Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PDC ENERGY, INC. | pdc8k08092010.htm |

| EX-99.1 - EX 99.1 - PDC ENERGY, INC. | pdcrelease2010_0809.htm |

Second Quarter 2010 Results Teleconference

August 9, 2010

Disclaimer

The following information contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on Management’s current expectations and beliefs, as well as a number of assumptions concerning future

events.

forward-looking statements are based on Management’s current expectations and beliefs, as well as a number of assumptions concerning future

events.

These statements are based on certain assumptions and analyses made by Management in light of its experience and its perception of historical

trends, current conditions and expected future developments as well as other factors it believes are appropriate in the circumstances. However,

whether actual results and developments will conform with Management’s expectations and predictions is subject to a number of risks and

uncertainties, general economic, market or business conditions; the opportunities (or lack thereof) that may be presented to and pursued by PDC

Energy; actions by competitors; changes in laws or regulations; and other factors, many of which are beyond the control of PDC Energy.

trends, current conditions and expected future developments as well as other factors it believes are appropriate in the circumstances. However,

whether actual results and developments will conform with Management’s expectations and predictions is subject to a number of risks and

uncertainties, general economic, market or business conditions; the opportunities (or lack thereof) that may be presented to and pursued by PDC

Energy; actions by competitors; changes in laws or regulations; and other factors, many of which are beyond the control of PDC Energy.

You are cautioned not to put undue reliance on such forward-looking statements because actual results may vary materially from those expressed

or implied, as more fully discussed in our safe harbor statements found in our SEC filings, including, without limitation, the discussion under the

heading “Risk Factors” in the Company’s 2009 annual report on Form 10-K and in subsequent Form 10-Qs. All forward-looking statements are

based on information available to Management on this date and PDC Energy assumes no obligation to, and expressly disclaims any obligation to,

update or revise any forward looking statements, whether as a result of new information, future events or otherwise.

or implied, as more fully discussed in our safe harbor statements found in our SEC filings, including, without limitation, the discussion under the

heading “Risk Factors” in the Company’s 2009 annual report on Form 10-K and in subsequent Form 10-Qs. All forward-looking statements are

based on information available to Management on this date and PDC Energy assumes no obligation to, and expressly disclaims any obligation to,

update or revise any forward looking statements, whether as a result of new information, future events or otherwise.

The SEC permits oil and gas companies to disclose in their filings with the SEC proved reserves, probable reserves and possible reserves. SEC

regulations define “proved reserves” as those quantities of oil or gas which, by analysis of geosciences and engineering data, can be estimated

with reasonable certainty to be economically producible in future years from known reservoirs under existing economic conditions, operating

methods and government regulations; “probable reserves” as unproved reserves which, together with proved reserves, are as likely as not to be

recovered; and “possible reserves” as unproved reserves which are less certain to be recovered than probable reserves. Estimates of probable

and possible reserves which may potentially be recoverable through additional drilling or recovery techniques are by nature more uncertain than

estimates of proved reserves and accordingly are subject to substantially greater risk of not actually being realized by the Company. In addition,

the Company’s reserves and production forecasts and expectations for future periods are dependent upon many assumptions, including

estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by

significant commodity price declines or drilling cost increases.

regulations define “proved reserves” as those quantities of oil or gas which, by analysis of geosciences and engineering data, can be estimated

with reasonable certainty to be economically producible in future years from known reservoirs under existing economic conditions, operating

methods and government regulations; “probable reserves” as unproved reserves which, together with proved reserves, are as likely as not to be

recovered; and “possible reserves” as unproved reserves which are less certain to be recovered than probable reserves. Estimates of probable

and possible reserves which may potentially be recoverable through additional drilling or recovery techniques are by nature more uncertain than

estimates of proved reserves and accordingly are subject to substantially greater risk of not actually being realized by the Company. In addition,

the Company’s reserves and production forecasts and expectations for future periods are dependent upon many assumptions, including

estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by

significant commodity price declines or drilling cost increases.

This material also contains certain non-GAAP financial measures as defined under the Securities and Exchange Commission rules.

2

8/9/2010

Rick McCullough

Chairman and Chief Executive Officer

3

8/9/2010

Second Quarter 2010 Highlights

8/9/2010

4

• Gas and oil revenues up 22% over same period 2009

• Q2 2010 realized prices of $6.66 per Mcfe compared to Q2 2009 realized prices of $5.97

per Mcfe

per Mcfe

• Net loss from continuing operations was $0.02 per diluted share for the second quarter

2010, compared to a net loss of $2.25 per diluted share in the same 2009 period

2010, compared to a net loss of $2.25 per diluted share in the same 2009 period

• Production of 9.0 Bcfe was above guidance due to continued strong performance in

Wattenberg; production of 36.4 Bcfe expected for full year 2010

Wattenberg; production of 36.4 Bcfe expected for full year 2010

• Second quarter oil and gas operating margin per Mcfe improved 56% over second quarter

2009 to $3.84 per Mcfe from $2.47 per Mcfe predominantly due to a higher percentage of

oil production and improved pricing in Q2 2010

2009 to $3.84 per Mcfe from $2.47 per Mcfe predominantly due to a higher percentage of

oil production and improved pricing in Q2 2010

• Drilled 44.1 net wells vs. 19.7 net wells in Q2 2009

• G&A expense reflects 33% and 24% year-over-year improvement for the second quarter

2010 and year-to-date 2010, respectively

2010 and year-to-date 2010, respectively

• Liquidity improved to $268.7million

Bart Brookman

Senior Vice President - Exploration and Production

5

8/9/2010

Q1 2010 Production:

8.1

Bcfe

8.1

Bcfe

Rocky Mountains

Q1 2010 Production:

0.6

Bcfe

0.6

Bcfe

Q2 2010 Production:

0.6

Bcfe

0.6

Bcfe

2010E Production:

2.5

Bcfe

2.5

Bcfe

Appalachian Basin (PDCM)

Q1 2010 Production:

0.3

Bcfe

0.3

Bcfe

Q2 2010 Production

9.0 Bcfe (8.6 Bcfe*)

Michigan

Basin (4%)

Basin (4%)

Appalachian Basin (7%)

Rocky

Mountains (90%)

Mountains (90%)

Rocky

Mountains (89%)

Mountains (89%)

8/9/2010

6

Core Operating Regions

Area of operations starting

August 2010

August 2010

Permian Basin (2H 2010)

*8.6 Bcfe excludes 0.4 Bcfe of Michigan production classified as discontinued operations in Q2 2010.

Quarterly Net Production

7

8/9/2010

• First horizontal Marcellus well

connected to sales in late June

connected to sales in late June

• Outstanding Wattenberg

production

production

• Remote telemetry enhancing

well management

well management

• Improved frac designs

• Production includes large oil

and liquids component

and liquids component

• Piceance production in line with

guidance

guidance

• PDC Mountaineer JV production

below original budget; in line

with updated guidance

below original budget; in line

with updated guidance

• Drilling delays

• Difficulty in scheduling fracs

Michigan

(reflected as discontinued operations)

Quarterly Drilling Activity

8

8/9/2010

• Two rigs operating in Wattenberg

• Add third rig in Q4

• First horizontal Niobrara well in Q4

• One Flex rig operating in

Piceance

Piceance

• Significant improvement in spud to

spud time

spud time

• Marcellus horizontal drilling

• Promising results from first three wells

• One rig returning in September 2010

• Expected additional Q4 drilling:

• Spud Beekmantown/Rose Run

prospect in Ohio

prospect in Ohio

• Spud Permian Basin operations

• NECO program under evaluation

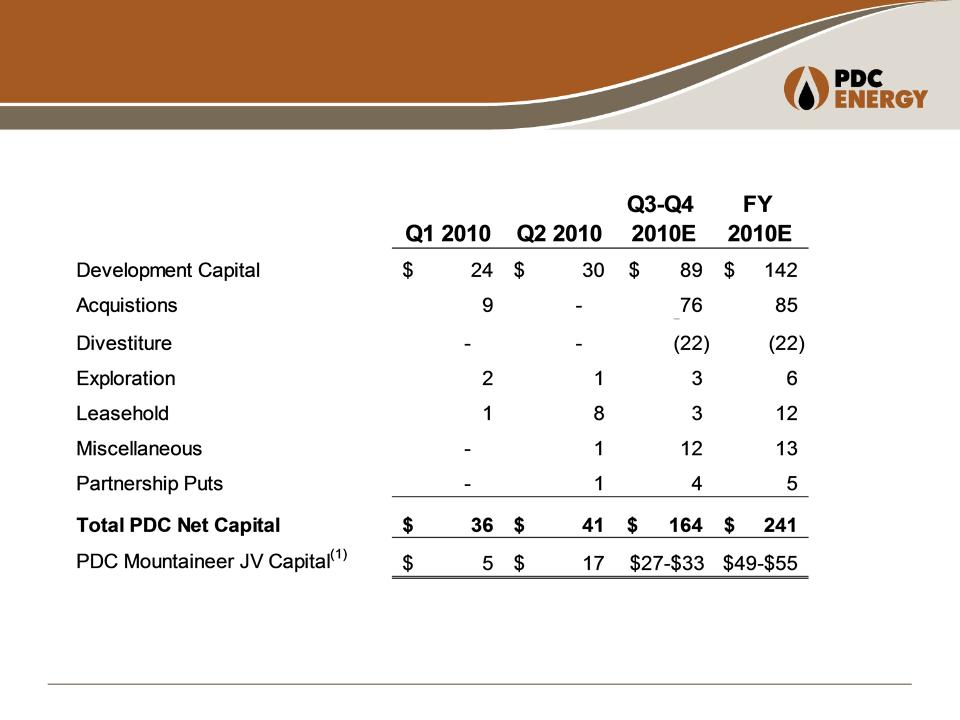

Capital Expenditure Update

$ in Millions

9

8/9/2010

Note: Excludes $36.4 million of potential partnership repurchases.

(1) PDC carried by JV partner.

8/9/2010

10

2010 Production by Area

Billion Cubic Feet Equivalent (Bcfe)

|

Area

|

Q1 2010

Actual |

Q2 2010

Actual |

FY 2010E

|

|

Wattenberg

|

4.0

|

4.0

|

15.9

|

|

Piceance

|

3.0

|

2.8

|

11.9

|

|

NECO

|

1.1

|

1.1

|

4.4

|

|

Michigan*

|

0.3

|

0.4

|

0.7

|

|

West Texas

|

0.0

|

0.0

|

0.6

|

|

Other

(ND, TX, WY)

|

0.1

|

0.1

|

0.4

|

|

Appalachia (PDCM)

|

0.6

|

0.6

|

2.5

|

|

TOTAL

|

9.1

|

9.0

|

36.4

|

* Michigan production through 6/30/10 reflected as discontinued operations.

Lifting Costs

|

|

Q1 2010

Actual

|

Q2 2010

Actual

|

FY 2010E

|

|

Direct Costs ($/Mcfe)

|

$0.75

|

$0.98

|

$0.73 - $0.87

|

|

Indirect Costs ($/Mcfe)

|

$0.29

|

$0.26

|

$0.27 - $0.31

|

|

Total Lifting Cost ($/Mcfe)

|

$1.04

|

$1.24

|

$1.00 - $1.18

|

|

Production (MMcfe/d)

|

101

|

98

|

100

|

11

8/9/2010

• Q2 2010 per unit costs increased as a result of:

• Increased workovers - production enhancement based projects (primarily Piceance)

• Regulatory and environmental expenses - accrual of facility upgrades in Piceance and Wattenberg

• Piceance water disposal expenses anticipated to improve in Q4 2010

• 2009 per unit costs included an operating cost reimbursement credit which reduced the per unit costs by

approximately $0.15. Second quarter 2010 per unit costs were higher than 2009 second quarter per unit

costs due to: lower production and the addition of approximately $0.29 per unit due to the incurrence of

approximately $1.3 million of environmental maintenance expenses, and well workover expenses of

approximately $1.2 million. When amounts are adjusted for these items the comparison was $.95 per unit in

2010 compared to an adjusted $.79 per unit in 2009. Most of the difference in per unit costs was related to

lower production volumes in 2010.

approximately $0.15. Second quarter 2010 per unit costs were higher than 2009 second quarter per unit

costs due to: lower production and the addition of approximately $0.29 per unit due to the incurrence of

approximately $1.3 million of environmental maintenance expenses, and well workover expenses of

approximately $1.2 million. When amounts are adjusted for these items the comparison was $.95 per unit in

2010 compared to an adjusted $.79 per unit in 2009. Most of the difference in per unit costs was related to

lower production volumes in 2010.

Q2 2010 Operations Highlights

• Production, activity, and CAPEX in line with guidance

• Planning for Q4 CAPEX and production increases

• Wattenberg

– Expanding drilling program

– Anticipate drilling of first horizontal Niobrara well in October 2010

• Piceance

– 2010 CAPEX drilling (10 wells) online and initial production results are

encouraging

encouraging

– Executed 2 mega-fracs

• Marcellus

– Three horizontal completions with promising results

– Full time drilling rig activity commencing in late Q3 2010

• Permian

– Operational team in place

– Drilling commencement scheduled for October 2010

8/9/2010

12

Gysle Shellum

Chief Financial Officer

13

8/9/2010

Summary Financial Results

8/9/2010

14

In Millions, Except for Per Share Data

|

|

Three Months Ended

|

Six Months Ended

|

||

|

June 30,

|

June 30,

|

|||

|

Measure

|

2010

|

2009

|

2010

|

2009

|

|

O&G Revenues

|

$49.4

|

$40.4

|

$108.1

|

$78.6

|

|

O&G Production & Well Operations Costs

|

$16.4

|

$13.7

|

$31.5

|

$29.5

|

|

O&G Operating Margin(1)

|

$33.0

|

$26.7

|

$76.6

|

$49.1

|

|

Adjusted cash flow from operations(2)

|

$28.8

|

$37.7

|

$78.2

|

$77.4

|

|

Adjusted EBITDA(2)

|

$30.0

|

$36.3

|

$82.1

|

$81.0

|

|

Adjusted EBITDA (per diluted share)(2)

|

$1.56

|

$2.45

|

$4.26

|

$5.47

|

|

DD&A

|

$27.1

|

$33.3

|

$54.8

|

$67.1

|

|

G&A

|

$9.9

|

$14.8

|

$20.5

|

$26.9

|

(1) O&G operating margin is defined as O&G revenue less O&G production and well operations costs.

(2) See appendix for Non-GAAP reconciliation of Adjusted Cash Flow from Operations and Adjusted EBITDA.

Summary Financial Results

8/9/2010

15

|

|

Three Months Ended

|

Six Months Ended

|

||

|

June 30,

|

June 30,

|

|||

|

Measure

|

2010

|

2009

|

2010

|

2009

|

|

Operating income (loss)

|

$7.1

|

($44.6)

|

$52.0

|

($46.9)

|

|

Net Income (loss) attributable to

.shareholders |

($2.7)

|

($33.1)

|

$21.0

|

($38.8)

|

|

Diluted earnings (loss) per share

.attributable to shareholders |

($0.15)

|

($2.24)

|

$1.09

|

($2.62)

|

|

|

Three Months Ended

|

Six Months Ended

|

||

|

June 30,

|

June 30,

|

|||

|

Measure

|

2010

|

2009

|

2010

|

2009

|

|

Adjusted net income (loss) from continuing

operations(1) |

($3.0)

|

($3.9)

|

$7.4

|

($0.8)

|

|

Adjusted earnings (loss) per share from

continuing operations(1)

|

($0.15)

|

($0.27)

|

$0.38

|

($0.06)

|

(1) See appendix for Non-GAAP reconciliation of Adjusted Net Income.

In Millions, Except for Per Share Data

Michigan Basin Property Swap

for Wolfberry Permian Basin

for Wolfberry Permian Basin

• Closed July 30, 2010 with an effective date of May 1, 2010

• $ 75 million purchase price for Wolfberry properties

– Paid $52.5 million and traded Michigan properties valued at $22.5 million

– Gain is tax deferred via ‘Like Kind Exchange’ treatment

• Financial results related to Michigan properties reflected as discontinued

operations for all periods presented

operations for all periods presented

– Net operating income from May 1, 2010 effective date and July 30, 2010 closing

date treated as a purchase price adjustment

date treated as a purchase price adjustment

8/9/2010

16

Debt Maturity Schedule

8/9/2010

17

• Maturity schedule reflects:

– Mitigation of liquidity risk

– Diversification of funding

sources

sources

• As of June 30, 2010:

– $37 million drawn balance

– $19 million undrawn L.O.C

– $19 million cash balance

– $269 million available liquidity

$305

$203

$37

$ in Millions

Quarterly Realized Hedge Price

8/9/2010

18

As of 6/30/10

Note: Weighted average for full year 2010 is $7.39/Mcfe.

Oil and Gas Per Unit Costs

8/9/2010

19

|

|

Three Months Ended

|

Six Months Ended

|

||

|

June 30,

|

June 30,

|

|||

|

Measure

|

2010

|

2009

|

2010

|

2009

|

|

Average Lifting Costs(1)

|

$1.24

|

$0.64

|

$1.14

|

$0.78

|

|

DD&A (O&G Properties Only)

|

$2.94

|

$2.89

|

$2.95

|

$2.91

|

(1) Lifting costs represent natural gas and oil lease operating expenses, exclusive of production taxes, on a per unit basis.

Per Mcfe

• 2009 per unit costs included an operating cost reimbursement credit which reduced the per unit costs by

approximately $0.15. Second quarter 2010 per unit costs were higher than 2009 second quarter per unit costs

due to: lower production and the addition of approximately $0.29 per unit due to the incurrence of

approximately $1.3 million of environmental maintenance expenses, and well workover expenses of

approximately $1.2 million. When amounts are adjusted for these items the comparison was $.95 per unit in

2010 compared to an adjusted $.79 per unit in 2009. Most of the difference in per unit costs was related to

lower production volumes in 2010.

approximately $0.15. Second quarter 2010 per unit costs were higher than 2009 second quarter per unit costs

due to: lower production and the addition of approximately $0.29 per unit due to the incurrence of

approximately $1.3 million of environmental maintenance expenses, and well workover expenses of

approximately $1.2 million. When amounts are adjusted for these items the comparison was $.95 per unit in

2010 compared to an adjusted $.79 per unit in 2009. Most of the difference in per unit costs was related to

lower production volumes in 2010.

Appendix

20

8/9/2010

Adjusted Net Income (Loss) from

Continuing Operations Reconciliation

Continuing Operations Reconciliation

Note: Amounts may not foot due to rounding.

|

|

Three Months Ended

|

Six Months Ended

|

||

|

June 30,

|

June 30,

|

|||

|

|

2010

|

2009

|

2010

|

2009

|

|

Net income (loss) from continuing operations

|

($0.3)

|

($33.3)

|

$22.9

|

($39.6)

|

|

Unrealized (gain) loss on derivatives, net (1)

|

(4.2)

|

47.6

|

(24.7)

|

60.8

|

|

Provision for underpayment of gas sales

|

-

|

-

|

-

|

2.6

|

|

Tax effect of above adjustments

|

1.6

|

(18.2)

|

9.3

|

(24.6)

|

|

Adjusted net income (loss) from continuing

operations |

($3.0)

|

($3.9)

|

$7.4

|

($0.8)

|

|

Weighted average diluted shares outstanding

|

19.2

|

14.8

|

19.3

|

14.8

|

|

Adjusted diluted earnings (loss) per share

from continuing operations |

($0.15)

|

($0.27)

|

$0.38

|

($0.06)

|

21

In Millions, Except for Per Share Data

8/9/2010

Adjusted Cash Flow Reconciliation

|

|

Three Months Ended

|

Six Months Ended

|

||

|

June 30,

|

June 30,

|

|||

|

|

2010

|

2009

|

2010

|

2009

|

|

Net Cash provided by operating activities

|

$44.0

|

$24.8

|

$95.4

|

$60.7

|

|

Changes in assets and liabilities

|

(15.2)

|

12.9

|

(17.2)

|

16.7

|

|

Adjusted cash flow from operations

|

$28.8

|

$37.7

|

$78.2

|

$77.4

|

|

Weighted average diluted shares outstanding

|

19.2

|

14.8

|

19.3

|

14.8

|

|

Adjusted cash flow per share

|

$1.50

|

$2.54

|

$4.05

|

$5.23

|

22

In Millions, Except for Per Share Data

8/9/2010

Adjusted EBITDA Reconciliation

|

|

Three Months Ended

|

Six Months Ended

|

||

|

June 30,

|

June 30,

|

|||

|

|

2010

|

2009

|

2010

|

2009

|

|

Net Income (loss) from continuing operations

|

($0.3)

|

($33.3)

|

$22.9

|

($39.6)

|

|

Unrealized (gain) loss on derivatives, net

|

(4.2)

|

47.6

|

(24.7)

|

60.8

|

|

Interest, net

|

7.6

|

9.4

|

15.4

|

17.8

|

|

Income taxes expense (benefit)

|

(0.2)

|

(20.7)

|

13.8

|

(25.1)

|

|

Depreciation, depletion & amortization

|

27.1

|

33.3

|

54.8

|

67.1

|

|

Adjusted EBITDA

|

$30.0

|

$36.3

|

$82.1

|

$81.0

|

|

Weighted average diluted shares outstanding

|

19.2

|

14.8

|

19.3

|

14.8

|

|

Adjusted EBITDA per share

|

$1.56

|

$2.45

|

$4.26

|

$5.47

|

23

In Millions, Except for Per Share Data

8/9/2010

Contact Information

Investor Relations

• Peter Schreck, Vice President - Finance and Treasurer

pschreck@petd.com

• Marti Dowling, Manager Investor Relations

mdowing@petd.com

• Heather Davis, Investor Relations Coordinator

hdavis@petd.com

Corporate Headquarters

• PDC Energy

1775 Sherman Street

Suite 3000

Denver, CO 80203

303-860-5800

Website

• www.petd.com

24

8/9/2010