Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGILE THERAPEUTICS INC | agrx-20210910x8k.htm |

Exhibit 99.1

| NASDAQ: AGRX Agile Therapeutics (AGRX) Corporate Presentation September 2021 1 |

| NASDAQ: AGRX Forward-Looking Statements Certain information contained in this presentation and other matters discussed today or answers that may be given in response to questions may include “forward-looking statements.” We may, in some cases, use terms such as “predicts,” “believes,” “potential,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Our forward-looking statements are based on current beliefs and expectations of our management team that involve risks, potential changes in circumstances, assumptions, and uncertainties, including statements regarding our ongoing and planned manufacturing and commercialization of Twirla®, the potential market acceptance and uptake of Twirla®, the size of our addressable market, our results of operations, our estimates on the net sales and number of units sold based on total prescription demand for Twirla in the third quarter 2021 and operating expenses for the second half of 2021, financial condition, liquidity, prospects, growth and strategies, the length of time that we will be able to continue to fund our operating expenses and capital expenditures and our expected financing needs and sources of financing, including our debt financing from Perceptive Advisors. Any or all of the forward-looking statements may turn out to be wrong or be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. These forward-looking statements are subject to risks and uncertainties including risks related to our ability to maintain regulatory approval of Twirla, the ability of Corium to produce commercial supply in quantities and quality sufficient to satisfy market demand for Twirla, our ability to successfully commercialize Twirla, the accuracy of our estimates of the potential market for Twirla, regulatory and legislative developments in the United States and foreign countries, our ability to obtain and maintain intellectual property protection for Twirla, our strategy, business plans and focus, the effects of the COVID-19 pandemic on our operations and the operations of third parties we rely upon as well as on our potential customer base, our ability to meet or exceed the revenue thresholds necessary to permit us to access the remaining amount available under our existing debt financing from Perceptive Advisors and the other risks set forth in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. These factors could cause actual results and developments to be materially different from those expressed in or implied by such statements. These forward-looking statements are made only as of the date of this presentation and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. |

| NASDAQ: AGRX 3 Who We Are |

| NASDAQ: AGRX 4 • A commercial-stage company dedicated to building a robust Women’s Health Franchise • Headquartered in Princeton, NJ • Currently focused on contraception, specifically our first FDA-approved product Twirla® • Senior leadership largely comprised of J&J alumni responsible for the launch of Ortho Evra Who We Are Establish Agile in Contraceptive Market with Twirla Become Contraceptive Market Leader Broaden Women’s Health Portfolio in Areas of Unmet Need |

| NASDAQ: AGRX 5 Our Product |

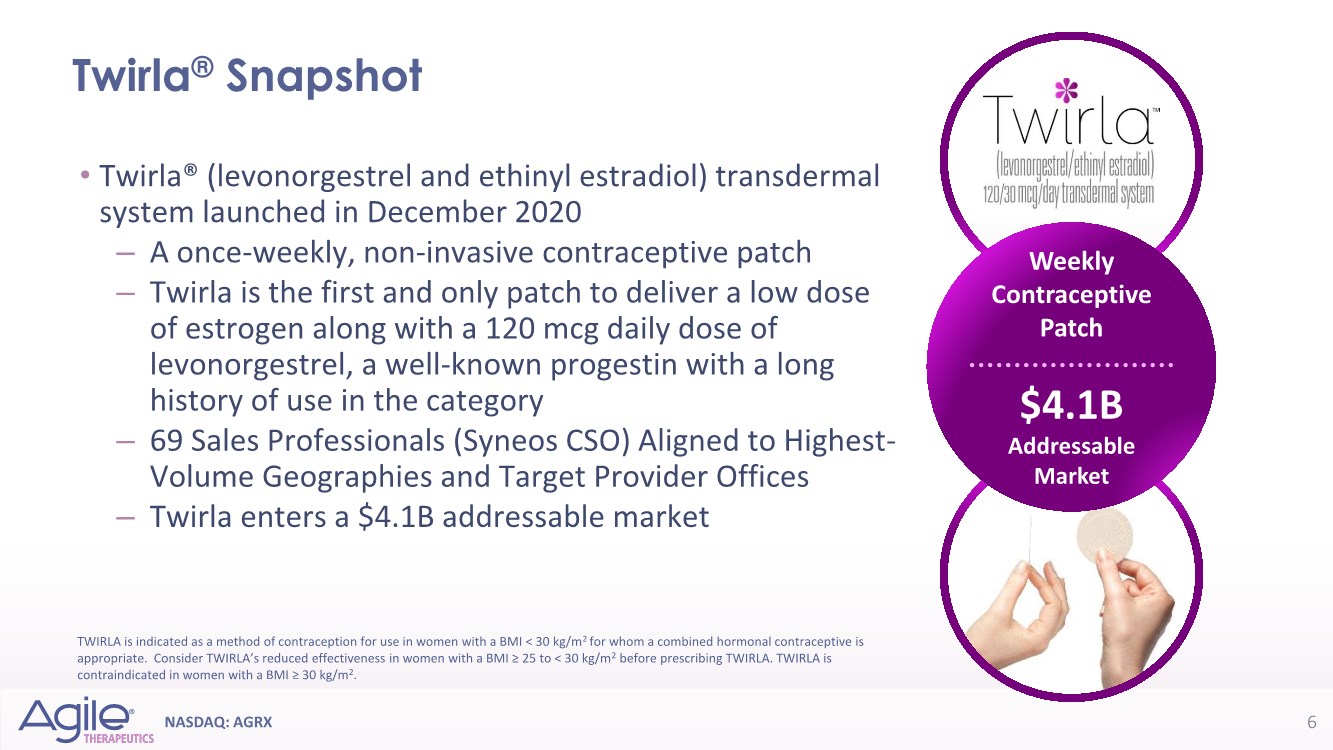

| NASDAQ: AGRX 6 • Twirla® (levonorgestrel and ethinyl estradiol) transdermal system launched in December 2020 ‒ A once-weekly, non-invasive contraceptive patch ‒ Twirla is the first and only patch to deliver a low dose of estrogen along with a 120 mcg daily dose of levonorgestrel, a well-known progestin with a long history of use in the category ‒ 69 Sales Professionals (Syneos CSO) Aligned to Highest- Volume Geographies and Target Provider Offices ‒ Twirla enters a $4.1B addressable market Twirla® Snapshot Weekly Contraceptive Patch $4.1B Addressable Market TWIRLA is indicated as a method of contraception for use in women with a BMI < 30 kg/m2 for whom a combined hormonal contraceptive is appropriate. Consider TWIRLA’s reduced effectiveness in women with a BMI ≥ 25 to < 30 kg/m2 before prescribing TWIRLA. TWIRLA is contraindicated in women with a BMI ≥ 30 kg/m2. |

| NASDAQ: AGRX Potential to reduce burden associated with daily pills 49% of contraception users prefer non-daily method3 52% are frustrated with taking the pill daily3 NON- DAILY OPTIONS May be preferred by some women4 Some women prefer to avoid injections, implants, and intrauterine devices LESS INVASIVE METHODS LOWER ESTROGEN DOSE The dose of estrogen in CHCs is believed to be the primary factor contributing to unwanted side effects1 The only other non-daily transdermal patch currently available delivers a high dose of estrogen2 “Some women are just not good at remembering to take a pill at the same time every day…Others don’t want something in their vagina while others don’t want an injection.” - Ob/Gyn 1-Poindexter, A., Fertility and Sterility 2001; 2-Xulane Package Insert; 3-Mansour D., International Journal of Women’s Health 2014; 4- Qualitative and quantitative HCP research, Kantar Health 2010; Third party research, 2017 Considerations for Hormonal Contraceptive Choices 7 |

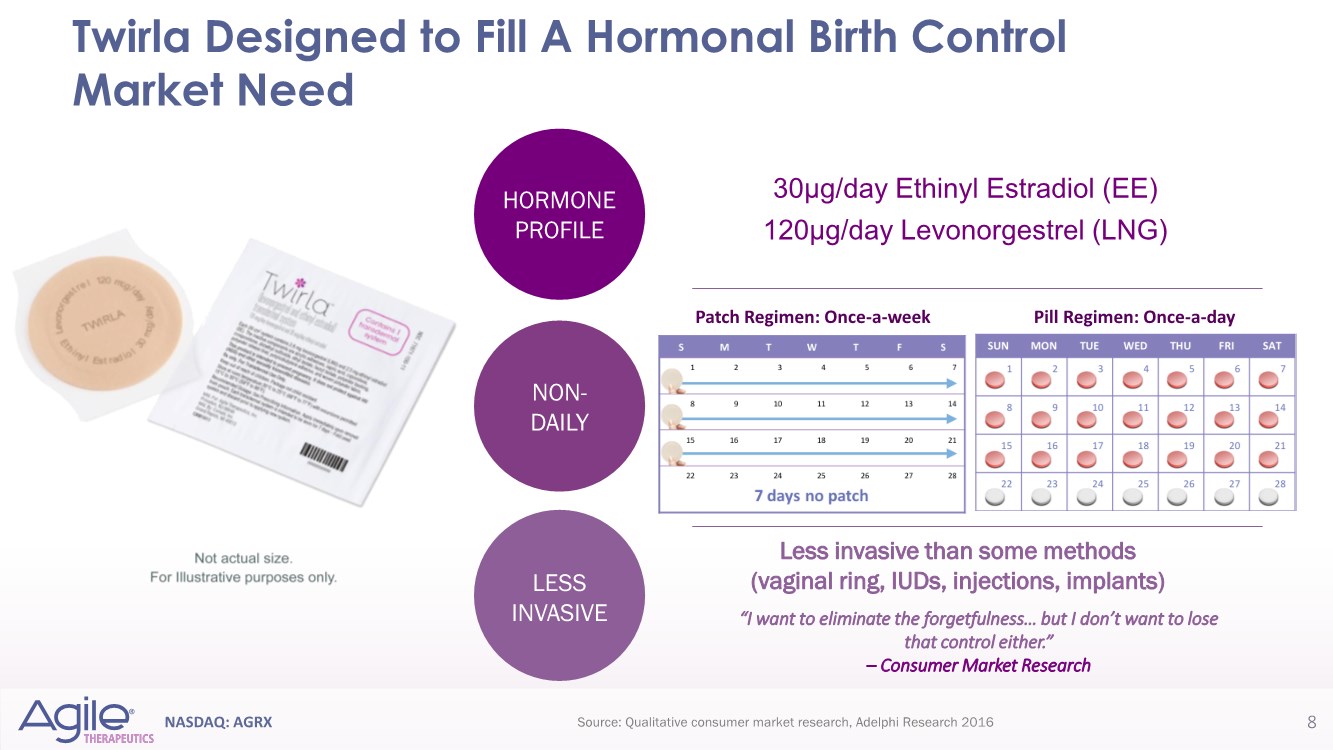

| NASDAQ: AGRX 30µg/day Ethinyl Estradiol (EE) 120µg/day Levonorgestrel (LNG) Twirla Designed to Fill A Hormonal Birth Control Market Need 8 Less invasive than some methods (vaginal ring, IUDs, injections, implants) “I want to eliminate the forgetfulness… but I don’t want to lose that control either.” – Consumer Market Research Source: Qualitative consumer market research, Adelphi Research 2016 Pill Regimen: Once-a-day Patch Regimen: Once-a-week NON- DAILY LESS INVASIVE HORMONE PROFILE |

| NASDAQ: AGRX 9 Where We Are |

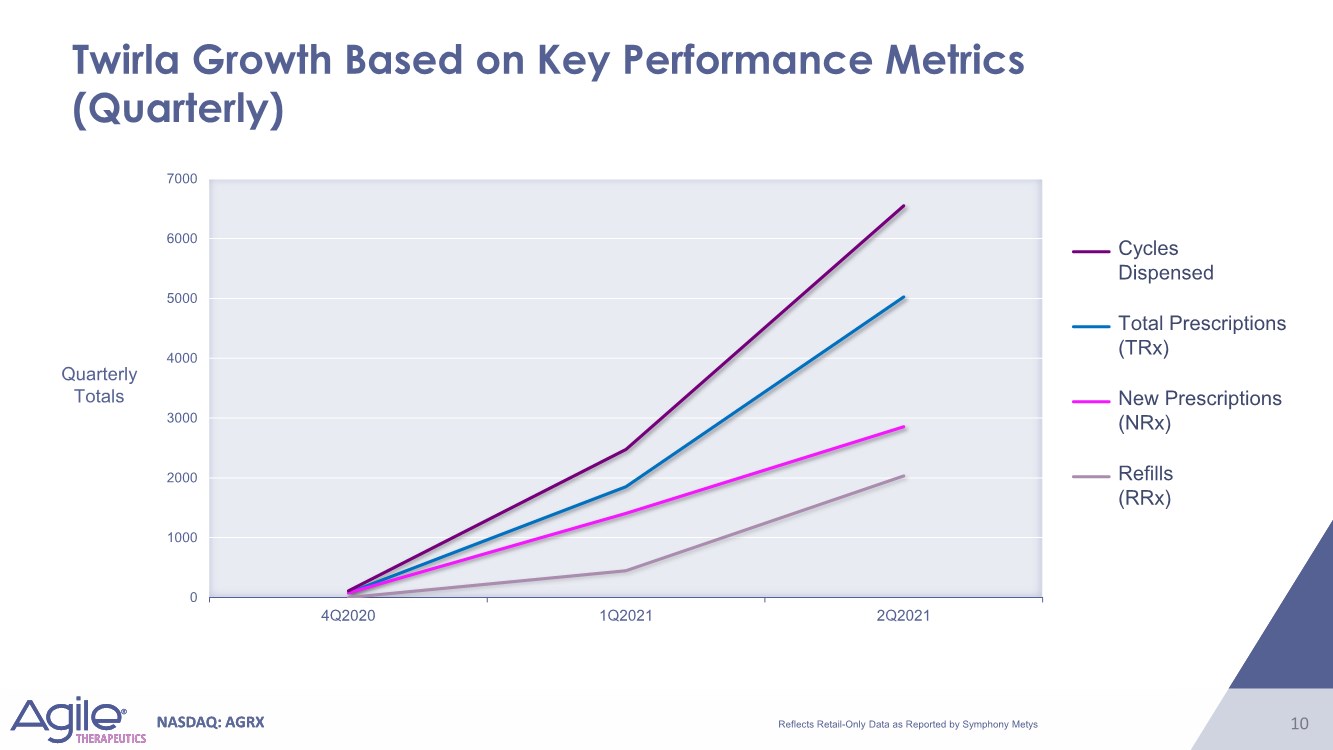

| NASDAQ: AGRX 10 NASDAQ: AGRX 10 0 1000 2000 3000 4000 5000 6000 7000 4Q2020 1Q2021 2Q2021 Twirla Growth Based on Key Performance Metrics (Quarterly) Quarterly Totals Cycles Dispensed Total Prescriptions (TRx) New Prescriptions (NRx) Refills (RRx) Reflects Retail-Only Data as Reported by Symphony Metys |

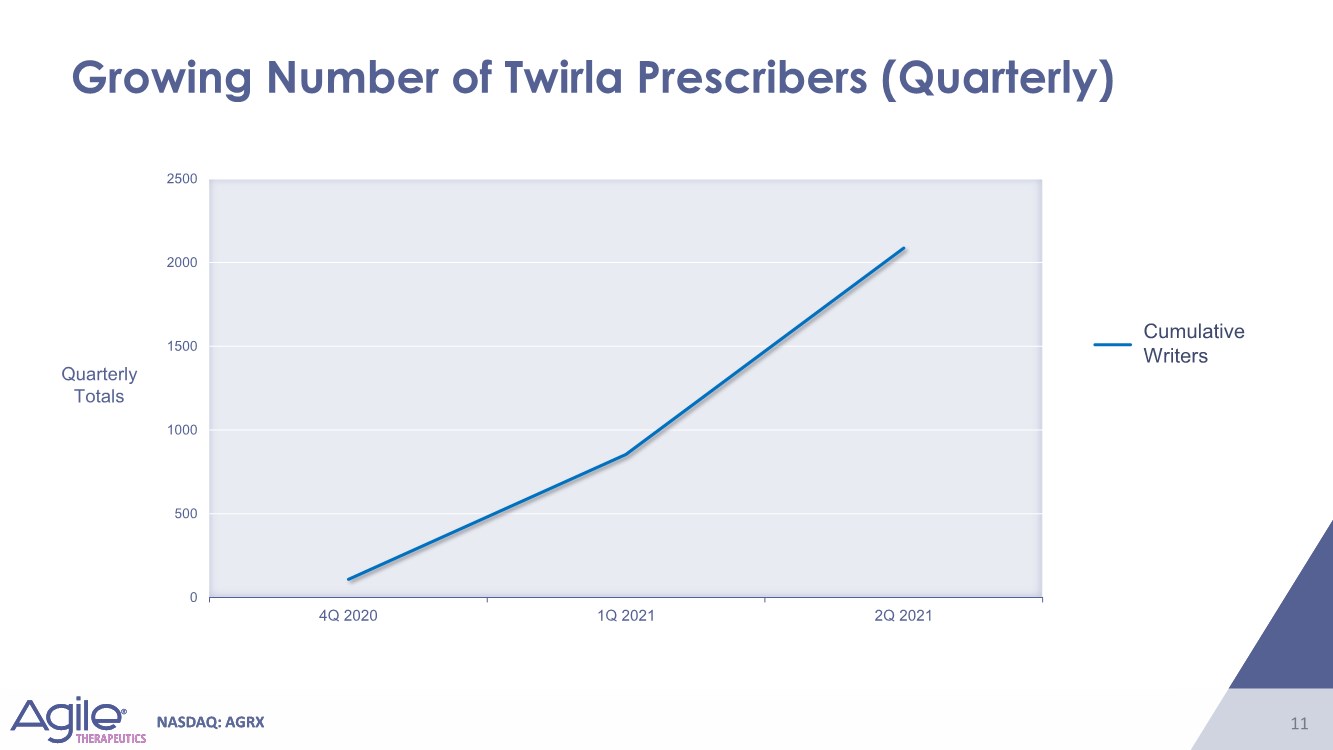

| NASDAQ: AGRX 11 NASDAQ: AGRX 11 Growing Number of Twirla Prescribers (Quarterly) Cumulative Writers Quarterly Totals 0 500 1000 1500 2000 2500 4Q 2020 1Q 2021 2Q 2021 |

| NASDAQ: AGRX 12 NASDAQ: AGRX 12 How We Plan to Accelerate Growth |

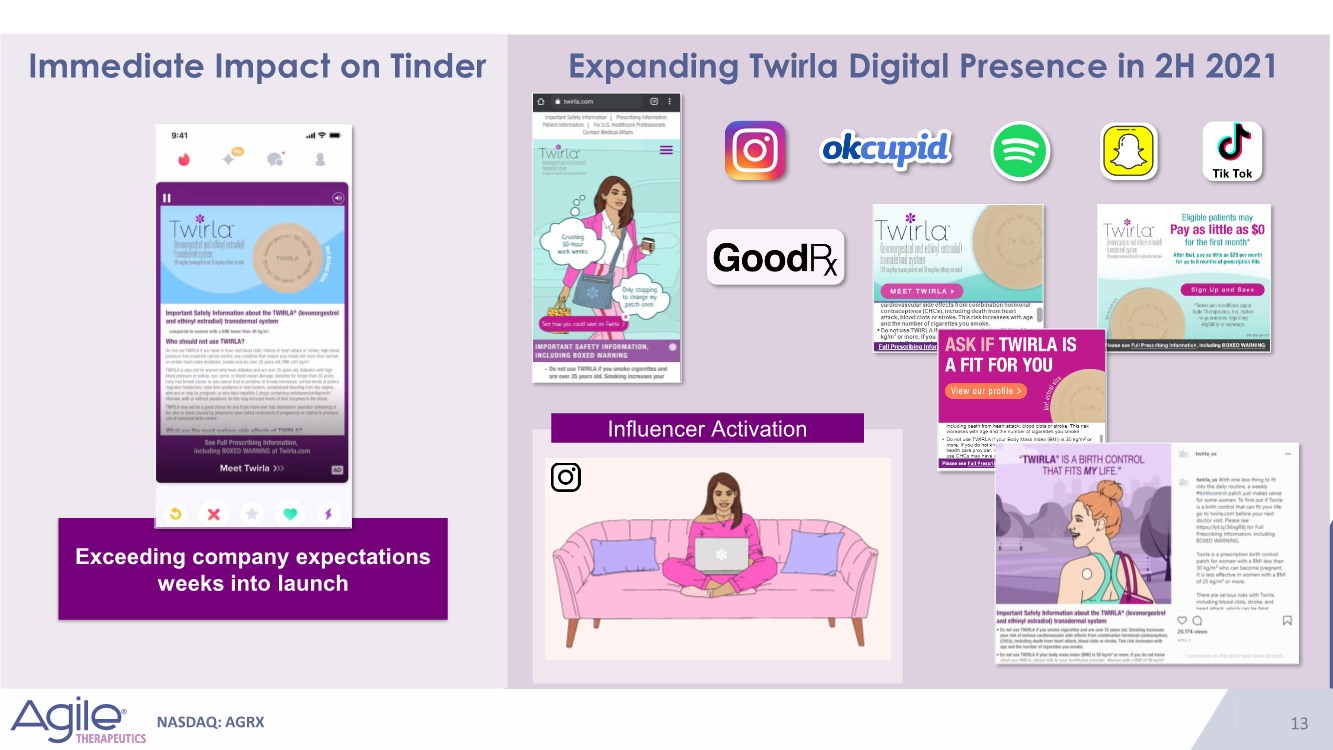

| NASDAQ: AGRX 13 Immediate Impact on Tinder Expanding Twirla Digital Presence in 2H 2021 Influencer Activation Exceeding company expectations weeks into launch |

| NASDAQ: AGRX Minimize Access Barriers for Patients 14 • Twirla is now available to Medicaid patients in approximately 75% of states either through traditional Medicaid and/or managed Medicaid. With these new additions, Twirla now has coverage in approximately 50% of the total Medicaid transdermal TRx market with no restrictions. • Overall, Twirla has access in approximately 55% of the commercial and government CHC market based on claims. • In addition to progress on Medicaid and Managed Care access, the Company also saw expanded access through state clinics, where there was significant non-retail prescription volume in the second quarter 2021. • Additional access support: - Third-party support to facilitate timely submission of prior authorizations for patient access - Co-Pay card reimbursement assistance - Full-month samples for patient trial |

| NASDAQ: AGRX Recent Partnership Announcement 15 |

| NASDAQ: AGRX 16 Beyond Twirla® |

| NASDAQ: AGRX Commitment to Enhancing Shareholder Value 17 The Company believes that building a U.S. women’s health franchise on the foundation of Twirla’s commercial success can enhance value for our shareholders. A successful launch of Twirla is our primary focus. • Reevaluation and planning potential development of our internal pipeline candidates is on-going in 2021 • We are open to potentially acquiring new assets to expand our reach in women’s health We have sought out and will continue to explore partnerships and opportunities that leverage our existing infrastructure: • Co-promotion within the U.S. • Partnerships outside of the U.S. • Any other opportunities that have the potential to enhance shareholder value |

| NASDAQ: AGRX 18 Financial Update |

| NASDAQ: AGRX 19 Financial Update & Company Outlook Second Quarter 2021 Results Net product sales revenue of $1.2 million reflected market demand as we completed our inventory drawdown. Total expenses were in-line with expectations, addressing commercialization activities for Twirla Near-Term Outlook Revenue expected to more closely reflect TRx demand in 2H21 and wholesaler restocking Operating expense at similar levels to Q2 spending in 2H21 within a range of $1- $2 million as a result of continued spending on commercial costs from product samples, branded marketing and potential inventory reserves. Financial Flexibility • $30.1 million cash, cash equivalents and marketable securities as of June 30, 2021, and potential access to additional capital under existing loan facility subject to financial milestones • Potential to access additional capital through at-the-market arrangement to sell up to $50 million of company common stock. |

| NASDAQ: AGRX 20 We Continue to Focus on Growth in Q3 2021 Agile continues to focus on growing sales of Twirla in both the retail and non-retail channels. We are seeking to expand access to Twirla through initiatives like the recent collaboration with telemedicine provider, Pandia Health. Progress in the Retail channel. Estimated Q3 2021 retail units (cycles) sold based on script demand is expected to be in the range of 9,500 to 10,000 units, which would reflect an estimated 50% to 56% quarterly growth over the 6,400 retail units sold in Q2 2021. We seek to cultivate strategic Institutional Accounts. We do not expect meaningful sales into the non-retail institutional channel in 3Q 2021 but continue to explore developing institutional accounts. In Q2 2021 we had a significant purchase of 2,100 units of Twirla. Revenue outlook for Q3 2021. As previously guided, we expect net sales from our retail accounts to reflect more closely TRx script demand, with each script representing 1.3 cycles or monthly prescriptions of Twirla (3 patches). We estimate Q3 2021 net sales will be in the range of $1.4 million to $1.6 million. |