Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CUMULUS MEDIA INC | a991investorpresentationpr.htm |

| 8-K - 8-K - CUMULUS MEDIA INC | cmls-20210920.htm |

Investor September 2021 Presentation

SAFE HARBOR STATEMENTS Forward-Looking Statements: Certain statements in this presentation may constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Such statements are statements other than historical fact and relate to our intent, belief or current expectations, primarily with respect to our future operating, financial and strategic performance. These statements generally are accompanied by words such as “intend,” “anticipate,” “believe,” “estimate,” “project,” “target,” “plan,” “expect,” “will,” “should,” “would” or similar statements. Any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ from those contained in or implied by the forward-looking statements as a result of various factors including, but not limited to, risks and uncertainties relating to the impact of the COVID-19 global pandemic and related measures taken by governmental or regulatory authorities to combat the global pandemic, including the impact of the global pandemic on our results of operations, financial condition and liquidity; our achievement of certain expected revenue results, including as a result of factors or events that are unexpected or otherwise outside of our control; our ability to generate sufficient cash flows to service our debt and other obligations and our ability to access capital, including debt or equity; general economic or business conditions affecting the radio broadcasting industry which may be less favorable than expected, decreasing spending by advertisers; changes in market conditions which could impair our intangible assets and the effects of any material impairment of our intangible assets; our ability to execute our business plan and strategy; our ability to attract, motivate and/or retain key executives and associates; increased competition in the radio broadcasting industry and our ability to respond to changes in technology in order to remain competitive; shift in population, demographics, audience tastes and listening preferences; disruptions or security breaches of our information technology infrastructure; the impact of current, pending or future legislation and regulations, antitrust considerations, and pending or future litigation or claims; changes in regulatory or legislative policies or actions or in regulatory bodies; changes in uncertain tax positions and tax rates; changes in the financial markets; changes in capital expenditure requirements; changes in interest rates; the possibility that we may be unable to achieve any expected cost-saving or operational synergies in connection with any acquisitions or business improvement initiatives, or achieve them within the expected time periods or other risks identified from time to time in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2020 and subsequent Quarterly Reports on Form 10-Q. Many of these risks and uncertainties are beyond our control, and the unexpected occurrence or failure to occur of any such events or matter could significantly alter our actual results or our operations or financial condition. Cumulus Media Inc. assumes no responsibility to update any forward-looking statement as a result of new information, future events or otherwise. Non-GAAP Measures: In addition to U.S. GAAP financial measures, this presentation includes certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP and may differ from non-GAAP measures used by other companies in our industry. The Company considers these non-GAAP financial measures to be important because they provide useful measures of the operating performance of the Company, exclusive of unusual events, as well as factors that do not directly affect what we consider to be our core operating performance. Non-GAAP results are presented for supplemental informational purposes only for understanding the Company’s operating results and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP and may differ from similar measures presented by other companies. With respect to our forward-looking guidance, no reconciliation between a non-GAAP measure to the closest corresponding GAAP measure is included because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts, and we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. In particular, a reconciliation of forward-looking EBITDA to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the amounts required to reconcile such measure. The unavailable information could have a significant impact on the company's future financial results. All reconciliations of non-GAAP financial measures to the most directly comparable GAAP measure are set forth in the Appendix to this presentation. Third-Party Data: This presentation contains statistical data that we obtained from industry publications and reports generated by third parties. Although we believe that the publications and reports are reliable, we have not independently verified this statistical data and accordingly we cannot guarantee their accuracy or completeness. Please refer to the list of sources beginning on page 33 for all referenced numbers. 2

STRATEGIC POSITIONING INVESTMENT HIGHLIGHTS HISTORY AND RESULTS VALUE CREATION MODEL COMPANY OVERVIEW 3

AN AUDIO-FIRST MEDIA COMPANY and delivering highly efficient TRADITIONAL + DIGITAL advertising & marketing SOLUTIONS… connecting tens of thousands of BUSINESSES… Captivating LISTENERS with engaging, multi-platform audio content in every community in the U.S…. with 250+ million potential CUSTOMERS 4

CUMULUS MEDIA INVESTMENT HIGHLIGHTS AUDIO-FIRST MEDIA STRATEGY SUPPORTING SUSTAINABLE, LONG-TERM SHAREHOLDER RETURNS BALANCED BUSINESS MODEL: FAST GROWING DIGITAL BUSINESS LINES AND HIGH FREE CASH FLOW GENERATED BY RADIO PROVEN MANAGEMENT TEAM WITH TRACK RECORD OF STRONG OPERATING PERFORMANCE SIGNIFICANT FLEXIBILITY TO OPTIMIZE CAPITAL ALLOCATION, INCLUDING DEBT PAYDOWN & RETURN OF CAPITAL CONTINUED VALUE CREATION THROUGH PORTFOLIO OPTIMIZATION AND ACCRETIVE M&A DIVERSE, EXPERIENCED BOARD FOCUSED ON LONG-TERM VALUE CREATION AND ESG 5

413 Stations in 86 Markets #1 Network with ~7,300 Affiliates 1.2B+ Annual Podcast Downloads 5.0B+ Annualized Streaming Impressions ~3K Digital Marketing Services Clients STREAMING NETWORK 6 News/Talk Sports Music & Entertainment Kevin Harlan Larry O’Connor Chris Salcedo Mitch Albom John Phillips Hallerin Hilton Hill Bruce St. James Tiki Barber Greg McElroy Kix BrooksRoula Christie Kenny Smoov LEADING TALENT & BRANDS CUMULUS MEDIA AT A GLANCE

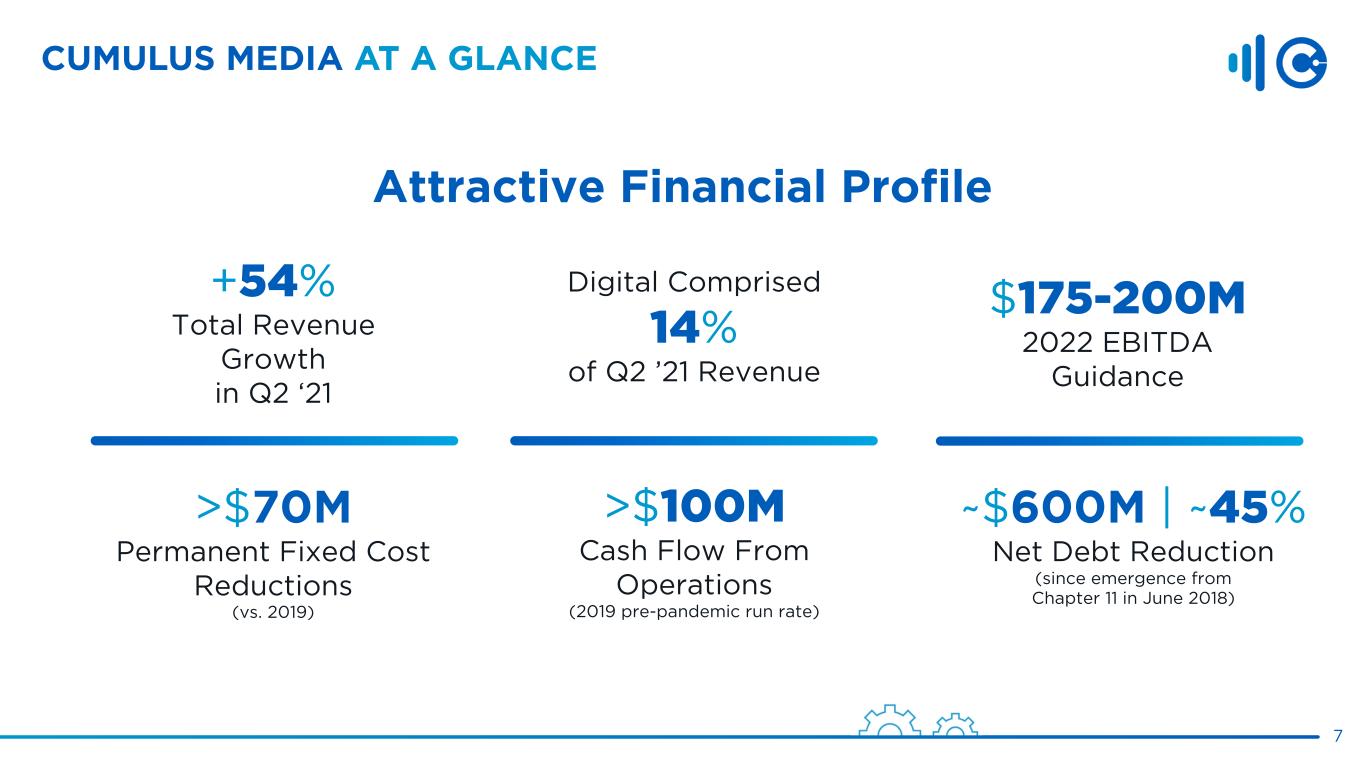

>$70M Permanent Fixed Cost Reductions (vs. 2019) >$100M Cash Flow From Operations (2019 pre-pandemic run rate) +54% Total Revenue Growth in Q2 ‘21 Digital Comprised 14% of Q2 ’21 Revenue ~$600M | ~45% Net Debt Reduction (since emergence from Chapter 11 in June 2018) $175-200M 2022 EBITDA Guidance Attractive Financial Profile 7 CUMULUS MEDIA AT A GLANCE

STRATEGIC POSITIONING INVESTMENT HIGHLIGHTS HISTORY AND RESULTS VALUE CREATION MODEL COMPANY OVERVIEW 8

HISTORICAL AUDIENCE ACQUISITION: ONE-DIMENSIONAL RADIO-FIRST MODEL THE CONTENT WE CREATED HOW IT WAS CONSUMED HOW IT WAS DISTRIBUTED One Product One Way Radio Device | Set Schedule 9

CURRENT AUDIENCE ACQUISITION: MULTI-DIMENSIONAL AUDIO-FIRST MODEL THE CONTENT WE CREATE HOW IT’S CONSUMED HOW IT’S DISTRIBUTED Multiple Products Multiple Ways Multiple Devices | On-Demand 10

AUDIO-FIRST MODEL LEVERAGING TALENT ACROSS PLATFORMS TO GROW AUDIENCES AND SELLABLE IMPRESSIONS Began on podcast platform Leading millennial conservative political news/talk voice Launched 1-hour broadcast syndicated show repurposing podcast content Expanded to 3-hour syndicated show, including two hours of live content Now with over 375 radio affiliates with a total monthly broadcast reach of 1.6 mm listeners on top of over 25 mm podcast downloads per month Highly popular CHR morning show host in Atlanta on Q99.7 Began exclusively as local radio show host Created initial podcasting and streaming platform Began distributing 20 different daily podcasts using repurposed show content Now with a monthly reach of more than 1 mm streaming & broadcast listeners plus more than 6 mm podcast downloads per month Expanded into syndication to 25+ radio stations Bert Weiss Ben Shapiro 11

HISTORICAL MONETIZATION: ONE-DIMENSIONAL RADIO-FIRST MODEL THE PRODUCT WE SOLD ADDRESSABLE AD MARKET ~800 SELLERS ACROSS 90+ LOCATIONS (1) 12

CURRENT MONETIZATION: MULTI-DIMENSIONAL AUDIO-FIRST MODEL THE PRODUCTS WE SELL ADDRESSABLE AD MARKET ~800 SELLERS ACROSS 90+ LOCATIONS & PROGRAMMATIC (2) 13

Multi- Million $ Spend New business with very little marketing spend Developed a multi- year advertising and content relationship utilizing the full audio platform New Client MONETIZATION STRATEGY RESULTING IN INCREASED REVENUE FROM EXISTING AND NEW CLIENTS National Auto Aftermarket Company Local Financial Services Company National Insurance Company +58% YoY +100% YoY +45% YoY 100% podcast client in 2020 Added network radio in 2021 with total spend up 100% digital marketing services client for three years Added radio in 2021 with total spend up 100% network radio client in 2020 Added podcast in 2021 with total spend up National Sports-Betting Company 14

STRATEGIC POSITIONING INVESTMENT HIGHLIGHTS HISTORY AND RESULTS VALUE CREATION MODEL COMPANY OVERVIEW 15

HISTORICAL TURNAROUND STRATEGY FOCUSED ON SUSTAINABLE REVENUE GROWTH, OPERATIONAL EFFICIENCY & ASSET OPTIMIZATION Successful Turnaround 2016 – 6/2018 (Ch. 11 Exit) Strategic Realignment 6/2018-2019 Expanded revenue focus to audio-first audience acquisition and monetization, increasing digital to 8% of revenue from 3% in 2016 In 2019, delivered 2nd straight year of same station revenue growth, and 3rd straight year of same station EBITDA growth (ex-political) Initiated ongoing asset optimization effort with highly accretive divestitures and swaps/acquisitions Reduced debt by $275 mm through aggressive paydown and FCF generation ü Established strong leadership team under CEO Mary Berner ü Reversed three-year ratings decline and delivered EBITDA growth for first time in five years ü Reduced debt by $1 bn through Chapter 11 completed in 6 months ü Executed cultural overhaul leading to substantially increased employee engagement and reduction of crippling levels of turnover Pandemic Triage/ Recovery 2020-Mid 2021 Generated $33 mm of cash from operations for full year 2020 by strong working capital management Realized ~$320 mm of gross proceeds from non-core M&A Permanently reduced fixed costs by $50 mm and lowered net debt by ~$300 mm Launched unique, cross- platform partnerships and accelerated digital growth Maintained high levels of employee confidence and engagement despite pandemic Mid 2021+ Growth Acceleration Intensifying efforts to build audiences and revenue through multiple digital paths Executing additional fixed cost reductions (now anticipating $70+ mm vs. 2019) Exploring M&A opportunities and partnerships that bolster growth, profitability and/or competitive position Considering multiple options for capital allocation among M&A, debt paydown and return of capital to shareholders 16

COMPANY TRANSITION TO AUDIO-FIRST MEDIA STRATEGY WITH EXPANDED MONETIZATION OPPORTUNITIES RESULTS Broadcast Revenue (78% of Q2 2021 Total Revenue) Digital Revenue (14% of Q2 2021 Total Revenue) Spot Revenue: Monetization of local station listeners via local and national advertisers Highly engaged fan base with significant ROI and brand loyalty 413 stations across 86 markets Network Revenue: Monetization of owned and third-party radio advertising inventory, acquired primarily through content and services syndication and bundled for nation-wide scale, via national advertisers Highest efficiency medium for achieving national radio exposure #1 network with ~7,300 affiliated stations Streaming: Simultaneous & on-demand broadcasts of radio programming through digital distribution outlets Enhanced targeting capabilities for advertisers with comparable contribution margin to broadcast radio Highest average time spent listening of major peers (3) Podcasting: Monetization of pre-roll and in-stream (including host-read) ads on podcasts distributed on all major platforms Highly effective brand endorsements in high-growth market Over 1.2 bn annual downloads; 30%+ YoY* revenue growth Digital Marketing Services & Campaigns: Full suite of digital marketing solutions – from websites to reputation management to targeted digital ads Leverages relationships with tens of thousands of clients ROI increases 19% when bundled with core radio buy (4) * Q2 2021 compared to Q2 2020 Note: Other revenue (including trade, barter, event & non-traditional revenue) represented 8% of Q2 2021 revenue 17

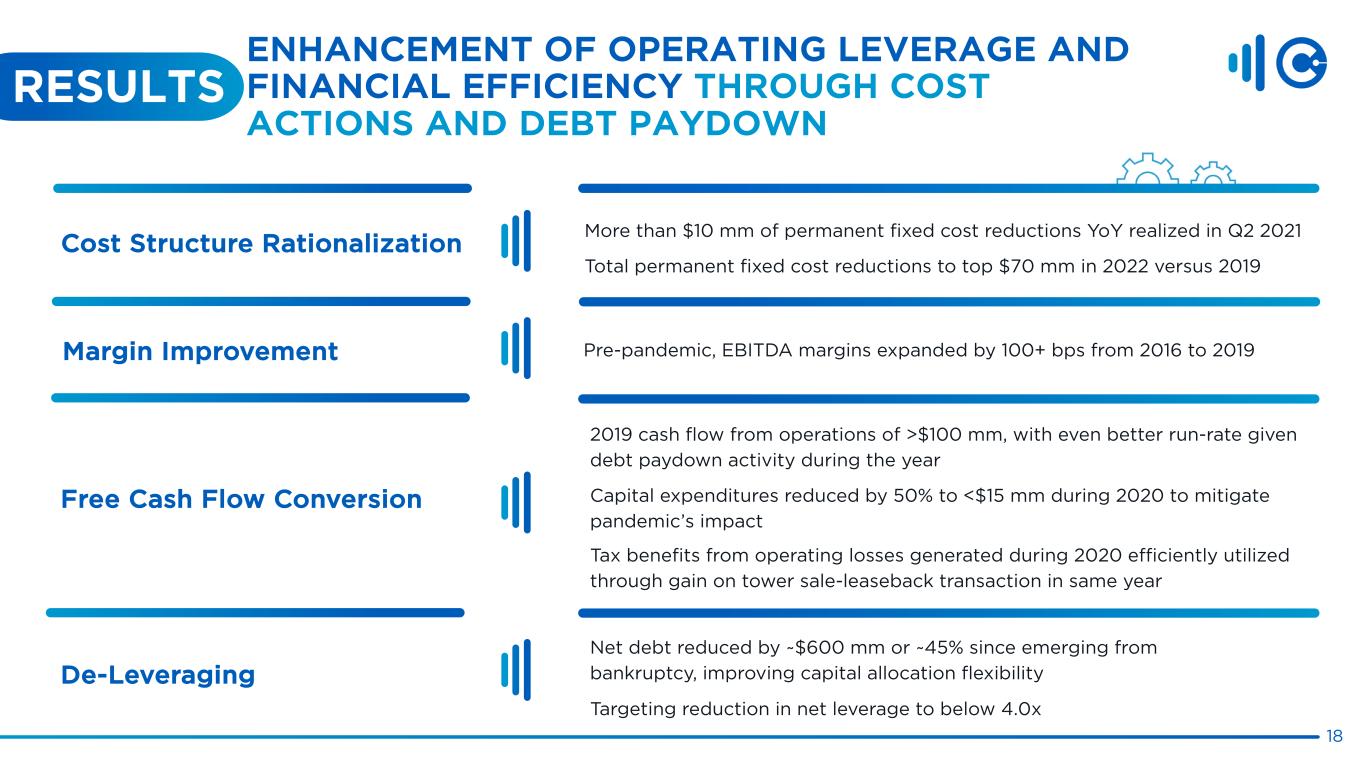

ENHANCEMENT OF OPERATING LEVERAGE AND FINANCIAL EFFICIENCY THROUGH COST ACTIONS AND DEBT PAYDOWN Cost Structure Rationalization More than $10 mm of permanent fixed cost reductions YoY realized in Q2 2021 Total permanent fixed cost reductions to top $70 mm in 2022 versus 2019 Margin Improvement De-Leveraging Free Cash Flow Conversion Pre-pandemic, EBITDA margins expanded by 100+ bps from 2016 to 2019 Net debt reduced by ~$600 mm or ~45% since emerging from bankruptcy, improving capital allocation flexibility Targeting reduction in net leverage to below 4.0x 2019 cash flow from operations of >$100 mm, with even better run-rate given debt paydown activity during the year Capital expenditures reduced by 50% to <$15 mm during 2020 to mitigate pandemic’s impact Tax benefits from operating losses generated during 2020 efficiently utilized through gain on tower sale-leaseback transaction in same year RESULTS 18

GROWTH PROFILE IMPROVEMENT THROUGH PLATFORM-WIDE STRATEGIC PARTNERSHIPS AND ACCRETIVE M&A WynnBET Multi-Platform, Multi-Year Marketing Partnership Secured WynnBET as one of company’s largest clients via multi-platform relationship utilizing entire portfolio of assets Anticipating incremental revenue generation from sports- betting legalization in more states Acquisitions & Swaps Non-Core Asset Monetization Expanded partnership with podcast host (whose podcast delivered #1 or #2 in Apple podcast rankings during 4Q 2020 and achieved 117 mm downloads for year) into radio Surpassed 300-station milestone in syndication of show within two months on air Acquired WKQX-FM in Chicago for $18 mm during bankruptcy Completed two immediately accretive swaps in 2019, resulting in market-leading positions in Indianapolis and Allentown Divested nearly $480 mm of non-core assets (land, towers and certain stations) from 2018 to 2021 Collectively, non-core asset sales had virtually no impact on EBITDA or business operations The Dan Bongino Show Multi-Platform Content, Distribution & Monetization Partnership Establishes strong beachhead in area of high listener, advertiser interest Upside through creative and strategically-aligned equity consideration, providing exposure to sports-betting growth outside partnership Increases audience and revenue opportunities from existing talent relationship Demonstrates benefits from successful execution of cross-platform talent/content repurposing Consistent with portfolio optimization strategy to grow in markets where there is a path to leadership Accretive acquisitions with limited integration risk Consistent with focus on generating liquidity through divestiture of non-core assets Strengthened balance sheet to increase financial flexibility and capital allocation optionality for execution of growth-oriented opportunities Summary Impact RESULTS 19

ROBUST Q2 2021 FINANCIAL PERFORMANCE WITH STRONG BALANCE SHEET & LIQUIDITY PROFILE Positive Revenue Trajectory Increased total revenue by 54% year-over-year Increased digital revenue by 55% year-over-year Reduced Fixed Costs Realized >$10 mm of year-over-year permanent cost reductions in the quarter Announced an additional $20 mm of permanent fixed cost reductions expected to be realized in 2022 New Multi-Platform Partnerships Launched The Dan Bongino Show (an extension of our successful podcast relationship), which now has 300+ affiliates, a record-breaking start Established strong beachhead in the sports-betting sector through unique multi-year partnership with WynnBET, the sports-betting app from Wynn Resorts Strengthened Balance Sheet Finished quarter with $125 mm of cash on hand and $221 mm of total available liquidity Paid down $175 mm of debt, finishing the quarter with net debt of $701 mm Bolstered cash further through $34 mm sale of Nashville real estate, completed on August 2, 2021 Continued EBITDA Recovery Anticipating 2022 EBITDA in the range of $175 - $200 mm RESULTS 20

STRATEGIC POSITIONING INVESTMENT HIGHLIGHTS HISTORY AND RESULTS VALUE CREATION MODEL COMPANY OVERVIEW 21

MULTIPLE DRIVERS FOR SHAREHOLDER VALUE CREATION Improved Operating Leverage Continued Cost Optimization 3 Top Line Stability and Growth Tailwinds from Ongoing Radio Recovery Digital Revenue Growth Leveraging Cumulus Media’s Competitive Strengths Capital Allocation Flexibility Accretive M&A Opportunities and Portfolio Optimization Further Strengthening of Balance Sheet Through Rapid De- Leveraging 4 5 22 21

TAILWINDS FROM ONGOING RADIO INDUSTRY RECOVERY Radio remains a large and attractive market… … with additional audience recovery as return-to-work increases… … and upside from rebound of key advertising categories Key advertising categories remain well below pre-pandemic levels largely as a result of exogenous factors that are expected to resolve over time Employers who continue to delay a full return-to-work (7) Represents opportunity for recapture of drive-time listening (8) Share of ad-supported audio time spent (persons 18+) (5) Americans aged 18+ reached monthly by AM / FM radio (6) Local radio industry revenue selected categories (1H 2021 vs. 1H 2019) (9) 23 66% 1 Commuting Every Day Commuting Some Days Working From Home Every Day 93%

SIGNIFICANT DIGITAL REVENUE GROWTH FROM MULTIPLE DRIVERS Streaming Podcasting Digital Marketing Services Robust Market Dynamics Cumulus Media Competitive Positioning Cumulus Media Performance Highlights ~$1.2 bn Estimated 2022 broadcast streaming market revenue (10) 94+ mm Estimated households with a smart speaker (11) Content distributed anywhere and everywhere, through all major listening outlets (owned + 3rd party) Favorable economics and exclusivity of inventory control regardless of distribution channel 30% % of streams consumed through a smart speaker 59 mins Average time spent listening, which leads all major peers ~$1.8 bn Estimated 2022 podcast market revenue (12) 41% Projected 2018 to 2021 revenue CAGR (13) Best-in-class promotional & monetization partner for podcast content creators Focused on personality-driven content with audio-first extension potential and commercial appeal 1.2 bn Downloads in 2020 from 250+ represented podcasts +25% Q3 2021 year-over-year pacing at time of Q2 2021 earnings call ~$15 bn Estimated market revenue opportunity (14) +5-10% Estimated ‘17-’20 market revenue CAGR (15) Full suite of digital marketing solutions, including presence and campaign- oriented products delivered through white-label partners Leveraging high-touch sales force relationships with SMBs seeking “Do-It- For-Me” solutions +57% Q2 2021 year-over-year revenue growth 11% Q2 2021 attachment rate to local orders, representing significant upside potential 2 24

ENHANCED OPERATING LEVERAGE FROM ADDITIONAL COST REDUCTIONS Permanent improvement in fixed expense run-rate vs. 2019 (Q1 2021 guidance) Total permanent fixed expense improvement by 2022 (Q2 2021 guidance) Business process improvements enabled by technology Major contract renegotiations Facility consolidations and reductions Reductions in travel, entertainment and supplies Headcount reductions and improved employee efficiency 25 $50M $70M 3

CONTINUED VALUE CREATION FROM FUTURE M&A AND INVESTMENTS JUNE Purchased WKQX-FM from Merlin Media for $18.0 mm Sold Blacksburg market cluster to Monticello Media for $450K NOVEMBER Sold six stations contributing a combined annual EBITDA of ~$6 mm to Educational Media Foundation for $103.5 mm MAY Sold KLOS-FM to Meruelo Media for $43.0 mm at 8.6x EBITDA APRIL Sold DC land to Toll Brothers for $74.1 mm JUNE Announced completion of Nashville land sale for $34.0 mm AUGUST Announced WynnBET partnership extending Cumulus’s reach in emerging sports- betting market JULYMARCH Swapped Nash 94.7 and other assets in NYC / Maryland with Entercom for assets in Indianapolis MAY Swapped Bridgeport cluster with Connoisseur Media for Allentown cluster MARCH Sold WABC-AM to Red Apple Media for $12.5 mm SEPTEMBER Sold-leased back tower portfolio to Vertical Bridge REIT for $210.6 mm gross proceeds at a multiple of 14.25x Cash Flow 98.1/ 1450 Cumulus Media (NYC/Springfield, MA) Entercom (Indianapolis) Connoisseur Media (Allentown) Cumulus Media (Bridgeport) WEEX-AM and WTKZ-AM 26 4 2018 2019 2020 2021

STRONG BALANCE SHEET & SIGNIFICANT LIQUIDITY WITH CAPITAL ALLOCATION FLEXIBILITY Net Debt ($ mm) and Net Leverage Substantial available liquidity including cash of $125 mm as of Q2 2021 plus $96 mm of availability under ABL Revolver and cash from Nashville land sale Continuation of debt paydown ($175 mm in Q2 2021) Covenant-lite capital structure with long- dated (2026) maturities for Term Loan and Senior Notes Disciplined Growth De-Leveraging Capital Return Organic and inorganic (M&A / partnerships) actions to achieve and/or expand leadership positions Focus on de-risking balance sheet through rapid de-leveraging to below 4.0x net leverage Potential to return capital to shareholders as part of capital allocation strategy 27 5 8.7x

STRATEGIC POSITIONING INVESTMENT HIGHLIGHTS HISTORY AND RESULTS VALUE CREATION MODEL COMPANY OVERVIEW 28

CUMULUS MEDIA INVESTMENT HIGHLIGHTS AUDIO-FIRST MEDIA STRATEGY SUPPORTING SUSTAINABLE, LONG-TERM SHAREHOLDER RETURNS BALANCED BUSINESS MODEL: FAST GROWING DIGITAL BUSINESS LINES AND HIGH FREE CASH FLOW GENERATED BY RADIO PROVEN MANAGEMENT TEAM WITH TRACK RECORD OF STRONG OPERATING PERFORMANCE SIGNIFICANT FLEXIBILITY TO OPTIMIZE CAPITAL ALLOCATION, INCLUDING DEBT PAYDOWN & RETURN OF CAPITAL CONTINUED VALUE CREATION THROUGH PORTFOLIO OPTIMIZATION AND ACCRETIVE M&A DIVERSE, EXPERIENCED BOARD FOCUSED ON LONG-TERM VALUE CREATION AND ESG 29

Appendix

Bob Walker President, Cumulus Operations Mary Berner President & CEO Richard Denning EVP, General Counsel & Secretary Francisco J. Lopez- Balboa EVP, CFO Suzanne Grimes President, Westwood One EVP, Corporate Marketing Dave Milner President, Cumulus Operations Former CEO, The Association of Magazine Media Former CEO, Reader’s Digest Former President & CEO, Fairchild Publications Former EVP & CFO, Univision Former MD, Goldman, Sachs-Investment Banking, TMT Former Attorney, Dow, Lohnes & Albertson Member, Pennsylvania Bar, District of Columbia Bar & Georgia Bar Former President & COO, Clear Channel Outdoor NA Former President, U.S. Lifestyle Communities, Canada & India, Reader’s Digest Former President & Market Manager, iHeart (Sacramento) Former VP of Sales, Entercom (San Francisco) Co-Head, Office of Programming, Cumulus Media Former EVP & General Manager, The Weather Channel Former President & General Manager, Gannett (Atlanta) EXPERIENCED LEADERSHIP TEAM EXECUTING OUR VISION 50% of Executive Officers are Female or from Diverse Backgrounds 31

OUR ESG PRIORITIES Our Board and management continue to oversee our ESG strategy and enhance our disclosures to align with the SASB standard ü Developed Programming Principles that describe our commitment to accuracy and respect for cultural rights and diversity ü Constantly monitor our content to ensure compliance with programming guidelines ü Enforce our Payola-Plugola Policy which strictly prohibits every employee from improperly profiting personally from the use of public airwaves ü Codify our approach to intellectual property protections in our employee handbook ü Conduct bi-annual company-wide anonymous culture survey to gauge employee sentiment and engage our workforce ü Monitor employee turnover and present detailed data to our Board as part of their oversight of our human capital strategy ü Driven by FORCE – our guiding principles and commitment to be Focused, Responsible, Collaborative and Empowered that guides our work and the decisions that we make every day ü Established hiring and promotion diversity goals for women and black, indigenous, people of color (BIPOC) ü Created a DEI Steering Committee, led by the CEO, composed of six leadership team members to lead our ongoing our DEI strategy ü Joined CEO Action for Diversity & Inclusion, and committed to promote DEI in the workplace ü Senior leaders completed an intensive 28-day anti-racism program in addition to ongoing trainings on race, allyship and managing unconscious biases for business leaders ü Rolled out Programming Principles to memorialize how the FORCE CUMULUS values should be expressed in programming ü Utilize industry best practices to protect consumer privacy and personally identifiable information, and to secure all information assets ü Conduct bi-annual mandatory company-wide information security training ü Adopted both proactive and reactive data breach measures and operational plans to address any potential disaster recovery-related issues Promoting Journalistic Integrity and Protecting Intellectual Property Attracting and Retaining Our Human Capital Prioritizing Diversity, Equity and Inclusion Managing Cybersecurity and Data Privacy 32

SOURCES & METHODOLOGY 33 1) BIA (2019); Over-the-air revenues plus Company estimate for total network radio market revenue 2) Calculated as the sum of over-the-air radio market revenues (BIA, 2019), online revenues (BIA, 2019), network radio market revenues (Company estimate), podcasting market revenues (IAB, PwC, May 2021), and local digital marketing services revenues (Company estimate, see note 14 below for methodology) 3) Triton Webcast Metrics Rankers (June 2021); Daypart: Monday-Sunday, 6am-Midnight 4) Analytic Partners (2016); Analysis based on over 3,200 ad campaigns from 2010-2015 5) Edison Research (Q3-Q4 2020, Q1-Q2 2021); “Share of Ear” study 6) Nielsen (Spring 2021); Nationwide Survey; Adults 18+ 7) Gartner, Inc. (August 2021); Poll of 238 executive leaders 8) Real-Time Population Survey (May 2021); Alexander Bick, Adam Blandin, and Karel Mertens; “Work From Home After COVID-19 Outbreak”; Federal Reserve Bank of Dallas 9) Miller Kaplan Arase LLP (September 2021); Ad hoc analysis 10) BIA (March 2021); 2021 U.S. Local Advertising Forecast; “Online Revenues” 11) Edison Research, Triton Digital (March 2021); The Infinite Dial 2021 Report 12) IAB, PwC (May 2021); U.S. Podcast Advertising Revenue Study 13) IAB, PwC (May 2021); U.S. Podcast Advertising Revenue Study 14) Company estimate (2021); Assumes ~3.7 mm addressable market of U.S. small-and-mid-sized businesses with 1-50 employees in verticals that generally have digital marketing services needs with average annual spend of $4,000; LSA/Mono Small Business Survey (2018); U.S. Census Bureau (2017 County Business Patterns) 15) Company estimate (2021); Based on publicly available comparable analysis and interviews with market participants

GLOSSARY OF NON-GAAP TERMS 34 The non-GAAP terms referenced below may be provided on an As-Reported Basis as well as a Same Station Basis. “EBITDA” or “Adjusted EBITDA” Net income or loss excluding: interest, taxes, depreciation, amortization, stock-based compensation expense, gain or loss on the exchange, sale, or disposal of any assets or stations, local marketing agreement fees, restructuring costs, expenses relating to acquisitions and divestitures, non-routine legal expenses incurred in connection with certain litigation matters, and non-cash impairments of assets, if any. “EBITDA (ex political)” or “Adjusted EBITDA (ex political)” EBITDA excluding the impact of political advertising. “Net debt” “Net leverage” These non-GAAP terms are not defined in GAAP and our definitions may differ from, and therefore not be comparable to, similarly titled measures used by other companies, thereby limiting their usefulness. Such terms are used by management in addition to and in conjunction with results presented in accordance with GAAP and should be considered as supplements to, and not as substitutes for, net income and cash flows reported in accordance with GAAP. Total debt less cash and cash equivalents. Net debt divided by trailing twelve month Adjusted EBITDA

RECONCILIATIONS TO NON-GAAP TERMS NET INCOME TO ADJUSTED EBITDA (AS REPORTED BASIS, 2016-2020, EX. POLITICAL) 35 ($ in ‘000s) 2016 2017 2018 2019 2020 Net (loss) income $ (510,720) $ (206,565) $ 757,581 $ 61,257 $ (59,719) Income tax (benefit) expense (26,154) (163,726) (189,212) 22,263 (19,249) Non-operating expense, including net interest expense 136,102 127,179 54,260 83,068 68,366 Local marketing agreement fees 12,824 10,884 4,280 3,500 3,149 Depreciation and amortization 87,267 62,239 56,106 52,554 52,290 Stock-based compensation expense 2,948 1,614 3,635 5,301 3,337 Impairment of assets held for sale - - - 6,165 - Impairment of intangible assets and goodwill 604,965 335,909 - 15,563 4,509 Impairment of capitalized software development costs - - - - 4,139 (Gain) loss on sale of assets or stations (95,695) (2,499) 261 (55,403) 8,761 Reorganization items, net - 31,603 (466,201) - - Restructuring costs 1,817 19,492 13,649 18,315 14,859 Franchise taxes 530 558 189 786 815 (Gain) loss on early extinguishment of debt (8,017) 1,063 (201) (381) - As reported Adjusted EBITDA $ 205,867 $ 217,751 $ 234,347 $ 212,988 $ 81,257 Political EBITDA (15,086) (5,303) (18,501) (5,850) (23,630) As reported Adjusted EBITDA, excluding impact of political EBITDA $ 190,781 $ 212,448 $ 215,846 $ 207,138 $ 57,627

RECONCILIATIONS TO NON-GAAP TERMS NET INCOME TO ADJUSTED EBITDA (SAME STATION BASIS, 2018-2019, EX. POLITICAL) 36 Same Station 2018 2019 Net income $ 747,055 $ 60,892 Income tax expense (benefit) (189,212) 22,263 Non-operating expense, including net interest expense 54,260 83,068 Local marketing agreement fees 4,280 3,500 Depreciation and amortization 56,106 52,554 Stock-based compensation expense 3,635 5,301 Impairment of assets held for sale - 6,165 Impairment of intangible assets - 15,563 (Gain) loss on sale of assets or stations 261 (55,403) Reorganization items, net (466,201) - Restructuring costs 13,649 18,315 Franchise taxes 189 786 Gain on early extinguishment of debt (201) (381) Same Station Adjusted EBITDA $ 223,821 $ 212,623 Political EBITDA (18,009) (5,850) Same Station Adjusted EBITDA, excluding impact of political EBITDA $ 205,812 $ 206,773 ($ in ‘000s)

RECONCILIATIONS TO NON-GAAP TERMS NET INCOME TO ADJUSTED EBITDA (SAME STATION BASIS, 2019-2020, EX. POLITICAL) 37 Same Station 2019 2020 Net (loss) income $ 62,705 $ (57,160) Income tax (benefit) expense 22,263 (19,249) Non-operating expense, including net interest expense 83,068 68,366 Local marketing agreement fees 3,500 3,149 Depreciation and amortization 52,522 52,232 Stock-based compensation expense 5,301 3,337 Impairment of assets held for sale 6,165 - Impairment of intangible assets 15,563 4,509 Impairment of capitalized software development costs - 4,139 (Gain) loss on sale of assets or stations (55,427) 7,270 Restructuring costs 18,293 14,839 Franchise taxes 786 815 Gain on early extinguishment of debt (381) - Same Station Adjusted EBITDA $ 214,358 $ 82,247 Political EBITDA (5,738) (23,630) Same Station Adjusted EBITDA, excluding impact of political EBITDA $ 208,620 $ 58,617 ($ in ‘000s)

RECONCILIATIONS TO NON-GAAP TERMS NET INCOME TO ADJUSTED EBITDA (SELECTED PERIODS) 38 Q2 2018 LTM Q1 2021 LTM Q2 2021 LTM Net income (loss) $ 496,294 $ (74,285) $ (43,861) Income tax benefit (339,187) (22,049) (9,338) Non-operating expense, including net interest expense 65,451 68,894 70,725 Local marketing agreement fees 7,631 2,598 1,785 Depreciation and amortization 56,262 52,910 52,951 Stock-based compensation expense 1,429 3,675 4,048 Impairment of intangible assets and goodwill 335,909 4,509 - Impairment of capitalized software development costs - 4,139 4,139 Loss on sale of assets or stations 161 6,662 2,716 Reorganization items, net (434,598) - - Restructuring costs 27,270 13,518 14,069 Franchise taxes 560 865 835 Loss on early extinguishment of debt 1,063 - - Non-routine legal expenses - 1,028 7,627 As reported Adjusted EBITDA $ 218,245 $ 62,464 $ 105,696 Political EBITDA (7,709) (20,399) (20,222) As reported Adjusted EBITDA, excluding impact of political EBITDA $ 210,536 $ 42,065 $ 85,474 ($ in ‘000s)

RECONCILIATIONS TO NON-GAAP TERMS TOTAL DEBT TO NET DEBT & NET LEVERAGE RATIO (SELECTED PERIODS) 39 ($ in '000s) Q2 2018 2018 2019 2020 Q1 2021 Total debt $ 1,300,000 $ 1,243,299 $ 1,023,688 $ 982,247 $ 982,635 Cash and cash equivalents 37,444 27,584 15,142 271,761 293,806 Net debt $ 1,262,556 $ 1,215,715 $ 1,008,546 $ 710,486 $ 688,829 LTM EBITDA 218,245 234,347 212,988 81,257 62,464 Net leverage Ratio 5.8x 5.2x 4.7x 8.7x 11.0x