Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atkore Inc. | atkr-20210909.htm |

© Atkore Investor Presentation & Company Overview September 2021

© Atkore Cautionary Statements This presentation is provided for general informational purposes only and it does not include every item which may be of interest, nor does it purport to present full and fair disclosure with respect to Atkore Inc. (“Atkore”) or its operational and financial information. Atkore expressly disclaims any current intention to update any forward-looking statements contained in this presentation as a result of new information or future events or developments or otherwise, except as required by federal securities laws. This presentation is not a prospectus and is not an offer to sell securities. This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs, assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or any other litigation; and the impact of prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K and the Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission, could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. Further, any forward- looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this presentation after the date of this presentation. Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, but you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. This presentation should be read along with the historical financial statements of Atkore, including the most recent audited financial statements. Historical results may not be indicative of future results. We use non-GAAP financial measures to help us describe our operating and financial performance. These measures may include Adjusted EBITDA, Adjusted EBITDA margin (Adjusted EBITDA over Net Sales), Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Share, Leverage ratio (net debt or total debt less cash and cash equivalents, over Adjusted EBITDA on trailing twelve month (“TTM”) basis), Free Cash Flow (net cash provided by operating activities less capital expenditures) and Return on Capital to help us describe our operating and financial performance. These non-GAAP financial measures are commonly used in our industry and have certain limitations and should not be construed as alternatives to net income, total debt, net cash provided by operating activities, return on assets, and other income data measures as determined in accordance with generally accepted accounting principles in the United States, or GAAP, or as better indicators of operating performance. These non-GAAP financial measures as defined by us may not be comparable to similarly-titled non-GAAP measures presented by other companies. Our presentation of such non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See the appendix to this presentation for a reconciliation of the non-GAAP financial measures presented herein to the most comparable financial measures as determined in accordance with GAAP. Fiscal Periods - The Company has a fiscal year that ends on September 30th. It is the Company's practice to establish quarterly closings using a 4-5-4 calendar. The Company's fiscal quarters typically end on the last Friday in December, March and June. Any information contained in the following slides that has been previously publicly presented by Atkore speaks as of the date that it was originally presented, as indicated. Atkore is not updating or affirming any of such information as of today’s date. The provision of this information shall not imply that the information has not changed since it was originally presented. 2

© Atkore Atkore: a Compelling Investment 3 Disciplined Operational Focus Values-based organization driven by the Atkore Business System Track Record of Success Strong track record of earnings growth, increasing free cash flow and excellent return on capital Market Leadership Leading market share in key product categories with a portfolio of must-stock products for electrical distributors Opportunities for Growth Multiple levers and opportunities to drive sustainable growth through both organic and inorganic investments Strong Financial Profile Strong financial position with a disciplined and balanced approach to capital allocation

© Atkore Atkore at a Glance 4 1. As of September 30, 2020 A leading manufacturer of electrical, safety and infrastructure solutions 1959 Founded 2016 IPO (NYSE: ATKR) Harvey, IL Headquarters ~3,700 Employees1 65 Global Facilities1 Electrical 72% Safety & Infrastructure 28% By Segment United States 89% Intl. 11% By Geography U.S. Non- Residential Construction - New ~33% U.S. Non- Residential Construction - R&R, ~20% U.S. Residential Construction ~14% OEM ~16% Other ~6% Intl. 11% Management Estimate By End Market FY 20201 Net Sales Breakdown, $1.8B

© Atkore Our Foundation is the Atkore Business System 5

© Atkore Our Products Are All Around You Everyday 6

© Atkore Leading Market Positions, Brands & Customers 7 • #1 or #2 market positions in majority of product categories in the U.S. • “Must stock” products with short order cycles and reliable service • Quality of products, the strength of brands, scale and national presence Overview Portfolio of Trusted Brands Electrical Safety & Infrastructure #1PVC Conduit #1 Stainless Steel Conduit #1 In-line Galvanized Mechanical Tube #1Barbed Tape #2Steel Conduit #2 Metal Framing and Related Fittings #2 Cable Tray, Cable Ladder & Fittings NA #3 PVC Coated Conduit #2 Armored Cable Top 10 Security Bollards Prefabricated Device Assemblies #3#3 Flexible and Liquidtight Conduit Well-Established Customer Base

© Atkore Levers to Drive Organic Growth Recent Example & Highlights Broad range of innovative and new products introduced in the past few years MC GlideTM named 2021 Product of the Year in the Wire & Cable category by EC&M Magazine; U.S. Patent No. 11,101,056 Expanding global distribution and product capabilities for safety and security product solutions Completed launch of new toolbar for increasing contractor and designer access to digital offerings and tools for our products such as BIM Models (Building Information Modeling) Strategically aligned to several mega-trends such as electrification, growth in digital infrastructure, and safely protecting both people and critical assets Organic Growth Drivers ORGANIC GROWTH New Product Innovation Global Category Expansion Focused Product Categories Digital Capabilities & Resources Improving Customer Experience 1 2 3 4 5 8

© Atkore QUICK FACTS Spent over $290 million of cash on acquisitions since FY2017 Successful Track Record of Portfolio Management Bolt-On Acquisition Playbook TARGET PROFILE • Privately held small to medium sized businesses • Build and foster long-term relationships • Sales and distribution through similar or existing channels for Atkore STRATEGY • Strategic fit from a product or category perspective, or fills a portfolio gap • Identified path to synergy & value creation • Debt responsible • Within existing management bandwidth and capacity VALUE CREATION • Leverage global spend for key raw material input categories to reduce costs • Add products into Atkore sales & distribution umbrella for “One order, one shipment, one invoice” • Drive 1-2 turns of synergy Fiscal Year Related Segment Electrical Safety & Infrastructure 2013 Acquired Heritage Plastics Closed manufacturing location in France Closed manufacturing location in Brazil 2015 Acquired American Pipe & Plastics Acquired SCI 2017 Acquired Marco Acquired Flexicon Closed manufacturing location in Ohio Acquired Cobra Systems 2019 Acquired Vergokan Acquired Rocky Mountain Colby Pipe Acquired FlyTec Systems Acquired U.S. Tray 2021 Acquired Queen City Plastics Acquired FRE Composites Acquired Sign Support Systems 2020 Closed manufacturing location in Wales 2018 Acquired CalPipe Divested Flexhead 2016 Ceased operations for fence & sprinkler business 2014 Acquired Ridgeline Pipe Manufacturing M&A Strategy Focused on Profitable Growth QUICK FACTS Spent over $300 million of cash on acquisitions since FY2017 Added over $400 million in profitable revenue through M&A activities since 2012 Exited over $400 million in breakeven proforma revenue since 2012 9

© Atkore Strong Cash Flow & Financial Profile 10 1. See non-GAAP reconciliation in appendix. Generating Strong Free Cash Flow Capital Investments Continue to make internal investments to grow business for the future Strategic M&A Strategic acquisitions remain key element of long-term business model, will continue to pursue those that align with top priorities Return Capital to Shareholders Share repurchases remain priority as primary form of capital return Manage Leverage Focused on maintaining and further strengthening balance sheet in order to be ready to support future growth Balanced Approach to Capital Deployment $284 $113 $34 $43 $25 $110 $7 Capital Expenditures Net Repayments of Long- Term Debt & Other Debt Associated Costs and Fees Cash Flow From Operating Activities Free Cash Flow1 M&A Activities Stock Repurchases Net Other Sources of Cash Net Increase in Cash vs. Q4 20 $319M FY21 YTD Cash Flow Bridge, $M

© Atkore Focused on Environment, Social & Governance We seek to utilize sustainable business principles and processes that achieve a balance between profitability and protection of all stakeholders, while reducing our impact on the environment and climate. 43% Reduction in recordable incident rate since 2015 13% Less purchased water intensity since 2016 7% Reduction in greenhouse gas emitted from Energy Star sites since 2016 ~4.5% FY20 Revenue from renewable or energy efficiency- related products 33% Percentage of female or minority members of the Board of Directors 89% Percentage of Independent members of the Board of Directors People and Community We seek to protect people and communities in which our facilities are located. Energy and Climate We are committed to safeguarding climate and ecosystems through preventive practices. Natural Resources We promote social and environmental stewardship throughout our supply chain. Material Efficiency We strive to prevent or minimize activities and conditions that pose a threat to human health and the environment. Strong Governance We are dedicated to creating an organizational structure that is aligned with industry best practices and stockholder interests such as a separate independent Chairman and Delaware incorporation. Our Focus Key Performance Metrics as of FY2020 11

© Atkore Questions? THANK YOU!

© Atkore Appendix: Net Income to Adjusted EBITDA Consolidated Atkore Inc. Fiscal Year Ended (in thousands) September 30, 2020 September 30, 2019 September 30, 2018 September 30, 2017 September 30, 2016 September 30, 2015 Net income $ 152,302 $ 139,051 $ 136,645 $ 84,639 $ 58,796 $ (4,955) Income tax expense 49,696 45,618 29,707 41,486 27,985 (2,916) Depreciation and amortization 74,470 72,347 66,890 54,727 55,017 59,465 Interest expense, net 40,062 50,473 40,694 26,598 41,798 44,809 Loss (gain) on extinguishment of debt 273 — — 9,805 (1,661) — Restructuring & impairments 3,284 3,804 1,849 1,256 4,096 32,703 Net periodic pension benefit cost — — — — 441 578 Stock-based compensation 13,064 11,798 14,664 12,788 21,127 13,523 Gain on purchase of business — (7,384) — — — — Gain on sale of business — — (27,575) — — — Gain on sale of joint venture — — — (5,774) — — ABF product liability impact — — — — 850 (216) Consulting fees — — — — 15,425 3,500 Certain legal matters — — (4,833) 7,551 1,382 — Transaction costs 196 1,200 9,314 4,779 7,832 6,039 Impact of Fence and Sprinkler exit — — — — 811 (2,885) Other(a) (6,712) 7,501 4,194 (10,247) 1,103 14,305 Adjusted EBITDA $ 326,635 $ 324,408 $ 271,549 $ 227,608 $ 235,002 $ 163,950 (a) Represents other items, such as inventory reserves and adjustments, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment, release of indemnified uncertain tax positions and realized or unrealized gain (loss) on foreign currency impacts of intercompany loans and related forward currency derivatives. 13

© Atkore Appendix: Free Cash Flow 14 Consolidated Atkore Inc. Fiscal Year Ended (in thousands) September 30, 2020 September 30, 2019 September 30, 2018 September 30, 2017 September 30, 2016 September 30, 2015 Net cash provided by operating activities $ 248,762 $ 209,694 $ 145,703 $ 121,654 $ 156,646 $ 141,073 Capital expenditures (33,770) (34,860) (38,501) (25,122) (16,830) (26,849) Free Cash Flow $ 214,992 $ 174,834 $ 107,202 $ 96,532 $ 139,816 $ 114,224 Nine months ended (in thousands) June 25, 2021 June 26, 2020 Net cash provided by operating activities $ 318,621 $ 156,019 Capital expenditures $ (34,242) $ (25,590) Free Cash Flow: $ 284,379 $ 130,429

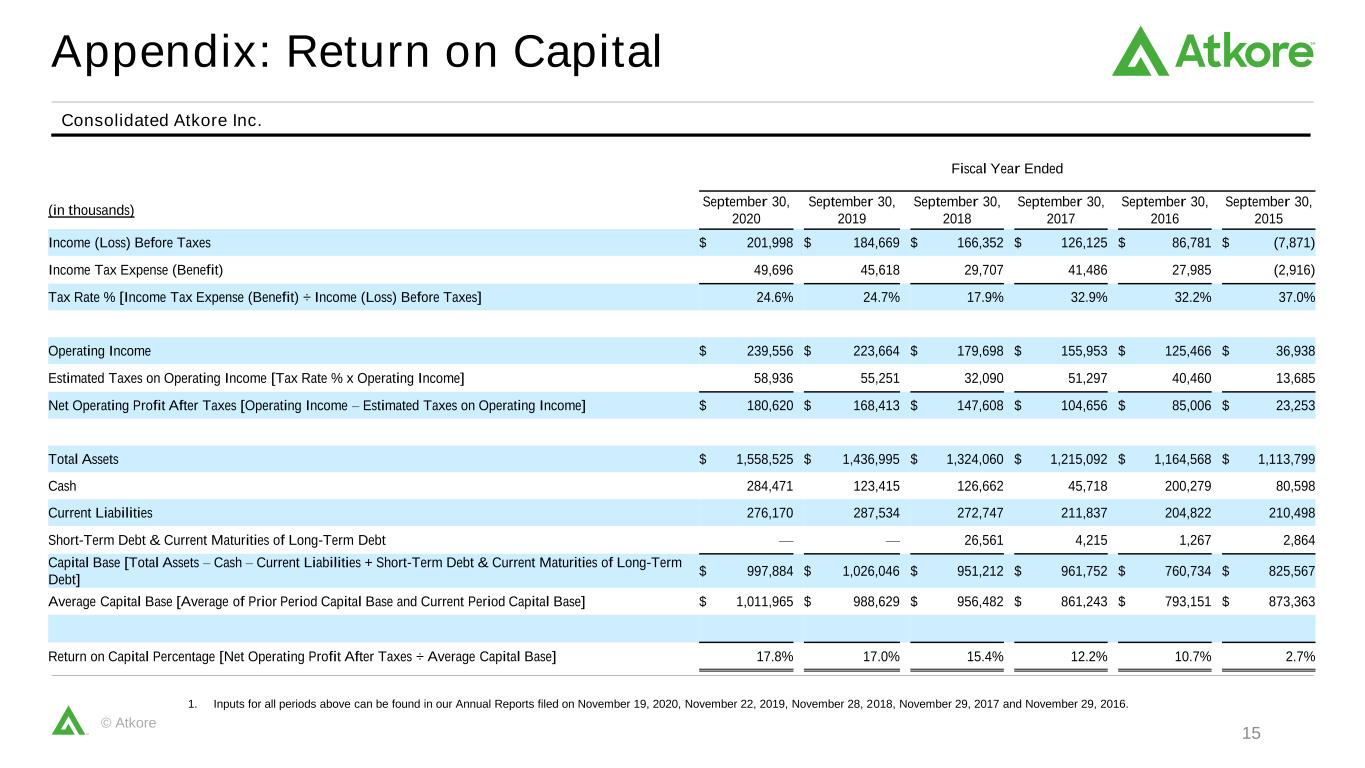

© Atkore Appendix: Return on Capital 15 1. Inputs for all periods above can be found in our Annual Reports filed on November 19, 2020, November 22, 2019, November 28, 2018, November 29, 2017 and November 29, 2016. Consolidated Atkore Inc. Fiscal Year Ended (in thousands) September 30, 2020 September 30, 2019 September 30, 2018 September 30, 2017 September 30, 2016 September 30, 2015 Income (Loss) Before Taxes $ 201,998 $ 184,669 $ 166,352 $ 126,125 $ 86,781 $ (7,871) Income Tax Expense (Benefit) 49,696 45,618 29,707 41,486 27,985 (2,916) Tax Rate % [Income Tax Expense (Benefit) ÷ Income (Loss) Before Taxes] 24.6% 24.7% 17.9% 32.9% 32.2% 37.0% Operating Income $ 239,556 $ 223,664 $ 179,698 $ 155,953 $ 125,466 $ 36,938 Estimated Taxes on Operating Income [Tax Rate % x Operating Income] 58,936 55,251 32,090 51,297 40,460 13,685 Net Operating Profit After Taxes [Operating Income – Estimated Taxes on Operating Income] $ 180,620 $ 168,413 $ 147,608 $ 104,656 $ 85,006 $ 23,253 Total Assets $ 1,558,525 $ 1,436,995 $ 1,324,060 $ 1,215,092 $ 1,164,568 $ 1,113,799 Cash 284,471 123,415 126,662 45,718 200,279 80,598 Current Liabilities 276,170 287,534 272,747 211,837 204,822 210,498 Short-Term Debt & Current Maturities of Long-Term Debt — — 26,561 4,215 1,267 2,864 Capital Base [Total Assets – Cash – Current Liabilities + Short-Term Debt & Current Maturities of Long-Term Debt] $ 997,884 $ 1,026,046 $ 951,212 $ 961,752 $ 760,734 $ 825,567 Average Capital Base [Average of Prior Period Capital Base and Current Period Capital Base] $ 1,011,965 $ 988,629 $ 956,482 $ 861,243 $ 793,151 $ 873,363 Return on Capital Percentage [Net Operating Profit After Taxes ÷ Average Capital Base] 17.8% 17.0% 15.4% 12.2% 10.7% 2.7%

© Atkore atkore.com Thank You!