Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FUELCELL ENERGY INC | fcel-20210914x8k.htm |

| EX-99.1 - EX-99.1 - FUELCELL ENERGY INC | fcel-20210914xex99d1.htm |

Exhibit 99.2

| FuelCell Energy Q3 2021 Investor Presentation Third Quarter of Fiscal 2021 Financial Results & Strategy Update September 14, 2021 Exhibit 99.2 |

| FuelCell Energy Q3 2021 Investor Presentation This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 regarding future events or our future financial performance that involve certain contingencies and uncertainties, including those discussed in our Quarterly Report on Form 10-Q for the quarter ended July 31, 2021 in the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations”. Forward-looking statements include, without limitation, statements with respect to the Company’s anticipated financial results and statements regarding the Company’s plans and expectations regarding the continuing development, commercialization and financing of its fuel cell technology and its business plans and strategies. These statements are not guarantees of future performance, and all forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Factors that could cause such a difference include, without limitation: general risks associated with product development and manufacturing; general economic conditions; changes in the utility regulatory environment; changes in the utility industry and the markets for distributed generation, distributed hydrogen, and fuel cell power platforms configured for carbon capture or carbon sequestration; potential volatility of energy prices; availability of government subsidies and economic incentives for alternative energy technologies; our ability to remain in compliance with U.S. federal and state and foreign government laws and regulations and the listing rules of The Nasdaq Stock Market; rapid technological change; competition; the risk that our bid awards will not convert to contracts or that our contracts will not convert to revenue; market acceptance of our products; changes in accounting policies or practices adopted voluntarily or as required by accounting principles generally accepted in the United States; factors affecting our liquidity position and financial condition; government appropriations; the ability of the government and third parties to terminate their development contracts at any time; the ability of the government to exercise “march-in” rights with respect to certain of our patents; the arbitration and other legal proceedings with POSCO Energy Co., Ltd.; our ability to implement our strategy; our ability to reduce our levelized cost of energy and our cost reduction strategy generally; our ability to protect our intellectual property; litigation and other proceedings; the risk that commercialization of our products will not occur when anticipated; our need for and the availability of additional financing; our ability to generate positive cash flow from operations; our ability to service our long-term debt; our ability to increase the output and longevity of our power plants and to meet the performance requirements of our contracts; our ability to expand our customer base and maintain relationships with our largest customers and strategic business allies; changes by the U.S. Small Business Administration or other governmental authorities to, or with respect to the implementation or interpretation of, the Coronavirus Aid, Relief, and Economic Security Act, the Paycheck Protection Program or related administrative matters; and concerns with, threats of, or the consequences of, pandemics, contagious diseases or health epidemics, including the novel coronavirus, and resulting supply chain disruptions, shifts in clean energy demand, impacts to our customers’ capital budgets and investment plans, impacts to our project schedules, impacts to our ability to service existing projects, and impacts on the demand for our products, as well as other risks set forth in the Company’s filings with the Securities and Exchange Commission. The forward-looking statements contained herein speak only as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement contained or incorporated by reference herein to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based. The Company refers to non-GAAP financial measures in this presentation. The Company believes that this information is useful to understanding its operating results and assessing performance and highlighting trends on an overall basis. Please refer to the Company’s earnings release and the appendix to this presentation for further disclosure and reconciliation of non-GAAP financial measures. (As used herein, the term “GAAP” refers to generally accepted accounting principles in the U.S.) The information set forth in this presentation is qualified by reference to, and should be read in conjunction with, our Annual Report on Form 10-K for the fiscal year ended October 31, 2020, filed with the SEC on January 21, 2021, our Quarterly Report on Form 10-Q for the fiscal quarter ended July 31, 2021, filed with the SEC on September 14, 2021, and our earnings release for the third fiscal quarter ended July 31, 2021, filed as an exhibit to our Current Report on Form 8-K filed with the SEC on September 14, 2021. Safe Harbor Statement 2 |

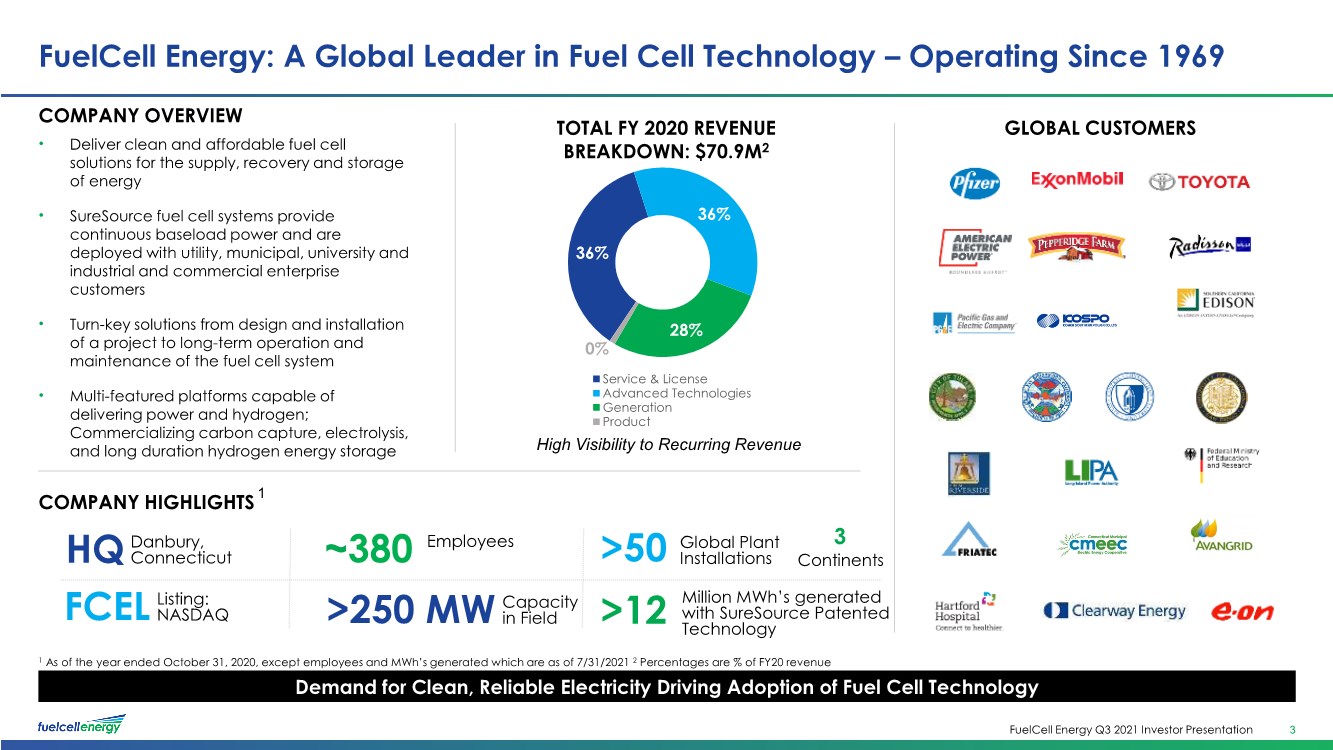

| FuelCell Energy Q3 2021 Investor Presentation 36% 36% 28% 0% Service & License Advanced Technologies Generation Product GLOBAL CUSTOMERS COMPANY OVERVIEW • Deliver clean and affordable fuel cell solutions for the supply, recovery and storage of energy • SureSource fuel cell systems provide continuous baseload power and are deployed with utility, municipal, university and industrial and commercial enterprise customers • Turn-key solutions from design and installation of a project to long-term operation and maintenance of the fuel cell system • Multi-featured platforms capable of delivering power and hydrogen; Commercializing carbon capture, electrolysis, and long duration hydrogen energy storage COMPANY HIGHLIGHTS FuelCell Energy: A Global Leader in Fuel Cell Technology – Operating Since 1969 3 TOTAL FY 2020 REVENUE BREAKDOWN: $70.9M2 Demand for Clean, Reliable Electricity Driving Adoption of Fuel Cell Technology High Visibility to Recurring Revenue 1 As of the year ended October 31, 2020, except employees and MWh’s generated which are as of 7/31/2021 2 Percentages are % of FY20 revenue >250 MW Capacity in Field >50 Global Plant Installations 3 Continents ~380 Employees FCEL Listing: NASDAQ HQ Danbury, Connecticut 1 >12 Million MWh’s generated with SureSource Patented Technology |

| FuelCell Energy Q3 2021 Investor Presentation Purpose Statement 4 Enable The World To Live A Life Empowered By Clean Energy Distributed Baseload – Energy Storage – Carbon Capture |

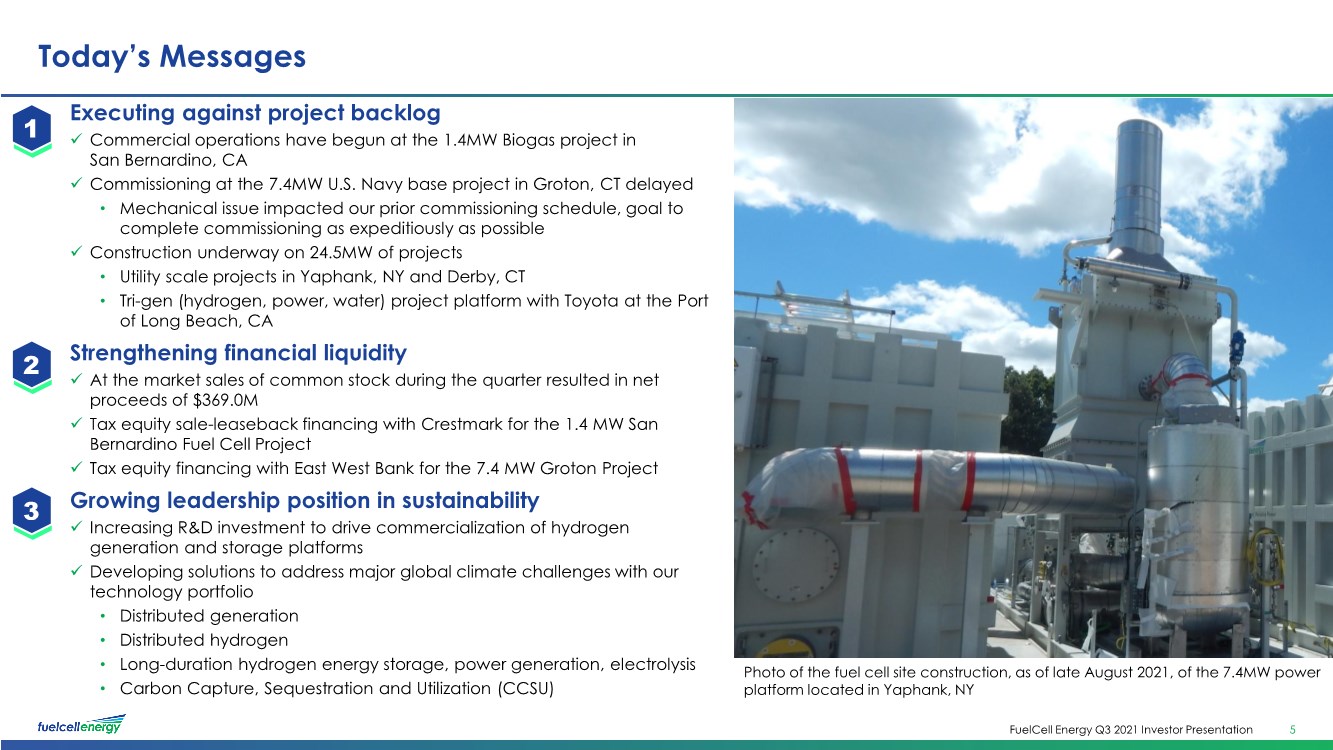

| FuelCell Energy Q3 2021 Investor Presentation Today’s Messages 5 Executing against project backlog ✓ Commercial operations have begun at the 1.4MW Biogas project in San Bernardino, CA ✓ Commissioning at the 7.4MW U.S. Navy base project in Groton, CT delayed • Mechanical issue impacted our prior commissioning schedule, goal to complete commissioning as expeditiously as possible ✓ Construction underway on 24.5MW of projects • Utility scale projects in Yaphank, NY and Derby, CT • Tri-gen (hydrogen, power, water) project platform with Toyota at the Port of Long Beach, CA Strengthening financial liquidity ✓ At the market sales of common stock during the quarter resulted in net proceeds of $369.0M ✓ Tax equity sale-leaseback financing with Crestmark for the 1.4 MW San Bernardino Fuel Cell Project ✓ Tax equity financing with East West Bank for the 7.4 MW Groton Project Growing leadership position in sustainability ✓ Increasing R&D investment to drive commercialization of hydrogen generation and storage platforms ✓ Developing solutions to address major global climate challenges with our technology portfolio • Distributed generation • Distributed hydrogen • Long-duration hydrogen energy storage, power generation, electrolysis • Carbon Capture, Sequestration and Utilization (CCSU) 1 2 Photo of the fuel cell site construction, as of late August 2021, of the 7.4MW power platform located in Yaphank, NY 3 |

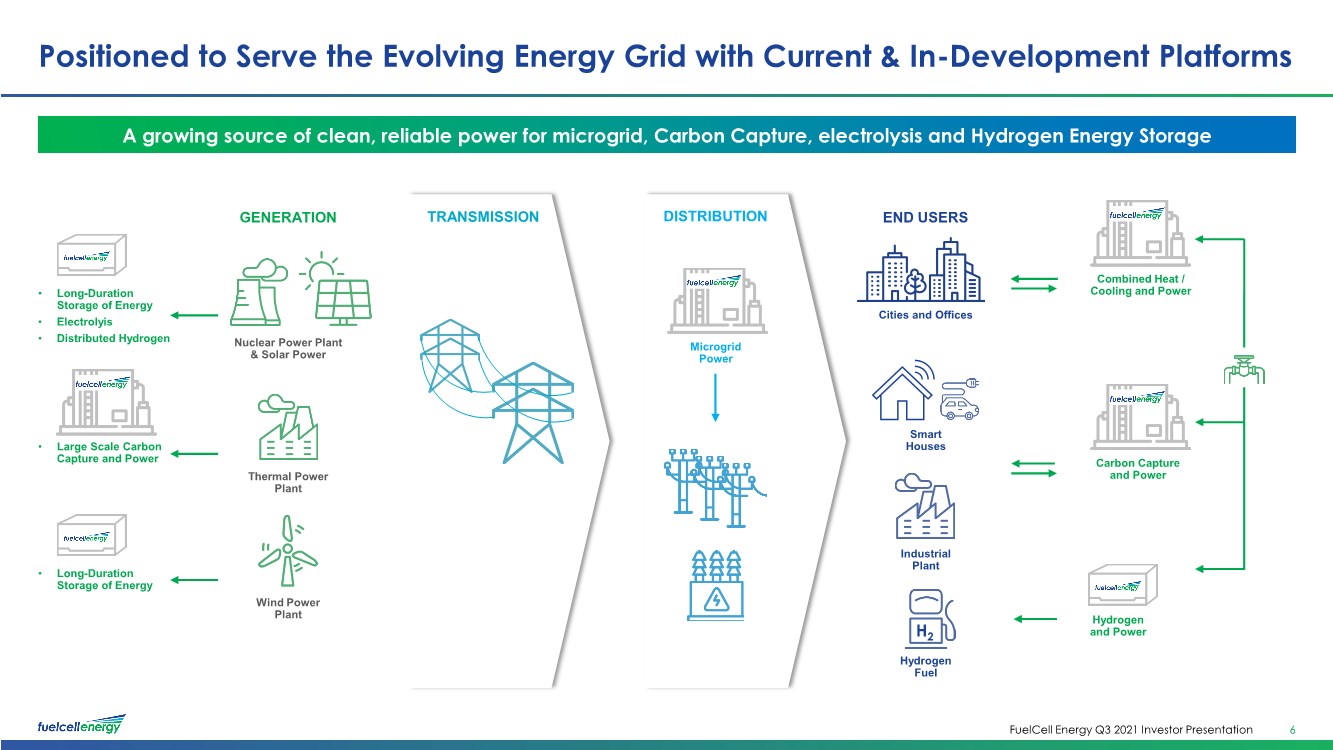

| FuelCell Energy Q3 2021 Investor Presentation Positioned to Serve the Evolving Energy Grid with Current & In-Development Platforms 6 A growing source of clean, reliable power for microgrid, Carbon Capture, electrolysis and Hydrogen Energy Storage GENERATION Nuclear Power Plant & Solar Power Thermal Power Plant Wind Power Plant TRANSMISSION Hydrogen Fuel Cities and Offices Smart Houses Industrial Plant • Large Scale Carbon Capture and Power • Long-Duration Storage of Energy • Long-Duration Storage of Energy • Electrolyis • Distributed Hydrogen Combined Heat / Cooling and Power Carbon Capture and Power Hydrogen and Power Microgrid Power DISTRIBUTION END USERS H2 |

| FuelCell Energy Q3 2021 Investor Presentation Q3 2021 Financial Performance |

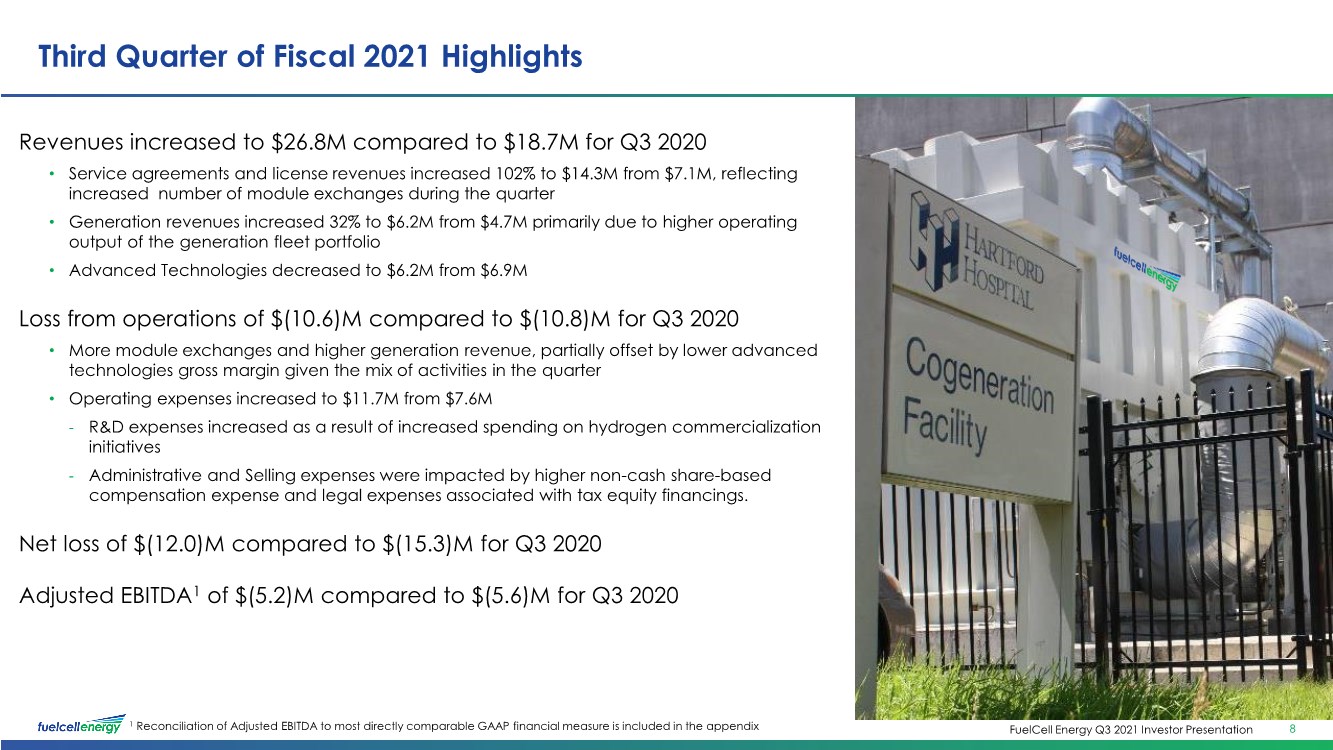

| FuelCell Energy Q3 2021 Investor Presentation Third Quarter of Fiscal 2021 Highlights Revenues increased to $26.8M compared to $18.7M for Q3 2020 • Service agreements and license revenues increased 102% to $14.3M from $7.1M, reflecting increased number of module exchanges during the quarter • Generation revenues increased 32% to $6.2M from $4.7M primarily due to higher operating output of the generation fleet portfolio • Advanced Technologies decreased to $6.2M from $6.9M Loss from operations of $(10.6)M compared to $(10.8)M for Q3 2020 • More module exchanges and higher generation revenue, partially offset by lower advanced technologies gross margin given the mix of activities in the quarter • Operating expenses increased to $11.7M from $7.6M - R&D expenses increased as a result of increased spending on hydrogen commercialization initiatives - Administrative and Selling expenses were impacted by higher non-cash share-based compensation expense and legal expenses associated with tax equity financings. Net loss of $(12.0)M compared to $(15.3)M for Q3 2020 Adjusted EBITDA1 of $(5.2)M compared to $(5.6)M for Q3 2020 Winter 2020 Summer 2020 FuelCell Project with CMEEC SureSourceTM 7.4 MW Location: U.S. Navy Subbase | Groton, CT Current 8 1 Reconciliation of Adjusted EBITDA to most directly comparable GAAP financial measure is included in the appendix |

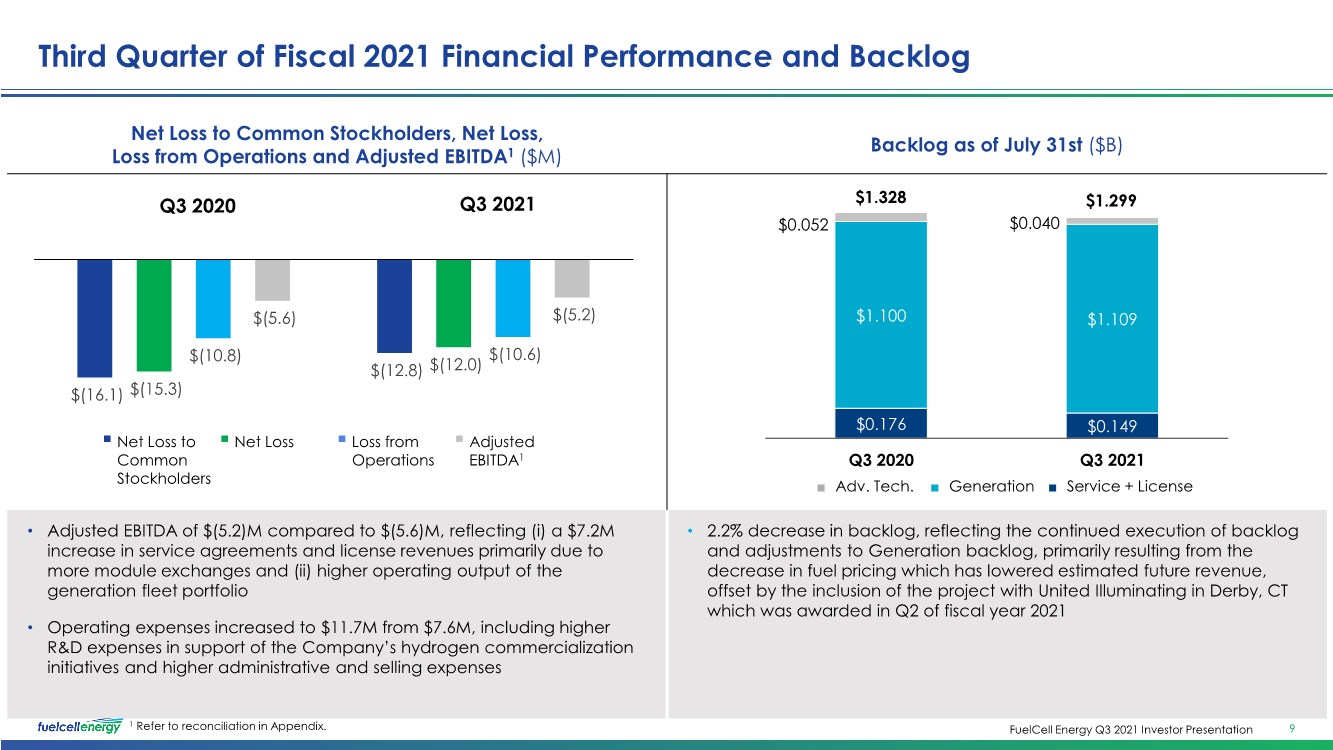

| FuelCell Energy Q3 2021 Investor Presentation 9 1 Refer to reconciliation in Appendix. Net Loss to Common Stockholders, Net Loss, Loss from Operations and Adjusted EBITDA1 ($M) Backlog as of July 31st ($B) • Adjusted EBITDA of $(5.2)M compared to $(5.6)M, reflecting (i) a $7.2M increase in service agreements and license revenues primarily due to more module exchanges and (ii) higher operating output of the generation fleet portfolio • Operating expenses increased to $11.7M from $7.6M, including higher R&D expenses in support of the Company’s hydrogen commercialization initiatives and higher administrative and selling expenses • 2.2% decrease in backlog, reflecting the continued execution of backlog and adjustments to Generation backlog, primarily resulting from the decrease in fuel pricing which has lowered estimated future revenue, offset by the inclusion of the project with United Illuminating in Derby, CT which was awarded in Q2 of fiscal year 2021 $0.176 $0.149 $1.100 $1.109 $0.052 $0.040 Q3 2020 Q3 2021 $1.299 $1.328 ■ Adv. Tech. ■ Generation ■ Service + License $(16.1) $(12.8) $(15.3) $(12.0) $(10.8) $(10.6) $(5.6) $(5.2) ▪ Net Loss to Common Stockholders ▪ Loss from Operations ▪ Adjusted EBITDA1 ▪ Net Loss Q3 2020 Q3 2021 Third Quarter of Fiscal 2021 Financial Performance and Backlog |

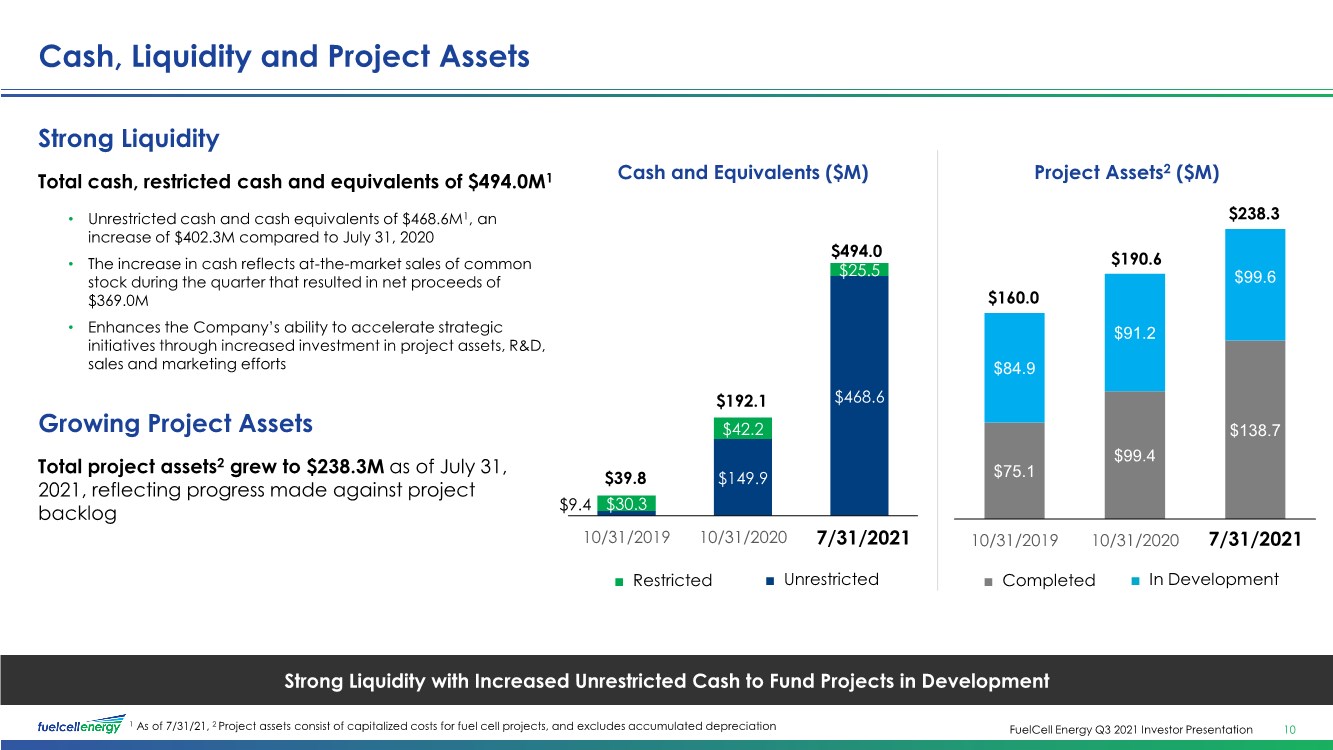

| FuelCell Energy Q3 2021 Investor Presentation 1 As of 7/31/21, 2 Project assets consist of capitalized costs for fuel cell projects, and excludes accumulated depreciation Strong Liquidity with Increased Unrestricted Cash to Fund Projects in Development ■ Restricted ■ Unrestricted $9.4 $149.9 $468.6 $30.3 $42.2 $25.5 10/31/2019 10/31/2020 7/31/2021 $192.1 $494.0 Cash and Equivalents ($M) Strong Liquidity Total cash, restricted cash and equivalents of $494.0M1 • Unrestricted cash and cash equivalents of $468.6M1, an increase of $402.3M compared to July 31, 2020 • The increase in cash reflects at-the-market sales of common stock during the quarter that resulted in net proceeds of $369.0M • Enhances the Company’s ability to accelerate strategic initiatives through increased investment in project assets, R&D, sales and marketing efforts Growing Project Assets Total project assets2 grew to $238.3M as of July 31, 2021, reflecting progress made against project backlog ■ Completed ■ In Development $75.1 $99.4 $138.7 $84.9 $91.2 $99.6 10/31/2019 10/31/2020 7/31/2021 Project Assets2 ($M) $190.6 $160.0 $39.8 7/31/2021 7/31/2021 Cash, Liquidity and Project Assets 10 $238.3 |

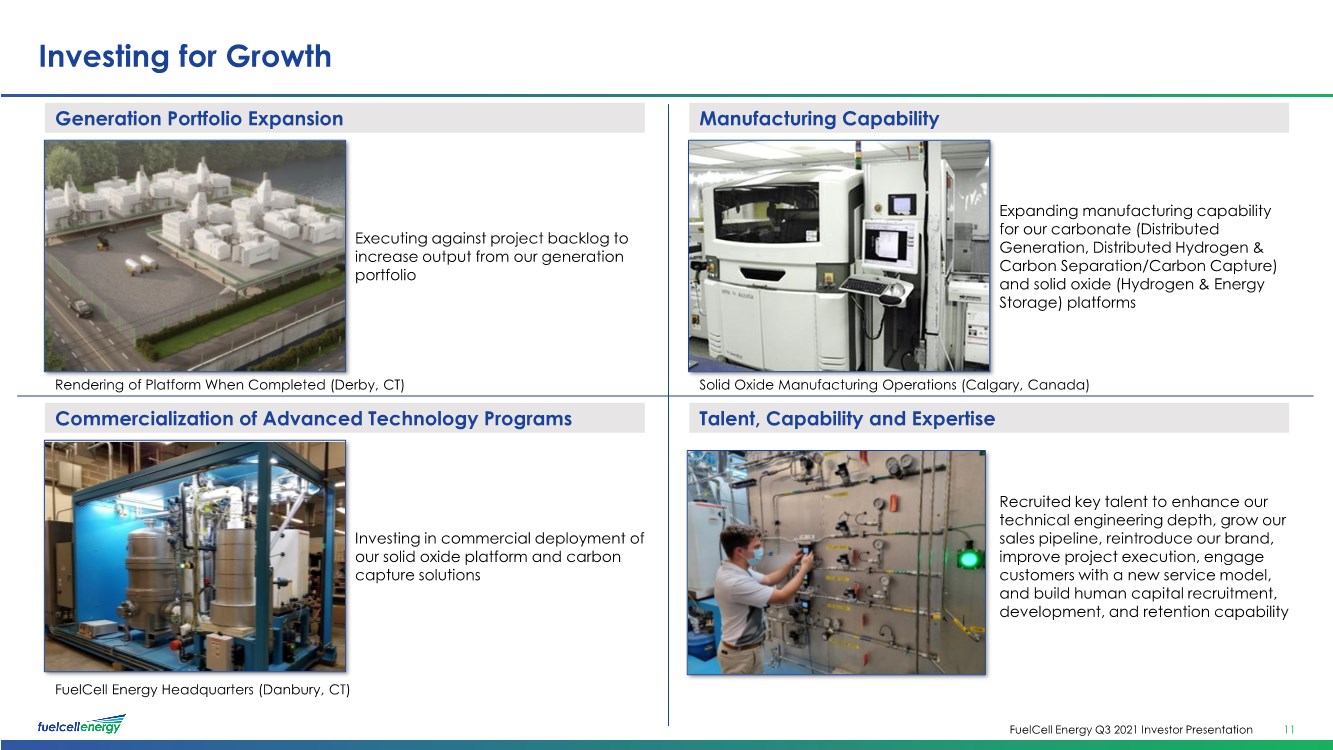

| FuelCell Energy Q3 2021 Investor Presentation Investing for Growth 11 Manufacturing Capability Generation Portfolio Expansion Talent, Capability and Expertise Commercialization of Advanced Technology Programs Rendering of Platform When Completed (Derby, CT) FuelCell Energy Headquarters (Danbury, CT) Solid Oxide Manufacturing Operations (Calgary, Canada) Executing against project backlog to increase output from our generation portfolio Investing in commercial deployment of our solid oxide platform and carbon capture solutions Expanding manufacturing capability for our carbonate (Distributed Generation, Distributed Hydrogen & Carbon Separation/Carbon Capture) and solid oxide (Hydrogen & Energy Storage) platforms Recruited key talent to enhance our technical engineering depth, grow our sales pipeline, reintroduce our brand, improve project execution, engage customers with a new service model, and build human capital recruitment, development, and retention capability |

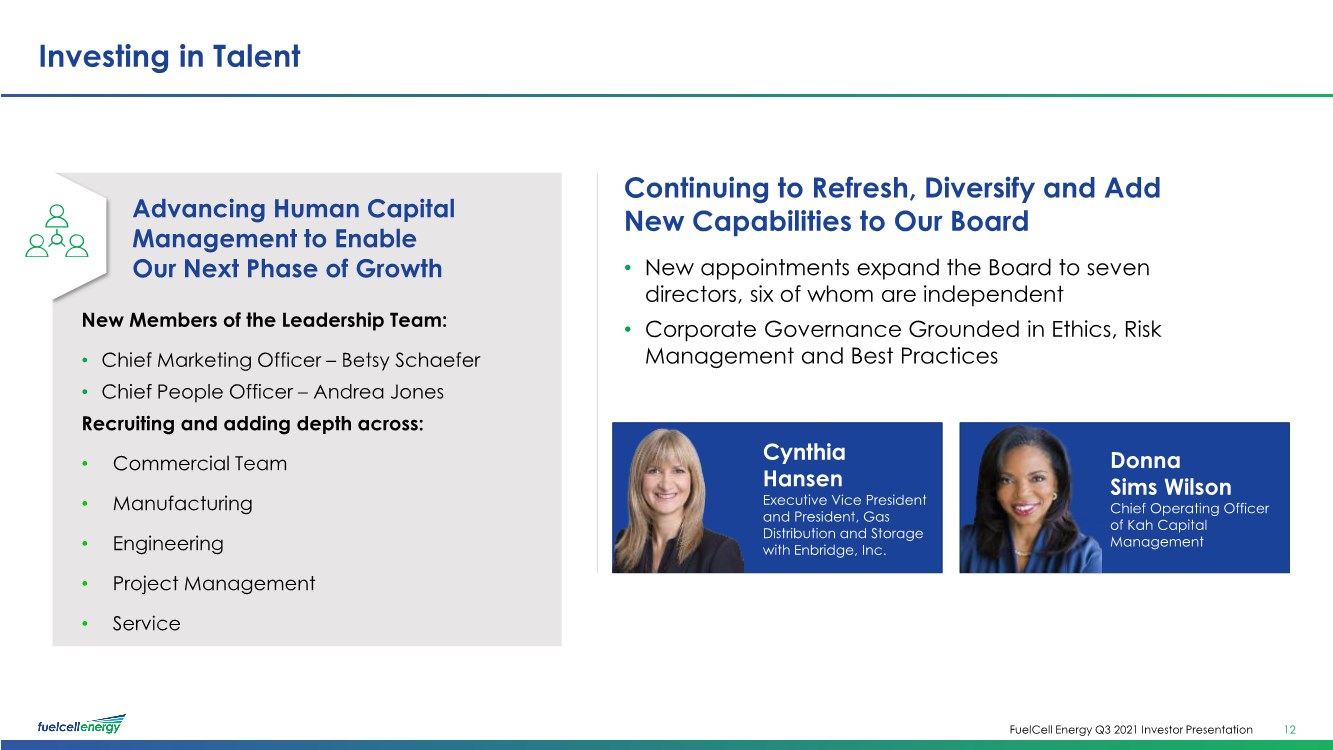

| FuelCell Energy Q3 2021 Investor Presentation Investing in Talent 12 Advancing Human Capital Management to Enable Our Next Phase of Growth New Members of the Leadership Team: • Chief Marketing Officer – Betsy Schaefer • Chief People Officer – Andrea Jones Recruiting and adding depth across: • Commercial Team • Manufacturing • Engineering • Project Management • Service Continuing to Refresh, Diversify and Add New Capabilities to Our Board • New appointments expand the Board to seven directors, six of whom are independent • Corporate Governance Grounded in Ethics, Risk Management and Best Practices Donna Sims Wilson Chief Operating Officer of Kah Capital Management Cynthia Hansen Executive Vice President and President, Gas Distribution and Storage with Enbridge, Inc. |

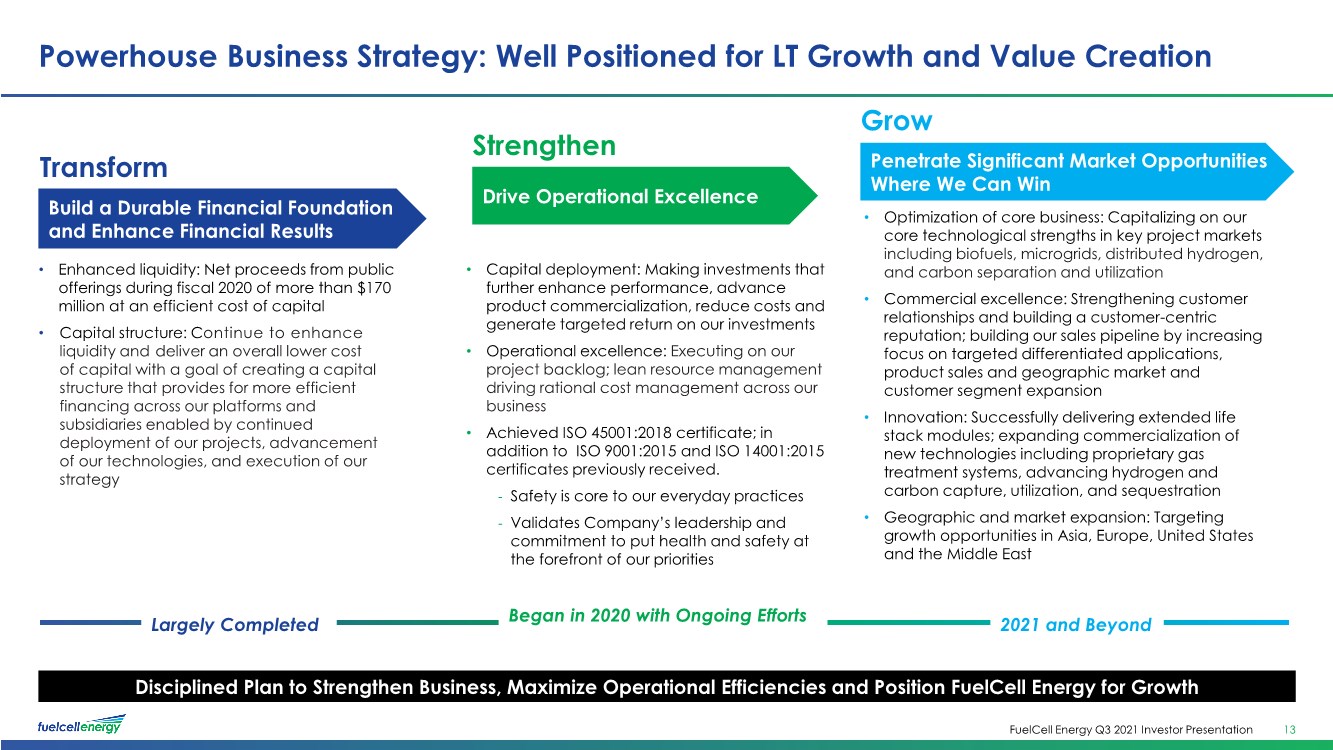

| FuelCell Energy Q3 2021 Investor Presentation • Enhanced liquidity: Net proceeds from public offerings during fiscal 2020 of more than $170 million at an efficient cost of capital • Capital structure: Continue to enhance liquidity and deliver an overall lower cost of capital with a goal of creating a capital structure that provides for more efficient financing across our platforms and subsidiaries enabled by continued deployment of our projects, advancement of our technologies, and execution of our strategy Powerhouse Business Strategy: Well Positioned for LT Growth and Value Creation 13 • Optimization of core business: Capitalizing on our core technological strengths in key project markets including biofuels, microgrids, distributed hydrogen, and carbon separation and utilization • Commercial excellence: Strengthening customer relationships and building a customer-centric reputation; building our sales pipeline by increasing focus on targeted differentiated applications, product sales and geographic market and customer segment expansion • Innovation: Successfully delivering extended life stack modules; expanding commercialization of new technologies including proprietary gas treatment systems, advancing hydrogen and carbon capture, utilization, and sequestration • Geographic and market expansion: Targeting growth opportunities in Asia, Europe, United States and the Middle East • Capital deployment: Making investments that further enhance performance, advance product commercialization, reduce costs and generate targeted return on our investments • Operational excellence: Executing on our project backlog; lean resource management driving rational cost management across our business • Achieved ISO 45001:2018 certificate; in addition to ISO 9001:2015 and ISO 14001:2015 certificates previously received. - Safety is core to our everyday practices - Validates Company’s leadership and commitment to put health and safety at the forefront of our priorities Disciplined Plan to Strengthen Business, Maximize Operational Efficiencies and Position FuelCell Energy for Growth Build a Durable Financial Foundation and Enhance Financial Results Drive Operational Excellence Penetrate Significant Market Opportunities Where We Can Win Transform Strengthen Grow Largely Completed Began in 2020 with Ongoing Efforts 2021 and Beyond |

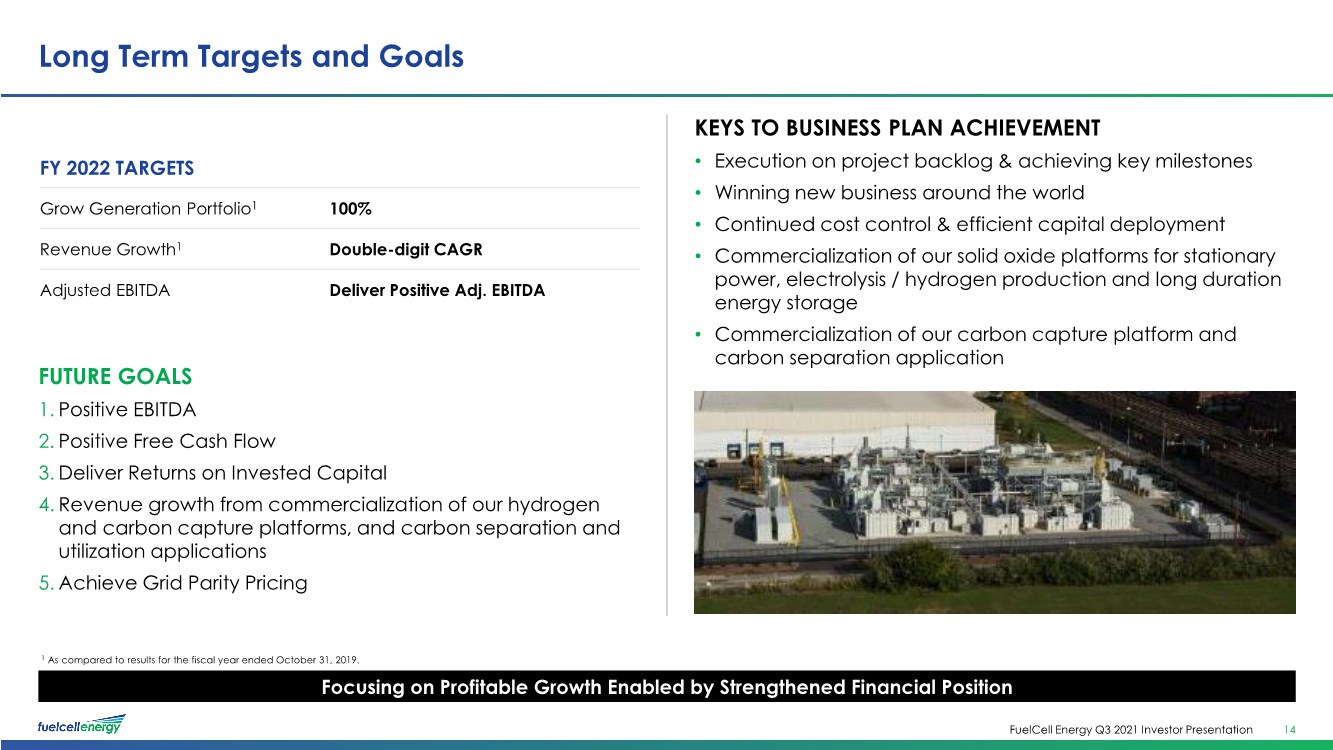

| FuelCell Energy Q3 2021 Investor Presentation FUTURE GOALS 1. Positive EBITDA 2. Positive Free Cash Flow 3. Deliver Returns on Invested Capital 4. Revenue growth from commercialization of our hydrogen and carbon capture platforms, and carbon separation and utilization applications 5. Achieve Grid Parity Pricing Long Term Targets and Goals 14 KEYS TO BUSINESS PLAN ACHIEVEMENT • Execution on project backlog & achieving key milestones • Winning new business around the world • Continued cost control & efficient capital deployment • Commercialization of our solid oxide platforms for stationary power, electrolysis / hydrogen production and long duration energy storage • Commercialization of our carbon capture platform and carbon separation application Focusing on Profitable Growth Enabled by Strengthened Financial Position FY 2022 TARGETS Grow Generation Portfolio1 100% Revenue Growth1 Double-digit CAGR Adjusted EBITDA Deliver Positive Adj. EBITDA 1 As compared to results for the fiscal year ended October 31, 2019. |

| FuelCell Energy Q3 2021 Investor Presentation Key Investment Highlights 15 1 2 3 4 Strengthened balance sheet with liquidity to complete project backlog, accelerate commercialization of new technologies and invest in capacity expansion for solid oxide and carbonate fuel cell manufacturing Leadership committed to project execution, achieving financial milestones, and delivering state-of-the-art fuel cell platforms to contribute to decarbonization and global climate change mitigation Innovative technology for clean, reliable and scalable distributed baseload power, distributed hydrogen, long-duration storage and carbon capture, separation and utilization Progressing on our path of execution to Transform, Strengthen and Grow the organization for long-term success 5 A Leader in Sustainability and Environmental Stewardship with our technology platform solutions |

| FuelCell Energy Q3 2021 Investor Presentation Fuel Cell Project: SureSourceTM 7.4 MW Yaphank, NY Q&A |

| FuelCell Energy Q3 2021 Investor Presentation Fuel Cell Project: SureSourceTM 7.4 MW Yaphank, NY Appendix |

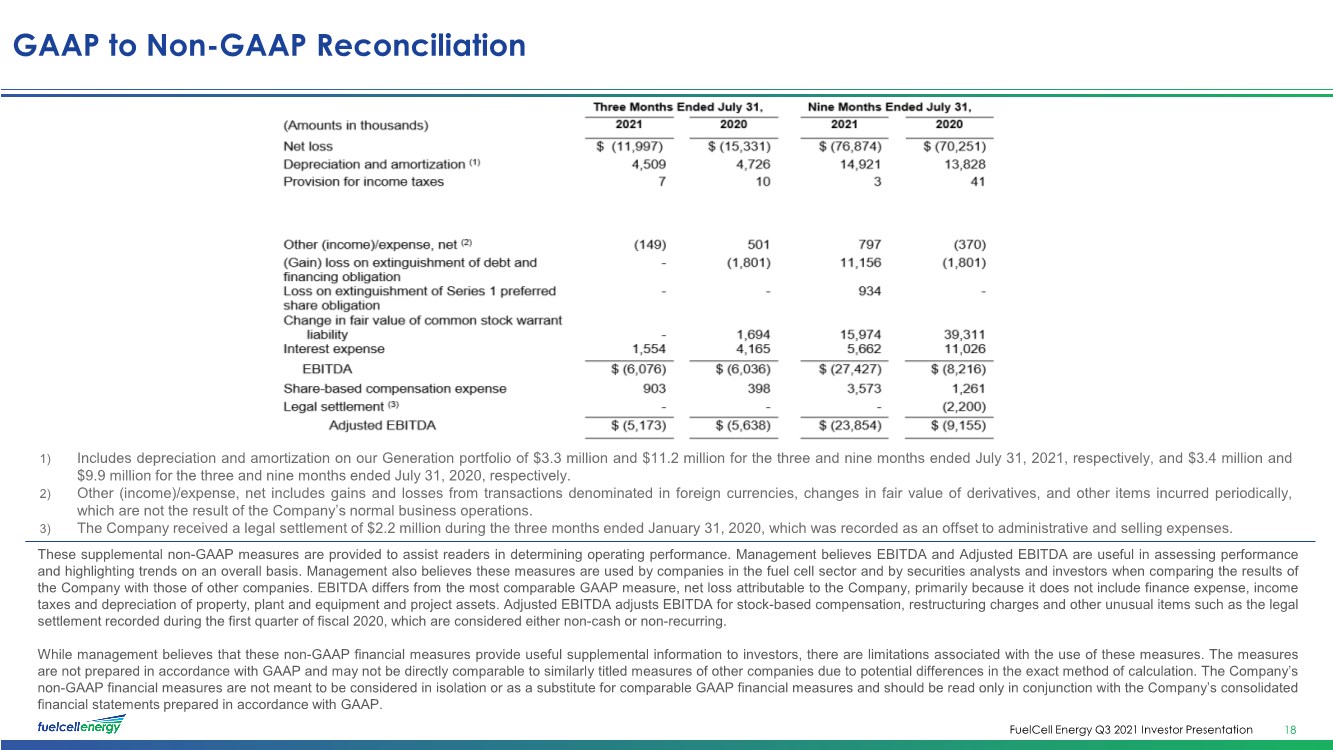

| FuelCell Energy Q3 2021 Investor Presentation GAAP to Non-GAAP Reconciliation These supplemental non-GAAP measures are provided to assist readers in determining operating performance. Management believes EBITDA and Adjusted EBITDA are useful in assessing performance and highlighting trends on an overall basis. Management also believes these measures are used by companies in the fuel cell sector and by securities analysts and investors when comparing the results of the Company with those of other companies. EBITDA differs from the most comparable GAAP measure, net loss attributable to the Company, primarily because it does not include finance expense, income taxes and depreciation of property, plant and equipment and project assets. Adjusted EBITDA adjusts EBITDA for stock-based compensation, restructuring charges and other unusual items such as the legal settlement recorded during the first quarter of fiscal 2020, which are considered either non-cash or non-recurring. While management believes that these non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these measures. The measures are not prepared in accordance with GAAP and may not be directly comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation. The Company’s non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. 1) Includes depreciation and amortization on our Generation portfolio of $3.3 million and $11.2 million for the three and nine months ended July 31, 2021, respectively, and $3.4 million and $9.9 million for the three and nine months ended July 31, 2020, respectively. 2) Other (income)/expense, net includes gains and losses from transactions denominated in foreign currencies, changes in fair value of derivatives, and other items incurred periodically, which are not the result of the Company’s normal business operations. 3) The Company received a legal settlement of $2.2 million during the three months ended January 31, 2020, which was recorded as an offset to administrative and selling expenses. 18 |

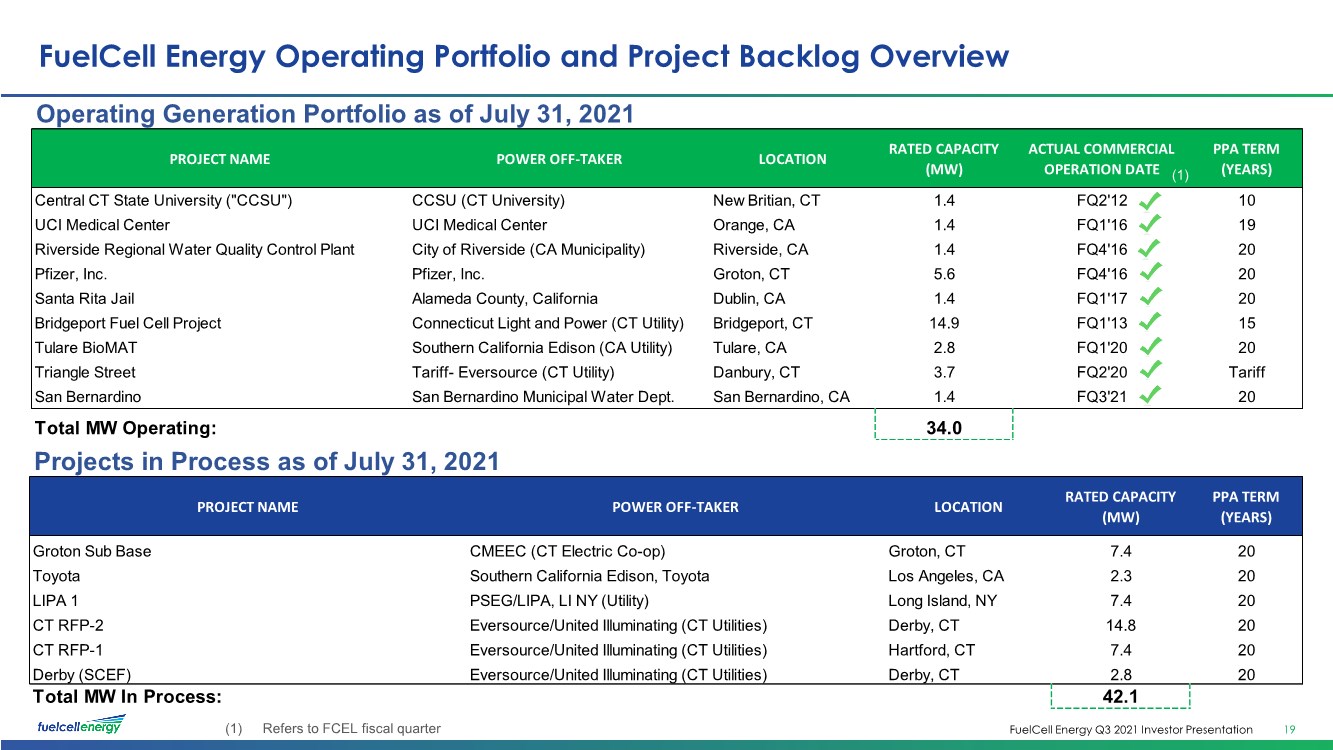

| FuelCell Energy Q3 2021 Investor Presentation PROJECT NAME POWER OFF-TAKER LOCATION RATED CAPACITY (MW) ACTUAL COMMERCIAL OPERATION DATE PPA TERM (YEARS) Central CT State University ("CCSU") CCSU (CT University) New Britian, CT 1.4 FQ2'12 10 UCI Medical Center UCI Medical Center Orange, CA 1.4 FQ1'16 19 Riverside Regional Water Quality Control Plant City of Riverside (CA Municipality) Riverside, CA 1.4 FQ4'16 20 Pfizer, Inc. Pfizer, Inc. Groton, CT 5.6 FQ4'16 20 Santa Rita Jail Alameda County, California Dublin, CA 1.4 FQ1'17 20 Bridgeport Fuel Cell Project Connecticut Light and Power (CT Utility) Bridgeport, CT 14.9 FQ1'13 15 Tulare BioMAT Southern California Edison (CA Utility) Tulare, CA 2.8 FQ1'20 20 Triangle Street Tariff- Eversource (CT Utility) Danbury, CT 3.7 FQ2'20 Tariff San Bernardino San Bernardino Municipal Water Dept. San Bernardino, CA 1.4 FQ3'21 20 34.0 Operating Generation Portfolio as of July 31, 2021 Total MW Operating: FuelCell Energy Operating Portfolio and Project Backlog Overview 19 (1) Refers to FCEL fiscal quarter (1) (1) PROJECT NAME POWER OFF-TAKER LOCATION RATED CAPACITY (MW) PPA TERM (YEARS) Groton Sub Base CMEEC (CT Electric Co-op) Groton, CT 7.4 20 Toyota Southern California Edison, Toyota Los Angeles, CA 2.3 20 LIPA 1 PSEG/LIPA, LI NY (Utility) Long Island, NY 7.4 20 CT RFP-2 Eversource/United Illuminating (CT Utilities) Derby, CT 14.8 20 CT RFP-1 Eversource/United Illuminating (CT Utilities) Hartford, CT 7.4 20 Derby (SCEF) Eversource/United Illuminating (CT Utilities) Derby, CT 2.8 20 42.1 Total MW In Process: Projects in Process as of July 31, 2021 |

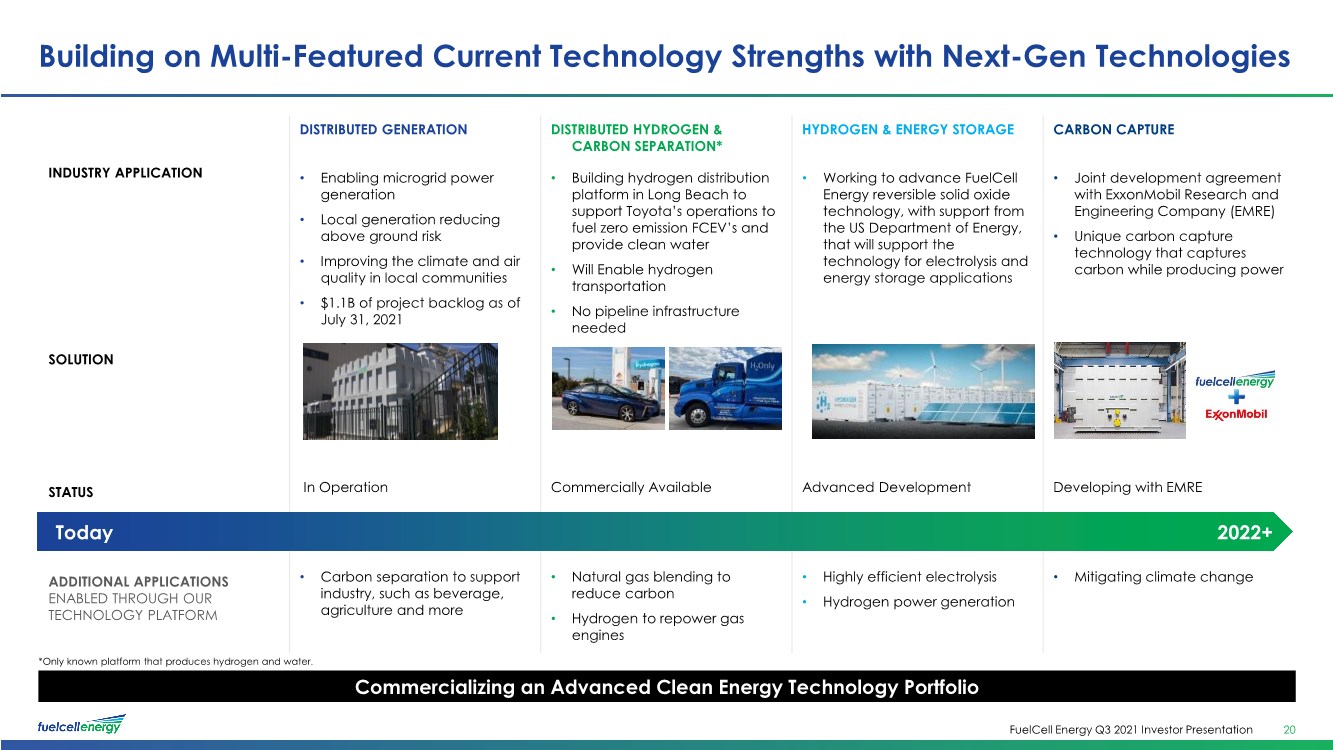

| FuelCell Energy Q3 2021 Investor Presentation *Only known platform that produces hydrogen and water. DISTRIBUTED GENERATION DISTRIBUTED HYDROGEN & CARBON SEPARATION* HYDROGEN & ENERGY STORAGE CARBON CAPTURE INDUSTRY APPLICATION • Enabling microgrid power generation • Local generation reducing above ground risk • Improving the climate and air quality in local communities • $1.1B of project backlog as of July 31, 2021 • Building hydrogen distribution platform in Long Beach to support Toyota’s operations to fuel zero emission FCEV’s and provide clean water • Will Enable hydrogen transportation • No pipeline infrastructure needed • Working to advance FuelCell Energy reversible solid oxide technology, with support from the US Department of Energy, that will support the technology for electrolysis and energy storage applications • Joint development agreement with ExxonMobil Research and Engineering Company (EMRE) • Unique carbon capture technology that captures carbon while producing power SOLUTION STATUS In Operation Commercially Available Advanced Development Developing with EMRE ADDITIONAL APPLICATIONS ENABLED THROUGH OUR TECHNOLOGY PLATFORM • Carbon separation to support industry, such as beverage, agriculture and more • Natural gas blending to reduce carbon • Hydrogen to repower gas engines • Highly efficient electrolysis • Hydrogen power generation • Mitigating climate change Building on Multi-Featured Current Technology Strengths with Next-Gen Technologies 20 Commercializing an Advanced Clean Energy Technology Portfolio Today 2022+ |

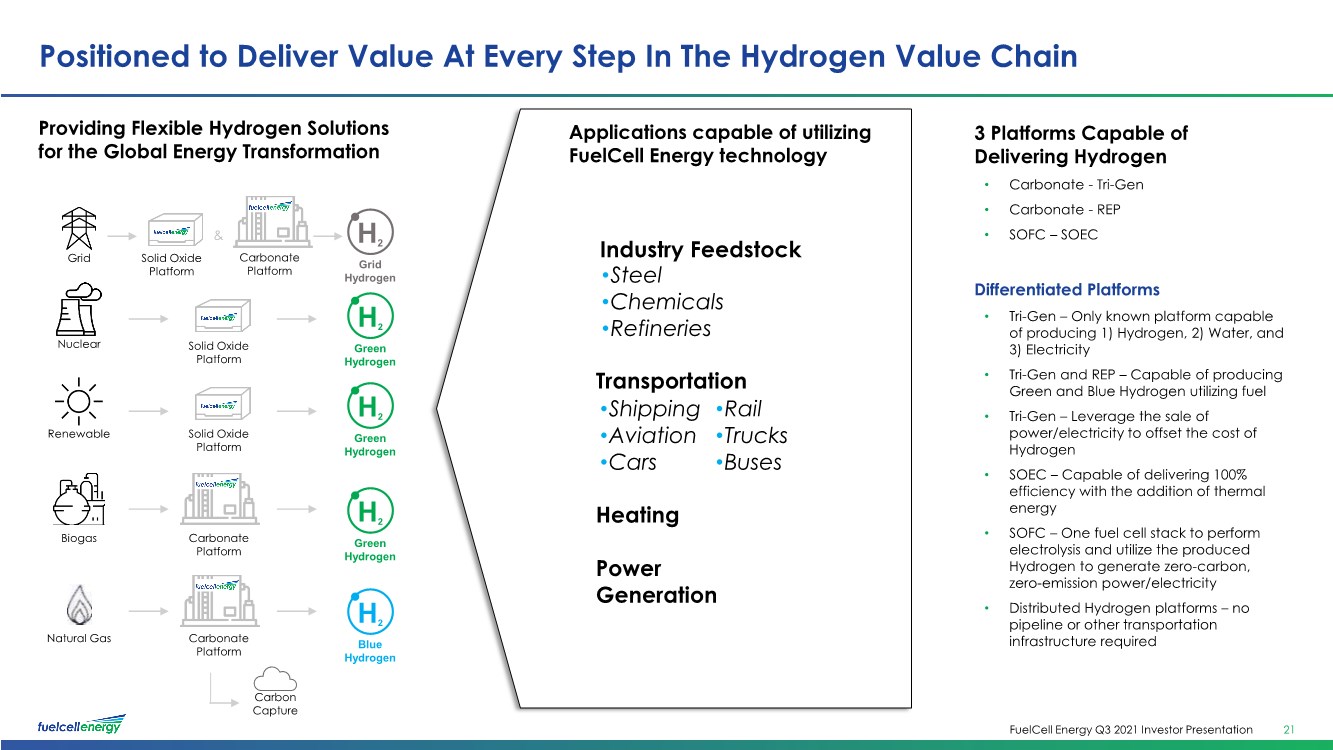

| FuelCell Energy Q3 2021 Investor Presentation Providing Flexible Hydrogen Solutions for the Global Energy Transformation Positioned to Deliver Value At Every Step In The Hydrogen Value Chain 21 3 Platforms Capable of Delivering Hydrogen • Carbonate - Tri-Gen • Carbonate - REP • SOFC – SOEC Differentiated Platforms • Tri-Gen – Only known platform capable of producing 1) Hydrogen, 2) Water, and 3) Electricity • Tri-Gen and REP – Capable of producing Green and Blue Hydrogen utilizing fuel • Tri-Gen – Leverage the sale of power/electricity to offset the cost of Hydrogen • SOEC – Capable of delivering 100% efficiency with the addition of thermal energy • SOFC – One fuel cell stack to perform electrolysis and utilize the produced Hydrogen to generate zero-carbon, zero-emission power/electricity • Distributed Hydrogen platforms – no pipeline or other transportation infrastructure required Industry Feedstock Transportation Applications capable of utilizing FuelCell Energy technology Heating Power Generation •Shipping •Aviation •Cars •Rail •Trucks •Buses •Steel •Chemicals •Refineries H2 Blue Hydrogen H2 Green Hydrogen H2 Green Hydrogen H2 Grid Hydrogen Solid Oxide Platform Solid Oxide Platform Solid Oxide Platform Carbonate Platform Carbonate Platform Grid Nuclear Renewable Biogas Natural Gas Carbon Capture Carbonate Platform & H2 Green Hydrogen |