Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REPLIGEN CORP | d217967d8k.htm |

| EX-99.1 - EX-99.1 - REPLIGEN CORP | d217967dex991.htm |

Repligen Announces Agreement to Acquire Avitide, Inc. Tony J. Hunt, President and CEO September 16, 2021 Jon K. Snodgres, CFO Exhibit 99.2

Safe Harbor This presentation contains forward-looking statements within the meaning of the federal securities laws. Investors are cautioned that statements in this presentation which are not strictly historical statements including, without limitation, express or implied statements or guidance regarding the expected results of the proposed acquisition of Avitide, Inc. on Repligen’s future financial performance, including the accretive nature and the timing of the accretive nature of the acquisition, expected synergies following the acquisition of Avitide, customer adoption of Avitide’s products, the expected expansion of Repligen’s product lines, and other statements identified by words like “believe,” “expect,” “anticipate,” “may,” “will,” “should,” “targeted,” “seek,” or “could” and similar expressions, constitute forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated, including, without limitation, risks associated with: the risk that the proposed acquisition may not be completed in a timely manner, or at all; the occurrence of any event, change or other circumstance that could give rise to the termination of the acquisition; our ability to integrate Avitide’s business and personnel and to achieve expected synergies; our ability to maintain or expand Avitide’s historical sales; our ability to accurately forecast the acquisition, related restructuring costs and allocation of the purchase price, goodwill and other intangibles acquisition related and other asset adjustments; and other risks detailed in Repligen’s most recent Annual Report on Form 10-K and the most recently filed Quarterly Report on Form-10-Q on file with the Securities and Exchange Commission and the other reports that Repligen periodically files with the Securities and Exchange Commission. Actual results may differ materially from those Repligen contemplated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. These forward-looking statements reflect management’s current views and are based only on information currently available to us. Repligen does not undertake to update, whether written or oral, any of these forward-looking statements to reflect a change in its views or events or circumstances, whether as a result of new information or otherwise, that occur after the date hereof except as required by law. The industry and market data contained in this presentation are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe these sources are reliable, we have not independently verified the information.

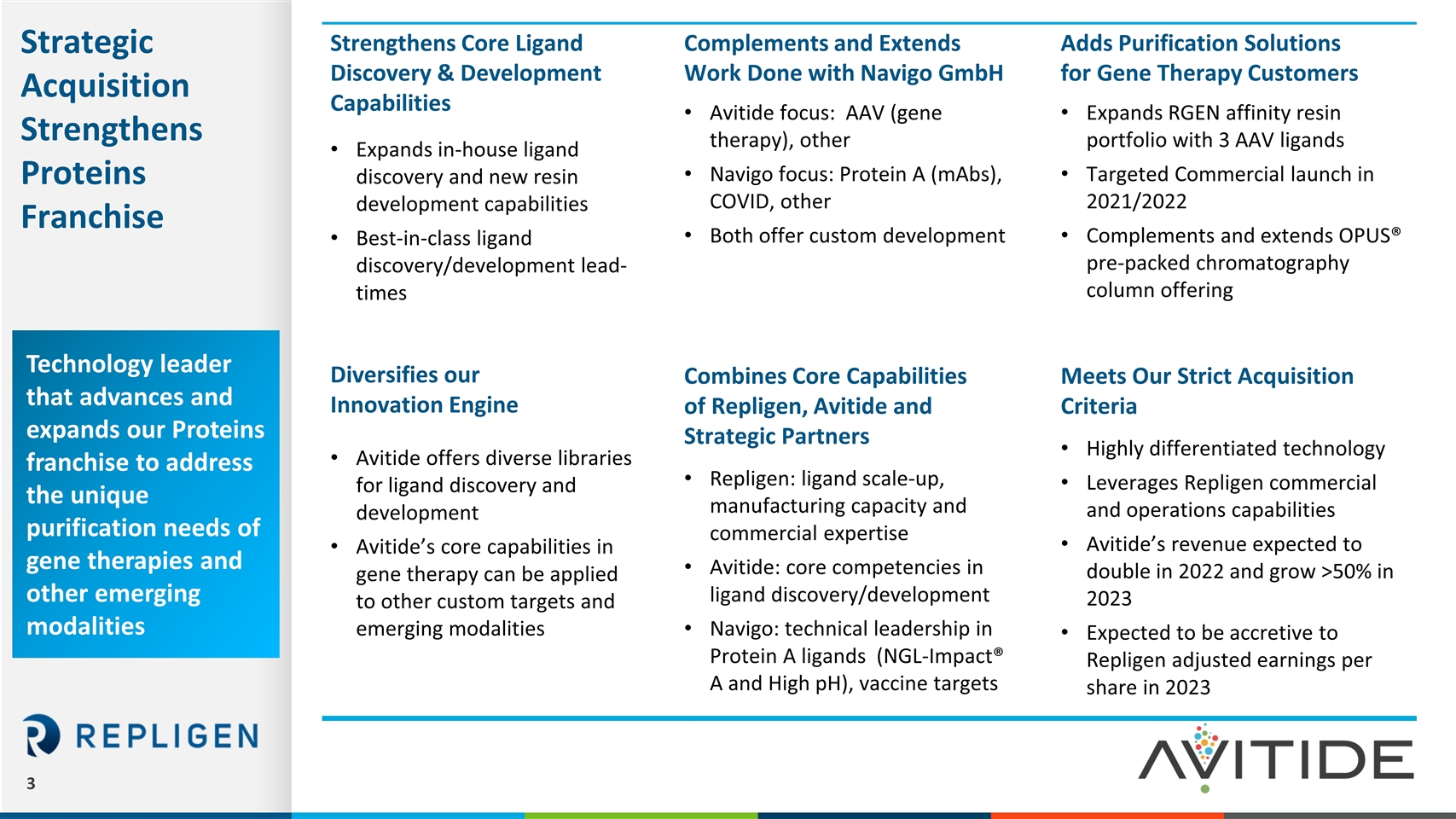

Strengthens Core Ligand Discovery & Development Capabilities Expands in-house ligand discovery and new resin development capabilities Best-in-class ligand discovery/development lead-times Complements and Extends Work Done with Navigo GmbH Avitide focus: AAV (gene therapy), other Navigo focus: Protein A (mAbs), COVID, other Both offer custom development Adds Purification Solutions for Gene Therapy Customers Expands RGEN affinity resin portfolio with 3 AAV ligands Targeted Commercial launch in 2021/2022 Complements and extends OPUS® pre-packed chromatography column offering Diversifies our Innovation Engine Avitide offers diverse libraries for ligand discovery and development Avitide’s core capabilities in gene therapy can be applied to other custom targets and emerging modalities Combines Core Capabilities of Repligen, Avitide and Strategic Partners Repligen: ligand scale-up, manufacturing capacity and commercial expertise Avitide: core competencies in ligand discovery/development Navigo: technical leadership in Protein A ligands (NGL-Impact® A and High pH), vaccine targets Meets Our Strict Acquisition Criteria Highly differentiated technology Leverages Repligen commercial and operations capabilities Avitide’s revenue expected to double in 2022 and grow >50% in 2023 Expected to be accretive to Repligen adjusted earnings per share in 2023 Strategic Acquisition Strengthens Proteins Franchise Technology leader that advances and expands our Proteins franchise to address the unique purification needs of gene therapies and other emerging modalities

Technology leadership in affinity ligand discovery and development Avitide and partnership with Navigo provide best-in-class screening for affinity ligand candidates across multiple modalities Avitide differentiates with speed and accuracy; ~6 weeks for ligand discovery versus standard 4-6 months Strengthens and expands Repligen Proteins portfolio Strengthens Repligen’s market position as leader in affinity ligands (content ownership) Expands Repligen’s market reach into AAV and other non-protein A targets Moves us further into affinity resins and leverages OPUS® pre-packed column format with content Operational and commercial leverage Leverages our investments in global market presence; downstream commercial team Avitide has no commercial team today Leverages our operational network for affinity ligand development and scale-up Avitide outsources ligand manufacture and scale-up; Repligen will bring in house Avitide’s revenue expected to double in 2022 to ~$10M Expected to be accretive to adjusted EPS in 2023, ~$0.05 dilutive in 2022 Avitide Meets Repligen’s Acquisition Criteria ~$150M purchase: ~$75M cash, ~$75M shares, plus contingent earnouts

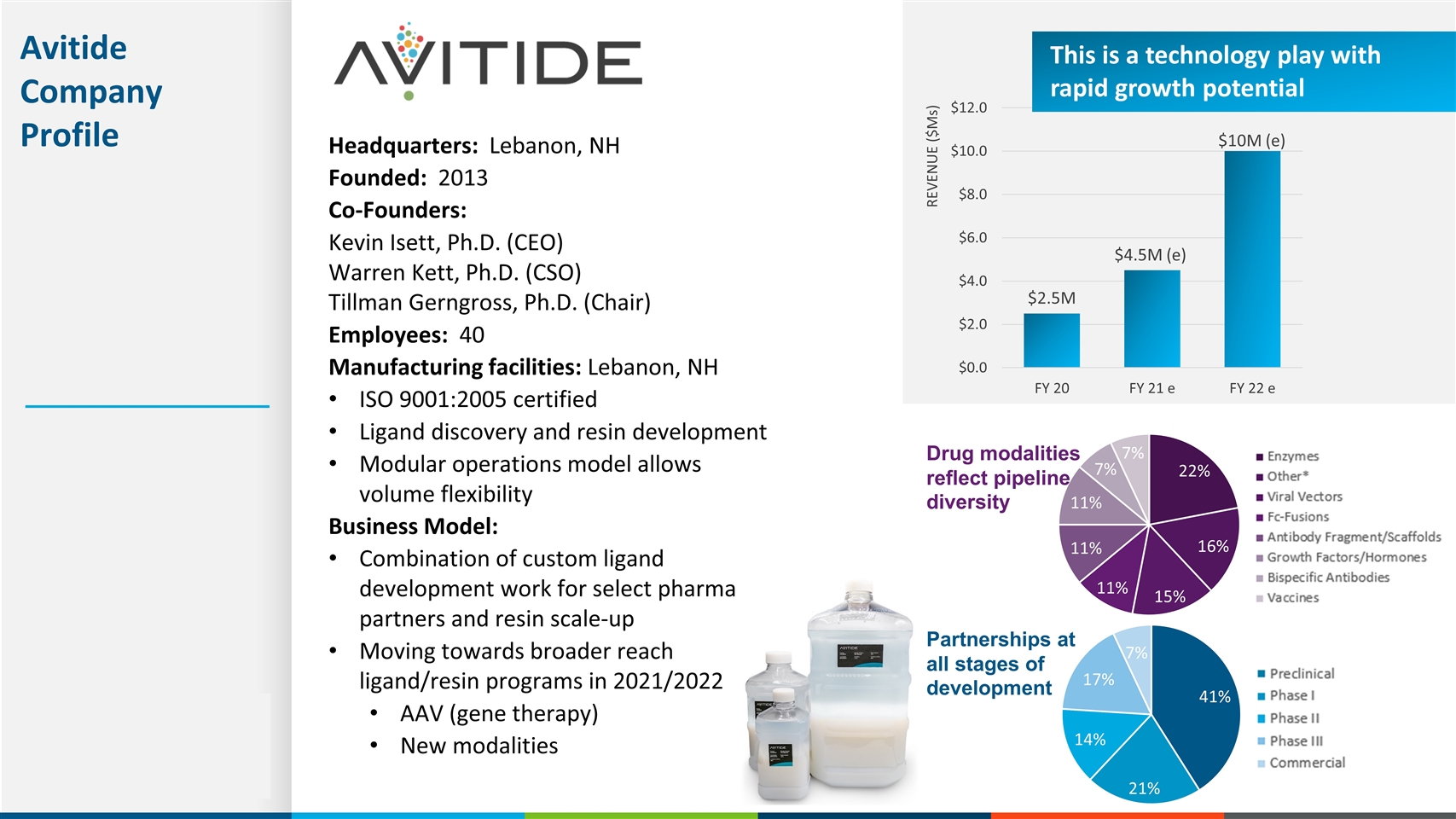

Headquarters: Lebanon, NH Founded: 2013 Co-Founders: Kevin Isett, Ph.D. (CEO) Warren Kett, Ph.D. (CSO) Tillman Gerngross, Ph.D. (Chair) Employees: 40 Manufacturing facilities: Lebanon, NH ISO 9001:2005 certified Ligand discovery and resin development Modular operations model allows volume flexibility Business Model: Combination of custom ligand development work for select pharma partners and resin scale-up Moving towards broader reach ligand/resin programs in 2021/2022 AAV (gene therapy) New modalities Avitide Company Profile This is a technology play with rapid growth potential REVENUE ($Ms) Drug modalities reflect pipeline diversity Partnerships at all stages of development

6 weeks ligand discovery, 6 weeks resin development (target dependent) High diversity improves the overall probability of success to identify well-differentiated binders

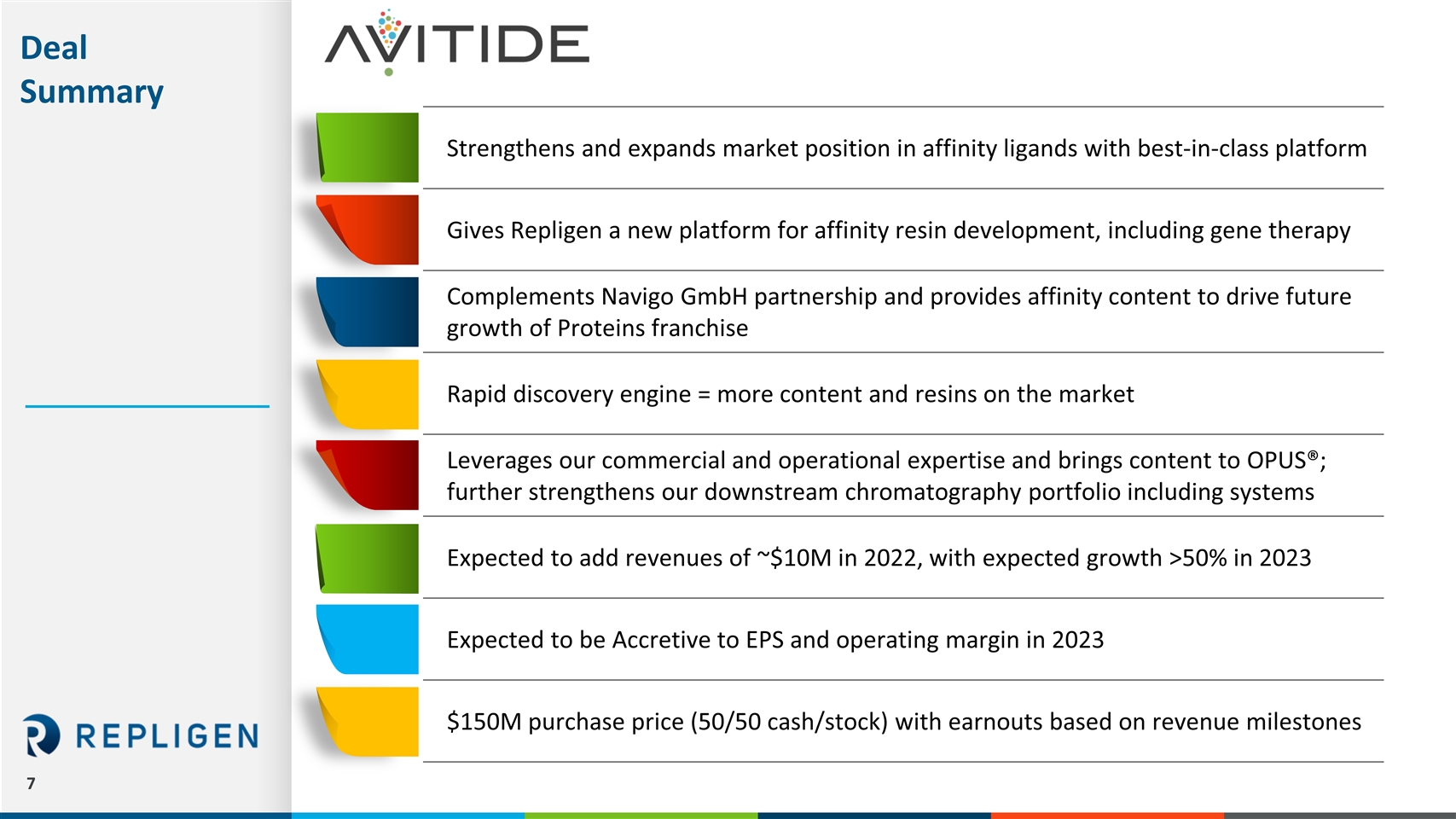

Deal Summary Strengthens and expands market position in affinity ligands with best-in-class platform Gives Repligen a new platform for affinity resin development, including gene therapy Complements Navigo GmbH partnership and provides affinity content to drive future growth of Proteins franchise Rapid discovery engine = more content and resins on the market Leverages our commercial and operational expertise and brings content to OPUS®; further strengthens our downstream chromatography portfolio including systems Expected to add revenues of ~$10M in 2022, with expected growth >50% in 2023 Expected to be Accretive to EPS and operating margin in 2023 $150M purchase price (50/50 cash/stock) with earnouts based on revenue milestones

Questions? Contact Investor Relations investors@repligen.com