Attached files

| file | filename |

|---|---|

| EX-10.16 - EX-10.16 - MATRIX SERVICE CO | exhibit1016-formoflongxter.htm |

| EX-10.17 - EX-10.17 - MATRIX SERVICE CO | exhibit1017-formofrestrict.htm |

| EX-10.19 - EX-10.19 - MATRIX SERVICE CO | exhibit1019-creditagreemen.htm |

| EX-21 - EX-21 - MATRIX SERVICE CO | exhibit21-mtrxx2021x06x30x.htm |

| EX-23 - EX-23 - MATRIX SERVICE CO | exhibit23-mtrxx2021x06x30x.htm |

| EX-31.1 - EX-31.1 - MATRIX SERVICE CO | exhibit311-mtrxx2021x06x30x.htm |

| EX-31.2 - EX-31.2 - MATRIX SERVICE CO | exhibit312-mtrxx202106x30x.htm |

| 10-K - 10-K - MATRIX SERVICE CO | mtrx-20210630.htm |

| EX-32.1 - EX-32.1 - MATRIX SERVICE CO | exhibit321-mtrxx2021x06x30x.htm |

| EX-32.2 - EX-32.2 - MATRIX SERVICE CO | exhibit322-mtrxx2021x06x30x.htm |

| EX-95 - EX-95 - MATRIX SERVICE CO | exhibit95-mtrxx2021x06x30x.htm |

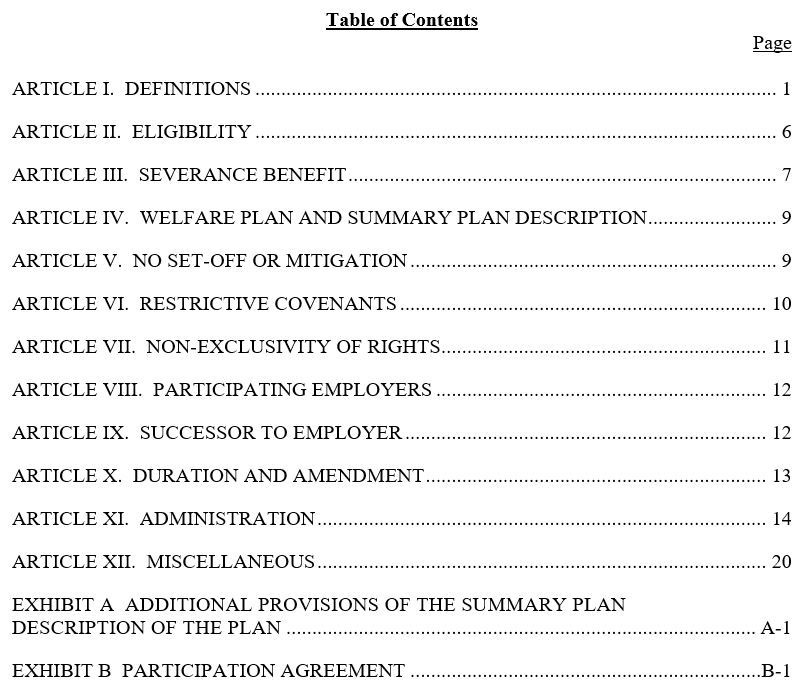

Exhibit 10.20

MATRIX SERVICE COMPANY

2021 SEVERANCE PLAN

FOR EXECUTIVES

MATRIX SERVICE COMPANY

2021 SEVERANCE PLAN

FOR EXECUTIVES

MATRIX SERVICE COMPANY

2021 SEVERANCE PLAN

FOR EXECUTIVES

_________________________

(Effective September 13, 2021)

MATRIX SERVICE COMPANY (the “Company”) hereby adopts the 2021 MATRIX SERVICE COMPANY SEVERANCE PLAN FOR EXECUTIVES, hereinafter referred to as the “Plan,” for the benefit of certain designated participants.

ARTICLE I. DEFINITIONS

1.1 Definitions. In addition to the terms defined elsewhere herein, the following words and phrases, when used herein with initial capital letters, shall have the following respective meanings:

1.1.1 “Act” means the United States Securities Exchange Act of 1934, as amended.

1.1.2 “Affiliate” means any Person (including a Subsidiary) that directly or indirectly through one or more intermediaries, controls, or is controlled by or is under common control with the Company. For purposes of this definition the term “control” with respect to any Person means the power to direct or cause the direction of management or policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise.

1.1.3 “Annual Base Compensation” means the amount a Participant is entitled to receive as wages or salary on an annualized basis, excluding all bonus, overtime and incentive compensation, payable by an Employer as consideration for the Participant’s services, in effect on the Termination Date but disregarding any reduction that would qualify as Good Reason.

1.1.4 “Board” means the Board of Directors of the Company.

1.1.5 “Cause” means, the Participant’s theft of Company property, embezzlement or dishonesty that results in harm to the Company; continued gross or willful neglect of his or her job responsibilities after receiving written warnings regarding such neglect from the Company; conviction of a felony or pleading nolo contender to a felony charged under state or federal law; or willful violation of Company policy. A determination by the Board that an event constituting “Cause” has occurred shall be binding upon the Company and the Participant.

1.1.6 “Cause Determination” has the meaning set forth in Section 3.2.1.

1

1.1.7 “Change of Control” means (i) the acquisition by any Person or “group” (as defined pursuant to Section 13(d) under the Act) of “beneficial ownership” (as defined in Rule 13d-3 under the Act) of in excess of 35% of the Voting Securities of the Company; (ii) during any one (1) year period, individuals who at the beginning of such period constituted the Board (together with any new directors whose election by the Board or nomination for election by the Company’s stockholders was approved by a vote of at least two-thirds (2/3) of the directors of the Company then still in office who either were directors at the beginning of such period or whose election or nomination for election was previously so approved (but excluding, for purposes of this definition, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board) cease for any reason to constitute a majority of the members of the Board; (iii) consummation of a merger, consolidation, recapitalization or reorganization of the Company, other than a merger, consolidation, recapitalization or reorganization which would result in the Voting Securities of the Company outstanding immediately prior thereto continuing to represent, either by remaining outstanding or by being converted into voting stock of the surviving entity (or if the surviving entity is a subsidiary of another entity, then of the parent entity of such surviving entity), more than fifty percent (50%) of the total voting power represented by the voting stock of the surviving entity (or parent entity) outstanding immediately after such merger, consolidation, recapitalization or reorganization; or (iv) the Company’s stockholders approve a plan of complete liquidation of the Company or an agreement for the sale or disposition by the Company (in one transaction or a series of related transactions) of all or substantially all of the Company’s assets to any Person. Upon identification and notice to the Board of the occurrence of one of the above events, the Board shall consider all the facts and circumstances at its next meeting and shall confirm or deny by resolution or majority vote whether a “Change of Control” exists within the meaning of this Plan.

1.1.8 “Change of Control Severance Compensation” means, with respect to each Participant, the sum of the following:

(i) such Participant’s Annual Base Compensation in effect on the date of such Participant’s Separation from Service; plus

(ii) the annual target opportunity that could have been earned by the Participant for the fiscal year of the Company during which the Participant’s Termination Date occurs (determined as if all applicable goals and targets had been satisfied in full at the target level of performance).

1.1.9 “Code” means the United States Internal Revenue Code of 1986, as amended.

1.1.10 “Committee” means a committee consisting of the Company’s President and CEO, the Chief Financial Officer, the Chief Administrative Officer, and the General Counsel.

2

1.1.11 “Company” means Matrix Service Company, a Delaware corporation, and any successor thereto.

1.1.12 “Disability” means any medically determinable physical or mental impairment of Participant where such Participant: (a) is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months, or (b) is, by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months, receiving income replacement benefits for a period of not less than three (3) months under an accident and health plan covering employees of Participant’s Employer. Notwithstanding the foregoing, all determinations of whether a Participant is Disabled shall be made in accordance with Section 409A of the Code.

1.1.13 “Effective Date” means September 13, 2021.

1.1.14 “Employee” means a common law employee of an Employer.

1.1.15 “Employer” means the Company or, if Participant is not employed by the Company, a Subsidiary that employs the Participant, and the successor of either (provided, in the case of a Subsidiary, that each successor is also a Subsidiary).

1.1.16 “ERISA” means the United States Employee Retirement Income Security Act of 1974, as amended.

1.1.17 “Excise Tax” has the meaning set forth in Section 3.3.

1.1.18 “General Severance Compensation” means, with respect to each Participant, such Participant’s Annual Base Compensation in effect on the date of such Participant’s Separation from Service.

1.1.19 “Good Reason” means a Separation from Service by a Participant in accordance with the substantive and procedural provisions of this Section.

(a) Separation from Service by a Participant for “Good Reason” means a Separation from Service initiated by the Participant on account of any one or more of the following actions or omissions that, unless otherwise specified, occurs following a Change of Control:

(i) a material reduction in the rate of the Participant’s Annual Base Compensation or a material reduction in the Participant’s target annual incentive compensation;

(ii) a change in the location of a Participant’s principal place of employment by the Employer by more than thirty-five (35) miles from the location where the Participant was principally employed immediately prior to the date on which a Change of Control occurs;

3

(iii) a material adverse reduction in the nature or scope of Participant’s office, position, duties, functions, responsibilities or authority (including reporting responsibilities and authority) from those applicable to such Participant immediately prior to the date on which a Change of Control occurs; or

(iv) the failure at any time of the successor to the Participant’s Employer explicitly to assume and agree to be bound by this Plan.

(b) Notwithstanding anything in this Plan to the contrary, no act or omission shall constitute grounds for “Good Reason”:

(i) unless the Participant gives a Notice of Termination to the Employer thirty (30) days prior to the Participant’s intent to terminate his or her employment for Good Reason which describes the alleged act or omission giving rise to Good Reason;

(ii) unless such Notice of Termination is given within sixty (60) days of the Participant’s first actual knowledge of such act or omission; and

(iii) unless the Employer fails to cure such act or omission within the thirty (30) day period after receiving the Notice of Termination.

1.1.20 “Net After-Tax Benefit” has the meaning set forth in Section 3.3.

1.1.21 “Notice of Consideration” has the meaning set forth in Section 3.2.1.

1.1.22 “Notice of Termination” means a written notice of a Separation from Service, if applicable, given in accordance with Section 10.3 that sets forth: (a) the specific termination provision in the Plan relied on by the party giving such notice, (b) in reasonable detail the specific facts and circumstances claimed to provide a basis for such Separation from Service, and (c) if the Termination Date is other than the date of receipt of such Notice of Termination, the Termination Date.

1.1.23 “Participant” means an Employee selected for participation in the Plan pursuant to Section 2.1 hereof.

1.1.24 “Participation Agreement” means an agreement between a Participant and the Company in substantially the form of Exhibit B hereto, and which may include such other terms as the Committee deems necessary or advisable in the administration of the Plan.

1.1.25 “Payment Date” means the date which is the sixtieth (60th) day after the date of a Separation from Service as to which a Severance Benefit is payable.

4

1.1.26 “Person” shall have the meaning assigned in the Act.

1.1.27 “Plan” means the 2021 Matrix Service Company Severance Plan for Executives, effective September 13, 2021, as amended from time to time.

1.1.28 “Reduced Payment” has the meaning set forth in Section 3.3.

1.1.29 “Sale of a Business” means the Company has sold or otherwise disposed of a Subsidiary, branch or other business unit (or all or substantially all of the assets thereof), in which the Participant was employed before such sale or disposition, to any Person, other than the Company or an Affiliate, and the Participant has been offered employment with the acquirer of such Subsidiary, branch or unit on substantially the same terms and conditions under which the Participant worked for the Participant’s Employer.

1.1.30 “Separation from Service” means a Participant’s termination or deemed termination from employment with the Employer. A termination of employment shall not be deemed to have occurred for purposes of any provision of this Plan providing for the payment of any amounts or benefits upon or following a termination of employment unless such termination is also a “separation from service” within the meaning of Code Section 409A.

1.1.31 “Severance Benefit” means the amounts payable in accordance with Section 3.1 hereof.

1.1.32 “Subsidiary” means any corporation, partnership, limited liability company or joint venture in which the Company, directly or indirectly, holds a majority of the voting power of such corporation’s outstanding shares of capital stock or a majority of the capital or profits interests of such partnership, limited liability company, or joint venture.

1.1.33 “Termination Date” means the date of the receipt of the Notice of Termination by Participant (if such notice is given by Participant’s Employer) or by Participant’s Employer (if such notice is given by Participant), or any later date, not more than thirty (30) days after the giving of such notice, specified in such notice; provided, however, that:

(a) if Participant’s employment is terminated by reason of death or Disability, the Termination Date shall be the date of Participant’s death or the date of deemed termination of employment due to Disability, as applicable, regardless of whether a Notice of Termination has been given; and

(b) if no Notice of Termination is given, the Termination Date shall be the last date on which the Participant is employed by an Employer; and

(c) for purposes of Article VI (Restrictive Covenants) if the Participant does not have a Separation from Service, the Termination Date shall be the date

5

the entity that employs the Participant ceases to be a Subsidiary, or the date of the Sale of a Business.

1.1.34 “Voting Securities” means any securities of the Company which carry the right to vote generally in the election of directors.

ARTICLE II. ELIGIBILITY

2.1 Participation. An Employee shall be entitled to be a Participant if the Employee is selected for participation by the Board and such Employee signs and returns to the Company a Participation Agreement, in a form acceptable to the Company, within the time period required therein.

2.2 Duration of Participation. A Participant shall cease to be a Participant when the Participant incurs a Separation from Service, unless such Participant is then entitled to a Severance Benefit. A Participant entitled to a Severance Benefit shall remain a Participant until the full amount of the Severance Benefit has been provided to such Participant. The Board may, from time to time, determine that a Participant shall no longer be a Participant; provided, however, that the Board shall not change the status of a Participant in any manner as of, after, or in anticipation of a Separation from Service or a Change of Control. The Company shall provide a notice to each Participant of any revocation of Participant status.

2.3 Plan Benefits Provided in Lieu of any Previous Benefits. This Plan shall supersede any change of control or severance benefit plan, policy or practice previously maintained by the Company with respect to a Participant and any change of control or severance benefits in any employment contract, change of control/severance agreement, change of control agreement or other agreement between the Company and a Participant. Notwithstanding the foregoing, a Participant’s outstanding equity awards shall remain subject to the terms of the equity incentive plan under which such awards were granted (including the award agreements governing such awards) that may apply upon a Change of Control and/or termination of such Participant’s service and all restricted stock units, performance units and other forms of long-term incentive awards granted to the Executive shall vest upon a Change of Control of the Company but only if so provided and in the manner set forth in the change of control vesting provisions set forth in the award agreements governing such restricted stock units, performance units and other forms of long-term incentive award.

6

ARTICLE III. SEVERANCE BENEFIT

3.1 Right to Severance Benefit. Subject to Sections 3.5 and 3.6, a Participant shall be entitled to receive a Severance Benefit from the Participant’s Employer or the Company as set forth in the Participation Agreement. The cash payments described therein shall be paid on the Payment Date. The Severance Benefit shall be payable in addition to, and not in lieu of, all other accrued or vested or earned but deferred compensation, rights, options and other benefits which may be owed to a Participant under any other plan or arrangement following termination, including, but not limited to, accrued vacation or sick pay, amounts or benefits payable under any incentive plan, any life insurance plan, health plan, disability plan, or any similar or successor plans.

3.2 Terminations Which do not Give Rise to a Severance Benefit. If a Participant dies, becomes Disabled, incurs a Separation from Service from the Employer for Cause or by reason of the Participant’s voluntary Separation from Service (other than for Good Reason), or incurs a Separation from Service due to the Sale of a Business, the Participant shall not be entitled to a Severance Benefit, regardless of the occurrence of a Change of Control.

3.2.1 Procedural Requirements for Termination for Cause Following a Change of Control. For any Separation from Service for Cause following a Change of Control, the Company and its Affiliates shall strictly observe each of the following substantive and procedural provisions:

(i) The Board shall call a meeting for the stated purpose of determining whether Participant’s acts or omissions satisfy the requirements of the definition of “Cause” and, if so, whether to terminate Participant’s employment for Cause.

(ii) Not less than fifteen (15) days prior to the date of such meeting, the Board shall provide or cause to be provided Participant and each member of the Board written notice (a “Notice of Consideration”) of: (A) a detailed description of the acts or omissions alleged to constitute Cause, (B) the date of such meeting of the Board, and (C) Participant’s rights under clauses (iii) and (iv) below.

(iii) Participant shall have the opportunity to present to the Board a written response to the Notice of Consideration, but shall not have the right to appear in person or by counsel before the Board.

(iv) Participant’s employment may be terminated for Cause only if: (A) the acts or omissions specified in the Notice of Consideration did in fact occur and such actions or omissions do constitute Cause as defined in this Plan, (B) the Board, by affirmative vote of a simple majority of its members, makes a specific determination to such effect and to the effect that Participant’s employment should be terminated for Cause (“Cause Determination”), and (C) the Company or the Employer thereafter provides Participant with a Notice of Termination that specifies in specific detail the basis of such Separation from Service for Cause and which Notice shall be consistent with the reasons set forth in the Notice of Consideration.

7

(v) In the event that the existence of Cause shall become an issue in any action or proceeding between Participant, on the one hand, and any one or more of the Company and its Affiliates, on the other hand, the Cause Determination shall be final and binding on all parties, except as provided in Section 3.2.2 below.

Nothing in this Section 3.2.1 shall preclude the Board, by majority vote, from suspending Participant from his or her duties, with pay, at any time.

3.2.2 Standard of Review. In the event that the existence of Cause shall become an issue in any action or proceeding between a Participant following a Change of Control, on the one hand, and any one or more of the Company and its Affiliates, on the other hand, the Company and its Affiliates, as applicable, shall, notwithstanding the Cause Determination, have the burden of establishing that the actions or omissions specified in the Notice of Consideration did in fact occur and do constitute Cause and that the Company and its Affiliates have satisfied all applicable substantive and procedural requirements of this Section.

3.3 Maximum Payments. It is the objective of this Plan to maximize the Participants’ Net After-Tax Benefit (as defined herein) if payments or benefits provided under this Plan are subject to excise tax under Section 4999 of the Code. Therefore, in the event it is determined that any payment or benefit by the Company to or for the benefit of a Participant, whether paid or payable or distributed or distributable pursuant to the terms of this Plan or otherwise, including, by example and not by way of limitation, acceleration by the Company or otherwise of the date of vesting or payment or rate of payment under any plan, program or arrangement of the Company, would be subject to the excise tax imposed by Section 4999 of the Code or any interest or penalties with respect to such excise tax (such excise tax, together with any such interest and penalties, are hereinafter collectively referred to as the “Excise Tax”), the Company shall first make a calculation under which such payments or benefits provided to the Participant under this Agreement are reduced to the extent necessary so that no portion thereof shall be subject to the excise tax imposed by Section 4999 of the Code (the “Reduced Payment”), provided that, for purposes of this calculation, the payments and benefits that do not constitute deferred compensation within the meaning of Section 409A of the Code shall first be reduced and the portion of the payments and benefits that do constitute deferred compensation within the meaning of Section 409A of the Code shall thereafter be reduced as necessary. The Company shall then compare (x) the Participant’s Net After-Tax Benefit assuming application of the Reduced Payment with (y) the Participant’s Net After-Tax Benefit without the application of the Reduced Payment and the Participant shall be entitled to the greater of (x) or (y). “Net After-Tax Benefit” shall mean the sum of (i) all payments and benefits which the Participant receives or is then entitled to receive from the Company, less (ii) the amount of federal income taxes payable with respect to the payments and benefits described in (i) above calculated at the maximum marginal income tax rate for each year in which such payments and benefits shall be paid to the Participant (based upon the rate for such year as set forth in the Code at the time of the first payment of the foregoing), less (iii) the amount of excise taxes imposed with respect to the payments and benefits described in (i) above by Section 4999 of the Code. The determination of whether a payment or benefit constitutes an excess parachute payment shall be made by tax counsel or other tax professional selected by the Company. The costs of obtaining this determination shall be borne by the Company.

8

3.4 Payment Date Limitation. Notwithstanding anything to the contrary in this Plan, no payment under the Plan shall be paid later than the December 31 of the second calendar year following the calendar year in which the Separation from Service occurs.

3.5 Waiver and Release. Notwithstanding anything to the contrary in this Plan, in the event that the Participant becomes entitled to a Severance Benefit, neither the Company nor the Employer shall have any obligation to the Participant unless and until the Participant executes and delivers to the Company within sixty (60) days after Separation from Service a release and waiver in form and substance satisfactory to the Company which is no longer subject to revocation.

3.6 Breach of Covenants. If a court determines that the Participant has breached the covenants of Article VI or other obligation entered into at any time between the Participant and the Company, then neither the Company nor the Employer shall have any obligation to pay or provide any Severance Benefits under Article III of the Plan.

ARTICLE IV. WELFARE PLAN AND SUMMARY PLAN DESCRIPTION

This Plan is intended to be a welfare plan under Section 3(1) of ERISA, and if this Plan were found to be a pension plan under Section 3(2) of ERISA, the Plan is intended to qualify as a plan maintained for the purpose of providing deferred compensation for a select group of management or highly compensated employees, within the meaning of Sections 201(2), 301(3) and 401(a)(1) of ERISA. This Plan also is intended to be a summary plan description under Section 102 of ERISA. The Plan, as a summary plan description, has been written in a manner calculated to be understood by the average Participant of the Plan and to reasonably apprise the Participants and their beneficiaries of their rights and obligations under the Plan. Additional provisions of the Plan which are intended to satisfy the requirements of a summary plan description under Section 102 of ERISA are set out in Exhibit A, attached hereto and made a part hereof. A copy of the Plan shall be provided to each Participant.

ARTICLE V. NO SET-OFF OR MITIGATION

5.1 No Set-off. The Participant’s right to receive when due the payments and other benefits provided for under this Plan is absolute, unconditional and subject to no setoff, counterclaim, recoupment, or other claim, right or action that the Company or the Employer may have against Participant or others, except as expressly provided in this Section 5.1 or as specifically otherwise provided in this Plan. Notwithstanding the prior sentence, the Company or the Employer shall have the right to deduct any amounts outstanding on any loans or other extensions of credit to Participant from the Participant’s payments and other benefits (if any) provided for under this Plan. Notwithstanding any provision of this Plan to the contrary, the Participant acknowledges that any incentive-based compensation paid to the Participant under this Plan may be subject to recovery by the Company under any clawback policy which the Company may adopt from time to time, including, without limitation, any policy which the Company may be required to adopt under Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations of the United States Securities and Exchange Commission thereunder or the requirements of any national securities exchange on which the Company’s common stock may be listed. The Participant agrees to promptly return

9

any such incentive-based compensation which the Company determines it is required to recover from the Participant under any such clawback policy.

5.2 No Mitigation. The Participant shall not have any duty to mitigate the amounts payable by the Company or the Employer under this Plan by seeking new employment or self-employment following termination. Except as specifically otherwise provided in this Plan, all amounts payable pursuant to this Plan shall be paid without reduction regardless of any amounts of salary, compensation or other amounts which may be paid or payable to the Participant as the result of Participant’s employment by another employer or self-employment.

ARTICLE VI. RESTRICTIVE COVENANTS

6.1 Non-Solicitation. During the period beginning on the Effective Date and ending on the second anniversary of the date of Separation from Service, regardless of the reason for Participant’s Separation from Service, the Participant shall not, directly or indirectly:

6.1.1 cause or attempt to cause or encourage any employee of the Company or an Affiliate to terminate his or her relationship with the Company or an Affiliate; or

6.1.2 solicit the employment or engagement as a consultant or adviser, of any employee of the Company or an Affiliate or any former employee of the Company or an Affiliate who left the employ of the Company or Affiliate within two years following your Separation from Service, or cause or attempt to cause any Person to do any of the foregoing.

6.2 Reasonableness of Restrictive Covenants.

6.2.1 Participant acknowledges that the covenants contained in this Plan are reasonable in the scope of the activities restricted, the geographic area covered by the restrictions, and the duration of the restrictions, and that such covenants are reasonably necessary to protect the Company’s and its Affiliates’ legitimate interests in their confidential and proprietary information, their proprietary work, and in their relationships with their employees, customers, suppliers and agents.

6.2.2 Participant acknowledges that Participant’s observance of the covenants contained herein will not deprive Participant of the ability to earn a livelihood or to support his or her dependents.

6.2.3 Participant understands he or she is bound by the terms of this Article VI, whether or not Participant receives severance payments under this Plan or otherwise.

6.3 Right to Injunction; Survival of Undertakings.

6.3.1 In recognition of the necessity of the limited restrictions imposed by this Plan, Participant and the Company agree that it would be impossible to measure solely in money the damages which the Company and its Affiliates would suffer if Participant were to breach any of his or her obligations hereunder. Participant acknowledges that any breach of any provision of this Plan would irreparably injure the Company and its

10

Affiliates. Accordingly, Participant agrees that if he or she breaches any of the provisions of this Plan, the Company and its Affiliates shall be entitled, in addition to any other remedies to which the Company and its Affiliates may be entitled under this Plan or otherwise, to an injunction to be issued by a court of competent jurisdiction, to restrain any breach, or threatened breach, of any provision of this Plan without the necessity of posting a bond or other security therefor, and Participant hereby waives any right to assert any claim or defense that the Company and its Affiliates have an adequate remedy at law for any such breach.

6.3.2 The covenants in this Article VI are severable and separate, and the unenforceability of any specific covenant shall not affect the provisions of any other covenant. In the event any court of competent jurisdiction determines that a covenant included in this Article VI is unenforceable in whole or in part because of such covenant’s duration or geographical or other scope, it is the intention of the Company and the Participant that the court shall modify such restrictions, as the case may be, so as to cause such covenant as so modified to be enforceable, and this Plan shall thereby be reformed.

6.3.3 All of the provisions of this Plan shall survive any Separation from Service of Participant, without regard to the reasons for such termination. Notwithstanding anything to the contrary in this Plan, in addition to any other rights it may have, neither the Company nor any Affiliate shall have any obligation to pay or provide severance or other benefits (except as may be required under ERISA) after the date of Separation from Service if Participant has materially breached any of Participant’s obligations under this Plan.

6.3.4 The covenants in this Article VI shall be construed as an agreement independent of any other provision in this Plan, and the existence of any claim or cause of action of the Participant against the Company or an Affiliate, whether predicated on this Plan, or otherwise, shall not constitute a defense to the enforcement by the Company or an Affiliate of such covenants.

ARTICLE VII. NON-EXCLUSIVITY OF RIGHTS

7.1 Waiver of Certain Other Rights. To the extent that Participant shall have received severance payments or other severance benefits under any other plan, program, policy, practice or procedure or agreement of the Company or any Affiliate prior to receiving severance payments or other severance benefits pursuant to Article III, the severance payments or other severance benefits under such other plan, program, policy, practice or procedure or agreement shall reduce (but not below zero) the corresponding severance payments or other benefits to which Participant shall be entitled under Article III. To the extent that Participant accepts payments made pursuant to Article III, the Participant shall be deemed to have waived his or her right to receive a corresponding amount of future severance payments or other severance benefits under any other plan, program, policy, practice or procedure or agreement of the Company or any Affiliate.

7.2 Other Rights. Except as expressly provided in this Plan, the Participant’s participation in the Plan shall not prevent or limit Participant’s continuing or future participation

11

in any benefit, bonus, incentive or other plan, program, policy, practice or procedure provided by the Company or any Affiliate and for which Participant may qualify, nor shall this Plan limit or otherwise affect such rights as Participant may have under any other plans with the Company or any Affiliate. Amounts that are vested benefits or that Participant is otherwise entitled to receive under any plan, program, policy, practice or procedure and any other payment or benefit required by law at or after the date of Separation from Service shall be payable in accordance with such plan, program, policy, practice or procedure or applicable law except as expressly modified by this Plan.

7.3 No Right to Continued Employment. Nothing in this Plan shall guarantee the right of Participant to continue in employment, and the Company and the Employer retain the right to terminate Participant’s employment at any time for any reason or for no reason.

ARTICLE VIII. PARTICIPATING EMPLOYERS

Upon the selection by the Board of an employee of any Subsidiary to be a Participant in this Plan, the Subsidiary shall become an Employer and the provisions of the Plan shall be fully applicable to the Employees of that Subsidiary who are designated Participants by the Board. This Plan establishes and vests in each Participant a contractual right to the relevant benefits hereunder, enforceable by the Participant against the Participant’s Employer.

ARTICLE IX. SUCCESSOR TO EMPLOYER

This Plan shall bind any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) which becomes such after a Change of Control has occurred in the same manner and to the same extent that the Employer would be obligated under this Plan if no succession had taken place. In the case of any transaction in which a successor (which becomes such after a Change of Control has occurred) would not by the foregoing provision or by operation of law be bound by this Plan, the Employer shall require such successor expressly and unconditionally to assume and agree to perform the Employer’s obligations under this Plan, in the same manner and to the same extent that the Employer would be required to perform if no such succession had taken place. The terms “Company” and “Employer,” as used in this Plan, shall mean the Company or an Employer, respectively, as hereinbefore defined and any successor or assignee to the business or assets which by reason hereof becomes bound by this Plan.

12

ARTICLE X. DURATION AND AMENDMENT

10.1 Duration. The initial term of the Plan shall be the period beginning on the Effective Date and ending on (and including) December 31, 2021. Beginning on the last day of such initial term, and on each successive anniversary of such date, the term of the Plan shall be extended automatically for an additional successive one (1)-year term; provided, however, that if, at least three (3) months prior to the last day of any such term, the Company shall give to the Participants written notice that no such automatic extension shall occur, then this Plan shall terminate on the last day of such term. This Plan shall remain in effect until so terminated by the Company. Failure of the Company to provide the required notice to Participants shall be considered as an extension of this Plan for an additional one (1)-year term. Notwithstanding anything to the contrary contained in this “sunset provision,” if a Change of Control occurs while this Plan is in effect, then this Plan shall not be subject to termination under this “sunset provision,” and this Plan shall remain in force for a period of two (2) years after such Change of Control, and if within said two (2)-year period the contingency factors occur which would entitle a Participant to the benefits as provided herein, then this Plan shall remain in effect in accordance with its terms. If, within such two (2) years after a Change of Control, the contingency factors that would entitle a Participant to benefits do not occur, thereupon this Plan shall terminate at the expiration of two (2) years after such Change of Control.

10.2 Amendment. The Plan may not be amended except for: (i) an amendment that increases the benefits payable under the Plan or otherwise constitutes a bona fide improvement of a Participant’s rights under the Plan, or (ii) an amendment which decreases the benefits of a Participant that is consented to in writing by such Participant or that is required in order for the Plan to comply with applicable law or regulation. The parties intend that all payments and reimbursements made under this Plan be excepted from Section 409A of the Code, and the regulations and other guidance promulgated thereunder (collectively, “Section 409A”) and, if not excepted, be compliant with Section 409A. Accordingly, in the event of any ambiguity in this Plan, this Plan shall be interpreted and administered so as to be excepted from or, if not excepted from, compliant with, Section 409A to the fullest extent possible. In the event the Company determines that a payment or reimbursement or a series of payments or reimbursements is neither excepted from nor compliant with 409A, notwithstanding anything in this Plan to the contrary, the Company shall have the unilateral right to modify or amend this Plan as it deems reasonably appropriate with respect to Section 409A and other applicable law to render such payment excepted or compliant so as, to the extent possible, to avoid any adverse tax consequences to either the Company, any Affiliate or the Participants. Each payment under this Plan shall be deemed a separate payment for purposes of Section 409A.

13

10.3 Notices. All notices and other communications under this Plan shall be in writing and delivered by hand, by a nationally recognized delivery service that promises overnight delivery, or by first-class registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

If to Participant:

to Participant at his or her most recent home address on file with the Company.

If to the Company or the Employer:

Matrix Service Company

5100 E. Skelly Drive, Suite 100

Tulsa, OK 74135

Attention: General Counsel

or to such other address as either party shall have furnished to the other in writing. Notice and communications shall be effective when actually received by the addressee.

ARTICLE XI. ADMINISTRATION

11.1 Fiduciaries. Under certain circumstances, the Board or the Committee may be determined by a court of law to be a fiduciary with respect to a particular action under the Plan. As authorized by ERISA, to prevent any two parties to the Plan from being deemed co-fiduciaries with respect to a particular function, the Plan is intended, and should be construed, to allocate to each party to the Plan only those specific powers, duties, responsibilities, and obligations as are specifically granted to it under the Plan.

11.2 Allocation of Responsibilities.

11.2.1 Board of Directors. The Board shall have exclusive authority and responsibility for:

(i) The amendment or termination of this Plan in accordance with Sections 10.1 and 10.2; and

(ii) The delegation to the Committee of any authority and responsibility reserved herein to the Board.

11.2.2 Committee. The Committee shall serve as plan administrator and shall have exclusive authority and responsibility for those functions set forth in Section 11.3, in other provisions of this Plan, and in provisions of a trust used to pay benefits under this Plan.

14

11.3 Provisions Concerning the Committee.

11.3.1 Membership and Voting. The Committee shall consist of not less than three (3) members. The Committee shall act by a majority of its members at the time in office, and such action may be taken by a vote at a meeting, in writing without a meeting, or by telephonic communications. Attendance at a meeting, in person or by telephone, shall constitute waiver of notice thereof. A member of the Committee who is a Participant of the Plan shall not vote on any question relating specifically to such Participant. Any such action shall be voted or decided by a majority of the remaining members of the Committee. The Committee may designate one of its members as the Chairman and may appoint a Secretary who may, but need not, be a member thereof. The Committee may appoint from its members such subcommittees with such powers as the Committee shall determine.

11.3.2 Duties of the Committee. The Committee shall administer the Plan in accordance with its terms and shall have all the powers necessary to carry out such terms. The Committee shall execute any certificate, instrument or other written direction on behalf of the Plan and may make any payment on behalf of the Plan. All interpretations of the Plan, and questions concerning its administration and application, shall be determined by the Committee (or its delegate). The Committee may appoint such accountants, counsel, specialists, and other persons as it deems necessary or desirable in connection with the administration of the Plan. Such accountants and counsel may, but need not, be accountants and counsel for the Company.

11.4 Delegation of Responsibilities; Bonding.

11.4.1 Delegation and Allocation. The Board and the Committee, respectively, shall have the authority to delegate or allocate, from time to time, by a written instrument, all or any part of their responsibilities under the Plan to such person or persons as each may deem advisable and in the same manner to revoke any such delegation or allocation of responsibility. Any action of a person in the exercise of such delegated or allocated responsibility shall have the same force and effect for all purposes hereunder as if such action had been taken by the Board or the Committee, as the case may be. Neither the Company, any Employer, the Board, the Committee nor any member thereof shall be liable for any acts or omissions of any such person, who shall periodically report to the Board or the Committee, as applicable, concerning the discharge of the delegated or allocated responsibilities.

11.4.2 Bonding. The members of the Committee shall serve without bond (except as expressly required by federal law) and without compensation for their services as such.

11.5 No Joint Fiduciary Responsibilities. This Plan is intended to allocate to each named fiduciary the individual responsibility for the prudent execution of the functions assigned to it, and none of such responsibilities and no other responsibility shall be shared by two or more of such named fiduciaries unless such sharing is provided for by a specific provision of the Plan. Whenever one named fiduciary is required herein to follow the directions of another named fiduciary, the two named fiduciaries shall not be deemed to have been assigned a shared

15

responsibility, but the responsibility of a named fiduciary receiving such directions shall be to follow them insofar as such instructions are on their face proper under applicable law.

11.6 Information to be Supplied by Employer. Each Employer shall provide to the Committee or its delegate such information as it shall from time to time need in the discharge of its duties.

11.7 Fiduciary Capacity. Any person or group of persons may serve in more than one fiduciary capacity with respect to the Plan.

11.8 Claims Procedures. Generally, a Participant will not need to file a claim for a Severance Benefit in order to receive benefits payable under the Plan. If, however, a Participant believes that the Participant has not received Severance Benefits to which the Participant believes the Participant is entitled, including a disagreement with respect to the amount of the Severance Benefit paid, then the Participant may file a claim for benefits as follows below.

11.8.1 Definitions. For purposes of this Section 11.8, the following terms, when capitalized, will be defined as follows:

(i) Adverse Benefit Determination: Any denial, reduction or termination of or failure to provide or make payment (in whole or in part) for a Plan benefit, including any denial, reduction, termination or failure to provide or make payment that is based on a determination of a Claimant’s eligibility to participate in the Plan. Further, any invalidation of a claim for failure to comply with the claim submission procedure will be treated as an Adverse Benefit Determination.

(ii) Benefits Administrator: The person or office, if any, to whom the Committee has delegated day-to-day Plan administration responsibilities and who, pursuant to such delegation, processes Plan benefit claims in the ordinary course.

(iii) Claimant: A Participant or beneficiary or an authorized representative of such Participant or beneficiary who has filed or desires to file a claim for a Plan benefit.

11.8.2 Filing of Benefit Claim. A Claimant must file with the Committee (or the Benefits Administrator) a written claim for benefits under the Plan on the form provided by, or in any other manner approved by, the Committee. (For purposes of applying the time periods for benefit determination pursuant to Section 11.8.4, filing a claim with the Benefits Administrator will be treated as filing a claim with the Committee.) In connection with the submission of a claim, the Claimant may examine the Plan and any other relevant documents relating to the claim, and may submit written comments relating to such claim to the Committee coincident with the filing of the benefit claim form. Failure of a Claimant to comply with the claim submission procedure will invalidate such claim unless the Committee in its discretion determines that it was not reasonably possible to provide such proof or comply with such procedure.

16

11.8.3 Processing of Benefit Claim. Upon receipt of fully completed benefit claim forms from a Claimant, the Committee (or the Benefits Administrator) shall process such benefit claim considering (i) all materials submitted by the Claimant in connection with the claim, (ii) all Plan provisions pertaining to the benefit claim, and (iii) where appropriate, all information as to whether such Plan provisions have in the past been consistently applied with respect to other similarly situated Claimants. The Committee (or the Benefits Administrator) shall process the claim within the time frame provided in Section 11.8.4.

11.8.4 Notification of Adverse Benefit Determination. In any case of an Adverse Benefit Determination of a claim for a Plan benefit, the Committee shall furnish written notice to the affected Claimant within a reasonable period of time but not later than ninety (90) days after receipt of such claim for Plan benefits (or within one hundred and eighty (180) days if special circumstances necessitate an extension of the ninety (90)-day period and the Claimant is informed of such extension in writing within the ninety (90)-day period and is provided with an extension notice consisting of an explanation of the special circumstances requiring the extension of time and the date by which the benefit determination will be rendered). Any notice that denies a benefit claim of a Claimant in whole or in part shall, in a manner calculated to be understood by the Claimant:

(i) State the specific reason or reasons for the Adverse Benefit Determination;

(ii) Provide specific reference to pertinent Plan provisions on which the Adverse Benefit Determination is based;

(iii) Describe any additional material or information necessary for the Claimant to perfect the claim and explain why such material or information is necessary; and

(iv) Describe the Plan’s review procedures and the time limits applicable to such procedures, including a statement of the Claimant’s right to bring a civil action under Section 502(a) of ERISA following an Adverse Benefit Determination on review.

11.8.5 Review of Adverse Benefit Determination. A Claimant has the right to have an Adverse Benefit Determination reviewed in accordance with the following claims review procedure:

(i) The Claimant must submit a written request for such review to the Committee not later than sixty (60) days following receipt by the Claimant of the Adverse Benefit Determination notification;

(ii) The Claimant shall have the opportunity to submit written comments, documents, records, and other information relating to the claim for benefits to the Committee;

17

(iii) The Claimant shall have the right to have all comments, documents, records, and other information relating to the claim for benefits that have been submitted by the Claimant considered on review without regard to whether such comments, documents, records or information were considered in the initial benefit determination; and

(iv) The Claimant shall have reasonable access to, and copies of, all documents, records, and other information relevant to the claim for benefits free of charge upon request, including (a) documents, records or other information relied upon for the benefit determination, (b) documents, records or other information submitted, considered or generated without regard to whether such documents, records or other information were relied upon in making the benefit determination, and (c) documents, records or other information that demonstrates compliance with the standard claims procedure.

The decision on review by the Committee will be binding and conclusive upon all persons, and the Claimant shall neither be required nor be permitted to pursue further appeals to the Committee.

11.8.6 Notification of Benefit Determination on Review. Notice of the Committee’s final benefit determination regarding an Adverse Benefit Determination will be furnished in writing or electronically to the Claimant after a full and fair review. Notice of an Adverse Benefit Determination upon review will:

(i) State the specific reason or reasons for the Adverse Benefit Determination;

(ii) Provide specific reference to pertinent Plan provisions on which the Adverse Benefit Determination is based;

(iii) State that the Claimant is entitled to receive, upon request and free of charge, reasonable access to, and copies of, all documents, records, and other information relevant to the Claimant’s claim for benefits including (a) documents, records or other information relied upon for the benefit determination, (b) documents, records or other information submitted, considered or generated without regard to whether such documents, records or other information were relied upon in making the benefit determination, and (c) documents, records or other information that demonstrates compliance with the standard claims procedure; and

(iv) Describe the Claimant’s right to bring an action under Section 502(a) of ERISA.

The Committee shall notify a Claimant of its determination on review with respect to the Adverse Benefit Determination of the Claimant within a reasonable period of time but not later than sixty (60) days after the receipt of the Claimant’s request for review unless the Committee determines that special circumstances require an extension of time for processing the review of the Adverse Benefit Determination. If the Committee

18

determines that such extension of time is required, written notice of the extension (which shall indicate the special circumstances requiring the extension and the date by which the Committee expects to render the determination on review) shall be furnished to the Claimant prior to the termination of the initial sixty (60)-day review period. In no event shall such extension exceed a period of sixty (60) days from the end of the initial sixty (60)-day review period. In the event such extension is due to the Claimant’s failure to submit necessary information, the period for making the determination on a review will be tolled from the date on which the notification of the extension is sent to the Claimant until the date on which the Claimant responds to the request for additional information.

11.8.7 Exhaustion of Administrative Remedies. Completion of the claims procedures described in this Section 11.8 will be a condition precedent to the commencement of any legal or equitable action in connection with a claim for benefits under the Plan by a Claimant or by any other person or entity claiming rights individually or through a Claimant; provided, however, that the Committee may, in its sole discretion, waive compliance with such claims procedures as a condition precedent to any such action.

11.8.8 Payment of Benefits. If the Committee (or the Benefits Administrator) determines that a Claimant is entitled to a benefit hereunder, payment of such benefit will be made to such Claimant (or commence, as applicable) as soon as administratively practicable after the date the Committee (or the Benefits Administrator) determines that such Claimant is entitled to such benefit or on such other date as may be established pursuant to the Plan provisions or, as applicable, designated by the Committee.

11.8.9 Authorized Representatives. An authorized representative may act on behalf of a Claimant in pursuing a benefit claim or an appeal of an Adverse Benefit Determination. An individual or entity will only be determined to be a Claimant’s authorized representative for such purposes if the Claimant has provided the Committee with a written statement identifying such individual or entity as the Claimant’s authorized representative and describing the scope of the authority of such authorized representative. In the event a Claimant identifies an individual or entity as an authorized representative in writing to the Committee but fails to describe the scope of the authority of such authorized representative, the Committee shall assume that such authorized representative has full powers to act with respect to all matters pertaining to the Claimant’s benefit claim under the Plan or appeal of an Adverse Benefit Determination with respect to such benefit claim.

19

ARTICLE XII. MISCELLANEOUS

12.1 Employment Status. The Plan does not constitute a contract of employment or impose on the Participant or the Participant’s Employer any obligation to retain the Participant as an Employee, any restriction on changing the status of the Participant’s employment, or any restriction on changing the policies of the Company or its Affiliates regarding termination of employment.

12.2 Validity and Severability. The invalidity or unenforceability of any provision of the Plan shall not affect the validity or enforceability of any other provision of the Plan, which shall remain in full force and effect, and any prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

12.3 Governing Law. The validity, interpretation, construction and performance of the Plan shall in all respects be governed by the laws of the United States and, to the extent not preempted by such laws, by the laws of the State of Delaware, without regard to choice of law principles.

12.4 Withholding and Payment of Taxes. The Company or its Affiliates may withhold from any amounts payable under the Plan all federal, state, local and/or other taxes as shall be legally required. In addition, except as otherwise provided herein, each Participant shall be solely responsible for the payment of all income, excise and other taxes which are individually levied on the Participant by any taxing authority with respect to any amount paid to such Participant under the Plan.

12.5 Obligations Unfunded. All benefits due a Participant under the Plan are unfunded and unsecured and are payable out of the general funds of the Employers. One or more Employers may establish a “grantor trust” for the payment of benefits and obligations hereunder, the assets of which shall be at all times subject to the claims of creditors as provided for in such trust.

12.6 Construction. For purposes of the Plan, the following rules of construction shall apply:

12.6.1 The word “or” is disjunctive but not necessarily exclusive.

12.6.2 Words in the singular include the plural; words in the plural include the singular; and words in the neuter gender include the masculine and feminine genders.

The Plan has been adopted by the Company to be effective as of the 13th day of September 2021.

MATRIX SERVICE COMPANY

By: ____________________________________

Name: __________________________________

Title: ___________________________________

20

EXHIBIT A

ADDITIONAL PROVISIONS OF THE SUMMARY PLAN

DESCRIPTION OF THE PLAN

I. General Plan Information:

Name of Plan: Matrix Service Company 2021 Severance Plan for Executives (the “Plan”)

Plan Sponsor and Employer Identification Number:

Matrix Service Company

5100 E. Skelly Drive, Suite 100 Tulsa, OK 74135

EIN: 73-1352174

Plan Number: Plan #515

Type of Plan: Welfare Benefits

Type of Administration: Plan Administrator

Plan Administrator (and Agent for Service of Legal Process):

Matrix Severance Plan Committee

5100 E. Skelly Drive, Suite 100

Tulsa, OK 74135

Plan Year: The Plan Year ends on the 31st day of December of each year.

II. The Statement of ERISA Rights.

As a Participant in the Plan, you are entitled to certain rights and protections under ERISA. ERISA provides that all Plan Participants shall be entitled to:

Receive Information About Your Plan and Benefits

* Examine, without charge, at the Plan Administrator’s office and at other specified locations, such as worksites, all documents governing the Plan and a copy of the latest annual report (Form 5500 Series), if applicable, filed by the Plan with the U.S. Department of Labor and available at the Public Disclosure Room of the Pension and Welfare Benefit Administration.

* Obtain, upon written request to the Plan Administrator, copies of documents governing the operation of the Plan and copies of the latest annual report (Form 5500 Series), if applicable, and of the updated summary plan description. The Plan Administrator may make a reasonable charge for the copies.

A-1

* Receive a summary of the Plan’s annual financial report, if applicable. The Plan Administrator is required by law to furnish each Participant with a copy of this summary annual report.

Prudent Actions by Plan Fiduciaries

In addition to creating rights for Plan Participants, ERISA imposes duties upon the people who are responsible for the operation of the employee benefit plan. The people who operate your Plan, called “fiduciaries” of the Plan, have a duty to do so prudently and in the interest of you and other Plan Participants and beneficiaries. No one, including your employer, your union, or any other person, may fire you or otherwise discriminate against you in any way to prevent you from obtaining a welfare benefit or exercising your rights under ERISA.

Enforce Your Rights

If your claim for a welfare benefit is denied or ignored, in whole or in part, you have a right to know why this was done, to obtain copies of documents relating to the decision without charge, and to appeal any denial, all within certain time schedules.

Under ERISA, there are steps you can take to enforce the above rights. For instance, if you request a copy of Plan documents or the latest annual report from the Plan and do not receive them within 30 days, you may file suit in a Federal court. In such a case, the court may require the Plan Administrator to provide the materials and pay you up to $110 a day until you receive the materials, unless the materials were not sent because of reasons beyond the control of the Plan Administrator. If you have a claim for benefits which is denied or ignored, in whole or in part, you may file suit in a state or Federal court. If it should happen that Plan fiduciaries misuse the Plan’s money, or if you are discriminated against for asserting your rights, you may seek assistance from the U.S. Department of Labor, or you may file suit in a Federal court. The court will decide who should pay court costs and legal fees. If you are successful, the court may order the person you have sued to pay these costs and fees. If you lose, the court may order you to pay these costs and fees, for example, if it finds your claim is frivolous.

Assistance with Your Questions

If you have any questions about your Plan, you should contact the Plan Administrator. If you have any questions about this statement or about your rights under ERISA, or if you need assistance in obtaining documents from the Plan Administrator, then you should contact the nearest office of the Employee Benefits Security Administration, U.S. Department of Labor, listed in your telephone directory or the Division of Technical Assistance and Inquiries, Employee Benefits Security Administration, U.S. Department of Labor, 200 Constitution Avenue N.W., Washington, D.C. 20210. You may also obtain certain publications about your rights and responsibilities under ERISA by calling the publications hotline of the Employee Benefits Security Administration.

A-2

EXHIBIT B

PARTICIPATION AGREEMENT

Name:

Section 1. ELIGIBILITY.

You have been designated as eligible to participate as a Participant in the Matrix Service Company 2021 Severance Plan for Executives (the “Plan”), a copy of which is attached to this Participation Agreement (the “Participation Agreement”). Capitalized terms not explicitly defined in this Participation Agreement but defined in the Plan shall have the same definitions as in the Plan. Subject to all of the terms and conditions set forth in the Plan, you will receive the benefits described herein if you meet all the eligibility requirements described in the Plan, including, without limitation, executing and returning this Participation Agreement no later than ___________ and the required Release within the applicable time period set forth therein.

Section 2. CHANGE OF CONTROL SEVERANCE BENEFITS.

If, within two (2) years following a Change of Control, you incur an involuntary Separation from Service by action of the Employer other than for Cause or voluntarily incur a Separation from Service for Good Reason, you shall be entitled to a lump sum cash payment in an amount equal to ________ percent (___[1]%) of your Change of Control Severance Compensation set forth in Section 1.1.8 of the Plan on the Payment Date.

Section 3. NON-CHANGE OF CONTROL SEVERANCE BENEFITS.

If, prior to a Change of Control, you incur an involuntary Separation from Service by action of the Employer other than for Cause, you shall be entitled to a lump sum cash payment in an amount equal to ________ percent (___[2]%) of your General Severance Compensation under Section 1.1.18 of the Plan.

Section 4. ACKNOWLEDGMENTS; INTERACTION WITH PRIOR BENEFITS.

As a condition to participation in the Plan, you hereby acknowledge each of the following:

(a) The benefits that may be provided to you under the Plan are subject to certain reductions and termination under Article III of the Plan.

(b) Your eligibility for and receipt of any Severance Benefits to which you may become entitled as described in the Plan is expressly contingent upon your compliance with the terms and conditions of the Plan and your execution and compliance with a waiver and release in form and substance satisfactory to the Company. Severance Benefits under the Plan shall immediately cease in the event of your violation of the provisions of Article VI of the Plan or any other written agreement with the Company.

B-1

(c) As further described in Section 2.3 of the Plan, the Plan supersedes and replaces any change of control or severance benefits previously provided to you, including but not limited to any benefits under a Change of Control or Change of Control/Severance Agreement, and by executing below you expressly agree to such treatment.

To accept the terms of this Participation Agreement and participate in the Plan, please sign and date this Participation Agreement in the space provided below and return it to _____________________ no later than _________, ____.

B-2

Matrix Service Company

By: ________________________________

___________________________________

___________________________________

Participant

________________________________

[Insert Name]

Date: ______________________________

B-3