Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HOME BANCSHARES INC | homb-ex991_6.htm |

| EX-2.1 - EX-2.1 - HOME BANCSHARES INC | homb-ex21_126.htm |

| 8-K - 8-K - HOME BANCSHARES INC | homb-8k_20210915.htm |

Home BancShares Announces Acquisition of Happy Bancshares Creating a Happy HOMB from Panhandle to Panhandle Exhibit 99.2

Forward looking statement This presentation contains forward-looking statements which include, but are not limited to, statements about the benefits of the business combination transaction involving Home BancShares, Inc. (“Home”) and Happy Bancshares, Inc. (“Happy”), including the combined company’s future financial and operating results, plans, expectations, goals and outlook for the future. Statements in this presentation that are not historical facts should be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements of this type speak only as of the date of this presentation. By nature, forward-looking statements involve inherent risk and uncertainties. Various factors could cause actual results to differ materially from those contemplated by the forward-looking statements, including, but not limited to, (i) the possibility that the acquisition does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; (ii) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (iii) the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, ongoing or future effects of the COVID-19 pandemic, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Home and Happy operate; (iv) the ability to promptly and effectively integrate the businesses of Home and Happy; (v) the reaction to the transaction of the companies’ customers, employees and counterparties; and (vi) diversion of management time on acquisition-related issues. Additional information on factors that might affect Home’s financial results is included in its Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on February 26, 2021. Home assumes no obligation to update the information in this presentation, except as otherwise required by law. 2

Additional information and where to find it This presentation may be deemed to be solicitation material in respect of the proposed transaction by Home and Happy. In connection with the proposed acquisition, Home intends to file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 (the “Registration Statement”) to register the shares of Home common stock to be issued to shareholders of Happy in connection with the transaction. The Registration Statement will include a Joint Proxy Statement of Home and Happy and a Prospectus of Home, as well as other relevant materials regarding the proposed merger transaction involving Home and Happy. INVESTORS AND SECURITY HOLDERS OF HOME AND HAPPY ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER TRANSACTION. Investors and security holders may obtain free copies of these documents, once they are filed, and other documents filed with the SEC on the SEC’s website at http://www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the SEC by Home at Home’s website at http://www.homebancshares.com, Investor Relations, or by contacting Donna Townsell, by telephone at (501) 328-4625. Home and Happy and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Home and Happy in connection with the merger transaction. Information about the directors and executive officers of Home and their ownership of Home common stock is set forth in the proxy statement for Home’s 2021 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on March 2, 2021. Information about the directors and executive officers of Happy and their ownership of Happy common stock will be set forth in the Joint Proxy Statement/Prospectus to be included in the Registration Statement. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the merger transaction. Free copies of this document may be obtained as described in the preceding paragraph when it becomes available. 3

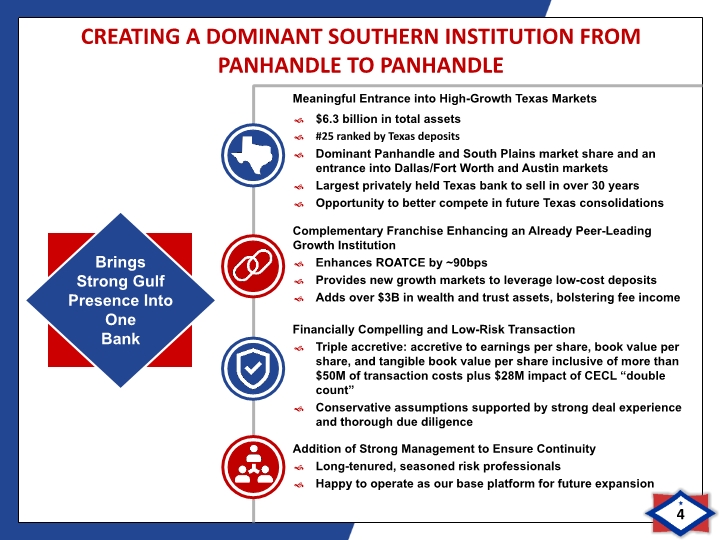

Creating a dominant southern institution from panhandle to panhandle Meaningful Entrance into High-Growth Texas Markets $6.3 billion in total assets #25 ranked by Texas deposits Dominant Panhandle and South Plains market share and an entrance into Dallas/Fort Worth and Austin markets Largest privately held Texas bank to sell in over 30 years Opportunity to better compete in future Texas consolidations 4 Complementary Franchise Enhancing an Already Peer-Leading Growth Institution Enhances ROATCE by ~90bps Provides new growth markets to leverage low-cost deposits Adds over $3B in wealth and trust assets, bolstering fee income Financially Compelling and Low-Risk Transaction Triple accretive: accretive to earnings per share, book value per share, and tangible book value per share inclusive of more than $50M of transaction costs plus $28M impact of CECL “double count” Conservative assumptions supported by strong deal experience and thorough due diligence Addition of Strong Management to Ensure Continuity Long-tenured, seasoned risk professionals Happy to operate as our base platform for future expansion Brings Strong Gulf Presence Into One Bank

EXPANSION INTO HIGH GROWTH TEXAS MARKETS 5 Expansive Geographic Footprint Enhancing Our Presence in High Growth Markets Attractive Market Presence Represents MSAs with population of at least 250,000 Deposit and market share information per FDIC from S&P Global Market Intelligence as of June 30, 2021; Ranking excludes credit unions, credit card companies, trust companies and subsidiaries of foreign banks Source: S&P Global Market Intelligence, Company Filings Amarillo Austin Dallas Destin Fayetteville Fort Myers Fort Smith Lakeland Little Rock Lubbock Miami Naples New York Orlando Pensacola Sarasota Tallahassee Tampa

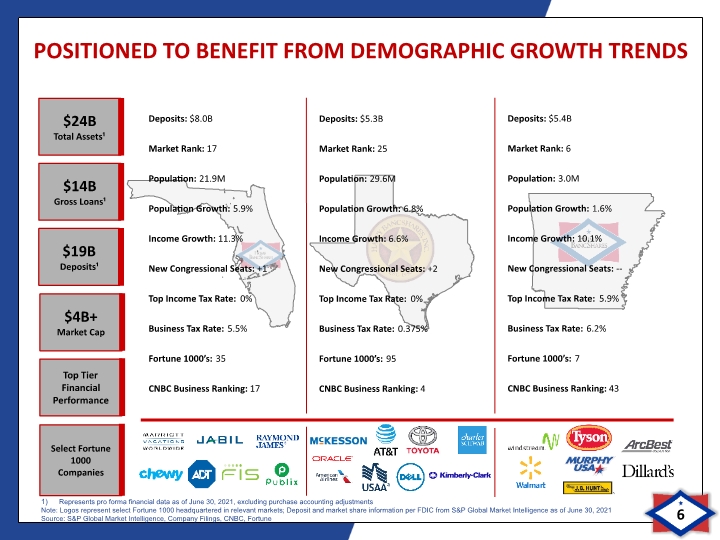

Deposits: $5.3B Market Rank: 25 Population: 29.6M Population Growth: 6.8% Income Growth: 6.6% New Congressional Seats: +2 Top Income Tax Rate: 0% Business Tax Rate: 0.375% Fortune 1000’s: 95 CNBC Business Ranking: 4 Deposits: $8.0B Market Rank: 17 Population: 21.9M Population Growth: 5.9% Income Growth: 11.3% New Congressional Seats: +1 Top Income Tax Rate: 0% Business Tax Rate: 5.5% Fortune 1000’s: 35 CNBC Business Ranking: 17 Positioned to Benefit from Demographic Growth Trends 6 Represents pro forma financial data as of June 30, 2021, excluding purchase accounting adjustments Note: Logos represent select Fortune 1000 headquartered in relevant markets; Deposit and market share information per FDIC from S&P Global Market Intelligence as of June 30, 2021 Source: S&P Global Market Intelligence, Company Filings, CNBC, Fortune Deposits: $5.4B Market Rank: 6 Population: 3.0M Population Growth: 1.6% Income Growth: 10.1% New Congressional Seats: -- Top Income Tax Rate: 5.9% Business Tax Rate: 6.2% Fortune 1000’s: 7 CNBC Business Ranking: 43

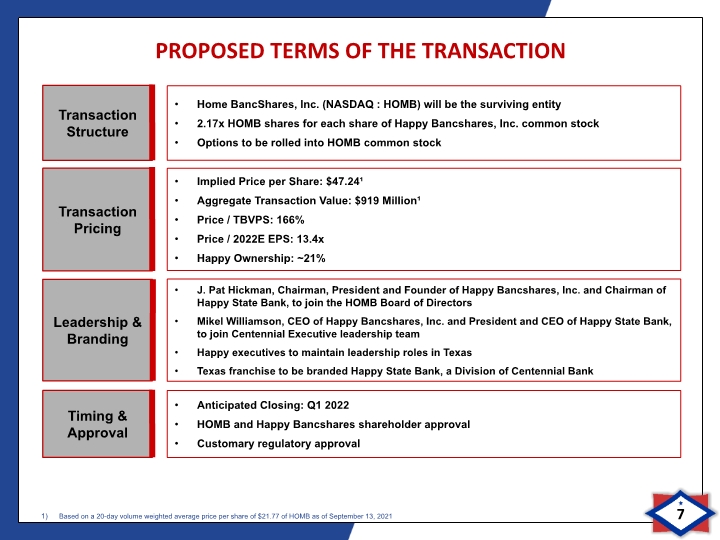

Proposed Terms of the Transaction 7 Home BancShares, Inc. (NASDAQ : HOMB) will be the surviving entity 2.17x HOMB shares for each share of Happy Bancshares, Inc. common stock Options to be rolled into HOMB common stock Leadership & Branding J. Pat Hickman, Chairman, President and Founder of Happy Bancshares, Inc. and Chairman of Happy State Bank, to join the HOMB Board of Directors Mikel Williamson, CEO of Happy Bancshares, Inc. and President and CEO of Happy State Bank, to join Centennial Executive leadership team Happy executives to maintain leadership roles in Texas Texas franchise to be branded Happy State Bank, a Division of Centennial Bank Anticipated Closing: Q1 2022 HOMB and Happy Bancshares shareholder approval Customary regulatory approval Implied Price per Share: $47.24¹ Aggregate Transaction Value: $919 Million¹ Price / TBVPS: 166% Price / 2022E EPS: 13.4x Happy Ownership: ~21% Based on a 20-day volume weighted average price per share of $21.77 of HOMB as of September 13, 2021

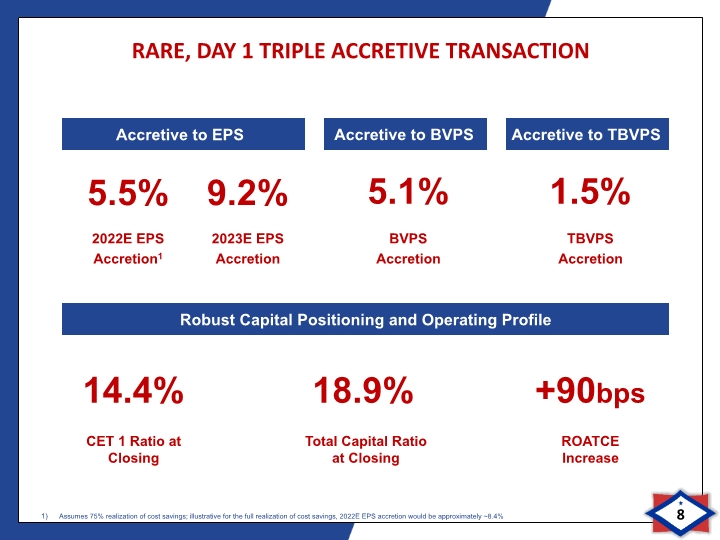

Rare, Day 1 Triple Accretive transaction 8 Robust Capital Positioning and Operating Profile Accretive to EPS Accretive to BVPS 2022E EPS Accretion1 2023E EPS Accretion BVPS Accretion TBVPS Accretion 5.5% 9.2% 5.1% 1.5% CET 1 Ratio at Closing Total Capital Ratio at Closing ROATCE Increase 14.4% 18.9% +90bps Assumes 75% realization of cost savings; illustrative for the full realization of cost savings, 2022E EPS accretion would be approximately ~8.4% Accretive to TBVPS

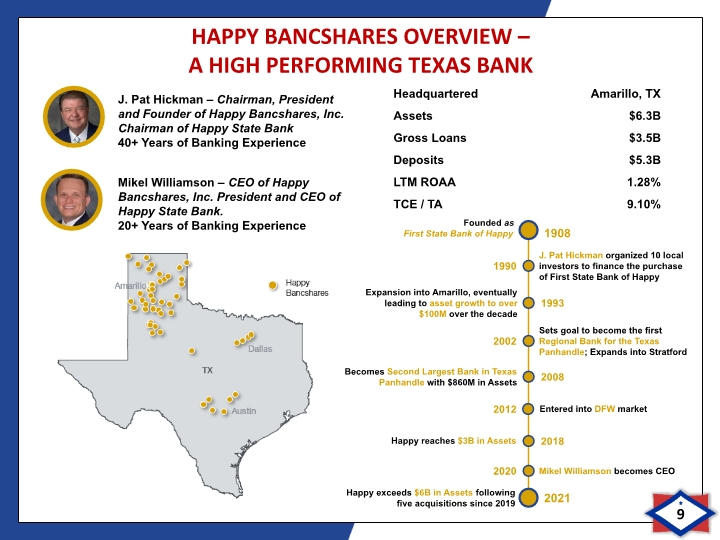

Happy Bancshares overview – a high performing Texas bank 9 J. Pat Hickman – Chairman, President and Founder of Happy Bancshares, Inc. Chairman of Happy State Bank 40+ Years of Banking Experience Mikel Williamson – CEO of Happy Bancshares, Inc. President and CEO of Happy State Bank. 20+ Years of Banking Experience Founded as First State Bank of Happy 1990 J. Pat Hickman organized 10 local investors to finance the purchase of First State Bank of Happy 1993 Expansion into Amarillo, eventually leading to asset growth to over $100M over the decade 2002 Sets goal to become the first Regional Bank for the Texas Panhandle; Expands into Stratford 2008 Becomes Second Largest Bank in Texas Panhandle with $860M in Assets 2018 Happy reaches $3B in Assets 2021 Happy exceeds $6B in Assets following five acquisitions since 2019 1908 2020 Mikel Williamson becomes CEO 2012 Entered into DFW market

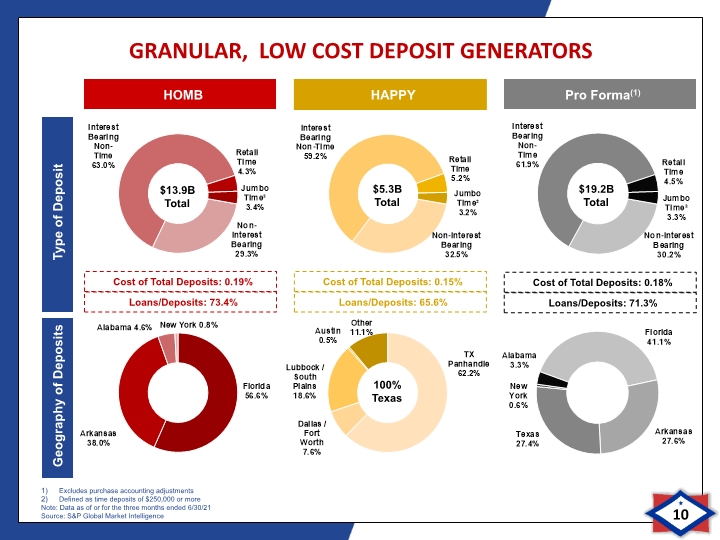

Granular, low cost deposit Generators 10 HOMB HAPPY Pro Forma(1) Type of Deposit Geography of Deposits Cost of Total Deposits: 0.19% Cost of Total Deposits: 0.15% Cost of Total Deposits: 0.18% $13.9B Total $5.3B Total $19.2B Total Loans/Deposits: 73.4% Loans/Deposits: 65.6% Loans/Deposits: 71.3% 100% Texas Excludes purchase accounting adjustments Defined as time deposits of $250,000 or more Note: Data as of or for the three months ended 6/30/21 Source: S&P Global Market Intelligence

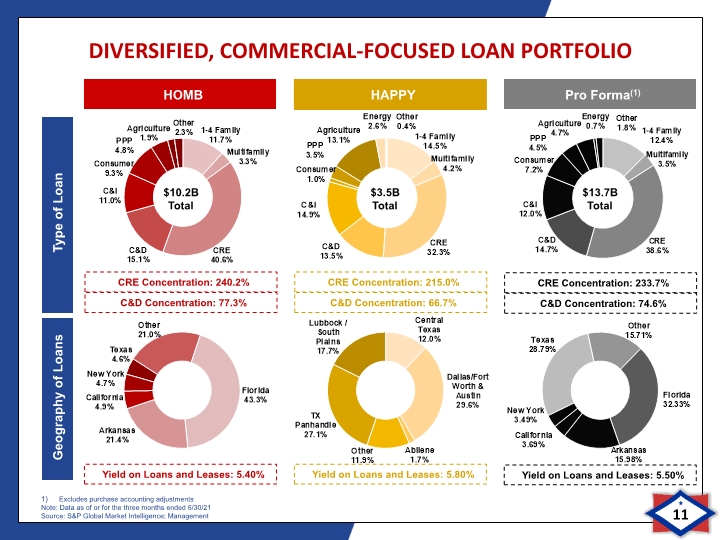

Diversified, commercial-focused loan portfolio 11 HOMB HAPPY Pro Forma(1) Type of Loan Geography of Loans Yield on Loans and Leases: 5.40% Yield on Loans and Leases: 5.80% Yield on Loans and Leases: 5.50% CRE Concentration: 240.2% CRE Concentration: 215.0% CRE Concentration: 233.7% C&D Concentration: 77.3% C&D Concentration: 66.7% C&D Concentration: 74.6% $10.2B Total $3.5B Total $13.7B Total Excludes purchase accounting adjustments Note: Data as of or for the three months ended 6/30/21 Source: S&P Global Market Intelligence; Management

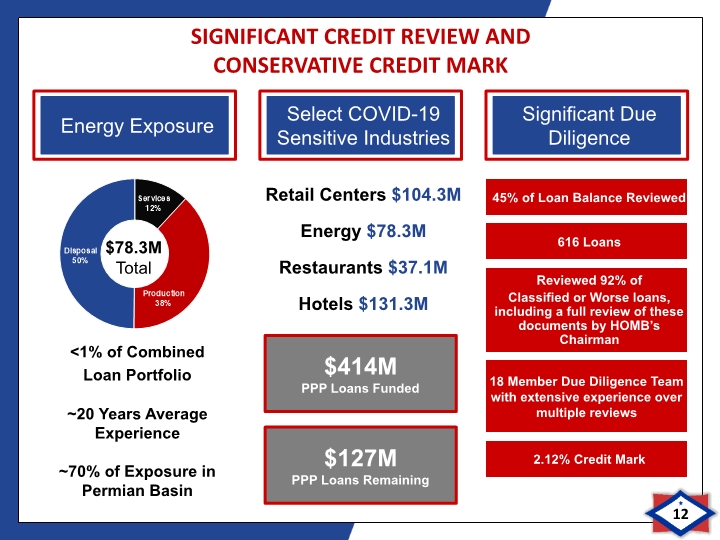

Significant Due Diligence Significant credit review and conservative credit mark 12 Retail Centers $104.3M Energy $78.3M Restaurants $37.1M Hotels $131.3M $78.3M Total <1% of Combined Loan Portfolio ~20 Years Average Experience ~70% of Exposure in Permian Basin 45% of Loan Balance Reviewed 616 Loans Reviewed 92% of Classified or Worse loans, including a full review of these documents by HOMB’s Chairman $414M PPP Loans Funded $127M PPP Loans Remaining Select COVID-19 Sensitive Industries Energy Exposure 18 Member Due Diligence Team with extensive experience over multiple reviews 2.12% Credit Mark

The combination of shared values provides benefits for all stakeholders 13

Creating a dominant southern Institution from panhandle to panhandle 14

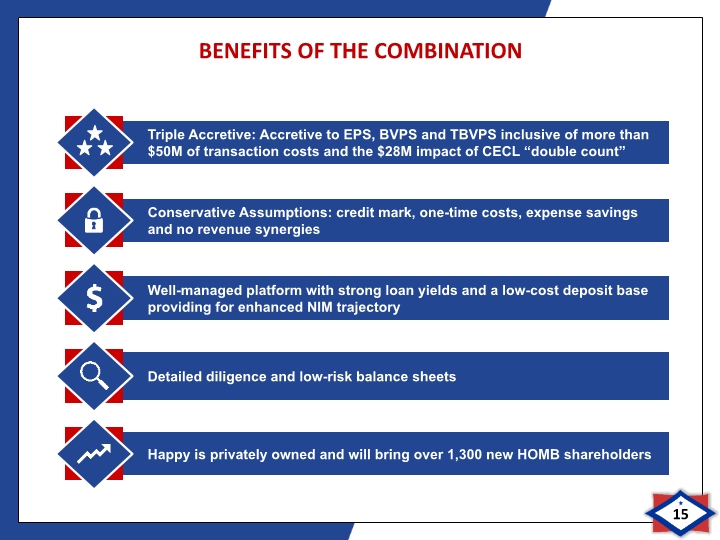

Benefits of the combination 15

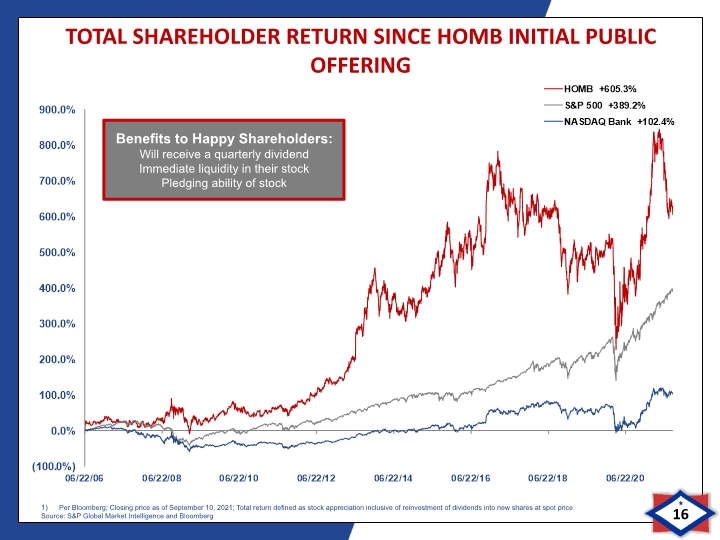

Total shareholder Return Since HOMB Initial Public Offering 16 Benefits to Happy Shareholders: Will receive a quarterly dividend Immediate liquidity in their stock Pledging ability of stock Per Bloomberg; Closing price as of September 10, 2021; Total return defined as stock appreciation inclusive of reinvestment of dividends into new shares at spot price Source: S&P Global Market Intelligence and Bloomberg

appendix 17

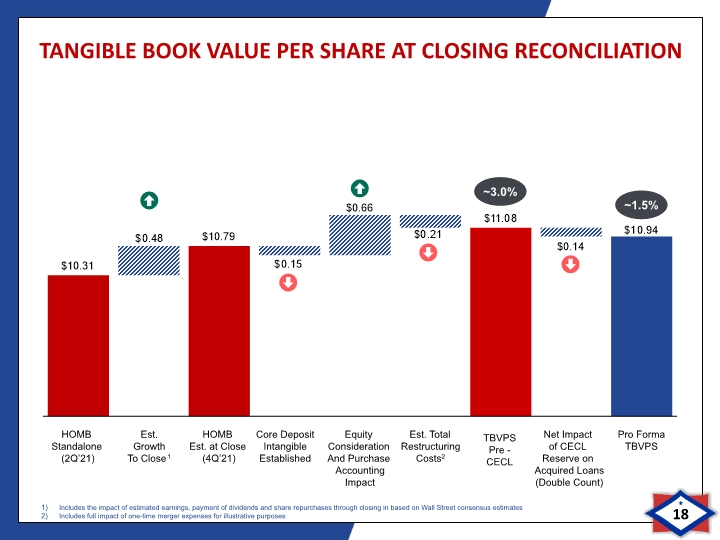

Tangible book value per share at closing Reconciliation 18 ~1.5% HOMB Standalone (2Q’21) Est. Growth To Close1 HOMB Est. at Close (4Q’21) Equity Consideration And Purchase Accounting Impact Est. Total Restructuring Costs2 Pro Forma TBVPS Core Deposit Intangible Established Net Impact of CECL Reserve on Acquired Loans (Double Count) TBVPS Pre - CECL ~3.0% Includes the impact of estimated earnings, payment of dividends and share repurchases through closing in based on Wall Street consensus estimates Includes full impact of one-time merger expenses for illustrative purposes

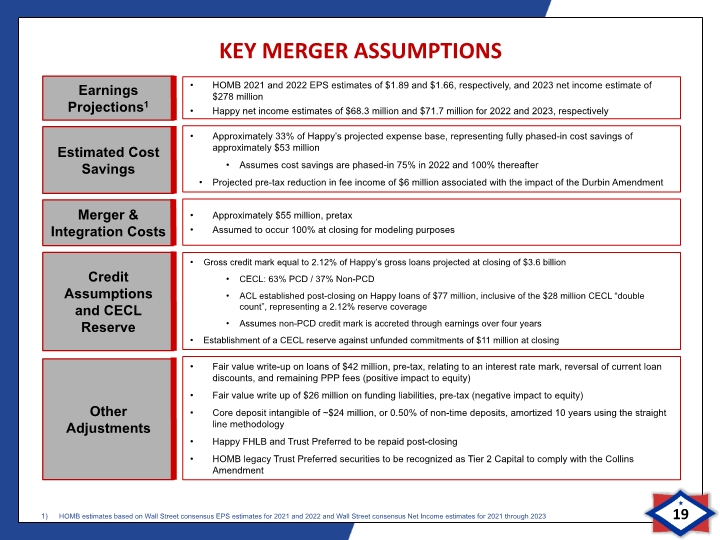

Key merger Assumptions 19 Approximately $55 million, pretax Assumed to occur 100% at closing for modeling purposes HOMB 2021 and 2022 EPS estimates of $1.89 and $1.66, respectively, and 2023 net income estimate of $278 million Happy net income estimates of $68.3 million and $71.7 million for 2022 and 2023, respectively Approximately 33% of Happy’s projected expense base, representing fully phased-in cost savings of approximately $53 million Assumes cost savings are phased-in 75% in 2022 and 100% thereafter Projected pre-tax reduction in fee income of $6 million associated with the impact of the Durbin Amendment Gross credit mark equal to 2.12% of Happy’s gross loans projected at closing of $3.6 billion CECL: 63% PCD / 37% Non-PCD ACL established post-closing on Happy loans of $77 million, inclusive of the $28 million CECL “double count”, representing a 2.12% reserve coverage Assumes non-PCD credit mark is accreted through earnings over four years Establishment of a CECL reserve against unfunded commitments of $11 million at closing Fair value write-up on loans of $42 million, pre-tax, relating to an interest rate mark, reversal of current loan discounts, and remaining PPP fees (positive impact to equity) Fair value write up of $26 million on funding liabilities, pre-tax (negative impact to equity) Core deposit intangible of ~$24 million, or 0.50% of non-time deposits, amortized 10 years using the straight line methodology Happy FHLB and Trust Preferred to be repaid post-closing HOMB legacy Trust Preferred securities to be recognized as Tier 2 Capital to comply with the Collins Amendment HOMB estimates based on Wall Street consensus EPS estimates for 2021 and 2022 and Wall Street consensus Net Income estimates for 2021 through 2023

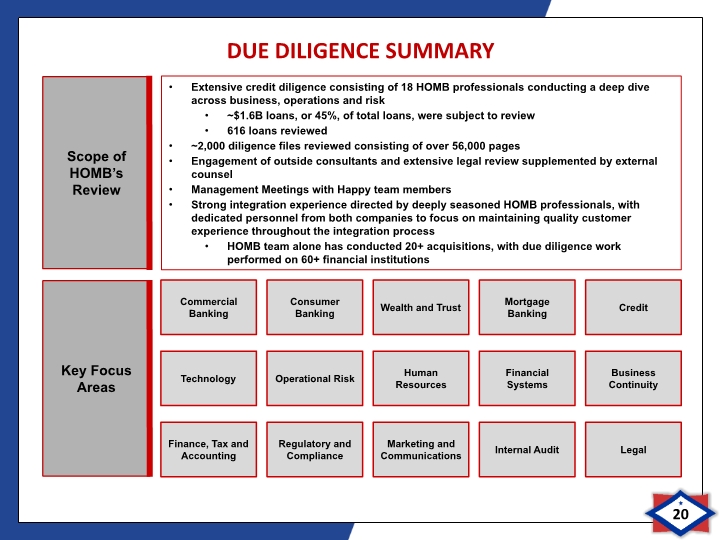

Due diligence summary 20 Extensive credit diligence consisting of 18 HOMB professionals conducting a deep dive across business, operations and risk ~$1.6B loans, or 45%, of total loans, were subject to review 616 loans reviewed ~2,000 diligence files reviewed consisting of over 56,000 pages Engagement of outside consultants and extensive legal review supplemented by external counsel Management Meetings with Happy team members Strong integration experience directed by deeply seasoned HOMB professionals, with dedicated personnel from both companies to focus on maintaining quality customer experience throughout the integration process HOMB team alone has conducted 20+ acquisitions, with due diligence work performed on 60+ financial institutions

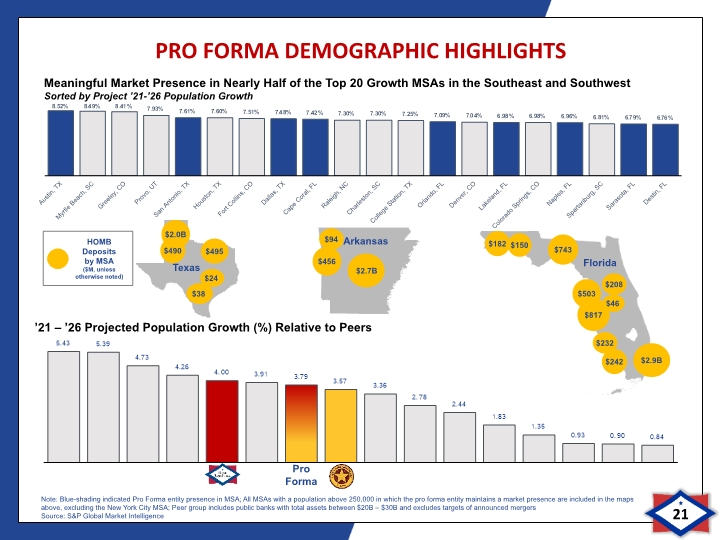

Pro forma Demographic highlights 21 ’21 – ’26 Projected Population Growth (%) Relative to Peers Meaningful Market Presence in Nearly Half of the Top 20 Growth MSAs in the Southeast and Southwest Sorted by Project ’21-’26 Population Growth Arkansas Florida $150 $503 $242 $2.9B $817 $456 $743 $182 $2.0B $490 Pro Forma Note: Blue-shading indicated Pro Forma entity presence in MSA; All MSAs with a population above 250,000 in which the pro forma entity maintains a market presence are included in the maps above, excluding the New York City MSA; Peer group includes public banks with total assets between $20B – $30B and excludes targets of announced mergers Source: S&P Global Market Intelligence

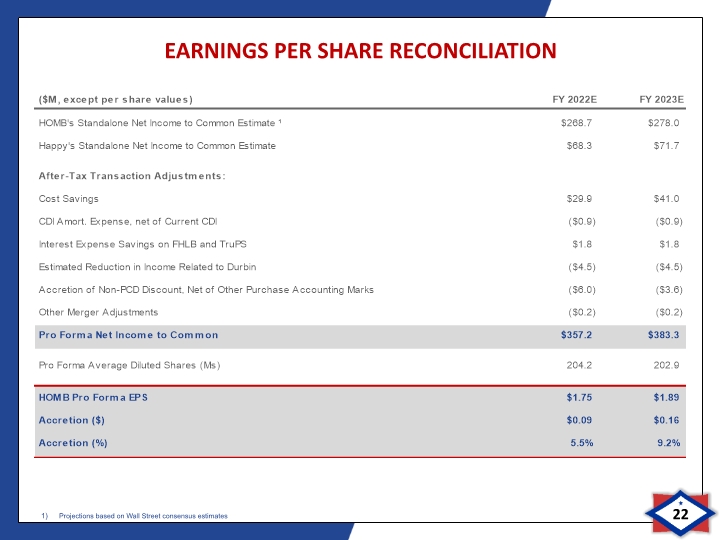

Earnings per share Reconciliation 22 Projections based on Wall Street consensus estimates