Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Rocket Lab USA, Inc. | d203150dex991.htm |

| 8-K - 8-K - Rocket Lab USA, Inc. | d203150d8k.htm |

Exhibit 99.2 Rocket Lab USA, Inc 1H 2021 INVESTOR UPDATE SEPTEMBER 8, 2021 rocketlabusa.comExhibit 99.2 Rocket Lab USA, Inc 1H 2021 INVESTOR UPDATE SEPTEMBER 8, 2021 rocketlabusa.com

DISCLAIMER AND FORWARD LOOKING STATEMENTS Forward Looking Statements and disruptions in expansion efforts; our also exacerbate the risks described therein), Use of Non-GAAP Financial Measures We are providing this information to enable dependence on a limited number of customers; as well as other reports and information we investors to perform more meaningful This presentation may contain certain the harsh and unpredictable environment of file with the SEC from time to time. These To supplement our unaudited consolidated comparisons of our operating results in a “forward-looking statements” within the space in which our products operate which forward-looking statements are based on financial statements presented on a basis manner similar to management's analysis of meaning of the Private Securities Litigation could adversely affect our launch vehicle and Rocket Lab’s current plans, expectations and consistent with GAAP, we disclose certain non- our business. We believe that these non-GAAP Reform Act of 1995, Section 27A of the spacecraft; increased congestion from the beliefs concerning future developments and GAAP financial measures, including non-GAAP measures have limitations in that they do not Securities Act of 1933, as amended, and Section proliferation of low Earth orbit constellations their potential effects. Although we believe gross margin, operating expenses, operating reflect all of the amounts associated with our 21E of the Securities and Exchange Act of which could materially increase the risk of that we have a reasonable basis for each expenses as a percentage of revenue, income GAAP results of operations. These non-GAAP 1934, as amended. All statements, other than potential collision with space debris or another forward-looking statement contained in this from operations as percentage of revenue, and measures should only be viewed in conjunction statements of historical facts, contained in this spacecraft and limit or impair our launch presentation, there can be no assurance that diluted earnings per share. These supplemental with corresponding GAAP measures presentation, including statements regarding flexibility and/or access to our own orbital slots; the future developments affecting Rocket Lab measures exclude the effects of (i) stock- Reconciliations of non-GAAP measures our expectations of financial results for the increased competition in our industry due in will be those that we have anticipated and we based compensation expense; (ii) amortization for the historical periods disclosed are third and fourth quarter of 2021, strategy, future part to rapid technological development and may not actually achieve the plans, intentions of purchased intangible assets; (iii) other non- included in this presentation. We have not operations, future financial position, projected decreasing costs, technological change in our or expectations disclosed in our forward- recurring interest and other income provided a reconciliation for forward-looking costs, prospects, plans and objectives of industry which we may not be able to keep looking statements, and you should not (expenses), net attributable to acquisitions non-GAAP financial measures because, management, are forward-looking statements. up with or which may render our services place undue reliance on our forward-looking and (iv) non-cash income tax benefits and without unreasonable efforts, we are unable Words such as, but not limited to, “anticipate,” uncompetitive; average selling price trends; statements. Moreover, we operate in a very expenses. We also supplement our unaudited to predict with reasonable certainty the “aim,” “believe,” “contemplate,” “continue,” failure of our satellites to operate as intended competitive and rapidly changing environment. historical statements and forward-looking amount and timing of adjustments that are “could,” “design,” “estimate,” “expect,” “intend,” either due to our error in design in production New risks emerge from time to time. It is not guidance with the measure of adjusted used to calculate these non-GAAP financial “may,” “might,” “plan,” “possible,” “potential,” or through no fault of our own; launch schedule possible for our management to predict all EBITDA, where adjustments to EBITDA include measures, particularly related to stock based “predict,” “project,” “seek,” “should,” “suggest,” disruptions; supply chain disruptions; product risks, nor can we assess the impact of all sharebased compensation, warrant expense compensation and its related tax effects. “strategy,” “target,” “will,” “would,” and similar delays or failures; design and engineering flaws; factors on our business or the extent to related to customers and partners, foreign expressions or phrases, or the negative of launch failures; natural disasters and which any factor, or combination of factors, exchange gains or losses, and other non- those expressions or phrases, are intended to epidemics or pandemics; changes in may cause actual results to differ materially recurring gains or losses. These non-GAAP identify forward-looking statements, although governmental regulations, including with from those contained in any forward-looking measures are not in accordance with and not all forward-looking statements respect to trade and export restrictions, or statements we may make. You should read this do not serve as an alternative for GAAP. We contain these identifying words. These forward- in the status of our regulatory approvals or presentation with the understanding that our believe that these non-GAAP measures have looking statements involve a number of risks, applications, or other events that force us actual results may be materially different limitations in that they do not reflect all of the uncertainties (many of which are beyond to cancel or reschedule launches, including from the plans, intentions and expectations amounts associated with our GAAP results Rocket Lab’s control), or other assumptions customer contractual rescheduling and disclosed in the forward-looking statements of operations. These non-GAAP measures that may cause actual results or performance termination rights; and the other risks detailed we make. All forward-looking statements are should only be viewed in conjunction to be materially different from those under the heading “Risk Factors” contained qualified in their entirety by this cautionary with corresponding GAAP measures. We expressed or implied by the forward-looking in our final prospectus and definitive proxy statement. The forward-looking statements compensate for the limitations of statements contained in this presentation, statement filed with the Securities and contained in this presentation are made as of non-GAAP financial measures by relying upon including risks related to the global COVID-19 Exchange Commission (the “SEC”) on July 21, the date of this presentation, and we do not GAAP results to gain a complete picture of our pandemic, including risks related to government 2021 and the information contained in Exhibit assume any obligation to update any forward- performance. Non-GAAP financial measures restrictions and lock-downs in New Zealand 99.1 to our Current Report on Form 8-K filed looking statements, whether as a result of new are not in accordance with and do not serve as and other countries in which we operate that with the SEC on August 31, 2021 (including information, future events or otherwise except an alternative for the presentation of our GAAP could delay or suspend our operations; delays the risk that the COVID-19 pandemic may as required by applicable law. financial results. 2 Rocket Lab USA, IncDISCLAIMER AND FORWARD LOOKING STATEMENTS Forward Looking Statements and disruptions in expansion efforts; our also exacerbate the risks described therein), Use of Non-GAAP Financial Measures We are providing this information to enable dependence on a limited number of customers; as well as other reports and information we investors to perform more meaningful This presentation may contain certain the harsh and unpredictable environment of file with the SEC from time to time. These To supplement our unaudited consolidated comparisons of our operating results in a “forward-looking statements” within the space in which our products operate which forward-looking statements are based on financial statements presented on a basis manner similar to management's analysis of meaning of the Private Securities Litigation could adversely affect our launch vehicle and Rocket Lab’s current plans, expectations and consistent with GAAP, we disclose certain non- our business. We believe that these non-GAAP Reform Act of 1995, Section 27A of the spacecraft; increased congestion from the beliefs concerning future developments and GAAP financial measures, including non-GAAP measures have limitations in that they do not Securities Act of 1933, as amended, and Section proliferation of low Earth orbit constellations their potential effects. Although we believe gross margin, operating expenses, operating reflect all of the amounts associated with our 21E of the Securities and Exchange Act of which could materially increase the risk of that we have a reasonable basis for each expenses as a percentage of revenue, income GAAP results of operations. These non-GAAP 1934, as amended. All statements, other than potential collision with space debris or another forward-looking statement contained in this from operations as percentage of revenue, and measures should only be viewed in conjunction statements of historical facts, contained in this spacecraft and limit or impair our launch presentation, there can be no assurance that diluted earnings per share. These supplemental with corresponding GAAP measures presentation, including statements regarding flexibility and/or access to our own orbital slots; the future developments affecting Rocket Lab measures exclude the effects of (i) stock- Reconciliations of non-GAAP measures our expectations of financial results for the increased competition in our industry due in will be those that we have anticipated and we based compensation expense; (ii) amortization for the historical periods disclosed are third and fourth quarter of 2021, strategy, future part to rapid technological development and may not actually achieve the plans, intentions of purchased intangible assets; (iii) other non- included in this presentation. We have not operations, future financial position, projected decreasing costs, technological change in our or expectations disclosed in our forward- recurring interest and other income provided a reconciliation for forward-looking costs, prospects, plans and objectives of industry which we may not be able to keep looking statements, and you should not (expenses), net attributable to acquisitions non-GAAP financial measures because, management, are forward-looking statements. up with or which may render our services place undue reliance on our forward-looking and (iv) non-cash income tax benefits and without unreasonable efforts, we are unable Words such as, but not limited to, “anticipate,” uncompetitive; average selling price trends; statements. Moreover, we operate in a very expenses. We also supplement our unaudited to predict with reasonable certainty the “aim,” “believe,” “contemplate,” “continue,” failure of our satellites to operate as intended competitive and rapidly changing environment. historical statements and forward-looking amount and timing of adjustments that are “could,” “design,” “estimate,” “expect,” “intend,” either due to our error in design in production New risks emerge from time to time. It is not guidance with the measure of adjusted used to calculate these non-GAAP financial “may,” “might,” “plan,” “possible,” “potential,” or through no fault of our own; launch schedule possible for our management to predict all EBITDA, where adjustments to EBITDA include measures, particularly related to stock based “predict,” “project,” “seek,” “should,” “suggest,” disruptions; supply chain disruptions; product risks, nor can we assess the impact of all sharebased compensation, warrant expense compensation and its related tax effects. “strategy,” “target,” “will,” “would,” and similar delays or failures; design and engineering flaws; factors on our business or the extent to related to customers and partners, foreign expressions or phrases, or the negative of launch failures; natural disasters and which any factor, or combination of factors, exchange gains or losses, and other non- those expressions or phrases, are intended to epidemics or pandemics; changes in may cause actual results to differ materially recurring gains or losses. These non-GAAP identify forward-looking statements, although governmental regulations, including with from those contained in any forward-looking measures are not in accordance with and not all forward-looking statements respect to trade and export restrictions, or statements we may make. You should read this do not serve as an alternative for GAAP. We contain these identifying words. These forward- in the status of our regulatory approvals or presentation with the understanding that our believe that these non-GAAP measures have looking statements involve a number of risks, applications, or other events that force us actual results may be materially different limitations in that they do not reflect all of the uncertainties (many of which are beyond to cancel or reschedule launches, including from the plans, intentions and expectations amounts associated with our GAAP results Rocket Lab’s control), or other assumptions customer contractual rescheduling and disclosed in the forward-looking statements of operations. These non-GAAP measures that may cause actual results or performance termination rights; and the other risks detailed we make. All forward-looking statements are should only be viewed in conjunction to be materially different from those under the heading “Risk Factors” contained qualified in their entirety by this cautionary with corresponding GAAP measures. We expressed or implied by the forward-looking in our final prospectus and definitive proxy statement. The forward-looking statements compensate for the limitations of statements contained in this presentation, statement filed with the Securities and contained in this presentation are made as of non-GAAP financial measures by relying upon including risks related to the global COVID-19 Exchange Commission (the “SEC”) on July 21, the date of this presentation, and we do not GAAP results to gain a complete picture of our pandemic, including risks related to government 2021 and the information contained in Exhibit assume any obligation to update any forward- performance. Non-GAAP financial measures restrictions and lock-downs in New Zealand 99.1 to our Current Report on Form 8-K filed looking statements, whether as a result of new are not in accordance with and do not serve as and other countries in which we operate that with the SEC on August 31, 2021 (including information, future events or otherwise except an alternative for the presentation of our GAAP could delay or suspend our operations; delays the risk that the COVID-19 pandemic may as required by applicable law. financial results. 2 Rocket Lab USA, Inc

Today’s Presenters Peter Beck Adam Spice Founder, CEO, Chief Engineer Chief Financial Ofc fi er 3 3 R Ro oc ck ke et L t La ab U b US SA A , Inc

AGENDA Introduction 1 Key Accomplishments 2 Financial Highlights and Outlook 3 Sell-Side Q&A 4 Upcoming Conferences and Events 5 4 Rocket Lab USA, IncAGENDA Introduction 1 Key Accomplishments 2 Financial Highlights and Outlook 3 Sell-Side Q&A 4 Upcoming Conferences and Events 5 4 Rocket Lab USA, Inc

Rocket lab at a glance A vertically integrated provider of small launch services, satellites and spacecraft components Delivering end-to-end space solutions Launch: Proven rocket delivering dedicated access to orbit for 3+ years ND 21 3 2 2 7 105 Satellites Most frequently Launches Launch Mission Successful Space Systems: Manufacturing satellites and 1 to space deployed pads launched control missions best-in-class heritage spacecraft components to orbit U.S. rocket centers for USG customers Space Applications: Uniquely positioned to leverage launch and satellite capabilities and infrastructure to build and operate our own constellations 2 2 3 1 1 2 of our own Recovered Interplanetary Awarded Strategic Factories acquisition built satellites on rockets missions contract for orbit (+ more scheduled Photon demo to come) (Moon, Mars, of propellant Venus) depot in orbit 5 Rocket Lab USA, Inc 1 Includes Pad B at Launch Complex-1 that is under construction and Wallops Island that may be used upon certification of our flight termination system software by NASARocket lab at a glance A vertically integrated provider of small launch services, satellites and spacecraft components Delivering end-to-end space solutions Launch: Proven rocket delivering dedicated access to orbit for 3+ years ND 21 3 2 2 7 105 Satellites Most frequently Launches Launch Mission Successful Space Systems: Manufacturing satellites and 1 to space deployed pads launched control missions best-in-class heritage spacecraft components to orbit U.S. rocket centers for USG customers Space Applications: Uniquely positioned to leverage launch and satellite capabilities and infrastructure to build and operate our own constellations 2 2 3 1 1 2 of our own Recovered Interplanetary Awarded Strategic Factories acquisition built satellites on rockets missions contract for orbit (+ more scheduled Photon demo to come) (Moon, Mars, of propellant Venus) depot in orbit 5 Rocket Lab USA, Inc 1 Includes Pad B at Launch Complex-1 that is under construction and Wallops Island that may be used upon certification of our flight termination system software by NASA

Key 1H 2021 Accomplishments Three Launches in 1H REACHED OUR 20TH ELECTRON LAUNCH 6 Rocket Lab USA, IncKey 1H 2021 Accomplishments Three Launches in 1H REACHED OUR 20TH ELECTRON LAUNCH 6 Rocket Lab USA, Inc

DEPLOYED th 100 SATELLITE TO ORBIT 7 Rocket Lab USA, IncDEPLOYED th 100 SATELLITE TO ORBIT 7 Rocket Lab USA, Inc

SUCCESSFULLY RECOVERED nd 2 BOOSTER Further advancing Electron recoverability program to enable increased launch cadence and reduce our cost per mission. 8 Rocket Lab USA, IncSUCCESSFULLY RECOVERED nd 2 BOOSTER Further advancing Electron recoverability program to enable increased launch cadence and reduce our cost per mission. 8 Rocket Lab USA, Inc

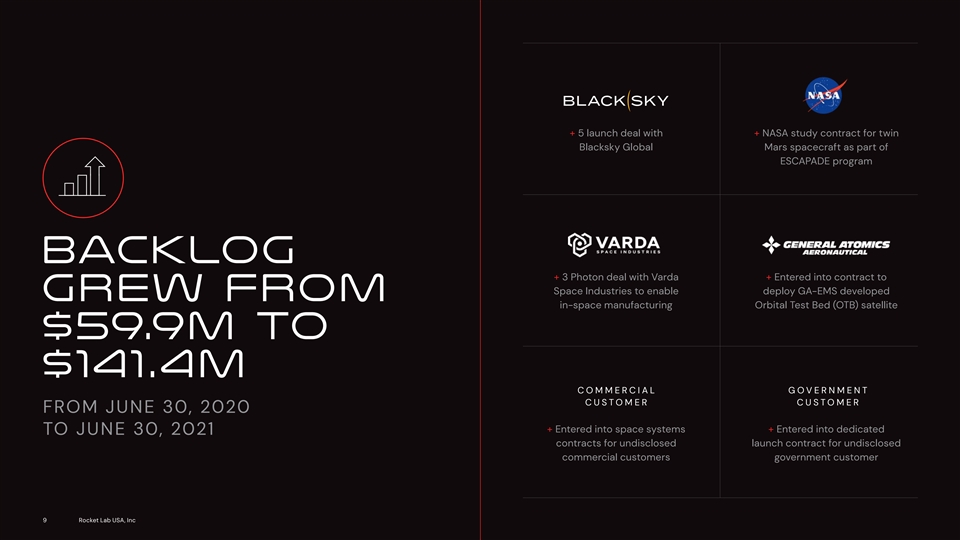

+ 5 launch deal with + NASA study contract for twin Blacksky Global Mars spacecraft as part of ESCAPADE program Backlog + 3 Photon deal with Varda + Entered into contract to Space Industries to enable deploy GA-EMS developed grew from in-space manufacturing Orbital Test Bed (OTB) satellite $59.9m to $141.4m C O M M E R C IAL GOVERNMENT C U S T O M E R C U S T O M E R FROM JUNE 30, 2020 + Entered into space systems + Entered into dedicated TO JUNE 30, 2021 contracts for undisclosed launch contract for undisclosed commercial customers government customer 9 Rocket Lab USA, Inc+ 5 launch deal with + NASA study contract for twin Blacksky Global Mars spacecraft as part of ESCAPADE program Backlog + 3 Photon deal with Varda + Entered into contract to Space Industries to enable deploy GA-EMS developed grew from in-space manufacturing Orbital Test Bed (OTB) satellite $59.9m to $141.4m C O M M E R C IAL GOVERNMENT C U S T O M E R C U S T O M E R FROM JUNE 30, 2020 + Entered into space systems + Entered into dedicated TO JUNE 30, 2021 contracts for undisclosed launch contract for undisclosed commercial customers government customer 9 Rocket Lab USA, Inc

EXECUTED ADDED MERGER THREE BOARD agreement MEMBERS + + + WITH VECTOR ACQUISITION CORP Merline Saintil Jon Olson Alex Slusky 10 Rocket Lab USA, IncEXECUTED ADDED MERGER THREE BOARD agreement MEMBERS + + + WITH VECTOR ACQUISITION CORP Merline Saintil Jon Olson Alex Slusky 10 Rocket Lab USA, Inc

Announced NEUTRON ROCKET AN 8 TON MEDIUM CLASS LAUNCH VEHICLE DEVELOPMENT PROGRAM 11 Rocket Lab USA, IncAnnounced NEUTRON ROCKET AN 8 TON MEDIUM CLASS LAUNCH VEHICLE DEVELOPMENT PROGRAM 11 Rocket Lab USA, Inc

Additional accomplishments AFTER 30 JUNE 2021 12 Rocket Lab USA, Inc

ADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 US SPACE FORCE MISSION SUCCESSFULLY LAUNCHED ON JULY 29TH, 2021 13 Rocket Lab USA, IncADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 US SPACE FORCE MISSION SUCCESSFULLY LAUNCHED ON JULY 29TH, 2021 13 Rocket Lab USA, Inc

ADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 + U ndisclosed commercial C O M M E R C IAL & and government launch G O V ER N M EN T contracts and satellite C U S T O M E R component sales FURTHER + A urora Propulsion Technologies contract to launch a satellite to test space Expanded junk removal technologies Backlog to $174m AS OF AUGUST 31, 2021 + A lba Orbital contract to launch a cluster of small satellites designed to demonstrate innovative radio and night-time Earth observation technologies 14 Rocket Lab USA, IncADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 + U ndisclosed commercial C O M M E R C IAL & and government launch G O V ER N M EN T contracts and satellite C U S T O M E R component sales FURTHER + A urora Propulsion Technologies contract to launch a satellite to test space Expanded junk removal technologies Backlog to $174m AS OF AUGUST 31, 2021 + A lba Orbital contract to launch a cluster of small satellites designed to demonstrate innovative radio and night-time Earth observation technologies 14 Rocket Lab USA, Inc

ADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 SIGNED FIVE LAUNCH DEAL WITH Kinéis TO DEPLOY ENTIRE IOT CONSTELLATION WITH ELECTRON 15 Rocket Lab USA, IncADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 SIGNED FIVE LAUNCH DEAL WITH Kinéis TO DEPLOY ENTIRE IOT CONSTELLATION WITH ELECTRON 15 Rocket Lab USA, Inc

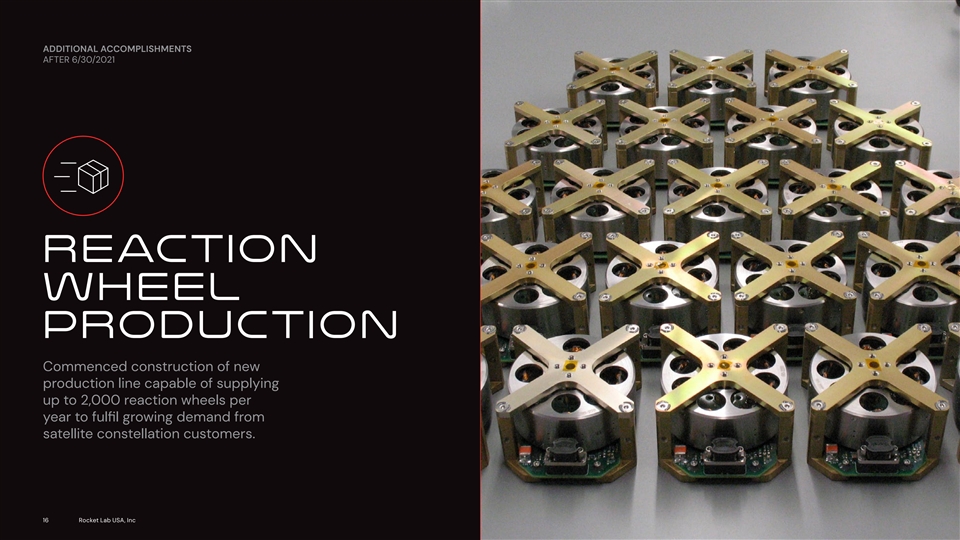

ADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 REACTION WHEEL PRODUCTION Commenced construction of new production line capable of supplying up to 2,000 reaction wheels per year to full gr fi owing demand from satellite constellation customers. 16 Rocket Lab USA, IncADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 REACTION WHEEL PRODUCTION Commenced construction of new production line capable of supplying up to 2,000 reaction wheels per year to full gr fi owing demand from satellite constellation customers. 16 Rocket Lab USA, Inc

ADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 SUCCESSFULLY closed de-spac MERGER transaction WITH VECTOR ACQUISITION CORPORATION + $ 777M in gross proceeds from the PIPE and cash from Vector Trust. 17 Rocket Lab USA, IncADDITIONAL ACCOMPLISHMENTS AFTER 6/30/2021 SUCCESSFULLY closed de-spac MERGER transaction WITH VECTOR ACQUISITION CORPORATION + $ 777M in gross proceeds from the PIPE and cash from Vector Trust. 17 Rocket Lab USA, Inc

COVID-19 IMPACT LAUNCH CADENCE IMPACTED BY NEW ZEALAND'S COVID-19 RESTRICTIONS, SOME OF THE STRICTEST MEASURES IN THE WORLD. 18 Rocket Lab USA, IncCOVID-19 IMPACT LAUNCH CADENCE IMPACTED BY NEW ZEALAND'S COVID-19 RESTRICTIONS, SOME OF THE STRICTEST MEASURES IN THE WORLD. 18 Rocket Lab USA, Inc

Review of Financial results Increasing diversity in $29.5M 237% REVENUE IN 1H YEAR-ON-YEAR REVENUE GROWTH revenue, with Space Systems contributing 18% of total revenue in the period, compared to Year-On-Year Revenue Growth and Gross Margin 3% in the prior year. $24.1 $8.5 Expansion in gross $5.4 $3.9 margins from negative $0.3 ($5.9) 67% to a positive 13%, 1H'20 1H'21 aided by Space Systems Gross Margins of 65%. Space Systems ($M) Gross Margin ($M) Launch ($M) 19 Rocket Lab USA, IncReview of Financial results Increasing diversity in $29.5M 237% REVENUE IN 1H YEAR-ON-YEAR REVENUE GROWTH revenue, with Space Systems contributing 18% of total revenue in the period, compared to Year-On-Year Revenue Growth and Gross Margin 3% in the prior year. $24.1 $8.5 Expansion in gross $5.4 $3.9 margins from negative $0.3 ($5.9) 67% to a positive 13%, 1H'20 1H'21 aided by Space Systems Gross Margins of 65%. Space Systems ($M) Gross Margin ($M) Launch ($M) 19 Rocket Lab USA, Inc

Review of Financial results R&D vs. SG&A Spending $15.6 Targeted and aggressive $13.7 investments in TAM $11.3 expanding technical capabilities with a 156% Year-on-Year $6.1 increase in R&D spending, compared with a 21% increase in SG&A. 1H'20 1H'21 R&D ($M) SG&A ($M) 20 Rocket Lab USA, Inc

CONSOLIDATED STATEMENT OF OPERATIONS GAAP to Non-GAAP Reconciliations AND COMPREHENSIVE LOSS Six Months Ended Six Months Ended June 30, 2021 June 30, 2020 June 30, 2021 June 30, 2020 REVENUES 29,472,311 8,753,013 Cost of goods sold 24,001,754 6,264,592 GAAP Gross Margin 3,873,965 (5,878,626) Production costs 16,052,808 14,519,306 Launch costs 6,650,539 4,829,276 Stock-based compensation 603,549 715,139 Recoveries (21,106,756) (10,981,536) COST OF GOODS SOLD 25,598,346 14,631,638 Amortization of purchased intangible assets 112,464 12,664 GROSS PROFIT 3,873,965 (5,878,626) Non-GAAP Gross Margin 4,589,978 (5,150,823) 13% -67% OPERATING EXPENSES: - 16% -59% Research and development 15,607,346 6,105,448 Selling, general and administrative 13,691,768 11,320,228 Total operating expenses 29,299,113 17,425,675 GAAP Operating Expenses 29,299,113 17,425,675 OPERATING LOSS (25,425,148) (23,304,301) Stock-based compensation (1,775,553) (1,208,078) OTHER INCOME (EXPENSE):- Research and development income- Amortization of purchased intangible assets (786,902) (88,426) Interest income, net (401,742) 242,879 Acquisition costs- (833,505) Gain (loss) on foreign exchange (404,920) (435,357) Other income (expense), net (5,611,345) 792,787 Non-GAAP Operating expenses 26,736,659 15,295,667 Total Other income (expense), net (6,418,007) 600,310 LOSS BEFORE INCOME TAXES (31,843,155) (22,703,992) PROVISION FOR INCOME TAXES (704,206) (748,551) GAAP income (loss) from operations (25,425,148) (23,304,301) NET LOSS (32,547,361) (23,452,542) Total non-GAAP adjustments 3,278,468 2,857,812 - OTHER COMPREHENSIVE LOSS- Non-GAAP income (loss) from operations (22,146,680) (20,446,489) Foreign currency translation adjustments 1,074,005 (367,644) COMPREHENSIVE LOSS (31,473,356) (23,820,187) GAAP income (loss) from operations (25,425,148) (23,304,301) Six Months Ended Total non-GAAP adjustments 3,278,468 2,857,812 Adjusted EBITDA June 30, 2021 June 30, 2020 Non-GAAP income (loss) from operations (22,146,680) (20,446,489) NET LOSS (32,547,361) (23,452,542) Depreciation 3,554,780 2,824,546 GAAP and non-GAAP interest and other income (expense), net (6,418,007) 600,310 Amortisation 1,292,389 665,289 Stock Based Comp 2,379,102 1,923,217 Non-recurring interest and other income (expense), net 6,084,337 176,969 Acquisition costs 833,505 Non-GAAP interest and other income (expense), net (333,670)777,279 Loss on extinguishment of debt 794,992 - Interest income (expense) 401,742 (242,879) Other Income/Expense Warrants 4,884,424 (258,388) Taxes 704,206 748,551 Foreign Exchange Currency 435,357 404,920 ADJUSTED EBITDA (18,130,805) (16,523,344) 21 Rocket Lab USA, IncCONSOLIDATED STATEMENT OF OPERATIONS GAAP to Non-GAAP Reconciliations AND COMPREHENSIVE LOSS Six Months Ended Six Months Ended June 30, 2021 June 30, 2020 June 30, 2021 June 30, 2020 REVENUES 29,472,311 8,753,013 Cost of goods sold 24,001,754 6,264,592 GAAP Gross Margin 3,873,965 (5,878,626) Production costs 16,052,808 14,519,306 Launch costs 6,650,539 4,829,276 Stock-based compensation 603,549 715,139 Recoveries (21,106,756) (10,981,536) COST OF GOODS SOLD 25,598,346 14,631,638 Amortization of purchased intangible assets 112,464 12,664 GROSS PROFIT 3,873,965 (5,878,626) Non-GAAP Gross Margin 4,589,978 (5,150,823) 13% -67% OPERATING EXPENSES: - 16% -59% Research and development 15,607,346 6,105,448 Selling, general and administrative 13,691,768 11,320,228 Total operating expenses 29,299,113 17,425,675 GAAP Operating Expenses 29,299,113 17,425,675 OPERATING LOSS (25,425,148) (23,304,301) Stock-based compensation (1,775,553) (1,208,078) OTHER INCOME (EXPENSE):- Research and development income- Amortization of purchased intangible assets (786,902) (88,426) Interest income, net (401,742) 242,879 Acquisition costs- (833,505) Gain (loss) on foreign exchange (404,920) (435,357) Other income (expense), net (5,611,345) 792,787 Non-GAAP Operating expenses 26,736,659 15,295,667 Total Other income (expense), net (6,418,007) 600,310 LOSS BEFORE INCOME TAXES (31,843,155) (22,703,992) PROVISION FOR INCOME TAXES (704,206) (748,551) GAAP income (loss) from operations (25,425,148) (23,304,301) NET LOSS (32,547,361) (23,452,542) Total non-GAAP adjustments 3,278,468 2,857,812 - OTHER COMPREHENSIVE LOSS- Non-GAAP income (loss) from operations (22,146,680) (20,446,489) Foreign currency translation adjustments 1,074,005 (367,644) COMPREHENSIVE LOSS (31,473,356) (23,820,187) GAAP income (loss) from operations (25,425,148) (23,304,301) Six Months Ended Total non-GAAP adjustments 3,278,468 2,857,812 Adjusted EBITDA June 30, 2021 June 30, 2020 Non-GAAP income (loss) from operations (22,146,680) (20,446,489) NET LOSS (32,547,361) (23,452,542) Depreciation 3,554,780 2,824,546 GAAP and non-GAAP interest and other income (expense), net (6,418,007) 600,310 Amortisation 1,292,389 665,289 Stock Based Comp 2,379,102 1,923,217 Non-recurring interest and other income (expense), net 6,084,337 176,969 Acquisition costs 833,505 Non-GAAP interest and other income (expense), net (333,670)777,279 Loss on extinguishment of debt 794,992 - Interest income (expense) 401,742 (242,879) Other Income/Expense Warrants 4,884,424 (258,388) Taxes 704,206 748,551 Foreign Exchange Currency 435,357 404,920 ADJUSTED EBITDA (18,130,805) (16,523,344) 21 Rocket Lab USA, Inc

Statement of Cash Flows Six-Months Ended June 30 2021 2020 Cash flows from operating activities: Net loss $ (32,547) $ (23,453) Adjustments to reconcile net (loss) to net cash used in operating activities: Depreciation and amortization 4,847 3,663 Amortization of deferred debt costs 149 – Stock compensation expense 2,379 1,923 Loss on disposal of assets 55 3,451 Loss on extinguishment of long-term debt 496 – Noncash lease expense 997 1,532 Noncash expense associated with preferred stock warrants 5,478 (137) Deferred taxes (612) (459) Changes in operating assets and liabilities: Accounts receivable (19,580) (5,794) Contract assets 1,201 4,707 Inventories (5,347) (11,080) Prepaids and other current assets 2,796 (915) Increase (decrease) in liabilities: Trade payables (3,384) 598 Accrued expenses 2,849 152 Employee benefits payable 756 1,406 Contract liabilities 5,006 11,901 Other current liabilities (930) 1,703 Non-current lease liabilities (1,191) (720) Other non-current liabilities – (576) Net cash used in operating activities (36,582) (12,098) Cash flows from investing activities: Purchases of property, equipment and software (5,699) (15,618) Cash paid for acquisition, net of acquired cash – (12,208) Net cash used in investing activities (5,699) (27,826) Cash flows from financing activities: Payment of deferred transaction costs associated with planned reverse (2,298) – recapitalization transaction Proceeds from the exercise of stock options 772 22 Proceeds from long-term revolving line of credit 15,000 – Repayments on long-term revolving line of credit 98,895 – Net Proceeds from issuance of Series E-1 Preferred Stock (15,000) Net cash provided by financing activities – 20,500 Effect of exchange rates on cash and cash equivalents 97,369 20,522 Net increase (decrease) in cash and cash equivalents and restricted cash 20 (113) Cash and cash equivalents, and restricted cash, beginning of period 55,108 (19,515) Cash and cash equivalents, and restricted cash, end of period 53,933 97,694 Supplemental disclosures of non-cash investing and financing activities: $ 109,041 $ 78,179 Unpaid purchases of property, equipment and software $ 1,231 $ 1,062 Deferred transaction costs in accrued expenses 1,096 – 22 Rocket Lab USA, Inc

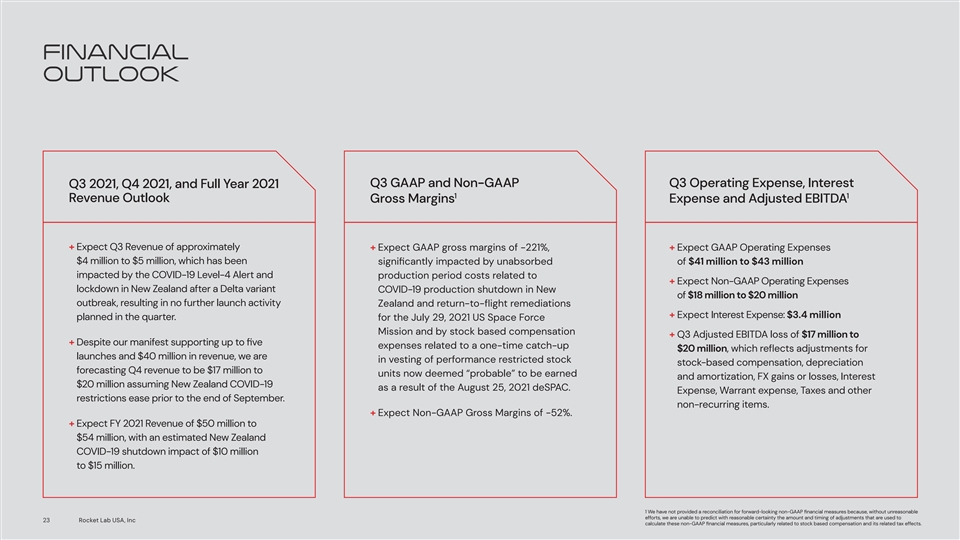

Financial Outlook Q3 GAAP and Non-GAAP Q3 Operating Expense, Interest Q3 2021, Q4 2021, and Full Year 2021 1 1 Revenue Outlook Gross Margins Expense and Adjusted EBITDA + E xpect Q3 Revenue of approximately + Expec t GAAP gross margins of -221%, + E xpect GAAP Operating Expenses $4 million to $5 million, which has been significantly impacted by unabsorbed of $41 million to $43 million impacted by the COVID-19 Level-4 Alert and production period costs related to + E xpect Non-GAAP Operating Expenses lockdown in New Zealand after a Delta variant COVID-19 production shutdown in New of $18 million to $20 million outbreak, resulting in no further launch activity Zealand and return-to-flight remediations + E xpect Interest Expense: $3.4 million planned in the quarter. for the July 29, 2021 US Space Force Mission and by stock based compensation + Q 3 Adjusted EBITDA loss of $17 million to + D espite our manifest supporting up to five expenses related to a one-time catch-up $20 million, which ree fl cts adjustments for launches and $40 million in revenue, we are in vesting of performance restricted stock stock-based compensation, depreciation forecasting Q4 revenue to be $17 million to units now deemed “probable” to be earned and amortization, FX gains or losses, Interest $20 million assuming New Zealand COVID-19 as a result of the August 25, 2021 deSPAC. Expense, Warrant expense, Taxes and other restrictions ease prior to the end of September. non-recurring items. + Expec t Non-GAAP Gross Margins of -52%. + E xpect FY 2021 Revenue of $50 million to $54 million, with an estimated New Zealand COVID-19 shutdown impact of $10 million to $15 million. 1 We have not provided a reconciliation for forward-looking non-GAAP financial measures because, without unreasonable efforts, we are unable to predict with reasonable certainty the amount and timing of adjustments that are used to 23 Rocket Lab USA, Inc calculate these non-GAAP financial measures, particularly related to stock based compensation and its related tax effects.Financial Outlook Q3 GAAP and Non-GAAP Q3 Operating Expense, Interest Q3 2021, Q4 2021, and Full Year 2021 1 1 Revenue Outlook Gross Margins Expense and Adjusted EBITDA + E xpect Q3 Revenue of approximately + Expec t GAAP gross margins of -221%, + E xpect GAAP Operating Expenses $4 million to $5 million, which has been significantly impacted by unabsorbed of $41 million to $43 million impacted by the COVID-19 Level-4 Alert and production period costs related to + E xpect Non-GAAP Operating Expenses lockdown in New Zealand after a Delta variant COVID-19 production shutdown in New of $18 million to $20 million outbreak, resulting in no further launch activity Zealand and return-to-flight remediations + E xpect Interest Expense: $3.4 million planned in the quarter. for the July 29, 2021 US Space Force Mission and by stock based compensation + Q 3 Adjusted EBITDA loss of $17 million to + D espite our manifest supporting up to five expenses related to a one-time catch-up $20 million, which ree fl cts adjustments for launches and $40 million in revenue, we are in vesting of performance restricted stock stock-based compensation, depreciation forecasting Q4 revenue to be $17 million to units now deemed “probable” to be earned and amortization, FX gains or losses, Interest $20 million assuming New Zealand COVID-19 as a result of the August 25, 2021 deSPAC. Expense, Warrant expense, Taxes and other restrictions ease prior to the end of September. non-recurring items. + Expec t Non-GAAP Gross Margins of -52%. + E xpect FY 2021 Revenue of $50 million to $54 million, with an estimated New Zealand COVID-19 shutdown impact of $10 million to $15 million. 1 We have not provided a reconciliation for forward-looking non-GAAP financial measures because, without unreasonable efforts, we are unable to predict with reasonable certainty the amount and timing of adjustments that are used to 23 Rocket Lab USA, Inc calculate these non-GAAP financial measures, particularly related to stock based compensation and its related tax effects.

Q&A 24 Rocket Lab USA, IncQ&A 24 Rocket Lab USA, Inc

Upcoming conferences Deutsche Bank TechCrunch UBS Disruptive Technology Virtual Technology Conference Disrupt 2021 CEO Summit September 10, 2021 September 22, 2021 October 19, 2021 Peter Beck Peter Beck Peter Beck Adam Spice Founder & Chief Executive Chief Financial Officer Founder & Chief Executive Founder & Chief Executive 25 Rocket Lab USA, IncUpcoming conferences Deutsche Bank TechCrunch UBS Disruptive Technology Virtual Technology Conference Disrupt 2021 CEO Summit September 10, 2021 September 22, 2021 October 19, 2021 Peter Beck Peter Beck Peter Beck Adam Spice Founder & Chief Executive Chief Financial Officer Founder & Chief Executive Founder & Chief Executive 25 Rocket Lab USA, Inc

Rocket Lab USA, Inc. All rights reserved.