Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDO HEALTH SOLUTIONS INC. | d8k.htm |

| EX-99.1 - PRESS RELEASE - ENDO HEALTH SOLUTIONS INC. | dex991.htm |

ENDO

PHARMACEUTICALS Endo Pharmaceuticals to Acquire HealthTronics, Inc.

1

Exhibit 99.2 |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

FORWARD LOOKING STATEMENT

2

This presentation contains forward-looking statements regarding, among other things, the

proposed business combination between Endo and HealthTronics, Endo’s and

HealthTronics’ financial position, results of operations, market position, product development and business strategy, as

well as estimates of Endo’s future total revenues, future expenses, future net income and

future earnings per share. Statements including words such as

“believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may” “intend,” “guidance” or similar expressions are

forward- looking statements. Because these statements reflect our current

views, expectations and beliefs concerning future events, these forward-looking

statements involve risks and uncertainties. Investors should note that many factors could

affect the proposed business combination of the companies, future financial results and

could cause actual results to differ materially from those expressed in forward-looking statements contained

in this presentation. These factors include, but are not limited to: the risk that the tender

offer and merger will not close, the risk that Endo’s business and/or

HealthTronics’ business will be adversely impacted during the pendency of the tender offer and merger, the risk that the operations

of the two companies will not be integrated successfully, Endo’s ability to successfully

develop, commercialize and market new products; timing and results of pre-clinical

or clinical trials on new products; Endo’s ability to obtain regulatory approval of any of Endo’s pipeline products; competition

for the business of Endo’s branded and generic products, and in connection with its

acquisition of rights to intellectual property assets; market acceptance of our future

products; government regulation of the pharmaceutical industry; Endo’s dependence on a small number of products;

Endo’s dependence on outside manufacturers for the manufacture of a majority of its

products; Endo’s dependence on third parties to supply raw materials and to

provide services for certain core aspects of its business; new regulatory action or lawsuits relating to Endo’s use of narcotics in most

of its core products; Endo’s exposure to product liability claims and product recalls and

the possibility that they may not be able to adequately insure themselves; the

successful efforts of manufacturers of branded pharmaceuticals to use litigation and legislative and regulatory efforts to limit the

use of generics and certain other products; Endo’s ability to successfully implement its

acquisition and in-licensing strategy; regulatory or other limits on the

availability of controlled substances that constitute the active ingredients of some of its products and products in development; the

availability of third-party reimbursement for Endo’s products; the outcome of any

pending or future litigation or claims by third parties or the government, and the

performance of indemnitors with respect to claims for which Endo has been indemnified; Endo’s dependence on sales to a

limited number of large pharmacy chains and wholesale drug distributors for a large portion of

its total revenues; a determination by a regulatory agency that Endo is engaging or has

engaged in inappropriate sales or marketing activities, including promoting the “off-label” use of its products,

the risk that demand for and acceptance of Endo’s and HealthTronics’ products or

services may be reduced; the risk of changes in governmental regulations; the impact of

economic conditions; the impact of competition and pricing and other risks and uncertainties, including those detailed

from time to time in the companies’ periodic reports filed with the Securities and

Exchange Commission, including current reports on Form 8-K, quarterly reports on

Form 10-Q and annual reports on Form 10-K, particularly the discussion under the caption “RISK FACTORS" in their annual

reports on Form 10-K for the year ended December 31, 2009, which were filed with the

Securities and Exchange Commission. The forward-looking statements in this

presentation are qualified by these risk factors. These are factors that, individually or in the aggregate, could cause our actual

results to differ materially from expected and historical results. The companies’ assume

no obligation to publicly update any forward-looking statements, whether as a

result of new information, future developments or otherwise. |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

FORWARD LOOKING STATEMENT CONTINUED

3

The tender offer described in this document has not yet commenced. At the time the tender

offer is commenced, Endo will file a tender offer statement on Schedule TO with the

SEC. Investors and HealthTronics shareholders are strongly advised to read the tender offer statement

(including an offer to purchase, letter of transmittal and related tender offer documents) and

the related solicitation/recommendation statement on Schedule 14D-9 that will be

filed by HealthTronics with the SEC, because they will contain important information. These

documents will be available at no charge on the SEC’s website at www.sec.gov once such

documents are filed with the SEC. A copy of the solicitation/recommendation statement

on Schedule 14D-9 (once it becomes available) may be obtained free of charge from HealthTronics’

website at www.healthtronics.com or by directing a request to HealthTronics at 9825 Spectrum

Drive, Building 3, Austin, Texas 78717, Attn: Corporate Secretary. In addition, a

copy of the offer to purchase, letter of transmittal and certain other related tender offer documents (once

they become available) may be obtained free of charge from Endo’s website at www.endo.com

or by directing a request to Endo at www.endo.com, or Endo Pharmaceuticals, 100 Endo

Boulevard, Chadds Ford, PA 19317, Attn: Corporate Secretary’s Office. Additional

Information |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

TRANSACTION RATIONALE

4

May 5, 2010

Enhanced Revenue Growth Through Diversification

Sustainable, long-term growth

Diversified revenue stream

Enhanced product offerings in urology

Expand Urology Business

Elevates Endo’s leadership in urology

Expands Endo’s reach and relationships with key urology practices

Increase Shareholder Value

Accretive to adjusted earnings in 2010

Diversified revenue stream beyond pharmaceuticals

Enhanced offerings in urology |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

5

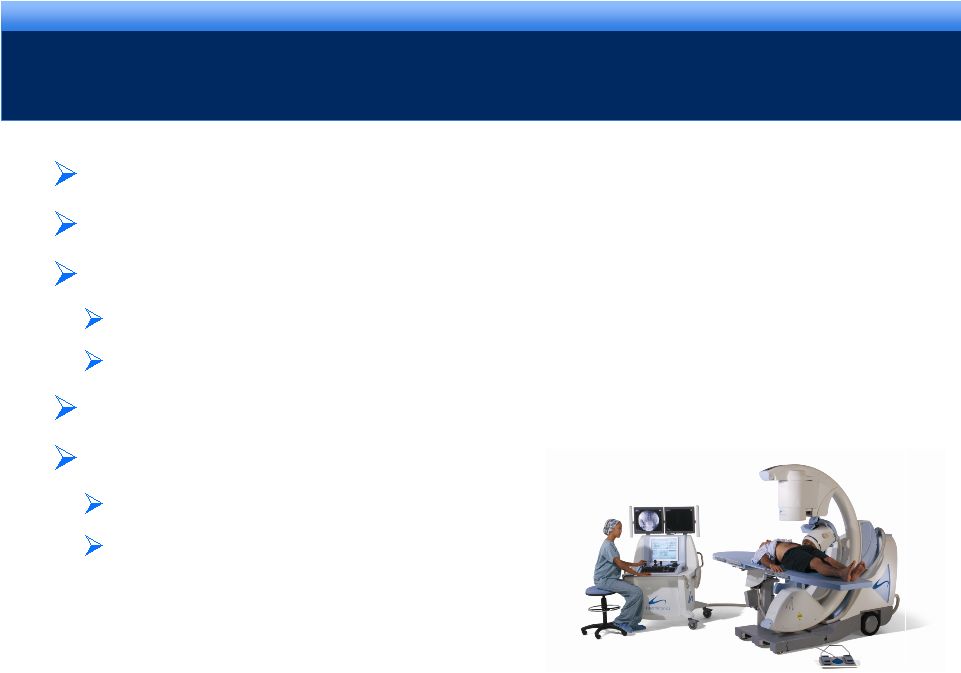

Leading provider of urology services

Leader in lithotripsy, BPH laser and cryosurgery

Emerging urologic business in:

Anatomic pathology

Radiation therapy

Unique business relationship with 1/3 of urologists in U.S.

Total solution for the urology marketplace

Improve patient care

Enhance practice economics

HEALTHTRONICS -

CORPORATE OVERVIEW |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

6

•

Most influential national player in urology services

•

Partner

with 1/3 of U.S. urologists as co-investor, technology advisor

and advocate

Largest Urologist

Network

Unique Channel

•

Record of deploying new technology on favorable terms

•

Opportunity to bring new technologies to market quickly as partner

of choice for manufacturers

Experienced

Management Team

•

Record of successful acquisitions and integration

•

Proven ability to execute operating plans

Scalable and National

Platform

•

Scalable model provides turnkey support

•

Successful partnerships with small and large practices

HEALTHTRONICS -

STRONG COMPETITIVE POSITIONS |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

7

Lithotripsy

•

Extracorporeal Shock Wave Lithotripsy

•

Deployed in partnership with invested

Urologists

•

Mobile

Prostate Therapies

Radiation Therapy

Devices, Maintenance

and Consumables

Anatomic Pathology

•

BPH Laser

•

Cryoablation

•

Deployed in partnership with invested

Urologists

•

Mobile

•

Cancer centers with IGRT deployed within

large practices

•

ClariPath Labs

•

Uropath (acq. 2008)

•

Full offering of revenue sharing

opportunities for urologists

•

Both inside and outside of our service

network

•

BPH Laser and Cryocare

•

Equipment from all litho manufacturers

HEALTHTRONICS -

BROAD UROLOGY BUSINESS |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

8

SIGNIFICANT GROWTH OPPORTUNITIES WITH ENDO

Organic opportunities

Leverage current urology sales force

Laboratory Services

Cryo

business utilization

Benign Prostatic Hyperplasia strategy in growing market

Expanded urology relationships

Leveraged opportunities

Infusion of capital for additional acquisitions

Increase market share

Improve competitive position |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

9

Drug/Device approach to improve patient outcomes

Compelling clinical data

PMA approval pending

FDA Devices Panel unanimously recommended product in 2008

Strong fit with Urology business commitment

SYNERGO®

enhances current investments in bladder cancer

VALSTAR

UROCIDIN

MEDICAL ENTERPRISES GROUP—POTENTIAL

TRANSACTION

TM

TM |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

Urologic

Indications

Combined

Opportunities

BPH

PVP

Laser

Expand use of technology

enhanced BPH lasers

Bladder Cancer

Laser

VALSTAR

UROCIDIN

Multiple therapeutic options

in patient care pathway with

potential addition of

SYNERGO®

Prostate Cancer

Cryotherapy

IGRT

VANTAS®

Grow cryotherapy

footprint

with increased Endo reach

Hypogonadism

AVEED

FORTESTA

Multiple therapeutic options

to treat hypogonadism

Stones

Lithotripsy

Expand physician

partnerships

Pathology

Urology Conditions

Enhance value of lab services

with extended reach of Endo

sales force

UROLOGY OPPORTUNITIES

10

TM

TM

TM

TM |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

TRANSACTION TERMS

11

May 5, 2010

HealthTronics $223 million cash tender offer

$4.85 per share of HTRN

$0.05 accretive to adjusted diluted EPS in 2010

$0.25 dilutive to GAAP EPS in 2010

Approximately $40 Million of transaction and integration costs

Medical Enterprises Group

In exclusive negotiation to acquire |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

REVISED ENDO GUIDANCE FOR 2010

12

May 5, 2010

Revenue: $1.63B -

$1.68B

Adjusted diluted EPS: $3.20 -

$3.25

Reported (GAAP) diluted EPS: $2.06 -

$2.14 |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

ENDO PHARMACEUTICALS

13

May 5, 2010

Appendix |

grow.

collaborate. innovate. thrive. ©2010 Endo Pharmaceuticals Inc.

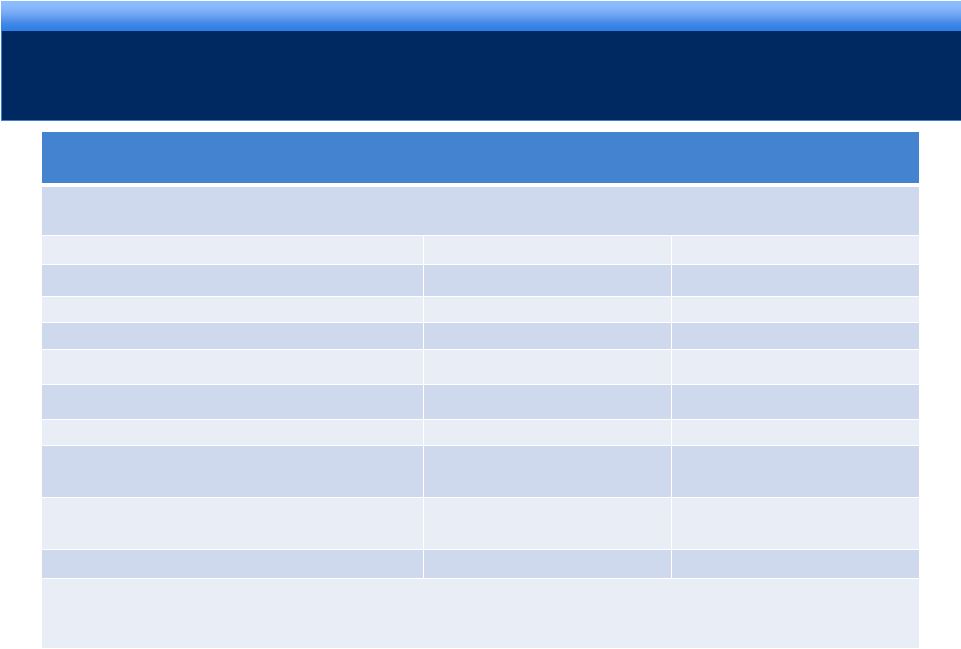

RECONCILIATION OF NON-GAAP MEASURES

14

May 5, 2010

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s

Current Report on Form 8-K filed today with the Securities and Exchange

Commission Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted

Earnings Per Share Guidance for the Year Ending December 31, 2010

Lower End of Range

Upper End of Range

Projected GAAP diluted income per common share

$2.06

$2.14

Upfront and milestone-related payments to partners

$0.20

$0.15

Amortization of commercial intangible assets

$0.59

$0.59

Costs incurred in connection with continued efforts to enhance the

cost structure of the Company

$0.05

$0.05

Indevus related costs and change in fair value of contingent

consideration

$0.01

$0.01

Costs related to the acquisition of HealthTronics, Inc.

$0.41

$0.41

Interest expense adjustment for ASC 470-20

and the amortization

of the premium on debt acquired from Indevus

$0.15

$0.15

Tax effect of pre-tax adjustments at the applicable tax rates

and

certain other expected cash tax savings as a result of the Indevus

and HealthTronics acquisitions

($0.27)

($0.25)

Diluted adjusted income per common share guidance

$3.20

$3.25

The company's guidance is being issued based on certain assumptions including:

•Certain

of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

•Includes

all completed business development transactions as of March 31, 2010 and the announced acquisition of HealthTronics,

Inc. |

Endo

Pharmaceuticals |