Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - HEALTHCARE TRUST OF AMERICA, INC. | ex991businessupdatesept21.htm |

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | hta-20210913.htm |

HEALTHCARE TRUST OF AMERICA, INC. The Largest Dedicated Owner & Operator of Medical Office Buildings in the U.S. September 2021 Memorial Hospital MOB Bakersfield, CA

F O R WA R D L O O K I N G S TAT E M E N T S This document contains both historical and forward‐looking statements. Forward‐looking statements are based on current expectations, plans, estimates, assumptions and beliefs, including expectations, plans, estimates, assumptions and beliefs about our company, the real estate industry, pending acquisitions, future medical office building performance and the debt and equity capital markets. All statements other than statements of historical fact are, or may be deemed to be, forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward‐looking statements include information concerning possible or assumed future results of operations of our Company. The forward‐looking statements included in this document are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward‐looking statements. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward‐looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward‐looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: changes in economic conditions affecting the healthcare property sector, the commercial real estate market and the credit market; our ability to complete our pending acquisitions; competition for acquisition of medical office buildings and other facilities that serve the healthcare industry; economic fluctuations in certain states in which our property investments are geographically concentrated; retention of our senior management team; financial stability and solvency of our tenants; supply and demand for operating properties in the market areas in which we operate; our ability to acquire properties, and to successfully operate those properties once acquired; changes in property taxes; legislative and regulatory changes, including changes to laws governing the taxation of REITs and changes to laws governing the healthcare industry; fluctuations in reimbursements from third party payors such as Medicare and Medicaid; changes in interest rates; the availability of capital and financing; restrictive covenants in our credit facilities; changes in our credit ratings; our ability to remain qualified as a REIT; and the risk factors set forth in our 2020 Annual Report on Form 10‐K filed on February 24, 2021. Forward‐looking statements speak only as of the date made. Except as otherwise required by the federal securities laws, we undertake no obligation to update any forward‐looking statements to reflect the events or circumstances arising after the date as of which they are made. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the forward looking statements included in this document or that may be made elsewhere from time to time by, or on behalf of, us. The Company has an effective registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”). Before you invest in any offering of the Company’s securities, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and any such offering. You may obtain copies of the Company’s most recent Annual Report on Form 10‐K and the other documents it files with the SEC for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company will arrange to send such information if you request it by calling (480) 998‐3478. For definitions of terms and reconciliations for certain financial measures disclosed herein, including, but not limited to, funds from operations (FFO), normalized funds from operations (Normalized FFO), annualized base rents (ABR), net operating income (NOI), and on‐campus/aligned, please see our Company’s earnings press release and Supplemental Financial Package for the quarter ended June 30, 2021 issued on August 3, 2021, each of which is available in the investor relations section of our Company’s website located at www.htareit.com.

3 All values as of June 30, 2021, unless otherwise noted. (1) Includes 100% of consolidated and unconsolidated properties as of June 30, 2021 (2) Top 20 markets based on % of annualized base rent contribution as of June 30, 2021 (3) Based on GLA (4) Listing was on June 6th, 2012; Market data as of 9/10/21; Most recent dividend raise of $0.005 in 3Q21 to $0.325/share per quarter 461 Properties (1) 25.3MM Square Feet Owned (1) 93% On‐campus / Aligned (3) ~$10B Total Market Capitalization 97% of GLA internally managed 78% of Current Investments in Top 20 MSAs (2) 131% Total Shareholder Return since Listing (4) ~6.5% Yield on Cost for Development / Redevelopment since 2019 17 Markets in Top 20 MSAs, with > 500k SF 850k Square Feet Development Pipeline in Pre‐ Leasing 74% of ABR from Health Systems, National / Regional Providers 13% Dividend Growth since 2014 (4) HTA: THE LARGEST DEDICATED OWNER & OPERATOR OF MEDICAL OFFICE BUILDINGS IN THE U.S. 3

67% • High-Demand Sector Leader: Medical office is in demand from tenants and investors. Private capital interest remains high given return profile. • Industry Leading Portfolio: Core, critical MOBs where healthcare demand is growing: on‐campus, core community outpatient, and academic locations. With limited ground lease restrictions • Key Market Focus: Investing in high growth markets where we can achieve operational scale. 10 markets of ~1MM SF and 17 markets >500k SF. ~78% of investments are concentrated in our top 20 MSAs • Unique, Vertically Integrated Operating Platform: Dedicated, national platform delivering tenant satisfaction, performance and growth in our key markets • Strong and Diverse Tenant Base: Partners with leading healthcare providers in our markets. ~74% of tenants are Health Systems or National/Regional providers. 60% of tenants are credit rated. • Steady and Consistent Performance and Dividend Growth: Delivering earnings growth to the bottom line. Only MOB REIT to raise dividend in each of the last 8 years, increasing by 13% since 2014 • Capacity for Growth: Path for above average earnings growth through lease‐up opportunity and accretive development pipeline • Investment Grade Balance Sheet: $1.3 billion in liquidity and low leverage positions HTA for future growth and stability Best in Class Portfolio Focused in 20-25 Key Markets All values as of June 30, 2021, unless otherwise noted. 4 THE HTA DIFFERENCE

PERFORMANCE HIGHLIGHTS Lincoln Medical Center Parker, CO

HIGHLIGHTS PORTFOLIO PERFORMANCE INVESTMENT ACTIVITY BALANCE SHEET & LIQUIDITY • Normalized FFO of $0.44 per diluted share, an increase of 4.8% compared to Q2 2020. • Normalized FAD of $81MM, an increase of 4.5% compared to Q2 2020. • Same Store Cash NOI growth of 2.1%. • Leased rate of 89.3% by GLA and occupancy rate of 87.9% by GLA for Q2 2021. • Year‐to‐date, executed 1.4MM SF of leases, including 361k SF of new leases and 992k SF of renewals with re-leasing spreads of 2.1%. • As of August 3, 2021, closed or under contract on total investments of approximately $373MM, including $304MM of medical office acquisitions that have closed or are under contract and $69MM in loan funding commitments to projects in the Texas Medical Center in Houston; $68.5MM of investments closed in the second quarter. • Existing development projects remain on‐track for delivery in 2021 while our pipeline of projects in pre‐leasing have increased to over $375MM. Year‐to‐date, completed development projects in Florida and California, totaling 136K SF and $51MM of investment. • Development pipeline consists of five projects totaling over 850K SF of space, located in Houston, Orlando and Raleigh, highlighted by our previously announced strategic partnership with Medistar Corporation to co‐develop the Texas A&M Innovation Plaza – Horizon Tower located in Houston Texas, a 485K SF medical office and life sciences tower with anticipated costs of $215M expected to commence construction in 2022. • Closed on previously announced sale of portfolio in secondary markets in Tennessee and Virginia, with an aggregate gross sales price of $67MM, generating a gain of $33MM. • Maintained our strong balance sheet with liquidity of $1.3 billion. Leverage of 5.5x Debt/ EBITDAre including $277MM of forward equity, and no bond maturities before 2026. Q2 2021 PERFORMANCE RECAP AND EARNINGS GUIDANCE 6 2021 UPDATED GUIDANCE • Normalized FFO of $1.74 to $1.78 • Same Store NOI Growth of 2.0% – 2.5% • Acquisitions of $375 ‐ $600MM, Dispositions of $70 – $125MM, Development Completions of $130MM • Utilize our Forward Equity as we acquire assets

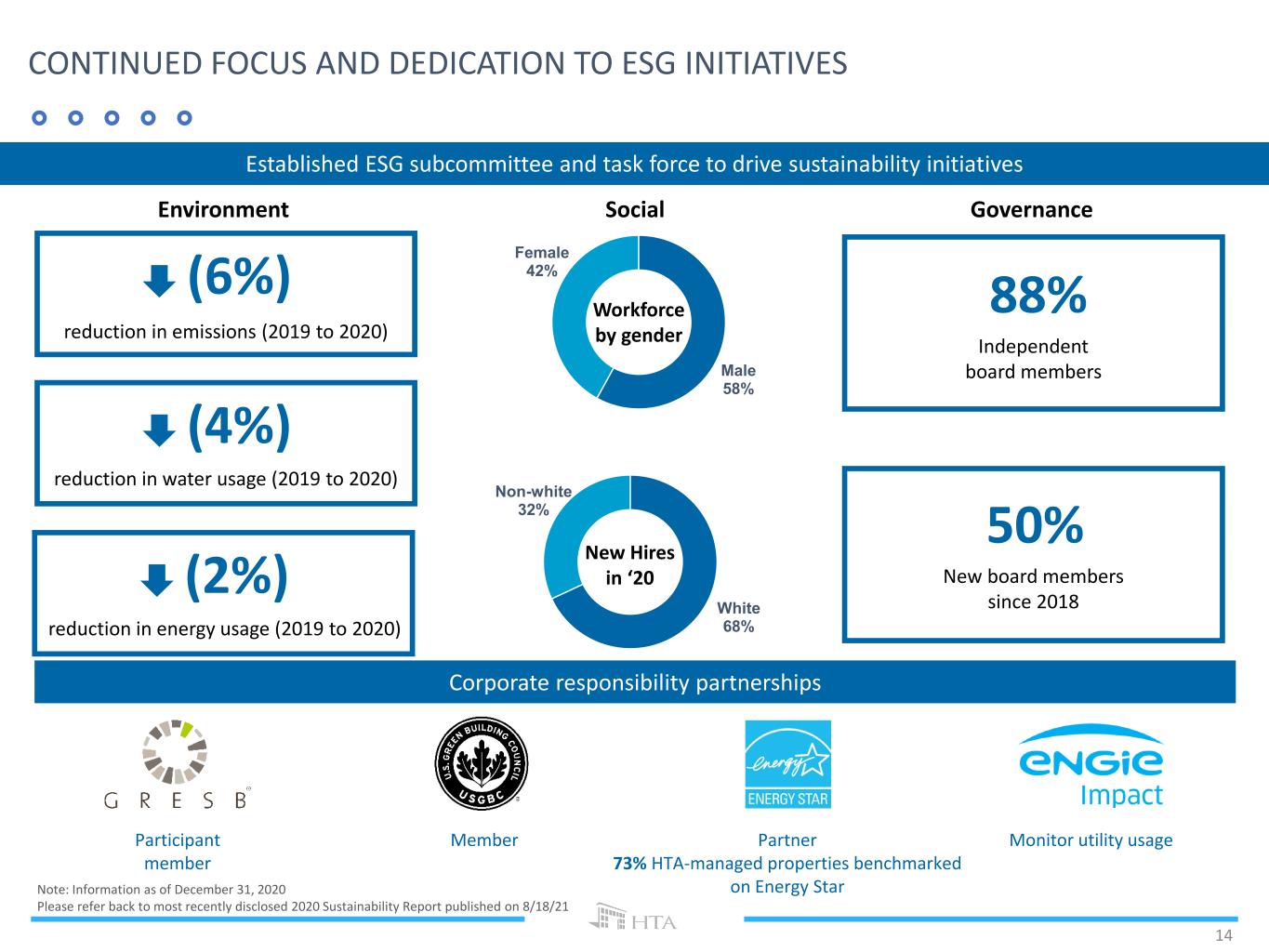

LEADERSHIP UPDATE INVESTMENT ACTIVITY • HTA’s Board has initiated its search for a permanent CEO. As part of this, it has formed an independent Search Committee and has retained Spencer Stuart, a leading global executive search firm, to assist with these efforts. • In Q3 2021, closed on four MOB acquisitions totaling $130MM and 469K SF of GLA, increasing market densification in HTA’s existing key markets of Houston, TX and Miami, FL. Year‐to‐date, closed on $183MM of medical office investments totaling over 625K SF of GLA, with an additional $121MM of investments encompassing over 280K SF of GLA under contract or exclusive letters of intent, subject to customary closing conditions. • 2021 investments showcase HTA’s campus densification strategy, which includes adding more than 600K SF of GLA to the Texas Medical Center, the largest medical complex in the world, including the acquisition of 6655 Travis in Q3 2021 and the previously announced Horizon Tower development, increasing HTA’s exposure in the Texas Medical Center to over 1MM SF of GLA with over $300MM invested. • Completed core and shell construction on 109k SF Class A medical office development located on HCA’s new Medical City Heart & Spine Hospital in Dallas, TX. Building is 74% pre‐leased with cash rents expected to commence in Q4 2021. HTA’s investment on this campus now totals over 300K SF of fee‐simple MOB space, with additional land for a 4th MOB on‐site. SEPTEMBER 2021 BUSINESS UPDATE 7 COMMITMENT TO ESG • Published 2nd Annual Sustainability Report, highlighting progress towards ESG initiatives, including participation in the internationally recognized Global Real Estate Sustainability Benchmark (“GRESB”) reporting for the past two years and partnerships with US Green Building Council and Energy Star, and outlining long‐term ESG goals aligned with six of the 17 defined UN Sustainable Development Goals. • Established greenhouse gas (GHG) emissions reduction and electricity consumption reduction targets over the next 5 years. • Committed to respecting and promoting human rights in accordance with principles outlined in the UN Universal Declaration of Human Rights.

Critical Mass in Established Gateway Markets PORTFOLIO SNAPSHOT 8 Key Markets Total GLA (1) % of Portfolio Dallas, TX 2,101 8.3% Houston, TX 1,665 6.6% Indianapolis, IN 1,396 5.5% Phoenix, AZ 1,316 5.2% Miami, FL 1,227 4.8% Hartford/New Haven, CT 1,165 4.6% Atlanta, GA 1,121 4.4% Pittsburgh, PA 1,094 4.3% Boston, MA 965 3.8% Tampa, FL 954 3.8% Charlotte, NC 922 3.6% Albany, NY 833 3.3% Raleigh, NC 790 3.1% Orange Count/Los Angeles, CA 719 2.8% New York, NY 615 2.4% Denver, CO 607 2.4% Orlando, FL 513 2.0% El Paso, TX 476 2.0% Chicago, IL 454 1.8% Austin, TX 409 1.7% Top 20 MSAs 19,342 76.4% Additional Top MSAs 4,649 18.4% Total Key Markets in Top 75 MSAs 23,991 94.8% HTA MARKET CRITERIA HIGH GROWTH MARKETS WITH DENSE PATIENT BASE Location, Location, Location. 95% of our GLA located is in the top 75 MSAs, most with strong academic university concentration. We strategically invest in some of the fastest growing markets where we can build scale to efficiently service our properties and provide value to our tenants. SCALABILITY We believe each key market should hit a critical mass of 1‐2 million SF to create operating synergies and enhance relationships with key health systems that drive growth. We have reached economies of scale in 10 markets of ~1MM SF and 17 markets >500k SF. (1) As of June 30, 2021

‐ 500 1,000 1,500 2,000 2,500 Dallas Houston Indianapolis Phoenix Miami Hartford/New Haven Atlanta Pittsburgh Boston Tampa Charlotte Albany Raleigh Orange County/Los Angeles New York Denver Orlando GLA 2016 2021 HTA MARKET STRATEGY 9 Key Market Strategy Drives Investment Decisions 2021 Dispositions (1) Exited non‐key markets in Tennessee and Virginia generating $67MM of available capital to deploy into our key markets 2021 Acquisitions (1) Year‐to‐date, closed MOB acquisitions of over $180MM, representing over 625K SF of space, increasing densification in our key markets Non-Key Market GLA Kingsport/Bristol, TN 347 VA Non‐Metropolitan Area 63 Total Disposed GLA 410 Key Market GLA Houston, TX 267 Miami, FL 102 Raleigh, NC 42 Acquisitions in Top 20 MSAs 411 Additional Top MSAs/Other Markets 215 Total Acquired GLA 626 (1) As of August 31, 2021 (2) Markets with >500K SF as of June 30, 2021 KEY MARKET DENSIFICATION OVER THE LAST 5 YEARS (2) GLA in Top 20 MSAs Increased by Over 60% in the Last 5 Years

DEVELOPMENT PLATFORM DRIVES ACCRETIVE GROWTH WakeMed Cary MOB – Raleigh, NC Project Highlights: GLA: 127,000 SF Project Cost: $46MM Currently Leased: 90%+ Completed Fall 2020 Adjacent to WakeMed Cary Hospital HTA’s Development Platform utilizes our MOB expertise, market intelligence, and relationships to develop medical office for the future of healthcare delivery that generate above average returns for investors, generating an aggregate yield on cost in excess of 6.5% Recently Completed Projects in Key Markets Jackson South MOB – Miami, FL Project Highlights: GLA: 52,000 SF Project Cost: $21MM Currently Leased: 70% Completed Spring 2021 Adjacent to Jackson South Hospital Memorial Hospital MOB– Bakersfield, CA Project Highlights: GLA: 84,000 SF Project Cost: $29MM Currently Leased: 90%+ Completed Spring 2021 Adjacent to CommonSpirit’s Memorial Hospital 10 Pavilion III – Dallas, TX Project Highlights: GLA: 109,000 SF Project Cost: $60MM Currently Leased: 74%+ Completed Core/Shell Summer 2021 Adjacent to HCA’s Medical City Heart & Spine Hospital

DEVELOPMENT PIPELINE 2021 Investment Activity Development Update HTA is actively pursuing multiple development opportunities in our key markets. These projects include hospital direct deals, local developer JV’s, and developments on land HTA owns or has purchased. It total, our pipeline consists of 5 projects, including the Texas A&M Innovation Plaza and 4 projects that are in the pre‐leasing phase in Florida, North Carolina and Texas. These projects are located in submarkets experiencing significant population growth, with some projects anticipated to start construction as soon as 4Q 2021. Raleigh MOB – Local JV $55MM+; 107,000 SF Houston MOB – HTA Land $54MM+; 109,000 SF Cary MOB II – Campus Densification $34MM+; 81,000 SF 11 Orlando MOB – High Growth Market $40MM+; 95,000 SF Development Pipeline totals over $375MM and 850K of space in Key Markets, expected to generate an aggregate yield on cost of approximately 7.0% Texas A&M Horizon Tower – Strategic Partnership $215MM+; 485,000 SF Raleigh, NC Raleigh, NC Orlando, FL Houston, TXHouston, TX

HTA’S INVESTMENT IN THE TEXAS MEDICAL CENTER 12 Texas A&M Horizon Tower 6655 Travis MOB HTA 7900 Fannin HTA 1200 Binz 1 4 3 2 1 4 3 2 127k square feet Leased to: UT Health (majority) Acquired in 2021 for $43MM Fee‐Simple ownership 178k square feet Leased to: HCA Acquired in 2010 for $38MM Located on HCA’s Women’s Hospital of Texas 256k square feet Leased to: HCA Acquired in 2016 for $60MM Located on HCA’s Houston Healthcare Medical Center 485k medical office / life sciences tower In collaboration with Texas A&M Health Sciences Center Average stabilized yield of ~7.5% Campus densification is a key component of HTA’s growth strategy. HTA’s investment in the Texas Medical Center, which includes a recent acquisition and announced development, will total over $300MM and over 1MM SF of space Re ce nt A cq ui sit io n N ew D ev el op m en t Ex ist in g Po rt fo lio 2021 InvestmentsTEXAS MEDICAL CENTER Largest Medical Complex in the World 50MM SF Developed Healthcare Space 10MM Patients Per Year 9,500 Hospital Beds 180K Surgeries Per Year 750K ER Visits Per Year 110,000 Employees

TEXAS A&M INNOVATION PLAZA HTA has formed a strategic partnership with Medistar Corporation to finance and co‐develop the Texas A&M Innovation Plaza, a five‐acre mixed‐use project located at the Texas Medical Center, the largest medical center in the world Innovation Plaza Highlights The Texas A&M Innovation Plaza is one of the last remaining parcels available for development within the TMC and represents Texas A&M’s first‐ever campus in the Texas Medical Center as well as Texas A&M’s largest Public‐Private‐ Partnership (P3) in its history located outside of College Station. Phase I: 714‐bed Medical Student Housing Facility Phase II: 2,600 Stall Parking Structure Phase III: 485,000 SF Medical Office/Life Science Tower HTA has committed over $50 million of mezzanine debt to fund the construction of the 19‐story, purpose‐built student housing structure and parking garage, of which $33 million has been invested through June 30, 2021, with an additional $21 million expected to fund in Q3 2021, in addition to another $15 million real estate note. HTA will be the equity partner and co‐developer with Medistar of the medical office and life science tower, known as Horizon Tower, with a total project budget of approximately $215 million. 13

CONTINUED FOCUS AND DEDICATION TO ESG INITIATIVES 14 SocialEnvironment Governance Corporate responsibility partnerships Participant member Member Partner 73% HTA‐managed properties benchmarked on Energy Star Monitor utility usage reduction in water usage (2019 to 2020) (4%) Established ESG subcommittee and task force to drive sustainability initiatives White 68% Non-white 32% New Hires in ‘20 88% Independent board members 50% New board members since 2018 Male 58% Female 42% Workforce by genderreduction in emissions (2019 to 2020) (6%) reduction in energy usage (2019 to 2020) (2%) Note: Information as of December 31, 2020 Please refer back to most recently disclosed 2020 Sustainability Report published on 8/18/21

CONTINUED FOCUS AND DEDICATION TO ESG INITIATIVES Goal Alignment with United Nations Sustainable Development Goals (SDGs) SDG Number (1) Objective Maintain comprehensive employee benefits package Maintain inclusive and diverse workforce Provide training opportunities to develop employee talent Provide equitable employment opportunities within our key markets SDG Number (1) Objective Target Reduce GHG Emissions by 10% over 5 years 2025 Reduce energy consumption by 5% over 5 years 2025 Operate 80% of HTA‐managed assets on automated controls 2024 Benchmark 100% of HTA‐managed assets on Energy Star Platform 2022 Derive less than 10% of annual NOI from properties in high flood risk areas Continual Social (1) Sustainable Development Goal number and theme area as defined by the UN’s 2030 Agenda for Sustainable Development. For more information visit https://sdgs.un.org/goals. Environmental 15

THE HTA DIFFERENCE WakeMed Medical Park of Cary Raleigh, NC

SINCE 2014, WE HAVE GROWN OUR PORTFOLIO & EARNINGS WHILE INCREASING OUR CAPABILITIES AND ESTABLISHING SCALE IN KEY MARKETS WHICH WE BELIEVE FACILITATES COMPANY OPERATIONS & LONG‐TERM GROWTH OPPORTUNITIES Portfolio Size ($B) $3.0B $7.5B Portfolio Size (GLA in millions) 14.1MM SF 25.3MM SF Top Five MSAs Phoenix Pittsburgh Greenville Albany Indianapolis Dallas Boston Houston Miami Indianapolis 1 MM SF Markets 3 10 500K SF Markets 10 17 In-House Property Management (GLA in MM) 90% 13.4MM SF 97% 24.5MM SF % MOB’s 92% 95% Development Pipeline ($ in MM) $0 $375MM Earnings (NFFO/Share) $1.46 $1.76 (1) Payout Ratio (2) 91% 89% Leverage (Net Debt / Adjusted EBITDAre) 5.7x 5.5x (3) 2014 2021 Please reference the Company’s filed and furnished financial reports for the respective periods for financial reconciliations. 2021 data as of June 30, 2021 (1) 2021 NFFO/Share annualized as of June 30, 2021 (2) Payout ratio defined as dividends paid per share out of funds available for distribution (FAD) on a per share basis (3) Includes Unsettled Equity Forward Agreements CREATING THE SUPERIOR PLATFORM 17 Estrella Medical Plaza Phoenix, AZ

INCREASING NORMALIZED FFO/ SHARE SAME STORE CASH NOI GROWTH DIVIDENDS PER SHARE PROVEN TRACK RECORD OF PERFORMANCE TO BOTTOM LINE 18 Continued earnings growth through COVID‐19 2.6% Average Same Store NOI Growth Since 2014 13% Dividend Growth Since 2014 203% Shareholder Return since Inception CONSISTENT PERFORMANCE IN DYNAMIC MARKET CONDITIONS $0.34 $0.36 $0.38 $0.40 $0.42 $0.44 $0.46 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 $0.250 $0.260 $0.270 $0.280 $0.290 $0.300 $0.310 $0.320 $0.330 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21

THE ONLY MOB REIT WITH PROVEN, CONSISTENT DIVIDEND GROWTH 19 DIVIDEND/SH GROWTH (2Q’14 – CURRENT) Source: FactSet (1) Information for PEAK is reflective of dividend growth post spinoff of Quality Care Properties, Inc. in Q4 2016 13.0% 2.2% 0.8% (18.9%) HTA DOC HR PEAK

CONTINUED LEASING STRENGTH 20 OCCUPANCY LEASINGRE-LEASING SPREADS RETENTION (In thousands) 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 ‐ 200 400 600 800 1,000 1,200 1,400 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 Leased SF ‐ New Leased SF ‐ Renewal

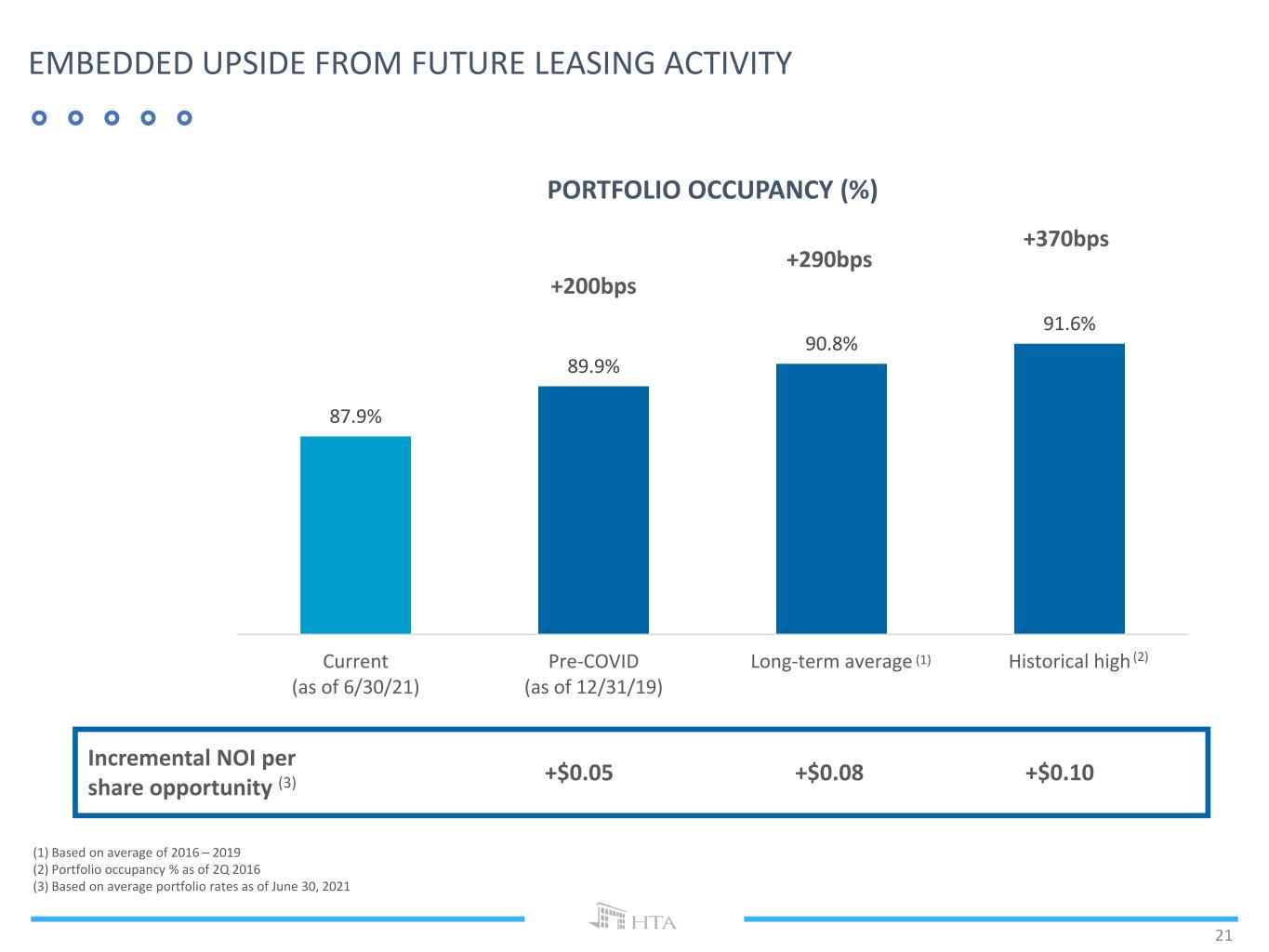

EMBEDDED UPSIDE FROM FUTURE LEASING ACTIVITY 21 PORTFOLIO OCCUPANCY (%) 87.9% 89.9% 90.8% 91.6% Current (as of 6/30/21) Pre‐COVID (as of 12/31/19) Long‐term average Historical high Incremental NOI per share opportunity (3) (1) Based on average of 2016 – 2019 (2) Portfolio occupancy % as of 2Q 2016 (3) Based on average portfolio rates as of June 30, 2021 +$0.05 +$0.08 (1) +200bps +290bps +$0.10 (2) +370bps

Key Considerations: Strategically located, multi‐tenanted MOBs within high‐income, faster growth submarkets that are increasingly targeted by healthcare providers Advances in technology have allowed an increasing number of procedures to be performed off‐campus; including knee and hip replacements. Provider preferences shifting to “off‐campus” (source: Revista Survey) No restrictions – multiple providers and health system networks compete for space Our Portfolio of Both On‐Campus and Off‐Campus Facilities are Essential to the Delivery of Healthcare. Our diligent underwriting and investment expertise has created a portfolio where both our on‐campus and off‐campus MOBs are focused on attractive submarkets, with similar mix of primary care and specialists, and health system tenancy that drives strong levels of tenant retention, occupancy stability, and rent growth over time. ON‐CAMPUS AND OFF‐CAMPUS STRATEGY 22 Key Considerations: Long‐term demand supported by hospital infrastructure and ancillary services Limited developable land around hospital campuses Designated healthcare cluster drives referral patterns Hospital / University name recognition and reputation Clinical, lab, research, and academic space shapes future delivery of healthcare On-Campus / Adjacent: Many on-campus MOB’s are subject to ground leases that allow health systems to restrict leasing and other activities. As such, HTA’s portfolio of On- Campus MOBs is specifically targeted to fee-simple ownership which allows for greater leasing flexibility and superior returns. O n- Ca m pu s - 67 % Co re C om m un ity O ut pa tie nt - 33 % Tenant Specialty – On Campus (% of GLA) Tenant Specialty – Off Campus (% of GLA) 72% 16% 4% 9% Specialty Primary Care Ambulatory Surgery Center Other 67% 18% 6% 10% Specialty Primary Care Ambulatory Surgery Center Other

Tenant Diversification and Viability Position our Portfolio for Long-Term Performance Credit Rated Tenancy (% of Annualized Base Rent) Tenant Classification (% of Annualized Base Rent) Our Partners are the Top Health Systems in our Key Markets in both On‐Campus and Off‐Campus Facilities STRONG STABLE TENANT RELATIONSHIPS 23 49% 11% 40% Investment Grade Other Credit Rated Not Rated/Other MOB Tenant Diversification (% of MOB GLA) 74% of our tenant base is comprised of health systems, universities, and large/regional providers and 60% of our tenant base is credit rated 60% 14% 26% Health Systems/Universities National/Large Regional Providers Local Healthcare Providers/Other 76% 24% Multi‐Tenant Single‐Tenant

STRONG BALANCE SHEET AND SIGNIFICANT LIQUIDITY POSITIONED FOR GROWTH 24 Capital structure Well-Staggered Debt Maturities ($mm) Multiple Capital Sources ($mm) Highlights (1) Includes undrawn capacity on unsecured revolving credit facility, cash and cash equivalents, restricted cash and net cash from outstanding forward equity (2) Pro forma for equity forward agreements of $277.5MM of cash to be settled with issuance of ~9.4mm common shares; Based on share price as of 9/10/21 (3) Includes $65MM of restricted cash for funds held in a 1031 exchange account pending re‐investment (4) HTA had $277.5MM of equity, based on an average initial forward price of $29.46 per share, to be settled on a forward basis with the issuance of approximately 9.4MM shares of common stock, subject to adjustment for costs to borrow under the terms of the applicable equity distribution agreements ►~ $1.3(1) billion of liquidity to fund future growth ►No near‐term debt maturities until 2023 ► Investment grade rating, BBB/Baa2 Stable ►Conservative leverage ratios ►Net Debt / LQA Adjusted EBITDA: 5.5x(2)(3) ►Net Debt / Total Market Capitalization: 28.0%(2)(3) $300 $600 $500 $650 $200 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Unsecured Revolving Credit Facility Unsecured Term Loans Unsecured Senior Notes $20 $1,317 $65 $277 $955 Cash Restricted cash Net cash from forward equity Unsecured undrawn RCF Near‐term liquidity (1) (4) Unsecured debt, net, 28% Equity, 72% Low leverage, flexible capital structure with proven access to debt and equity markets (2) (2)(3) $45 $800

MOB SECTOR UPDATE The Pavilion MOB Dallas, TX

13% 52% 10% 24% REITs Hospitals / Health Systems Provider Owner Investor / Private THE MEDICAL OFFICE BUILDING THESIS Why Healthcare? • Healthcare is the fastest growing sector in dollars and in employment within the US. • Healthcare is shifting to outpatient locations to focus on cost‐effective care. Medical Office Buildings, or “MOBs,” are the primary beneficiary of this trend. • Utilization of ambulatory surgery centers (ASCs) over traditional hospital settings improves access to high‐quality care in a low‐cost setting, driving increased demand for outpatient surgery space. • Healthcare providers are consolidating and will require new and innovative capital providers who can help meet their strategic goals. Why Medical Office Buildings? • MOBs are traditional real estate where location, barriers to entry, and operations are critical. • MOBs deliver steady and consistent growth with limited capital and volatility in all market conditions. • MOB sector is fragmented, which provides opportunity for HTA to capture market share. • MOBs have limited new supply concerns. • Dedicated MOB operators understand healthcare providers and the real estate dynamics to ensure premium performance. Source: Revista 26

TRENDS IN HEALTHCARE DELIVERY 27 Shift to Outpatient Care • ASCs drive efficiency and accessibility through streamlined care, resulting in more affordable healthcare delivery and increased demand. As a result, ASC market is projected to grow at a compound annual growth rate of 6% between 2018 and 2023 (1) • Large health systems, such as UnitedHealth Group have committed to driving more outpatient surgeries and services to lower‐cost outpatient settings over the next 10 years, with 55% of outpatient surgeries and radiology services to be delivered at high‐quality, cost‐ efficient sites of care by 2030 (2) • Seismic shifts expected in the outpatient landscape over the next decade (3) Surgical volumes expected to shift from inpatient to outpatient, with patient volume expected to increase by 25% in ASCs and 18% in physician office and clinical settings by 2029 Shift will accelerate as CMS eliminates all of the procedures listed on their in‐patient only list and expands the number of ASC‐covered procedures by 278 by the end of 2023 (1) Source: Kumar, P. & Parthasarathy, R., “Walking out of the hospital: The continued rise of ambulatory care and how to take advantage of it,” McKinsey & Company, September 2020 (2) Source: UHG 2020 Sustainability Report; https://www.unitedhealthgroup.com/viewer.html?file=/content/dam/UHG/PDF/sustainability/final/2020_SustainabilityReport.pdf (3) Source: Sg2 Impact of Change Forecast Predicts Enormous Disruption in Health Care Provider Landscape by 2029; https://newsroom.vizientinc.com/content/1221/files/Documents/2021_PR_ImpactOfChange.pdf Note: Analysis excludes volumes for ICD‐10 diagnosis code U07.1, COVID‐19 infection. OP surgery defined as outpatient procedures—major. E&M = evaluation and management. Sources: Impact of Change®, 2021; Proprietary Sg2 AllPayer Claims Data Set, 2018; The following 2018 CMS Limited Data Sets (LDS): Carrier, Denominator, Home Health Agency, Hospice, Outpatient, Skilled Nursing Facility; Claritas Pop‐Facts®, 2021; Sg2 Analysis, 2021. Surgical Volumes Shift to Lower-Cost Care Sites Adult Outpatient Forecast Impact of Change® 2021 Care Site 2019 Baseline Volume 5-Year Growth 2024 Volume 10-Year Growth 2029 Volume ASCs 32.0M +14% 36.5M +25% 40.1M Office/Clinic 19.2M +9% 21.0M +18% 22.7M Note: Analysis excludes 0–17 age group. Forecast pulled for procedures—major and endoscopy volumes only. Sources: Impact of Change®, 2021; Proprietary Sg2 All‐Payer Claims Data Set, 2018; The following 2018 CMS Limited Data Sets (LDS): Carrier, Denominator, Home Health Agency, Hospice, Outpatient, Skilled Nursing Facility; Claritas Pop‐Facts®, 2021; Sg2 Analysis, 2021.

PRIVATE MARKET DEMAND FOR MOB REMAINS HIGH 28 (1) Source: Revista Q2’21 Medical Real Estate Transactions Report published 8/10/21; Cap rate represents the average between the 75th percentile and the lowest cap rate in the Revista report 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 1Q 17 2Q 17 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 Institutional Quality MOB Cap Rates (1) High Demand Sector: Institutional interest in the MOB sector remains high given its steady, consistent returns and long‐term growth outlook. High‐quality, institutional MOBs continue to trade into the high 4’s, low 5 cap rate area, while the median MOB trades in the mid to high 5 cap rate area. Portfolio transactions are pricing 25 – 100bps lower than individual transactions, on average. Transaction volumes have rebounded in 2Q21 after decreasing in 2020 as a result of COVID.

Community-Core Trends: • Over the past decade, care options, including those provided by ambulatory surgery centers have expanded in community‐core settings • Convenience plays an increasing role as patients have an alternative to traditional on‐campus visits – allowing for care delivery typically closer to residential areas • Diverse practice types located in multi‐tenant community‐ core locations provides for broad and comprehensive care options ON‐CAMPUS & COMMUNITY CORE OUTPATIENT 29 Both On‐Campus and Community Core Locations Demonstrate Strong Fundamentals Source: Revista http://mobscene.revistamed.com/wp‐ content/uploads/2021/02/Off‐Campus‐Report.pdf Pricing and Growth: • Despite the assumption on‐campus favors higher rents and growth, the data on these metrics suggests otherwise • Rent growth and average base rents for community‐core properties have trended to be equal to or greater than their on‐campus medical office counterparts • High quality community‐core assets continue to be a key component of our asset mix and affords investment flexibility Source: Revista http://mobscene.revistamed.com/wp‐ content/uploads/2021/02/Off‐Campus‐Report.pdf

MOBs demonstrated their stability during the COVID pandemic, with patient visits rebounding quickly after the initial shut‐downs. Note: Data are presented as a percentage change in the number of visits in a given week from the baseline week (Week 10, or March 1–7, 2020). “Typical year” data from 2016 to 2019 were also calculated as a percentage change from the baseline week — week 10 — in those years. Data are equally weighted across the four years. Source: Ateev Mehrotra et al., The Impact of COVID‐19 on Outpatient Visits in 2020: Visits Remained Stable, Despite a Late Surge in Cases (Commonwealth Fund, Feb. 2021). https://doi.org/10.26099/bvhf‐e411 Percent Change in Number of Ambulatory Visits In A Given Week Since Baseline Week (March 1 – 7) MEDICAL OFFICE RESILIENCY DURING COVID‐19 ‐70% ‐60% ‐50% ‐40% ‐30% ‐20% ‐10% 0% 10% 20% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 Week Number Typical‐year trend 2020 Baseline Week HTA’s COVID-19 Response: 1. Focused on healthcare relationships 2. Positioned portfolio for rebound and focus on outpatient growth 3. Remained disciplined in our investment approach, focusing on key markets and assets that we expect to perform over the long‐term 4. Preserved our capital and balance sheet Trends Accelerated by COVID-19: Increased use of telemedicine, which is growing overall patient volumes Shift to lower‐cost and more convenient outpatient locations Increasing provider consolidation 30

There is a distinct variation in telemedicine use across specialties. Specialty practices are continuing to see the majority of patients in a clinical setting, which we expect to continue post‐COVID TELEMEDICINE: IMPACT ON MEDICAL OFFICE 56% 25% 17% 17% 14% 14% 13% 12% 8% 7% 6% 6% 5% 4% 3% 3% 3% 3% 2% 1% 1% 0% Behavioral health Endocrinology Neurology Rheumatology Gastroenterology Anesthesiology Pulmonology Adult primary care Pediatrics Allergy/Immunology Oncology Urgent care Cardiology Urology Physical medicine & rehab Dermatology Surgery Obstetrics/Gynecology Orthopedics Otolaryngology Podiatry Ophthalmology December 2020 Virtual Visits as a Percentage of Total Baseline Visits Note: Data presented are for the selected specialties shown only and expressed as a percentage: the number of telemedicine visits over the final three nonholiday weeks of 2020 is the numerator, while the number of visits in the baseline week (March 1– 7), multiplied by three, is the denominator. Telemedicine includes both telephone and video visits. We did not include weeks in December with holidays or the shortened week at the end of the year. Source: Ateev Mehrotra et al., The Impact of COVID‐19 on Outpatient Visits in 2020: Visits Remained Stable, Despite a Late Surge in Cases (Commonwealth Fund, Feb. 2021). https://doi.org/10.26099/bvhf‐e411 31

THANK YOU Coral Reef MOB Miami, FL