Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - HUNTINGTON BANCSHARES INC /MD/ | d198629dex992.htm |

| 8-K - 8-K - HUNTINGTON BANCSHARES INC /MD/ | d198629d8k.htm |

Exhibit 99.1 Barclays Global Financial Services Conference September 13, 2021 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2021 Huntington Bancshares Incorporated.

Disclaimer CAUTION REGARDING FORWARD-LOOKING STATEMENTS This communication may contain certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; the magnitude and duration of the COVID-19 pandemic and its impact on the global economy and financial market conditions and our business, results of operations, and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and credit markets; movements in interest rates; reform of LIBOR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd- Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; the possibility that the anticipated benefits of the transaction with TCF are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Huntington does business; the possibility that the proposed branch divestiture will not close when expected or at all because conditions to the closing are not satisfied on a timely basis or at all; the possibility that the branch divestiture may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the branch divestiture; and other factors that may affect the future results of Huntington. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2020 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarters ended March 31, 2021 and June 30, 2021, each of which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website, www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Huntington does not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. Barclays Global Financial Services Conference 2

Building the Leading People-First, Digitally Powered Bank Creating a sustainable competitive advantage with focused investment in customer experience, product differentiation, and key growth initiatives We are a Purpose-driven company à Our Purpose is to make people’s lives better, help businesses thrive, and strengthen the communities we serve Drive organic growth across all business segments à Deliver a superior customer experience through differentiated products, digital capabilities, market segmentation, and tailored expertise à Leverage the value of our brand, our deeply-rooted leadership in our communities, and our market-leading convenience to efficiently acquire, deepen, and retain client relationships Deliver sustainable, top quartile financial performance and efficiency à Drive diversified revenue growth à Leverage increased scale from the TCF acquisition à Minimize earnings volatility through the cycle à Deliver consistent annual positive operating leverage and top quartile returns on capital Be a source of stability and resilience through enterprise risk management & balance sheet strength à Maintain an aggregate moderate-to-low, through-the-cycle risk profile à Disciplined capital allocation and priorities (first fund organic growth, second maintain the dividend, and then other capital uses) Barclays Global Financial Services Conference 3

Key Messages Extending our Fair Play Banking philosophy through innovative 1 1 product and capability enhancements, leading to strong new household acquisition and deepening of customer relationships Driving momentum in commercial by leveraging expertise across 2 2 middle market and corporate banking, specialty commercial, treasury management, and capital markets to increase primary bank relationships Delivering on the successful integration of TCF, achieving cost 3 3 savings and executing on revenue synergy opportunities Barclays Global Financial Services Conference 4

Strategic Priorities Initiatives underway gaining traction to drive organic growth Consumer Business Commercial Wealth Payments Treasury Management à Persistent market à Expand into new growth à Extend Fair Play strategy à Grow share of wallet and leadership and to business customers deepen relationships markets à Continue to penetrate in differentiation via Fair through analytics commercial and business à Synchronize consumer à Optimize go-to-market Play – innovative and digital capabilities with à Leverage expertise and approach for mass à Digitize and simplify disruptive products Business Banking (digital scale to move up-market affluent and high net customer experience à Deepen customer worth segments origination roadmap) à Continue to penetrate Card relationships à Expand leadership in SBA treasury management à Capitalize on strength in à Increase debit card à Ongoing digital lending and practice and capital markets organic sales and AUM penetration enhancements to drive finance to new growth momentum à Enhance capabilities to à New credit card products new customer geographies improve customer à Enhance digital tools for acquisition and à Digital-led improvements advisory relationships à Tailored treasury experience and drive engagement to user experience management offerings efficiencies Strategic Partnerships & Innovation Distinguished Awards & Established Expertise #1 Customer Satisfaction #8 Receive Volume with Consumer Banking in 200+ (2) (1) Real-Time Payments the North Central Region Client-facing colleagues U.S. Small Business Banking - U.S. Middle Market Banking - th #1 Customer Satisfaction 11 Largest ACH Six National and Two Regional Eight National and Four with Mobile Banking Apps (3) receiver volume 2020 Greenwich Excellence Regional 2020 Greenwich (1) among Regional Banks $24 Billion Awards, including Overall Excellence Awards, including J.D. Power 2021 U.S. Banking Mobile th Assets Under Management Satisfaction (National) Overall Satisfaction (National) 14 Largest U.S. App Satisfaction Study; among banks (4) with $55B to $150B in deposits. Visit Debit Card Issuer jdpower.com/awards for more details See Notes on Slide 12 Barclays Global Financial Services Conference 5

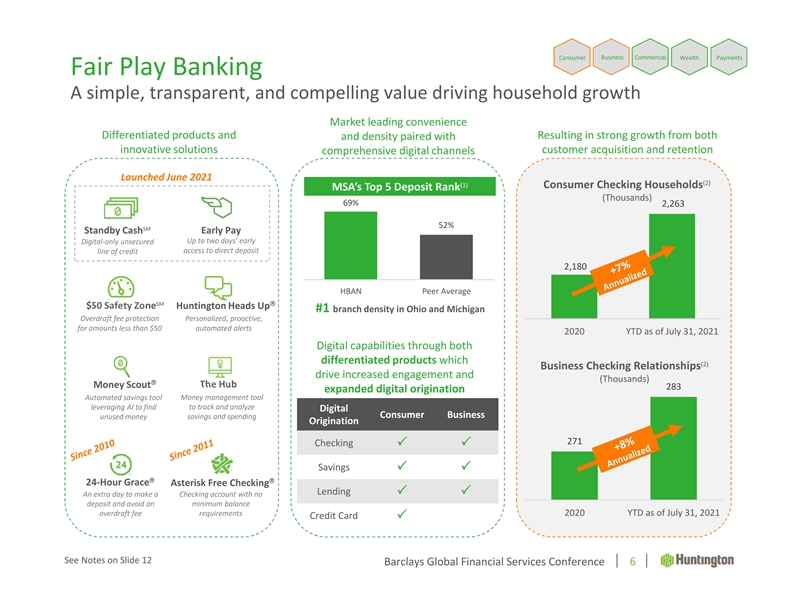

Business Commercial Consumer Wealth Payments Fair Play Banking A simple, transparent, and compelling value driving household growth Market leading convenience Differentiated products and Resulting in strong growth from both and density paired with innovative solutions customer acquisition and retention comprehensive digital channels Launched June 2021 (2) (1) Consumer Checking Households MSA’s Top 5 Deposit Rank (Thousands) 69% 2,263 52% SM Standby Cash Early Pay Up to two days’ early Digital-only unsecured access to direct deposit line of credit 2,180 HBAN Peer Average SMâ $50 Safety Zone Huntington Heads Up #1 branch density in Ohio and Michigan Overdraft fee protection Personalized, proactive, for amounts less than $50 automated alerts 2020 YTD as of July 31, 2021 Digital capabilities through both differentiated products which (2) Business Checking Relationships drive increased engagement and (Thousands) â The Hub Money Scout 283 expanded digital origination Automated savings tool Money management tool to track and analyze leveraging AI to find Digital Consumer Business unused money savings and spending Origination 271 Checking PP Savings PP ââ 24-Hour Grace Asterisk Free Checking Lending PP An extra day to make a Checking account with no deposit and avoid an minimum balance overdraft fee requirements 2020 YTD as of July 31, 2021 Credit Card P See Notes on Slide 12 Barclays Global Financial Services Conference 6

Business Commercial Consumer Wealth Payments Commercial Banking Strategy Focused on deepening customer relationships and leveraging expertise Strategic Priorities 1 Market Expansion • Targeted and deliberate growth in new attractive markets: Driving Middle • Middle Market & Mid-Corporate: Twin Cities, Denver, Chicago Acquisition and Market Deepening 2 Equipment & Inventory Finance • Leverage size and scale of combined platform Treasury Corporate Management Banking* 3 Corporate Banking • Up-market focus in Mid-Corporate and Middle Market opportunities Commercial • Leverage expertise through industry verticals and specialization: • Healthcare, Asset-based Lending, Franchise, Tech / Telecom Banking Amplifying Capital Markets 4 Expertise and • Continue to increase penetration, aligned with up-market focus Capital Commercial Capabilities • Added expertise in public finance, syndications, sales and trading Markets Real Estate 5 Treasury Management • Grow share of wallet and deepen customer relationships Equipment • Technology-enabled solutions that address customer pain points and & Inventory improve efficiency Finance 6 Digital Transformation Extending • Enhanced digital products and capabilities with a focus on the Digital customer journey, servicing efficiency, and relationship manager *Corporate Banking Verticals: analytics Mid-Corporate Specialty Commercial • Healthcare • Asset-based Lending • Franchise • Tech / Telecom Barclays Global Financial Services Conference 7

Revenue Synergies - Selected Opportunities Multiple initiatives underway to build upon organic growth momentum Consumer Product Set Equipment Finance Middle Market Business Banking Wealth Management Deployed Across TCF and Inventory Finance; Expansion Expansion Expansion Customers Combined Size & Scale • Twin Cities (MN) • Michigan • Twin Cities (MN) • Twin Cities (MN) • Nationally • Denver (CO) • Twin Cities (MN) • Denver (CO) • Denver (CO) • Chicago (IL) • Denver (CO) • Chicago (IL) • Chicago (IL) Geographies • Chicago (IL) • Milwaukee (WI) • Expand Middle Market • Introducing customer- • Deploying #1 SBA • Expand Wealth • Capitalize on serving offerings to Legacy friendly fair play lending platform and Management broader client sizes TCF geographies banking and leading business banking offerings to Legacy and markets with a • New growth markets digital tools to TCF offerings to Legacy TCF TCF geographies wider set of solutions with opportunity to customers geographies • Mass affluent banker • Accelerate digital leverage Huntington • Bringing competitive • Business banking program rolling out in leadership and Description commercial banking product offerings to digital capabilities MN, CO, IL technology roadmap expertise TCF customers such as significantly enhanced • Deepen existing client, • Increased capacity to mortgage, home with online account vendor and partner with larger equity, and credit card opening and digital manufacturer companies loan origination relationships capabilities th • Twin Cities: >4,000 • 1.5 million TCF • 6.8 million small • 1.4 million high net • 7 largest bank- (1) mid/large companies customers added businesses in footprint worth households in owned Equipment Key Stats (4) • Denver: >4,000 (2.4 million in footprint (475k in Finance business (1) (2) (3) mid/large companies MN/CO/IL) MN/CO/IL) • Recruitment and • Upgraded experience • SBA team for MN and • Wealth Management • TCF Equipment Finance hiring underway and capabilities post CO starting in Q4 leader for Twin Cities key verticals / channels Current conversion in October • Hiring underway for hired August 2021 integrated Status Practice Finance, SBA, • Twin Cities team • Aligned sales Business Bankers and hiring underway leadership structure Treasury Management See Notes on Slide 12 Barclays Global Financial Services Conference 8

3Q21 Mid-Quarter Update Balance sheet and capital update Loans and Leases Loans and Leases $ billions $111.9 Commercial: $110.2 $4.2 $3.6 à Average balances lower versus 2Q ending due to lower PPP and dealer floorplan à C&I utilization ex-floorplan remains relatively unchanged, while inventory finance $106.6 $107.7 utilization declined à New loan production remains strong, and pipelines continue to be up year-over-year Consumer: (1) 2Q21 3Q21 QTD Balance Ending, ex-PPP Average, ex-PPP à Average balances modestly lower on a net basis, driven by growth in residential Sheet Ending Average PPP PPP Ending PPP Average PPP mortgage, offset by home equity paydowns Deposits $ billions PPP Update: $142.8 $142.2 à 3Q21 QTD net interest income includes $32.0 million related to PPP, including $19.7 million of accelerated fees from forgiveness Deposits à Average balances largely unchanged from 2Q ending balances (1) à Approximately $12 billion of excess cash at the Federal Reserve Bank, as of August 31 2Q21 3Q21 QTD Ending Average Share Repurchase Authorization à Common Stock: Repurchased 27.9 million shares of common stock through 9/3; $ millions $385 million remaining under $800 million share repurchase authorization à Preferred Stock: Redeemed $600 million of 6.25% Series D preferred stock on July 15, 2021 Capital à Announced the redemption of 5.875% Series C preferred stock (Nasdaq: HBANN), having an aggregate liquidation value of $100 million, expected to occur on October 15, 2021 à Subordinated Debt: Issued $500 million of subordinated debt at 2.487% on August Authorized Repurchased Remaining 16, 2021 to date See Notes on Slide 12 Barclays Global Financial Services Conference 9 9

Focus on Achieving Medium-Term Financial Goals Driving organic revenue growth across all businesses to deliver top quartile financial performance Return on Positive Efficiency CET1 Tangible Operating Common Equity Ratio Ratio Leverage 17%+ 56% 9 – 10% à Targeting annual revenue growth slightly above nominal GDP à Managing annual expense growth relative to revenue outlook to achieve positive operating leverage à Targeting lower half of the long-term CET1 operating range à Capital Priorities 1. Organic growth 2. Dividend 3. Buybacks / other à Expecting a normalized effective tax rate to be in the range of 18% to 19% Barclays Global Financial Services Conference 10

Appendix

Notes Slide 5: 1. For J.D. Power 2021 award information, visit jdpower.com/awards. Huntington received the highest score among regional banks in the J.D. Power 2021 U.S. Banking Mobile App Satisfaction Study of customers’ satisfaction with their financial institution’s mobile applications for banking account management. Huntington received the highest ranking in Customer Satisfaction with Consumer Banking in the North Central Region of the J.D. Power 2021 U.S. Retail Banking Satisfaction Study. 2. Eighth largest receive volume during May among banks participating in The Clearing House’s RTP (Real-Time Payments) network 3. NACHA. Ranked by receiver volume in 2020. Pro forma of standalone Huntington and legacy TCF 4. Nilson Report issued April 2021. Ranked by purchase volume in 2020. Pro forma of standalone Huntington and legacy TCF Slide 6: 1. S&P Global. Market share data as of 6/30/2021. Peers include CFG, CMA, FHN, FITB, KEY, MTB, PNC, RF, TFC, and ZION. Excludes all deposits above $0.5B at any branch (excluded deposits are assumed to include a significant level of commercial deposits or are headquarter branches for direct banks) 2. Huntington standalone metrics only Slide 8: 1. U.S. Census Bureau. Firms with >100 employees 2. SBA.gov. 2020 Small Business Economic Profiles 3. Phoenix Marketing International. Rankings based on 2019 data 4. 2021 Monitor 100 Report. Ranked by net assets in 2020. Pro forma of standalone Huntington and legacy TCF Slide 9: 1. QTD through 8/31/2021 Barclays Global Financial Services Conference 12