Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Knowlton Development Corp Inc | d39510dex231.htm |

| EX-10.2 - EX-10.2 - Knowlton Development Corp Inc | d39510dex102.htm |

| EX-5.1 - EX-5.1 - Knowlton Development Corp Inc | d39510dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 14, 2021

Registration No. 333-257845

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Knowlton Development Corporation, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| British Columbia | 2844 | N/A | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

375 Roland-Therrien Boulevard

Suite 210

Longueuil, Québec J4H 4A6

Canada

(450) 243-2000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Nicholas Whitley

250 Pehle Avenue

Suite 1000

Saddle Brook, New Jersey 07663

(201) 688-2300

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Roshni Banker Cariello Pedro J. Bermeo Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Nicolas Beugnot Chief Legal Officer and Corporate Secretary 375 Roland-Therrien Boulevard Longueuil, Québec J4H 4A6 Canada (450) 243-2000 |

Robert DeLaMater Jared Fishman Sullivan & Cromwell LLP 125 Broad Street New York, New York 10004 (212) 558-4000 | ||

|

Warren Silversmith David Tardif Stikeman Elliott LLP 1155 René-Lévesque Boulevard West Montréal, Québec H3B 3V2, Canada (514) 397-3000 |

François Paradis Osler, Hoskin & Harcourt LLP 1000 De La Gauchetière Street West, Suite 2100 Montréal, Québec H3B 4W5, Canada (514) 904-8100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price per Share(2) |

Proposed Aggregate |

Amount of Registration Fee(3) | ||||

| Common shares, no par value |

65,714,285 | $15.00 | $985,714,275 | $107,542 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes additional common shares which the underwriters have the option to purchase to cover over-allotments. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933. |

| (3) | A portion of this amount totaling $10,910.00 was previously paid in connection with the previous filing of this Registration Statement on August 27, 2021. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

On July 1, 2021, Knowlton Development Corporation Inc., the operating company and the indirect wholly owned subsidiary of Knowlton Development Parent, Inc., changed its name to kdc/one Development Corporation, Inc. On the same day, Knowlton Development Parent, Inc., and Knowlton Development Holdco, Inc., a wholly-owned subsidiary of Knowlton Development Parent, Inc., amalgamated under the laws of British Columbia and continued as one corporation named Knowlton Development Corporation, Inc., which became the direct parent of kdc/one Development Corporation, Inc. These changes occurred after the end of the fiscal year ended April 30, 2021, such that the financial statements for the year ended April 30, 2021 included herein refer to Knowlton Development Parent, Inc. and Knowlton Development Corporation Inc. for the Successor Period and Predecessor Period (each as defined herein), respectively. See “Financial Statement Presentation” for further explanation of the presentation of financials in this registration statement.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 14, 2021

Preliminary Prospectus

57,142,857 Shares

Knowlton Development Corporation, Inc.

Common Shares

Knowlton Development Corporation, Inc. is offering 57,142,857 common shares. This is our initial public offering and no public market exists for our common shares. We anticipate that the initial public offering price of our common shares will be between $13.00 and $15.00 per share. Our common shares have been approved for listing on the New York Stock Exchange (“NYSE”) and we have applied to list our common shares on the Toronto Stock Exchange (the “TSX”), both under the symbol “KDC.” Listing on the TSX will be subject to us fulfilling all the listing requirements of the TSX.

Investing in our common shares involves risk. See “Risk Factors” beginning on page 24.

Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission or Canadian securities regulatory authority has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us before expenses |

$ | $ | ||||||

| (1) | See “Underwriting (Conflicts of Interest)” for a description of compensation to be paid to the underwriters. |

At our request, the underwriters have reserved up to 2,857,142 common shares, or 5% of the common shares to be offered by this prospectus, for sale at the initial public offering price through a directed share program for certain persons designated by the Company. See “Underwriting (Conflicts of Interest)—Directed Share Program.”

The underwriters have the option to purchase up to an additional 8,571,428 common shares from us at the initial public offering price less the underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment in New York, New York on or about , 2021 through the book-entry facilities of The Depository Trust Company.

| Goldman Sachs & Co. LLC | J.P. Morgan | UBS Investment Bank | BMO Capital Markets |

| BofA Securities | Guggenheim Securities | Jefferies | Morgan Stanley | RBC Capital Markets |

The date of this prospectus is , 2021.

Table of Contents

Beauty, Personal Care, and Home Care Uniquely Imagined and Expertly Delivered

Table of Contents

kdc/one Is a Diïerentiated and Compelling Consumer Opportunity Diversified, Scaled and Vertically Integrated Global Growth Platform Aligned to Attractive Consumer Markets and Growth Trends Strong Competitive Advantage Built on Innovative and Trust Strong Financial Profile With Highly Attractive Recent Growth and Margins

Table of Contents

We create products that consumers use every day — morning to night When they When catering start their day to their well being When relaxing When out at home and about When they When they start to get ready to go out wind down

Table of Contents

Global, Vertically Integrated End-to-End Solutions Ideation Formulation Design Packaging & devices Manufacturing

Table of Contents

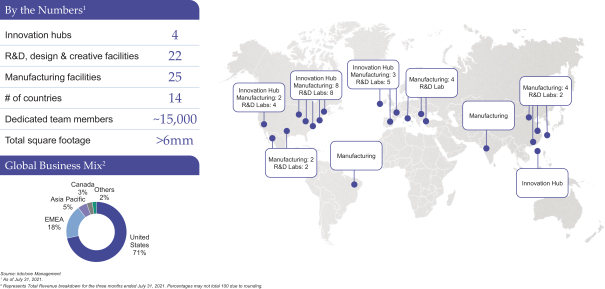

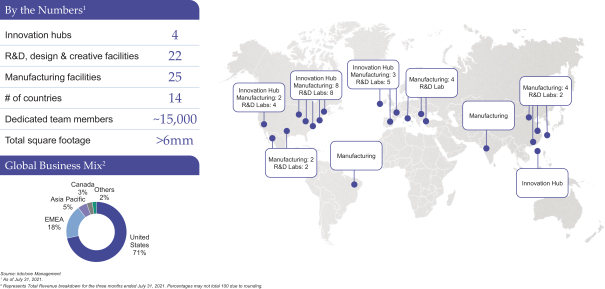

One Network, Infinite Possibilities Innovation Hub Manufacturing: 3 Innovation Hub R&D Labs: 5 Manufacturing: 8 Manufacturing: 4 R&D Labs: 8 R&D Lab Innovation Hub Manufacturing: 4 Manufacturing: 2 R&D Labs: 2 R&D Labs: 4 Manufacturing Manufacturing: 2 Manufacturing R&D Labs: 2 Innovation Hub 25 ~15,000 22 Manufacturing facilities Dedicated team members creative R&D, Design facilities and 14 6mm 4 Countries kdc/one operations with Total square footage Innovation hubs

Table of Contents

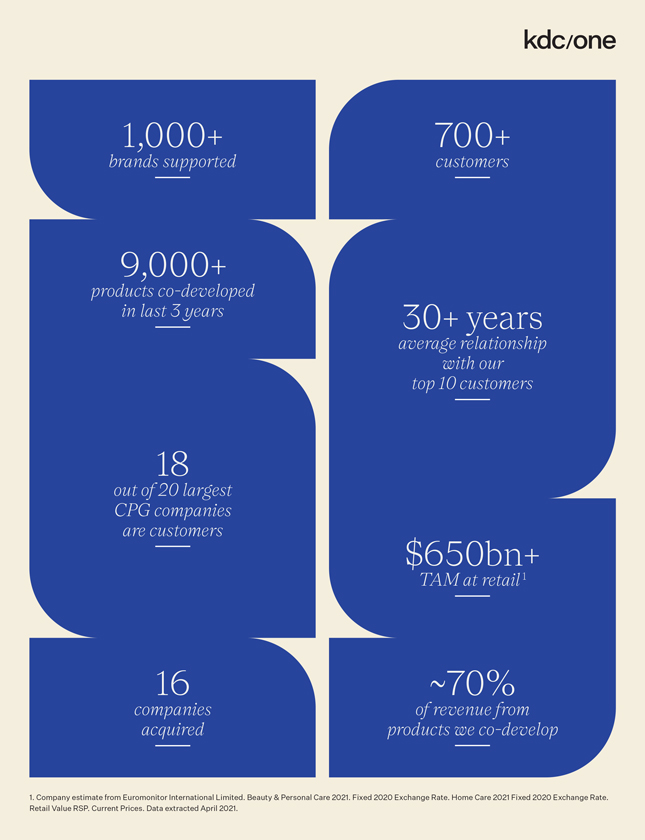

1,000+ 700+ brands supported customers 9,000+ products co-developed in last 3 years 30+ years average relationship with our top 10 customers 18 out of 20 largest CPG companies are customers $650bn+ TAM at retail 1 16 ~70% companies of revenue from acquired products we co-develop 1. Company estimate from Euromonitor International Limited. Beauty & Personal Care 2021. Fixed 2020 Exchange Rate. Home Care 2021 Fixed 2020 Exchange Rate. Retail Value RSP. Current Prices. Data extracted April 2021.

Table of Contents

| Page | ||||

| 1 | ||||

| 16 | ||||

| 18 | ||||

| 22 | ||||

| 24 | ||||

| 59 | ||||

| 62 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 67 | ||||

| 69 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

72 | |||

| 119 | ||||

| 150 | ||||

| 161 | ||||

| 181 | ||||

| 187 | ||||

| 189 | ||||

| 192 | ||||

| 211 | ||||

| 216 | ||||

| 218 | ||||

| 228 | ||||

| 228 | ||||

| 229 | ||||

| F-1 | ||||

In this prospectus, unless the context otherwise requires, “Knowlton Development Corporation, Inc.,” the “Company,” “kdc/one,” “we,” “us” and “our” refer to Knowlton Development Corporation, Inc. and its subsidiaries. All currency amounts in this prospectus are expressed in United States (“U.S.”) dollars, unless otherwise indicated.

Neither we nor any of the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We are offering to sell, and seeking offers to buy, common shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

Market and Industry Data

This prospectus includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, including from Euromonitor, as well as from filings of public companies in our

i

Table of Contents

industry and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. Each publication, study and report speaks as of its original publication date (and not as of the date of this prospectus). Certain of these publications, studies and reports were published before the COVID-19 pandemic and therefore do not reflect any impact of COVID-19 on any specific market or globally. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein.

Trademarks and Service Marks

This prospectus contains references to a number of trademarks and service marks which are our registered trademarks or service marks, such as “kdc/one,” “HCT,” “Kolmar” and “Zobele,” as well as the “kdc/one” logo, or trademarks or service marks for which we have pending applications or common law rights. Trade names, trademarks and service marks of third parties appearing in this prospectus are the property of their respective holders. Solely for convenience, the trademarks, service marks and trade names are referred to in this prospectus without the ®, SM and TM symbols, but such references are not intended to indicate, in any way, that the owner thereof will not assert, to the fullest extent under applicable law, such owner’s rights to their trademarks, service marks and trade names.

Non-GAAP Financial Measures

We refer in this prospectus to the following non-GAAP financial measures:

| • | Adjusted EBITDA; |

| • | Adjusted EBITDA Margin; and |

| • | Value-Added Contribution Margin (“VACM”). |

These non-GAAP financial measures are not prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States. They are supplemental financial measures of our performance only, and should not be considered substitutes for net income or loss, revenue or any other measure derived in accordance with GAAP.

As used in this prospectus, these non-GAAP financial measures have the following meanings:

| • | Adjusted EBITDA is net income or loss before interest expense, other expense (income), net, income tax benefit, depreciation and amortization, share-based compensation, acquisition-related costs, costs associated with becoming a public company, certain incremental costs associated with COVID-19 that are not expected to continue once the pandemic has significantly subsided globally and operations return to pre-COVID-19 levels, plant start-up costs incurred at our new facility in Columbus, Ohio (the “Columbus II facility”) before significant operations begin, including payroll and rent, sponsor fees (including the Sponsor Fees (as defined below) which are terminating in connection with this offering), impairment loss on assets and other intangibles and certain other adjustment items; |

| • | Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by revenue; and |

| • | VACM is calculated by dividing Adjusted EBITDA by revenue from value added contributions (as defined elsewhere in this prospectus). |

ii

Table of Contents

Management utilizes Adjusted EBITDA and Adjusted EBITDA Margin as measures of operating performance and the operating leverage in the Company’s business. Management believes that these non-GAAP financial measures are useful to investors for period-to-period comparisons of the Company’s business and in understanding and evaluating the Company’s operating results for the following reasons:

| • | Adjusted EBITDA and Adjusted EBITDA Margin are widely used by investors and securities analysts to measure a company’s operating performance without regard to items such as share-based compensation expense, depreciation and amortization expense, impairment loss on assets, interest expense, other expense (income), net, and income taxes expense (benefit) that can vary substantially from company to company depending upon their financing, capital structures and the method by which assets were acquired; and |

| • | Adjusted EBITDA and Adjusted EBITDA Margin provide consistency and comparability with the Company’s past financial performance, facilitate period-to-period comparisons of the Company’s primary operating results, and also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. |

Management utilizes VACM as a measure of operating performance and believes that VACM is an important measure in analyzing the results of the business for the following reasons:

| • | our business is focused on innovation, product development and operational excellence, and, as a result, VACM reflects the way customers interact with us and the value embedded in the Company’s product delivery that we provide to them; |

| • | a significant portion of revenue from raw materials is generated through arrangements with mechanisms that pass through raw material costs, and accordingly the associated revenue is recorded as revenue from pass-through raw materials (as defined elsewhere in this prospectus) and is excluded from the calculation of VACM; and |

| • | we utilize revenue from value added contributions to assess growth between fiscal periods and to analyze the resulting margins without the revenue from pass-through raw materials (VACM will fluctuate between periods depending upon the Company’s ability to drive sales of higher margin solutions (i.e., favorable product mix, integrated sales) and to generate operating efficiencies across our network, including the ability to scale operations, as well as changes to the product portfolio and by the nature of the Company’s acquisitions from time to time). |

As a result, we believe that VACM is the best way to measure our business in a consistent manner, taking into account that customers have the flexibility to do business with us in more than one way, with some choosing a customer-supplied materials framework (which would not result in revenue to us) while others choose a kdc/one-supplied materials framework (which would result in revenue to us equal to the pass-through cost of such materials). If VACM is not used to measure performance, the transaction with the customer that chooses a kdc/one-supplied materials framework would appear to be lower margin than the transaction with the customer that chooses a customer-supplied materials framework when the profitability to us of both transactions would be the same.

For a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure, see “Prospectus Summary—Summary Consolidated Financial and Other Data.” The most directly comparable GAAP measure to Adjusted EBITDA Margin and VACM is net income margin. In this prospectus we have excluded a presentation of net income margin because we have experienced a net loss for all the relevant periods and therefore the net income margin would be less than zero and consequently we believe not helpful to investors. However, wherever we present Adjusted EBITDA Margin and VACM we present net loss. For a description of the revenue from value added contributions, see “Management’s Discussion and Analysis—Components of Revenue.”

The non-GAAP financial measures used in this prospectus have not been reviewed or audited by our auditors or any independent registered public accounting firm.

iii

Table of Contents

Adjusted EBITDA and Adjusted EBITDA Margin have important limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of our financial results as reported under GAAP. For example, Adjusted EBITDA and Adjusted EBITDA Margin:

| • | do not reflect any cash capital expenditure requirements for the assets being depreciated and amortized that may have to be replaced in the future; |

| • | do not reflect changes in, or cash requirements for, our working capital needs; |

| • | do not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our primary operations; |

| • | do not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our debt; |

| • | do not reflect share-based compensation expense and other non-cash charges including asset impairments; |

| • | exclude certain tax payments that may represent a reduction in cash available to us; and |

| • | do not reflect transaction-related expenses associated with acquisitions, certain incremental costs associated with COVID-19 that are not expected to continue once the pandemic has significantly subsided globally and operations return to pre-COVID-19 levels, plant start-up costs incurred at our Columbus II facility and costs associated with becoming a public company. |

Because of these limitations, Adjusted EBITDA and Adjusted EBITDA Margin should be considered along with other operating and financial performance measures presented in accordance with GAAP.

VACM has important limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our financial results as reported under GAAP. For example, VACM:

| • | excludes revenue from pass-through raw materials; |

| • | includes revenue from raw materials from our packaging design and production business where variations in raw material prices are not passed through to the customer due to customer order management practices unique to the packaging business, which are typically based on high frequency, recurrent orders, where prices are determined at project onset and there may be limited ability to renegotiate to account for fluctuations in raw material prices; and |

| • | VACM in comparison to Adjusted EBITDA Margin will be higher as the former is calculated based on revenue from value added contributions only whereas the latter is calculated based on total revenue, which includes revenue from pass-through raw materials. |

Because of these limitations, VACM should be considered along with other operating and financial performance measures presented in accordance with GAAP.

Our use of the terms Adjusted EBITDA, Adjusted EBITDA Margin and VACM may vary from the use of similar terms by other companies in our industry and accordingly may not be comparable to similarly titled measures used by other companies.

Financial Statement Presentation

This prospectus includes historical consolidated financial and other data for the Company and the Company’s operating subsidiary, kdc/one Development Corporation, Inc. (previously named Knowlton Development Corporation Inc.), a company existing under the laws of British Columbia (“KDC Opco”).

The Purchase Agreement was entered into on October 26, 2018 among KDC Opco, the holders of all its issued and outstanding common shares and the Purchaser named therein, which was formed by Cornell Capital

iv

Table of Contents

LLC for the purpose of consummating the transactions under the Purchase Agreement. On December 21, 2018 (the “Closing Date”), Cornell Capital LLC transferred its ownership of the Purchaser to Knowlton Development Corporation, Inc. (previously named Knowlton Development Parent, Inc.), which was incorporated by a group of investors led by Cornell Capital LLC in British Columbia on November 30, 2018 originally as a holding company with no assets or operations of its own. The Purchaser was subsequently amalgamated with KDC Opco immediately following the acquisition of the outstanding common shares of KDC Opco by Knowlton Development Corporation, Inc. through the Purchaser. This is referred to herein as the Acquisition. Prior to the Acquisition, Knowlton Development Corporation, Inc. efforts were limited to organizational activities directly related to the Acquisition and for which it incurred acquisition-related costs. The 21-day overlap between Knowlton Development Corporation, Inc.’s incorporation and the Closing Date is not presented as a separate financial statement as there were no operations by Knowlton Development Corporation, Inc. between the date of its incorporation and the Closing Date except for the organizational activities mentioned above. Knowlton Development Corporation, Inc. currently owns no significant assets nor has any operations other than the ownership of all the common shares of kdc/one Development Corporation, Inc.

As a result of the Acquisition, Knowlton Development Corporation, Inc. was identified as the acquirer for accounting purposes, and kdc/one Development Corporation, Inc. as the acquiree and accounting predecessor. The Company’s financial statement presentation distinguishes (i) a Predecessor Period for the 234-day period ended December 20, 2018 (i.e., the 234 days of the fiscal year prior to the Closing Date), which reflects the financial statements for kdc/one Development Corporation, Inc. (under the name Knowlton Development Corporation Inc.) for the period prior to the Closing Date and (ii) a Successor Period for the years ended April 30, 2021 and 2020 and the 152-day period ended April 30, 2019 (i.e., the 152 days following Knowlton Development Corporation, Inc.’s incorporation (under the name Knowlton Development Parent, Inc.)) which reflects the financial statements of the Company for the period after the Closing Date. The Acquisition was accounted for as a business combination using the acquisition method of accounting, and the Successor’s financial statements reflect a basis of accounting that is based on the fair value of the assets acquired and the liabilities assumed. As a result of the application of the acquisition method of accounting as of the Closing Date, the financial statements for the Predecessor Period and for the Successor Period are presented on a different basis and, therefore, are not comparable. The Company utilizes a fiscal year from May 1 to April 30. The combination of Predecessor and Successor Periods is referred to as the “Combined 2019 Financial Information.” On July 1, 2021, Knowlton Development Corporation Inc. changed its name to kdc/one Development Corporation, Inc. On the same day, Knowlton Development Parent, Inc., and Knowlton Development Holdco, Inc., a wholly-owned subsidiary of Knowlton Development Parent, Inc., amalgamated under the laws of British Columbia and continued as one corporation named Knowlton Development Corporation, Inc. These changes occurred after the end of the fiscal year ended April 30, 2021, such that the financial statements for the year ended April 30, 2021 included herein refer to Knowlton Development Parent, Inc. and Knowlton Development Corporation Inc. for the Successor Period and Predecessor Period, respectively.

The financial statements and the related notes thereto included elsewhere in this prospectus, including the share and per share information therein, are presented on a historical basis and therefore do not reflect the Share Capital Amendments. See “Description of Share Capital—Share Capital Amendments.”

Commonly Used Defined Terms

As used in this prospectus, unless the context otherwise requires:

| • | “2020 Transactions” refers, collectively, to the seven acquisitions completed across the Company’s operating segments in the fiscal year ended April 30, 2020, comprising the acquisitions of Alkos, Swallowfield, Benchmark, HCT, Paristy, CLA and Zobele (each as defined herein). |

| • | “2021 Revolver Increase” refers to the Company’s January 27, 2021 $170.0 million increase to its commitments under the Revolving Facility. |

v

Table of Contents

| • | “2021 Term Loan Increase” refers to the Company’s January 27, 2021 €100.0 million increase to the available Euro Term Loan. |

| • | “Acquisition” refers to the acquisition of all issued and outstanding common shares of KDC Opco by the Purchaser and the subsequent amalgamation of the Purchaser and KDC Opco completed on December 21, 2018, resulting from a series of transactions through which Knowlton Development Corporation, Inc. became the ultimate parent company of KDC Opco. |

| • | “Acupac” refers to Acupac Packaging, Inc. |

| • | “Alkos” refers to Aaxen SAS. |

| • | “Aromair” refers to Aromair Fine Fragrance Company. |

| • | “Benchmark” refers to Benchmark Cosmetic Laboratories. |

| • | “CDPQ” refers to Caisse de dépôt et placement du Québec. |

| • | “Chemaid” refers to Chemaid Laboratories. |

| • | “CLA” refers to Cosmetic Laboratories of America. |

| • | “Combined 2019 Financial Information” refers to the unaudited supplemental financial information for the fiscal year ended April 30, 2019, which combines the Predecessor Period and the Successor Period. |

| • | “compound annual growth rate” refers to the average rate of growth per year over multiple-year periods that assumes compounding at each interval within that time span, calculated by factoring each year’s absolute growth into the calculation of the succeeding year’s percentage growth. |

| • | “Cornell” refers to Cornell Capital LLC. |

| • | “Credit Agreement” refers to the credit agreement dated as of December 21, 2018 by and among the Purchaser, KDC US Holdings, Inc., Holdings, UBS Securities LLC, Guggenheim Securities, LLC and Jefferies Finance LLC, as Joint Lead Arrangers and Joint Bookrunners, and Sumitomo Mitsui Banking Corporation, as Documentation Agent, and the Lenders party thereto, as amended, supplemented or otherwise modified from time to time. |

| • | “DGCL” refers to the Delaware General Corporation Law. |

| • | “Disaggregated 2020 Financial Information” refers to the unaudited supplemental disaggregated financial information for the fiscal year ended April 30, 2020, which excludes the impact of the 2020 Transactions. |

| • | “Disaggregated 2021 Financial Information” refers to the unaudited supplemental disaggregated financial information for the fiscal year ended April 30, 2021, which excludes the impact of the 2020 Transactions. |

| • | “Distribution Financing Transactions” refers to, collectively, (i) the returns of capital the Company effected on or about February 3, 2021 in the amount of $232.65 per Class A and Class B common share of the Company, totaling $318.5 million in the aggregate, which were distributed to the Company’s shareholders and funded, along with cash, by the 2021 Term Loan Increase, the 2021 Revolver Increase and Incremental Amendment No. 9, and (ii) the adjustments made in accordance with the equitable adjustment provision of the Stock Option Plan composed of a reduction in the exercise price of options and adjustment payments in cash. |

| • | “Euro Term Loan” refers to the Company’s euro-denominated term loan tranche under the Credit Agreement obtained on July 28, 2020 in an aggregate amount of €460.0 million, maturing on December 21, 2025, and which was incrementally increased by the 2021 Term Loan Increase. |

| • | “First Lien Term Loan” refers to the term loan entered into by the Company under the Credit Agreement on December 21, 2018 in an aggregate principal amount equal to $525.0 million, maturing |

vi

Table of Contents

| on December 21, 2025, and which was subsequently increased on each of August 22, 2019, January 23, 2020 and April 30, 2020 by $105.0 million, $300.0 million and $500.0 million, respectively. |

| • | “GAAP” refers to generally accepted accounting principles in the United States. |

| • | “HCT” refers to Clover Park 2 (BVI) Limited, a subsidiary acquired by the Company in fiscal year ended April 30, 2020. |

| • | “HCT Metals” refers to Geng Xian Metal Treatment (Jiangmen) Company Limited and Yaochang Metal Works (Zhuhai) Co., Ltd. |

| • | “Incremental Amendment No. 9” refers to the incremental amendment (Amendment No. 9 to the Credit Agreement) dated as of January 27, 2021, which amended the Credit Agreement in connection with the 2021 Term Loan Increase and the 2021 Revolver Increase. |

| • | “Kolmar” refers to Kolmar Laboratories, Inc. |

| • | “Northern Labs” refers to Northern Labs, Inc. |

| • | “Omnibus Plan” refers to the new equity compensation plan, in the form of an omnibus incentive plan, adopted by the Company’s board of directors, and submitted for approval of the Company’s pre-offering shareholders, prior to the completion of this offering. |

| • | “Paristy” refers to, collectively, Mei Shual Cosmetics Co., Pte Ltd and Mei Shual Cosmetics Co., Ltd. |

| • | “Predecessor Period” refers to the period from May 1, 2018 through December 20, 2018. |

| • | “Purchase Agreement” refers to the share purchase agreement entered into on October 26, 2018 among KDC Opco, the holders of all its issued and outstanding common shares and the Purchaser. |

| • | “Purchaser” refers to the purchaser named in the Purchase Agreement, which was formed by Cornell for the purpose of entering into the transactions contemplated in the Purchase Agreement. |

| • | “Registration Rights Agreement” refers to the registration rights agreement to be entered into in connection with this offering between the Company and certain shareholders of the Company. |

| • | “Revolving Facility” refers to the revolving credit facility provided for in the Credit Agreement in an aggregate principal amount of $75.0 million, maturing on December 21, 2023, and which was subsequently increased on January 23, 2020, July 28, 2020, December 4, 2020, January 27, 2021 and February 24, 2021 by $50.0 million, $25.0 million, $25.0 million, $170.0 million and $10.0 million, respectively. |

| • | “Services Agreement” refers to the services agreement, as amended, dated as of December 21, 2018, between the Company and Cornell, entered into in connection with the Acquisition and pursuant to which the Company pays Cornell the Sponsor Fees for financial and management consulting services, as well as quarterly reimbursements of customary expenses, which agreement will be terminated concurrently with the closing of this offering. |

| • | “Share Capital Amendments” has the meaning ascribed thereto under “Description of Share Capital—Share Capital Amendments.” |

| • | “Shareholders’ Agreement” refers to the shareholders’ agreement to be entered into in connection with this offering between the Company and certain shareholders of the Company. |

| • | “Sponsor Acquisition Fees” refers to the cash fees we pay to Cornell, pursuant to the Services Agreement, upon consummation of an acquisition by us of any company, business or entity, equal to 1% of the total enterprise value of such company, business or entity. |

| • | “Sponsor Fees” refers to, collectively, the Sponsor Acquisition Fees and the Sponsor Management Fees. |

| • | “Sponsor Management Fees” refers to an annual cash fee we pay to Cornell, pursuant to the Services Agreement, equal to 2.5% of consolidated adjusted EBITDA, as defined in the Services Agreement. |

vii

Table of Contents

| • | “Stock Option Plan” refers to the Knowlton Development Corporation, Inc. Stock Option Plan under which the Company has granted equity awards in the form of stock options to certain employees and other persons, including its named executive officers. |

| • | “Successor Period” refers to the period from November 30, 2018 through April 30, 2019, along with the fiscal years ended April 30, 2021 and 2020. |

| • | “Swallowfield” refers to Curzon Supplies Ltd. |

| • | “TAM” refers to the total addressable market. |

| • | “Term Loans” refers, collectively, to the First Lien Term Loan and the Euro Term Loan. |

| • | “Thibiant” refers to Thibiant International, Inc. |

| • | “Zobele” refers to Z Gamma B.V. |

viii

Table of Contents

Letter from Nicholas Whitley, President and Chief Executive Officer

Dear Prospective Shareholder,

Trust is a formidable proposition, often taking years to establish.

It is this powerful foundation of trust with our beauty, personal care and home care customers combined with our differentiated, value-added solutions that has allowed kdc/one to reach the scale it enjoys today. Every time a customer turns to us to help ideate, innovate and create new products or provide solutions, it presents an opportunity for kdc/one to enhance a trusted relationship or forge anew. This is what drives our global organization of approximately 15,000 talented team members.

Our focus on innovation, problem solving and partnerships has allowed us to cultivate a customer base in excess of 700 companies. These world-class consumer products businesses include iconic industry leaders and some of the fastest growing independent and emerging brands. Many of our most important customer relationships have extended for well beyond a decade.

While few end consumers may know of kdc/one, many likely use a product that we ideate, formulate, design, package or manufacture on a daily basis. Products we help develop are available in more than 70 countries worldwide and across a range of distribution platforms, meeting the end consumer’s rapidly evolving shopping preferences. In fact, over the past three years, kdc/one co-developed more than 9,000 unique beauty, personal care and home care products across a broad spectrum of price-points from mass to prestige.

When I joined the company in 2013, it was a different business than the integrated global solutions provider I am proud to lead today. At the time, the company had approximately 50 customers and was primarily focused on North American personal care. It was the fantastic set of core competencies and shared values, upon which we could build, that inspired me to move my family across the world for the opportunity to lead this organization. The company’s long-standing trusted customer relationships, industry-leading innovation capabilities and deep commitment to operational excellence are fueled by our entrepreneurial spirit.

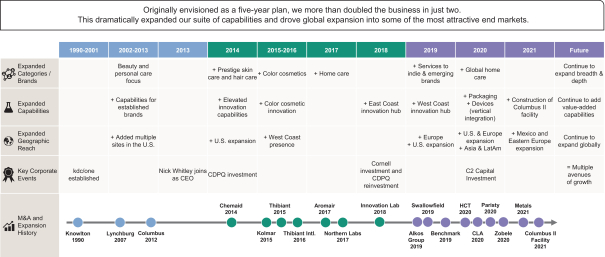

I have been fortunate that my entire tenure at kdc/one has been enhanced by partnerships with a terrific management team and supportive investors. Our shared objective of building a unique, growth-oriented company drives our actions. In December 2018, after our acquisition by Cornell and concurrent reinvestment by CDPQ (a preeminent Canadian investment fund), we developed and executed an ambitious strategy. Originally envisioned as a five-year plan, we more than doubled the business in just two. This dramatically expanded our suite of capabilities and drove global expansion into the most attractive end markets.

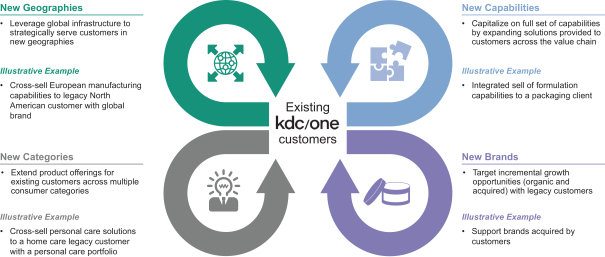

Our growth plan allowed kdc/one to benefit from structural shifts in the beauty, personal care and home care markets. Consumers have greater access to information and influence around their brand choices than ever before. They seek out brands that better reflect their own values and lifestyles, which, in turn, drives demand for product innovation and new brand introductions at an ever-increasing pace. These shifts, paired with our customers’ specific needs, crystallized a strategy, comprised of both organic expansion and acquisitions, that would quickly allow kdc/one to (i) obtain a global innovation and manufacturing footprint, (ii) deliver turn-key solutions incorporating ideation, formulation, design, packaging and manufacturing, and (iii) develop the breadth of expertise to seamlessly service both large and small customers alike. Following significant investments in both existing and new facilities, and a series of highly strategic acquisitions since December 2018, we are now uniquely positioned to build from these foundations, disrupt the industry and empower our brand partners across the globe.

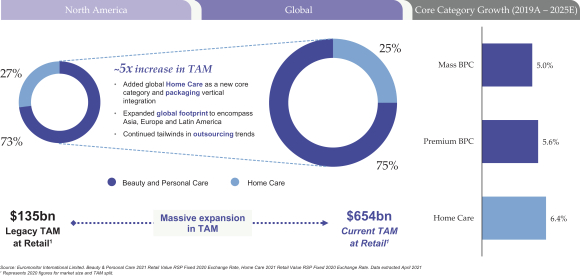

As a result of our growth strategy, we believe the TAM for the value-added solutions we provide has expanded from approximately $135 billion to approximately $654 billion of retail sales for 2020.1 This nearly five-fold increase is a direct result of our deliberate evolution from a North America focused personal care business to a global enterprise spanning beauty, personal care and home care. kdc/one has been disciplined in targeting our

| 1 | Company estimate from Euromonitor International Limited, Beauty & Personal Care 2021 Fixed 2020 Exchange Rate, Home Care 2021 Fixed 2020 Exchange Rate, Retail Value RSP, Current Prices. Data extracted April 2021. |

ix

Table of Contents

growth investments into the most attractive, fastest growing and resilient subsectors of the broader consumer market. We will continue to utilize this compass to inform our future organic expansion and M&A activity.

While the past two and a half years have certainly been exciting, there is much more to come. We are in the early stages of harnessing and optimizing the cross-selling potential across this exceptional network of assets.

Our categories are demonstrating strong growth across our global footprint in the United States and Canada; Europe, the Middle East and Africa; and the Asia Pacific region. The Chinese beauty market, in particular, is experiencing exceptional growth and is poised to become the world’s largest by 2022, according to Euromonitor.2 We fully intend to grow with this dynamic market by providing solutions not just to international brands but also to the many rapidly growing domestic brands. We are making additional investments in our people and capabilities in China, alongside the unique China market insights we receive from C2 Capital, a current investor. Alibaba Group, the leading e-commerce platform in China, is an anchor investor in C2 Capital.

Another key area of focus for kdc/one is environmental sustainability, which encompasses cleaner formulations, sustainable packaging solutions as well as sustainable manufacturing processes. Our unique vantage point across the industry landscape provides access to a vast amount of market intelligence and data insight, which allows us to stay ahead in the emergence of conscious beauty and home care products. This is enabled by scouting sustainable eco-friendly ingredients, leading in clean breakthrough formulations and more sustainable packaging solutions, designed without compromise of performance. To continue building on this momentum, kdc/one recently created a new role, appointing a senior executive to lead our sustainability initiatives.

While all these developments have been taking place across the organization, we have been careful not to lose sight of our culture, which is predicated on seven key values:

| • | Innovation that inspires our customers |

| • | Passion that fuels our dedication |

| • | Accountability that anchors our teams |

| • | Excellence that propels our growth |

| • | Inclusion that drives our diversity |

| • | Wellbeing that sustains our energy |

| • | Compassion that serves our environment and employees |

It is important for me to see these values extend across the global organization. As a result, we have made significant investments to enhance our internal communications capabilities, increased the frequency of town-halls, and commenced the roll-out of employee surveys, all with the goal of forging a stronger personal link between kdc/one and its employees.

The resiliency of our organization and strength of our relationships with customers and key stakeholders has never been more evident than during the COVID-19 pandemic. Our teamwork and entrepreneurial spirit allowed us to take care of our kdc/one family, support our customers while continuing to expand our business capabilities and build towards the future.

kdc/one provides an attractive way for prospective investors to access the excitement and innovation across the most compelling and fast-growing consumer product segments without single brand or channel risk. I hope you will join us on our continuing journey, built on trust and differentiated value, as kdc/one continues to define beauty, personal care and home care, uniquely imagined and expertly delivered.

Nicholas Whitley

President and Chief Executive Officer

| 2 | Euromonitor International Limited. Beauty & Personal Care 2021, Fixed 2020 Exchange Rate, Retail Value RSP, Current Prices. Data extracted April 2021. |

x

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common shares. You should read this entire prospectus carefully, including the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus, before deciding whether to purchase our common shares.

Company Overview

Beauty, Personal Care and Home Care, Uniquely Imagined and Expertly Delivered

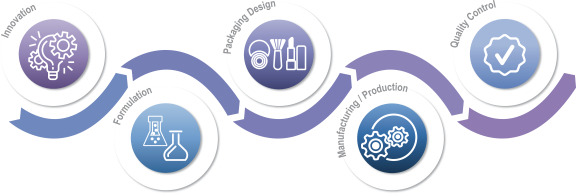

We are a trusted global provider of value-added solutions to many of the world’s leading brands in the beauty, personal care and home care categories. We partner closely with both industry-leading consumer products companies and fast-growing independent brands as a critical enabler of their success through ideation, formulation, design, packaging and manufacturing of products sold under more than 1,000 different brand names. Over the past three years, we have been responsible for co-developing over 9,000 products across growing categories that include skin care, body and hair care, soaps and sanitizers, cosmetics, deodorants, sun care, fragrances, air care, fabric care, pest control and surface care products. The innovative products that we have helped to develop are sold by our brand partners in more than 70 countries worldwide.

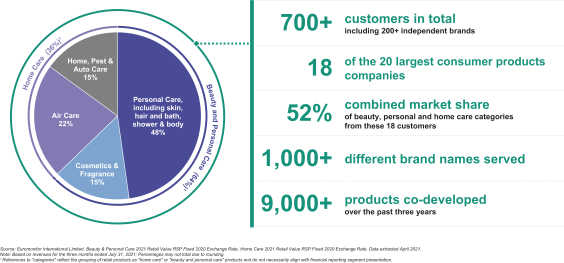

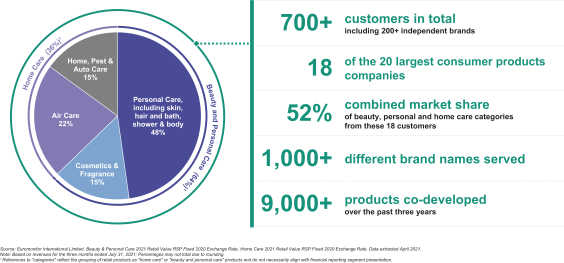

Revenue by Category

The pace of innovation and new brand and product introduction is accelerating across the beauty, personal care and home care categories. This, in turn, has underscored the importance of rapid strategic product development partnerships with companies such as ours to accelerate the speed to market. Against that backdrop, we have benefited by building a leading suite of end-to-end, value added solutions across a global platform. We believe the vertical integration of product solutions, coupled with the ability to service both established and emerging brands worldwide, provides us with a significant competitive advantage.

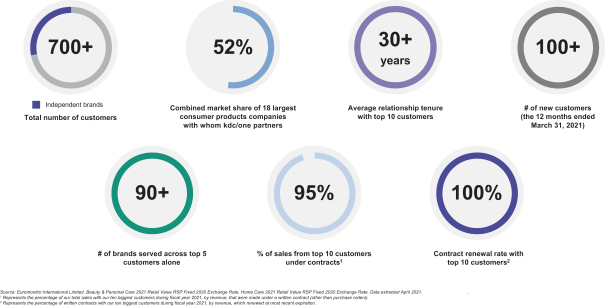

We provide our value-added solutions to more than 700 customers worldwide as of July 31, 2021, across 13 different product categories. Our customers include many of the most recognizable and rapidly emerging

1

Table of Contents

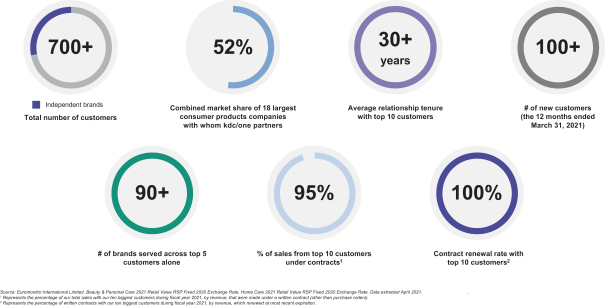

companies in beauty, personal care and home care. Our customer base encompasses 18 of the 20 largest beauty, personal care and home care companies worldwide, when ranked by retail sales in 2020, according to Euromonitor.3 In total, these 18 customers had a 52% share of the beauty, personal care, and home care categories in 2020, according to Euromonitor.3 As of July 31, 2021, our portfolio also included more than 200 independent and emerging customers, who we have selectively targeted as being among the fastest growing and most noteworthy brands.

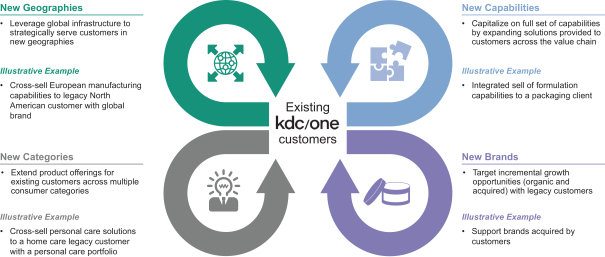

Diverse Customer Base Underpinned by Long-Term Relationships

Our relationships with our largest customers are often multifaceted and can extend across their business portfolio to encompass multiple brands, products and geographies, creating a diversified portfolio approach aligned to multifaceted growth with resilience. We partner in the development of brands and products across the retail pricing spectrum, from mass to masstige to prestige. Products incorporating our value-added solutions are distributed across a broad array of channels from mass to specialty retail to e-commerce. We leverage our diverse suite of leading capabilities to support our customers across the product development and production cycle. Through our global footprint, we expect to be able to deliver our expertise wherever our customers choose to operate.

| 3 | Euromonitor International Limited. Beauty & Personal Care 2021, Retail Value RSP Fixed 2020 Exchange Rate, Home Care 2021 Retail Value RSP Fixed 2020 Exchange Rate. Data extracted April 2021. |

2

Table of Contents

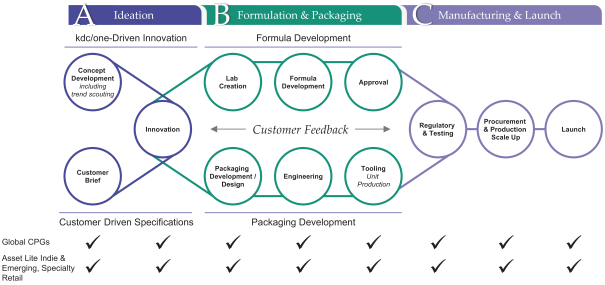

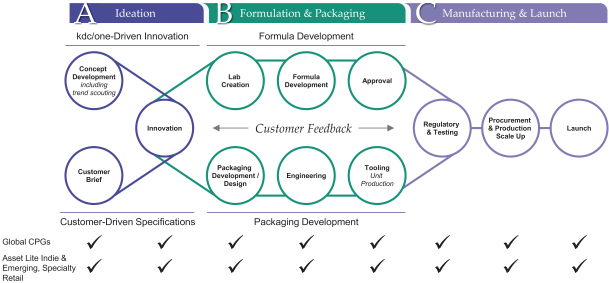

Global End-to-End Solutions:

Vertical Integration from Beaker to Box Enables Speed to Market

Since fiscal year 2016, we have delivered significant growth through a combination of organic expansion and strategic acquisitions, increasing our revenue, net income (loss) (as we grew our business) and Adjusted EBITDA from $516.2 million to $2,143.8 million, $7.5 million to $(125.8) million and $61.5 million to $238.5 million, respectively, for fiscal year 2016 (with fiscal 2016 numbers derived from unaudited financial information not included in this prospectus) and fiscal year 2021, respectively. Adjusted EBITDA is a non-GAAP measure; for a reconciliation of Adjusted EBITDA to the most directly comparable financial measure in accordance with GAAP, see the section titled “Prospectus Summary—Summary Consolidated Financial and Other Data.”

Innovation is at the heart of both our culture and our value proposition. We have approximately 400 employees focused on research and development (“R&D”) as of July 31, 2021, including chemists, formulators, engineers and designers. As of July 31, 2021, our R&D personnel operate across 22 R&D, design and creative facilities and four innovation hubs globally, connecting locally with our customers wherever they are located. For each of the year ended April 30, 2021 and the three months ended July 31, 2021, approximately 73% of our total revenue was attributable to products we helped ideate, design or develop. We believe our R&D capabilities position us as a driving force for growth in our categories. For example, teams at our four innovation hubs, which are located in North America, Europe and the Asia Pacific region, focus on identifying emerging consumer trends and developing new technologies to leverage them. Our current and prospective customers are able to utilize the technologies we develop in the customization of their own branded products.

Our track record of innovation speaks for itself. We developed or co-developed over 3,500 formulations and 7,500 packaging designs during the year ended April 30, 2021. We also own an extensive library of proprietary formulations and packaging designs to which our customers have access. Over the last three years, on average, we have played a role in the launch of more than 3,000 new products annually. Products that we have co-developed are highly regarded and have won numerous industry awards.

3

Table of Contents

Select Recent Awards Enabled Through our Industry-leading Innovation Network

In addition to our focus on innovation through ideation and formulation, we have expansive capabilities in product delivery systems, design and packaging. We believe that we are the leader in customized delivery and packaging solutions, making us a “go-to” partner for brands seeking to differentiate themselves in terms of performance, look and feel. Customized packaging is an increasingly important way for brands to stand out from their competition in a crowded marketplace. In partnership with our customers, our expertise has led to the creation of many of the most distinctive beauty, personal care and home care products in consumers’ homes today.

We also have a sizeable and flexible global manufacturing footprint, operating to the most rigorous standards in the industry and allowing us to seamlessly deliver solutions for the complex production requirements of our customers. As of July 31, 2021, our manufacturing platform includes 25 facilities across North America, Europe, Latin America and the Asia Pacific region, 12 of which are over-the-counter (“OTC”) registered. At these facilities, we are able to engineer and manufacture products both at scale and in shorter runs. Our global infrastructure and integrated supply chain enable us to develop and deliver complex products while also maintaining the flexibility to respond to the needs of our customers as they arise. This, in turn, allows us to seamlessly support global brand launches across our customer base. We believe the stringent standards by which we operate provide our customers with confidence in the quality of our products and in our adherence to strict regulatory standards.

4

Table of Contents

Well-Invested Network to Support Our Customers Globally

We have grown significantly over the past two decades, systematically expanding our product capabilities, category reach and geographic footprint to better serve the needs of our customers globally. We have done this both organically and through acquisitions.

At our Knowlton, Québec, facility, for example, we recently completed a multi-step investment to expand and enhance our capabilities in the antiperspirant and deodorant category. We added a dedicated and flexible automated production line to support the growth of our on-trend natural deodorant products. We are currently undertaking a number of large-scale organic growth initiatives. Operations at our new facility in Columbus, Ohio commenced in the second quarter of fiscal year 2022, adding capabilities across a range of products, including foaming soap, hand soap, shower gel, hand sanitizer and body cream. We are expanding the footprint of our facility in Mexico, which is expected to increase by more than 70% and allow us, for the first time, to serve beauty and personal care customers, in addition to home care customers, through this location. We also expect to double capacity in Texas through our investment in our highly automated manufacturing facility. Each of these projects has been undertaken on the basis of supporting organic growth.

Acquisitions have also been, and we expect will continue to be, an important part of our growth. In 2020, we added industry-leading expertise in the field of complex packaging design and production through the acquisition of HCT, enabling us to better service the premium beauty category. HCT, through its global platform, increased our exposure to many of the most innovative and fast-growing emerging brands worldwide, while further expanding our relationship with many multinational leaders in prestige beauty. We believe the vertically integrated solutions that we now provide are a differentiated and important value proposition for brands, allowing them to accelerate speed to market.

In addition, in 2020, we added advanced capabilities in device design for the global home care category through the acquisition of Zobele, providing us with greater access to a large and growing market. Our acquisition of Paristy the same year provided us with the capability to offer leading, China-based capabilities in product formulation and manufacturing to both international beauty companies as well as leading domestic beauty brands in that region. We have developed a rich pipeline of acquisition opportunities, and we will

5

Table of Contents

continue to take a disciplined approach focused only on assets that we believe enable us to better serve our customers through expansive, end-to-end capabilities.

As we have extended our reach in terms of capabilities and geographies, the TAM for the value-added solutions we provide has meaningfully increased. Adding expansive capabilities in the home care category through acquisitions, and the extension of our geographic reach beyond our North American origins into Europe, Latin America and the Asia Pacific region, have enabled us to expand the size of our addressable market by a factor of five from approximately $135 billion to over $654 billion, based on 2020 retail sales, according to industry information from Euromonitor.4

We generated total revenue of approximately $2.1 billion for the year ended April 30, 2021. Over the same period, we incurred a net loss of $125.8 million and recognized Adjusted EBITDA of $238.5 million. In addition, we generated total revenue of $603.4 million for the three months ended July 31, 2021. Over the same period, we incurred a net loss of $12.7 million and recognized Adjusted EBITDA of $54.7 million.

Many of our customer contracts allow us to effectively pass through raw material costs, providing us with a hedge against fluctuations in commodity prices. As a result, we evaluate the performance of our business on the basis of Value-Added Contribution Margin (“VACM”), which we define as Adjusted EBITDA divided by revenue from value added contributions.

Our business is focused on innovation, product development and operational excellence. As a result, we believe VACM best reflects the profitable solutions we provide to our customers. We delivered VACM of 22.0% for the year ended April 30, 2021. In addition, we delivered VACM of 18.3% for the three months ended July 31, 2021.

Since fiscal year 2016, revenue (derived from unaudited financial information not included in this prospectus) from our Knowlton, Lynchburg, Columbus, Chemaid and Toronto facilities, which were our only facilities in existence at the beginning of fiscal year 2016, grew at a compounded annual growth rate of 5.6%. Although these facilities (including revenue attributable to the Toronto facility, which closed in fiscal year 2017 and had its business transferred to our Knowlton and Lynchburg facilities) generated 26% of the Company’s total fiscal year 2021 revenue, we believe this metric is meaningful as it demonstrates the growth, over an extended period of time, for a core portion of the Company’s operations. The financial information for the year ended April 30, 2016 has been derived from unaudited books and records of the Company, which are prepared on the same basis and using the same accounting principles as the audited consolidated financial statements of the Company included elsewhere in this prospectus.

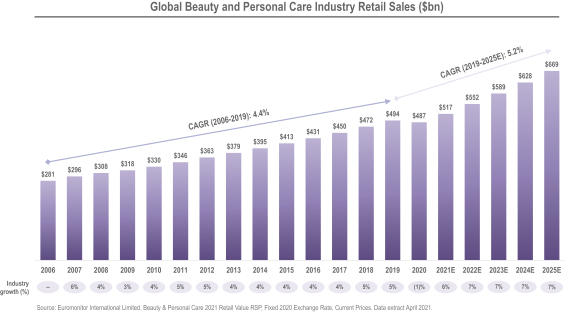

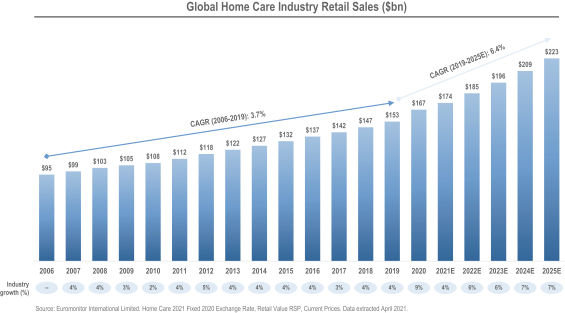

Favorable Industry Dynamics

We operate in many of the largest, fastest growing, most resilient and most valuable product categories within beauty, personal care and home care. Product categories served by our Beauty and Personal Care segment represented retail sales value of $487 billion globally for 2020, according to Euromonitor.5 On a weighted-average basis, they are expected to deliver a compound annual growth rate of 5.2% through 2025. Product categories served by our Home Care segment represented retail sales value of $167 billion globally for 2020, according to Euromonitor.6 On a weighted-average basis, they are expected to deliver a compound annual growth rate of 6.4% through 2025.6

Within these product categories, a number of structural shifts are taking place that favor a value-added, integrated solutions partner such as kdc/one. Through digitization, consumers have more immediate access than

| 4 | Company estimate from Euromonitor International Limited. Beauty & Personal Care 2021, Fixed 2020 Exchange Rate, Home Care 2021 Fixed 2020 Exchange Rate, Retail Value RSP, Current Prices. Data extracted April 2021. |

| 5 | Euromonitor International Limited. Beauty & Personal Care 2021, Fixed 2020 Exchange Rate, Retail Value RSP, Current Prices. Data extracted April 2021. |

| 6 | Euromonitor International Limited. Home Care 2021, Fixed 2020 Exchange Rate, Retail Value RSP, Current Prices. Data extracted April 2021. |

6

Table of Contents

ever before to information around their purchasing choices, giving the consumer increasingly direct influence over the nature of the products that are brought to market. This has resulted in a faster pace of innovation across the beauty, personal care and home care categories, both for existing products and through a significant increase in the rate at which new brands are introduced.

As established brands adapt to this faster-paced consumer environment, they are increasingly reliant on outsourced strategic partnerships to help drive product innovation and speed to market. Likewise, owners of emerging brands often favor an asset-lite approach, freeing up time and resources to focus on consumer connectivity.

We believe the following capabilities, in particular, make kdc/one well-suited to benefit from these structural shifts:

| • | Innovation: We have developed comprehensive innovation capabilities, from ideation to formulation to design and packaging, allowing us to partner with our customers in addressing increasing consumer demand for new products and brands. |

| • | End-to-end solutions: As consumer demand for “newness” accelerates, brands are increasingly partnering with kdc/one across all facets of the strategic product planning process. We believe that our ability to offer integrated, end-to-end solutions on a global basis makes us a preferred partner across the categories we serve. |

| • | Speed to market: Our end-to-end capabilities reduce lead times for new products, meaning we are often able to shorten time to market compared with others in our industry, essential in a “fast beauty” environment. |

| • | Agile production capabilities: As the pace of innovation has increased, brands have shifted towards shorter product runs and more frequent innovation. Our manufacturing platform is flexible and agile, meaning that we are able to accommodate shorter runs for our customers across multiple geographies. At the same time, we are also able to scale production rapidly as brands grow. |

| • | Unique global network: We believe that partnering with kdc/one provides our customers with access to a unique network of capabilities across formulation, packaging and manufacturing; this allows them to focus investment of time and capital in meeting the needs of the consumer in a dynamic market. |

| • | Regulatory compliance and quality control: Customers rely on our expertise in complex global regulatory requirements enabling them to satisfy demand from an increasingly global consumer base. |

The structural industry shifts that favor reliance on outsourced capabilities are also creating pockets of demand from consumers, and, in turn, our direct customers, that far outpace category averages. Our deep industry expertise, coupled with constant, close communication with our customer base allows us to identify those opportunities and to focus our efforts appropriately.

We closely monitor the emerging brand landscape, and now count more than 200 customers that are independent and emerging among our customer base. The pace of growth for brands that are marketed and sold in a digital environment has been particularly strong in recent years. Industry estimates suggest that e-commerce growth in beauty and personal care, for example, has outpaced brick-and-mortar distribution by a factor of thirteen over the period from 2018 through 2020.7 We have partnered with our customers to ideate, formulate, design and package products that are specifically positioned for success in a digital marketing environment.

Consumers are increasingly seeking brands and products that better reflect their own values and lifestyles. This manifests itself in many ways, including more environmentally friendly ingredients, cleaner formulations,

| 7 | Euromonitor International Limited. Retailing 2021, Fixed 2020 Exchange Rate, Retail Value RSP excluding sales tax, Current prices. Data extracted April 2021. |

7

Table of Contents

sustainable packaging, and the way in which a company treats its employees or gives back to its community. We believe that the services and solutions we offer enable our brand partners to deliver cutting-edge products that are consistent with these values without compromising performance. Our broad suite of capabilities helps us partner with our customers to satisfy rapidly growing consumer demand and to help them achieve their own sustainability goals.

From a geographic perspective, industry estimates suggest that growth will continue across each of the major regions in which we operate, including the United States and Canada; Europe, the Middle East and Africa; and the Asia Pacific region. On a weighted-average basis, the markets for beauty, personal care and home care are expected to grow at a compound annual rate of 2.3%, 4.9% and 7.0% in the United States and Canada; Europe, the Middle East and Africa; and the Asia Pacific region, respectively, from 2019 through 2025, according to Euromonitor.8 China, in particular, is experiencing a period of elevated growth and is expected to grow at a compound annual rate of 10.2% over the period from 2019 through 2025.9 We have expanded our capabilities in the region through the acquisitions of industry-leading and well-respected companies, including Paristy, HCT and Zobele. We also benefit from China market insights provided by C2 Capital, a current investor. Alibaba Group, the leading e-commerce platform in China, is an anchor investor in C2 Capital.

Key Strengths

We are focused on driving deep and lasting relationships with our customers by leveraging the following competitive strengths:

We provide value-added solutions in some of the fastest growing, most resilient and most valuable categories across the consumer landscape, underpinned by an ongoing shift towards outsourced product development and innovation

The categories in which we operate represent, in aggregate, retail sales of approximately $654 billion globally for 2020, according to Euromonitor.10 On a weighted-average basis, these categories are expected to deliver a compound annual growth rate of 5.5% from 2019 through 2025.10 Across these categories, growth is underpinned by increasing consumer demand for product innovation and new brands, which in turn favors increasing reliance by consumer products companies on outsourced support for strategic product development. Our deep industry knowledge and insights also allow us to focus on areas of growth that are higher than the category average. Examples include: our focus on partnering with fast-growing, independent and emerging brands; our ability to service the fast-paced innovation requirements of brands focused on digital marketing and distribution (who often run asset-lite business models); and our increased focus on the rapidly-growing market for clean and sustainable product and packaging solutions.

We expect to deliver significant category growth across each major region in which we operate, including the United States and Canada; Europe, the Middle East and Africa; and the Asia Pacific region. China, in particular, is experiencing a period of elevated growth and its beauty, personal care and home care markets are expected to grow at a weighted-average compound annual rate of 10.2% from 2019 through 2025, according to Euromonitor.10 We have recently expanded our capabilities in the region through the acquisitions of Paristy, HCT and Zobele.

| 8 | Company estimate from Euromonitor International Limited, Beauty & Personal Care 2021 Fixed 2020 Exchange Rate, Home Care 2021 Fixed 2020 Exchange Rate, Retail Value RSP, Current Prices. Data extracted April 2021. |

| 9 | Euromonitor International Limited. Beauty & Personal Care 2021 Retail Value RSP Fixed 2020 Exchange Rate, Home Care 2021 Retail Value RSP Fixed 2020 Exchange Rate. Data extracted April 2021. |

| 10 | Company estimate from Euromonitor International Limited. Beauty & Personal Care 2021 Fixed 2020 Exchange Rate, Home Care 2021 Fixed 2020 Exchange Rate, Retail Value RSP, Current Prices. Data extracted April 2021. |

8

Table of Contents

Trusted, long-term partnerships with the industry’s leading consumer products companies and fast-growing independent and emerging brands

The breadth of our capabilities, coupled with our extensive geographic reach, allows us to develop long-term, trusted, strategic partnerships with our over 700 customers, encompassing over 1,000 brands across categories and geographies. As of July 31, 2021, our customers included more than 200 independent and emerging customers, who we have selectively targeted as owning many of the fastest growing and most noteworthy brands.

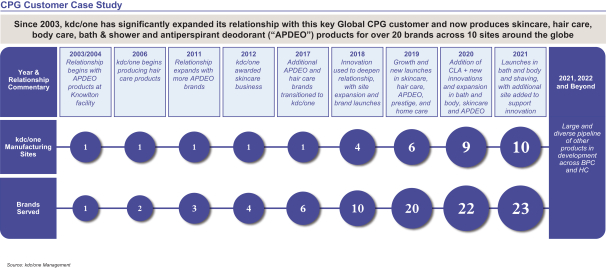

We enjoy close connectivity with our customers, reflecting the important role we play across the value chain. We have the ability to coordinate with our customers at every stage of the strategic product planning process. We have often been told that our ability to provide integrated solutions across the value chain makes us the first call for our customers when they seek to partner on new products or develop new solutions. The trust that our customers place in our capabilities leads to long-tenured relationships. For the year ended April 30, 2021, with our top 10 customers by revenue, we have an average relationship tenure of more than 30 years. We also have a track record of growing our revenue opportunities with customers over the duration of our partnership.

Differentiated Customer Solutions—Selected Case Studies

We offer a comprehensive, integrated and global portfolio of value-added solutions, including ideation, formulation, design and packaging and manufacturing

We have developed a comprehensive, integrated suite of value-added customer solutions and product capabilities. Our integrated approach allows us to offer services to our customers across every aspect of product development. We believe this is a significant competitive advantage, as we are able to partner with our customers to offer end-to-end solutions. Through our global footprint we are also able to deliver value-added solutions to customers worldwide. The comprehensive nature of our offering has allowed us both to add new customers and to increase share of spend with our existing customers.

9

Table of Contents

We support our comprehensive suite of solutions and capabilities with a sizeable and flexible manufacturing footprint, operating to stringent quality standards from our customers and adhering to strict regulatory standards. As of July 31, 2021, our manufacturing platform includes 25 facilities across North America, Europe, Latin America and the Asia Pacific region. At these facilities, we are able to engineer and manufacture products both at scale and in shorter product runs for our customers. Our global infrastructure and integrated supply chain enable us to develop and deliver highly complex products while also maintaining the flexibility to respond to the needs of our customers as they arise. We believe the stringent standards by which we operate provide our customers with confidence as to product quality and adherence to complex regulatory standards.

We enjoy leading capabilities in product innovation and design, enabling us to partner with our customers to meet increasing consumer demand for new products and brands

We believe we have the industry’s leading capabilities in product innovation. Teams at our four innovation hubs, located in the United States, Europe and Asia, focus on identifying emerging consumer trends and developing new technologies to leverage them. As of July 31, 2021, our R&D personnel operate across 22 R&D, design and creative facilities as well as four innovation hubs globally, connecting locally with our customers wherever they are located. For each of the year ended April 30, 2021 and the three months ended July 31, 2021, approximately 73% of our total revenue was attributable to products we helped ideate, design or develop.

Our track record of innovation speaks for itself. We developed or co-developed over 3,500 formulations and 7,500 packaging designs during the year ended April 30, 2021. We also own an extensive library of proprietary formulations and packaging designs to which our customers have access. Over the last three years, on average, we have played a role in the launch of more than 3,000 new products annually.

We have a successful track record of enhancing our product capabilities, category reach and geographic footprint through both organic expansion as well as highly selective and strategic acquisitions

We have grown significantly over the past two decades, systematically expanding our product capabilities, category reach and geographic footprint to better serve the needs of our customers. We have done this both organically and through acquisitions.

Our organic growth encompasses a range of initiatives including (i) upgrading and enhancing existing facilities; (ii) expanding capacity or building out new capabilities across the kdc/one network; and (iii) the construction of brand new facilities. kdc/one has a history of consistent execution success across all these forms of organic growth, and is currently in the process of completing several significant organic growth projects across the network. Importantly, these organic investments are supported by specific customer contracts.

At our Knowlton facility, we recently expanded and enhanced our antiperspirant and deodorant capabilities through the installation of new high speed production lines, supporting the growth of our on-trend natural deodorant products. We are currently in the process of a substantial expansion of our Home Care facility in Mexico (70% increase in square footage), transforming it into a facility capable of servicing Beauty and Personal Care customers as well. Upon completion of the project, this facility will also mark the introduction of wipes technology into the kdc/one network.

Following the successful construction of our Columbus facility in 2012 and subsequent fragrance build-out in 2016, the new 570,000 square-foot Columbus II facility adds a modern, flexible and highly automated facility to the kdc/one portfolio. While the Columbus II facility will be initially focused on the Beauty and Personal Care segment, the facility also contains 180,000 square feet of unutilized space underroof targeted to be used to support growth for our Home Care segment. We will continue to make disciplined investments in partnering with our global customers.

10

Table of Contents

We have a successful track record of acquisitions. Over our 30-year history, we have completed 16 transactions. Our current management team has completed six of those transactions over the past two years.

We have been systematic and disciplined in our approach to acquisitions. Our deep knowledge of the beauty, personal care and home care markets has allowed us to anticipate both significant industry shifts and the demands of our customers, and to identify acquisition targets that allow us to meet those demands. For example, the acquisition of HCT in 2020 added leading capabilities in design and packaging, which in combination with our existing platform has allowed us to provide both existing and new customers with a differentiated solution, and enhanced speed to market, from a truly integrated capability encompassing ideation to final product. The acquisition of Zobele in 2020 provided us with access to advanced device development and manufacturing capabilities in the large and growing global home care market. Similarly, our acquisitions of Zobele and Paristy, in particular, have enabled us to extend our geographic reach beyond North America to serve customers in Europe, Latin America and the Asia Pacific region. kdc/one is today a highly differentiated, vertically integrated brand enabler with global reach.

As a market leader in a fragmented industry, we believe we will benefit from ongoing opportunities to extend our reach through our buy and build strategy. We have developed a pipeline of opportunities that we will continue to monitor on a go forward basis. We will continue to be highly selective in our approach to acquisitions, focusing only on opportunities where we can add both leading capabilities and talent. We will continue to be careful and disciplined stewards of capital.

We have a diversified and resilient business model driving strong financial performance

Since fiscal year 2016, we have delivered significant growth through a combination of organic expansion and strategic acquisitions, increasing our revenue, net income (loss) (as we grew our business) and Adjusted EBITDA from $516.2 million to $2,143.8 million, $7.5 million to $(125.8) million and $61.5 million to $238.5 million, respectively, for fiscal year 2016 (with fiscal 2016 numbers derived from unaudited financial information not included in this prospectus) and fiscal year 2021, respectively. Adjusted EBITDA is a non-GAAP measure; for a reconciliation of Adjusted EBITDA to the most directly comparable financial measure in accordance with GAAP, see the section titled “Prospectus Summary—Summary Consolidated Financial and Other Data.”