Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Dell Technologies Inc. | d204906d8k.htm |

Management estimated pro forma financial statements Exhibit 99.1

PRO FORMA NON-GAAP FINANCIAL MEASURES This presentation includes information about pro forma non-GAAP revenue, pro forma non-GAAP gross margin, pro forma non-GAAP operating expenses, pro forma non-GAAP selling, general, and administrative expenses, pro forma non-GAAP research and development expenses, pro forma non-GAAP operating income, pro forma non-GAAP interest and other, net, pro forma non-GAAP income tax, pro forma non-GAAP net income, pro forma non-GAAP net income attributable to non-controlling interests, pro forma non-GAAP net income attributable to Dell Technologies Inc., pro forma non-GAAP earnings per share attributable to Dell Technologies Inc. – basic, and pro forma non-GAAP earnings per share attributable to Dell Technologies Inc. – diluted (collectively the “pro forma non-GAAP financial measures”), which are not measurements of financial performance prepared in accordance with U.S. generally accepted accounting principles. We have provided a reconciliation of the pro forma non-GAAP measures to the most directly comparable pro forma GAAP measures in the slides captioned “Supplemental management estimated pro forma non-GAAP measures.”

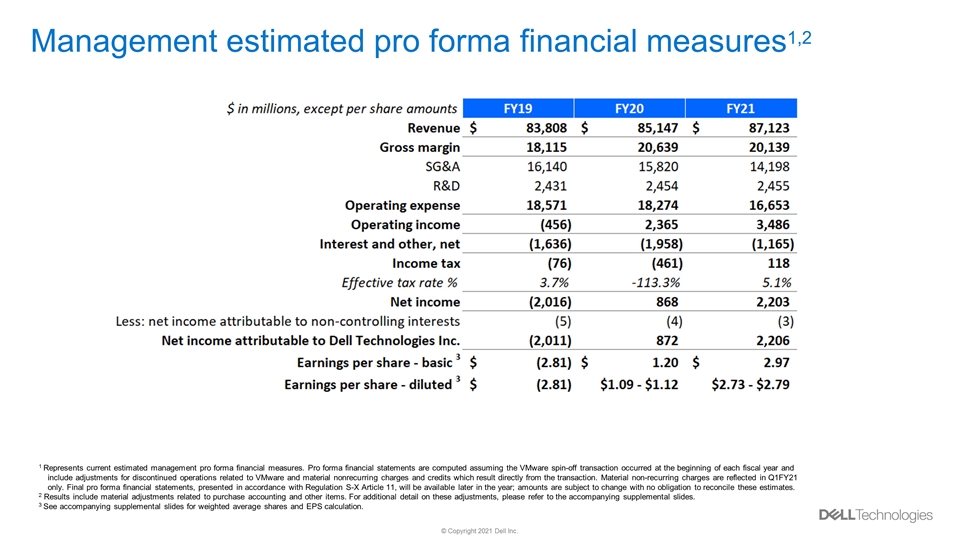

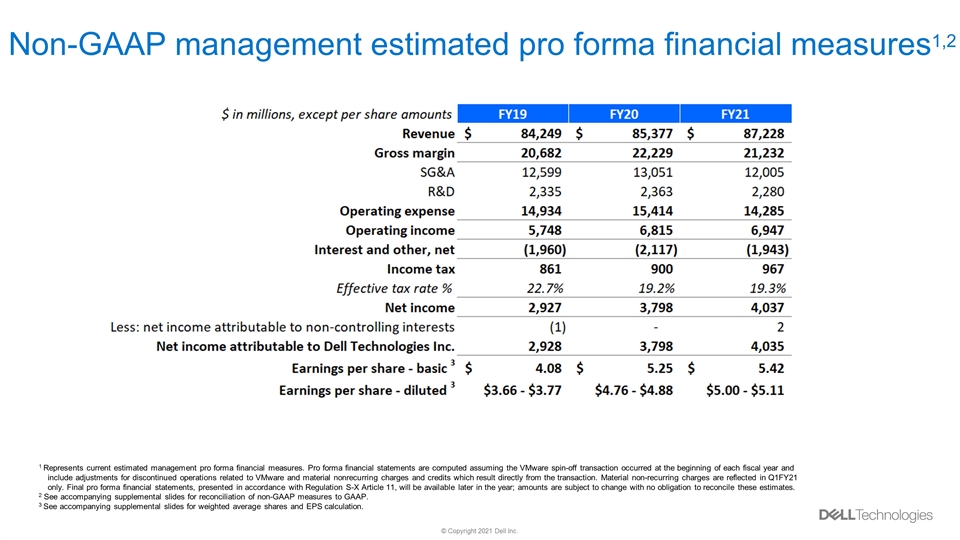

Management estimated pro forma financial measures1,2 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 Results include material adjustments related to purchase accounting and other items. For additional detail on these adjustments, please refer to the accompanying supplemental slides. 3 See accompanying supplemental slides for weighted average shares and EPS calculation. 2

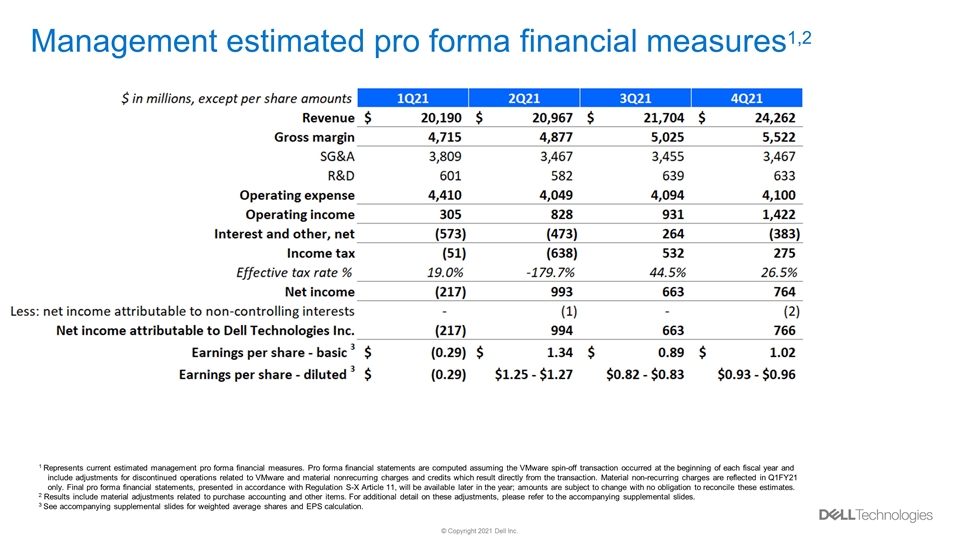

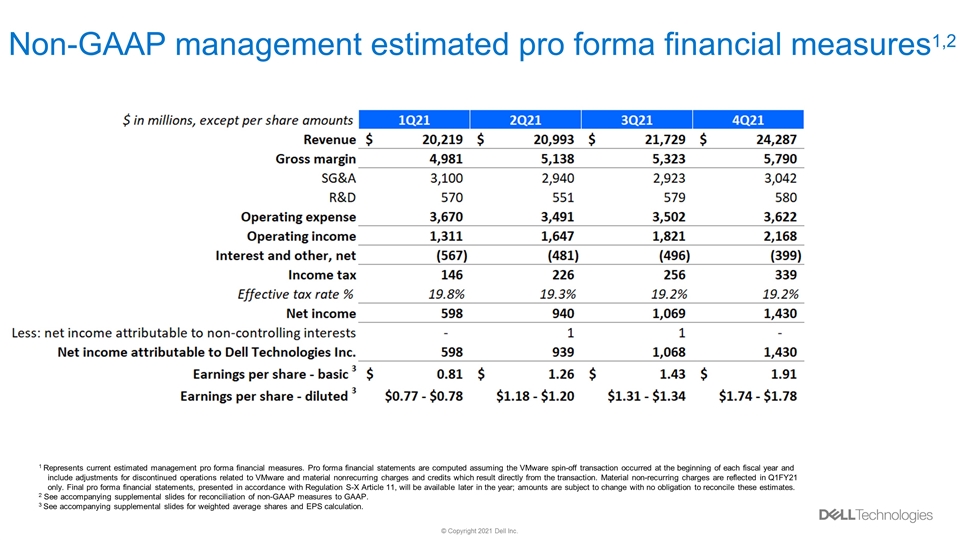

Management estimated pro forma financial measures1,2 2 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 Results include material adjustments related to purchase accounting and other items. For additional detail on these adjustments, please refer to the accompanying supplemental slides. 3 See accompanying supplemental slides for weighted average shares and EPS calculation.

Non-GAAP management estimated pro forma financial measures1,2 2 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 See accompanying supplemental slides for reconciliation of non-GAAP measures to GAAP. 3 See accompanying supplemental slides for weighted average shares and EPS calculation.

2 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 See accompanying supplemental slides for reconciliation of non-GAAP measures to GAAP. 3 See accompanying supplemental slides for weighted average shares and EPS calculation. Non-GAAP management estimated pro forma financial measures1,2

Appendix A Supplemental management estimated pro forma non-GAAP measures

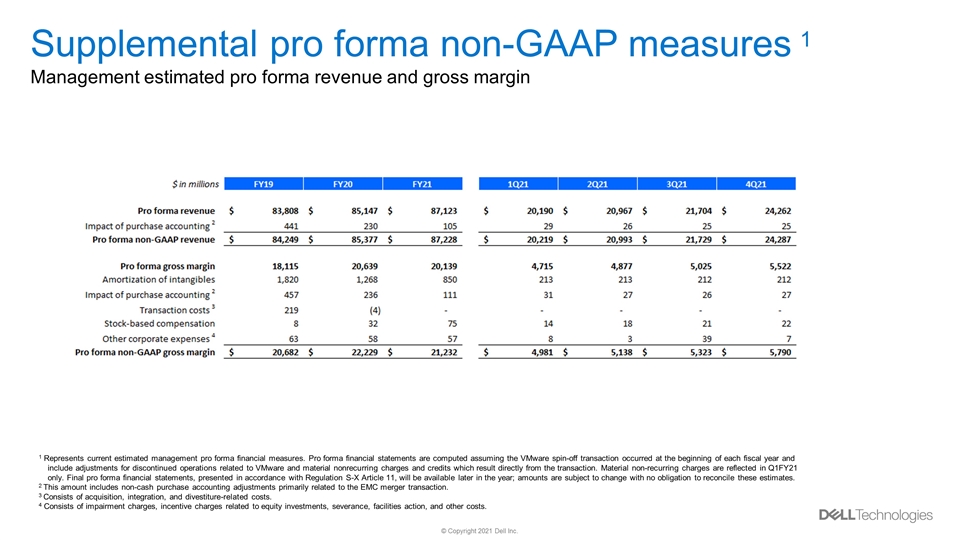

Supplemental pro forma non-GAAP measures 1 Management estimated pro forma revenue and gross margin 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 This amount includes non-cash purchase accounting adjustments primarily related to the EMC merger transaction. 3 Consists of acquisition, integration, and divestiture-related costs. 4 Consists of impairment charges, incentive charges related to equity investments, severance, facilities action, and other costs.

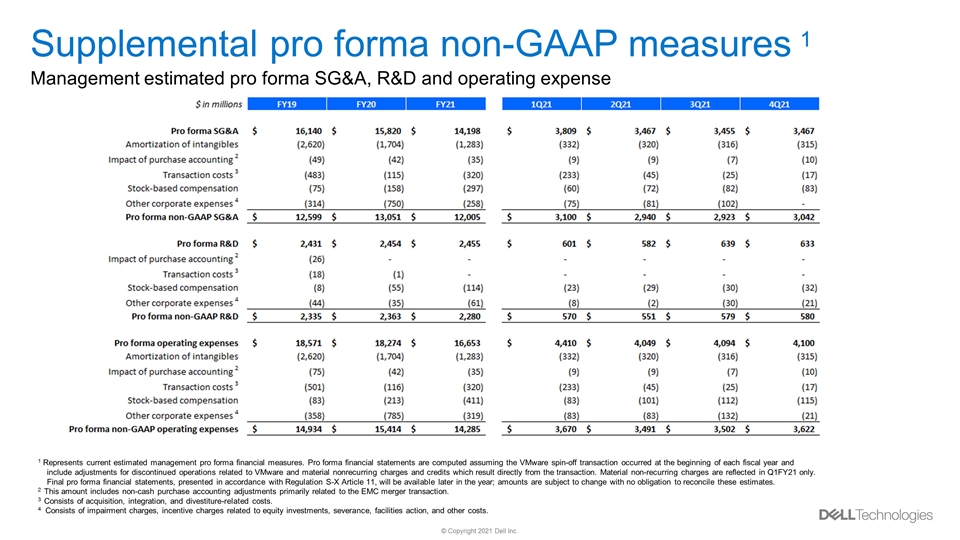

Supplemental pro forma non-GAAP measures 1 Management estimated pro forma SG&A, R&D and operating expense 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 This amount includes non-cash purchase accounting adjustments primarily related to the EMC merger transaction. 3 Consists of acquisition, integration, and divestiture-related costs. 4 Consists of impairment charges, incentive charges related to equity investments, severance, facilities action, and other costs.

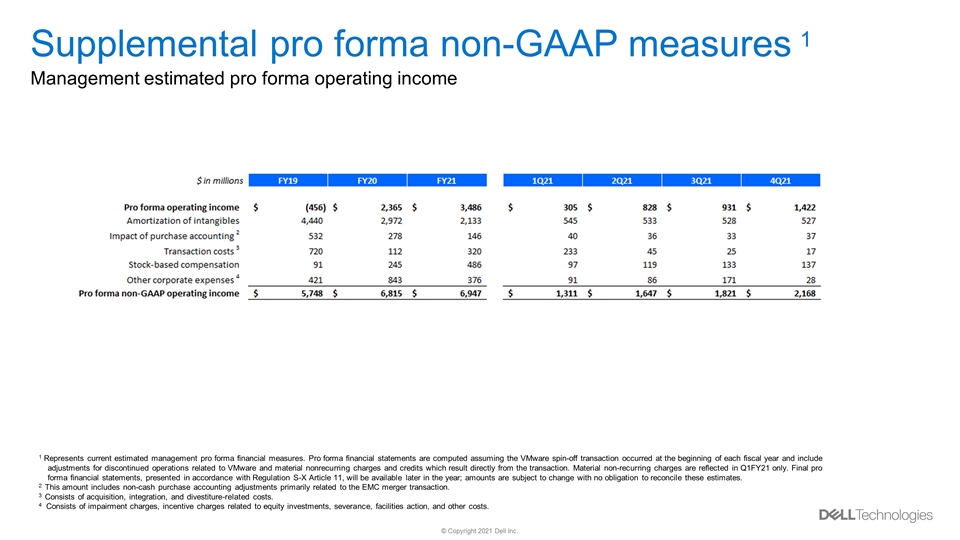

Supplemental pro forma non-GAAP measures 1 Management estimated pro forma operating income 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 This amount includes non-cash purchase accounting adjustments primarily related to the EMC merger transaction. 3 Consists of acquisition, integration, and divestiture-related costs. 4 Consists of impairment charges, incentive charges related to equity investments, severance, facilities action, and other costs.

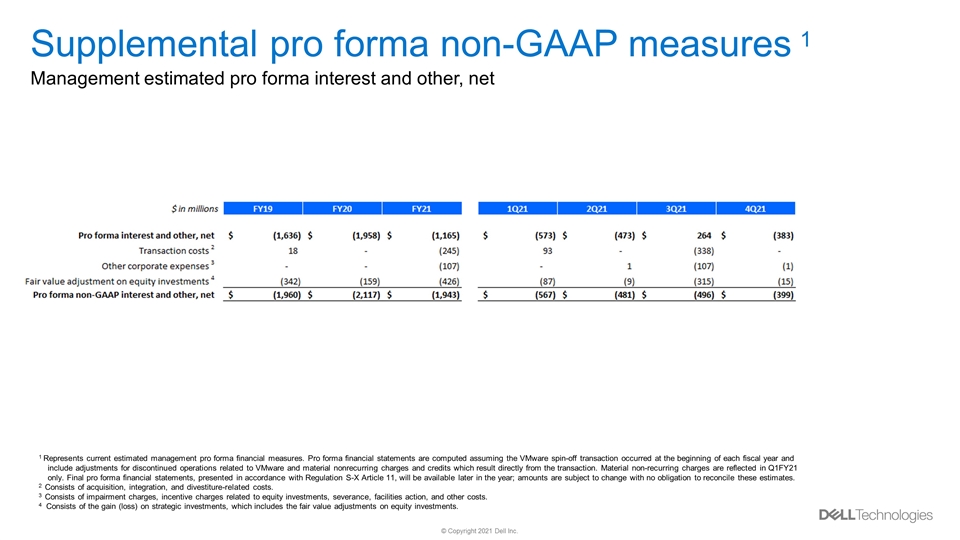

Supplemental pro forma non-GAAP measures 1 Management estimated pro forma interest and other, net 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 Consists of acquisition, integration, and divestiture-related costs. 3 Consists of impairment charges, incentive charges related to equity investments, severance, facilities action, and other costs. 4 Consists of the gain (loss) on strategic investments, which includes the fair value adjustments on equity investments.

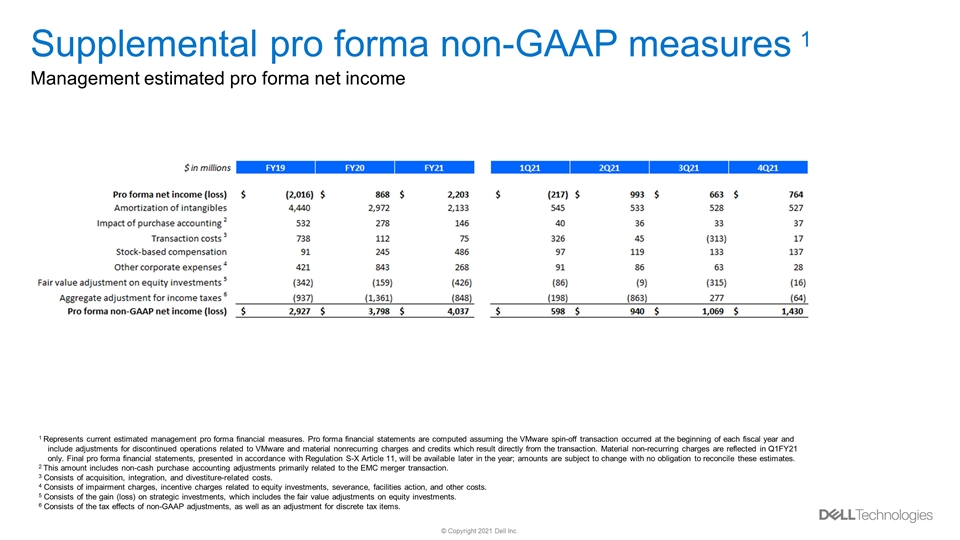

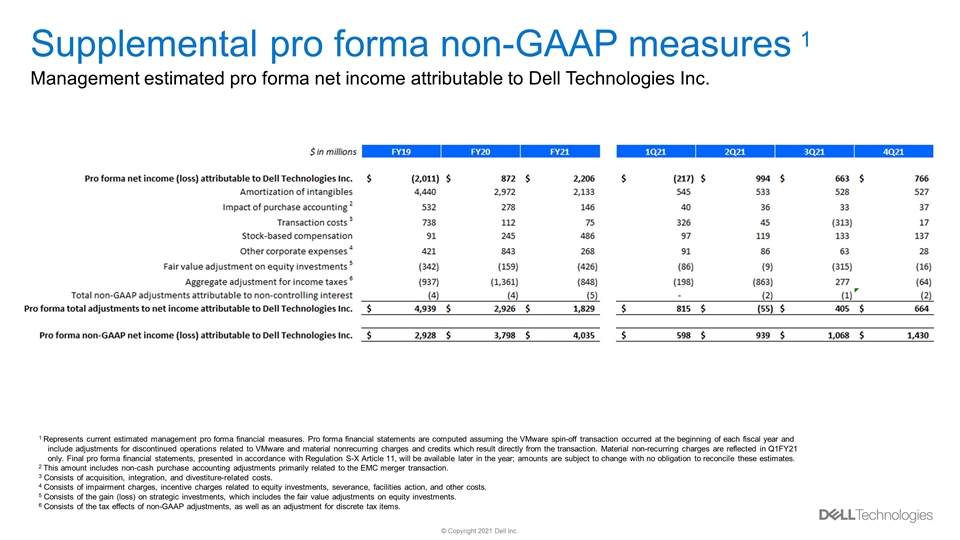

Supplemental pro forma non-GAAP measures 1 Management estimated pro forma net income 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 This amount includes non-cash purchase accounting adjustments primarily related to the EMC merger transaction. 3 Consists of acquisition, integration, and divestiture-related costs. 4 Consists of impairment charges, incentive charges related to equity investments, severance, facilities action, and other costs. 5 Consists of the gain (loss) on strategic investments, which includes the fair value adjustments on equity investments. 6 Consists of the tax effects of non-GAAP adjustments, as well as an adjustment for discrete tax items.

Supplemental pro forma non-GAAP measures 1 Management estimated pro forma net income attributable to Dell Technologies Inc. 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 This amount includes non-cash purchase accounting adjustments primarily related to the EMC merger transaction. 3 Consists of acquisition, integration, and divestiture-related costs. 4 Consists of impairment charges, incentive charges related to equity investments, severance, facilities action, and other costs. 5 Consists of the gain (loss) on strategic investments, which includes the fair value adjustments on equity investments. 6 Consists of the tax effects of non-GAAP adjustments, as well as an adjustment for discrete tax items.

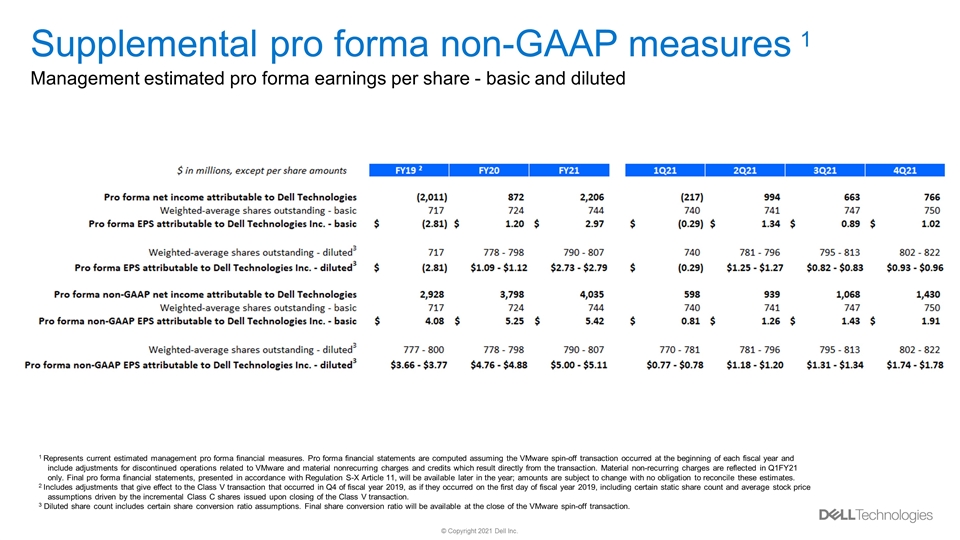

Supplemental pro forma non-GAAP measures 1 Management estimated pro forma earnings per share - basic and diluted 1 Represents current estimated management pro forma financial measures. Pro forma financial statements are computed assuming the VMware spin-off transaction occurred at the beginning of each fiscal year and include adjustments for discontinued operations related to VMware and material nonrecurring charges and credits which result directly from the transaction. Material non-recurring charges are reflected in Q1FY21 only. Final pro forma financial statements, presented in accordance with Regulation S-X Article 11, will be available later in the year; amounts are subject to change with no obligation to reconcile these estimates. 2 Includes adjustments that give effect to the Class V transaction that occurred in Q4 of fiscal year 2019, as if they occurred on the first day of fiscal year 2019, including certain static share count and average stock price assumptions driven by the incremental Class C shares issued upon closing of the Class V transaction. 3 Diluted share count includes certain share conversion ratio assumptions. Final share conversion ratio will be available at the close of the VMware spin-off transaction. 2