Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - US BANCORP \DE\ | tm2128006d1_ex99-1.htm |

| 8-K - FORM 8-K - US BANCORP \DE\ | tm2128006d1_8k.htm |

Exhibit 99.2

ibdroot \ projects \ IBD - NY \ bonelike2021 \ 677634_1 \ 7. Investor Presentation \ Presentation \ Project Symphony Investor Presentation IR v32.pptx U.S. BANCORP U.S. Bancorp to Acquire Union Bank from Mitsubishi UFJ Financial Group Creating value for all our stakeholders September 21, 2021

2 U.S. BANCORP | “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995 : This presentation contains forward - looking statements about U . S . Bancorp . Statements that are not historical or current facts, including statements about beliefs and expectations, are forward - looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof . These forward - looking statements cover, among other things, any projections or expectations regarding U . S . Bancorp’s proposed acquisition of Union Bank described herein, U . S . Bancorp’s future revenues, expenses, earnings, capital expenditures, deposits or stock price, as well as the assumptions on which such expectations are based . Forward - looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated . Such risks and uncertainties include, among others, ( 1 ) the risk that the cost savings, any revenue synergies and other anticipated benefits of the proposed acquisition may not be realized or may take longer than anticipated to be realized, ( 2 ) disruption to the parties’ businesses as a result of the announcement and pendency of the proposed acquisition and diversion of management’s attention from ongoing business operations and opportunities, ( 3 ) the occurrence of any event that could give rise to the right of one or both of the parties to terminate the definitive purchase agreement, ( 4 ) the failure to obtain required governmental approvals or a delay in obtaining such approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect U . S . Bancorp or the expected benefits of the proposed acquisition), ( 5 ) the failure of any of the closing conditions in the definitive purchase agreement to be satisfied on a timely basis or at all, ( 6 ) delays in closing the proposed acquisition, ( 7 ) the possibility that the proposed acquisition, including the integration of Union Bank, may be more costly or difficult to complete than anticipated, ( 8 ) the dilution caused by U . S . Bancorp’s issuance of additional shares of its capital stock in connection with the proposed acquisition, ( 9 ) other factors that may affect future results of U . S . Bancorp, including changes in asset quality and credit risk, the inability to sustain revenue and earnings growth, changes in interest rates and capital markets, inflation, customer borrowing, repayment, investment and deposit practices, the impact, extent and timing of technological changes, capital management activities, litigation, and legislative and regulatory actions and reforms, and ( 10 ) the impact of the ongoing global COVID - 19 pandemic on U . S . Bancorp’s or Union Bank’s businesses or our ability to complete the proposed acquisition . For discussion of these and other risks and uncertainties that may cause actual results to differ from expectations, refer to U . S . Bancorp’s Annual Report on Form 10 - K for the year ended December 31 , 2020 , on file with the Securities and Exchange Commission, including the sections entitled “Corporate Risk Profile” and “Risk Factors” contained in Exhibit 13 , and all subsequent filings with the Securities and Exchange Commission under Sections 13 (a), 13 (c), 14 or 15 (d) of the Securities Exchange Act of 1934 . In addition, factors other than these risks also could adversely affect U . S . Bancorp’s results, and the reader should not consider these risks to be a complete set of all potential risks or uncertainties . Forward - looking statements speak only as of the date hereof, and U . S . Bancorp undertakes no obligation to update them in light of new information or future events . Disclaimer

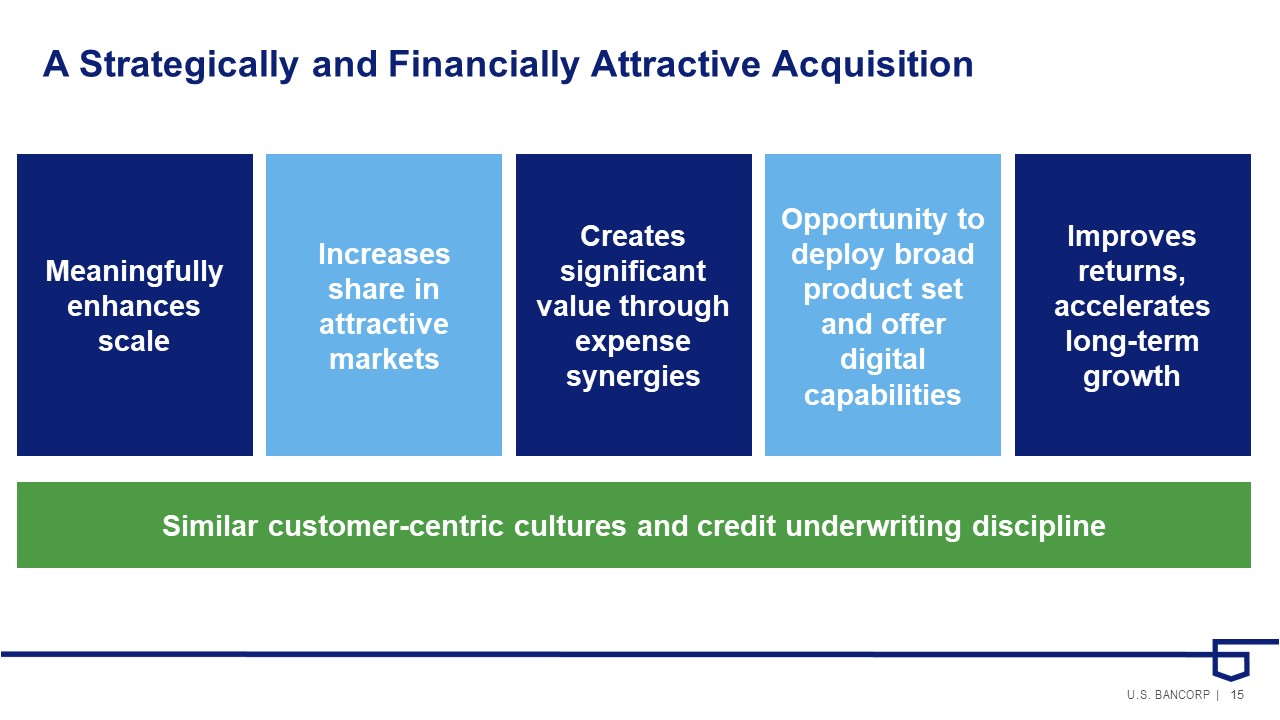

3 U.S. BANCORP | A Strategically and Financially Attractive Acquisition Meaningfully enhances scale Increases share in attractive markets Improves returns, accelerates long - term growth Creates significant value through expense synergies Opportunity to deploy broad product set and offer digital capabilities Similar customer - centric cultures and credit underwriting discipline

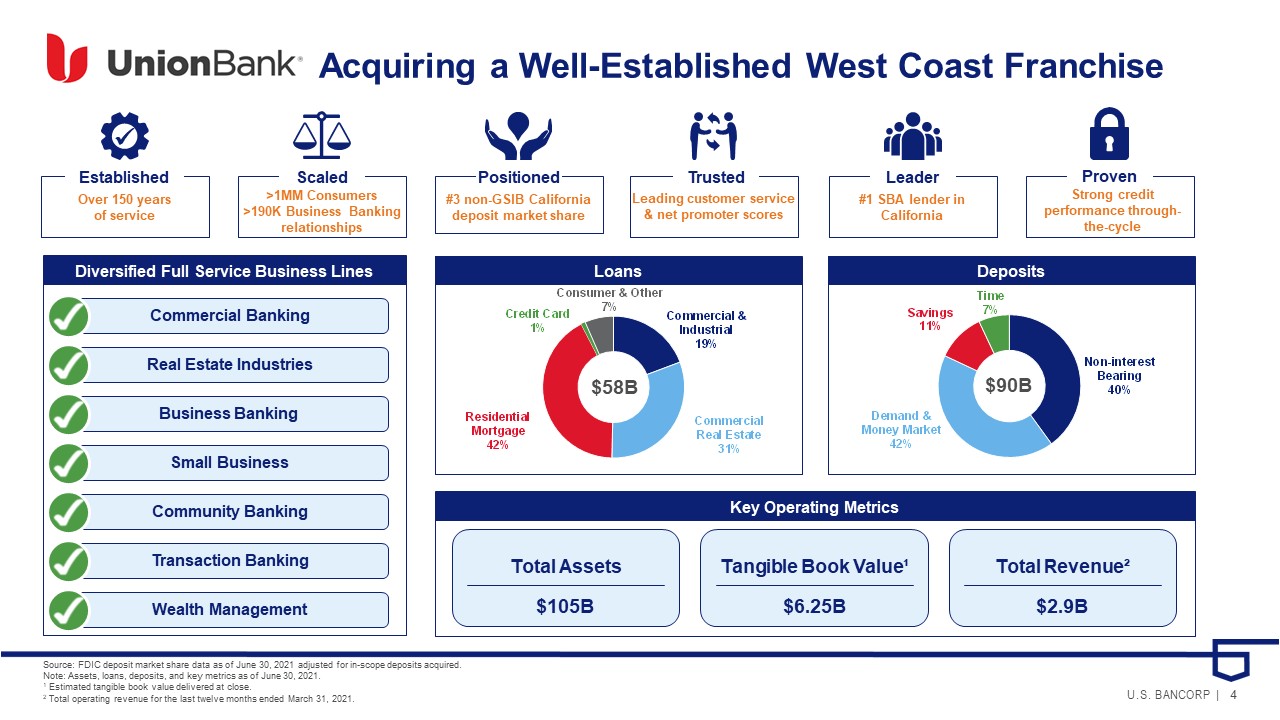

4 U.S. BANCORP | Leading customer service & net promoter scores $90B $58B Acquiring a Well - Established West Coast Franchise Key Operating Metrics Deposits Loans Source: FDIC deposit market share data as of June 30, 2021 adjusted for in - scope deposits acquired. Note: Assets, loans, deposits, and key metrics as of June 30, 2021. 1 Estimated tangible book value delivered at close. 2 Total operating revenue for the last twelve months ended March 31, 2021. Over 150 years of service Established x >1MM Consumers >190K Business Banking relationships Scaled #3 non - GSIB California deposit market share Positioned Trusted #1 SBA lender in California Leader Total Revenue² $2.9B Total Assets $105B Diversified Full Service Business Lines Commercial Banking Real Estate Industries Business Banking Small Business Community Banking Transaction Banking Wealth Management Tangible Book Value¹ $6.25B Strong credit performance through - the - cycle Proven Commercial & Industrial 19% Commercial Real Estate 31% Residential Mortgage 42% Credit Card 1% Consumer & Other 7%

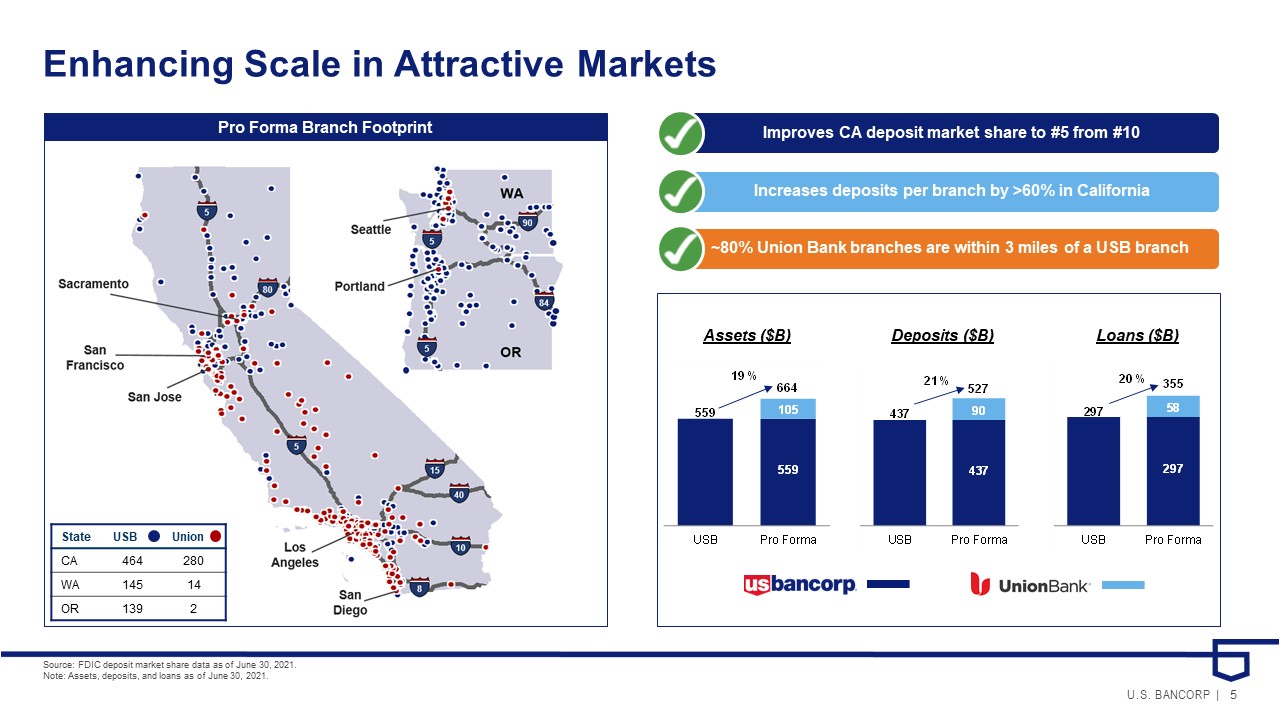

5 U.S. BANCORP | Improves CA deposit market share to #5 from #10 Increases deposits per branch by >60% in California ~80% Union Bank branches are within 3 miles of a USB branch Enhancing Scale in Attractive Markets Source: FDIC deposit market share data as of June 30, 2021. Note: Assets, deposits, and loans as of June 30, 2021. Pro Forma Branch Footprint Assets ($B) Deposits ($B) Loans ($B) State USB Union CA 464 280 WA 145 14 OR 139 2 559 559 105 USB Pro Forma 664 19 %

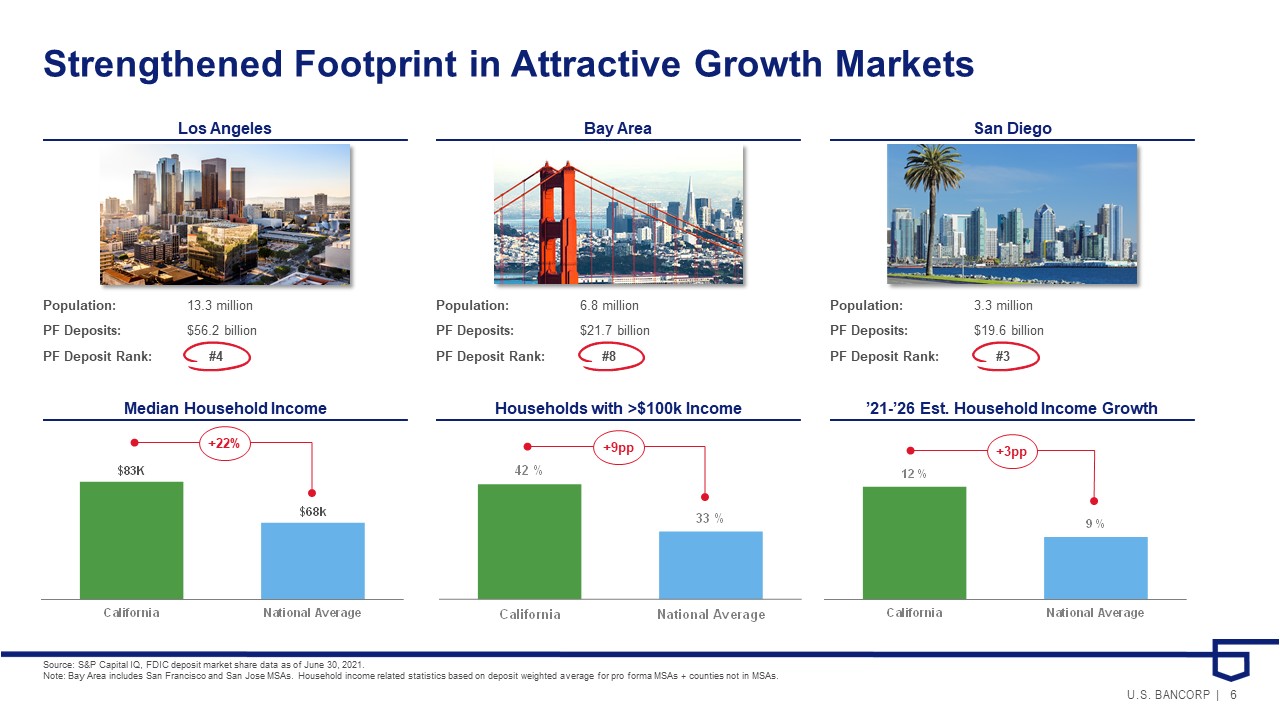

6 U.S. BANCORP | California National Average $68k $83K 42 % 33 % California National Average Strengthened Footprint in Attractive Growth Markets Los Angeles San Diego Bay Area Median Household Income ’21 - ’26 Est. Household Income Growth Households with >$100k Income Population: 13.3 million PF Deposits: $56.2 billion PF Deposit Rank: #4 Population: 6.8 million PF Deposits: $21.7 billion PF Deposit Rank: #8 Population: 3.3 million PF Deposits: $19.6 billion PF Deposit Rank: #3 +9pp +3pp +22% Source: S&P Capital IQ, FDIC deposit market share data as of June 30, 2021. Note: Bay Area includes San Francisco and San Jose MSAs. Household income related statistics based on deposit weighted averag e f or pro forma MSAs + counties not in MSAs.

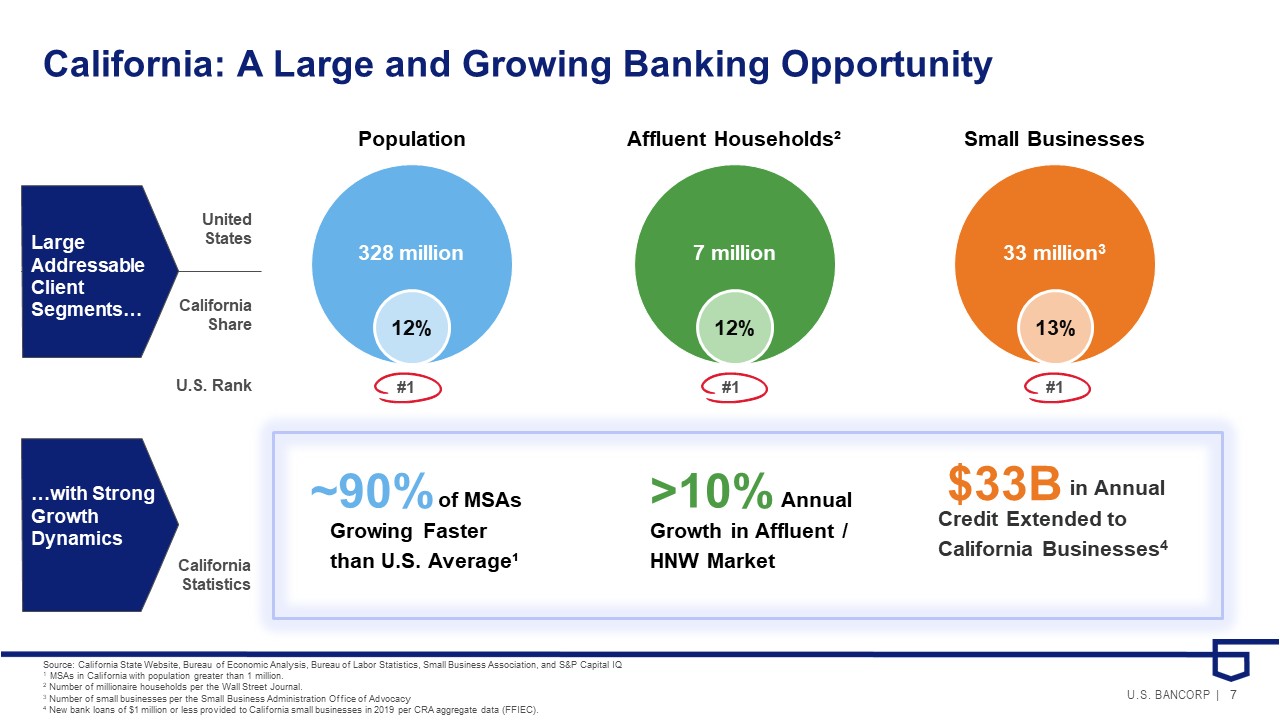

7 U.S. BANCORP | California Statistics California: A Large and Growing Banking Opportunity Source: California State Website, Bureau of Economic Analysis, Bureau of Labor Statistics, Small Business Association, and S&P Capital IQ 1 MSAs in California with population greater than 1 million. 2 Number of millionaire households per the Wall Street Journal. 3 Number of small businesses per the Small Business Administration Office of Advocacy 4 New bank loans of $1 million or less provided to California small businesses in 2019 per CRA aggregate data (FFIEC). Population 328 million 12% ~90% of MSAs Growing Faster than U.S. Average¹ United States California Share U.S. Rank Large Addressable Client Segments… …with Strong Growth Dynamics Affluent Households² 7 million 12% >10% Annual Growth in Affluent / HNW Market Small Businesses 33 million 3 13% $33B in Annual Credit Extended to California Businesses 4 #1 #1 #1

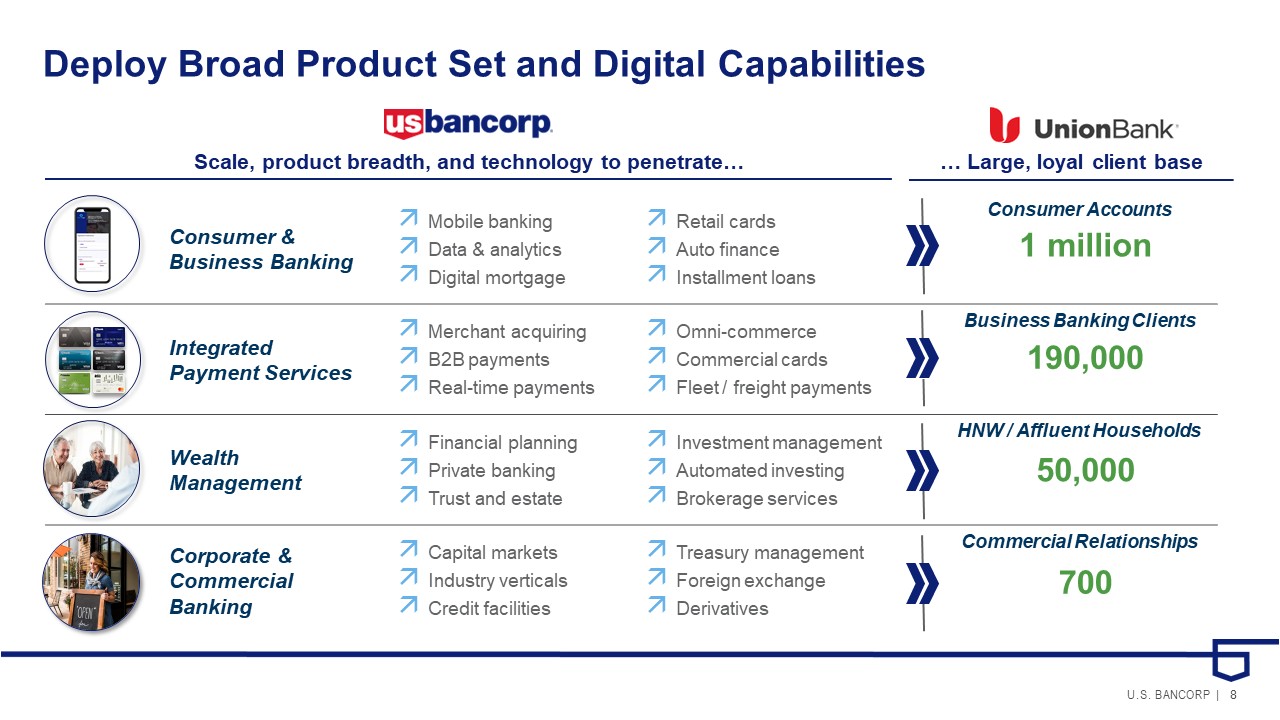

8 U.S. BANCORP | Deploy Broad Product Set and Digital Capabilities Scale, product breadth, and technology to penetrate… Consumer & Business Banking Mobile banking Data & analytics Digital mortgage Retail cards Auto finance Installment loans Consumer Accounts Integrated Payment Services Merchant acquiring B2B payments Real - time payments Omni - commerce Commercial cards Fleet / freight payments Business Banking Clients Wealth Management Financial planning Private banking Trust and estate Investment management Automated investing Brokerage services HNW / Affluent Households Corporate & Commercial Banking Capital markets Industry verticals Credit facilities Treasury management Foreign exchange Derivatives Commercial Relationships … Large, loyal client base 1 million 190,000 50,000 700

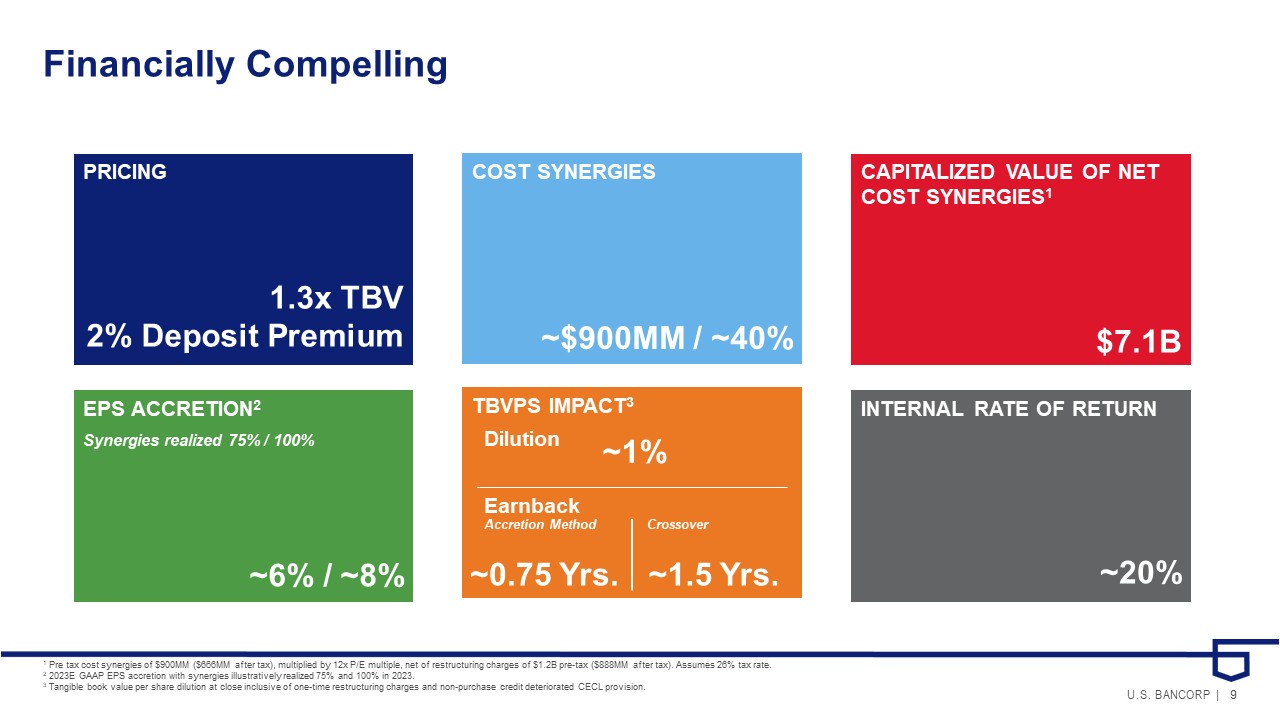

9 U.S. BANCORP | Financially Compelling CAPITALIZED VALUE OF NET COST SYNERGIES 1 $7.1B EPS ACCRETION 2 ~6% / ~8% TBVPS IMPACT 3 INTERNAL RATE OF RETURN ~20 % PRICING 1.3x TBV 2% Deposit Premium COST SYNERGIES ~$900MM / ~40% 1 Pre tax cost synergies of $900MM ($666MM after tax), multiplied by 12x P/E multiple, net of restructuring charges of $1.2B pr e - tax ($888MM after tax). Assumes 26% tax rate. 2 2023E GAAP EPS accretion with synergies illustratively realized 75% and 100% in 2023. 3 Tangible book value per share dilution at close inclusive of one - time restructuring charges and non - purchase credit deteriorate d CECL provision. Synergies realized 75% / 100% Earnback Dilution ~1.5 Yrs. ~0.75 Yrs. ~1% Accretion Method Crossover

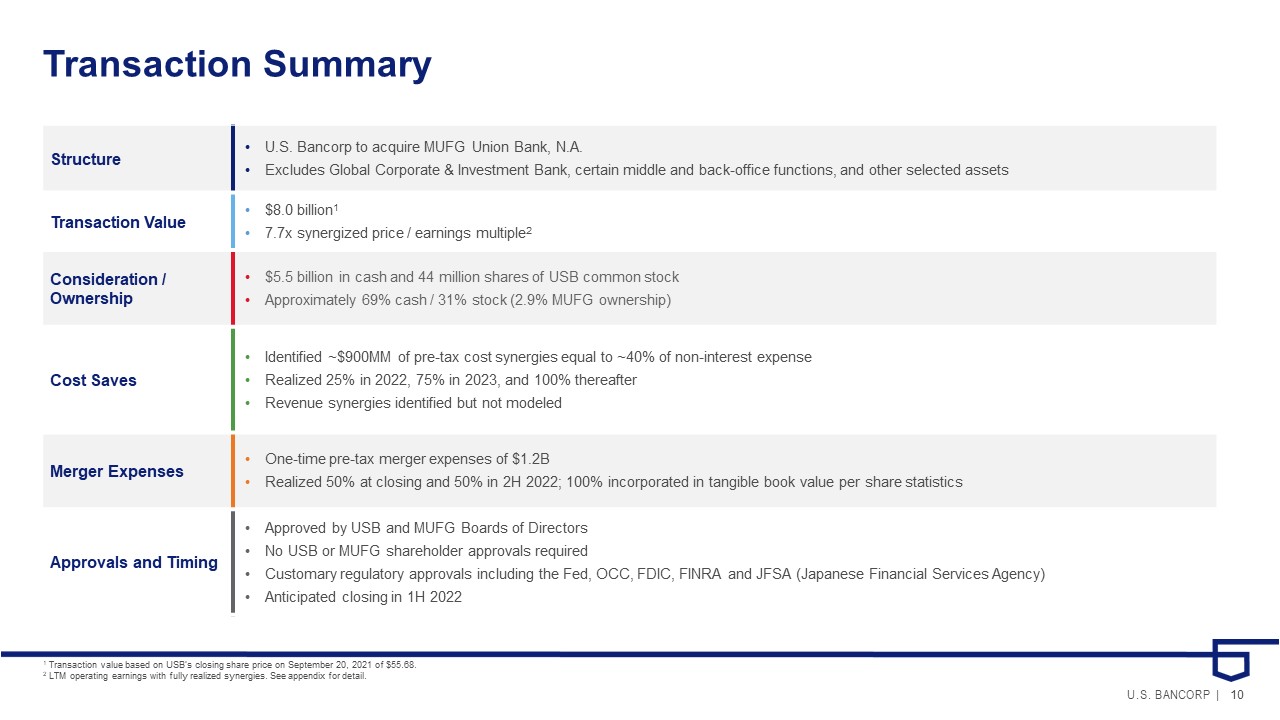

10 U.S. BANCORP | Structure • U.S. Bancorp to acquire MUFG Union Bank, N.A. • Excludes Global Corporate & Investment Bank, certain middle and back - office functions, and other selected assets Transaction Value • $8.0 billion 1 • 7.7x synergized price / earnings multiple 2 Consideration / Ownership • $5.5 billion in cash and 44 million shares of USB common stock • Approximately 69% cash / 31% stock (2.9% MUFG ownership) Cost Saves • Identified ~$900MM of pre - tax cost synergies equal to ~40% of non - interest expense • Realized 25% in 2022, 75% in 2023, and 100% thereafter • Revenue synergies identified but not modeled Merger Expenses • One - time pre - tax merger expenses of $1.2B • Realized 50% at closing and 50% in 2H 2022; 100% incorporated in tangible book value per share statistics Approvals and Timing • Approved by USB and MUFG Boards of Directors • No USB or MUFG shareholder approvals required • Customary regulatory approvals including the Fed, OCC, FDIC, FINRA and JFSA (Japanese Financial Services Agency) • Anticipated closing in 1H 2022 Transaction Summary 1 Transaction value based on USB’s closing share price on September 20, 2021 of $55.68. 2 LTM operating earnings with fully realized synergies. See appendix for detail.

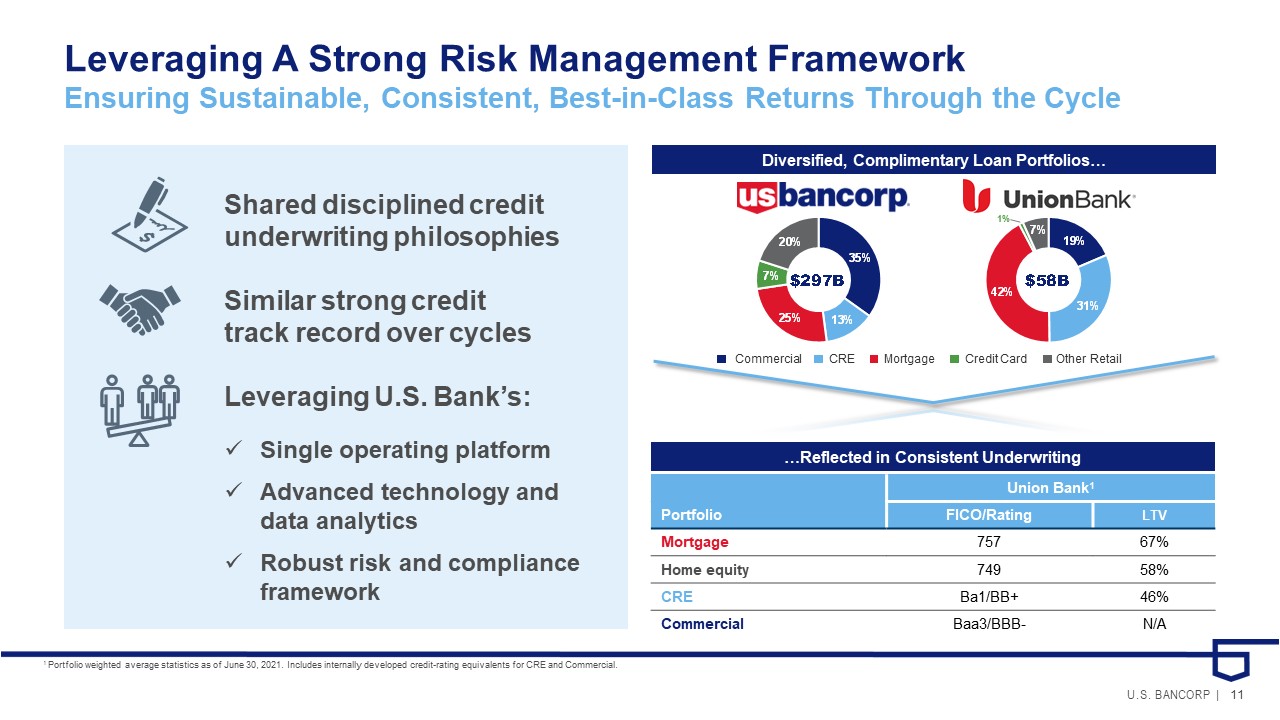

11 U.S. BANCORP | Leveraging A Strong Risk Management Framework Ensuring Sustainable, Consistent, Best - in - Class Returns Through the Cycle Union Bank 1 Portfolio FICO/Rating LTV Mortgage 757 67% Home equity 749 58% CRE Ba1/BB+ 46% Commercial Baa3/BBB - N/A Diversified, Complimentary Loan Portfolios… Commercial CRE Mortgage Credit Card Other Retail Shared disciplined credit underwriting philosophies Similar strong credit track record over cycles Leveraging U.S. Bank’s: x Single operating platform x Advanced technology and data analytics x Robust risk and compliance framework …Reflected in Consistent Underwriting 1 Portfolio weighted average statistics as of June 30, 2021. Includes internally developed credit - rating equivalents for CRE and C ommercial. 1% 35% 13% 25% 7% 20% $297B

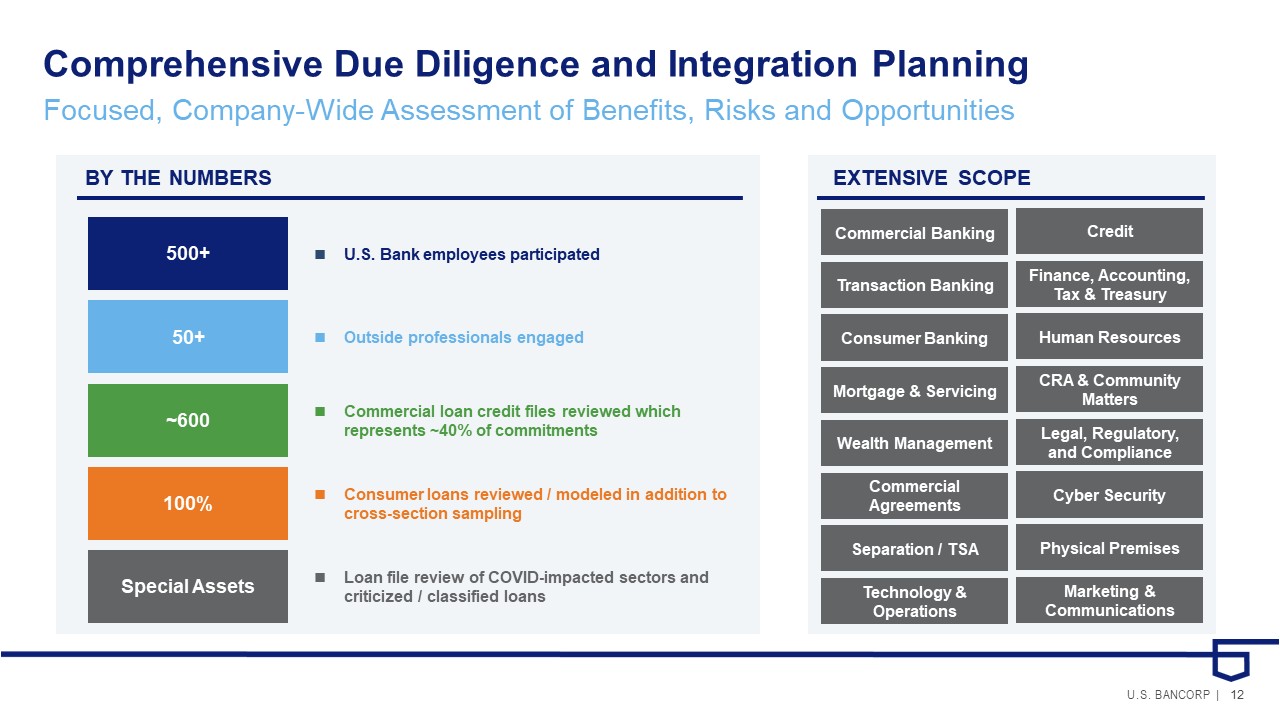

12 U.S. BANCORP | Comprehensive Due Diligence and Integration Planning Commercial Banking EXTENSIVE SCOPE BY THE NUMBERS Credit Transaction Banking Finance, Accounting, Tax & Treasury Consumer Banking Human Resources Mortgage & Servicing CRA & Community Matters Wealth Management Legal, Regulatory, and Compliance Commercial Agreements Cyber Security Separation / TSA Physical Premises Technology & Operations Marketing & Communications 500+ 50+ ~600 100% Special Assets U.S. Bank employees participated Outside professionals engaged Commercial loan credit files reviewed which represents ~40% of commitments Consumer loans reviewed / modeled in addition to cross - section sampling Loan file review of COVID - impacted sectors and criticized / classified loans Focused, Company - Wide Assessment of Benefits, Risks and Opportunities

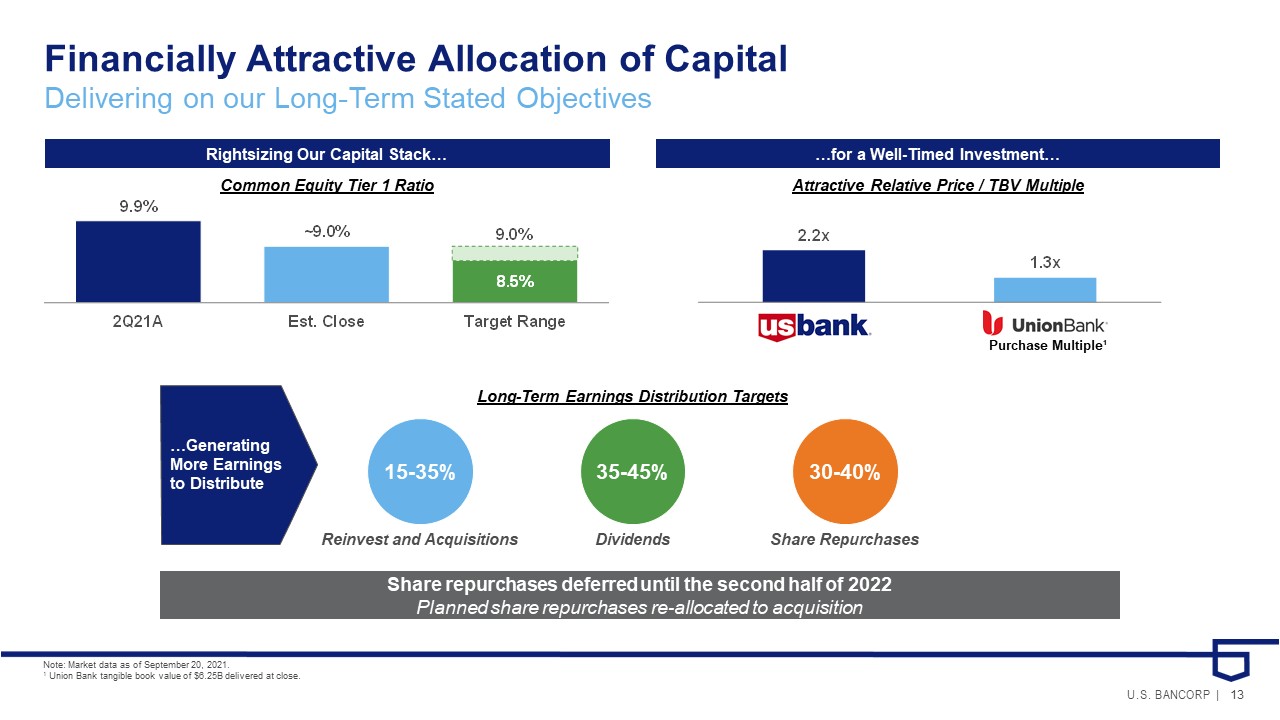

13 U.S. BANCORP | 2.2x 1.3x …for a Well - Timed Investment… Rightsizing Our Capital Stack… Common Equity Tier 1 Ratio Share repurchases deferred until the second half of 2022 Planned share repurchases re - allocated to acquisition Financially Attractive Allocation of Capital Delivering on our Long - Term Stated Objectives 30 - 40% 15 - 35% 35 - 45% Share Repurchases Reinvest and Acquisitions Dividends Long - Term Earnings Distribution Targets …Generating More Earnings to Distribute Attractive Relative Price / TBV Multiple 8.5% 9.9% ~9.0% 9.0% 2Q21A Est. Close Target Range Purchase Multiple¹ Note: Market data as of September 20, 2021. 1 Union Bank tangible book value of $6.25B delivered at close.

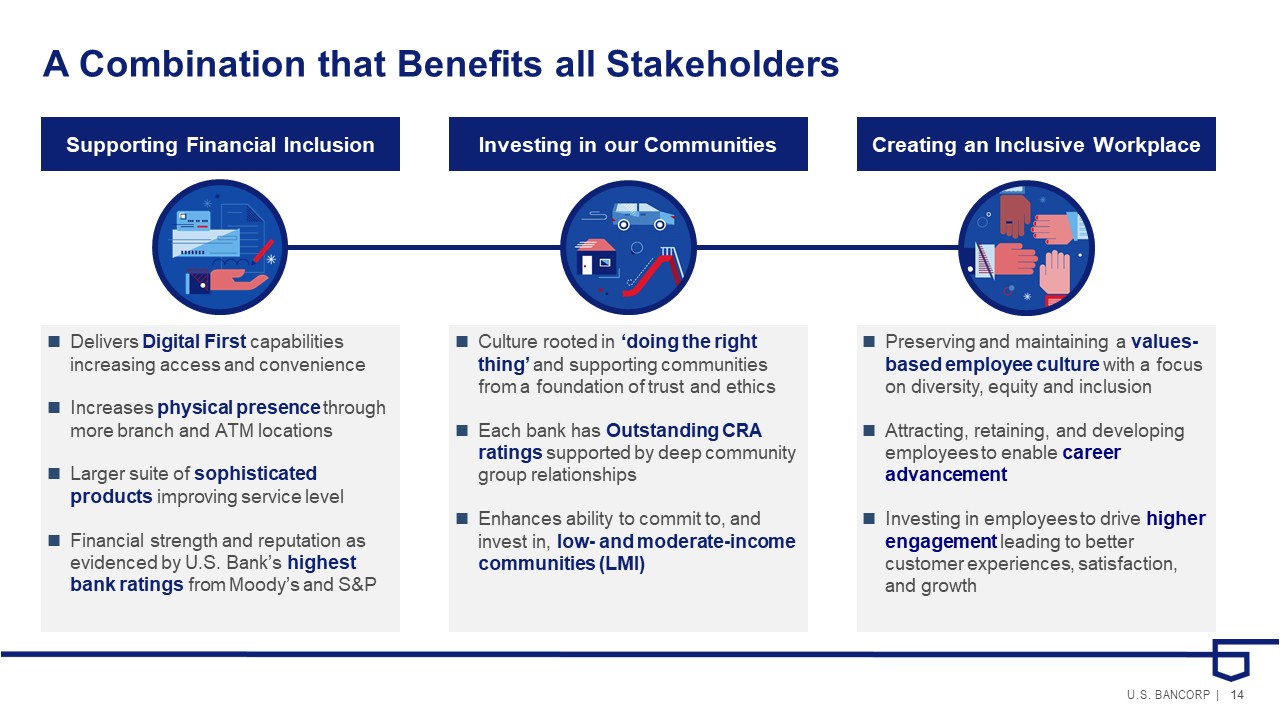

14 U.S. BANCORP | A Combination that Benefits all Stakeholders Supporting Financial Inclusion Investing in our Communities Creating an Inclusive Workplace Delivers Digital First capabilities increasing access and convenience Increases physical presence through more branch and ATM locations Larger suite of sophisticated products improving service level Financial strength and reputation as evidenced by U.S. Bank’s highest bank ratings from Moody’s and S&P Culture rooted in ‘doing the right thing’ and supporting communities from a foundation of trust and ethics Each bank has Outstanding CRA ratings supported by deep community group relationships Enhances ability to commit to, and invest in, low - and moderate - income communities (LMI) Preserving and maintaining a values - based employee culture with a focus on diversity, equity and inclusion Attracting, retaining, and developing employees to enable career advancement Investing in employees to drive higher engagement leading to better customer experiences, satisfaction, and growth

15 U.S. BANCORP | A Strategically and Financially Attractive Acquisition Meaningfully enhances scale Increases share in attractive markets Improves returns, accelerates long - term growth Creates significant value through expense synergies Opportunity to deploy broad product set and offer digital capabilities Similar customer - centric cultures and credit underwriting discipline

16 U.S. BANCORP | Appendix

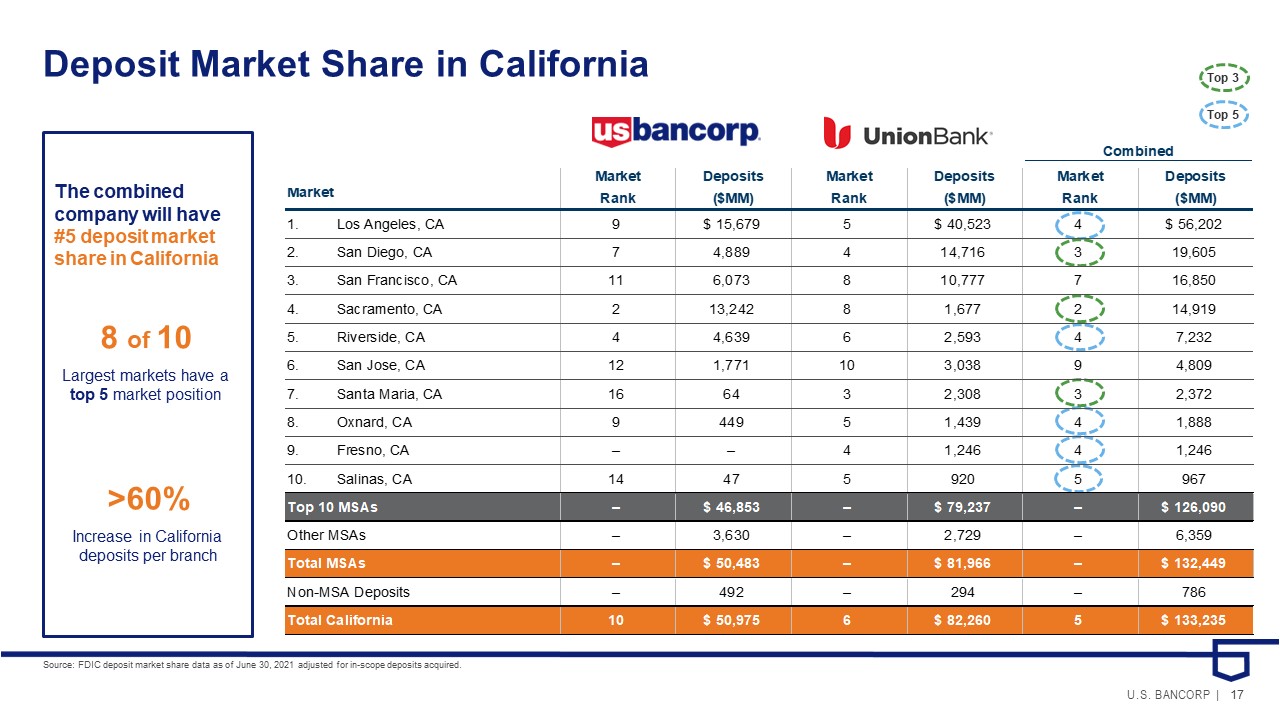

17 U.S. BANCORP | >60% Increase in California deposits per branch Deposit Market Share in California Source: FDIC deposit market share data as of June 30, 2021 adjusted for in - scope deposits acquired. 8 of 10 Largest markets have a top 5 market position The combined company will have #5 deposit market share in California Top 3 Top 5 Market Deposits Market Deposits Market Deposits Market Rank ($MM) Rank ($MM) Rank ($MM) 1. Los Angeles, CA 9 $15,679 5 $40,523 4 $56,202 2. San Diego, CA 7 4,889 4 14,716 3 19,605 3. San Francisco, CA 11 6,073 8 10,777 7 16,850 4. Sacramento, CA 2 13,242 8 1,677 2 14,919 5. Riverside, CA 4 4,639 6 2,593 4 7,232 6. San Jose, CA 12 1,771 10 3,038 9 4,809 7. Santa Maria, CA 16 64 3 2,308 3 2,372 8. Oxnard, CA 9 449 5 1,439 4 1,888 9. Fresno, CA – – 4 1,246 4 1,246 10. Salinas, CA 14 47 5 920 5 967 Top 10 MSAs – $46,853 – $79,237 – $126,090 Other MSAs – 3,630 – 2,729 – 6,359 Total MSAs – $50,483 – $81,966 – $132,449 Non-MSA Deposits – 492 – 294 – 786 Total California 10 $50,975 6 $82,260 5 $133,235 Combined

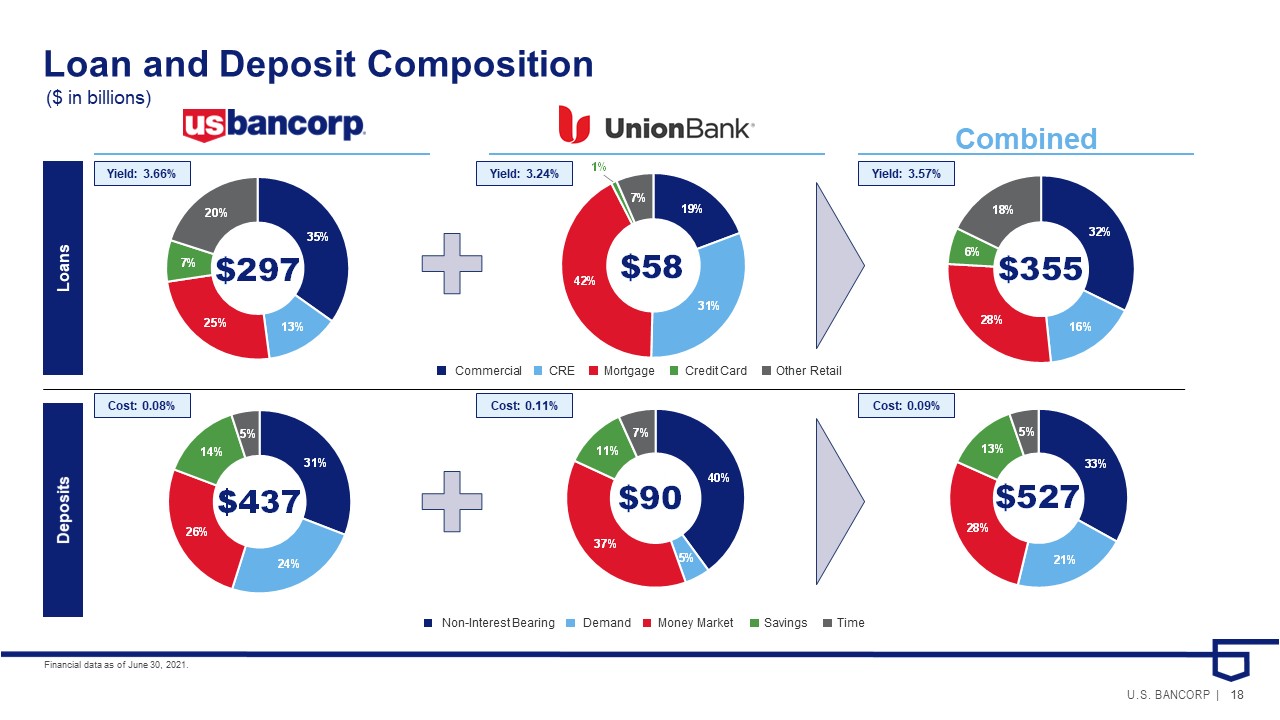

18 U.S. BANCORP | Loan and Deposit Composition Financial data as of June 30, 2021. Loans Deposits Combined ($ in billions) Yield: 3.57% Cost: 0.09% Yield: 3.24% Yield: 3.66% Cost: 0.11% Cost: 0.08% Commercial CRE Mortgage Credit Card Other Retail Non - Interest Bearing Demand Money Market Savings Time 31% 24% 26% 14% 5% $437 35% 13% 25% 7% 20% $297 19% 31% 42% 1% 7% $58 40% 5% 37% 11% 7% $90

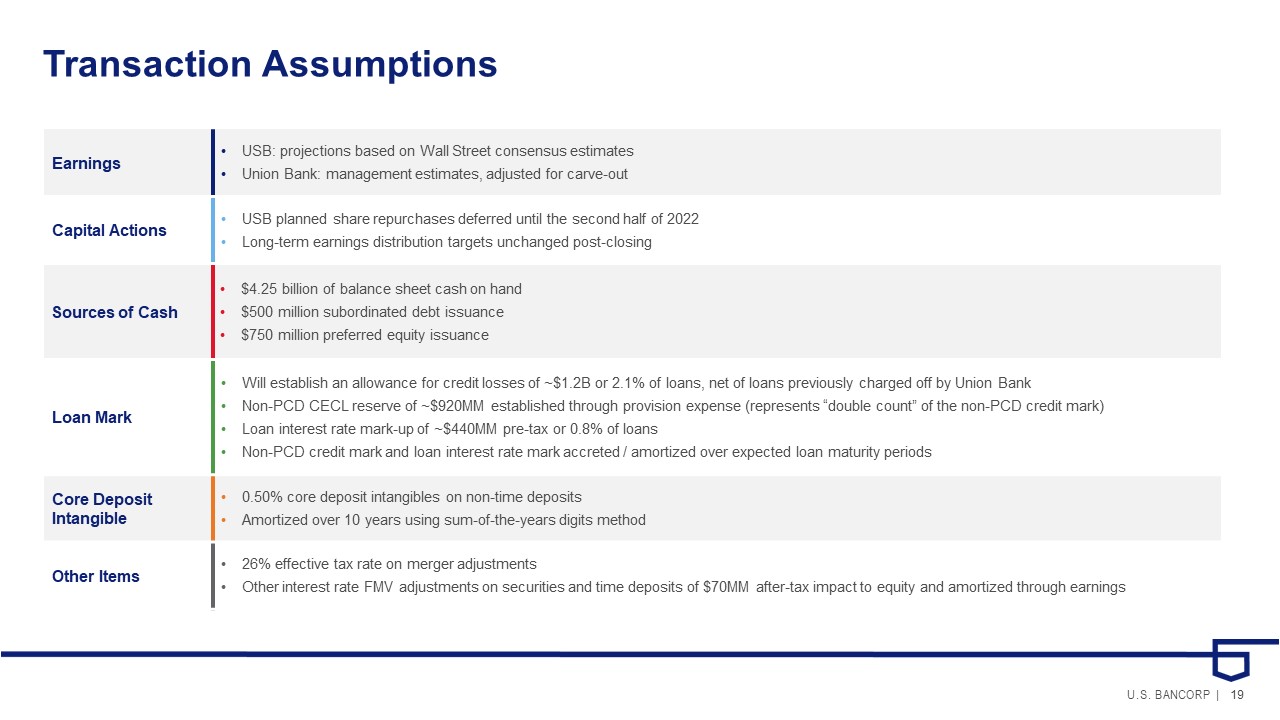

19 U.S. BANCORP | Earnings • USB: projections based on Wall Street consensus estimates • Union Bank: management estimates, adjusted for carve - out Capital Actions • USB planned share repurchases deferred until the second half of 2022 • Long - term earnings distribution targets unchanged post - closing Sources of Cash • $4.25 billion of balance sheet cash on hand • $500 million subordinated debt issuance • $750 million preferred equity issuance Loan Mark • Will establish an allowance for credit losses of ~$1.2B or 2.1% of loans, net of loans previously charged off by Union Bank • Non - PCD CECL reserve of ~$920MM established through provision expense (represents “double count” of the non - PCD credit mark) • Loan interest rate mark - up of ~$440MM pre - tax or 0.8% of loans • Non - PCD credit mark and loan interest rate mark accreted / amortized over expected loan maturity periods Core Deposit Intangible • 0.50% core deposit intangibles on non - time deposits • Amortized over 10 years using sum - of - the - years digits method Other Items • 26% effective tax rate on merger adjustments • Other interest rate FMV adjustments on securities and time deposits of $70MM after - tax impact to equity and amortized through earnings Transaction Assumptions

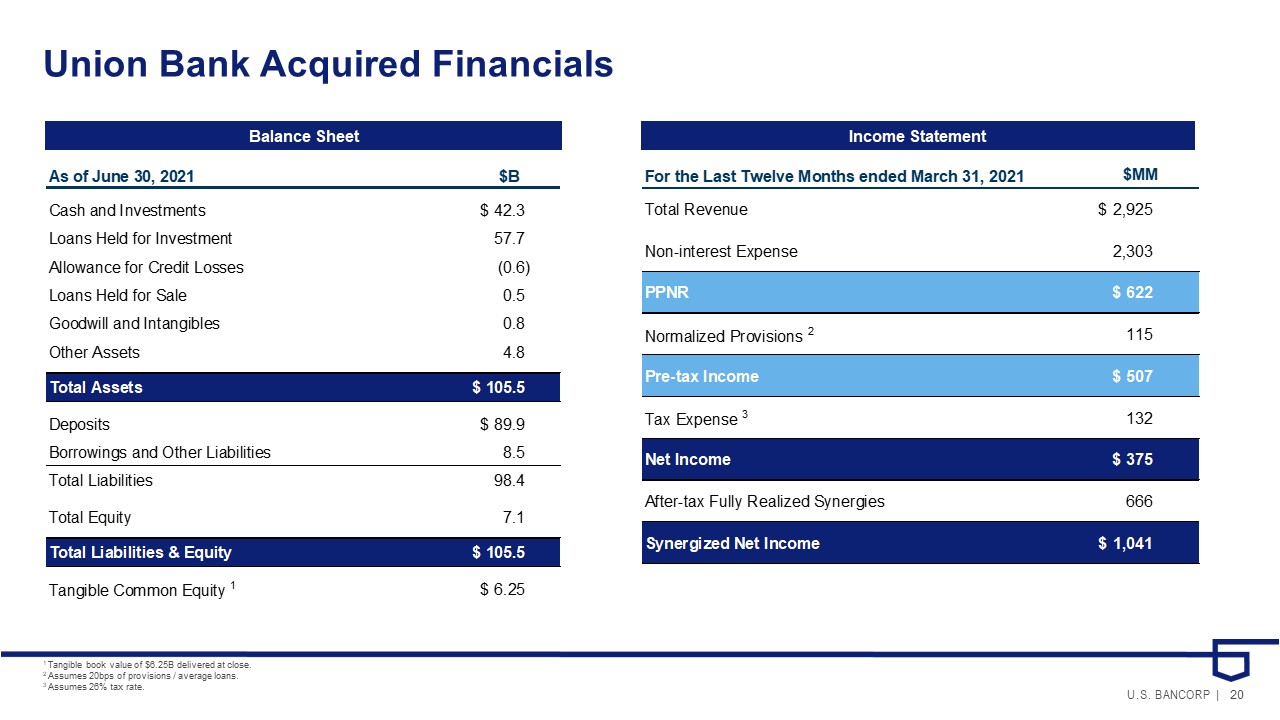

20 U.S. BANCORP | Union Bank Acquired Financials 1 Tangible book value of $6.25B delivered at close. 2 Assumes 20bps of provisions / a verage loans. 3 Assumes 26% tax rate. Income Statement Balance Sheet For the Last Twelve Months ended March 31, 2021 $MM Total Revenue $2,925 Non-interest Expense 2,303 PPNR $622 Normalized Provisions 2 115 Pre-tax Income $507 Tax Expense 3 132 Net Income $375 After-tax Fully Realized Synergies 666 Synergized Net Income $1,041 As of June 30, 2021 $B Cash and Investments $42.3 Loans Held for Investment 57.7 Allowance for Credit Losses (0.6) Loans Held for Sale 0.5 Goodwill and Intangibles 0.8 Other Assets 4.8 Total Assets $105.5 Deposits $89.9 Borrowings and Other Liabilities 8.5 Total Liabilities 98.4 Total Equity 7.1 Total Liabilities & Equity $105.5 Tangible Common Equity 1 $6.25