Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Enventis Corp | form8k.htm |

Exhibit 99.1

Fourth Quarter 2010

Earnings Conference Call

March 1, 2011

NASDAQ: HTCO

“Safe Harbor” Statement

Information set forth in this presentation contains financial estimates

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures are

available in our presentation.

Fourth Quarter 2010 Highlights

• Consolidated revenue totaled $41.8 million, up 9%

– Fiber and data revenue grew 18%

– Equipment revenue up 17%

– Broadband revenue grew 14%

• Net income increased 48% and totaled $2.1 M

• Debt reduced $3.0 M from Q3-10;

year-end debt balance of $119 M

year-end debt balance of $119 M

• Strategic investments in fiber network upgrades,

fiber route expansion, SMB market plan acceleration

fiber route expansion, SMB market plan acceleration

Q4 ’10 compared to Q4 ’09

• Fiber and data revenue +18%

• Equipment revenue +17%

• Broadband revenue +14%

2010 compared to 2009

• Fiber and data revenue +43%

• Equipment revenue +27%

• Broadband revenue +11%

• Fiber construction project added

$5 M

($ in Millions)

Quarterly Revenue

Business Sector

Telecom Sector

$153.2

$139.1

$162.2

Consolidated Revenue

Diluted EPS

• EPS in 2010 up 6% over 2009

1 Excluding tax reversals, EPS would have been

$0.52 in 2009 and $0.71 in 2010, up 37%

Income before Taxes

(continuing operations)

(continuing operations)

• Lower interest expense in 2010

• Fiber construction project, wholesale

transport sales and equipment sales

rebound positively impacted income

transport sales and equipment sales

rebound positively impacted income

($ in Millions)

Income before Taxes

1

1

Business Sector

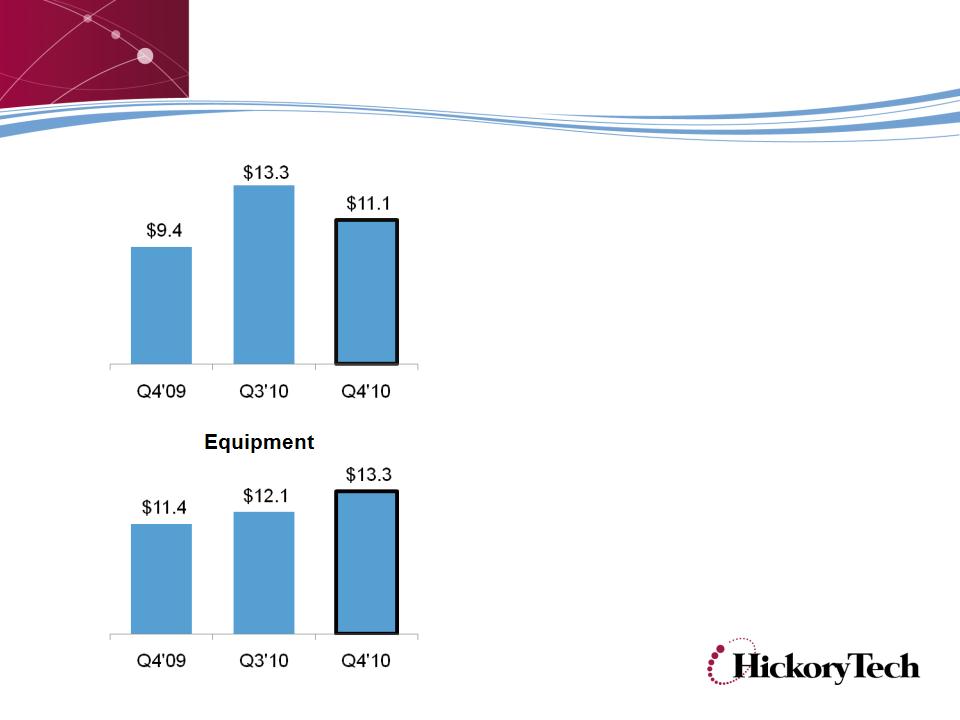

Fiber and Data

• Q4 ’10 revenue up 18% from Q4 ’09

• Steady wholesale services growth;

SMB market acceleration

SMB market acceleration

• Fiber construction project added $3.3 M

revenue in Q3 ’10, $0.6 M in Q4 ‘10

revenue in Q3 ’10, $0.6 M in Q4 ‘10

Equipment

• Q4 ’10 revenue up 17% from Q4 ’09

• Significant increase in product profitability

($ in Millions)

Fiber and Data

Telecom Sector

Q4 ’10 compared to Q4 ’09

• Broadband revenue up 14%

• Network Access revenue -11%

• Local Service revenue -5%

Broadband Highlights

• Strong Business Ethernet sales

• Digital TV subscribers +9%

• DSL subscribers +2%

Telecom Revenue

($ in Millions)

Debt Balance

Reduced debt, Increased capital expenditures for fiber network expansion in 2010

2011 Fiscal Outlook

2011 targets ranges as follows:

• Revenue: $158 M to $164 M

• Net Income: $7.4 M to $8.7 M

• Capital spending: $20.5 M to $24 M

• EBITDA: $41 M to $43.2 M

• Debt balance (year-end): $118 M to $123 M

2011 guidance provided in fourth quarter 2010 earnings release issued Feb. 28, 2011.

2010 Network Expansion

• Extended fiber network to Sioux Falls, So.

Dakota and Fargo, No. Dakota

Dakota and Fargo, No. Dakota

• Increased network capacity between

Minnesota and Des Moines, Iowa, added

local fiber network in Des Moines, Iowa

Minnesota and Des Moines, Iowa, added

local fiber network in Des Moines, Iowa

• Added network collocations to expand

Mid-band Ethernet services.

Mid-band Ethernet services.

• Secured Broadband stimulus grant, network

expansion plans in progress

expansion plans in progress

Strategic Initiatives

• Increased investment and focus on growing business services:

Ø Fiber network expansion

Ø Accelerated SMB market plan

Ø Expand Mid-band Ethernet services

Ø Target FTTT and last-mile fiber builds

• Grow broadband services and focus on customer retention

• Increase capital spending on key strategic initiatives

• Manage free cash flow, manage costs and potentially increase debt in

short term

short term

Long-term goal to double the value of HickoryTech over five years

HTCO Investment Highlights

• Stable growth and cash flows; more than 60 years of paying a dividend,

yield approximately 5-6%

yield approximately 5-6%

• Business transformation generating strong diversification,

operating results and financial position

operating results and financial position

• Emerging growth through B2B strategy and fiber network expansion

• High level of recurring revenue, dominant consumer market share,

expanded broadband service area

expanded broadband service area

• Experienced Company with 112-year track record and strong strategic

plan

plan

Appendix

Adjusted Net Income

Appendix

Reconciliation of Non-GAAP Measures