Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - rEVO Biologics, Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - rEVO Biologics, Inc. | dex991.htm |

Corporate Presentation January 2010 NASDAQ: GTCB www.gtc-bio.com Exhibit 99.2 |

2 Safe Harbor Statement This presentation contains forward-looking statements that reflect GTC Biotherapeutics management’s current view of future events and operations. These forward- looking statements are based on assumptions, external factors, uncertainties and other risks that are detailed in the Company’s SEC reports, including its Form 10-K for the year ending December 28, 2008. Actual results may differ materially from these statements. |

3 GTC Biotherapeutics Validated “Game-Changing” Production Technology – Recombinant plasma proteins – Biosimilar/biobetter antibodies – Enabling, scalable, cost-effective – Validated regulatory path and infrastructure ATryn ® Recombinant Human Antithrombin – Approved in US & EU – Secured US commercialization partner – Expanding indications to maximize commercial opportunity Broad Pipeline Focused on High-Value Products – Low development risk – Large, established markets Corporate – Developed key strategic partnerships – Active partnering strategy |

4 Strategic Goals for Value Creation Develop Biosimilar and Biobetter Antibodies – Focus on oncology & autoimmune indications – CD20, HER2, EGFR and TNF MAbs – Enhanced ADCC biobetters – Outside key cell culture MAb IP Pipeline – Advance 2 products into the clinic in 2010 • Factor VIIa (hemophilia) into Phase I • AFP (MG and MS) into Phase II Maximize commercial opportunity of ATryn ® – Label expansion – Geographical distribution Build on Existing Strategic Relationships – Pursue additional corporate partners – Share risk and rewards – Build value but maintain financial discipline Products Transgenic Technology Business |

5 Technology to Products Production Platform Products Lower Production Costs Enabling difficult to express proteins enhanced ADCC/glycosylation High Volume Production unconstrained supply scaleable/flexible established infrastructure Validated Regulatory Path (US/EU) Protected by Intellectual Property proprietary IP (2021) and FTO Recombinant Plasma Proteins Biosimilar & Biobetter MAbs Product Portfolio known clinical profile low development risk produced cost-effectively expedited approval process large, established markets |

6 Recombinant Plasma Proteins ATryn ® (US/EU) hereditary deficiency acquired deficiencies Factor VIIa (LFB) hemophilia Factor IX (LFB) hemophilia AFP MS and MG Biosimilar/Biobetter Monoclonal Antibodies TG20 (LFB) oncology & autoimmune HER2, TNF, EGFR oncology & autoimmune Products Indications R&D PC PI PII PIII Approved GTC Product Pipeline |

7 Partnerships Key Component of GTC’s strategy – Share product rewards and risks with partners – Financial support for clinical development and commercialization Established Partners – Commercialization partnership • ATryn ® US partnership with Lundbeck • $257M development and commercialization deal – Development collaboration • JV with LFB • Multiple products FVIIa, FIX, AAT, TG20 MAb Partnering Opportunities – ATryn – Ex-US – Factor VIIa and Factor IX – AFP – Biosimilar/Biobetter MAbs |

8 Recombinant Plasma Protein Products Focused portfolio – FVIIa, FIX – AFP – antithrombin (ATryn ® ) Addressing large, established markets Deliver: unconstrained supply Ensure: safe products Provide: lower COGS |

9 ATryn ® : Marketed in US and EU ATryn ® Recombinant Human Antithrombin Anticoagulant and Anti-Inflammatory – Broad range of therapeutic indications FDA & EMEA Approved – Hereditary Deficiency Product Unique Selling Points – Safe – Consistent, reliable supply – Robust clinical data package – Only recombinant product Commercial sales in US and EU – US: Lundbeck Partnership – Ex-US: Partnership opportunities |

10 Antithrombin Deficiencies Hereditary Deficiency Genetic disease/orphan indication US Incidence 1:3000 High risk of venous thrombosis and pulmonary embolism during trauma, surgery and childbirth Acquired Deficiencies Disease-associated antithrombin deficiency – Heparin resistance/CABG – DIC – Preeclampsia – Burns/Trauma TIME >$2.5B DIC/Sepsis ~$50M Hereditary Deficiency ~$200M Heparin Resistance |

11 ATryn ® Commercial Strategy EU EMEA Approved in 2006 – HD surgical cases – Label expansion - childbirth Secure EU Commercial Partner – Expand EU commercial availability – Maximize EU sales in HD Geographical Expansion – Secure commercial partners • Canada • Japan • Middle East – Maximize sales US Commercial Partner: Lundbeck – FDA approved HD surgery & childbirth – Launched May 2009 – Initial goal to maximize US sales – Established hospital-based sales force Label Expansion – Heparin resistance in CABG • partner funded – Develop further AD indications – DIC associated with sepsis • 250,000 patients/year in US • high mortality (40-50%) • published data supports potential efficacy ROW |

12 Hemophilia Genetic Diseases Orphan Diseases (US >20,000 patients) – Hemophilia A: FVIII deficient – Hemophilia B: FIX deficient Hemophiliacs with inhibitors to FVIII or FIX – FVIIa treats both conditions VIIa IX Large, Growing Markets Overall Markets >$6B FVIIa: NovoSeven ® >$1.2B (2008) FIX: BeneFIX ® >$600M (2008) VIII |

13 Factors VIIa and IX Expand markets with strong commercial partners – Acute and prophylactic treatments – Additional geographies – Expand Labeling e.g. trauma, surgery Factor VIIa Factor IX Strategy – Difficult to produce in cell culture – Comparable to NovoSeven ® – Discounted pricing Status: – Established production line – Data shows comparability – IND 1H 2010 – Conduct Phase I in 2010 Strategy – Difficult to produce in cell culture – Extended half-life product Status: – Established production line – Preclinical studies ongoing – IND 2011 Growth Opportunities |

Alpha

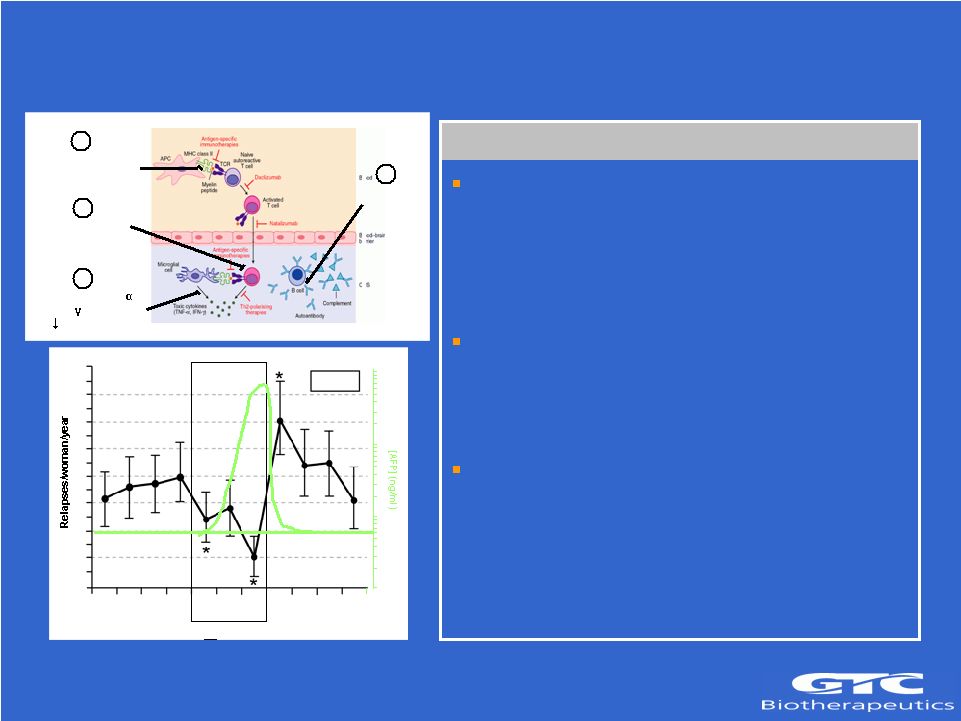

Fetoprotein (rhAFP) Alpha Fetoprotein Status: – Immune modulator – Disease remission during pregnancy – Compelling results in MS & MG Models Enabled by Transgenic Platform: – Difficult to express in cell culture – High expression during pregnancy Partnering Opportunity: – Strong KOL support – Strong safety database (>200 patients) – Phase II ready – Develop with partner Decreases TNF and IFN production by macrophages 14 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 Pre-pregnancy Pregnancy Post-partum Source: Confavreux et al. (1998) NEJM 339 285-291 NORMAL [AFP] 1 2

3 4 N = 227 1 2

3 4 1 2 3

1,000 100 10 1 Downregulates expression of MHC class II molecules Upregulates apoptosis of Inflammatory Cells 1 2 3 4 Inhibits antibody production |

15 Based on: – Pre-clinical evidence shows efficacy in robust MS animal models – Human safety data with favorable side-effect profile (>200 patients) – Competitive COGS – Convenient administration by subcutaneous injection Potential: – 1st line therapy for MS – 2nd line therapy for MG – Other autoimmune CNS diseases Significant Market Opportunity for AFP Myasthenia Gravis Multiple Sclerosis US Prevalence (per 100,000) 15 – 20 125 – 150 US Patients (‘000s) 45 – 60 >300 Potential Market $150 – 250M >$8B |

MAbs - A Manufacturing Challenge ~24 kg ~15 kg IFN- IFN- hGH G-CSF EPO ERT >2500 kg 16 |

Monoclonal Antibodies Technology Proven, competitive for MAb production >20 MAbs produced Easy scalability (10 – 1000+ kg) COGS, CapEx Avoids key cell culture MAb patents Biosimilar/Biobetter MAbs TG20 (CD20 MAb) (LFB JV) – Oncology/autoimmune disease – Target specificity similar to Rituxan – Enhanced ADCC + similar CDC HER-2, TNF and EGFR initiated Targeting >$15B sales (2008) Regulatory path evolving (EU/US) Develop with partners 15 10 5 0 ’01 ’02 ’03

’04 ’05 ’06 ’07 ‘08 MAb Sales 2001 – 2008 (Rituxan, Humira, Erbitux & Herceptin) 17 |

18 Goal: Cash Flow Positive by 2012 2010 2011 Development •ATryn® initiate PIII HR •FVIIa conduct Phase I •AFP initiate Phase II •Biosimilar characterization Partnering •ATryn ® EU •AFP •Biosimilar(s) Development •FVIIa initiate Phase II/III •AFP conclude Phase II •FIX file IND •TG20 Phase I (partner) Partnering •ATryn ROW •FVIIa •Biosimilar(s) 2012 Development •ATryn HR filing •AFP initiate Phase III •FIX initiate Phase II/III •Herceptin file IND Partnering •FIX Financial •Cash-Flow Positive |

19 GTC Fundamentals Validated “game-changing” production platform – enables production of difficult to express proteins – easily scalable for high volume products – cost competitive (COGS and CapEx) Demonstrated naturally enhanced ADCC MAbs – generate high value 2nd generation oncology MAbs Recombinant versions of plasma proteins – ATryn (launched US & EU) – FVII (Phase I 2010) – AFP (Phase II 2010) Biosimilar/Biobetter MAbs – HER2, TNF and EGFR in development – TG20 (Phase I 2011) Sharing risk/rewards through partnering – LFB, Lundbeck Significant events through 2012 – Products progressing in clinical development – Partnering deals Goal to be cash-flow positive by 2012 Products Technology Value Creation |

20 |

Forward-Looking Statements This slide presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, including without limitation statements related to GTC’s plans to enter into partnerships, build upon existing strategic relationships, maximize commercial opportunities, advance its programs relating to recombinant factor VIIa, alpha-fetoprotein, ATryn and monoclonal antibodies for use as follow-on

biologics, market opportunities and our plan to be cash flow positive by 2012. Such

forward-looking statements are subject to a number of risks, uncertainties and other factors

that could cause actual results to differ materially from future results expressed or implied by

such statements. Factors that may cause such differences include, but are not limited to,

the risks and uncertainties discussed in our most recent Annual Report on Form 10-K and our

other periodic reports filed with the Securities and Exchange Commission, including the

risks and uncertainties associated with our ability to enter into collaborations in the future,

the terms of such collaborations, the performance of our partners, regulatory approval of our transgenically produced products, designing and conducting clinical trials and pre- clinical studies, developing new biological products, continuing operating losses and our ability to raise additional capital. GTC cautions investors not to place undue reliance on the forward-looking statements contained in this presentation These statements speak only as of the date of this filing on Form 8-K, and GTC undertakes no obligation to update or revise the statements, except as may be required by law. |