Attached files

Exhibit 99.3

PRO FORMA VALUATION REPORT

MUTUAL HOLDING COMPANY

STOCK OFFERING

CFSB Bancorp, Inc. | Quincy, Massachusetts

HOLDING COMPANY FOR:

Colonial Federal Savings Bank | Quincy, Massachusetts

Valuation Date: August 20, 2021

1311-A Dolley Madison Boulevard, Suite 2A

McLean, Virginia 22101

703.528.1700

rpfinancial.com

August 20, 2021

Board of Directors

Colonial Federal Savings Bank

15 Beach Street

Quincy, Massachusetts 02170

Members of the Board of Directors:

At your request, we have completed and hereby provide an independent appraisal (“Appraisal”) of the estimated pro forma market value of the common stock which is to be issued in connection with the stock issuance transaction described below.

This Appraisal is furnished pursuant to the requirements stipulated in the Code of Federal Regulations and has been prepared in accordance with the “Guidelines for Appraisal Reports for the Valuation of Savings and Loan Associations Converting from Mutual to Stock Form of Organization” (the “Valuation Guidelines”) of the Office of Thrift Supervision (“OTS”) and accepted by the Federal Reserve Board (“FRB”), the Office of the Comptroller of the Currency (“OCC”) and the Federal Deposit Insurance Corporation (“FDIC”), and applicable regulatory interpretations thereof.

Description of Plan of Reorganization and Stock Issuance

The board of directors of Colonial Federal Savings Bank (“Colonial” or the “Bank”) has approved the Plan of Reorganization pursuant to which the Bank will reorganize from a federally-chartered mutual savings bank into a two-tier mutual holding company structure. After the reorganization, CFSB Bancorp, Inc. (“CFSB” or the “Company”) will be the mid-tier stock holding company and Colonial MHC (the “MHC”) will be the top-tier mutual holding company. After the offering, purchasers in the offering will own 45% and the MHC will own 55% of the outstanding shares of common stock of the Company. After the reorganization is completed, the Company will own all of the outstanding capital stock of the Bank.

CFSB Bancorp will offer its common stock in a subscription offering to Eligible Account Holders, Tax-Qualified Employee Plans, Supplemental Eligible Account Holders and Other Members as such terms are defined for purposes of applicable regulatory guidelines governing stock offerings by mutual institutions. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to members of the general public in a community offering and a syndicated or firm commitment offering.

At this time, no other activities are contemplated for the Company other than 100% ownership of its subsidiary, the Bank, investment of the net cash proceeds retained at the holding company level and extending a loan to the employee stock ownership plan (the “ESOP”). In the future, CFSB Bancorp may acquire or organize other operating subsidiaries, diversify into other banking-related activities, pay dividends or repurchase its stock, although there are no specific plans to undertake such activities at the present time.

| 1311-A Dolley Madison Boulevard, Suite 2A | Telephone: (703) 528-1700 | |

| McLean, VA 22101 | Fax No.: (703) 528-1788 | |

| www.rpfinancial.com | Toll-Free No.: (866) 723-0594 | |

| E-Mail: mail@rpfinancial.com |

Board of Directors

August 20, 2021

Page 2

The Plan provides for a contribution to the a newly-established charitable foundation incorporated by Colonial Federal Savings Bank (the “Foundation”). The Foundation contribution will be funded with a $250,000 cash contribution and 2% of the number of shares outstanding at the close of the offering. The purpose of the Foundation is to provide financial support to charitable organizations in the communities in which Colonial operates and to enable those communities to share in Colonial’s long-term growth. The Foundation is dedicated completely to community activities and the promotion of charitable causes.

RP® Financial, LC.

RP® Financial, LC. (“RP Financial”) is a financial consulting firm serving the financial services industry nationwide that, among other things, specializes in financial valuations and analyses of business enterprises and securities, including the pro forma valuation for savings institutions converting from mutual-to-stock form. The background and experience of RP Financial is detailed in Exhibit V-1. We believe that, except for the fee we will receive for the Appraisal, we are independent of the Bank and the other parties engaged by Colonial to assist in the minority stock offering process.

Valuation Methodology

In preparing our Appraisal, we have reviewed the regulatory applications of the Company, the Bank and the MHC, including the prospectus as filed with the FRB, the OCC and the Securities and Exchange Commission (“SEC”). We have conducted a financial analysis of Colonial that has included a review of audited financial information for the years ended 2017 through 2021 and conducted a review of various unaudited information and internal financial reports through June 30, 2021, and had due diligence related discussions with the Bank’s management; Wolf & Company, P.C., the Bank’s independent auditor; Luse Gorman, PC, the Bank’s counsel for the stock issuance and Piper Sandler & Company, the Bank’s marketing advisor in connection with the stock offering. All assumptions and conclusions set forth in the Appraisal were reached independently from such discussions. In addition, where appropriate, we have considered information based on other available published sources that we believe are reliable. While we believe the information and data gathered from all these sources are reliable, we cannot guarantee the accuracy and completeness of such information.

We have investigated the competitive environment within which Colonial operates and have assessed Colonial’s relative strengths and weaknesses. We have kept abreast of the changing regulatory and legislative environment for financial institutions and analyzed the potential impact on Colonial and the industry as a whole. We have analyzed the potential effects of the stock offering on Colonial’s operating characteristics and financial performance as they relate to the pro forma market value of CFSB Bancorp. We have reviewed the economic and demographic characteristics of the Bank’s primary market area. We have compared Colonial’s financial performance and condition with selected publicly-traded thrifts in accordance with the Valuation Guidelines, as well as all publicly-traded thrifts and thrift holding companies. We have reviewed the current conditions in the securities markets in general and the market for thrift stocks in particular, including the market for existing thrift issues and initial public offerings by thrifts and thrift holding companies. We have excluded from such analyzes thrifts subject to announced or rumored acquisitions, and/or institutions that exhibit other unusual characteristics.

Board of Directors

August 20, 2021

Page 3

The Appraisal is based on Colonial’s representation that the information contained in the regulatory applications and additional information furnished to us by Colonial and its independent auditor, legal counsel and other authorized agents are truthful, accurate and complete. We did not independently verify the financial statements and other information provided by Colonial, or its independent auditor, legal counsel and other authorized agents nor did we independently value the assets or liabilities of Colonial. The valuation considers Colonial only as a going concern and should not be considered as an indication of Colonial’s liquidation value.

Our appraised value is predicated on a continuation of the current operating environment for Colonial and for all thrifts and their holding companies. Changes in the local, state and national economy, the legislative and regulatory environment for financial institutions and mutual holding companies, the stock market, interest rates, and other external forces (such as natural disasters or significant world events) may occur from time to time, often with great unpredictability and may materially impact the value of thrift stocks as a whole or the value of CFSB Bancorp’s stock alone. It is our understanding that there are no current plans for selling control of CFSB Bancorp following completion of the stock offering. To the extent that such factors can be foreseen, they have been factored into our analysis.

The estimated pro forma market value is defined as the price at which CFSB Bancorp’s common stock, immediately upon completion of the stock offering, would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.

Valuation Conclusion

Based on the foregoing, it is our opinion that, as of August 20, 2021, the estimated aggregate pro forma market value of the shares to be issued immediately following the conversion, both shares issued publicly as well as to the MHC and the Foundation, equaled $50,000,000 at the midpoint, equal to 5,000,000 shares offered at a per share value of $10.00. Pursuant to conversion guidelines, the 15% offering range indicates a minimum value of $42,500,000 and a maximum value of $57,500,000. Based on the $10.00 per share offering price determined by the Board, this valuation range equates to total shares outstanding of 4,250,000 at the minimum and 5,750,000 at the maximum. In the event the appraised value is subject to an increase, the aggregate pro forma market value may be increased up to a super maximum value of $66,125,000 without a resolicitation. Based on the $10.00 per share offering price, the super maximum value would result in total shares outstanding of 6,612,500.

The Board of Directors has established a public offering range such that the public ownership of the Company will constitute a 43.0% ownership interest, prior to the issuance of shares to the Foundation. Accordingly, the offering to the public of the minority stock will equal $18,275,000 at the minimum, $21,500,000 at the midpoint, $24,725,000 at the maximum and $28,433,750 at the super maximum of the valuation range. Based on the public offering range and inclusive of the shares issued to the Foundation, equal to 2.0% of the shares issued in the conversion, the public ownership of shares will represent 45.0% of the shares issued throughout the valuation range.

Board of Directors

August 20, 2021

Page 4

Limiting Factors and Considerations

The valuation is not intended, and must not be construed, as a recommendation of any kind as to the advisability of purchasing shares of the common stock. Moreover, because such valuation is determined in accordance with applicable regulatory guidelines and is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of common stock in the stock offering will thereafter be able to buy or sell such shares at prices related to the foregoing valuation of the estimated pro forma market value thereof. The appraisal reflects only a valuation range as of this date for the pro forma market value of CFSB Bancorp immediately upon issuance of the stock and does not take into account any trading activity with respect to the purchase and sale of common stock in the secondary market on the date of issuance of such securities or at anytime thereafter following the completion of the stock offering.

RP Financial’s valuation was based on the financial condition and operations of Colonial as of June 30, 2021, the date of the financial data included in the prospectus.

RP Financial is not a seller of securities within the meaning of any federal and state securities laws and any report prepared by RP Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities. RP Financial maintains a policy which prohibits RP Financial, its principals or employees from purchasing stock of its client institutions.

This valuation will be updated as provided for in the conversion regulations and guidelines. These updates will consider, among other things, any developments or changes in the financial performance and condition of Colonial, management policies, and current conditions in the equity markets for thrift shares, both existing issues and new issues. These updates may also consider changes in other external factors which impact value including, but not limited to: various changes in the legislative and regulatory environment for financial institutions, the stock market and the market for thrift stocks, and interest rates. Should any such new developments or changes be material, in our opinion, to the valuation of the shares, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in the update at the date of the release of the update. The valuation will also be updated at the completion of CFSB Bancorp’s stock offering.

| Respectfully submitted, |

| RP® FINANCIAL, LC. |

|

| James P. Hennessey |

| Director |

| RP® Financial, LC. | TABLE OF CONTENTS i |

TABLE OF CONTENTS

CFSB Bancorp, Inc.

Quincy, Massachusetts

| PAGE | ||||||

| DESCRIPTION |

NUMBER | |||||

| CHAPTER ONE |

OVERVIEW AND FINANCIAL ANALYSIS |

|||||

| Introduction |

I.1 | |||||

| Plan of Reorganization and Minority Stock Issuance |

I.1 | |||||

| Strategic Overview |

I.2 | |||||

| Balance Sheet Trends |

I.5 | |||||

| Income and Expense Trends |

I.8 | |||||

| Interest Rate Risk Management |

I.11 | |||||

| Lending Activities and Strategy |

I.12 | |||||

| Loan Originations, Purchases and Sales |

I.15 | |||||

| Asset Quality |

I.15 | |||||

| Funding Composition and Strategy |

I.16 | |||||

| Subsidiary Operations |

I.16 | |||||

| CHAPTER TWO |

OPERATING ENVIRONMENT AND MARKET AREA |

|||||

| Introduction |

II.1 | |||||

| Primary Market Area Overview |

II.1 | |||||

| Market Area Demographics |

II.2 | |||||

| Primary Market Area Employment Sectors |

II.5 | |||||

| Major Market Area Employers |

II.5 | |||||

| Market Area Unemployment Data |

II.7 | |||||

| Deposit Trends and Competition |

II.7 | |||||

| Competition |

II.9 | |||||

| CHAPTER THREE |

PEER GROUP ANALYSIS |

|||||

| Peer Group Selection |

III.1 | |||||

| Financial Condition |

III.6 | |||||

| Income and Expense Components |

III.8 | |||||

| Loan Composition |

III.12 | |||||

| Credit Risk |

III.14 | |||||

| Interest Rate Risk |

III.14 | |||||

| Summary |

III.17 | |||||

| RP® Financial, LC. | TABLE OF CONTENTS |

ii

TABLE OF CONTENTS

CFSB Bancorp, Inc.

Quincy, Massachusetts

(continued)

| PAGE | ||||

| DESCRIPTION | NUMBER | |||

| CHAPTER FOUR VALUATION ANALYSIS |

||||

| Introduction |

IV.1 | |||

| Appraisal Guidelines |

IV.1 | |||

| RP Financial Approach to the Valuation |

IV.1 | |||

| Valuation Analysis |

IV.2 | |||

| 1. Financial Condition |

IV.2 | |||

| 2. Profitability, Growth and Viability of Earnings |

IV.4 | |||

| 3. Asset Growth |

IV.5 | |||

| 4. Primary Market Area |

IV.6 | |||

| 5. Dividends |

IV.7 | |||

| 6. Liquidity of the Shares |

IV.8 | |||

| 7. Marketing of the Issue |

IV.9 | |||

| A. The Public Market |

IV.9 | |||

| B. The New Issue Market |

IV.15 | |||

| C. The Acquisition Market |

IV.17 | |||

| 8. Management |

IV.18 | |||

| 9. Effect of Government Regulation and Regulatory Reform |

IV.18 | |||

| Summary of Adjustments |

IV.18 | |||

| Valuation Approaches: Fully-Converted Basis |

IV.19 | |||

| Basis of Valuation - Fully-Converted Pricing Ratios |

IV.20 | |||

| 1. Price-to-Earnings (“P/E”) |

IV.20 | |||

| 2. Price-to-Book (“P/B”) |

IV.21 | |||

| 3. Price-to-Assets (“P/A”) |

IV.24 | |||

| Comparison to Publicly-Traded MHCs |

IV.25 | |||

| Comparison to Recent Offerings |

IV.28 | |||

| Valuation Conclusion |

IV.29 | |||

| RP® Financial, LC. | LIST OF TABLES iii |

LIST OF TABLES

CFSB Bancorp, Inc.

Quincy, Massachusetts

| TABLE | ||||||

| NUMBER |

DESCRIPTION |

PAGE | ||||

| 1.1 |

Historical Balance Sheets |

I.6 | ||||

| 1.2 |

Historical Income Statements |

I.9 | ||||

| 2.1 |

Summary Demographic Data |

II.4 | ||||

| 2.2 |

Primary Market Area Employment Sectors |

II.5 | ||||

| 2.3 |

Largest Private Employers in the Boston Metropolitan Area |

II.6 | ||||

| 2.4 |

Unemployment Trends |

II.7 | ||||

| 2.5 |

Deposit Summary |

II.8 | ||||

| 2.6 |

Market Area Deposit Competitors – As of June 30, 2020 |

II.9 | ||||

| 3.1 |

Peer Group of Public Savings Institutions |

III.3 | ||||

| 3.2 |

Balance Sheet Composition and Growth Rates |

III.7 | ||||

| 3.3 |

Income as a Percent of Average Assets and Yields, Costs, Spreads |

III.9 | ||||

| 3.4 |

Loan Portfolio Composition and Related Information |

III.13 | ||||

| 3.5 |

Credit Risk Measures and Related Information |

III.15 | ||||

| 3.6 |

Interest Rate Risk Measures and Net Interest Income Volatility |

III.16 | ||||

| 4.1 |

Peer Group Market Area Unemployment Rates |

IV.7 | ||||

| 4.2 |

Pricing Characteristics and After-Market Trends |

IV.16 | ||||

| 4.3 |

Valuation Adjustments |

IV.19 | ||||

| 4.4 |

Public Market Pricing Versus Peer Group (Fully Converted Basis) |

IV.22 | ||||

| 4.5 |

Public Market Pricing Versus Peer Group (MHC Basis) |

IV.23 | ||||

| 4.6 |

Publicly-Traded MHCs (Fully Conv. Basis) versus the Peer Group |

IV.26 | ||||

| 4.7 |

Peer Group of MHC Institutions (Fully Converted Basis) |

IV.27 | ||||

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.1 |

I. OVERVIEW AND FINANCIAL ANALYSIS

Introduction

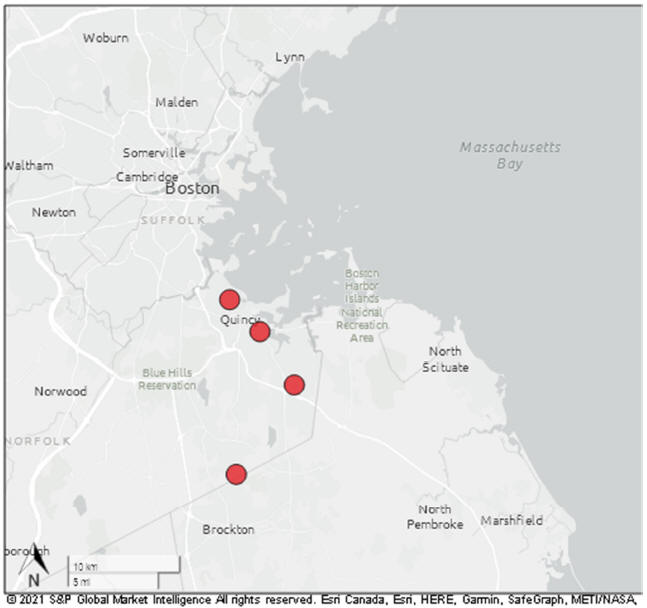

Colonial Federal Savings Bank (“Colonial” or the “Bank”), established in 1889, is a federally-chartered savings bank headquartered in Quincy, Massachusetts. The Company’s operations are conducted through the headquarters office location and three full-service branch offices, all of which are located within Norfolk County, Massachusetts. A map of Colonial’s branch office locations is provided in Exhibit I-1.

Colonial is a member of the Federal Home Loan Bank (“FHLB”) system and its deposits are insured up to the maximum allowable amount by the Federal Deposit Insurance Corporation (“FDIC”). As of June 30, 2021, Colonial had total assets of $338.9 million, total deposits of $284.6 million and total equity of $48.6 million equal to 14.36% of total assets. The Bank’s audited financial statements are included by reference as Exhibit I-2.

Plan of Reorganization and Minority Stock Issuance

On September 8, 2021, the Board of Directors of Colonial adopted the Plan of Reorganization and Minority Stock Issuance (the “Plan”). Pursuant to the Plan, Colonial will reorganize into the “two-tier” mutual holding company form of organization. In connection with the Plan, Colonial has organized a new Maryland stock holding company named CFSB Bancorp, Inc. (“CFSB Bancorp” or the “Company”), which will issue a majority of its common stock to a mutual holding company to be called 15 Beach MHC (the “MHC”) and sell a minority of its common stock to the public. When the reorganization and minority stock offering are completed, all of the outstanding capital stock of Colonial will be owned by Colonial. The MHC will own a controlling interest in the Company of % and the Company will become a subsidiary of the MHC.

CFSB Bancorp will offer its common stock in a subscription offering to Eligible Account Holders, Tax-Qualified Plans including Colonial’s employee stock ownership plan (the “ESOP”) and 401(k) plan, and Supplemental Eligible Account Holders as such terms are defined for purposes of applicable regulatory guidelines governing stock offerings by mutual institutions. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to members of the general public in a community offering and a syndicated or firm commitment offering. It is anticipated that %

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.2 |

of the net proceeds from the stock offering will be invested in Colonial and the balance of the net proceeds will be retained by the Company.

At this time, no other activities are contemplated for the Company other than the ownership of the Bank and funding a loan to the newly-formed ESOP and reinvestment of the proceeds that are retained by the Company. In the future, Colonial may acquire or organize other operating subsidiaries, diversify into other banking-related activities, pay dividends or repurchase its stock, although there are no specific plans to undertake such activities at the present time.

The Plan provides for the establishment of a new charitable foundation (the “Foundation”). The Foundation’s contribution will be funded with 2% of the outstanding shares of common stock issued in the mutual holding company reorganization and $250,000 and a $250,000 cash contribution. The purpose of the Foundation is to provide financial support to charitable organizations in the communities in which Colonial operates and to enable those communities to share in the Company’s long-term growth. The Foundation will be dedicated completely to community activities and the promotion of charitable causes.

Strategic Overview

Colonial maintains a local community banking emphasis, with a primary strategic objective of meeting the borrowing and savings needs of its local customer base. Colonial’s historical operating strategy has been a traditional thrift operating strategy, in which lending has emphasized originating 1-4 family residential mortgage loans and funding has been largely generated through retail deposits. While the Bank’s business plan calls for continuing to originate 1-4 family loans for portfolio, the Bank will continue to originate other types of loans primarily including mortgage loans secured by commercial and multi-family properties. The Bank’s objective is to fund asset growth primarily through deposit growth, emphasizing growth of lower cost core deposits.

Investments serve as a supplement to the Bank’s lending activities and the investment portfolio is considered to be indicative of a low risk investment philosophy. As of June 30, 2021, the Bank’s holdings of investment securities consisted of mortgage-backed securities that are guaranteed or insured by government sponsored enterprises (“GSEs”) and U.S. Government agency obligations. The Bank also maintained a material part of its June 30, 2021, balance sheet in cash and equivalents including interest-bearing deposits in other financial institutions. The Bank’s lending and investment strategies have generally supported management of credit risk

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.3 |

exposure and, in recent years, the balance of non-performing assets have been at near zero levels.

Retail deposits have consistently served as the primary interest-bearing funding source for the Bank. Unlike a traditional thrift that relies on certificates of deposit, however, the Bank has successfully diversified its retail deposit into demand deposits, money market accounts and savings accounts which comprise approximately 61% of total deposits. The Bank utilizes borrowings as a supplemental funding source to facilitate management of funding costs and interest rate risk. Borrowing currently consist of FHLB advances.

Colonial’s earnings base is largely dependent upon net interest income and operating expense levels. The Bank has historically been effective in preserving its net interest income to average assets ratio. However, in fiscal 2020 and 2021, the Bank has experienced some net interest margin compression, due to such factors as the relatively flat yield curve and a shift in the Bank’s interest-earning asset mix towards a higher concentration of lower yielding cash and investments. Non-interest operating income has been a small contributor to the Bank’s earnings in recent years. Operating expenses have trended higher in recent years but remained in a relatively narrow range as a percent of average assets. Loan loss provisions have been at nominal levels reflecting that the Bank has had little or no non-performing assets and/or loan chargeoffs.

The post-offering business plan of the Bank is expected to remain consistent with current strategic objectives. Specifically, Colonial will continue to be an independent community-oriented financial institution with a commitment to lending in local markets with operations funded primarily by retail deposits. Moderate growth strategies will continue to be implemented within the context of managing the Bank’s exposure to risk.

The operating environment in 2020 and the first six months of 2021 posed significant challenges to the Bank and the entire world as a result of the global pandemic. As a result of the COVID-19 pandemic, the Bank initiated all of the recommended CDC and Commonwealth of Massachusetts protocols for safety. The Bank’s operation has adjusted to the new norms of ensuring the virus does not spread within the Bank, either through staff, customer or vendor interaction. As part of the strategic discussion, the backdrop of operations which have taken place for banks operationally and especially in customer action and interaction have been an impetus for the corporate restructuring into the mutual holding company form which will provide additional operating flexibility in the future from a capital and structural standpoint.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.4 |

Accordingly, a key component of the Bank’s business plan is to complete a mutual-to-stock conversion offering. The Bank’s strengthened capital position will increase operating flexibility and facilitate implementation of planned growth strategies. Additionally, in the near term, the stock conversion offering will serve to substantially increase regulatory capital and liquidity. Colonial’s higher capital position resulting from the infusion of stock proceeds will also serve to reduce interest rate risk, particularly through enhancing the Bank’s interest-earning assets/interest-bearing liabilities (“IEA/IBL”) ratio. The additional funds realized from the stock offering will serve to raise the level of interest-earning assets funded with equity and, thereby, reduce the ratio of interest-earning assets funded with interest-bearing liabilities as the balance of interest-bearing liabilities will initially remain relatively unchanged following the conversion, which may facilitate a reduction in Colonial’s funding costs. Colonial’s strengthened capital position will also position the Bank to pursue expansion opportunities. Such expansion could potentially include acquiring another financial institution or acquiring additional branch offices to gain a market presence in nearby markets that are complementary to the Bank’s existing branch network. At this time, the Bank has no specific plans for expansion through acquisitions.

The projected uses of proceeds are highlighted below.

| • | CFSB Bancorp, Inc. The Company is expected to retain 50% of the net offering proceeds. At present, funds at the Company level, net of the loan to the ESOP, are expected to be primarily invested initially into liquid funds held as a deposit at the Bank. Over time, the funds may be utilized for various corporate purposes, possibly including acquisitions, infusing additional equity into the Bank, repurchases of common stock, and the payment of regular and/or special cash dividends. |

| • | Colonial. Approximately 50% of the net stock proceeds will be infused into the Bank in exchange for all of the Bank’s newly issued stock. Cash proceeds (i.e., net proceeds less deposits withdrawn to fund stock purchases) infused into the Bank are anticipated to become part of general operating funds and are expected to be primarily utilized to fund loan growth over time. |

Overall, it is the Bank’s objective to pursue growth that will serve to increase returns, while, at the same time, growth will not be pursued that could potentially compromise the overall risk associated with Colonial’s operations.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.5 |

Balance Sheet Trends

Table 1.1 shows the Company’s historical balance sheet data for the past five years. From fiscal yearend June 30, 2017 through June 30, 2021, Colonial’s assets increased at a 3.39% annual rate. Asset growth was largely driven by growth in the cash and investment portfolio as loan growth was less than 1% annually over the last four fiscal years. A summary of Colonial’s key operating ratios for the past five years is presented in Exhibit I-3.

Colonial’s loans receivable portfolio has fluctuated in a narrow range from yearend 2017 through June 30, 2021, with the balance increasing modestly through the end of fiscal 2020 while decreasing in the most recent fiscal year as a result of heavy refinancing activity within the loan portfolio. Additionally, the Bank was impacted by comparatively modest loan demand for commercial loans in the COVID-19 pandemic environment. In addition, the loan portfolio composition has remained relatively stable over the last five fiscal years with the portfolio primarily comprised of permanent 1-4 family residential loans which equaled 79.15% of total loans as of the fiscal year ended June 30, 2021. The balance of the loan portfolio was primarily comprised of mortgage loans which have primarily consisted of a mix of multi-family and commercial mortgage loans as well as second mortgage and home equity loans secured by 1-4 family properties. The Bank also holds relatively small balances of consumer non-mortgage loans which totaled $2.1 million, or 1.2% of total loans.

The intent of the Company’s investment policy is to provide adequate liquidity and to generate a favorable return within the context of supporting Colonial’s overall credit and interest rate risk objectives. The Company is still evaluating options for the reinvestment of funds retained by the Company, one of which would be to place the funds on deposit with the Bank. Since yearend 2017, the Company’s level of cash and investment securities (inclusive of FHLB stock) ranged from a low of 36.07% of assets at yearend 2018 to a high of 43.70% of assets at yearend 2021, with the recent increase the result of significant deposit growth achieved in the COVID-19 pandemic operating environment coupled with limited loan growth.

As of June 30, 2021, the balance of cash and investments equaled $148.5 million or 43.84% of assets. Municipal and corporate bonds totaling $38.4 million and $38.1 million respectively, comprised the largest components of the investment portfolio and together, equaled 22.6% of the loan portfolio. Mortgage-backed securities totaling $28.0 million (8.3% of assets) were also a significant component of the investment portfolio at June 30, 2021. As of June 30, 2021, investments maintained as held to maturity totaled $105.1 and investments maintained as

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.6 |

Table 1.1

Colonial Federal Savings Bank

Historical Balance Sheet Data

| Compounded | ||||||||||||||||||||||||||||||||||||||||||||

| As of the Fiscal Year Ended June 30, | Annual | |||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | Growth Rate | |||||||||||||||||||||||||||||||||||||||

| Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Pct | ||||||||||||||||||||||||||||||||||

| ($000) | (%) | ($000) | (%) | ($000) | (%) | ($000) | (%) | ($000) | (%) | (%) | ||||||||||||||||||||||||||||||||||

| Total Amount of: |

||||||||||||||||||||||||||||||||||||||||||||

| Assets |

$ | 296,400 | 100.00 | % | $ | 298,924 | 100.00 | % | $ | 298,924 | 100.00 | % | $ | 308,764 | 100.00 | % | $ | 338,854 | 100.00 | % | 3.40 | % | ||||||||||||||||||||||

| Cash and equivalents |

8,668 | 2.92 | % | 7,873 | 2.63 | % | 7,873 | 2.63 | % | 15,790 | 5.11 | % | 40,678 | 12.00 | % | 47.18 | % | |||||||||||||||||||||||||||

| Securities available for sale |

1,070 | 0.36 | % | 756 | 0.25 | % | 756 | 0.25 | % | 524 | 0.17 | % | 2,294 | 0.68 | % | 21.00 | % | |||||||||||||||||||||||||||

| Securities held to maturity |

104,202 | 35.16 | % | 97,967 | 32.77 | % | 97,967 | 32.77 | % | 98,584 | 31.93 | % | 105,114 | 31.02 | % | 0.22 | % | |||||||||||||||||||||||||||

| Federal Home Loan Bank stock |

934 | 0.32 | % | 1,220 | 0.41 | % | 1,220 | 0.41 | % | 879 | 0.28 | % | 453 | 0.13 | % | -16.55 | % | |||||||||||||||||||||||||||

| Loans receivable (net) |

168,251 | 56.76 | % | 177,330 | 59.32 | % | 177,330 | 59.32 | % | 179,043 | 57.99 | % | 174,433 | 51.48 | % | 0.91 | % | |||||||||||||||||||||||||||

| Fixed assets |

2,836 | 0.96 | % | 3,286 | 1.10 | % | 3,286 | 1.10 | % | 3,096 | 1.00 | % | 3,459 | 1.02 | % | 5.09 | % | |||||||||||||||||||||||||||

| BOLI |

8,320 | 2.81 | % | 8,553 | 2.86 | % | 8,553 | 2.86 | % | 8,783 | 2.84 | % | 9,250 | 2.73 | % | 2.68 | % | |||||||||||||||||||||||||||

| Other Assets |

2,119 | 0.71 | % | 1,939 | 0.65 | % | 1,939 | 0.65 | % | 2,065 | 0.67 | % | 3,173 | 0.94 | % | 10.62 | % | |||||||||||||||||||||||||||

| Deposits |

$ | 245,941 | 82.98 | % | $ | 242,490 | 81.12 | % | $ | 242,490 | 81.12 | % | $ | 251,151 | 81.34 | % | $ | 284,634 | 84.00 | % | 3.72 | % | ||||||||||||||||||||||

| FHLB advances |

5,000 | 1.69 | % | 8,774 | 2.94 | % | 8,774 | 2.94 | % | 7,719 | 2.50 | % | 918 | 0.27 | % | -34.54 | % | |||||||||||||||||||||||||||

| Other liabilities |

3,828 | 1.29 | % | 4,191 | 1.40 | % | 4,191 | 1.40 | % | 4,476 | 1.45 | % | 4,657 | 1.37 | % | 5.02 | % | |||||||||||||||||||||||||||

| Stockholders’ equity |

$ | 41,631 | 14.05 | % | $ | 43,469 | 14.54 | % | $ | 43,469 | 14.54 | % | $ | 45,418 | 14.71 | % | $ | 48,645 | 14.36 | % | 3.97 | % | ||||||||||||||||||||||

| Tangible stockholders’ equity |

$ | 41,631 | 14.05 | % | $ | 43,469 | 14.54 | % | $ | 43,469 | 14.54 | % | $ | 45,418 | 14.71 | % | $ | 48,645 | 14.36 | % | 3.97 | % | ||||||||||||||||||||||

| Net Unrealized Gain/(Loss) on Investment/MBS Available for Sale |

$ | 25 | 0.01 | % | $ | 19 | 0.01 | % | $ | 19 | 0.01 | % | $ | 10 | 0.00 | % | $ | 17 | 0.01 | % | — | |||||||||||||||||||||||

| Loans/Deposits |

68.41 | % | 73.13 | % | 73.13 | % | 71.29 | % | 61.28 | % | ||||||||||||||||||||||||||||||||||

| Offices Open |

4 | 4 | 4 | 4 | 4 | |||||||||||||||||||||||||||||||||||||||

| (1) | Ratios are as a percent of ending assets. |

Source: Preliminary prospectus; audited financial statements and RP Financial calculations.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.7 |

available for sale totaled $2.3 million. Investments maintained as available-at June 30, 2021 had a net unrealized gain of $23,000 while held-to-maturity investments had an unrealized gain equal to $2.3 million. Exhibit I-4 provides historical detail of the Bank’s investment portfolio. As of June 30, 2021, the Bank also held $40.3 million of cash and cash equivalents and $453,000 of FHLB stock.

The Bank also maintains an investment in bank-owned life insurance (“BOLI”) policies, which cover the lives of certain officers and Trustees of the Bank. The life insurance policies earn tax-exempt income through cash value accumulation and death proceeds. As of June 30, 2021, the cash surrender value of the Bank’s BOLI equaled $9.3 million.

Since yearend 2017, Colonial’s funding needs have been addressed through a combination of deposits, borrowings and internal cash flows. From yearend 2017 through June 30, 2021, the Bank’s deposits increased at a 3.72% annual rate. Deposits as a percent of assets increased from 82.98% at yearend 2017 to 84.00% at June 30, 2021. Deposits growth was sustained throughout the period covered in Table 1.1. Deposit growth trends in recent years reflect that deposit growth has primarily consisted of core deposits and, to a lesser extent, growth certificates of deposit (“CDs”). Core deposits comprised 60.80% of total deposits at June 30, 2021, versus 60.51% of total deposits at June 30, 2017, which reflects only nominal change.

Borrowings serve as an alternative funding source for the Bank to address funding needs for growth and to support management of deposit costs and interest rate risk. From yearend 2017 through the fiscal year ended June 30, 2021, borrowings were at modest levels peaking at $8.8 million as of June 30, 2018 and 2019, but had diminished to $918,000 or 0.27% of assets as of June 30, 2021. Borrowings currently held by the Bank consist of FHLB advances.

The Bank’s equity increased at a 3.94% annual rate from yearend 2017 through June 30, 2021, which was largely related to retention of earnings. A stronger rate of equity growth relative to asset growth since yearend 2017 provided for an increase in the Bank’s equity-to-assets ratio from 14.05% at yearend 2017 to 14.36% at June 30, 2021. Based on the foregoing, the Bank has a very strong capital position even before the proceeds to be realized from the Minority Stock Issuance. The addition of stock proceeds will serve to strengthen the Bank’s capital position, as well as support growth opportunities. At the same time, the increase in Colonial’s pro forma capital position will initially depress its ROE.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.8 |

Income and Expense Trends

Table 1.2 shows the Bank’s historical income statements for the past five fiscal years through June 30, 2021. The Bank’s reported earnings have reflected a declining trend over the last five fiscal years notwithstanding the modest balance sheet growth realized over the period. In this regard, net income has declined from $2.0 million or 0.69% of average assets during 2017 to a low of $1.4 million or 0.42% of average assets in fiscal 2021.

Net interest income and operating expenses represent the primary components of the Bank’s recurring earnings, while non-operating income has been a limited contributor to the Bank’s earnings. Loan loss provisions have had a modest impact on the Bank’s earnings over the past five years. Non-operating gains and losses generally have been negligible and thus, Colonial’s operations are primarily reliant on core operations. In view of the traditional thrift business model employed by Colonial, earnings are driven the difference between net interest income and operating expenses. The declining earnings trend, notwithstanding asset growth realized over the last five fiscal years, reflects the impact of low interest rates and loan portfolio shrinkage, both of which have contributed to declining asset yields and spread compression.

During the period covered in Table 1.2, the Bank’s net interest income to average assets ratio has diminished from a fiscal year end peak level of $8.1 million or 2.73 percent of average assets to only $7.4 million, or 2.16% of average assets as of the 2021 fiscal year end. The downward trend in the Bank’s net interest income ratio since 2017 has been primarily due to two factors as follows: (1) limited growth in the loan portfolio which has limited the Bank’s yield potential and in recent periods; and (2) historically low interest rates have resulted in the loan portfolio repricing downward faster than funding costs (which are at near zero rates).

The impact of spread compression is revealed in the yield/cost data shown in Exhibit I-5, which shows that Colonial’s spreads decreased from 2.28% in fiscal 2020, to 2.15% in fiscal 2021. Moreover, during this period, the Bank’s average yield on interest-earnings assets diminished by 44 basis points whereas the cost of funds declined by 32 basis points over the corresponding timeframe.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.9 |

Table 1.2

Colonial Federal Savings Bank

Historical Income Statements

| For the Fiscal Year Ended June 30, | ||||||||||||||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | ||||||||||||||||||||||||||||||||||||

| Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | |||||||||||||||||||||||||||||||

| ($000) | (%) | ($000) | (%) | ($000) | (%) | ($000) | (%) | ($000) | (%) | |||||||||||||||||||||||||||||||

| Interest Income |

$ | 9,197 | 3.13 | % | $ | 9,758 | 3.28 | % | $ | 9,972 | 3.34 | % | $ | 10,370 | 3.31 | % | $ | 9,482 | 2.86 | % | ||||||||||||||||||||

| Interest Expense |

(1,448 | ) | -0.49 | % | (1,645 | ) | -0.55 | % | (2,049 | ) | -0.69 | % | (2,715 | ) | -0.87 | % | (2,076 | ) | -0.63 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net Interest Income |

$ | 7,749 | 2.64 | % | $ | 8,113 | 2.73 | % | $ | 7,923 | 2.65 | % | $ | 7,655 | 2.44 | % | $ | 7,406 | 2.23 | % | ||||||||||||||||||||

| Provision for Loan Losses |

(106 | ) | -0.04 | % | (180 | ) | -0.06 | % | (60 | ) | -0.02 | % | (50 | ) | -0.02 | % | (60 | ) | -0.02 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net Interest Income after Provisions |

$ | 7,643 | 2.60 | % | $ | 7,933 | 2.67 | % | $ | 7,863 | 2.63 | % | $ | 7,605 | 2.43 | % | $ | 7,346 | 2.22 | % | ||||||||||||||||||||

| Other Income |

667 | 0.23 | % | 677 | 0.23 | % | 681 | 0.23 | % | 648 | 0.21 | % | 643 | 0.19 | % | |||||||||||||||||||||||||

| Operating Expense |

(5,737 | ) | -1.95 | % | (6,061 | ) | -2.04 | % | (6,271 | ) | -2.10 | % | (6,252 | ) | -2.00 | % | (6,351 | ) | -1.92 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net Operating Income |

$ | 2,573 | 0.88 | % | $ | 2,549 | 0.86 | % | $ | 2,272 | 0.76 | % | $ | 2,001 | 0.64 | % | $ | 1,638 | 0.49 | % | ||||||||||||||||||||

| Non-Operating Income/Expense |

||||||||||||||||||||||||||||||||||||||||

| Gain(Loss) on Sale/Impair of Investments |

$ | 0 | 0.00 | % | $ | 0 | 0.00 | % | $ | 0 | 0.00 | % | $ | 0 | 0.00 | % | $ | 0 | 0.00 | % | ||||||||||||||||||||

| Income/(Loss) Before Tax |

$ | 2,573 | 0.88 | % | $ | 2,549 | 0.86 | % | $ | 2,272 | 0.76 | % | $ | 2,001 | 0.64 | % | $ | 1,638 | 0.49 | % | ||||||||||||||||||||

| Income Tax Provision (Benefit) |

(547 | ) | -0.19 | % | (696 | ) | -0.23 | % | (316 | ) | -0.11 | % | (278 | ) | -0.09 | % | (246 | ) | -0.07 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Net Income (Loss) |

$ | 2,026 | 0.69 | % | $ | 1,853 | 0.62 | % | $ | 1,956 | 0.65 | % | $ | 1,723 | 0.55 | % | $ | 1,392 | 0.42 | % | ||||||||||||||||||||

| Expense Coverage Ratio (2) |

135.1 | % | 133.9 | % | 126.3 | % | 122.4 | % | 116.6 | % | ||||||||||||||||||||||||||||||

| Efficiency Ratio (3) |

68.2 | % | 69.0 | % | 72.9 | % | 75.3 | % | 78.9 | % | ||||||||||||||||||||||||||||||

| Effective Tax Rate Cost (Benefit) |

-21.3 | % | -27.3 | % | -13.9 | % | -13.9 | % | -15.0 | % | ||||||||||||||||||||||||||||||

| Return on Equity |

2.28 | % | 2.90 | % | 3.95 | % | 5.47 | % | 3.85 | % | ||||||||||||||||||||||||||||||

| (1) | Ratios are as a percent of average assets. |

| (2) | Expense coverage ratio calculated as net interest income before provisions for loan losses divided by operating expenses. |

| (3) | Efficiency ratio calculated as op. exp. divided by the sum of net int. inc. before prov. for loan losses plus other income (excluding net gains). |

Source: Preliminary prospectus; audited financial statements and RP Financial calculations.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.10 |

Non-interest operating income has historically been a modest contributor to the Bank’s income statement and averaged 0.21% of average assets for the most recent three fiscal years and equaled only 0.19% of average assets for the fiscal year ended June 30, 2021. Most of this income is gained from deposit account fees and the BOLI investment income. Importantly, the limited fee income is reflective of the traditional thrift business model employed by the Bank where the majority of income is generated through net interest income. Given recent trends with regard to market interest rate levels which have limited the Bank’s spreads, earnings have diminished as a result.

Operating expenses represent the other major component of the Bank’s income statement, and as shown in Table 1.2, and reflect the limited cost inherent in Colonial’s traditional thrift operating strategy. Operating expenses have increased modestly in dollar terms since the end of fiscal 2017, increasing from $5.7 million, or 1.95% of average assets to a level of $6.4 million or 1.92% of average assets in fiscal 2021. Upward pressure will be placed on the Bank’s expense ratio following the stock offering, due to expenses associated with operating as a publicly-traded company, including expenses related to the stock benefit plans, auditing and legal costs.

Overall, during the past five years, the Bank’s expense coverage ratios (net interest income divided by operating expenses) declined continuously, from a high of 135.1% in fiscal 2017, to 116.6% in fiscal 2021. Similarly, the Bank’s efficiency ratio (operating expenses as a percent of the sum of net interest income and other operating income) reflected an adverse trend in core earnings, increasing from 68.2% in fiscal 2017, to 78.9% in fiscal 2021.

During the period covered in Table 1.2, the amount of loan loss provisions established has been very low, as the Bank’s has experienced favorable asset quality and loan chargeoffs have been minimal. For the twelve months ended June 30, 2021, the Bank reported loan loss provisions of $60,000 or 0.02% of average assets. As of June 30, 2021 the Bank maintained loan loss allowances of $1.7 million, equal to 0.98% of total loans receivable. The Bank does not have any non-accrual, classified or criticized loans as of June 30, 2021. Exhibit I-6 sets forth the Bank’s loan loss allowance activity for the past two years.

Over the past five years, the Bank’s effective tax rate ranged from a 12.1% during 2021 to a high of 27.3% during fiscal 2017. The relatively high effective tax rates recorded for 2017 includes a reduction in the value of the Bank’s deferred tax assets and a corresponding charge to income tax expense of $212,000, as the result of the reduction in the Bank’s federal marginal

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.11 |

tax rate from 34% to 21%. The Bank’s marginal effective federal tax rate is 21% while corporate earnings are taxed at an effective rate of 9%, with exception of income in the securities corporation which is taxed at a lower rate of 1.32%, both of which are deductible expenses for federal income tax purposes. For purposes of estimating the pro forma impact of the conversion offering, we have assumed a 25.08% effective rate consistent with the prospectus disclosure.

Interest Rate Risk Management

Colonial’s balance sheet is asset-sensitive in the shorter-term and, thus, the net interest margin will typically be favorably affected during periods of rising and higher interest rates. Colonial measures its interest rate risk exposure by use of the economic value of equity (“EVE”) methodology, which provides an analysis of estimated changes in the Bank’s EVE under the assumed instantaneous changes in the U.S. treasury yield curve. Utilizing figures as of June 30, 2021, based on a 2.0% instantaneous and sustained increase in interest rates, the EVE model indicates that the Bank’s EVE would decrease by 11.4% (see Exhibit I-7).

The Bank pursues strategies to manage interest rate risk, particularly with respect to seeking to limit the repricing mismatch between interest rate sensitive assets and liabilities. The Bank manages interest rate risk from the asset side of the balance sheet through diversifying into other types of lending beyond 1-4 family permanent fixed rate mortgage loans such as originating commercial real estate, commercial business and construction/land loans, all of which have shorter terms to repricing or maturity and carry higher interest rates. On the liability side of the balance sheet, management of interest rate risk has been pursued through attempting to retain the balance of deposits in lower cost and less interest rate sensitive transaction and savings accounts and attempting to lengthen the term-to-maturity of the CD portfolio. The Bank has also lengthened the term-to-maturity of the borrowings portfolio, to the extent possible. Core deposits, which consist of transaction and savings accounts, comprised 60.8% of the Bank’s deposits at June 30, 2021. As of June 30, 2021, of the Bank’s total loans due after June 30, 2022, ARM loans comprised 21.4% of those loans (see Exhibit I-8). In addition, the Bank maintains a notable balance of cash and cash equivalents, which provide for short-term to maturity funds on the balance sheet. Finally, the Bank maintains an equity position of over 14% of assets on a pre-offering basis, representing interest-free funds that can be used to fund earning assets. The infusion of stock proceeds will serve to further limit the Bank’s interest rate risk exposure, as most of the net proceeds will be redeployed into interest-earning assets and the increase in the Bank’s equity will lessen the proportion of interest rate sensitive liabilities funding assets.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.12 |

There are numerous limitations inherent in interest rate risk analyses such as the credit risk of Bank’s loans pursuant to changing interest rates. Additionally, such analyses do not measure the impact of changing spread relationships, as interest rates among various asset and liability accounts rarely move in tandem, as the shape of the yield curve for various types of assets and liabilities is constantly changing in response to investor perceptions and economic events and circumstances.

Lending Activities and Strategy

Colonial operates two principal lending activities: (1) the origination of 1-4 family residential first and second position mortgage loans, with the first position fixed rate loans mostly sold in the secondary market; and, (2) commercial real estate/multifamily/commercial and industrial/construction lending as part of a commercial lending focus. The overall lending strategy is to diversify its overall loan portfolio, shorten the term-to-maturity or repricing, and increase the overall yield earned on loans. Details of the Bank’s loan portfolio composition are shown in Exhibit I-9, while Exhibit I-10 provides details of the Bank’s loan portfolio by contractual maturity date.

Residential Real Estate Lending

Colonial’s historical lending focus has been the origination of first position 1-4 family residential real estate loans. As of June 30, 2021, residential first and second position mortgage loans equaled $139.7 million, or 79.2% of total loans. The majority of the residential mortgage portfolio is fixed rate as adjustable loans totaled only $9.5 million or 6.8% of total residential loans. As shown in Exhibit I-9, the balance of residential mortgage loans has decreased since June 30, 2020, as low interest rates have provided the impetus for mortgage borrowers to refinance, often with other lenders including mortgage bankers and brokers.

Colonial’s first mortgage loans are generally underwritten to Fannie Mae or Freddie Mac origination guidelines and thus are deemed to be “conforming” loans with terms of 10 to 30 years. Most of the 1-4 family mortgage loans are secured by residences in the Colonial’s market, along with contiguous areas in eastern Massachusetts. Loan-to-value ratios (“LTV”) of mortgage loans are generally limited to an 80% LTV, whichever is lower, or up to 100% if the loans carry private mortgage insurance. Adjustable rate loans have an initial fixed interest rate period of one, three or five years, followed by annual adjustments to the interest rate, with a 2% period cap on changes in interest rates and a 6% lifetime interest rate cap. Colonial does not offer “interest

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.13 |

only” “negative amortization”, subprime or Alt-A loans, which have higher risk underwriting characteristics.

Second Mortgage and Home Equity Loans

As an adjunct to residential lending, the Bank also has a small portfolio of second mortgages and home equity lines of credit which totaled $2.5 million, or 1.4% of the Bank’s loan portfolio as of June 30, 2021. Second mortgages loans and home equity lines of credit are multi-purpose loans used to finance various home or personal needs, where a one- to four-family primary or secondary residence serves as collateral. Colonial generally originates home equity lines of credit on owner-occupied properties with adjustable rates of interest based on the Prime Rate plus a margin. The Bank generally originates home equity lines of credit with a maximum loan-to-value ratio of 80% (including the value of the underlying mortgage loan) and with terms of up to 20 years.

Commercial Real Estate/Multi-Family Lending

As of June 30, 2021, commercial real estate/multi-family loans totaled $32.2 million, or 18.3% of the total loan portfolio, which reflects a reduction from the aggregate balance of $36.6 million as of the prior fiscal year end. Overall, the relative proportion of commercial and multi-family loans to total loans has remained relatively stable over the last five fiscal years.

Commercial real estate loans (“CRE”) totaled $16.4 million as of June 30, 2021. The Bank’s commercial real estate loans are generally secured by office and industrial buildings, warehouses, small retail facilities and restaurants within its markets and are most typically originated with adjustable interest rates. Multi-family loans, which totaled $15.9 million as of June 30, 2021, are typically secured by properties consisting of five or more rental units, with the properties within the lending primary market area.

Commercial real estate loans originated by the Bank are primarily adjustable rate as adjustable rate loans totaled $13.1 million, or 79.8% of commercial real estate loans had adjustable rates as of June 30, 2021. Interest rates on adjustable-rate commercial real estate loans adjust and generally are fixed for the first five years of the loan and adjust annually thereafter based on the U.S. Treasury one-year constant maturity rate, plus a margin.

Multi-family real estate loans are generally secured by properties consisting of five or more rental units in eastern Massachusetts. The Bank offers multi-family real estate loans with terms of up to 30 years and emphasizes adjustable rate loans which totaled $13.6 million,

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.14 |

or 85.9% of multi-family real estate loans as of June 30, 2021. Interest rates on adjustable-rate multi-family real estate loans adjust and the interest rate is generally indexed to the one-year U.S. Treasury constant maturity rate, plus a margin.

Commercial and multi-family mortgage loans are generally priced at a higher rate of interest, have larger balances and involve a greater risk profile than 1-4 residential mortgage loans. In addition, the payments on commercial and multi-family mortgage loans are dependent on successful operations and management of the property. When originating income producing property loans, the Bank evaluates the qualifications and financial condition of the borrower, as well as the value and condition of the property securing the loan. The Bank will also generally require and obtain personal guarantees from the principals.

Consumer Lending (including HELOCs)

To a minor extent, Colonial originates personal consumer loans to individuals who reside or work in the Bank’s market area, including loans secured by home equity lines of credit and personal consumer loans. As of June 30, 2021, personal consumer loans totaled $0.6 million and consisted mostly of new and used automobile loans, and loans secured by CDs. The Bank offers such loans as a convenience to customers and does not emphasize such loans. These loans help to expand and create stronger customer relationships and opportunities for cross-marketing. Consumer loans have greater risk compared to mortgage loans, due to their dependence on the borrower’s continuing financial stability.

At June 30, 2021, home equity lines of credit totaled $1.6 million in outstanding balances. The underwriting standards utilized for home equity lines of credit include a determination of the applicant’s credit history, an assessment of the applicant’s ability to meet existing obligations and payments on the proposed loan and the value of the collateral securing the loan. Home equity lines of credit are offered with a loan-to-value ratio up to 80%. Colonial’s home equity lines of credit are generally 10-year balloon loans. The Bank’s home equity lines of credit have adjustable rates of interest which are indexed to the prime rate of interest.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.15 |

Loan Originations, Purchases and Sales

All lending activities are conducted by bank personnel located at the office locations, underwritten pursuant to bank policies and procedures. Loan sources typically include loan officers, marketing efforts, the existing customer base, walk-in customers and referrals from real estate brokers, builders and attorneys. The Bank generally originates loans for portfolio and has not sold loans over the last several fiscal years.

Colonial has also periodically purchased participation loans from other financial institutions in the market area, primarily within the state of Massachusetts. Such loans are underwritten according to the Bank’s underwriting criteria and procedures. At June 30, 2021, the outstanding balances of loan participations totaled $2.6 million or 2.1% of the loan portfolio, which consisted of five borrower relationships secured by commercial and multi-family mortgage loans

Asset Quality

Historically, the Company’s credit quality measures have implied relatively limited credit risk exposure, given the focus on 1-4 family permanent mortgage loans and conservative loan underwriting practices. Further, most loans are secured by property in the local market area. As of the end of the last two fiscal years, Colonial has had a zero level of non-performing assets (“NPAs”) (see Exhibit I-11 for details with respect to the Company’s asset quality). Balances of OREO have been minimal, and there have been zero balances of accruing troubled debt restructured loans.

Colonial maintains allowances for loan and lease losses (“ALLL”) to recognize probable losses associated with the loan portfolio. For the year ended June 30, 2021, the ratio of allowances to total loans equaled 0.98%. Given the lack of NPAs, the reserve coverage ratios are not meaningful (See Exhibit I-6 for details with respect to the Bank’s valuation allowances and loan charge-offs).

The overall level of NPAs remains low and loan charge-offs have been limited, reflective of Colonial’s conservative lending operations. The Bank’s management reviews and classifies loans on a monthly basis and establishes loan loss provisions based on the overall quality, size, and composition of the loan portfolio, as well as other factors such as historical loss experience, industry trends, and local real estate market and economic conditions

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS I.16 |

Funding Composition and Strategy

Colonial has traditionally utilized both deposits and borrowings as funding sources. At June 30, 2021, deposits equaled $284.6 million. Exhibit I-12 sets forth the Bank’s deposit composition since June 30, 2020 and Exhibit I-13 provides the maturity composition of the certificate of deposit (“CD”) portfolio at June 30, 2021 for all CDs. CDs constitute the largest portion of the Bank’s deposit base, totaling 39.2% of deposits at June 30, 2021 versus 47.1% of deposits as of June 30, 2020. Checking and savings accounts equaled $173.1 million, or 60.8% of total deposits as of June 30, 2021, versus $146.7 million, or 52.9% of total deposits at June 30, 2020.

Colonial has historically utilized borrowed funds as a funding source, and such borrowings totaled only $918,000 as of June 30, 2021 with the funds used to support short term funding and liquidity objectives.

Subsidiary Activities

Colonial has one subsidiary, Beach Street Securities Corporation, which was incorporated in Massachusetts in 1997 to buy, sell and hold investments for its own account. Upon completion of the reorganization, Colonial will become the wholly-owned subsidiary of CFSB Bancorp, Inc.

| RP Financial, LC. | OPERATING ENVIRONMENT AND MARKET AREA Page II.1 |

II. OPERATING ENVIRONMENT AND MARKET AREA

Introduction

Colonial conducts operations out of a main office and corporate headquarters in Quincy, Massachusetts, and three full services branch offices in Quincy, Weymouth and Holbrook, Massachusetts. All of the Bank’s facilities are located in Norfolk County, which is located directly south of the city of Boston, Massachusetts. The county includes twenty-eight eastern Massachusetts communities, all of which are residential suburbs of Boston. Norfolk County is also the wealthiest county in Massachusetts, indicative of a strong economy relative to other nearby areas.

The Bank focuses on providing personal service while meeting the needs of its retail and business customer base, emphasizes personalized banking services to retail customers and offers a broad array of deposit services including demand deposits, regular savings accounts, money market deposits, certificates of deposit and individual retirement accounts. Lending operations are focused on real estate secured lending, including residential mortgage lending/mortgage banking and real estate secured commercial lending.

Future business and growth opportunities will be partially influenced by economic and demographic characteristics of the regional markets, particularly the future growth and stability of the regional economy, and the nature and intensity of the competitive environment for financial institutions. These factors outlined herein have been considered in the analysis of the Bank’s pro forma market value.

Primary Market Area Overview

The primary market area for business operations is the eastern portion of the Commonwealth of Massachusetts, which includes the Boston metropolitan statistical area (the “Boston MSA”). To a much lesser extent, the Bank conducts business (primarily lending) in contiguous areas. Eastern Massachusetts is a relatively well-developed area settled in the early part of the country’s history that has a wide range of new and old housing and commercial building stock. Geographically, the market area covers a small area, and thus the Bank’s current branch office network provides access to a material portion of the statewide population base. Such operations are essentially limited to the southern portion of the Boston MSA (the region containing all of the Bank’s offices) and the southeastern region of Massachusetts.

| RP Financial, LC. | OPERATING ENVIRONMENT AND MARKET AREA Page II.2 |

The market area served by the Company, characterized primarily as the Boston MSA, has a highly developed and diverse economy, with the region’s many colleges and universities serving to attract industries in need of a highly skilled and educated workforce. Healthcare, high-tech and financial services companies constitute major sources of employment in the regional market area, as well as the colleges and universities that populate the Boston MSA. Tourism also is a prominent component of market area’s economy, as Boston annually ranks as one of the nation’s top tourist destinations.

Colonial holds a small market share of deposits in the primary market area, given its asset size, number and size of competitors and the overall population base, and thus has potential for additional growth. Similar to other areas of the country, Colonial operates in a competitive environment and competes with a number of national, regional and locally-based financial institutions. In addition, the Bank faces competition from mortgage banking companies, consumer finance companies, investment houses, mutual funds, insurance companies and other financial intermediaries. Competitive factors have intensified with the growth of electronic delivery systems.

Market Area Demographics

As shown in Table 2.1, Norfolk County, where all of the Bank’s branches are located, reported a population of 711,000 as of 2021, has increased over the last five years at a 0.5% annual rate and is projected to continue to increase at the same rate over the next six years. The Boston MSA’s population size reached 4.9 million in 2021, also increasing at a 0.5% annual rate over the past five years. These growth rates are in line with recent and expected statewide and national population growth rates. This represents a favorable statistic for financial institutions such as Colonial, as the demand for personal financial services may likely improve in the near term future. Additional detail regarding the demographic trends of the local market has been included in Table 2.1.

Similar to the population trends noted above, the number of households also recorded an increase in Norfolk County from 2016 to 2021, with the growth rate of 0.4% while Boston MSA’s household growth rate was slightly higher at 0.5%, reflecting a nationwide trend towards smaller household sizes. Households are also projected to increase at the same rate over the next five years. Norfolk County’s historical and projected changes in households were also similar to the levels reported by the state of Massachusetts and the United States. The population base in Norfolk County is also somewhat older than Massachusetts and the nation, as Norfolk County

| RP Financial, LC. | OPERATING ENVIRONMENT AND MARKET AREA Page II.3 |

reported a slightly lower proportion of residents between the ages of 0 and 34, and a higher proportion of residents above 34 years of age, as compared to state and nationwide aggregates.

Reflecting the above mentioned high levels of personal income, Norfolk County’s median household income was notably higher than both the statewide and nationwide averages. Similarly, per capita income levels were highest in Norfolk County, indicative of the more urban nature of the county as well as the wealth of the market. Median household income in Norfolk County equaled $108,468 in 2021, while the state’s median income was $87,126. Projected increases in median household income and per capita income for Norfolk County approximate the projected rates for the state and nation over the next five years, indicating a continuation of a high level of financial strength to the area. As for the Boston metropolitan area, per capita income levels reached $55,237, higher than both statewide and nationwide income levels, yet still below Norfolk County equal to $60,544. Household income distribution figures presented in Table 2.1 support these higher income statistics, as Norfolk County maintained a significantly higher percentage of households with income higher than $100,000. For example, 53.4% of the residents of Norfolk County reported incomes in excess of $100,000, versus 44.1% for the Commonwealth of Massachusetts and 32.7% for the nation.

| RP Financial, LC. | OPERATING ENVIRONMENT AND MARKET AREA Page II.4 |

Table 2.1

Colonial FSB

Summary Demographic Data

| Year | Growth Rate | |||||||||||||||||||

| 2016 | 2021 | 2026 | 2016-2021 | 2021-2026 | ||||||||||||||||

| (%) | (%) | |||||||||||||||||||

| Population (000) |

||||||||||||||||||||

| USA |

322,431 | 330,946 | 340,574 | 0.5 | % | 0.6 | % | |||||||||||||

| Massachusetts |

6,810 | 6,928 | 7,085 | 0.3 | % | 0.4 | % | |||||||||||||

| Boston-Cambridge-Newton, MA-NH |

4,790 | 4,908 | 5,042 | 0.5 | % | 0.5 | % | |||||||||||||

| Norfolk, MA |

699 | 711 | 729 | 0.4 | % | 0.5 | % | |||||||||||||

| Households (000) |

||||||||||||||||||||

| USA |

122,265 | 125,733 | 129,596 | 0.6 | % | 0.6 | % | |||||||||||||

| Massachusetts |

2,661 | 2,721 | 2,792 | 0.4 | % | 0.5 | % | |||||||||||||

| Boston-Cambridge-Newton, MA-NH |

1,864 | 1,920 | 1,980 | 0.6 | % | 0.6 | % | |||||||||||||

| Norfolk, MA |

269 | 275 | 283 | 0.4 | % | 0.5 | % | |||||||||||||

| Median Household Income ($) |

||||||||||||||||||||

| USA |

55,551 | 67,761 | 73,868 | 4.1 | % | 1.7 | % | |||||||||||||

| Massachusetts |

69,807 | 87,126 | 96,373 | 4.5 | % | 2.0 | % | |||||||||||||

| Boston-Cambridge-Newton, MA-NH |

76,046 | 96,785 | 107,822 | 4.9 | % | 2.2 | % | |||||||||||||

| Norfolk, MA |

88,926 | 108,468 | 118,393 | 4.1 | % | 1.8 | % | |||||||||||||

| Per Capita Income ($) |

||||||||||||||||||||

| USA |

30,002 | 37,689 | 41,788 | 4.7 | % | 2.1 | % | |||||||||||||

| Massachusetts |

38,791 | 50,520 | 56,238 | 5.4 | % | 2.2 | % | |||||||||||||

| Boston-Cambridge-Newton, MA-NH |

42,009 | 55,237 | 61,516 | 5.6 | % | 2.2 | % | |||||||||||||

| Norfolk, MA |

47,509 | 60,544 | 65,959 | 5.0 | % | 1.7 | % | |||||||||||||

| 2021 Age Distribution (%) |

0-14 Yrs. | 15-34 Yrs. | 35-54 Yrs. | 55-69 Yrs. | 70+ Yrs. | |||||||||||||||

| USA |

18.3 | 26.8 | 25.1 | 18.4 | 11.4 | |||||||||||||||

| Massachusetts |

16.0 | 27.0 | 25.5 | 19.6 | 11.9 | |||||||||||||||

| Boston-Cambridge-Newton, MA-NH |

16.1 | 27.4 | 26.0 | 19.1 | 11.3 | |||||||||||||||

| Norfolk, MA |

16.7 | 25.1 | 26.1 | 20.0 | 12.1 | |||||||||||||||

| 2021 HH Income Dist. (%) |

Less Than 25,000 |

$25,000 to 50,000 |

$50,000 to 100,000 |

$100,000+ | ||||||||||||

| USA |

18.0 | 20.3 | 29.0 | 32.7 | ||||||||||||

| Massachusetts |

15.6 | 15.3 | 25.0 | 44.1 | ||||||||||||

| Boston-Cambridge-Newton, MA-NH |

14.2 | 13.4 | 23.8 | 48.6 | ||||||||||||

| Norfolk, MA |

11.2 | 12.0 | 23.5 | 53.4 | ||||||||||||

| Source: | S&P Global Market Intelligence. |

| RP Financial, LC. | OPERATING ENVIRONMENT AND MARKET AREA Page II.5 |

Primary Market Area Employment Sectors

Table 2.2 provides an overview of employment by economic sector for the Commonwealth of Massachusetts, the Boston Metropolitan Area and Norfolk County. As shown, Massachusetts, the Boston MSA and Norfolk County reported the largest proportions of employment in services, education and healthcare, finance and wholesale/retail trade, indicative of a relatively diversified employment base. Overall, the distribution of employment exhibited in the primary market area is indicative of a diverse economic environment, and the employment base is thus not deemed to be overly dependent on a single economic sector.

Table 2.2

Colonial FSB

Primary Market Area Employment Sectors

(Percent of Labor Force)

| Employment Sector |

Massachusetts | Boston-Cambridge- Newton, MA-NH |

Norfolk, MA | |||||||||

| (%) | ||||||||||||

| Services |

26.6 | % | 28.1 | % | 27.9 | % | ||||||

| Education,Healthcare, Soc. Serv. |

28.3 | % | 27.4 | % | 28.3 | % | ||||||

| Government |

1.8 | % | 1.9 | % | 2.1 | % | ||||||

| Wholesale/Retail Trade |

10.9 | % | 10.6 | % | 8.1 | % | ||||||

| Finance/Insurance/Real Estate |

15.7 | % | 15.8 | % | 17.3 | % | ||||||

| Manufacturing |

4.6 | % | 4.6 | % | 4.6 | % | ||||||

| Construction |

5.6 | % | 5.3 | % | 5.5 | % | ||||||

| Information |

2.2 | % | 2.5 | % | 2.5 | % | ||||||

| Transportation/Utility |

3.9 | % | 3.6 | % | 3.6 | % | ||||||

| Agriculture |

0.4 | % | 0.3 | % | 0.2 | % | ||||||

|

|

|

|

|

|

|

|||||||

| 100.0 | % | 100 | % | 100 | % | |||||||

Source: S&P Global Market Intelligence

Major Market Area Employers

Table 2.3 below presents a list of the major private employers in the Boston MSA. In addition, the Federal, state and local governments As shown, the specific companies include various economic sectors such as health care, education, services, retail and technology. These economic sectors generally contain higher-income jobs that provide support for the local economy.

| RP Financial, LC. | OPERATING ENVIRONMENT AND MARKET AREA Page II.6 |

Table 2.3

Colonial Federal Savings Bank

Largest Private Employers in the Boston Metropolitan Area

| Rank |

Employer |

City |

Number of Employees |

|||||

| 1 | Massachusetts General Hospital |

Boston |

16,999 | |||||

| 2 | Brigham & Women’s Hospital |

Boston |

13,303 | |||||

| 3 | Dan Farber Cancer Institute |

Boston |

10,000 | |||||

| 4 | Raytheon Systems Intl Co |

Andover |

10,000 | |||||

| 5 | U Mass System Admin Ofc |

Worcester |

10,000 | |||||

| 6 | Coldwell Banker Realty |

Lexington |

8,200 | |||||

| 7 | Boston Children’s Hospital |

Boston |

8,000 | |||||

| 8 | Beth Israel Deaconess Med Ctr |

Boston |

7,743 | |||||

| 9 | Umass Memorial Medical Ctr |

Worcester |

7,033 | |||||

| 10 | Staples Inc |

Framingham |

6,600 | |||||

| 11 | Massachusetts Bay Trnsprtn |

Boston |

6,001 | |||||

| 12 | Mass General For Child |

Salem |

5,800 | |||||

| 13 | Lahey Hospital & Medical Ctr |

Burlington |

5,787 | |||||

| 14 | Boston Medical Ctr Corp |

Boston |

5,335 | |||||

| 15 | Boston University Sch-Medicine |

Boston |

5,000 | |||||

| 16 | Dell EMC Corp |

Hopkinton |

5,000 | |||||

| 17 | Floating Hospital For Children |

Boston |

5,000 | |||||

| 18 | Southcoast Wound Care Ctr |

Fall River |

4,134 | |||||

| 19 | Dana-Farber Cancer Institute |

Boston |

4,098 | |||||

| 20 | Cape Cod Healthcare Inc |

Hyannis |

4,000 | |||||

| 21 | GE Aviation |

Lynn |

4,000 | |||||

| 22 | Massachusetts Institute-Tech |

Lexington |

4,000 | |||||

| 23 | Sensata Technologies Inc |

Attleboro |

4,000 | |||||

| 24 | Medical Information Tech Inc |

Westwood |

3,700 | |||||

| 25 | Mit Lincoln Laboratory |

Lexington |

3,535 | |||||

| 26 | Tufts Medical Ctr |

Boston |

3,527 | |||||

| 27 | State Street Corp |

Boston |

3,500 | |||||

| 28 | Cambridge Health Alliance |

Cambridge |

3,296 | |||||

| 29 | Boston Police Dept |

Boston |

3,000 | |||||

| 30 | Boston University Gotlieb |

Boston |

3,000 | |||||

| 31 | Genesis Hr Solutions |

Burlington |

3,000 | |||||

| 32 | Houghton Mifflin Harcourt Co |

Boston |

3,000 | |||||

| 33 | Jamaica Plain VA Medical Ctr |

Jamaica Plain |

3,000 | |||||

| 34 | Kronos Inc |

Lowell |

3,000 | |||||

| 35 | Smith & Nephew |

Andover |

3,000 | |||||

| 36 | Tufts Associated Health Plans |

Watertown |

3,000 | |||||

| 37 | USPS |

Boston |

2,800 | |||||

| 38 | Depuy Inc |

Raynham |

2,600 | |||||

| 39 | North Reading School District |

North Reading |

2,600 | |||||

| 40 | Bose Corp |

Framingham |

2,500 | |||||

Source: www.careerinfonet.org

| RP Financial, LC. | OPERATING ENVIRONMENT AND MARKET AREA Page II.7 |

Market Area Unemployment Data

Comparative unemployment rates for Boston MSA and Norfolk County as well as for the U.S. and the Commonwealth of Massachusetts are shown in Table 2.4. The unemployment data reveals that the respective June 2021 unemployment rates for Norfolk County and Massachusetts of 4.9% and 5.4% were lower than the U.S. unemployment rate of 6.1%, indicating a somewhat more favorable economic environment. Moreover, all geographic areas showed marked improvement over the last year which where the impact of the pandemic caused unemployment to surge on a temporary basis. At the same time, the reduction in unemployment rates while not at pre-pandemic levels has been relatively favorable.

Table 2.4

Colonial FSB

Unemployment Trends

| Unemployment Rate | Net | |||||||||||

| Region |