Attached files

| file | filename |

|---|---|

| 8-K - COCA COLA ENTERPRISES FORM 8K - COCA COLA ENTERPRISES INC | cocacola8k_22510.htm |

Global Public Affairs &

Communications

P.O. Box

1734, Atlanta, GA 30301

Telephone

(404) 676-2683

FOR

IMMEDIATE RELEASE

THE COCA-COLA COMPANY AND

COCA-COLA ENTERPRISES STRATEGICALLY ADVANCE AND STRENGTHEN THEIR

PARTNERSHIP

The

Coca-Cola Company to Acquire CCE’s North American Bottling Business

CCE

Has Agreed In Principle To Buy The Coca-Cola Company’s Bottling Operations In

Norway And Sweden, And To Obtain The Right To Acquire The German

Bottler

|

·

|

Advancement

fully aligns with the Coca-Cola system’s 2020 Vision and drives long-term

value for all shareowners.

|

|

·

|

Evolves

The Coca-Cola Company’s North American business to more profitably deliver

the world’s greatest brands in the largest NARTD profit pool in the

world.

|

|

·

|

CCE

shareowners will benefit from the improved financial growth profile and

expansion of the Western European

business.

|

|

·

|

The

Coca-Cola Company will generate immediate efficiencies with expected

operational synergies of $350 million over four years, and the

transactions, which are substantially cashless, are expected to be

accretive to EPS on a fully diluted basis by

2012.

|

|

·

|

CCE

shareowners to exchange each CCE share for a share in a new CCE, focused

solely on Europe, and $10 per share in cash at

closing.

|

-more-

ATLANTA, Feb.25, 2010 – The

Coca-Cola Company (NYSE: KO) and Coca-Cola Enterprises Inc. (NYSE: CCE) announce

that they have entered into agreements that will strategically advance the

Coca-Cola system in North America and drive long-term value for all

shareholders. In addition, the parties have an agreement in principle to expand

CCE’s European business.

“Our 2020

Vision calls for decisive and timely action to continuously improve and evolve

our global franchise system to best serve our customers and consumers

everywhere. Consistent with the 2020 Vision, our roadmap for winning together,

we act today as an aligned system,” said The Coca-Cola Company’s Chairman and

Chief Executive Officer Muhtar Kent. “We are not acquiring CCE, rather we are

acquiring their North American operations, and they remain one of our key

bottling partners with world-class management, financial and operational

capabilities. We have a strong and unrelenting belief in our unique and thriving

global bottling system. Our new North American structure will create an

unparalleled combination of businesses, which will serve as our passport to

winning in the world’s largest nonalcoholic ready-to-drink profit pool. This

transaction offers compelling value to both The Coca-Cola Company and CCE

shareowners and will create substantial and sustainable benefits for both

companies’ stakeholders.”

Mr. Kent

continued, “Our North American business structure has remained essentially the

same since CCE was founded in 1986, while the market and industry have changed

dramatically. With this transaction, we are converting passive capital into

active capital, giving us direct control over our investment in North America to

accelerate growth and drive long-term profitability. We will work closely with

our bottling partners to create an evolved franchise system for the unique needs

of the North American market. Additionally, we will reconfigure our

manufacturing, supply chain and logistics operations to achieve cost reductions

over time. Importantly, the creation of a unified operating system will

strategically position us to better market and distribute North America’s most

preferred nonalcoholic beverage brands. At the same time, in Europe, we are

further strengthening our franchise system to provide broader, contiguous

geographic coverage and optimizing our marketing and distribution

leadership.”

CCE’s

Chairman and Chief Executive Officer John Brock said, “This transformation

creates significant near-term shareowner value through the sale of the North

American business for fair value, delivering over $4 billion in cash to CCE

shareowners, through cash distributions and planned share repurchases. At the

same time, this enables our shareowners to retain equity in a sales and

distribution company with an improved growth profile. In the future,

CCE shareowners will also benefit from the expansion of our European business

and our improved financial flexibility.”

-2-

Mr. Brock

added, “CCE remains the preeminent Western European bottler and a key strategic

partner with The Coca-Cola Company. Our European business

serves an attractive market with growing volumes and profit driven by rising per

capita consumption. As such, CCE will have an

improved profile with enhanced revenue, margins and EPS growth prospects. Together with The

Coca-Cola Company, we will continue to improve the effectiveness of our

operations in our expanded presence in Europe. These actions strengthen

our ability to compete effectively and sustainably in Europe and represent the

beginning of an exciting new era of long-term growth for CCE’s business and

shareowners.”

Mr. Kent

concluded, “This is a truly historic day for the Coca-Cola system. As the world’s leading

beverage Company, we are very excited about the vast opportunities before us and

I can say with confidence there is no better business to be in. Over the next several

years, the nearly $650 billion dollar global nonalcoholic ready-to-drink

beverage industry is expected to grow faster than worldwide GDP and we are best

positioned to capitalize on this enormous industry opportunity in North America

and Europe. These joint actions further reinforce our confidence in achieving

our 2020 Vision to more than double system revenue and double servings to over

3 billion

per day. With our system more aligned than ever, the timing is right, and we

believe that these actions will usher in a new era of winning for our Coca-Cola

system.”

Details of the

Transactions

The

Coca-Cola Company, in a substantially cashless transaction, will acquire CCE’s

entire North American business, which consists of approximately 75 percent of

U.S. bottler-delivered volume and almost 100 percent of Canadian

bottler-delivered volume. At the close of the transaction, The Coca-Cola Company

will have direct control over approximately 90 percent of the total North

America volume, including its current direct businesses. The Coca-Cola Company’s

acquisition of the assets and liabilities of CCE’s North American business

includes consideration of The Coca-Cola

Company’s current 34 percent equity ownership in CCE, valued at $3.4 billion,

based upon a thirty day trailing average as of February 24, 2010. In addition,

consideration includes the assumption of $8.88 billion of CCE debt and all of

the North American assets and liabilities – including CCE’s accumulated benefit

obligation for North America of $580 million as of December 31, 2009, and

certain other one-time costs and benefits.

In a

concurrent agreement, The Coca-Cola Company and CCE have agreed in principle

that CCE will buy The Coca-Cola Company’s bottling operations in Norway and

Sweden for $822 million, subject to the signing of definitive agreements, and

that CCE will have the right to acquire The Coca-Cola Company’s 83 percent

equity stake in its German bottling operations 18 to 36 months after closing for

fair value.

-3-

A new

entity, which will retain the name Coca-Cola Enterprises Inc., will be created

through a split-off that will hold CCE’s European businesses. CCE’s

public shareowners will exchange each existing CCE share for a share in the new

entity and will hold 100 percent of this new entity.

CCE will

provide its shareowners, excluding The Coca-Cola Company, with a special

one-time cash payment of $10 per share. In connection with the

transactions, CCE expects to raise initial debt financing of up to 3.0x EBITDA

to pay shareowners $10 per share in cash at closing, to acquire the Norway and

Sweden bottlers and to fund the expected share repurchase

program. Following completion of the transaction, it is expected that

CCE will adopt a program to repurchase up to approximately $1 billion of shares

and a policy of paying an expected annual dividend of $0.50 per share subject to

the discretion of CCE’s Board of Directors and its consideration of various

factors.

The

Coca-Cola Company and CCE expect the transactions to close in the fourth quarter

of 2010.

About CCR-USA and

CCRC

At the

close, The Coca-Cola Company will rename the sales and operational elements of

the North American businesses Coca-Cola Refreshments USA, Inc. (“CCR-USA”) and

Coca-Cola Refreshments Canada, Ltd. (“CCRC”), which will be wholly-owned

subsidiaries of The Coca-Cola

Company. Following the close, The Coca-Cola Company will combine the Foodservice

business, The Minute Maid Company, the Supply Chain organization, including

finished product operations, and our company-owned bottling operations in

Philadelphia with CCE’s North American business to form CCR-USA and CCRC. In the U.S., CCR-USA will

be organized as a unified operating entity with distinct capabilities to include

supply chain and logistics, sales and customer service operations. In Canada,

CCRC will be a single dedicated production, marketing, sales and distribution

organization. The Coca-Cola Company’s remaining North American operation will

continue to be responsible for brand marketing and franchise support. Details regarding the

structure, leadership and integration plans will be forthcoming.

Once

completed, the transactions are expected to generate operational synergies of

approximately $350 million over four years for The Coca-Cola Company and are

expected to be accretive to EPS on a fully diluted basis by 2012. Further, in

North America, this will generate system synergies that will increase the growth

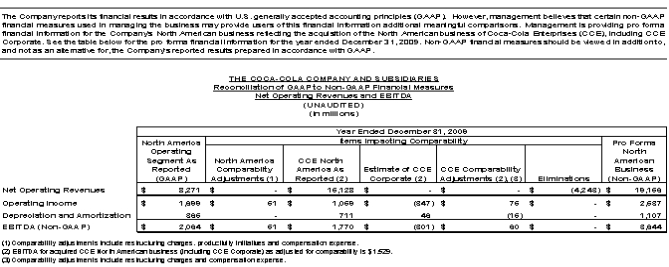

rate and cash flow on a pro forma basis over time. Pro forma for this

acquisition, the North American business, including CCR-USA and CCRC, would have

generated approximately $19.2 billion in revenues and $3.6 billion of EBITDA in

2009.

-4-

The Coca-Cola Company 2010

Outlook

As a result of these agreements, The

Coca-Cola Company has not made any share repurchases during the current fiscal

year and will continue to be out of the market until the close of these

transactions. However, the Company remains committed to repurchasing $1.5

billion in 2010.

About new

CCE

CCE will

be The Coca-Cola Company's strategic bottling partner in Western Europe and the

third-largest independent bottler globally. Reflecting CCE’s position

as The Coca-Cola Company's strategic bottling partner in Western Europe, the

companies will enter into a 10+10 year bottling agreement and a 5-year incidence

pricing agreement. Pro forma, including the

contributions of Norway and Sweden, CCE would have generated approximately $7.3

billion in revenues, $850 million in operating income, and $1.2 billion of

EBITDA in 2009.

At

closing, before planned share repurchases, CCE expects to have net debt of

approximately $2

billion. Immediately

after closing and before share repurchase, CCE is expected to have approximately

350-360 million outstanding shares on a fully diluted basis, substantially

comparable to the publicly owned shares of CCE today.

Shortly

after closing, the Board of CCE is expected to announce a planned share

repurchase program of approximately $1 billion and an initial annual dividend of

$0.50 per share. Payment of cash dividends and stock repurchases by CCE will be

at the discretion of CCE’s Board of Directors in accordance with applicable law

after taking into account various factors, including, but not limited to, CCE’s

financial condition, operating results, current and anticipated cash needs and

plans for growth. Therefore, no assurance can be given that CCE will pay any

dividends to its shareowners or make share repurchases, and no assurance can be

given to the amount of any such dividends or share repurchases if CCE’s Board of

Directors determines to do so.

CCE will

retain the Coca-Cola Enterprises Inc. corporate name and remain headquartered in

Atlanta. CCE will

continue to be traded on the NYSE under the CCE ticker. John Brock, Chairman and

Chief Executive Officer, Bill Douglas, Chief Financial Officer, Hubert Patricot,

President of the European Group, and other members of the CCE corporate

management team will continue to lead the company. In addition, the

current independent directors will continue to comprise the CCE

Board.

CCE 2010

Outlook

As a

result of these agreements, CCE has not made any share repurchases during the

current fiscal year, and it does not plan to do so before the transactions

close. CCE intends

to provide additional details on FY 2010 outlook during its upcoming first

quarter call.

-5-

Additional

Information

CCE’s

independent Affiliated Transaction Committee recommended that CCE’s Board

approve the transactions. The Boards of Directors of both The Coca-Cola Company

and CCE have approved the transactions, which are subject to approval by CCE’s

public shareowners and customary regulatory approvals.

Allen

& Company and Goldman Sachs & Co. acted as financial advisors to The

Coca-Cola Company. Skadden, Arps, Slate, Meagher & Flom LLP acted as legal

counsel. Cleary Gottlieb Steen & Hamilton LLP and Wilson Sonsini

Goodrich & Rosati provided antitrust counsel.

Credit

Suisse and Lazard acted as financial advisors to CCE and Cahill Gordon &

Reindel LLP acted as legal counsel. Greenhill & Co. acted as

financial advisor to the Affiliated Transaction Committee and McKenna Long &

Aldridge LLP provided legal counsel.

For more

information about the transactions, please access our transaction specific

website at: www.KOsystemevolution.com.

Conference

Call/Webcast

The

Coca-Cola Company and Coca-Cola Enterprises are hosting a joint conference call

with investors and analysts to discuss our transactions today at 9:30 a.m.

(EST). We invite investors to listen to the live audiocast of the conference

call at either web site, www.thecoca-colacompany.com

or at www.cokecce.com in

the “Investors” section. Further, the “Investors” section of each

website includes a reconciliation of non-GAAP financial measures that may be

used periodically by management when discussing their financial results with

investors and analysts to our results as reported under GAAP.

-6-

About The Coca-Cola

Company

The

Coca-Cola Company (NYSE: KO) is the world’s largest beverage company, refreshing

consumers with more than 500 sparkling and still brands. Together with

Coca-Cola, recognized as the world’s most valuable brand, the Company’s

portfolio includes 14 billion dollar brands, including Diet Coke, Fanta, Sprite,

Coca-Cola Zero, vitaminwater, Powerade, Minute Maid, Simply and Georgia Coffee.

Globally, we are the No. 1 provider of sparkling beverages, juices and juice

drinks and ready-to-drink teas and coffees. Through the world’s largest beverage

distribution system, consumers in more than 200 countries enjoy the Company’s

beverages at a rate of 1.6 billion servings a day. With an enduring commitment

to building sustainable communities, our Company is focused on initiatives that

protect the environment, conserve resources and enhance the economic development

of the communities where we operate. For more information about our Company,

please visit our web site at www.thecoca-colacompany.com.

The Coca-Cola Company

Forward-Looking Statements

This

press release may contain statements, estimates or projections that constitute

“forward-looking statements” as defined under U.S. federal securities laws.

Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,”

“project,” “will” and similar expressions identify forward-looking statements,

which generally are not historical in nature. Forward-looking statements are

subject to certain risks and uncertainties that could cause actual results to

differ materially from The Coca-Cola Company’s historical experience and our

present expectations or projections. These risks include, but are not limited

to, obesity and other health concerns; scarcity and quality of water; changes in

the nonalcoholic beverages business environment, including changes in consumer

preferences based on health and nutrition considerations and obesity concerns;

shifting consumer tastes and needs, changes in lifestyles and competitive

product and pricing pressures; impact of the global credit crisis on our

liquidity and financial performance; our ability to expand our operations in

developing and emerging markets; foreign currency exchange rate fluctuations;

increases in interest rates; our ability to maintain good relationships with our

bottling partners; the financial condition of our bottling partners; our ability

and the ability of our bottling partners to maintain good labor relations,

including the ability to renew collective bargaining agreements on satisfactory

terms and avoid strikes, work stoppages or labor unrest; increase in the cost,

disruption of supply or shortage of energy; increase in cost, disruption of

supply or shortage of ingredients or packaging materials; changes in laws and

regulations relating to beverage containers and packaging, including container

deposit, recycling, eco-tax and/or product stewardship laws or regulations;

adoption of significant additional labeling or warning requirements; unfavorable

general economic conditions in the United States or other major markets;

unfavorable economic and political conditions in international markets,

including civil unrest and product boycotts; changes in commercial or market

practices and business model within the European Union; litigation

uncertainties; adverse weather conditions; our ability to maintain brand image

and corporate reputation as well as other product issues such as product

recalls; changes in legal and regulatory environments; changes in accounting

standards and taxation requirements; our ability to achieve overall long-term

goals; our ability to protect our information systems; additional impairment

charges; our ability to successfully manage Company-owned bottling operations;

the impact of climate change on our business; global or regional catastrophic

events; and other risks discussed in our Company’s filings with the Securities

and Exchange Commission (SEC), including our Annual Report on Form 10-K, which

filings are available from the SEC. You should not place undue reliance on

forward-looking statements, which speak only as of the date they are made. The

Coca-Cola Company undertakes no obligation to publicly update or revise any

forward-looking statements.

-7-

About Coca-Cola Enterprises

Inc.

Coca-Cola

Enterprises Inc. is the world's largest marketer, distributor, and producer of

bottle and can liquid nonalcoholic refreshment. CCE sells

approximately 80 percent of The Coca-Cola Company's bottle and can volume in

North America and is the sole licensed bottler for products of The Coca-Cola

Company in Belgium, continental France, Great Britain, Luxembourg, Monaco, and

the Netherlands. For more information about our Company, please visit our web

site at www.cokecce.com.

Coca-Cola Enterprises Inc.

Forward-Looking Statements

Included

in this news release are forward-looking management comments and other

statements that reflect management’s current outlook for future periods. As

always, these expectations are based on currently available competitive,

financial, and economic data along with our current operating plans and are

subject to risks and uncertainties that could cause actual results to differ

materially from the results contemplated by the forward-looking statements. The

forward-looking statements in this news release should be read in conjunction

with the risks and uncertainties discussed in our filings with the Securities

and Exchange Commission, including our most recent annual report on Form 10-K

and subsequent SEC filings.

Important Additional

Information and Where to Find It

This

communication does not constitute an offer to sell or the solicitation of an

offer to buy any securities or a solicitation of any vote or

approval. In connection with the proposed transaction and required

shareowner approval, Coca-Cola Enterprises Inc. (“Company”) will file relevant

materials with the Securities and Exchange Commission (the “SEC”), including a

proxy statement/prospectus contained in a registration statement on Form S-4,

which will be mailed to the shareowners of the Company after the registration

statement is declared effective. The registration statement has not yet become

effective.

SHAREOWNERS

OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC,

INCLUDING THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

-8-

Shareowners

may obtain a free copy of the proxy statement/prospectus, when it becomes

available, and other documents filed by the Company at the SEC’s web site at

www.sec.gov. Copies of the documents filed with the SEC by the

Company will be available free of charge on the Company’s internet website at

www.cokecce.com under the tab “Investor Relations” or by contacting the Investor

Relations Department of Coca-Cola Enterprises at 770-989-3246.

Participants in the

Solicitation

Coca-Cola

Enterprises (“Company”) and its directors, executive officers and certain other

members of its management and employees may be deemed to be participants in the

solicitation of proxies from its shareowners in connection with the proposed

transaction. Information regarding the interests of such directors

and executive officers was included in the Company’s Proxy Statement for its

2009 Annual Meeting of Shareowners filed with the SEC March 3, 2009 and a Form

8-K filed on December 18, 2009 and information concerning the participants in

the solicitation will be included in the proxy statement/prospectus relating to

the proposed transaction when it becomes available. Each of these

documents is, or will be, available free of charge at the SEC’s website at

www.sec.gov and from the Company on its website or by contacting the Shareowner

Relations Department at the telephone number above.

###

FOR

MORE INFORMATION, PLEASE CONTACT:

The Coca-Cola

Company:

Jackson

Kelly, Investor Relations

Tel: +1

(404) 676-7563

Dana

Bolden, Media Relations

Tel: +1

(404) 676-2683; Email: pressinquiries@na.ko.com

Coca-Cola Enterprises

Inc.:

Thor

Erickson, Investor Relations

Tel: +1

(770) 989-3110

Laura

Brightwell, Media Relations

Tel: +1

(770) 989-3023