Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NCR CORP | d8k.htm |

| EX-99.1 - PRESS RELEASE ISSUED BY THE COMPANY, DATED APRIL 22, 2010 - NCR CORP | dex991.htm |

NCR Q1 2010

Results & Pension Strategy April 22, 2010

Exhibit 99.2 |

2

NCR Confidential

Note to Investors

Certain non-GAAP financial information regarding NCR’s operating

results may be discussed during this presentation. Reconciliation of

the differences between GAAP and non-GAAP measures are included

elsewhere in this presentation and are available on the Investor

page of NCR’s website at www.ncr.com.

Remarks and responses associated with this presentation include

forward-looking statements that are based on current expectations

and assumptions. These forward-looking statements are subject to a

number of risks and uncertainties that could cause actual results to

vary materially. These risk factors are detailed from time to time in

NCR’s SEC reports, including, but not limited to, Forms 10Q, 10K, 8K

and the Company’s

annual report to shareholders. These charts and

the associated remarks are integrally related and are intended to be

presented and understood together. |

3

NCR Confidential

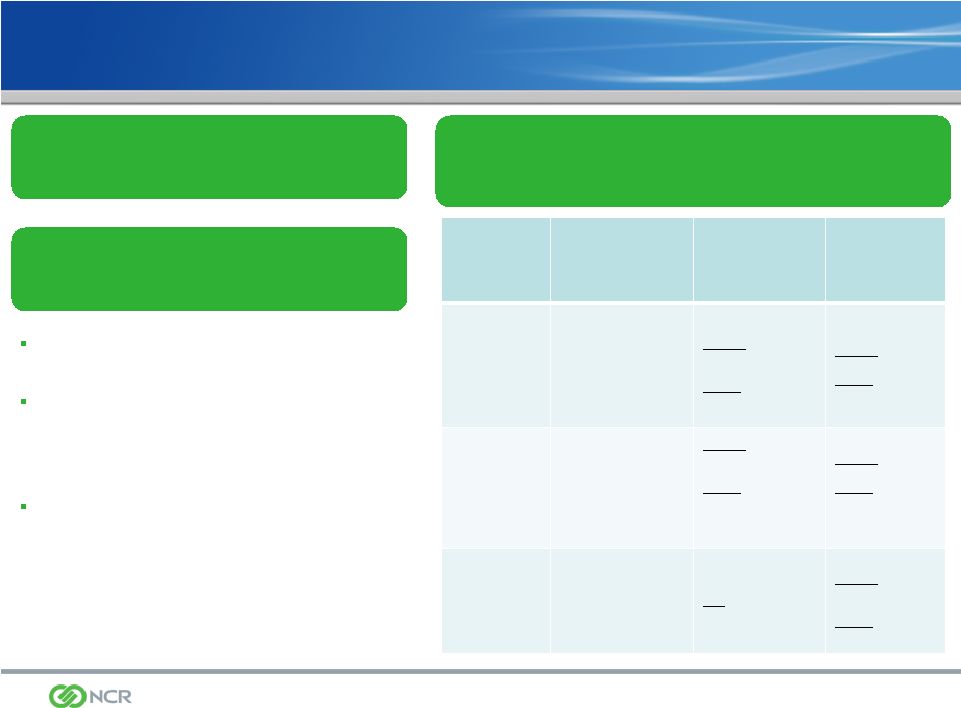

Overview of Q1 Results/Announcements

Q1 2010 Financial Results Above Expectations

•

A return to revenue growth

•

Gross margin improvement

•

Cost/expense program execution

•

Significant

non-pension

operating

income

(NPOI)

(1)

and non-pension EPS

(1)

growth

2010 Revenue & Non-GAAP Guidance Re-Affirmed

Pension Strategy

•

Company announces plan to address pension

funding status

•

Re-balancing pension assets to fixed income by end

of 2012 will substantially reduce risk and volatility

(1)

See reconciliation of GAAP to non-GAAP measures at the end of this presentation

|

4

NCR Confidential

Q1 2010 vs. Q1 2009 Financial Highlights

Revenue up 2% to $1.03B

Gross margin up 120 bps, inclusive of

negative 70 bps effect from Entertainment

NPOI

(1)

up 54% to $43M

Non-GAAP EPS ex pension expense

(1)

$0.15; up 150% from $0.06 in Q1-2009

Improved backlog driven by 18% increase

in orders; Double digit order growth

balanced; Financial & Retail

(1)

See reconciliation of GAAP to non-GAAP measures at the end of this presentation

|

5

NCR Confidential

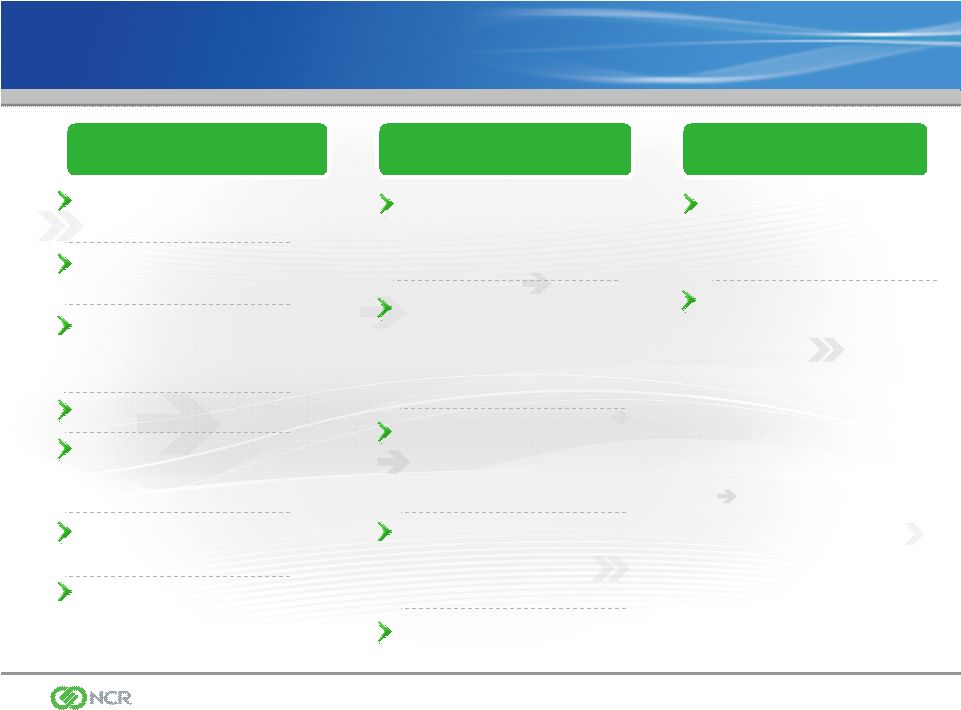

Overview of NCR’s Business

NCR core vs. competitors

•

Core produces more

revenue

•

Core produces more

profit

•

Core enterprise value is

less

than competitors

Primary competitors

•

Trade at higher EBITDA and EPS

multiples based on 2010

consensus

Grow revenue

•

Low-mid single digit market

growth in core

•

Select strategic acquisitions to

grow faster than the secular

market

•

New markets and new

geographies, adjacencies

Continue to manage costs and

increase productivity

•

Cost savings of $200-$250

million from 2008 through 2011

(50% re-invested)

Financials

•

Expect 2010 revenue of $125-

$150 million and $30 million

loss from operations

•

Goal to be breakeven by end

of 2011 on run-rate basis

•

$1B+ revenue opportunity

Largest competitor

•

Consensus $1B+ revenue in

2010

•

EBIT margin mid-high teens for

DVD rental-only business

Brand

•

License to use Blockbuster

brand in the kiosk channel

Grow revenue

•

Build

out

kiosk

network

-

up

to

10k units by year-end 2010

•

Continued domestic and

international build-out in 2011

Create new category; higher

growth and margins than core

•

Only multi-channel, multi-

segment offer in industry

GAAP impacts

•

$1 billion underfunded status as

of 2009 year end

•

$215 million expected expense in

2010

•

Majority of pension expense is

amortization of prior losses (non-

cash)

Cash impacts

•

Pre-tax net cash liability of ~$1

billion (~$750 million after-tax) as

of 2009 year end

•

Expect cash contributions of

~$110 million in 2010

Eliminate current underfunded

liability

•

Rebalance asset portfolio to fixed

income by end of 2012

•

Interest rate increases and asset

price improvement would reduce

the underfunded position

Eliminate future volatility of plan

expense and funded status

•

Match assets and liabilities

Overview:

Strategy:

Core Business

Entertainment

Pension |

6

NCR Confidential

Addressing NCR’s Valuation Gap

NCR trades at a material discount to the market and its peers, largely

due to the current pension situation

Pension assets invested in equities are not only volatile, but correlated

with NCR’s operating businesses

A significant portion of NCR’s capital is allocated to its “pension-

management”

business

•

This allocation has limited NCR’s ability to invest in our core operating

businesses and to provide immediate shareholder

returns •

Under-utilization of NCR balance sheet

To fix the valuation gap, NCR plans to:

•

Reduce risk and volatility by

re-allocating our domestic pension portfolio to

fixed-income securities

by year-end 2012

•

Direct freed-up risk-taking capacity to the highest value-added

investment alternatives: organic investments,

strategic acquisitions •

Fund the pension plan according to regulatory requirements (i.e., do

not pre-fund) |

NCR

Confidential 7

Pension Management Strategy

•

Shift asset allocation of US Pension Plans to 100% fixed income by the end

of 2012

–

Target 60% by end of 2010, 80% by end of 2011, and 100% by end of 2012

–

Mostly high grade corporate bonds with an overall duration that approximates

the duration of the liability

•

For International Pension Plans, work with local pension trustee

boards to

make similar changes in asset allocation to the extent that it is appropriate

to do so

–

Each plan operates in a unique environment which influences appropriate asset

allocation

–

Local

pension

trustee

boards

have

final

authority

in

determining

appropriate

asset allocation

Actions to Address Valuation Gap

7

NCR Confidential |

NCR Pension

Update – Q1 2010

Funded

Status

of

US

Plans

improved

by

$82

million

due

to

asset

returns

&

discount

rate

(2)

Funded

Status

of

International

Plans

has

deteriorated

slightly

driven

by

discount

rate

decreases

(2)

Funding

for

2011-2013

are

rough

estimates

based

on

expected

returns

and

current

discount

rate

Cash Funding for Pension Plans

2008

2009

2010E

2011E

2012E

2013E

International & Executive

$ 83

$ 83

$ 110

$ 125

$ 125

$ 125

US Qualified Plan*

0

0

0

0

125

175

Total

$ 83

$ 83

$ 110

$ 125

$ 250

$ 300

Pension Metrics & Funded Status

Asset

Return Discount rate

Funded

Status

3/31/10 YTD

(2)

12/31/09

3/31/10

(2)

12/31/09

3/31/10

(2)

US Plans

3.5%

5.75%

5.88%

$ (822)

$ (740)

International

2%

4.9%

4.8%

(226)

(250)

Global

2.9%

5.4%

5.45%

$ (1,048)

$ (990)

( $ Millions)

( $ Millions)

*Assumes no funding relief legislation

(2)

Estimated based on data available at March 31, 2010; for accounting

purposes the pension plans are not marked-to-market on a

quarterly basis

8

NCR Confidential |

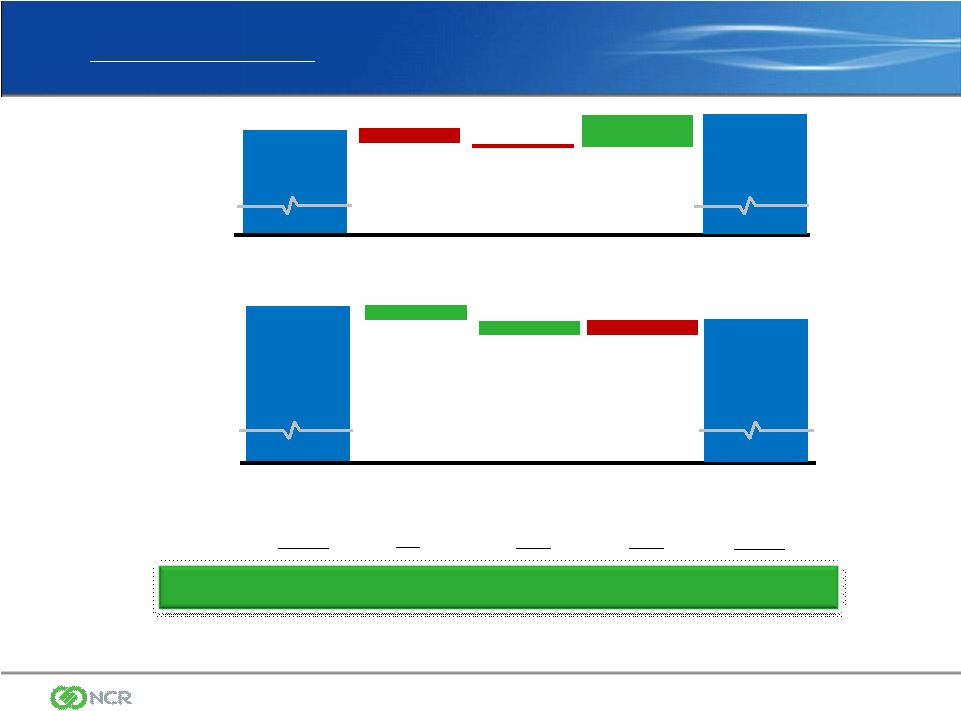

US Plans

Only –

Funded Status Bridge

•

Funded

Status

of

US

Plans

improved

~$82

million

in

Q1

to

($740

million)

(2)

•

Improvement

was

due

to

good

asset

returns

and

a

13bp

increase

in

discount

rate

(2)

Liabilities

Assets

Benefit

Payments

Asset

Returns

Fees &

Expenses

Asset Value,

12/31/09

$ (52)

$ (6)

$2,612

Asset Value,

3/31/10

(2)

Benefit

Payments

Interest

Liability Value,

12/31/09

$ (54)

$ 46

$3,352

Liability Value,

3/31/10

(2)

$ 88

$2,582

$3,404

$ (44)

Discount Rate

Movement

($Millions)

Funded Status

$ (822)

$ (740)

(2)

+2

+38

+42

(2)

Estimated based on data available at March 31, 2010;

for accounting purposes the pension plans are not

marked-to-

market on a

quarterly basis

9

NCR Confidential |

($

Millions) Pension Assets

Plan

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

U.S. Plans

$ 3,026

$ 2,686

$ 2,208

$ 2,797

$ 3,016

$ 3,098

$ 3,385

$ 3,423

$ 2,208

$ 2,582

International Plans

1,514

1,089

1,138

1,397

1,658

1,748

2,085

2,114

1,467

1,737

Total Plans

$ 4,540

$ 3,775

$ 3,346

$ 4,194

$ 4,674

$ 4,846

$ 5,470

$ 5,537

$ 3,675

$ 4,319

Pension Liability

Plan

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

U.S. Plans

$ 2,408

$ 2,494

$ 2,700

$ 2,960

$ 3,194

$ 3,372

$ 3,290

$ 3,199

$ 3,227

$ 3,404

International Plans

1,185

1,127

1,380

1,635

1,939

1,932

2,046

2,020

1,645

1,963

Total Plans

$ 3,593

$ 3,621

$ 4,080

$ 4,595

$ 5,133

$ 5,304

$ 5,336

$ 5,219

$ 4,872

$ 5,367

Funded Status

Plan

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

U.S. Plans

$ 618

$ 192

$ (492)

$ (163)

$ (178)

$ (274)

$ 95

$ 224

$ (1,019)

$ (822)

International Plans

329

(38)

(242)

(238)

(281)

(184)

39

94

(178)

(226)

Total Plans

$ 947

$ 154

$ (734)

$ (401)

$ (459)

$ (458)

$ 134

$ 318

$ (1,197)

$ (1,048)

NCR Historical Pension Overview

10

NCR Confidential |

11

NCR Confidential

Historical Funded Status, Funding and Expense

($ Millions)

NCR has experienced significant volatility in the funded status of its pension plans

over the years NCR’s focus moving forward will be to manage and reduce

the risk of funded status volatility Funded Status

Plan

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

U.S. Plans

$ 618

$ 192

$ (492)

$ (163)

$ (178)

$ (274)

$ 95

$ 224

$ (1,019)

$ (822)

International Plans

329

(38)

(242)

(238)

(281)

(184)

39

94

(178)

(226)

Total Plans

$ 947

$ 154

$ (734)

$ (401)

$ (459)

$ (458)

$ 134

$ 318

$ (1,197)

$ (1,048)

Funded Status %

Plan

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

U.S. Plans

126%

108%

82%

94%

94%

92%

103%

107%

68%

76%

International Plans

128%

97%

82%

85%

86%

90%

102%

105%

89%

88%

Total Plans

126%

104%

82%

91%

91%

91%

103%

106%

75%

80%

Pension Funding

Plan

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

All Plans

$ 62

$ 59

$ 55

$ 70

$ 111

$ 110

$ 112

$ 92

$ 83

$ 83

Pension Expense / (Income)

Plan

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

All Plans

$ (124)

$ (124)

$ (74)

$ 105

$ 135

$ 150

$ 145

$ 44

$ 25

$ 159

11

NCR Confidential |

Sensitivity

Analysis - US Plans ONLY

($ Millions)

Historical Asset Returns and Discount Rates for US Plan

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

10 yr

avg

20 yr

avg

Asset Returns

-2%

-6%

-12%

36%

15%

10%

16%

7%

-31%

28%

4%

10%

Discount Rate

7.5%

7.3%

6.8%

6.3%

5.8%

5.5%

5.8%

6.3%

6.3%

5.8%

6.3%

7.0%

(A) Assumes 6% at end 2010, 6.25% at end of 2011, and 6.5% at end of 2012

(B) Projected contribution

required for US Qualified plan in 2012 (no required contribution expected in 2010 or 2011),

also assumes no pension reform legislation

(C) Includes the impact of contributions on funded status

Projected Funded Status & Contributions -

Sensitivity Analysis

Discount Rate remains at 5.75%

Discount Rate increases to 6.5%

(A)

Scenario

Annual Equity

Returns

through 2012

Projected

Contribution in

2012

(B)

Projected

Funded Status

12/31/2012

(C)

Projected

Contribution in

2012

(B)

Projected

Funded Status

12/31/2012

(C)

3 yr. shift to 100% fixed income

5%

$145

($880)

$130

($770)

3 yr. shift to 100% fixed income

10%

$125

($775)

$115

($670)

3 yr. shift to 100% fixed income

15%

$115

($670)

$100

($565)

Funded Status as of 12/31/2009 = ($822)

12

NCR Confidential |

Shift pension

asset allocation to 100% fixed income by end of 2012 •

Risk of equity exposure in pension plan must be reduced

–

Size of NCR pension plan (and therefore the associated risk) is disproportionate to the size

of NCR –

Riskiness and volatility of pension plan increases stock price volatility and places a

discount on the stock price –

The US pension plan is closed and the duration of the liability is becoming shorter

•

Shifting over 3 years allows for some additional recovery from the recent market

downturn

–

Potential

additional

upside

in

the

equity

markets

and/or

benefit

from

increase

in

the

discount

rate

Pre-fund of US pension plan analyzed

•

Given NCR’s tax position, there is not a compelling financial benefit for NCR to fund

early

–

NCR has minimal near-term U.S. tax liability, so cannot take advantage of accelerating

tax deductions by funding earlier than required

–

Similarly,

would

not

be

able

to

take

advantage

of

tax

deductions

for

interest

expense

(if

funded

with

debt)

•

Inefficient capital allocation

–

The

underfunded

pension

liability

is

analogous

to

unsecured

debt

of

NCR.

NCR

has

no

other

outstanding

debt.

We

believe

we

have

better

investment

uses

for

our

cash

balances

and

operating

cash

flow

than

choosing

to

pre-pay

debt

at

the

present

time

•

Cash flow deployed into business opportunities

–

No cash funding is projected to be required for the U.S. qualified pension plan in 2010 or

2011 –

A

pre-fund

now

does

not

materially

change

required

funding

in

2012

and

2013

Rationale –

Analyzed Various Options

13

NCR Confidential |

14

NCR Confidential

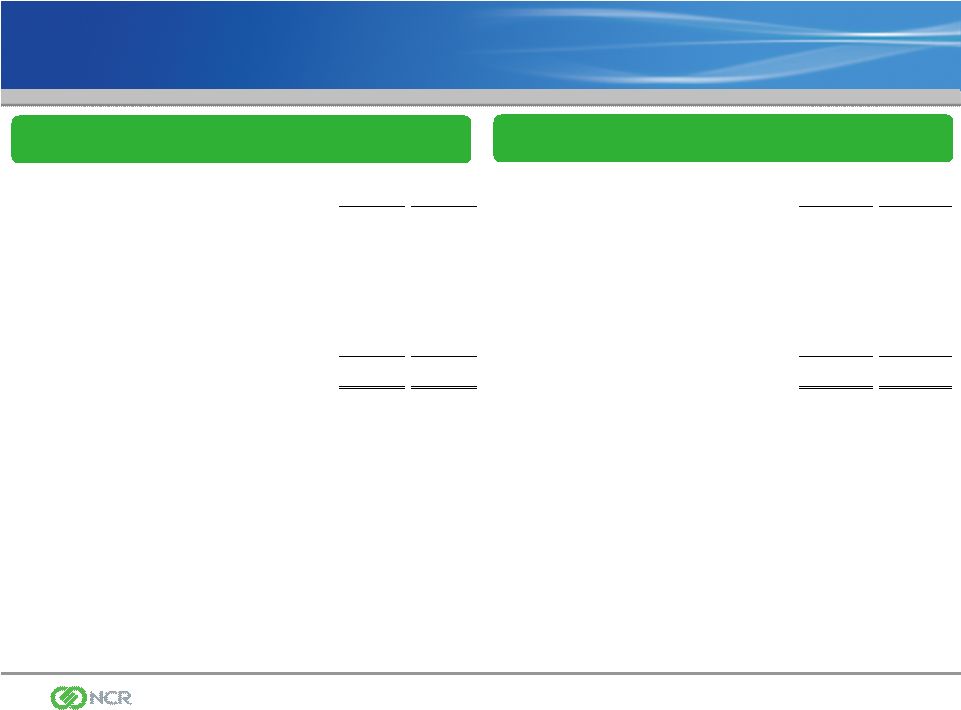

Possible Impact of Pension Funding Relief Legislation

on NCR

Pension Legislation Could Provide Relief

Two relief options; 2+7 and 15-year vs.

current law

Two options potentially subject to “cash

flow rules”

(e.g., limits on employee

compensation, dividends, and stock

redemption)

Balanced legislation passed in Senate –

provides relief; currently bill in House Ways

and Means Committee; anticipated closure

by Q3 2010

Key

Provisions

Impact on NCR

Conditions

Status

2+7 vs.

Current

Law

Provides marginal

relief. NCR not

likely to use.

Senate: 2 yrs of

cash flow rules

House: 3 yrs TBD

Senate: passed

House: TBD

15-Year vs.

Current

Law

Likely provides

meaningful relief for

NCR.

Senate: 5 yrs of

cash flow rules

House: 3-5 yrs of

cash flow rules

and “active plan”

requirement

Senate: passed

House: active

plan issue

Investment

Expenses

not

Included in

Normal

Cost

Helpful to NCR.

N/A

Senate: not

addressed

House: TBD

NCR Leading Industry Coalition to

Secure Passage of Pension Relief

Possible Impact of Pension Funding

Relief Legislation on NCR |

15

NCR Confidential

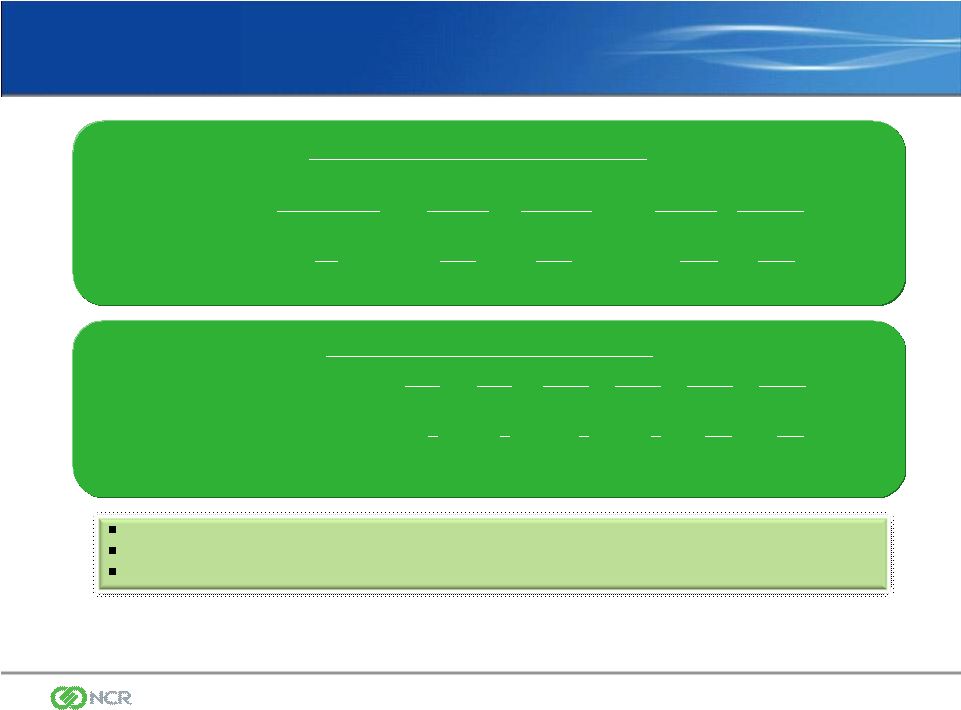

3-Year Vision for NCR

Leading Financial

Solutions provider

Leading Retail Solutions

provider

Leader in Hospitality,

Travel, Gaming and

Healthcare Solutions

Multi-Channel leadership

Leader in Managed

Services; 50% recurring

revenue stream

Sustainable, industry

leading cost structure

Continued significant

cash flow production

#1 or #2 market share

leader in DVD Kiosk

Market (US & Intl)

Physical DVD rental &

sell-through; digital

download leadership

“Automated Retail”

Market leader in multi-

channel distribution of

digital media

High growth; Significant

EBITDA; Positive cash

flow

Brand leadership

Under-funded

pension position

significantly reduced

Volatility and risk of

current pension asset

allocation eliminated

Core Business

Entertainment

Pension |

16

NCR Confidential

Reconciliation of GAAP to non-GAAP Measures

(1)

NCR reports its results in accordance with Generally Accepted Accounting Principles in the

United States, or GAAP. However, the Company believes that certain non-GAAP

measures found in this presentation are useful for investors. NCR’s management

evaluates the Company’s results excluding certain items, such as pension expense,

to assess the financial performance of the Company and believes this information is useful for

investors because it provides a more complete understanding of NCR’s underlying

operational performance, as well as consistency and comparability with past reports of

financial results. In addition, management uses earnings per share excluding

these items to manage and determine effectiveness of its business managers and as a basis for

incentive compensation. These non-GAAP measures should not be considered as

substitutes for or superior to results determined in accordance with GAAP.

Q1

Q1

Q1

Q1

2010

2009

2010

2009

Loss from Operations (GAAP)

(18)

$

(10)

$

Diluted Loss Per Share (GAAP)

(0.12)

$

(0.09)

$

Fox River Environmental Matter, Net

-

5

Fox River Environmental Matter, Net

-

0.03

Impairment of Equity Investment

-

(5)

Impairment of Equity Investment

-

(0.03)

Global Headquarters Relocation

5

-

Global Headquarters Relocation

(0.02)

-

Pension Expense

56

38

Pension Expense

(0.25)

(0.15)

Non-Pension Operating Income (non-GAAP)

(1)

43

$

28

$

Diluted Earnings Per Share (non-GAAP)

(1)

0.15

$

0.06

$

Loss from Operations (GAAP) to Non-Pension Operating

Income (non-GAAP)

Diluted Loss Per Share (GAAP) to Diluted Earnings Per

Share (non-GAAP) |