Attached files

| file | filename |

|---|---|

| 8-K - OSG FORM 8-K - OVERSEAS SHIPHOLDING GROUP INC | earn8k4q.htm |

| EX-99 - OSG FORM 8-K - EXHIBIT 99.1 - OVERSEAS SHIPHOLDING GROUP INC | earn8kx991.htm |

EXHIBIT

99.2

Fourth

Quarter Fiscal 2009

Earnings Conference Call

Earnings Conference Call

March

1, 2010

Page

2

This

presentation contains forward-looking statements regarding the Company's

prospects, including the outlook

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels of newbuilding and

scrapping, prospects for certain strategic alliances and investments, estimated fixed revenue for 2010 and 2011,

forecasted newbuilding delivery schedule for 2010 and 2011, projected scheduled drydock and off hire days for

the 2010, projected locked-in charter revenue and locked-in time charter days, forecasted 2010 vessel

expenses, charter hire expenses, depreciation and amortization, general and administrative expenses, and

levels of equity income, other income, taxes and capital expenditures, timely delivery of newbuildings in

accordance with contractual terms, the outcome of OSG negotiations with Maersk Oil Qatar, the sustainability of

OSG’s annual dividend, prospects of OSG’s strategy of being a market leader in the segments in which it

competes and the forecast of world economic activity and oil demand. These statements are based on certain

assumptions made by OSG management based on its experience and perception of historical trends, current

conditions, expected future developments and other factors it believes are appropriate in the circumstances.

Forward-looking statements are subject to a number of risks, uncertainties and assumptions, many of which are

beyond the control of OSG, which may cause actual results to differ materially from those implied or expressed

by the forward-looking statements. Factors, risks and uncertainties that could cause actual results to differ from

the expectations reflected in these forward-looking statements are described in the Company’s Annual Report

for 2009 on Form 10-K and those risks discussed in the other reports OSG files with the Securities and

Exchange Commission.

for tanker and articulated tug barge markets, changing oil trading patterns, anticipated levels of newbuilding and

scrapping, prospects for certain strategic alliances and investments, estimated fixed revenue for 2010 and 2011,

forecasted newbuilding delivery schedule for 2010 and 2011, projected scheduled drydock and off hire days for

the 2010, projected locked-in charter revenue and locked-in time charter days, forecasted 2010 vessel

expenses, charter hire expenses, depreciation and amortization, general and administrative expenses, and

levels of equity income, other income, taxes and capital expenditures, timely delivery of newbuildings in

accordance with contractual terms, the outcome of OSG negotiations with Maersk Oil Qatar, the sustainability of

OSG’s annual dividend, prospects of OSG’s strategy of being a market leader in the segments in which it

competes and the forecast of world economic activity and oil demand. These statements are based on certain

assumptions made by OSG management based on its experience and perception of historical trends, current

conditions, expected future developments and other factors it believes are appropriate in the circumstances.

Forward-looking statements are subject to a number of risks, uncertainties and assumptions, many of which are

beyond the control of OSG, which may cause actual results to differ materially from those implied or expressed

by the forward-looking statements. Factors, risks and uncertainties that could cause actual results to differ from

the expectations reflected in these forward-looking statements are described in the Company’s Annual Report

for 2009 on Form 10-K and those risks discussed in the other reports OSG files with the Securities and

Exchange Commission.

Forward-Looking

Statements

Page

3

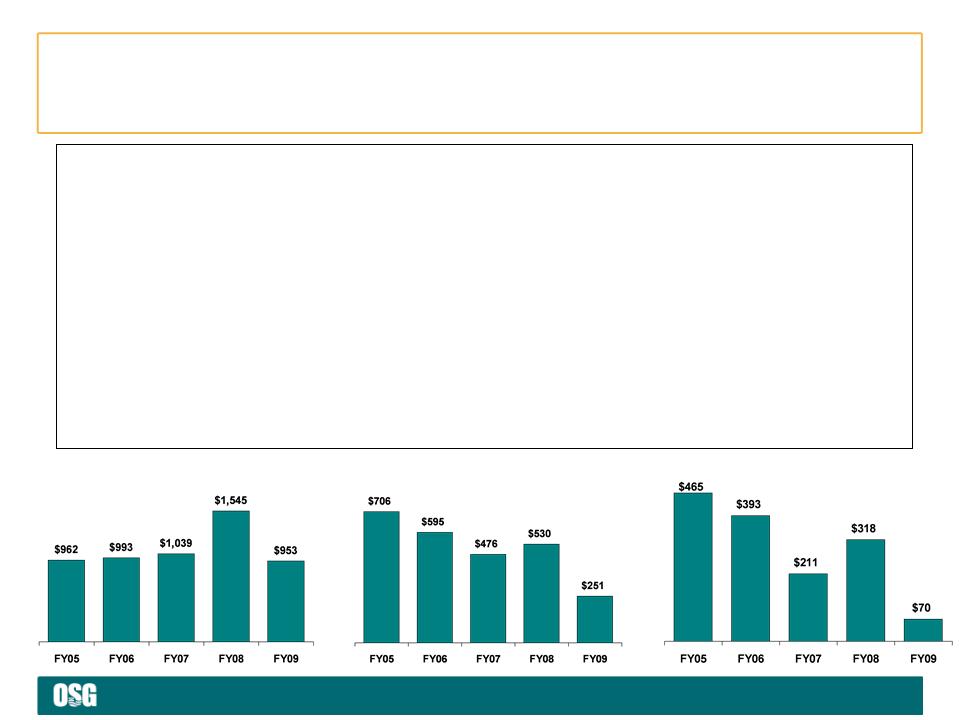

< 2009

was one of the toughest tanker markets in 20 years

• TCE revenues of $953M

down 38% YoY; Q4 down 41% to $203M

• EBITDA totaled $251M;

Q4 $867K

• Net income was $70M

compared to $318M; Q4 net loss was $23M vs. a loss of $80M Q408

• EPS was $2.61 compared

to $10.65; Q4 was a loss of $0.86 vs. a loss of $2.89

• Fourth quarter loss

per share included:

– Tender costs, Aker

settlement and other items that totaled $0.27

• Tax credit of $36M

substantially due to the Worker, Homeownership, and Business

Assistance Act of 2009

Assistance Act of 2009

< Despite

tough market conditions, the commercial, financial and operational

platforms of OSG performed well in 2009, and we enter 2010 in solid shape

platforms of OSG performed well in 2009, and we enter 2010 in solid shape

$

in millions

EBITDA

TCE

Revenues

Net

Income

$

in millions

$

in millions

FY09 /

4Q Financial Highlights

Page

4

Commercial

pools, COAs and triangulation trades optimize

OSG’s fleet, particularly in down markets

OSG’s fleet, particularly in down markets

$12,050

2009

Average

$4,819

$4,267

$5,495

$9,966

**

** 4Q09

Aframax blended daily TCE including Lightering was $16,563 resulting in

outperformance of $4,863 per day.

See

page 14 in the Appendix for additional information.

Outperforming in

Tough Market Conditions

Page

5

Overseas

Everest

Overseas

Cascade bow

loading system

loading system

FSO

Asia helipad, hose reel and

accommodation

accommodation

Quarter/Current

Highlights

< Tender for OSG

America L.P. completed on December 17th

• $72 million used to

finance the repurchase

• Difficult Jones Act

market conditions persist, but prospects for 2011-2012 are positive

< Vessel

Deliveries

• Overseas Everest,

newbuild VLCC from CSSC-Jiangnan

• Two MRs: Overseas

Skopelos from SPP and Overseas Mykonos from Hyundai Mipo

• Overseas Cascade,

U.S. flag from Aker

– After operating in

December entered yard for conversion

< FSO

Update

• FSO Asia hooked-up

off shore on January 4th; all

operations running smoothly

• FSO Africa

conversion near completion

• Maersk Oil Qatar AS

terminated contract but commercial discussions continue

< Aker Settlement

Reached

• All outstanding

commercial disputes settled

• Original bareboat

economics maintained

• Ownership costs of

the two shuttle tankers reduced by agreeing to purchase the two

vessels for $115M per ship

vessels for $115M per ship

Page

6

$522M

Construction Contract

Commitments

Commitments

*

Contract price Note all

amounts are in nominal dollars.

Highlights

< Capital commitments

for 14 owned

newbuilds fully funded

newbuilds fully funded

• An additional 8

newbuilds are chartered-in

< Cost reduction

efforts continue

< Active asset

management

• 20 planned

redeliveries

• 5 charter

terminations

– 2 time chartered-in

Aframaxes

– 2 newbuild time

chartered-in Suezmaxes

– 1 time chartered-in

VLCC

• Cancelled 2 owned

LR1s, swapping for 3

owned MRs

owned MRs

• Cost of 2 newbuild

VLCCs reduced in

exchange for accelerated payments

exchange for accelerated payments

Page

7

Key

Takeaways

< Strength of OSG’s

financial condition and business model position us well as

we manage through any market

we manage through any market

• Cash and short-term

investments $525M, up from $344M at Dec. 31, 2008

• Liquidity of

approximately $1.6B up slightly from $1.5B last year

• $522M of

construction commitments fully funded

• Annual dividend is

sustainable given the strength of OSG’s financial position

< Near-term

priorities

• Complete conversion

of FSO Africa

• Deliver OSG 350 and

351 to Sunoco

• Deliver Overseas

Cascade to Petrobras

• Corporate

efficiencies and further cost reductions without sacrificing

quality

Page

*

Financial

Review

Myles

Itkin, CFO

Page

9

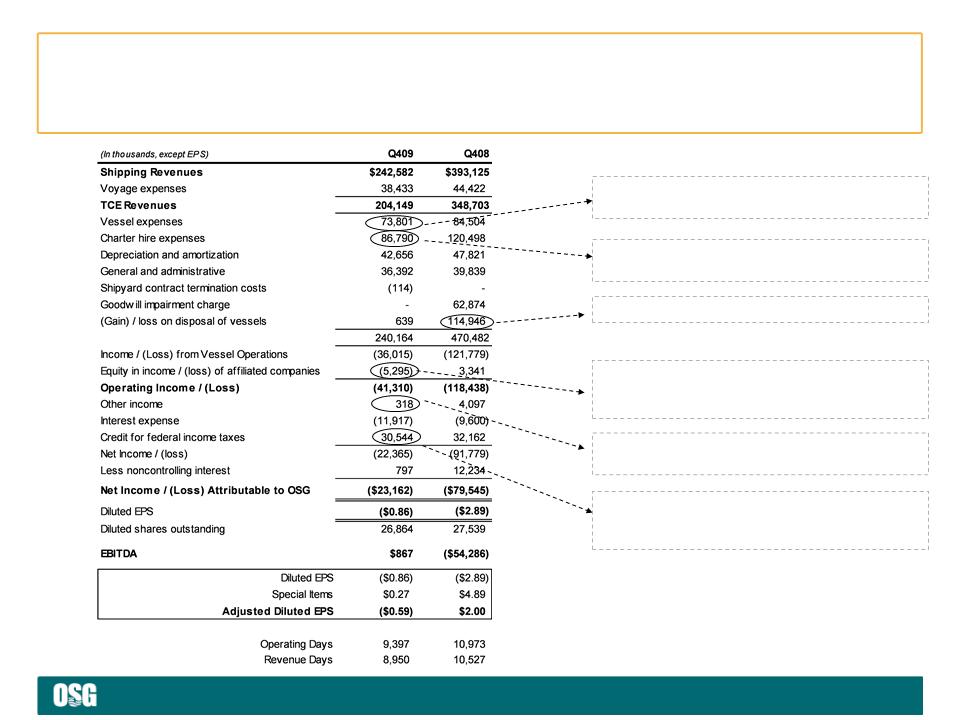

Redelivery of 11

single hull chartered-in MRs, lay up

of 4 U.S. Flag vessels and subsidy to DHT eliminated

of 4 U.S. Flag vessels and subsidy to DHT eliminated

959

fewer charter-in days and $12M lower profit

share

share

Impairments

recognized on U.S. Flag vessels

Primarily losses

associated with construction delays

on the FSOs; includes charge for interest rate swap

hedge ineffectiveness

on the FSOs; includes charge for interest rate swap

hedge ineffectiveness

Lower

gains from derivative positions and lower

interest income

interest income

Law

enacted in 2009 allows the carry back of 2009

tax losses 5 years instead of 2 years. Benefit

includes reversal of valuation allowance

tax losses 5 years instead of 2 years. Benefit

includes reversal of valuation allowance

Financial Review -

Income Statement

Page

10

Decrease

resulting from lower rates

Increase

resulting primarily from $42.2M carry back of

2009 tax loss after the Worker, Home Ownership and

Business Assistance Act of 2009 was signed into law

Q409

2009 tax loss after the Worker, Home Ownership and

Business Assistance Act of 2009 was signed into law

Q409

Includes

approx. $595M additions to vessels under

construction or purchased during the year

construction or purchased during the year

Increased funding of

FSO conversions and $70M

change in market value of derivatives held by JVs

change in market value of derivatives held by JVs

Primarily due to

release of $69M in margin call deposits

made in 2008

made in 2008

Reflects

$299M borrowing under CEXIM credit facility

and funding of the purchase of the Overseas Cascade

and OSP tender

and funding of the purchase of the Overseas Cascade

and OSP tender

Decrease

driven by $45M in regular amortization and

$16.6M reduction due to the termination of the Samho

Crown sale/leaseback transaction Q309

$16.6M reduction due to the termination of the Samho

Crown sale/leaseback transaction Q309

Increase

primarily due to improved mark-to-market on

effective portions of derivatives offset by the purchase of

the outstanding common units of OSG America L.P.

effective portions of derivatives offset by the purchase of

the outstanding common units of OSG America L.P.

Financial Review -

Balance Sheet

Page

11

|

|

Owned

|

Chartered-in

|

Total

|

|

2009 -

Beginning

|

59

|

63

|

122

|

|

2009 -

End

|

59

|

47

|

106

|

|

|

|

|

|

|

2010 -

Beginning

|

59

|

47

|

106

|

|

Deliveries

|

5

|

4

|

9

|

|

Redeliveries

|

|

<5>

|

<5>

|

|

2010 -

End

|

|

|

110

|

|

2010

Fixed Revenue

|

$275M

|

|

|

|

Fixed

|

Spot

|

|

TCE

Revenues

|

|

|

|

2008

|

35%

|

65%

|

|

2009

|

51%

|

49%

|

|

Revenue

Days

|

|

|

|

2008

|

45%

|

55%

|

|

2009

|

42%

|

58%

|

|

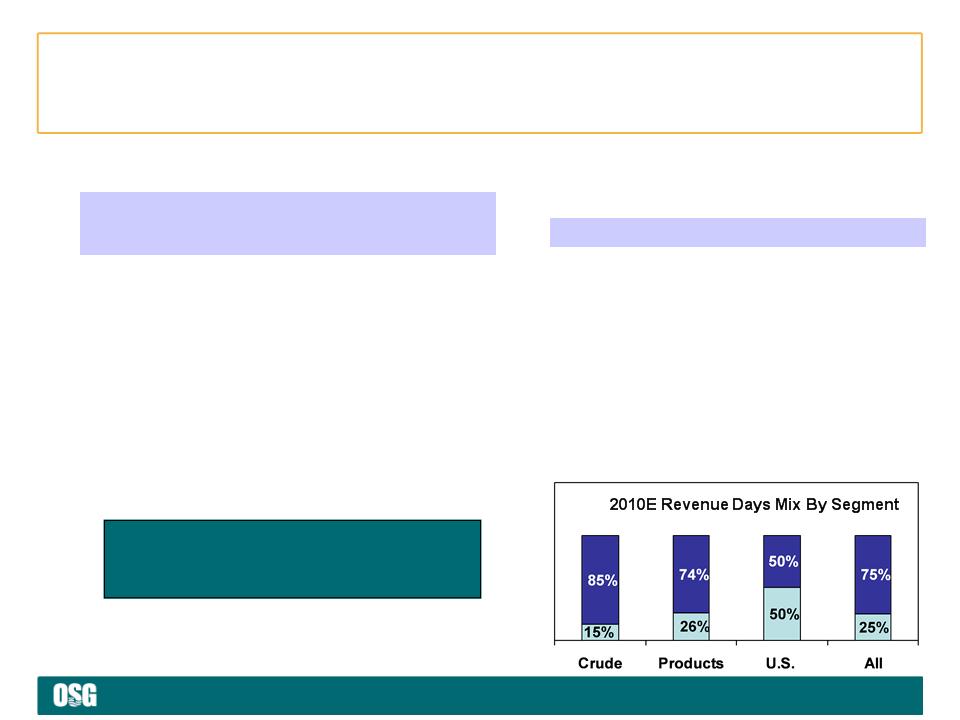

2010E

|

25%

|

75%

|

Operating

Fleet Composition

Spot

/ Fixed Mix

Expecting

tough market conditions, FFA

positions established in 2007/2008

generated $41M TCE revenues in 2009

positions established in 2007/2008

generated $41M TCE revenues in 2009

Fleet

Composition & Fixed Revenue

Page

12

2010

Guidance

< Estimated vessel

expenses

• $280M to

$300M

< Time and bareboat

charter hire expenses

• $345M to

$370M

< Depreciation and

Amortization

• $170M to

$190M

< G&A

• $100M to

$115M

< Equity income of

affiliated companies

• $15M to

$20M

< Interest

expense

• Interest expense

approx. $50M to $60M

< Capital

expenditures

• $23M in drydock

costs (Q1 $1M; Q2 $13; Q3 $2M and Q4 $7M) on 24 vessels

• $360M newbuild

progress payments, vessel improvements and capitalized interest (Q1

$123M;

Q2 $55M; Q3 $25M and Q4 $157M)

Q2 $55M; Q3 $25M and Q4 $157M)

Page

*

Appendix

Page

14

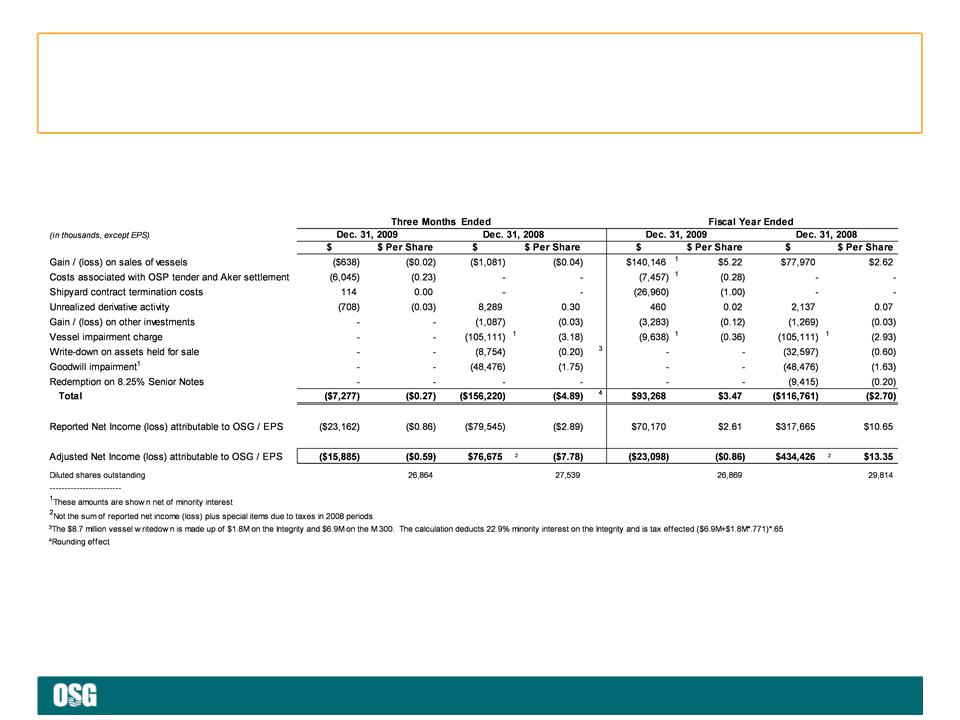

Set

forth below are significant items of income and expense that affected the

Company’s results for the three months and fiscal year ended

December 31, 2009 and 2008, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial results

December 31, 2009 and 2008, all of which are typically excluded by securities analysts in their published estimates of the Company’s financial results

Special

Items Affecting Net Income/(Loss)

Spot

rates by quarter in 2009 are reported in the Company’s quarterly earnings press

releases.

Average

rates are sourced from OSG’s Forms 10-Q and 10-K and assume a 50-50

ballast-to-laden voyage blending rates that prevailed in

markets in which the Company’s vessels operate. VLCCs are based on 60% AG-East and 40% AG-West; Suezmaxes W. Africa to USG;

Aframaxes Caribbean to USG and USAC; Panamaxes based on 50% Carib-USG / USAC and 50% Ecuador to USWC; MRs based on 60%

trans-Atlantic and 40% Caribbean to USAC

markets in which the Company’s vessels operate. VLCCs are based on 60% AG-East and 40% AG-West; Suezmaxes W. Africa to USG;

Aframaxes Caribbean to USG and USAC; Panamaxes based on 50% Carib-USG / USAC and 50% Ecuador to USWC; MRs based on 60%

trans-Atlantic and 40% Caribbean to USAC

Spot

and Average Rates Used on Slide 4

Reconciling Items

and Other Information

Page

15

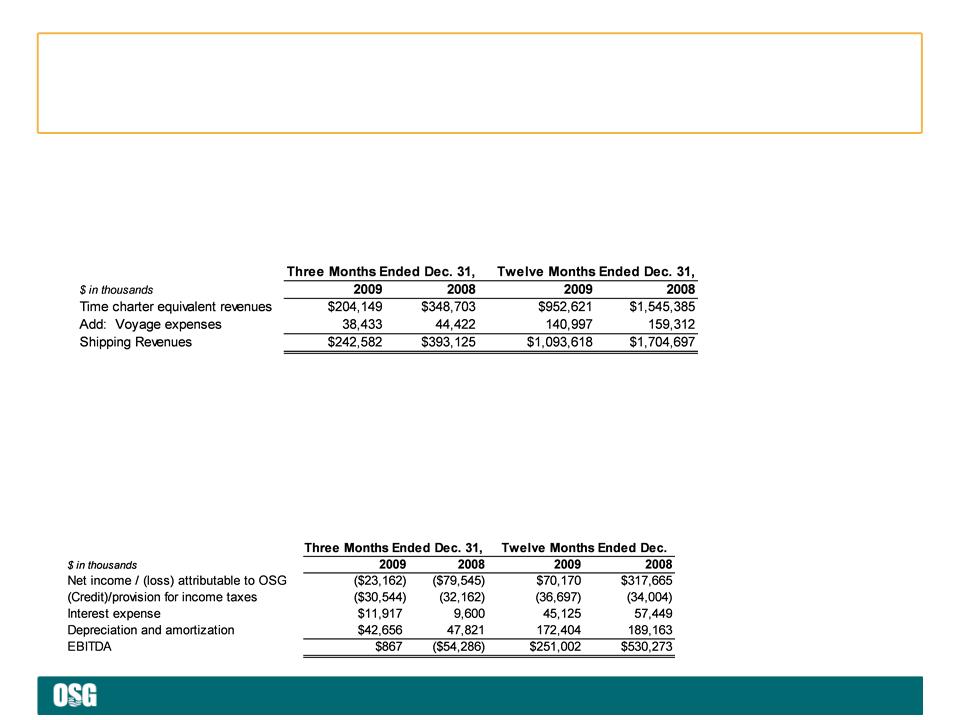

EBITDA

represents operating earnings excluding net income attributable to the

noncontrolling interest, which is before interest expense and

income taxes, plus other income and depreciation and amortization expense. EBITDA is presented to provide investors with meaningful additional

information that management uses to monitor ongoing operating results and evaluate trends over comparative periods. EBITDA should not be

considered a substitute for net income / (loss) attributable to the Company or cash flow from operating activities prepared in accordance with

accounting principles generally accepted in the United States or as a measure of profitability or liquidity. While EBITDA is frequently used as a

measure of operating results and performance, it is not necessarily comparable to other similarly titled captions of other companies due to

differences in methods of calculation.

income taxes, plus other income and depreciation and amortization expense. EBITDA is presented to provide investors with meaningful additional

information that management uses to monitor ongoing operating results and evaluate trends over comparative periods. EBITDA should not be

considered a substitute for net income / (loss) attributable to the Company or cash flow from operating activities prepared in accordance with

accounting principles generally accepted in the United States or as a measure of profitability or liquidity. While EBITDA is frequently used as a

measure of operating results and performance, it is not necessarily comparable to other similarly titled captions of other companies due to

differences in methods of calculation.

EBITDA

Consistent with

general practice in the shipping industry, the Company uses time charter

equivalent revenues, which represents shipping revenues

less voyage expenses, as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. Time charter

equivalent revenues, a non-GAAP measure, provides additional meaningful information in conjunction with shipping revenues, the most directly

comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in

evaluating their financial performance.

less voyage expenses, as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. Time charter

equivalent revenues, a non-GAAP measure, provides additional meaningful information in conjunction with shipping revenues, the most directly

comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in

evaluating their financial performance.

TCE

Revenues

Reconciling Items

and Other Information (continued)

Page

16

Fleet

Snapshot - As of February 25, 2010

Note: As of

February 25, 2010, 6 U.S. Flag ships are in lay up (M214, M209, Overseas Puget

Sound, Overseas

Philadelphia, Overseas New Orleans and Overseas Galena Bay)

Philadelphia, Overseas New Orleans and Overseas Galena Bay)

Owned

Chartered-in

Owned

Chartered-in

107

OPERATING

22 NEWBUILD/

CONVERSIONS

CONVERSIONS

60

47

14

8

Page

17

An

excel spreadsheet of OSG’s full fleet can be found on www.osg.com.

The Q3 2011 chartered-in newbuild is a chemical carrier

The Q3 2011 chartered-in newbuild is a chemical carrier

OSG’s

newbuild program totals

14 owned and 8 chartered-in vessels

delivering through 2011

14 owned and 8 chartered-in vessels

delivering through 2011

Vessel

Delivery Schedule - As of February 25, 2010

Page

18

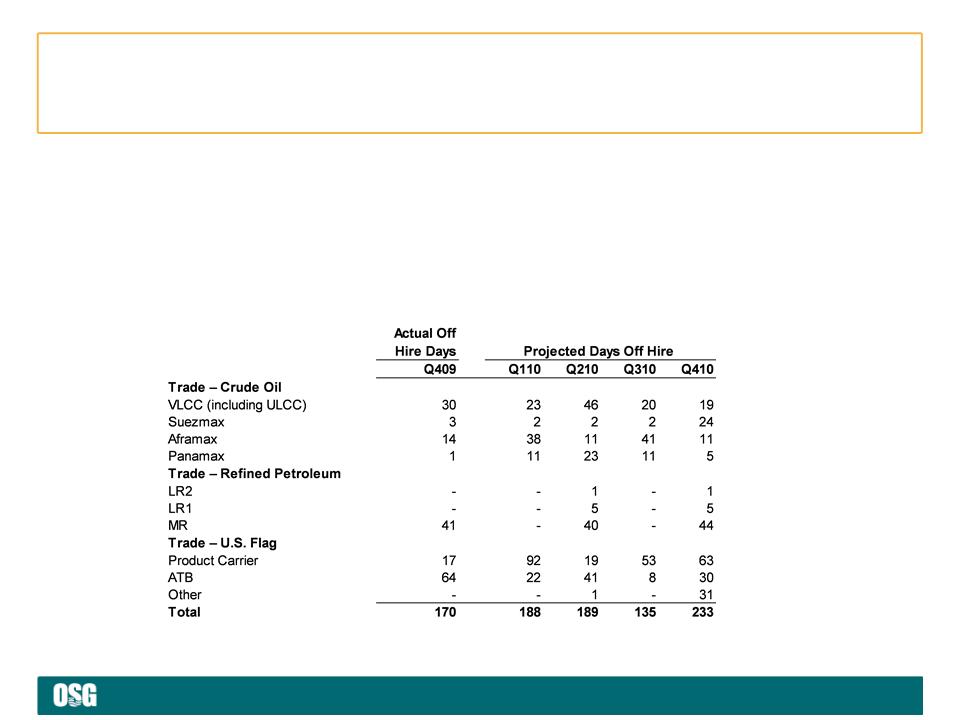

Off

Hire and Scheduled Drydock

In

addition to regular inspections by OSG personnel, all vessels are subject to

periodic drydock,

special survey and other scheduled maintenance. The table below sets forth actual days off hire for

the fourth quarter of 2009 and anticipated days off hire for the above-mentioned events by class for

2010. Fourth quarter 2009 excludes 279 days associated with four U.S. Flag vessels in lay up: the

OSG 214, Overseas Galena Bay, Overseas Puget Sound and Overseas New Orleans. Projected off

hire days exclude 1,339 days (2010) associated with U.S. Flag vessels expected to be in lay up.

special survey and other scheduled maintenance. The table below sets forth actual days off hire for

the fourth quarter of 2009 and anticipated days off hire for the above-mentioned events by class for

2010. Fourth quarter 2009 excludes 279 days associated with four U.S. Flag vessels in lay up: the

OSG 214, Overseas Galena Bay, Overseas Puget Sound and Overseas New Orleans. Projected off

hire days exclude 1,339 days (2010) associated with U.S. Flag vessels expected to be in lay up.

Off

Hire Schedule

Page

19

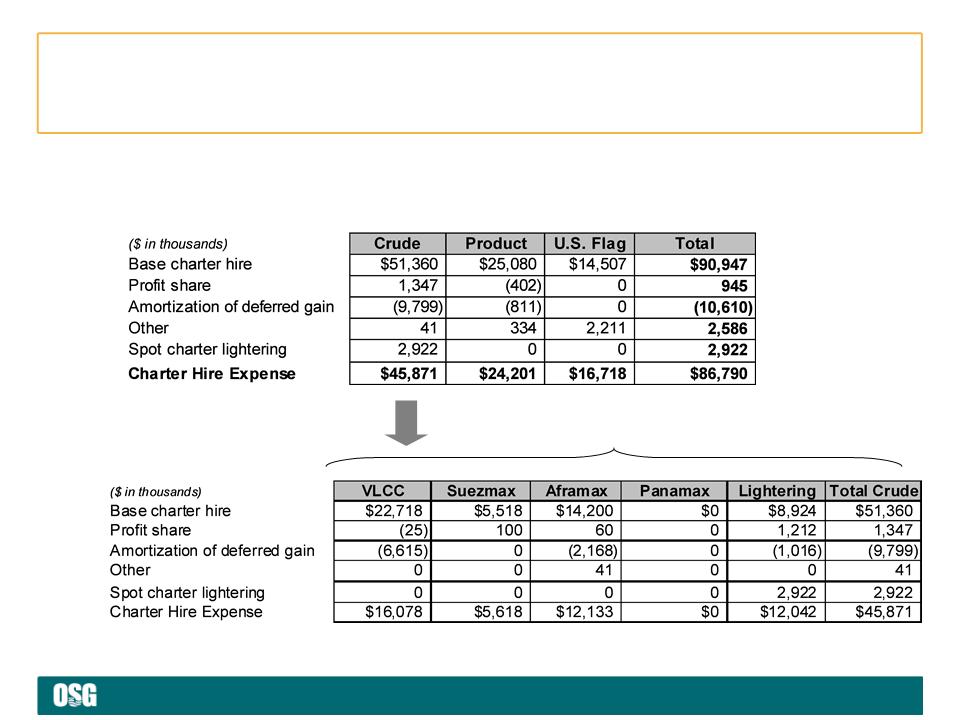

For

the Quarter Ended December 31, 2009

Charter

Hire Expense by Segment

Page

20

For

the Fiscal Year December 31, 2009

Charter

Hire Expense by Segment

Page

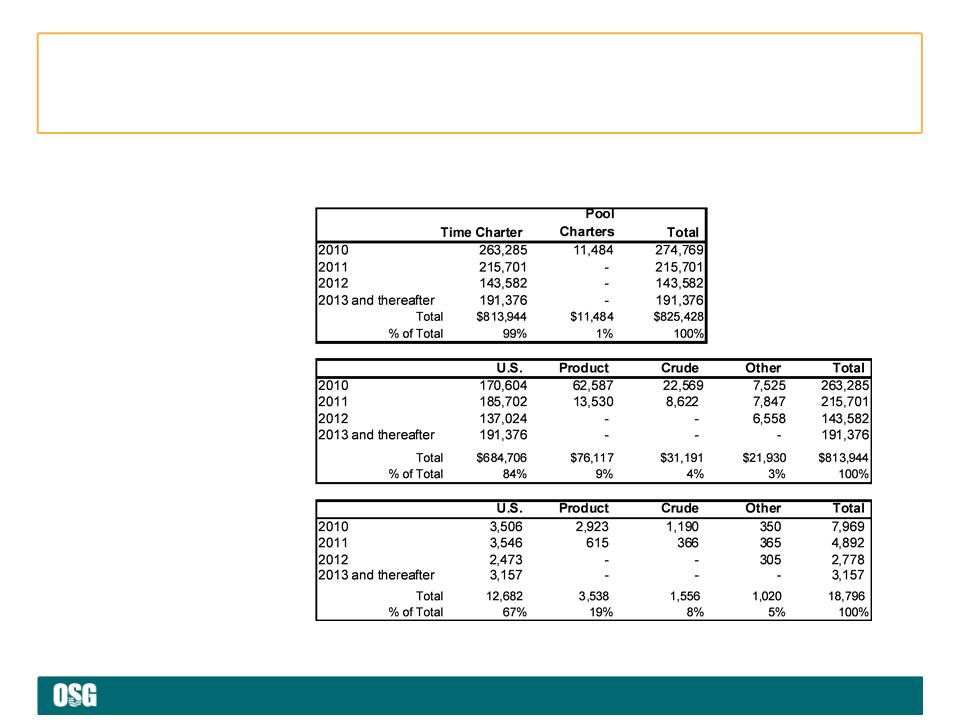

21

Locked-in

Time Charter

Days by Segment

Days by Segment

Locked-in

Time Charter

Revenue by Segment

Revenue by Segment

Locked-in

Charter Revenue

Charter Revenue

Note: Locked

in time charter days above for 2010 are as of 12/31/09 and will differ from a

later date used in

Appendices 3 and 4 in the FY09 earnings press release

Appendices 3 and 4 in the FY09 earnings press release

Future

Revenue $/Days by Segment - As of 12/31/09

Page

*

www.osg.com