000

6,500

2003

2004

2005

2006

2007

2008

2009

2010

Total Open Claims at Period End |

Strong Financial

Performance 12

-9.2%

13.6%

20.7%

21.0%

11.3%

4.7%

14.3%

15.3%

14.5%

12.1%

9.6%

8.4%

$7.42

$9.23

$11.66

$13.86

$16.00

$17.72

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

2005

2006

2007

2008

2009

2010

$(3.00)

$-

$3.00

$6.00

$9.00

$12.00

$15.00

$18.00

Pre-tax Underwriting ROE

Pre-tax Investing ROE

BVPS |

13

Investment Portfolio

Carrying value of cash and

investments was $826.5 million at

December 31, 2010

Investment

Book Value

($millions)

Fair Value

($millions)

Unrealized

Gain (Loss)

Municipals

$466.9

$479.1

$12.2

U.S. Agency MBS

$62.1

$65.9

$3.8

Commercial MBS

$51.5

$54.1

$2.6

U.S. Treasuries

$14.8

$15.8

$1.0

Corporate Bonds

$60.8

$62.2

$1.4

ABS

$6.4

$5.5

$(0.9)

Long-term CD

$0.8

$0.8

-

Total

$663.3

$683.4

$20.1

As of 12/31/2010, fixed-maturity

securities have an average

composite credit rating of “AA”

Value of Fixed-Maturity Securities

Classified as Held-to-Maturity

(as of

12/31/2010) Portfolio Allocation

(as of

12/31/2010) Municipals

56.5%

U.S. Agency

MBS

7.5%

Commerical

MBS

6.2%

U.S.

Treasuries/

agencies

2.5%

Corporates

9.3%

Asset-

backed

securities

0.8%

Long-term

CD

0.1%

Equities

0.2%

Cash & cash

equilvalents

7.4%

Short-term

investments

9.5% |

Combined

Ratio 14

71.9%

74.2%

79.5%

66.6%

64.7%

60.9%

65.1%

71.9%

27.3%

24.8%

24.7%

23.8%

21.3%

19.3%

21.5%

21.0%

99.6%

99.5%

104.2%

92.4%

85.9%

81.4%

86.9%

93.3%

0%

20%

40%

60%

80%

100%

120%

2003

2004

2005

2006

2007

2008

2009

2010

Loss

Expense

Dividend |

Current

Workers Compensation

Market Conditions

15 |

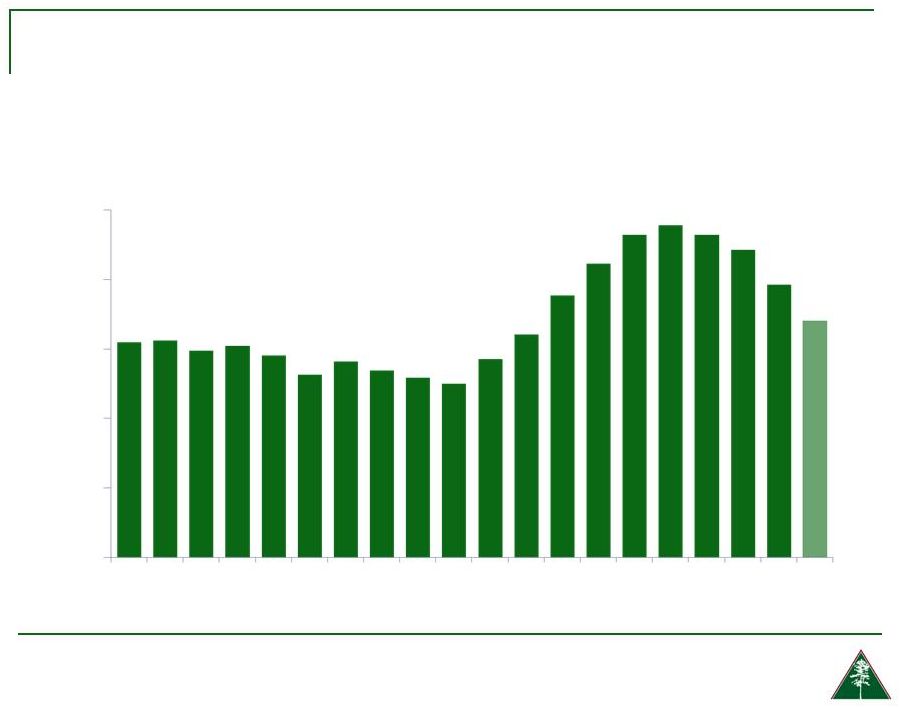

WC Premiums

Continue Declines ($ Billions)

P Preliminary

Source: NCCI Holdings, Inc. 2010 State of the Workers Compensation

Line 16

0.0

10.0

20.0

30.0

40.0

50.0

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009p

Net Written Premium

31.0

31.3

29.8

30.5

29.1

26.3

28.2

26.9

25.9

25.0

28.6

32.1

37.7

42.3

46.5

47.8

46.5

44.3

39.3

34.1 |

History of

Rates/Loss Cost Changes Source: NCCI Holdings, Inc. 2010 State of the

Workers Compensation Line Cumulative

1990-1993

+36.3%

Cumulative

2004-2010

-26.7%

Cumulative

1994-1999

-27.8%

Cumulative

2000-2003

+17.1%

Calendar Year

*States approved through 4/23/2010

Countrywide approved changes in advisory rates, loss costs, and assigned risk rates

as filed by the applicable rating organization 17

12.1

7.4

10.0

2.9

-6.4

-3.2

-6.0

-8.0

-5.4

-2.6

3.5

1.2

4.9

6.6

-6.0

-5.1

-5.7

-6.6

-3.1

-2.4

-1.4

-10

-5

0

5

10

15

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010*

Average Approved WC Bureau Rate/Loss Cost Level Changes |

Effect of

Recessions* on Payroll (Workers Comp Exposure)

*Data is an estimate and represents maximum recorded decline over 12-month

period using annualized quarterly wage and salary accrual data

Source: Insurance Information Institute research; Federal Reserve Bank of St. Louis

(wage and salary data); National Bureau of Economic Research (recession

dates). -4.4%

-2.0%

-1.1%

1.1%

3.7%

4.6%

8.5%

3.5%

2.1%

-0.5%

-3.6%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

1948-

1949

1953-

1954

1957-

1958

1960-

1961

1969-

1970

1973-

1975

1980

1981-

1982

1990-

1991

2001

2007-

2009

Recessions

in

the

1970s

and

1980s

saw smaller exposure impacts

because of continued wage

inflation, a factor not present

during the 2007-2009 recession

The Dec. 2007 to mid-

2009 recession

caused the largest

impact on WC

exposure in 60 years

(Percent

Change)

(All Post WWII Recessions)

Recession Dates (Beginning/Ending Years)

18 |

Calendar Year

Reserve Deficiencies ($ Billions)

Source: NCCI Holdings, Inc. 2010 State of the Workers Compensation

Line 19

Workers Compensation Loss and LAE Reserve Deficiency

Private Carriers

2009 Tabular Discount is $5.3 Billion

Calendar Year |

WC Required

Returns Percent

* Based on NCCI’s

2009 Internal Rate of Return model

Source: NCCI Holdings, Inc. 2010 State of the Workers Compensation

Line 20

Workers Compensation Combined Ratios for Given Cost of Capital*

Assumptions:

3.4% Pre-Tax Investment Yield

2.7% After-Tax Investment Yield

WC Reserve to Surplus Ratio = 2.05

Cost of Capital

75

80

85

90

95

100

105

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

103

100

98

96

94

93

91

90

88

87

86 |

WC Industry

Combined Ratio 118%

122%

111%

110%

107%

103%

98%

104%

104%

110%

94%

106%

104%

100%

100%

104%

92%

86%

81%

87%

93%

110%

60%

70%

80%

90%

100%

110%

120%

130%

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

WC Ind.

AMSF

Workers Comp Underwriting Results Are

Deteriorating Markedly

Sources: A.M. Best; Insurance Information Institute.

21 |

Investment

Considerations 22

Consistent growth in book value

Strong and growing balance sheet

Consistent high returns

Efficient expense structure

Specialized underwriting expertise developed

over 25-year history

Prudent reserving policy |

Appendix

23 |

Selected Balance

Sheet Data 24

(in thousands)

2008

2009

2010

Investments, Cash and cash equivalents

799,973

800,485

826,503

Amounts recoverable from reinsurers

67,763

81,878

95,133

Premiums receivable, net

156,567

151,570

122,618

Deferred income taxes

33,580

28,489

31,512

Deferred policy acquisition costs

20,289

18,128

17,400

Total Assets

1,107,833

1,118,809

1,128,134

Reserves for loss and loss adjustment expenses

531,293

534,655

532,204

Unearned premiums

137,100

122,500

111,494

Insurance-related assessments

42,505

40,072

33,898

Subordinated debt securities

36,090

36,090

36,090

Redeemable preferred stock

25,000

-

-

Shareholders’ equity

253,272

302,417

325,223

Metrics

Book Value Per Share 1

$13.86

$16.00

$17.72

Debt to Capital 1

11.5%

10.7%

10.0%

1 Includes redeemable preferred stock for 2008 |

Income

Statement 25

(in thousands)

2009

2010

Revenues:

Gross premiums written

$256,454

$228,424

Ceded premiums written

(20,158)

(20,549)

Net premiums written

$236,296

$207,875

Net premiums earned

$250,896

$218,881

Net investment income

28,014

26,242

Net realized gains on investments

2,033

2,449

Fee and other income

1,268

584

Total revenues

282,211

248,156

Expenses:

Loss and loss adjustment expenses incurred

163,316

157,388

Underwriting and other operating costs

53,957

45,959

Interest expense

1,810

1,548

Policyholder dividends

770

834

Total expenses

219,853

205,729

Income before taxes

62,358

42,427

Income tax expense

15,927

9,074

Net income

$46,431

$33,353 |

Return on Equity

Drivers 26

Year to Date

12/31/2010

Loss Ratio

71.9%

+

Expense Ratio

21.0%

+

Policyholder Dividend Ratio

0.4%

=

Combined Ratio

93.3%

Underwriting Profit

6.7%

x

Operating Leverage

0.7

=

ROE from Underwriting

4.7%

Pre-tax Investment Yield

3.2%

x

Investment Leverage

2.59

=

ROE from Investing

8.4%

ROE from Other Income (Expense)

0.4%

Pre-tax ROE (tax-equilvalent basis)

13.5%

Effective Tax Rate

21.4%

After-tax Return on Fully Converted Equity

10.6% |