Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TransUnion | d188220d8k.htm |

| EX-99.1 - EX-99.1 - TransUnion | d188220dex991.htm |

| EX-2.1 - EX-2.1 - TransUnion | d188220dex21.htm |

TransUnion to Acquire Neustar Enhances Revenue and EBITDA Growth and Furthers Diversification Chris Cartwright, President and CEO Todd Cello, CFO September 13, 2021 Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of TransUnion’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those described in the forward-looking statements. Any statements made in this presentation that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements include information concerning possible or assumed future results of operations, including our guidance and descriptions of our business plans and strategies. These statements often include words such as “anticipate,” “expect,” “guidance,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “could,” “would,” “may,” “will,” “forecast,” “outlook,” “potential,” “continues,” “seeks,” “predicts,” or the negative of these words and other similar expressions. Factors that could cause actual results to differ materially from those described in the forward-looking statements include: failure to realize the synergies and other benefits expected from the proposed acquisition of Neustar; the risk that required regulatory approvals are not obtained or are obtained subject to conditions that are not anticipated; the failure of any of the closing conditions in the definitive purchase agreement to be satisfied on a timely basis or at all; delay in closing the proposed acquisition; the possibility that the proposed acquisition, including the integration of Neustar, may be more costly to complete than anticipated; business disruption during the pendency of the proposed acquisition and following the acquisition closing; risks related to disruption of management time from ongoing business operations and other opportunities due to the proposed acquisition; the effects of pending and future legislation and regulatory actions and reforms; macroeconomic and industry trends and adverse developments in the debt, consumer credit and financial services markets and other macroeconomic factors beyond TransUnion’s control; risks related to TransUnion’s indebtedness, including our ability to make timely payments of principal and interest and our ability to satisfy covenants in the agreements governing our indebtedness; the effects of the ongoing COVID-19 pandemic on TransUnion, Neustar or our ability to complete the acquisition; and other one-time events and other factors that can be found in our Annual Report on Form 10-K for the year ended December 31, 2020, and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are filed with the Securities and Exchange Commission and are available on TransUnion’s website (www.transunion.com/tru) and on the Securities and Exchange Commission’s website (www.sec.gov). Many of these factors are beyond our control. The forward-looking statements contained in this presentation speak only as of the date of this presentation. We undertake no obligation to publicly release the result of any revisions to these forward-looking statements to reflect the impact of events or circumstances that may arise after the date of this presentation.

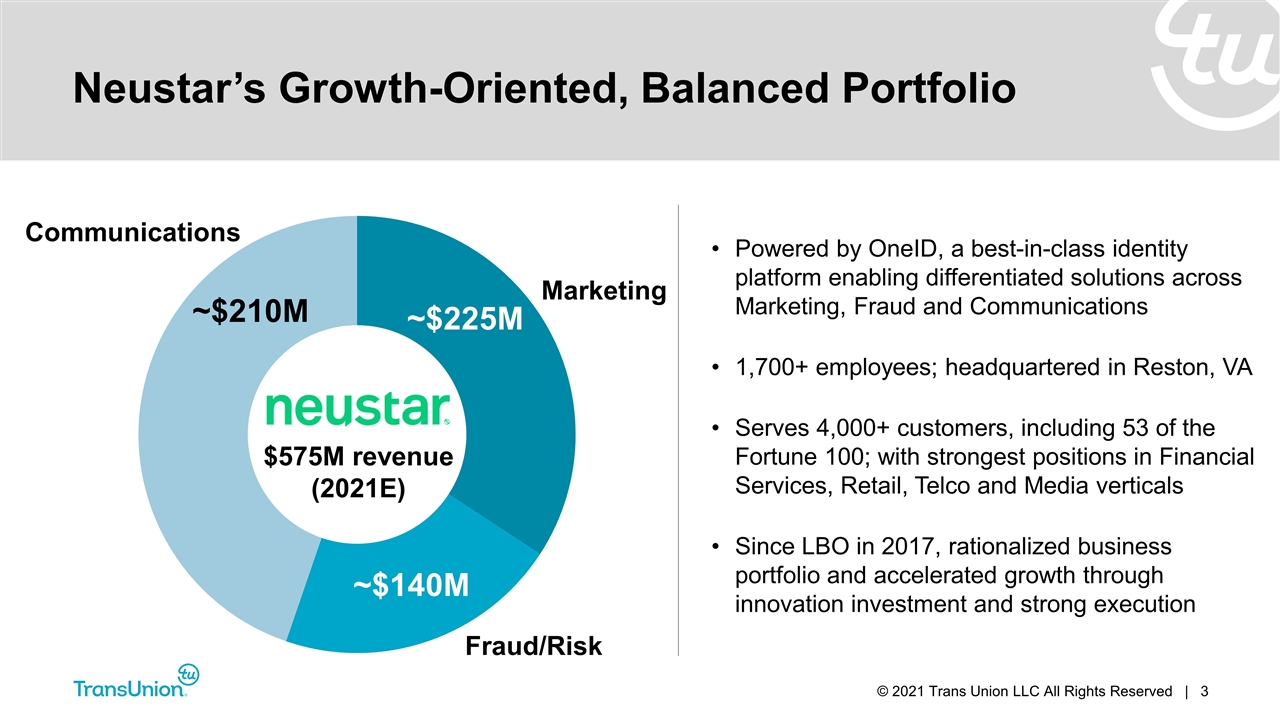

Neustar’s Growth-Oriented, Balanced Portfolio Powered by OneID, a best-in-class identity platform enabling differentiated solutions across Marketing, Fraud and Communications 1,700+ employees; headquartered in Reston, VA Serves 4,000+ customers, including 53 of the Fortune 100; with strongest positions in Financial Services, Retail, Telco and Media verticals Since LBO in 2017, rationalized business portfolio and accelerated growth through innovation investment and strong execution $575M revenue (2021E) Marketing Fraud/Risk Communications

Acquiring Neustar Enhances Our Financial Performance and Strengthens Industry Position Leading provider of real-time identity resolution, underpinned by its best-in-class OneID platform Diversifies our portfolio, scales our position in Marketing and Fraud and expands opportunities in Communications Fuels innovation and cross-selling opportunites Provides influx of relevant talent to complement our vertical-market capabilities Enhances our industry-leading revenue growth and provides material cost synergies from the combined enterprise

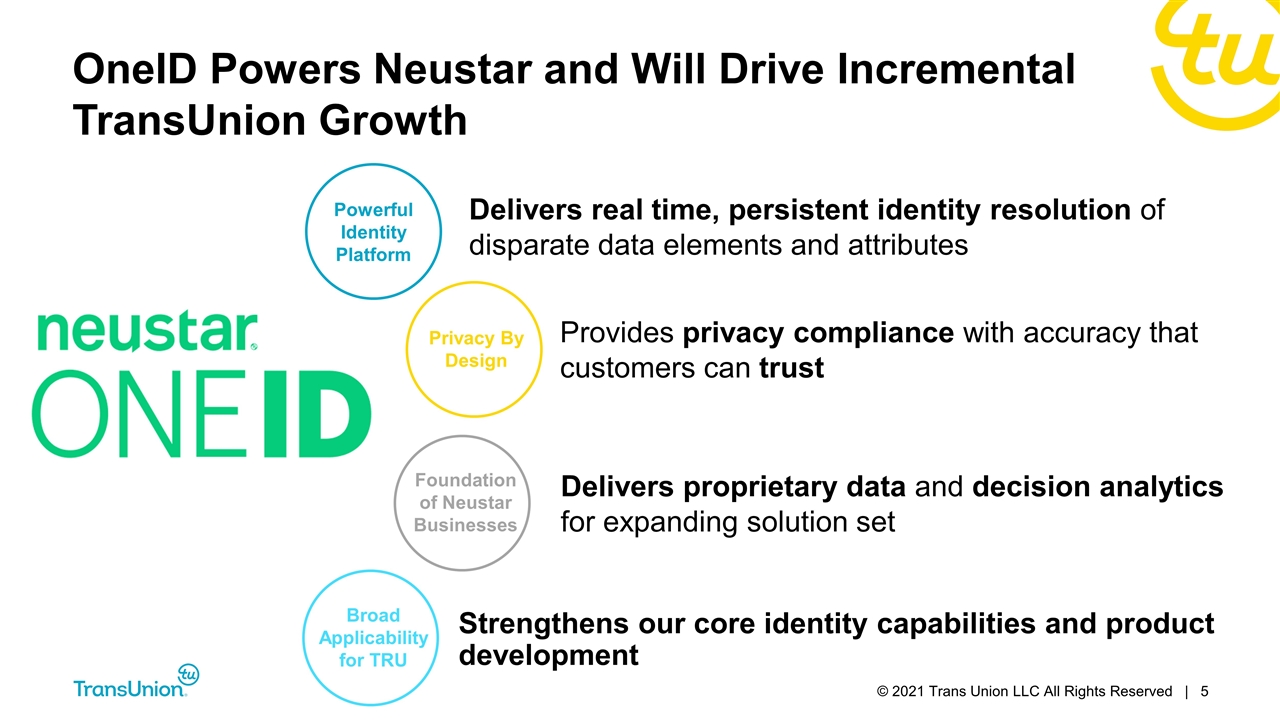

OneID Powers Neustar and Will Drive Incremental TransUnion Growth Delivers real time, persistent identity resolution of disparate data elements and attributes Powerful Identity Platform Provides privacy compliance with accuracy that customers can trust Privacy By Design Delivers proprietary data and decision analytics for expanding solution set Foundation of Neustar Businesses Strengthens our core identity capabilities and product development Broad Applicability for TRU

Identity Resolution in a Digital World Creates Complex Challenges Delivering superior consumer experiences while protecting against fraud Reaching target customers in an evolving digital marketing landscape Maintaining trusted telephony interactions

TransUnion + Neustar Provides a Unique Understanding of Identity to Solve These Challenges Sophisticated omnichannel fraud mitigation Powerhouse set of future-forward marketing solutions Ability to serve evolving needs of communications customers/consumers

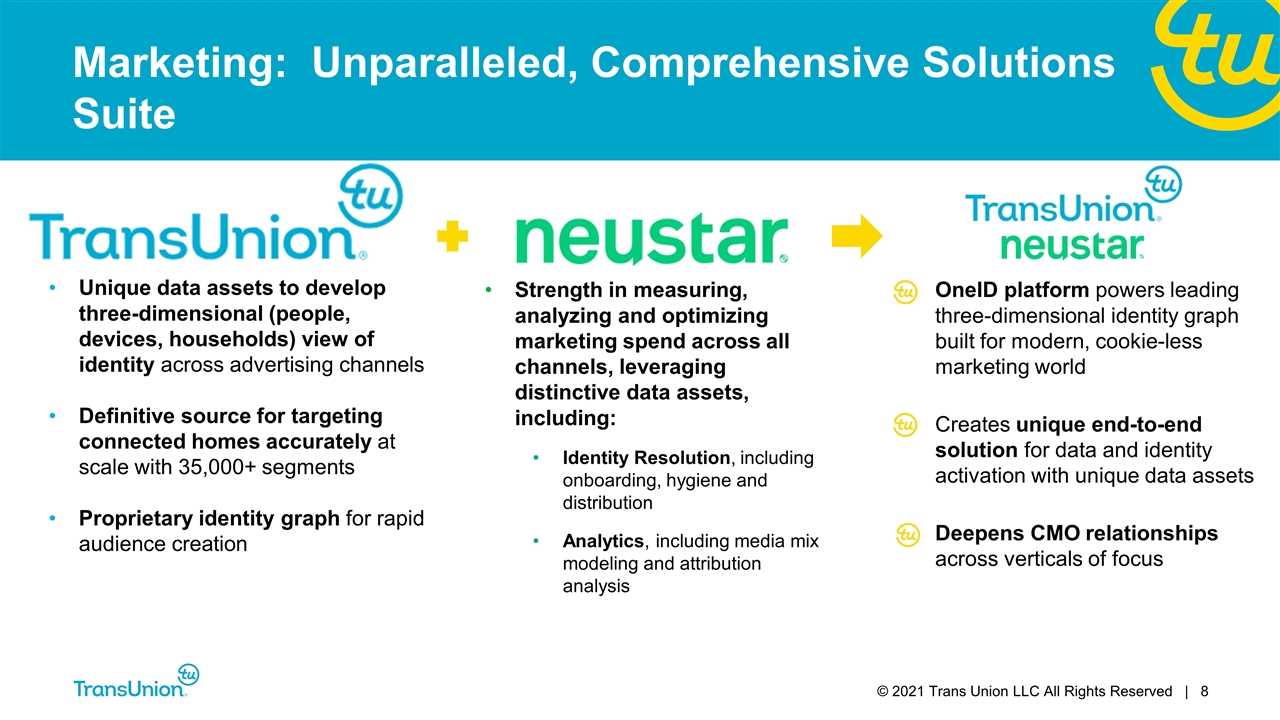

Marketing: Unparalleled, Comprehensive Solutions Suite Unique data assets to develop three-dimensional (people, devices, households) view of identity across advertising channels Definitive source for targeting connected homes accurately at scale with 35,000+ segments Proprietary identity graph for rapid audience creation Strength in measuring, analyzing and optimizing marketing spend across all channels, leveraging distinctive data assets, including: Identity Resolution, including onboarding, hygiene and distribution Analytics, including media mix modeling and attribution analysis OneID platform powers leading three-dimensional identity graph built for modern, cookie-less marketing world Creates unique end-to-end solution for data and identity activation with unique data assets Deepens CMO relationships across verticals of focus

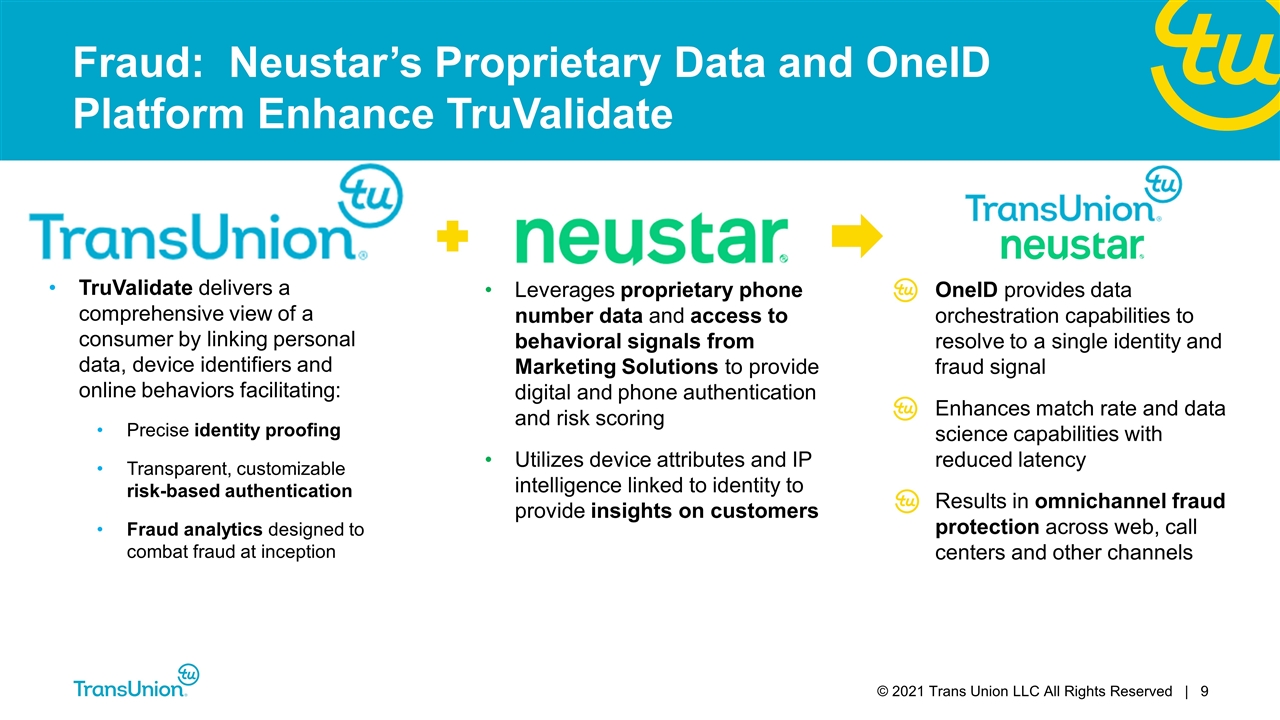

Fraud: Neustar’s Proprietary Data and OneID Platform Enhance TruValidate TruValidate delivers a comprehensive view of a consumer by linking personal data, device identifiers and online behaviors facilitating: Precise identity proofing Transparent, customizable risk-based authentication Fraud analytics designed to combat fraud at inception Leverages proprietary phone number data and access to behavioral signals from Marketing Solutions to provide digital and phone authentication and risk scoring Utilizes device attributes and IP intelligence linked to identity to provide insights on customers OneID provides data orchestration capabilities to resolve to a single identity and fraud signal Enhances match rate and data science capabilities with reduced latency Results in omnichannel fraud protection across web, call centers and other channels

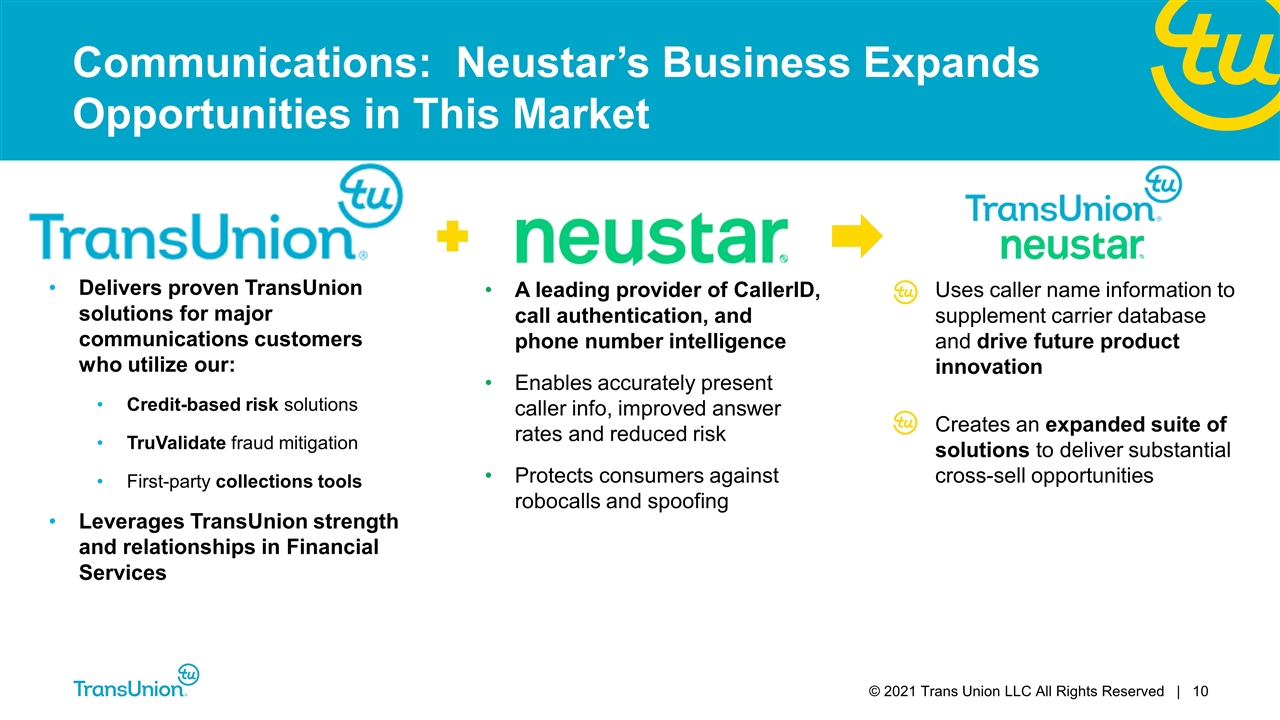

Communications: Neustar’s Business Expands Opportunities in This Market Delivers proven TransUnion solutions for major communications customers who utilize our: Credit-based risk solutions TruValidate fraud mitigation First-party collections tools Leverages TransUnion strength and relationships in Financial Services A leading provider of CallerID, call authentication, and phone number intelligence Enables accurately present caller info, improved answer rates and reduced risk Protects consumers against robocalls and spoofing Uses caller name information to supplement carrier database and drive future product innovation Creates an expanded suite of solutions to deliver substantial cross-sell opportunities

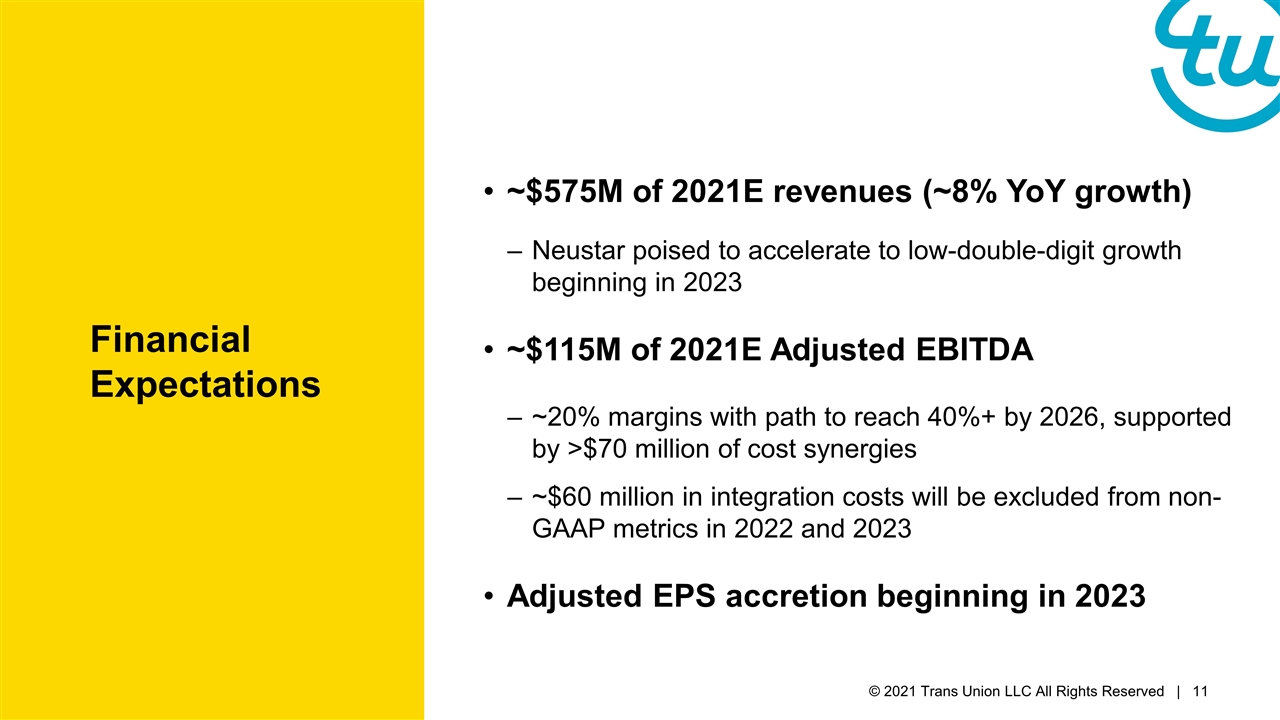

Financial Expectations ~$575M of 2021E revenues (~8% YoY growth) Neustar poised to accelerate to low-double-digit growth beginning in 2023 ~$115M of 2021E Adjusted EBITDA ~20% margins with path to reach 40%+ by 2026, supported by >$70 million of cost synergies ~$60 million in integration costs will be excluded from non-GAAP metrics in 2022 and 2023 Adjusted EPS accretion beginning in 2023

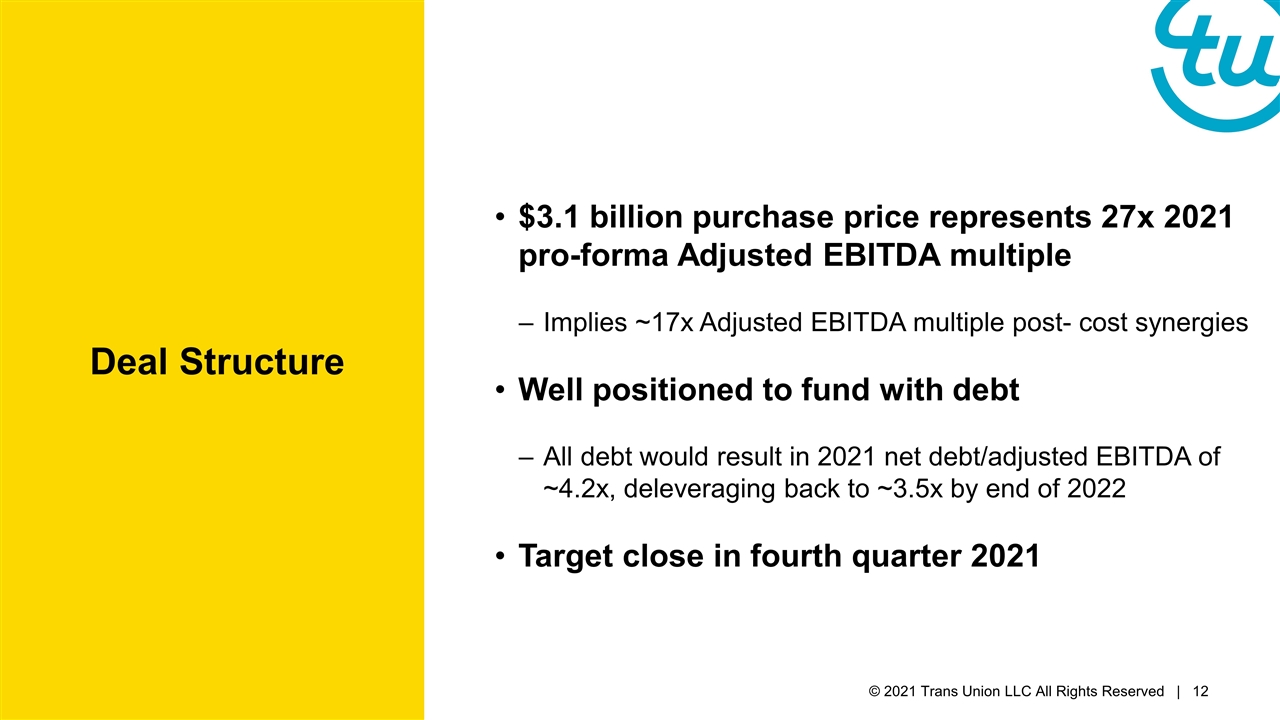

Deal Structure $3.1 billion purchase price represents 27x 2021 pro-forma Adjusted EBITDA multiple Implies ~17x Adjusted EBITDA multiple post- cost synergies Well positioned to fund with debt All debt would result in 2021 net debt/adjusted EBITDA of ~4.2x, deleveraging back to ~3.5x by end of 2022 Target close in fourth quarter 2021

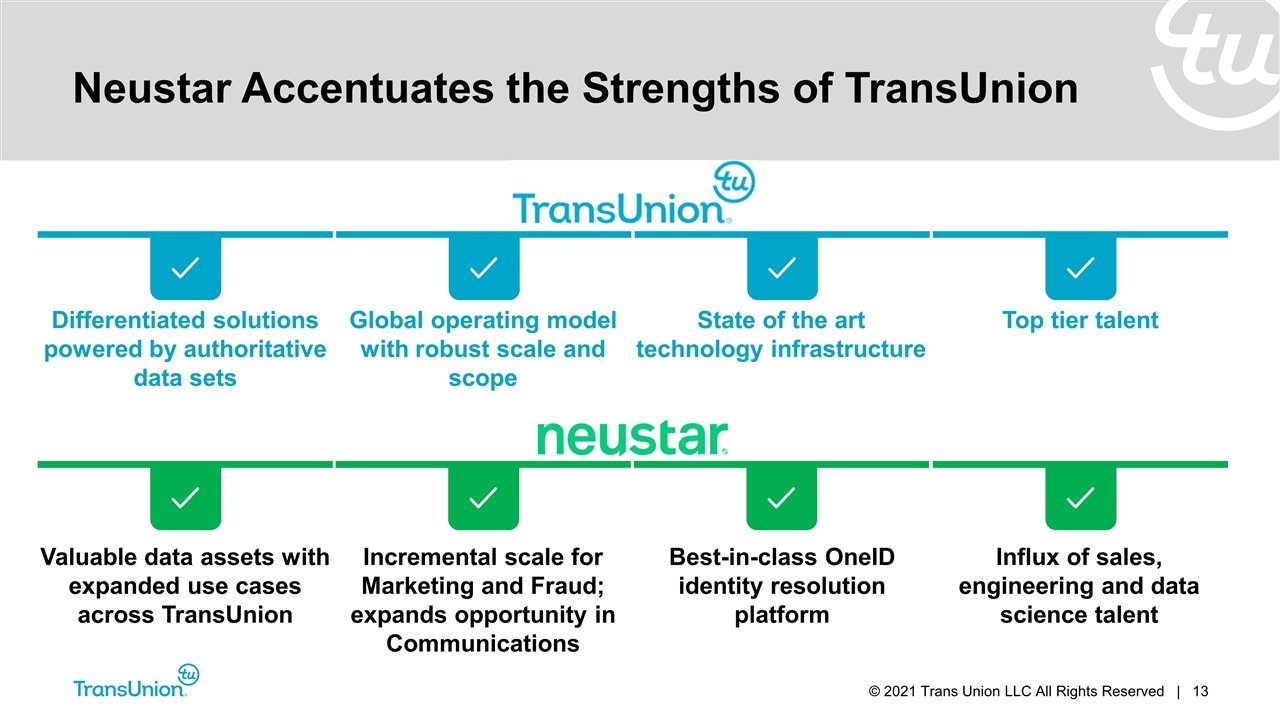

Neustar Accentuates the Strengths of TransUnion Differentiated solutions powered by authoritative data sets Global operating model with robust scale and scope State of the art technology infrastructure Top tier talent Valuable data assets with expanded use cases across TransUnion Incremental scale for Marketing and Fraud; expands opportunity in Communications Best-in-class OneID identity resolution platform Influx of sales, engineering and data science talent

Q&A