Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Great Elm Group, Inc. | geg-8k_20210920.htm |

| EX-99.1 - EX-99.1 - Great Elm Group, Inc. | geg-ex991_24.htm |

Great Elm Group, Inc. Conference Call Presentation Fiscal Fourth Quarter and Year Ended June 30, 2021 September 20, 2021 NASDAQ: GEG Exhibit 99.2

Disclaimer Statements in this press release that are “forward-looking” statements, including statements regarding expected growth, profitability, acquisition opportunities and outlook involve risks and uncertainties that may individually or collectively impact the matters described herein. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made and represent Great Elm’s assumptions and expectations in light of currently available information. These statements involve risks, variables and uncertainties, and Great Elm’s actual performance results may differ from those projected, and any such differences may be material. For information on certain factors that could cause actual events or results to differ materially from Great Elm’s expectations, please see Great Elm’s filings with the SEC, including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Additional information relating to Great Elm’s financial position and results of operations is also contained in Great Elm’s annual and quarterly reports filed with the SEC and available for download at its website www.greatelmgroup.com or at the SEC website www.sec.gov. Non-GAAP Financial Measures The SEC has adopted rules to regulate the use in filings with the SEC, and in public disclosures, of financial measures that are not in accordance with US GAAP, such as adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) and free cash flow. See the Appendix for important information regarding the use of non-GAAP financial measures and reconciliations of non-GAAP measures to their most directly comparable GAAP measures. This presentation does not constitute an offer of any securities for sale. 2

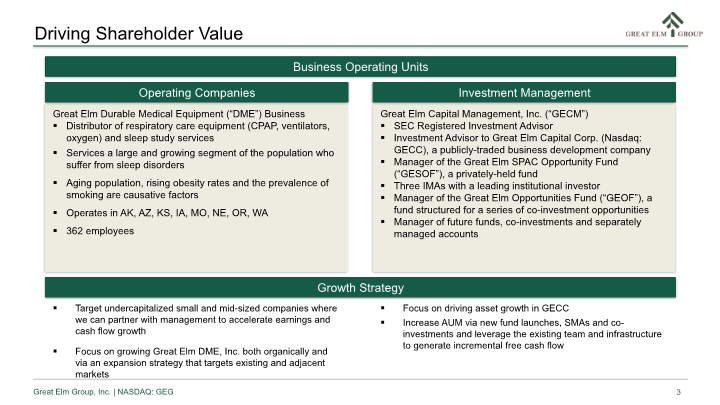

Driving Shareholder Value Growth Strategy Target undercapitalized small and mid-sized companies where we can partner with management to accelerate earnings and cash flow growth Focus on growing Great Elm DME, Inc. both organically and via an expansion strategy that targets existing and adjacent markets Great Elm Capital Management, Inc. (“GECM”) SEC Registered Investment Advisor Investment Advisor to Great Elm Capital Corp. (Nasdaq: GECC), a publicly-traded business development company Manager of the Great Elm SPAC Opportunity Fund (“GESOF”), a privately-held fund Three IMAs with a leading institutional investor Manager of the Great Elm Opportunities Fund (“GEOF”), a fund structured for a series of co-investment opportunities Manager of future funds, co-investments and separately managed accounts Investment Management Great Elm Durable Medical Equipment (“DME”) Business Distributor of respiratory care equipment (CPAP, ventilators, oxygen) and sleep study services Services a large and growing segment of the population who suffer from sleep disorders Aging population, rising obesity rates and the prevalence of smoking are causative factors Operates in AK, AZ, KS, IA, MO, NE, OR, WA 362 employees Operating Companies Business Operating Units Focus on driving asset growth in GECC Increase AUM via new fund launches, SMAs and co-investments and leverage the existing team and infrastructure to generate incremental free cash flow 3

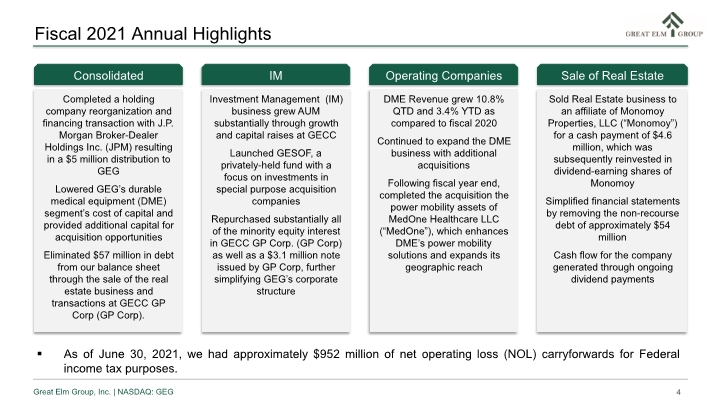

Fiscal 2021 Annual Highlights As of June 30, 2021, we had approximately $952 million of net operating loss (NOL) carryforwards for Federal income tax purposes. Completed a holding company reorganization and financing transaction with J.P. Morgan Broker-Dealer Holdings Inc. (JPM) resulting in a $5 million distribution to GEG Lowered GEG’s durable medical equipment (DME) segment’s cost of capital and provided additional capital for acquisition opportunities Eliminated $57 million in debt from our balance sheet through the sale of the real estate business and transactions at GECC GP Corp (GP Corp). Consolidated Sold Real Estate business to an affiliate of Monomoy Properties, LLC (“Monomoy”) for a cash payment of $4.6 million, which was subsequently reinvested in dividend-earning shares of Monomoy Simplified financial statements by removing the non-recourse debt of approximately $54 million Cash flow for the company generated through ongoing dividend payments Sale of Real Estate DME Revenue grew 10.8% QTD and 3.4% YTD as compared to fiscal 2020 Continued to expand the DME business with additional acquisitions Following fiscal year end, completed the acquisition the power mobility assets of MedOne Healthcare LLC (“MedOne”), which enhances DME’s power mobility solutions and expands its geographic reach Operating Companies Investment Management (IM) business grew AUM substantially through growth and capital raises at GECC Launched GESOF, a privately-held fund with a focus on investments in special purpose acquisition companies Repurchased substantially all of the minority equity interest in GECC GP Corp. (GP Corp) as well as a $3.1 million note issued by GP Corp, further simplifying GEG’s corporate structure IM 4

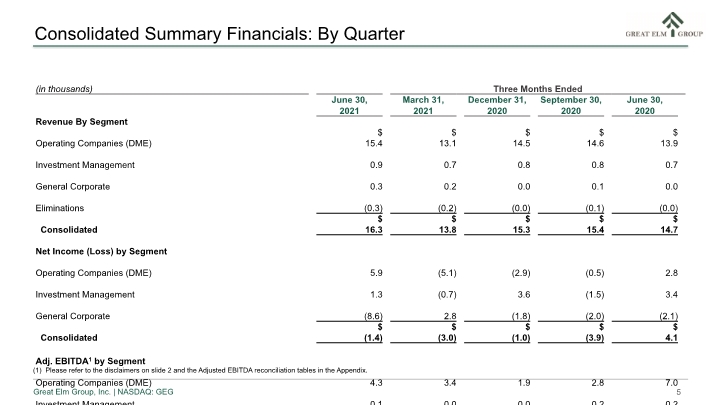

(1) Please refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix. Consolidated Summary Financials: By Quarter 5

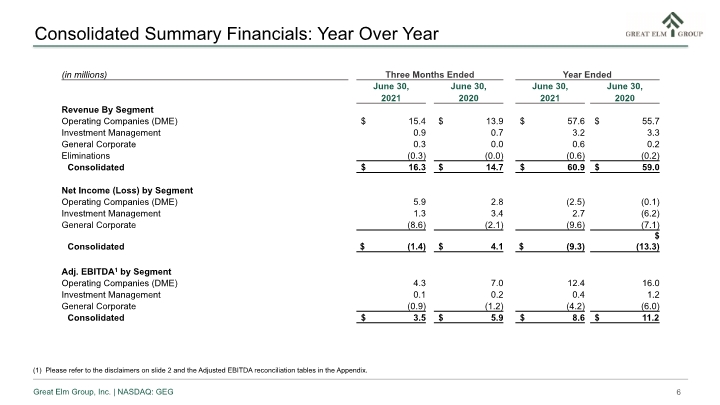

Consolidated Summary Financials: Year Over Year (1) Please refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix. 6

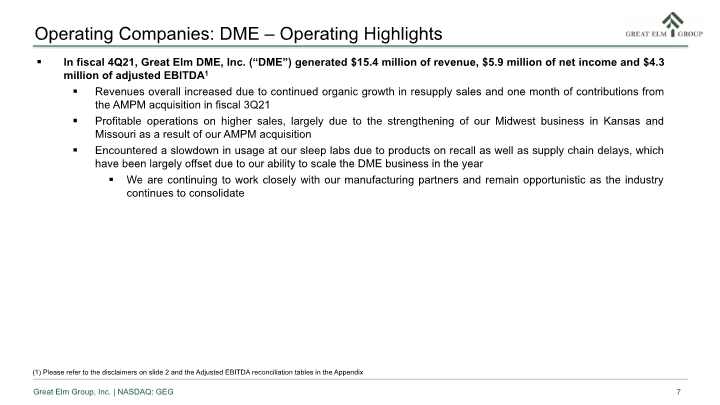

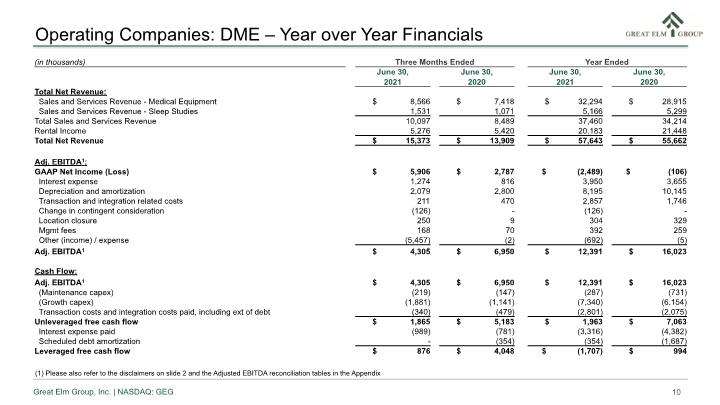

In fiscal 4Q21, Great Elm DME, Inc. (“DME”) generated $15.4 million of revenue, $5.9 million of net income and $4.3 million of adjusted EBITDA1 Revenues overall increased due to continued organic growth in resupply sales and one month of contributions from the AMPM acquisition in fiscal 3Q21 Profitable operations on higher sales, largely due to the strengthening of our Midwest business in Kansas and Missouri as a result of our AMPM acquisition Encountered a slowdown in usage at our sleep labs due to products on recall as well as supply chain delays, which have been largely offset due to our ability to scale the DME business in the year We are continuing to work closely with our manufacturing partners and remain opportunistic as the industry continues to consolidate (1) Please refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 7 Operating Companies: DME – Operating Highlights

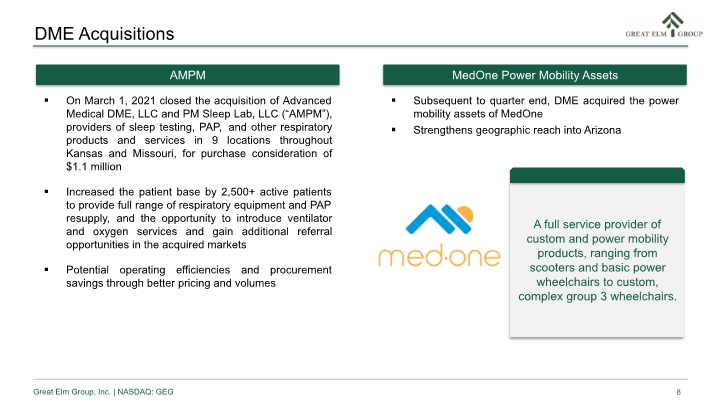

Subsequent to quarter end, DME acquired the power mobility assets of MedOne Strengthens geographic reach into Arizona 8 DME Acquisitions On March 1, 2021 closed the acquisition of Advanced Medical DME, LLC and PM Sleep Lab, LLC (“AMPM”), providers of sleep testing, PAP, and other respiratory products and services in 9 locations throughout Kansas and Missouri, for purchase consideration of $1.1 million Increased the patient base by 2,500+ active patients to provide full range of respiratory equipment and PAP resupply, and the opportunity to introduce ventilator and oxygen services and gain additional referral opportunities in the acquired markets Potential operating efficiencies and procurement savings through better pricing and volumes AMPM MedOne Power Mobility Assets

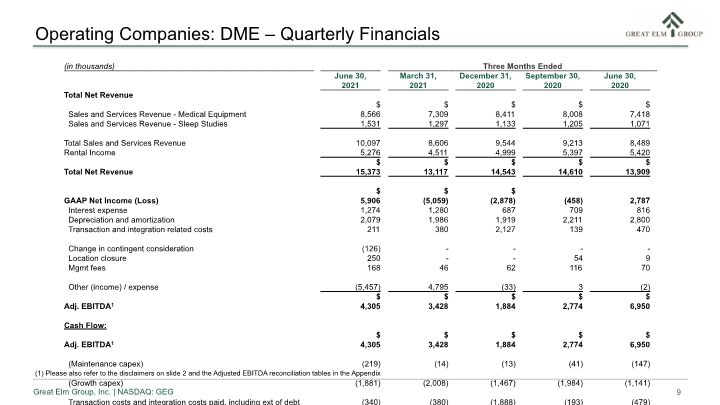

Operating Companies: DME – Quarterly Financials (1) Please also refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 9

Operating Companies: DME – Year over Year Financials (1) Please also refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 10

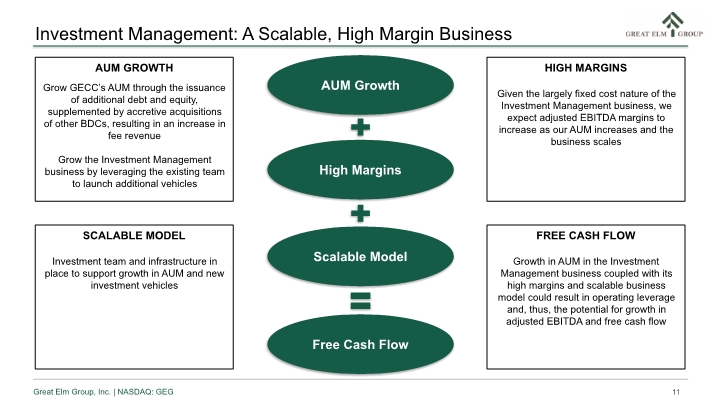

AUM Growth High Margins Scalable Model Free Cash Flow AUM GROWTH Grow GECC’s AUM through the issuance of additional debt and equity, supplemented by accretive acquisitions of other BDCs, resulting in an increase in fee revenue Grow the Investment Management business by leveraging the existing team to launch additional vehicles HIGH MARGINS Given the largely fixed cost nature of the Investment Management business, we expect adjusted EBITDA margins to increase as our AUM increases and the business scales SCALABLE MODEL Investment team and infrastructure in place to support growth in AUM and new investment vehicles FREE CASH FLOW Growth in AUM in the Investment Management business coupled with its high margins and scalable business model could result in operating leverage and, thus, the potential for growth in adjusted EBITDA and free cash flow 11 Investment Management: A Scalable, High Margin Business

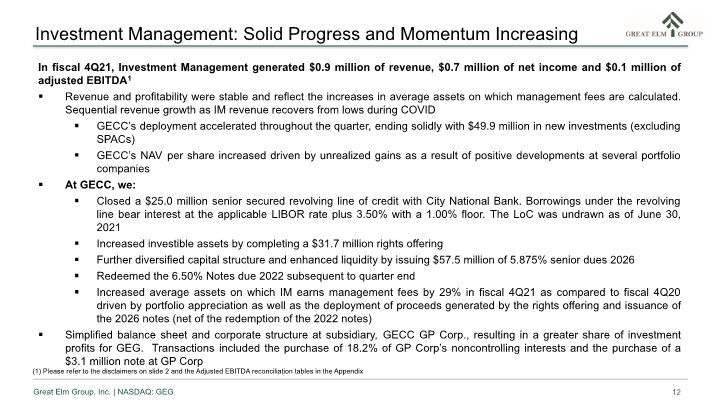

In fiscal 4Q21, Investment Management generated $0.9 million of revenue, $0.7 million of net income and $0.1 million of adjusted EBITDA1 Revenue and profitability were stable and reflect the increases in average assets on which management fees are calculated. Sequential revenue growth as IM revenue recovers from lows during COVID GECC’s deployment accelerated throughout the quarter, ending solidly with $49.9 million in new investments (excluding SPACs) GECC’s NAV per share increased driven by unrealized gains as a result of positive developments at several portfolio companies At GECC, we: Closed a $25.0 million senior secured revolving line of credit with City National Bank. Borrowings under the revolving line bear interest at the applicable LIBOR rate plus 3.50% with a 1.00% floor. The LoC was undrawn as of June 30, 2021 Increased investible assets by completing a $31.7 million rights offering Further diversified capital structure and enhanced liquidity by issuing $57.5 million of 5.875% senior dues 2026 Redeemed the 6.50% Notes due 2022 subsequent to quarter end Increased average assets on which IM earns management fees by 29% in fiscal 4Q21 as compared to fiscal 4Q20 driven by portfolio appreciation as well as the deployment of proceeds generated by the rights offering and issuance of the 2026 notes (net of the redemption of the 2022 notes) Simplified balance sheet and corporate structure at subsidiary, GECC GP Corp., resulting in a greater share of investment profits for GEG. Transactions included the purchase of 18.2% of GP Corp’s noncontrolling interests and the purchase of a $3.1 million note at GP Corp (1) Please refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 12 Investment Management: Solid Progress and Momentum Increasing

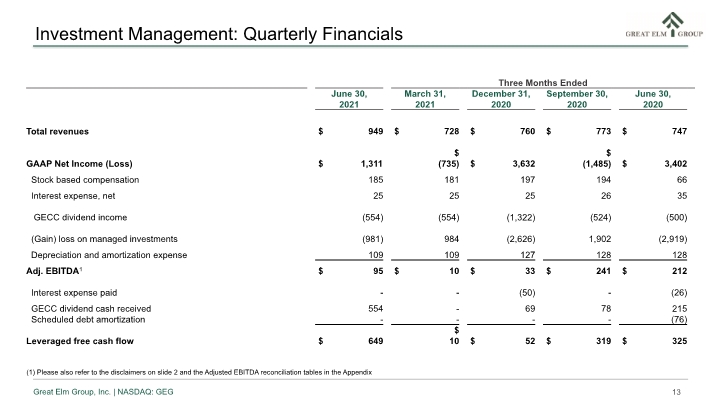

(1) Please also refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 13 Investment Management: Quarterly Financials

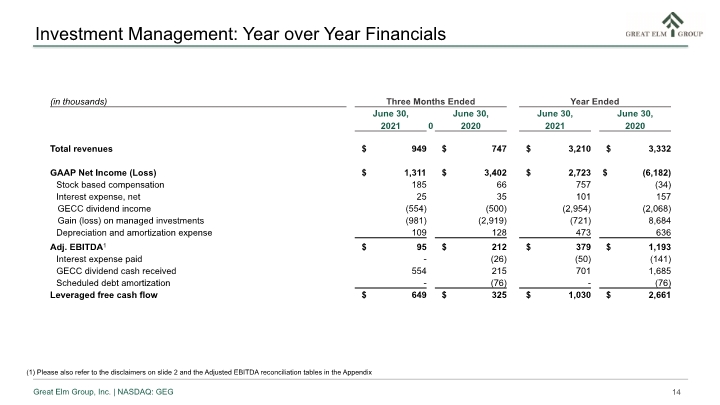

(1) Please also refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 14 Investment Management: Year over Year Financials

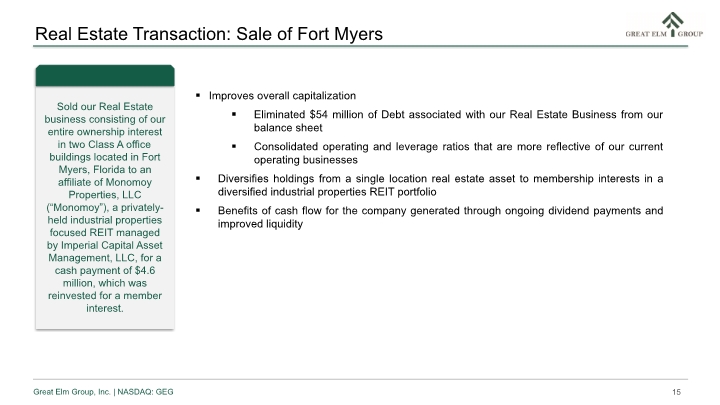

15 Sold our Real Estate business consisting of our entire ownership interest in two Class A office buildings located in Fort Myers, Florida to an affiliate of Monomoy Properties, LLC (“Monomoy”), a privately-held industrial properties focused REIT managed by Imperial Capital Asset Management, LLC, for a cash payment of $4.6 million, which was reinvested for a member interest. Improves overall capitalization Eliminated $54 million of Debt associated with our Real Estate Business from our balance sheet Consolidated operating and leverage ratios that are more reflective of our current operating businesses Diversifies holdings from a single location real estate asset to membership interests in a diversified industrial properties REIT portfolio Benefits of cash flow for the company generated through ongoing dividend payments and improved liquidity Real Estate Transaction: Sale of Fort Myers

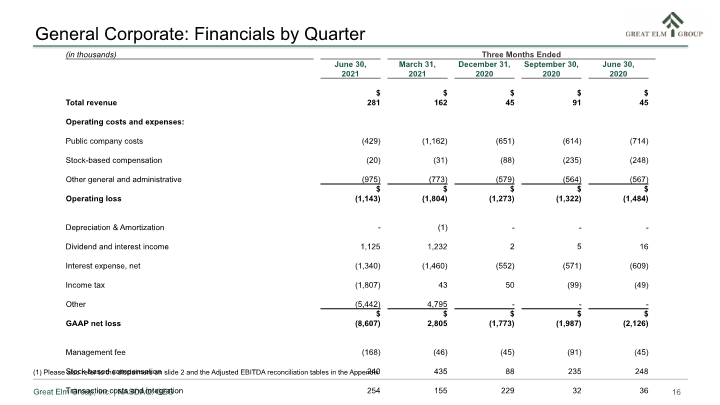

(1) Please also refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 16 General Corporate: Financials by Quarter

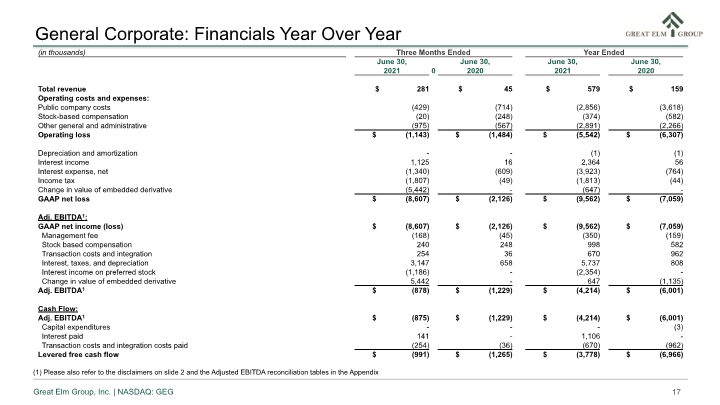

(1) Please also refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 17 General Corporate: Financials Year Over Year

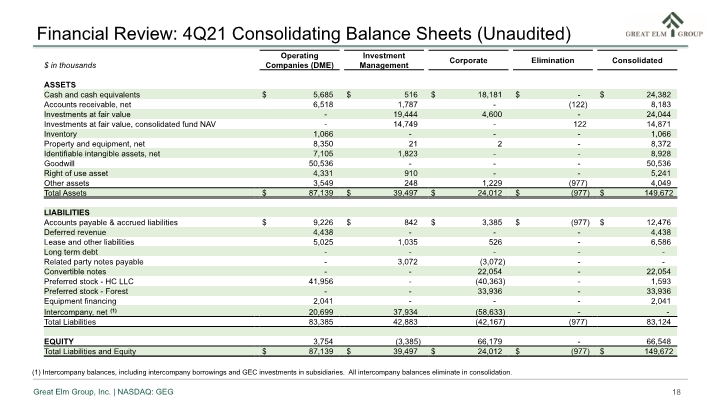

Financial Review: 4Q21 Consolidating Balance Sheets (Unaudited) (1) Intercompany balances, including intercompany borrowings and GEC investments in subsidiaries. All intercompany balances eliminate in consolidation. 18

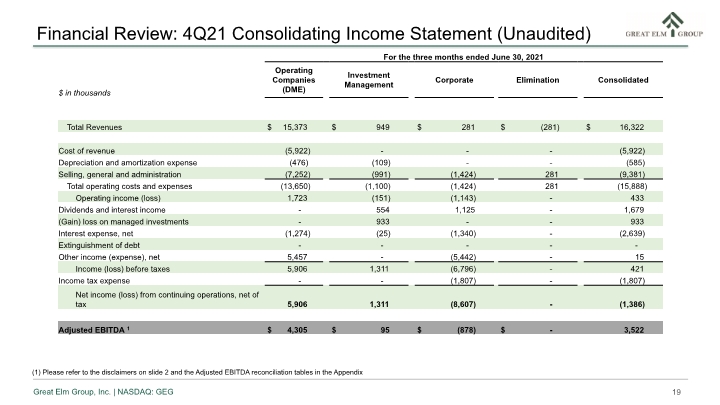

(1) Please refer to the disclaimers on slide 2 and the Adjusted EBITDA reconciliation tables in the Appendix 19 Financial Review: 4Q21 Consolidating Income Statement (Unaudited)

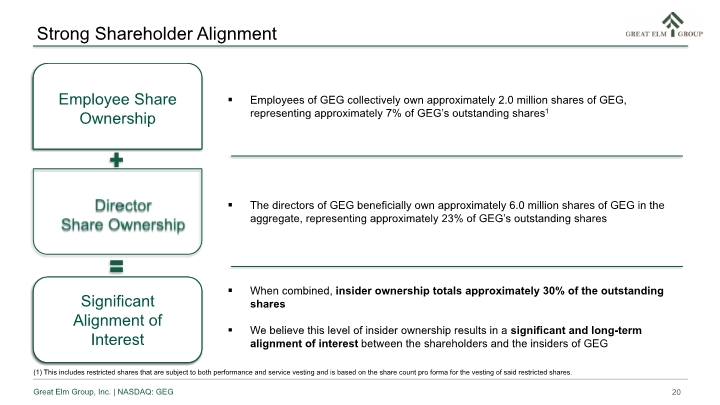

Employee Share Ownership Significant Alignment of Interest Director Share Ownership Employees of GEG/Great Elm Capital Management, Inc. (“GECM”) collectively own approximately 1.9 million shares of GEG, representing approximately 7% of GEG’s outstanding shares1 The directors of GEG beneficially own approximately 5.2 million shares of GEG in the aggregate, representing approximately 20% of GEG’s outstanding shares When combined, insider ownership totals approximately 27% of the outstanding shares We believe this level of insider ownership results in a significant and long-term alignment of interest between the shareholders and the insiders of GEG (1) This includes restricted shares that are subject to both performance and service vesting and is based on the share count pro forma for the vesting of said restricted shares. Employee Share Ownership Significant Alignment of Interest Employees of GEG collectively own approximately 2.0 million shares of GEG, representing approximately 7% of GEG’s outstanding shares1 The directors of GEG beneficially own approximately 6.0 million shares of GEG in the aggregate, representing approximately 23% of GEG’s outstanding shares When combined, insider ownership totals approximately 30% of the outstanding shares We believe this level of insider ownership results in a significant and long-term alignment of interest between the shareholders and the insiders of GEG 20 Strong Shareholder Alignment

Appendix 21

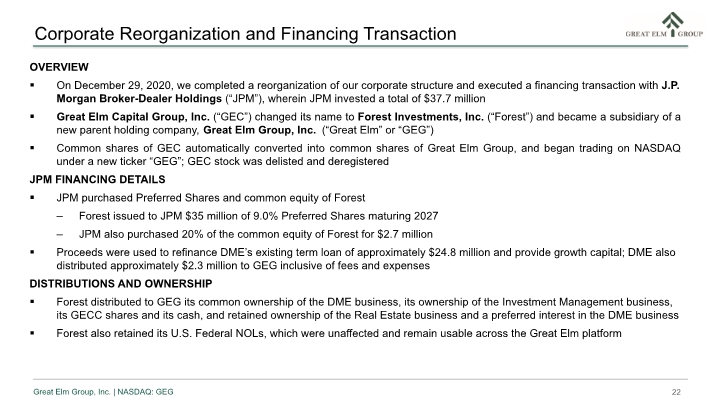

Corporate Reorganization and Financing Transaction Overview On December 29, 2020, we completed a reorganization of our corporate structure and executed a financing transaction with J.P. Morgan Broker-Dealer Holdings (“JPM”), wherein JPM invested a total of $37.7 million Great Elm Capital Group, Inc. (“GEC”) changed its name to Forest Investments, Inc. (“Forest”) and became a subsidiary of a new parent holding company, Great Elm Group, Inc. (“Great Elm” or “GEG”) Common shares of GEC automatically converted into common shares of Great Elm Group, and began trading on NASDAQ under a new ticker “GEG”; GEC stock was delisted and deregistered JPM Financing Details JPM purchased Preferred Shares and common equity of Forest Forest issued to JPM $35 million of 9.0% Preferred Shares maturing 2027 JPM also purchased 20% of the common equity of Forest for $2.7 million Proceeds were used to refinance DME’s existing term loan of approximately $24.8 million and provide growth capital; DME also distributed approximately $2.3 million to GEG inclusive of fees and expenses Distributions and Ownership Forest distributed to GEG its common ownership of the DME business, its ownership of the Investment Management business, its GECC shares and its cash, and retained ownership of the Real Estate business and a preferred interest in the DME business Forest also retained its U.S. Federal NOLs, which were unaffected and remain usable across the Great Elm platform 22

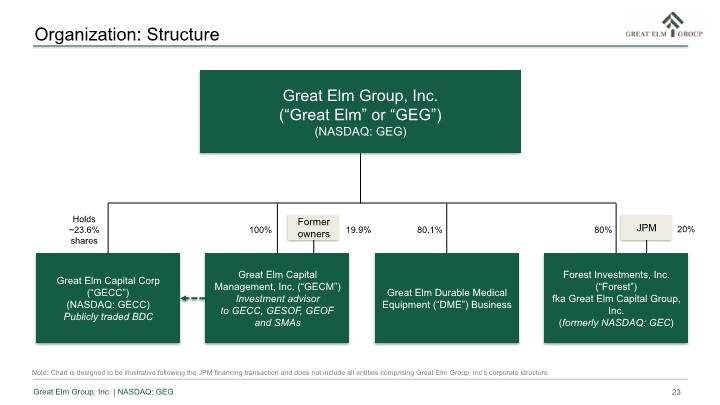

Organization: Structure Great Elm Group, Inc. (“Great Elm” or “GEG”) (NASDAQ: GEG) Great Elm Capital Management, Inc. (“GECM”) Investment advisor to GECC, GESOF, GEOF and SMAs Great Elm Capital Corp (“GECC”) (NASDAQ: GECC) Publicly traded BDC Great Elm Durable Medical Equipment (“DME”) Business Forest Investments, Inc. (“Forest”) fka Great Elm Capital Group, Inc. (formerly NASDAQ: GEC) 80% Holds ~23.6% shares 100% 80.1% Former owners 19.9% JPM 20% Note: Chart is designed to be illustrative following the JPM financing transaction and does not include all entities comprising Great Elm Group, Inc’s corporate structure. 23

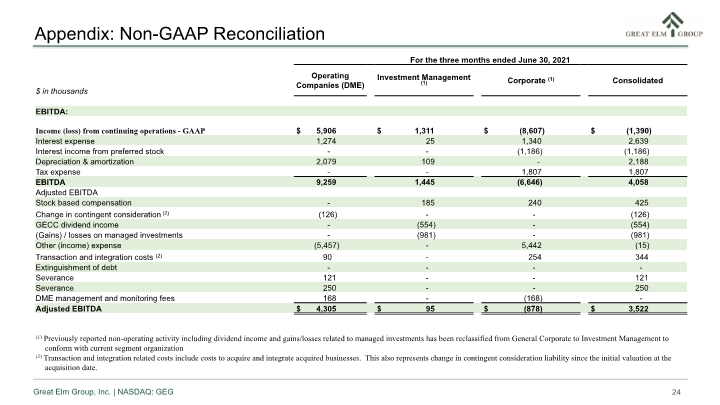

24 Appendix: Non-GAAP Reconciliation

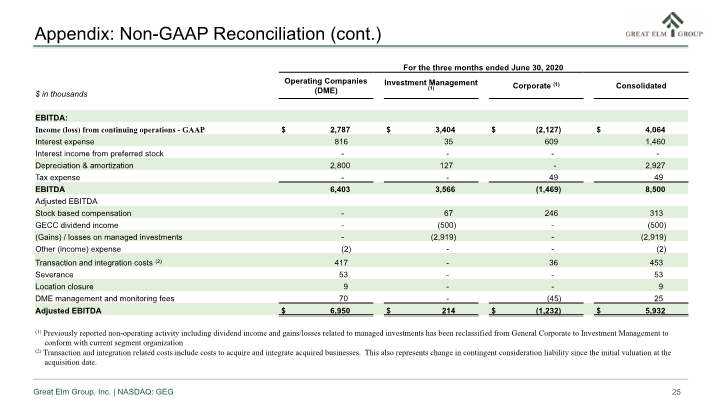

25 Appendix: Non-GAAP Reconciliation (cont.)

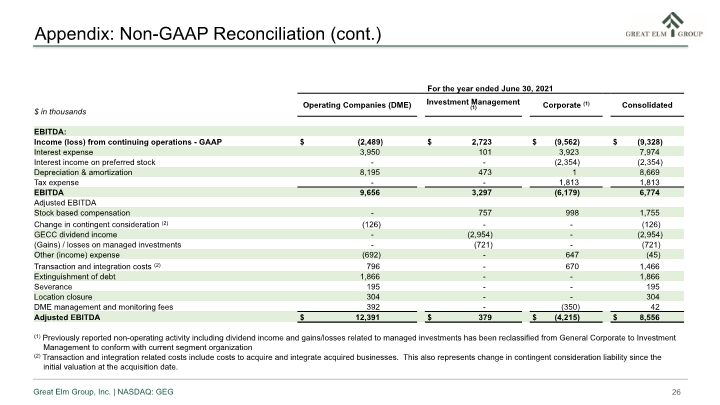

26 Appendix: Non-GAAP Reconciliation (cont.)

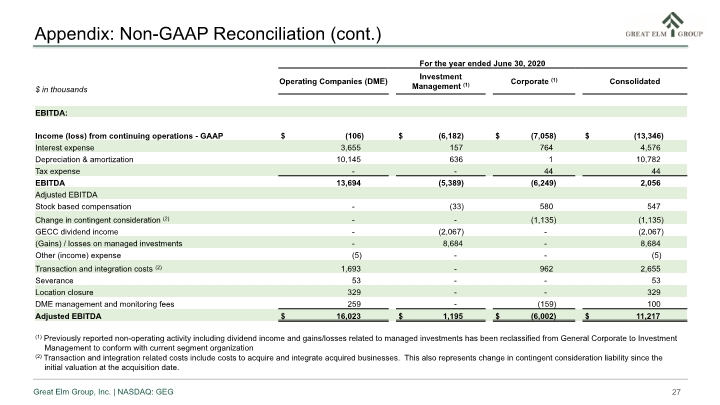

27 Appendix: Non-GAAP Reconciliation (cont.)

Investor Relations 800 South Street, Suite 230 Waltham, MA 02453 Phone: +1 (617) 375-3006 investorrelations@greatelmcap.com Adam Prior The Equity Group Inc. +1 (212) 836-9606 aprior@equityny.com 28 Appendix: Contact Information