Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - GERMAN AMERICAN BANCORP, INC. | tm2127353d1_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - GERMAN AMERICAN BANCORP, INC. | tm2127353d1_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - GERMAN AMERICAN BANCORP, INC. | tm2127353d1_ex2-1.htm |

| 8-K - FORM 8-K - GERMAN AMERICAN BANCORP, INC. | tm2127353d1_8k.htm |

Exhibit 99.2

| Symbol: GABC September 2021 Merger with Citizens Union Bancorp of Shelbyville, Inc. Shelbyville, Kentucky 1 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation contains forward‐looking statements made pursuant to the safe‐harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward‐looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. These forward‐looking statements include, but are not limited to, statements relating to the expected timing and benefits of the proposed merger (the “Merger”) between German American Bancorp, Inc.(“German American”) and Citizens Union Bancorp of Shelbyville, Inc.(“Citizens Union”), including future financial and operating results, cost savings, enhanced revenues, and accretion/dilution to reported earnings that may be realized from the Merger, as well as other statements of expectations regarding the Merger, and other statements of German American’s goals, intentions and expectations; statements regarding German American’s business plan and growth strategies; statements regarding the asset quality of German American’s loan and investment portfolios; and estimates of German American’s risks and future costs and benefits, whether with respect to the Merger or otherwise. These forward‐looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward‐looking statements, including, among other things: the risk that the businesses of German American and Citizens Union Bancorp will not be integrated successfully or such integration may be more difficult, time‐consuming or costly than expected; expected revenue synergies and cost savings from the Merger may not be fully realized or realized within the expected time frame; revenues following the Merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the Merger; the ability to obtain required regulatory approvals or the approval of Citizens Union Bancorp’s shareholders, and the ability to complete the Merger on the expected timeframe; the costs and effects of litigation and the possible unexpected or adverse outcomes of such litigation; possible changes in economic and business conditions; the severity and duration of the COVID-19 pandemic and its impact on general economic and financial market conditions and our business, results of operations and financial condition; the existence or exacerbation of general geopolitical instability and uncertainty; the ability of German American to complete integration and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the creditworthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like German American’s affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; changes in market, economic, operational, liquidity, credit and interest rate risks associated with German American’s business; and other risks and factors identified in German American’s filings with the Securities and Exchange Commission. German American does not undertake any obligation to update any forward‐looking statement, whether written or oral, relating to the matters discussed in this presentation. In addition, German American’s and Citizens Union Bancorp’s past results of operations do not necessarily indicate either of their anticipated future results, whether the Merger is effectuated or not. |

| ADDITIONAL INFORMATION FOR INVESTORS Communications in this presentation do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy vote or approval. The Merger will be submitted to the Citizens Union Bancorp’s shareholders for their consideration. In connection therewith, German American will file a Registration Statement on Form S-4 with the Securities and Exchange Commission (“SEC”) that will include a proxy statement for Citizens Union Bancorp and a prospectus for German American, as well as other relevant documents concerning the Merger. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE CORRESPONDING PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, TOGETHER WITH ALL AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, AS THEY WILL CONTAIN IMPORTANT INFORMATION. You will be able to obtain a copy of the proxy statement/prospectus (once filed), as well as other filings containing information about German American, without charge, at the SEC's website (http://www.sec.gov). You may also obtain these documents, without charge, by accessing German American’s Web site (http://www.germanamerican.com) under the tab “Investor Relations” and then under the heading “Financial Information.” Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus can also be obtained, without charge, by directing a request to Terri A. Eckerle, Shareholder Relations, German American Bancorp, Inc., 711 Main Street, Box 810, Jasper, Indiana 47546, telephone 812-482-1314 or to Mr. David Bowling, CEO, Citizens Union Bancorp, 1854 Midland Trail Shelbyville, KY 40065. German American and Citizens Union Bancorp and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Citizens Union Bancorp in connection with the Merger. Information regarding the interests of those persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. |

| Transaction Highlights 4 • Attractive addition to German American franchise: – Expands GABC’s market share position in the attractive Louisville, KY market (1) • Tripling market share to 2.47%, a top-10 overall market share position in a major metro market • Increases German American’s deposit market share rank to #4 of banks with less than $20 billion assets • Logical expansion within the Louisville market, enhancing the Company’s existing Indiana footprint and Louisville Commercial LPO • Further expands German American’s Kentucky footprint following upon the Citizens First Corp. merger in 2019 and First Security, Inc. merger in 2018 – Complimentary community banking model & culture with opportunity to expand relationships with Citizens Union customers – Retention of key Citizens Union personnel - David Bowling (current CEO) and Darryl Traylor (current President) will assume regional roles in a senior advisory capacity as Regional Chairman and Vice Chairman, respectively • Financially Compelling: – ~14% accretive to first full year EPS(2) – ~2.50 earn back period and 3.2% dilutive to TBV at closing(3) – ~200+ bps improvement in 2023E ROATCE (first full year of combined operations with 100% cost saves) – Price / LTM Net Income + Cost Savings of 8.2x(4) – Pro forma tangible common equity / tangible assets > 9.5% at close leaves GABC well positioned for continued growth 1) Defined as MSA of Louisville, KY 2) Excludes one-time costs. Assumes 100% phase-in of projected cost savings 3) Tangible book value per share earn back period defined as the number of years for pro forma tangible book value per share to exceed projected standalone tangible book value per share (“crossover”) 4) Based on GABC’s 10 Day VWAP $35.99 as of September 17, 2021 |

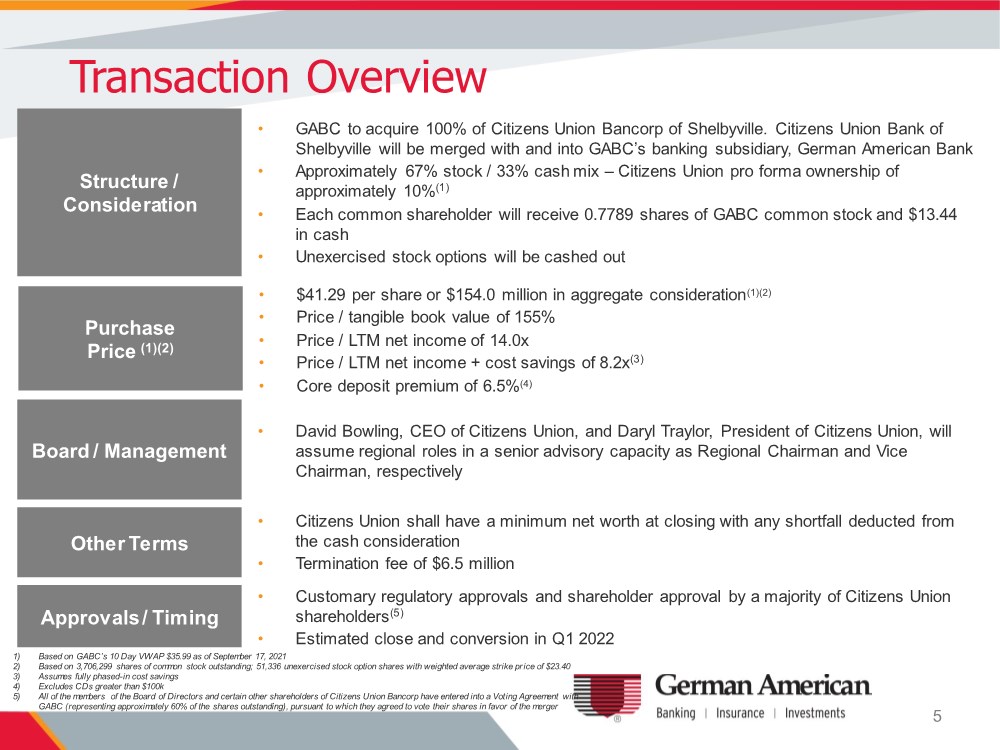

| Transaction Overview 5 • GABC to acquire 100% of Citizens Union Bancorp of Shelbyville. Citizens Union Bank of Shelbyville will be merged with and into GABC’s banking subsidiary, German American Bank • Approximately 67% stock / 33% cash mix – Citizens Union pro forma ownership of approximately 10%(1) • Each common shareholder will receive 0.7789 shares of GABC common stock and $13.44 in cash • Unexercised stock options will be cashed out Structure / Consideration Purchase Price (1)(2) Board / Management Other Terms Approvals / Timing • $41.29 per share or $154.0 million in aggregate consideration(1)(2) • Price / tangible book value of 155% • Price / LTM net income of 14.0x • Price / LTM net income + cost savings of 8.2x(3) • Core deposit premium of 6.5%(4) • David Bowling, CEO of Citizens Union, and Daryl Traylor, President of Citizens Union, will assume regional roles in a senior advisory capacity as Regional Chairman and Vice Chairman, respectively • Citizens Union shall have a minimum net worth at closing with any shortfall deducted from the cash consideration • Termination fee of $6.5 million • Customary regulatory approvals and shareholder approval by a majority of Citizens Union shareholders(5) • Estimated close and conversion in Q1 2022 1) Based on GABC’s 10 Day VWAP $35.99 as of September 17, 2021 2) Based on 3,706,299 shares of common stock outstanding; 51,336 unexercised stock option shares with weighted average strike price of $23.40 3) Assumes fully phased-in cost savings 4) Excludes CDs greater than $100k 5) All of the members of the Board of Directors and certain other shareholders of Citizens Union Bancorp have entered into a Voting Agreement with GABC (representing approximately 60% of the shares outstanding), pursuant to which they agreed to vote their shares in favor of the merger |

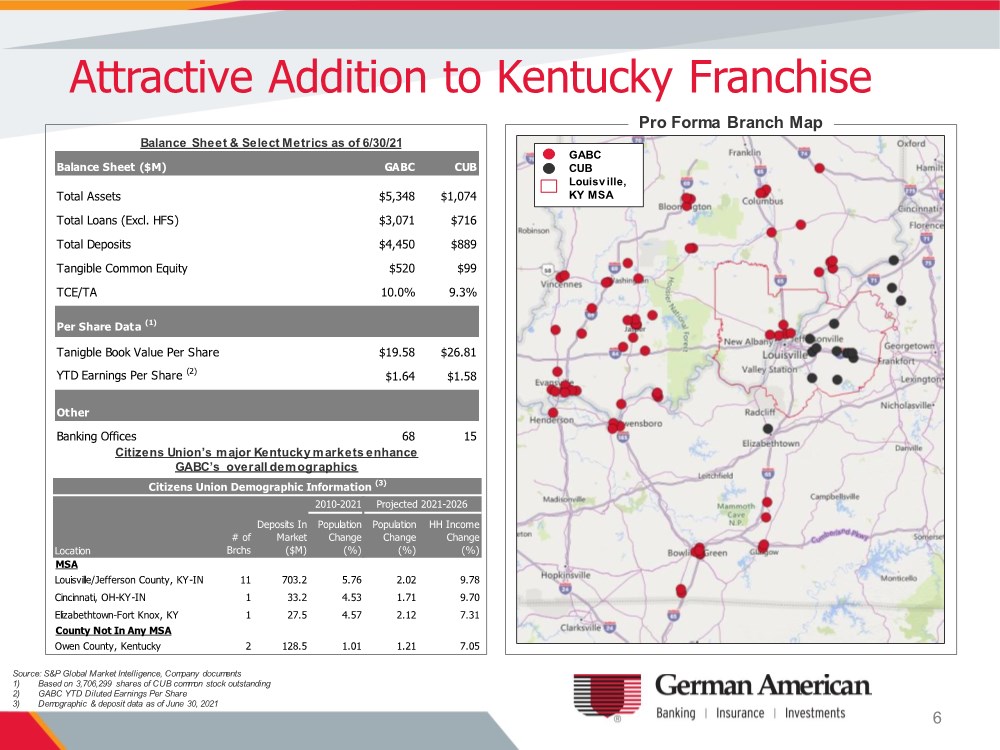

| Citizens Union’s major Kentucky markets enhance GABC’s overall demographics Attractive Addition to Kentucky Franchise GABC CUB Louisville, KY MSA Pro Forma Branch Map Source: S&P Global Market Intelligence, Company documents 1) Based on 3,706,299 shares of CUB common stock outstanding 2) GABC YTD Diluted Earnings Per Share 3) Demographic & deposit data as of June 30, 2021 6 Balance Sheet & Select Metrics as of 6/30/21 Balance Sheet ($M) GABC CUB Total Assets $5,348 $1,074 Total Loans (Excl. HFS) $3,071 $716 Total Deposits $4,450 $889 Tangible Common Equity $520 $99 TCE/TA 10.0% 9.3% Per Share Data (1) Tanigble Book Value Per Share $19.58 $26.81 YTD Earnings Per Share (2) $1.64 $1.58 Other Banking Offices 68 15 2010-2021 Projected 2021-2026 Location # of Brchs Deposits In Market ($M) Population Change (%) Population Change (%) HH Income Change (%) MSA Louisville/Jefferson County, KY-IN 11 703.2 5.76 2.02 9.78 Cincinnati, OH-KY-IN 1 33.2 4.53 1.71 9.70 Elizabethtown-Fort Knox, KY 1 27.5 4.57 2.12 7.31 County Not In Any MSA Owen County, Kentucky 2 128.5 1.01 1.21 7.05 Citizens Union Demographic Information (3) |

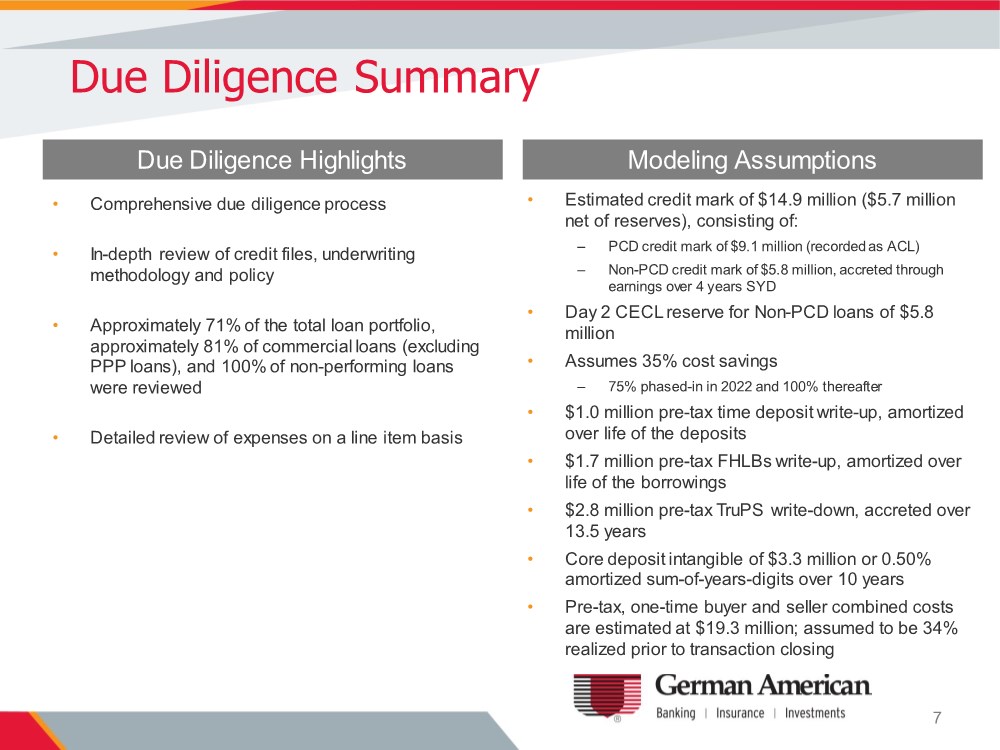

| Due Diligence Summary 7 • Comprehensive due diligence process • In-depth review of credit files, underwriting methodology and policy • Approximately 71% of the total loan portfolio, approximately 81% of commercial loans (excluding PPP loans), and 100% of non-performing loans were reviewed • Detailed review of expenses on a line item basis Modeling Assumptions • Estimated credit mark of $14.9 million ($5.7 million net of reserves), consisting of: – PCD credit mark of $9.1 million (recorded as ACL) – Non-PCD credit mark of $5.8 million, accreted through earnings over 4 years SYD • Day 2 CECL reserve for Non-PCD loans of $5.8 million • Assumes 35% cost savings – 75% phased-in in 2022 and 100% thereafter • $1.0 million pre-tax time deposit write-up, amortized over life of the deposits • $1.7 million pre-tax FHLBs write-up, amortized over life of the borrowings • $2.8 million pre-tax TruPS write-down, accreted over 13.5 years • Core deposit intangible of $3.3 million or 0.50% amortized sum-of-years-digits over 10 years • Pre-tax, one-time buyer and seller combined costs are estimated at $19.3 million; assumed to be 34% realized prior to transaction closing Due Diligence Highlights |

| Summary Highlights • Enhances market position, following upon prior mergers with Citizens First Corp. and First Security Inc., in key, attractive Kentucky markets • Similar cultural fit for transitioning post-close • Pro forma total assets approaching $6.5 billion at close • Financially compelling: – ~14% accretive to EPS in the first full year(1) – Modest TBV dilution with ~2.50 year earn back (crossover method)(2) – ~200+ bps improvement in 2023E ROATCE (first full year of combined operations with 100% cost saves) • Strong pro forma capital levels with flexibility to continue future growth 8 1) Excludes one-time costs. Assumes 100% phase-in of projected cost savings 2) Tangible book value per share earn back period defined as the number of years for pro forma tangible book value per share to exceed projected standalone tangible book value per share (“crossover”) |

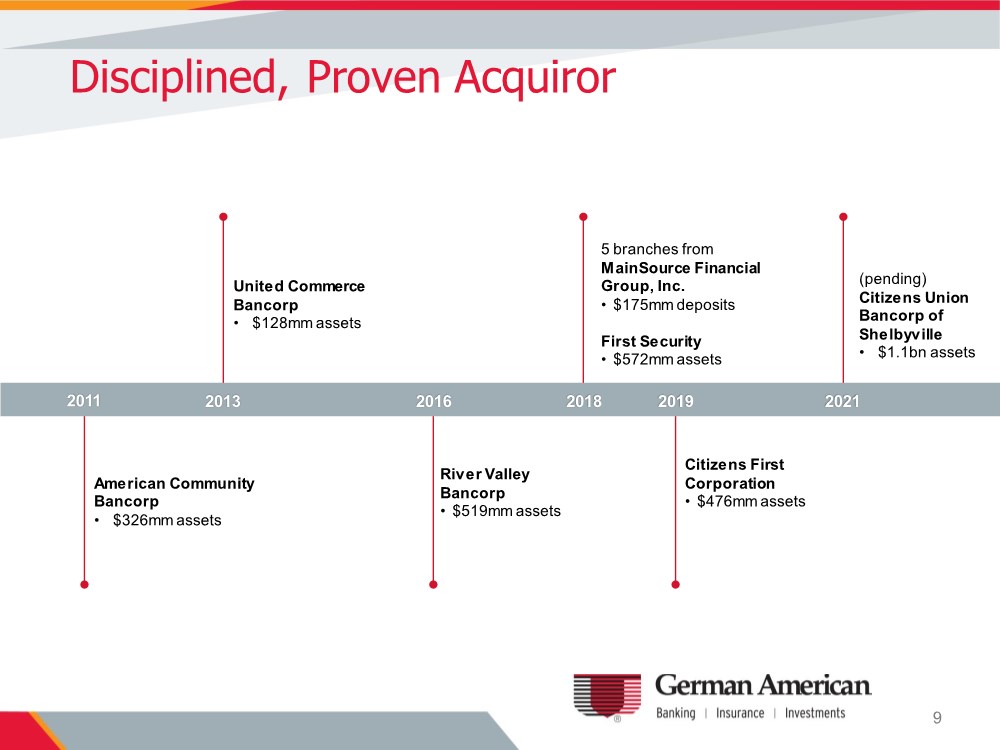

| 9 Disciplined, Proven Acquiror 2013 United Commerce Bancorp • $128mm assets 2016 River Valley Bancorp • $519mm assets 2018 5 branches from MainSource Financial Group, Inc. • $175mm deposits First Security • $572mm assets 2019 Citizens First Corporation • $476mm assets 2011 American Community Bancorp • $326mm assets 2021 (pending) Citizens Union Bancorp of Shelbyville • $1.1bn assets |