Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HYCROFT MINING HOLDING CORP | hymc-20210908.htm |

HYMC: Nasdaq BUILDING A WORLD-CLASS OPERATION HYMC: Nasdaq ALIGNED TEAM DISCIPLINED DEVELOPMENT SHAREHOLDER FOCUS Sept. 8-11, 2021 Precious Metals Summit 2021 – Beaver Creek

2HYMC: Nasdaq Disclaimer Financial Projections This presentation contains financial forecasts regarding certain financial metrics of the Company. The independent auditor of the Company has not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, it has not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections should not be relied upon as being necessarily indicative of future results. Hycroft does not undertake any commitment to update or revise the projections, whether as a result of new information, future events, or otherwise. In this presentation, certain of the above-mentioned projected information has been repeated (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective forecasts are indicative of the future performance of Hycroft or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Cautionary Note Regarding Forward-Looking Statements In addition to historical information, this presentation and other written reports and oral statements made from time to time by us may contain forward-looking statements. All statements, other than statements of historical fact, included herein that address activities, events or developments that we expect or anticipate will or may occur in the future, are forward-looking statements. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “estimate”, “plan”, “anticipate”, “expect”, “intend”, “believe”, “project”, “target”, “budget”, “may”, “can”, “will”, “would”, “could”, “should”, “seeks”, or “scheduled to”, or other similar words, or negatives of these terms or other variations of these terms or comparable language or any discussion of strategy or intentions. Forward-looking statements address activities, events or developments that the Company expects or anticipates will or may occur in the future and are based on current expectations and assumptions. These statements involve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Although these forward-looking statements were based on assumptions that the Company believes are reasonable when made, you are cautioned that forward-looking statements are not guarantees of future performance and that actual results, performance or achievements may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if Company results, performance, or achievements are consistent with the forward-looking statements contained in this presentation, those results, performance or achievements may not be indicative of results, performance or achievements in subsequent periods. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of those statements, and the Company undertakes no obligation to update those statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. This presentation contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the Unites States Securities Exchange Act of 1934, as amended, or the Unites States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included herein and public statements by our officers or representatives, that address activities, events or developments that our management expects or anticipates will or may occur in the future, are forward-looking statements, including but not limited to such things as future business strategy, plans and goals, competitive strengths and expansion and growth of our business. The words “estimate”, “plan”, “anticipate”, “expect”, “intend”, “believe” “target”, “budget”, “may”, “can”, “will”, “would”, “could”, “should”, “seeks”, or “scheduled to” and similar words or expressions, or negatives of these terms or other variations of these terms or comparable language or any discussion of strategy or intention identify forward-looking statements. Forward-looking statements address activities, events or developments that the Company expects or anticipates will or may occur in the future and are based on current expectations and assumptions. These risks may include the following and the occurrence of one or more of the events or circumstances alone or in combination with other events or circumstances, may have a material adverse effect on the Company’s business, cash flows, financial condition and results of operations. Forward-looking statements include, but are not limited to: industry related risks including: fluctuations in the price of gold and silver; uncertainties concerning estimates of mineral reserves and mineral resources; the results of the Company’s expanded drilling program and the timing and results of a mineral resource update and planned feasibility study; uncertainties relating to the ongoing COVID-19 pandemic; the intense competition within the mining industry; the inherently hazardous nature of mining activities, including environmental risks; our insurance may not be adequate to cover all risks associated with our business, or cover the replacement costs of our assets; potential effects on our operations of U.S. federal and state governmental regulations, including environmental regulation and permitting requirements; cost of compliance with current and future government regulations; uncertainties relating to obtaining or retaining approvals and permits from governmental regulatory authorities; potential challenges to title in our mineral properties; risks associated with proposed legislation in Nevada that could significantly increase the costs or taxation of our operations; and changes to the climate and regulations and pending legislation regarding climate change; business-related risks including: risks related to our liquidity and going concern considerations; risks related to our ability to raise capital on favorable terms or at all; risks related to proprietary two-stage heap oxidation and leach process at the Hycroft Mine and estimates of production; our ability to achieve our estimated production and sales rates and stay within our estimated operating and production costs and capital expenditure projections; risks related to a decline in our production of gold and silver; risk related to our ability to successfully eliminate or meaningfully reduce processing and mining constraints and related the results of our planned 2021 and 2022 technical efforts and how the data resulting from such efforts could adversely impact processing technologies applied to our ore, future operations and profitability; risks related to our reliance on one mine with a new process; risks related to our limited experience with a largely untested process of oxidizing and heap leaching sulfide ores; uncertainties and risks related to our reliance on contractors and consultants; risks related to the availability and cost of equipment, supplies, energy, or commodities; the commercial success of, and risks relating to, our development activities; risks related to slope stability; risks related to our substantial indebtedness, including cross acceleration and our ability to generate sufficient cash to service our indebtedness; uncertainties related to our ability to replace and expand our ore reserves; costs related to our land reclamation requirements; uncertainties resulting from the possible incurrence of operating and net losses in the future; the loss of key personnel or our failure to attract and retain personnel; risks related to technology systems and security breaches; any failure to remediate and possible litigation as a result of a material weakness in our internal controls over financial reporting; risks related to current and future legal proceedings; and risks that our principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval; risks related to our securities, including: volatility in the price of our common stock and warrants; risks that our warrants may expire worthless; the valuation of our private warrants could increase the volatility in our net income (loss); anti–takeover provisions could make a third party acquisition of us difficult; and risks related to limited access to our financial information, as we have elected to take advantage of the disclosure requirement exemptions granted to emerging growth companies and smaller reporting companies; and forward looking statements that we do not intend to pay cash dividends and depending upon results of testing and analysis, we may determine to conduct mining operations using a multi-process hybrid approach and update and amend the Hycroft Technical Report. These statements involve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. Please see our “Risk Factors” set forth in our Annual Report on Form 10-K for the year ended December 31, 2020, as amended May 14, 2021, for more information about these and other risks. You are cautioned against attributing undue certainty to forward-looking statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Although these forward-looking statements were based on assumptions that the Company believes are reasonable when made, you are cautioned that forward-looking statements are not guarantees of future performance and that actual results, performance or achievements may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results, performance, or achievements are consistent with the forward-looking statements contained in this presentation, those results, performance or achievements may not be indicative of results, performance or achievements in subsequent periods. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of those statements, and we undertake no obligation to update those statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments. No Offer or Sale of Securities The information provided in this presentation pertaining to the Company is for general informational purposes only and is not a formal offer to sell or a solicitation of an offer to buy any securities of the Company in any jurisdiction. Information contained in this presentation should not be relied upon as advice to buy or sell or hold such Company securities or as an offer to sell such Company securities. All dollar amounts are expressed in US dollars, unless otherwise stated. No Representations or Warranties This presentation does not purport to contain all of the information that may be required to evaluate a possible transaction. No representation or warranty, express or implied, is or will be given by Hycroft or any of its respective affiliates, directors, officers, employees, or advisers or any other person as to the accuracy or completeness of the information in this presentation (including as to the accuracy or reasonableness of statements, estimates, targets, projections, assumptions, or judgments) or any other written, oral, or other communications transmitted or otherwise made available to any party in the course of its evaluation of a possible transaction, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions, or misstatements, negligent or otherwise, relating thereto. Accordingly, neither the Company or any of its respective affiliates, directors, officers, employees, or advisers or any other person shall be liable for any direct, indirect, or consequential loss or damages suffered by any person as a result of relying on any statement in or omission from this presentation and any such liability is expressly disclaimed. This presentation is not intended to constitute and should not be construed as investment advice and does not constitute investment, tax, or legal advice. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, none of the Company, or its affiliates, directors, officers, employees, or advisers or any other person makes any representation or warranty with respect to the accuracy of such information. Industry and Market Data In this presentation, the Company relies on and refers to information and statistics regarding Hycroft and certain of its competitors and other industry data. The information and statistics are from third-party sources, including reports by market research firms.

HYMC: Nasdaq Hycroft Overview

4HYMC: Nasdaq Hycroft Overview Source: Company Filings 1. Mineral Reserves and Minerals Resources are estimated as of December 31, 2020 and Mineral Resources do not include Mineral Reserves. See “Cautionary Note to US Investors Regarding Reserves and Resources.” 2. The North Merrill-Crowe facility requires additional refurbishment prior to use. Strong Project Fundamentals 1 mi • One of the world’s largest precious metals deposits1 • P&P Mineral Reserves of ~11.9 mm ozs Au and 478.5 mm ozs Ag; • M&I Mineral Resources of ~3.6 mm ozs Au and 106.4 mm ozs Ag; and • Inferred Mineral Resources of ~5.7 mm ozs Au and 127.9 mm ozs Ag • Producing gold & silver mine in northern Nevada • Open pit heap leach operation • Operating at pre-commercial levels • All infrastructure on site for current operations • 3-stage crushing plant • 2 Merrill-Crowe processing facilities with total processing capacity of 26,500 gpm2 • Refinery, admin, maintenance buildings, lab • Fully permitted for current mine plan • Permitted for both leaching and milling operations • Enviable and stable mining jurisdiction

5HYMC: Nasdaq 2020-21 Achievements New Executive Management New Technical Leadership Team Identified gaps in prior metallurgical test work • Initiated $10 mm variability metallurgical program ✓ Constructed 4.5 million sqft of new leach pad (Phase I) Re-aligned operating team resulting in: • Increased production • Significantly cut spending • Significantly reduced unit operating costs • Reduced reliance on contractors • Dramatically improved safety performance to the best in 10 years Identified critical area/items necessary for commercial application of novel process TRIFR = Total Reportable Injury Frequency Rate TRIFR* = 2.77 0.53 ✓ ✓ ✓ ✓ ✓ Strengthened Board with addition of two technical directors ✓

6HYMC: Nasdaq New Leadership & Technical Teams • New highly experienced management team in place, led by: Former CEO of Romarco, US Global Investors (fund manager) Former CFO of Romarco, Phelps Dodge Former Stantec, Goldcorp, Newmont, Barrick • On-site technical team is supplemented with industry leading consultants in metallurgy, mine operations and processing, including: • John Marsden/Metallurgium – a metallurgical and processing consultant with specific expertise in gold and silver extraction • Ausenco Engineering – Feasibility study (AAO1), Pre-feasibility study (POX1) • Independent Mining Consultants (IMC) – Resource/ Reserve modeling, mine planning • Hazen Research – metallurgical testing Former Newmont, Barrick Diane R. Garrett President & CEO Mike Eiselein VP & GM Stan Rideout EVP & CFO Jack Henris EVP & COO Former Romarco, Barrick, Homestake James Berry VP, Exploration & Geology Former Kinross, Fluor, Freeport McMoran Kenji Umeno Process Manager 1. AAO – Atmospheric Alkaline Oxidation; POX – Pressure Oxidation

7HYMC: Nasdaq VORTEX BRIMSTONE CAMEL CENTRAL GAP BAY North Merrill- Crowe Administration, Warehouse, Maintenance Main East-West Railway (Union Pacific) State Route 49 (Jungo Road) New Leach Pad N Mine Site and Facilities

8HYMC: Nasdaq One of the World’s Largest Primary Gold Deposits… • 34-year mine life provides strong leverage to gold and silver prices • Potential resource conversion provides additional production upside and mine life extension 1. Minerals Reserves and Resources were estimated at 12/31/20. Total gold mineral resources includes Proven & Probable Mineral Reserves, Measured & Indicated Mineral Resources and stockpiled sulfide ore. 2. See “Cautionary Note to US Investors Regarding Reserves and Resources.” 3. Presents other assets’ gold and gold equivalent silver ounces converted at LT street consensus pricing of $1,500/oz Au and $18.00/oz Ag. 4. Lower risk denotes a Fraser Institute Policy Perception Index score above 75; mid risk indicates a Policy Perception Index score between 50 and 75; higher risk indicates a Policy Perception Index score below 50. World’s Largest Primary Gold Deposits (Moz AuEq.)(1,2,3,4) Hycroft ranks among the top 20 largest primary gold deposits in the world and the second largest in the U.S. 31 Moz AuEq.

9HYMC: Nasdaq …And One of the World’s Largest Silver Deposits Hycroft is the largest silver deposit in the United States

10HYMC: Nasdaq Source: BMO GoldPages for the week ended August 13, 2021 Low P / NPV multiple represents early opportunity to participate in potential rerating as development continues Valuation vs Peers Gold Sector Valuation at Spot Metal Prices H YM C

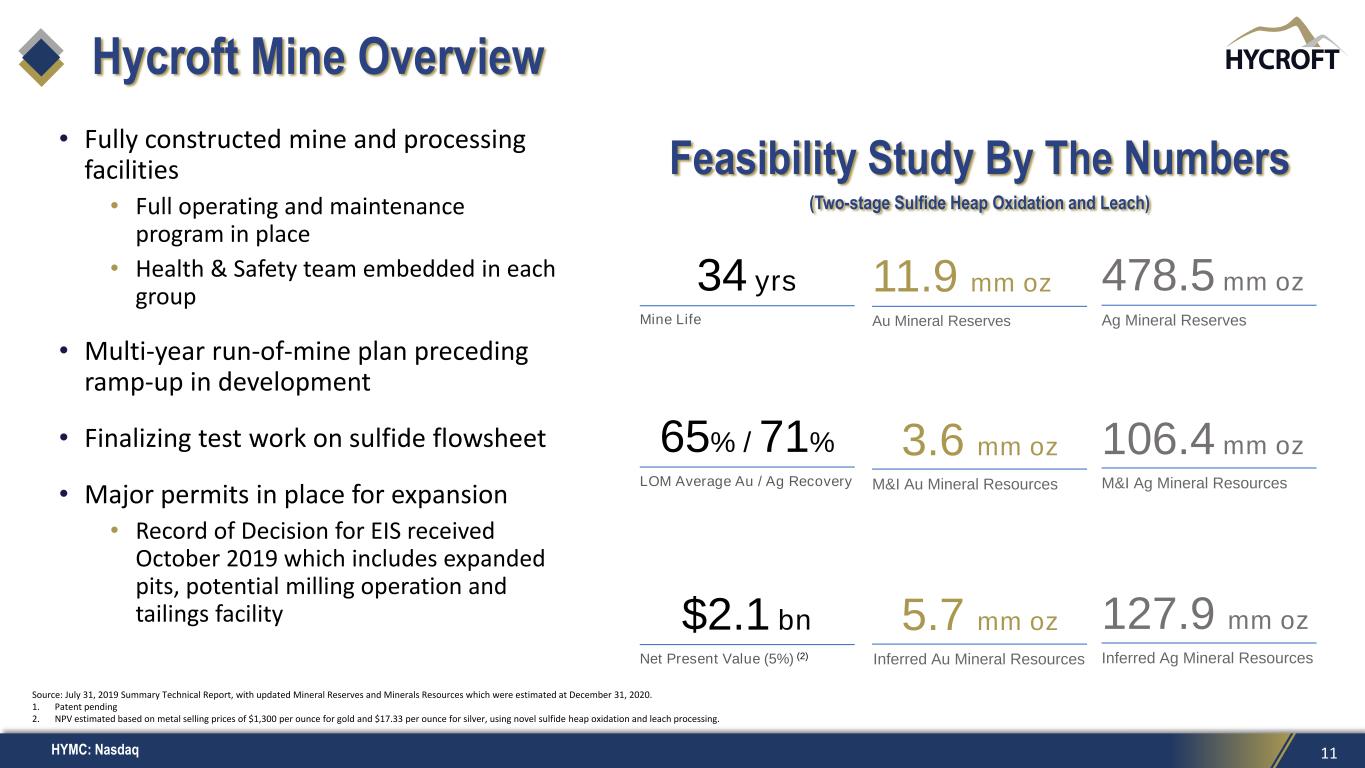

11HYMC: Nasdaq Hycroft Mine Overview • Fully constructed mine and processing facilities • Full operating and maintenance program in place • Health & Safety team embedded in each group • Multi-year run-of-mine plan preceding ramp-up in development • Finalizing test work on sulfide flowsheet • Major permits in place for expansion • Record of Decision for EIS received October 2019 which includes expanded pits, potential milling operation and tailings facility Source: July 31, 2019 Summary Technical Report, with updated Mineral Reserves and Minerals Resources which were estimated at December 31, 2020. 1. Patent pending 2. NPV estimated based on metal selling prices of $1,300 per ounce for gold and $17.33 per ounce for silver, using novel sulfide heap oxidation and leach processing. Feasibility Study By The Numbers (Two-stage Sulfide Heap Oxidation and Leach) 34 yrs Mine Life 65% / 71% LOM Average Au / Ag Recovery $2.1 bn Net Present Value (5%) (2) 11.9 mm oz Au Mineral Reserves 3.6 mm oz M&I Au Mineral Resources 5.7 mm oz Inferred Au Mineral Resources 478.5 mm oz Ag Mineral Reserves 106.4 mm oz M&I Ag Mineral Resources 127.9 mm oz Inferred Ag Mineral Resources

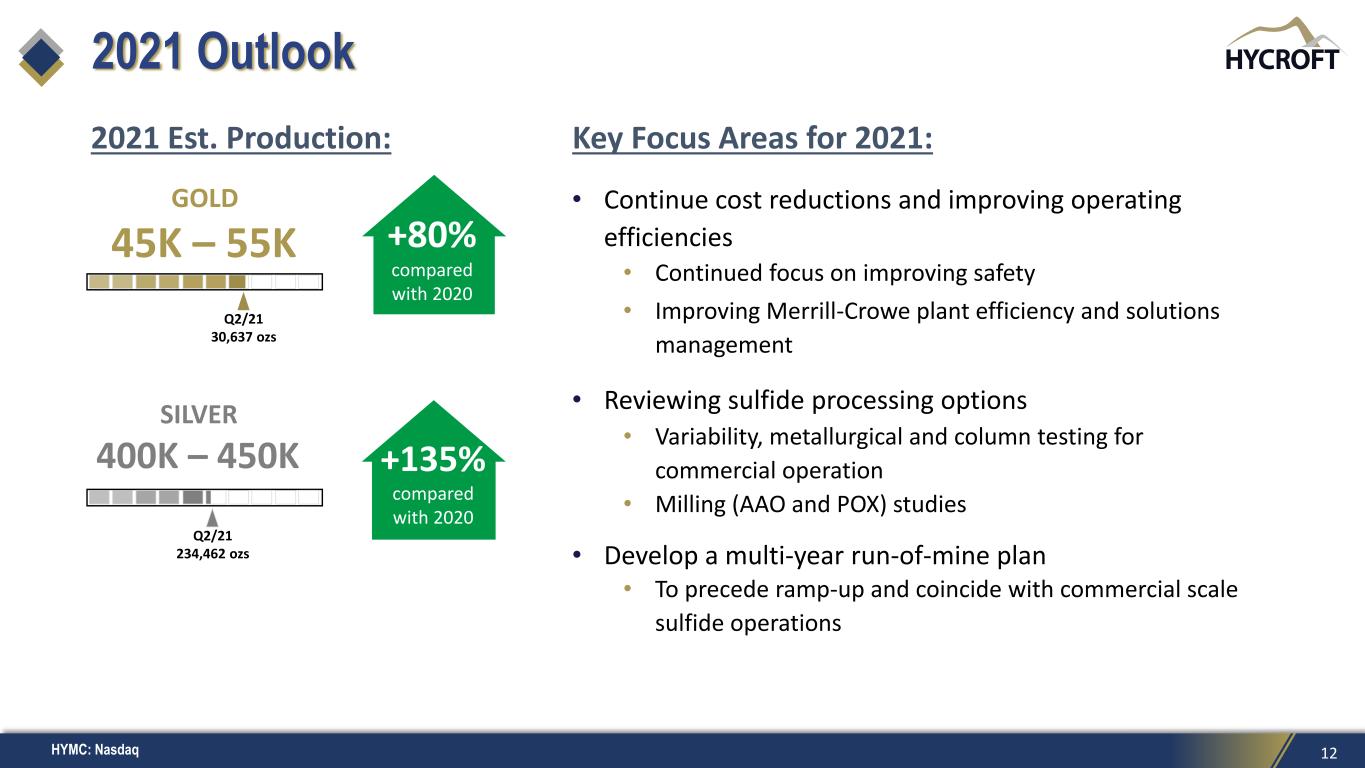

12HYMC: Nasdaq 2021 Outlook • Continue cost reductions and improving operating efficiencies • Continued focus on improving safety • Improving Merrill-Crowe plant efficiency and solutions management • Reviewing sulfide processing options • Variability, metallurgical and column testing for commercial operation • Milling (AAO and POX) studies • Develop a multi-year run-of-mine plan • To precede ramp-up and coincide with commercial scale sulfide operations 2021 Est. Production: GOLD 45K – 55K SILVER 400K – 450K +80% compared with 2020 +135% compared with 2020 Key Focus Areas for 2021: Q2/21 30,637 ozs Q2/21 234,462 ozs

13HYMC: Nasdaq ✓✓✓ ✓✓ 2021: Milestones Late Q1 Began drilling for metallurgical samples and variability testing Q2 Transition to a more cost- effective mining fleet arrangement Early Q2 994K loader in operation, expected to improve loading capability and reduce unit mining costs Q3 Developing multi-year run-of-mine plan Exploration program commences targeting higher-grade material Column tests on fresh sulfide material End of Q2 Mine planning and optimization work complete AAO mill review desktop studies Q4/21 – Q2/22 Metallurgical test work completed Finalize ultimate flowsheet design AAO Feasibility Study POX Pre-feasibility Study Q1 Q2 Q3 Q4

14HYMC: Nasdaq Development Paths – 2022 Forward • The Hycroft Mine has the opportunity for a flexible, scalable development program • Most large mines in Nevada operate multiple processing and recovery methods Run-of-mine Heap Leach Sulfide Processing Options ExplorationTwo-Stage Sulfide Heap Oxidation and Leach Mill & AAO Mill & POX Summary Transition to a multi-year ROM plan with modest capital investment • ~50 m tons (oxide and transition) • To expose commercial scale sulfides and expect to encounter additional material LOM Using a novel two-stage sulfide oxidation and heap leach process • Chemistry has been proven, working on commercial application • Work to date suggests capital and operating costs will be higher (studies ongoing) Design an appropriately sized mill to process higher grade sulfide material to yield better recoveries and value leveraging owned mills and motors • 2016 Feasibility completed and successful pilot plant demonstrated on-site • Completing new FS (Q1/22) Proven, well-established process • Desktop study indicates increased recoveries with incremental capital to AAO • Could yield increased gold and silver recoveries • Pre-feasibility Study underway, to be completed Q1/22 Follow-up on higher grade zones within current known resource, infill drilling, step-out drilling • Target upgrading and adding to all resource categories Timeframe Mine plan expected EOY 2021 Following metallurgical work and evaluation, timing to be considered as part of LOM plan development • Mill size based upon existing equipment, up to ~68k tpd capability • Start-up in 3-5 years • Mill size based upon existing equipment, up to ~68k tpd capability • Start-up in 3-5 years To begin in 2021 with initial goal of identifying higher grade zones within current reserve Capital Needs • Modest upgrades to plant and mobile mining fleet • Brimstone/North leach pad has 34 million tons of capacity – new leach pad provides optionality if needed • Majority of new leach pad and infrastructure complete, some final piping and electrical work required, additional mining equipment may be required • Long-lead items in storage (mills and motors) and major permitting completed (including tailings) • Provides flexibility for implementing • Long-lead items in storage (mills and motors) and major permitting completed (including tailings) • Provides flexibility for implementing Modest, results driven

HYMC: Nasdaq Upside Opportunities High-grade Targets & Expansion Potential

16HYMC: Nasdaq Mineralization Remains Open in Several Directions 16 Hycroft Mine Oblique View (0.010 Au opt Grade Shell) Looking Northeast Open Vortex High-grade Section 40700 North Open Open Open 2000 Feet Open Open South

17HYMC: Nasdaq Vortex Cross-section 40700 North (Historical Drilling) 17 Au Fire Assay (opt) No Assay/Sample 0 to 0.005 0.005 to 0.007 0.007 to 0.010 0.010 to 0.015 0.015 to 0.030 0.030 to 0.070 0.070 to 0.100 Greater than 0.100 H10D-3547 208’ of 0.031 opt (0.97 g/t) Au / 0.75 opt (23.4 g/t) Ag *including 26’ of 0.096 opt ( 3.0 g/t) Au / 1.464 opt (45.8 g/t) Ag H10D-3461 200’ of 0.062 opt (1.94 g/t) Au / 2.64 opt (82.3 g/t) Ag *including 55’ of 0.114 opt (3.56 g/t) Au / 1.35 opt (42.3 g/t) Ag H10D-3408 189’ of 0.063 opt (1.97 g/t) Au / 1.62 opt (50.7 g/t) Ag *including 88’ of 0.152 opt (1.46 g/t) Au / 1.46 opt (45.8 g/t) Ag *including 27’ of 0.129 opt (1.0 g/t) Au / 1.03 opt (32.2 g/t) Ag H10D-3477 188’ of 0.021 opt (0.66 g/t) Au / 0.46 opt (14.3 g/t) Ag *including 31’ of 0.072 opt (2.25 g/t) / 0.626 opt (19.6 g/t) Ag H11D-3514 198’ of 0.077 Au (2.41 g/t) opt / 1.41 opt (44.1 g/t) Ag *including 45’ of 0.242 opt (7.6 g/t) Au / 2.14 opt (66.9 g/t) Ag *including 15’ of 0.147 opt (4.6 g/t) Au / 0.651 opt (20.3 g/t) Ag 4500 Elev 4000 Elev 1 9 0 0 0 E 1 9 5 0 0 E 2 0 0 0 0 E

18HYMC: Nasdaq Historical Vortex Drilling • Vortex drilling in 2008 discovered a large area of sulfide gold and silver, with higher grade silver values • Significant intercepts include2: H09D-3768 with visible pyrargyrite: 15 feet of 0.011 opt Au and 73 opt Ag inc. 4 feet of 0.028 opt Au and 209.13 opt Ag Hole ID FROM TO INTERVAL Grade (meters) (meters) (meters) Au (g/t) Ag (g/t) AuEq1 (g/t) Au (opt) Ag (opt) AuEq1 (opt) HD08-3632 122 136 14 0.28 822.00 11.238 0.009 26.304 0.360 140 142 2 0.13 1,120.00 15.060 0.004 35.840 0.482 145 146 2 0.46 1,355.00 18.523 0.015 43.360 0.593 H09D-3768 311 315 5 0.34 2,285.00 30.805 0.011 73.120 0.986 including 314 315 1 0.88 6,535.22 87.994 0.028 209.127 2.816 H10D-3382 169 625 456 0.75 47.00 1.377 0.024 1.504 0.044 including 454 524 70 1.47 182.00 3.896 0.047 5.824 0.125 H10R-3288 376 631 255 0.70 93.00 1.940 0.022 2.976 0.062 including 497 520 23 0.75 543.00 7.989 0.024 17.376 0.256 H10D-3286 157 334 177 0.66 51.22 1.343 0.021 1.639 0.043 including 182 184 2 0.40 72.00 6.692 0.013 15.104 0.214 H10R-3833/3353 388 419 31 0.25 249.62 3.578 0.008 7.988 0.114 including 407 413 6 0.30 756.28 10.382 0.010 24.201 0.332 H10D-3843 434 471 37 0.83 162.79 3.000 0.027 5.209 0.096 including 446 454 8 1.28 321.39 5.564 0.041 10.284 0.178 including 464 471 7 0.91 244.95 4.175 0.029 7.838 0.134

19HYMC: Nasdaq Recent Vortex Drilling • Higher grades have been encountered in several holes during the 2021 metallurgical drill campaign • Significant intercepts include2: 1. Hycroft AuEq. calculated based on feasibility study commodity pricing of $1,300/oz Au and $17.33/oz Ag; includes stockpiled sulfide ore. 2. Complete drill results are included on our website at www.hycroftmining.com Hole ID FROM TO INTERVAL Grade (meters) (meters) (meters) Au (g/t) Ag (g/t) AuEq1 (g/t) Au (opt) Ag (opt) AuEq1 (opt) H21R-5591 365.8 396.2 30.5 0.71 17.54 0.944 0.021 0.528 0.028 H21R-5591 408.4 435.9 27.4 0.63 18.11 0.871 0.018 0.528 0.025 H21R-5591 443.5 455.7 12.2 0.59 28.94 0.976 0.017 0.844 0.028 H21R-5592 192 198.1 6.1 0.58 4.68 0.642 0.017 0.136 0.019 H21R-5592 320 371.9 51.8 2.47 25.50 2.810 0.072 0.744 0.082 H21R-5592 414.5 429.8 15.2 1.07 7.61 1.171 0.033 0.222 0.036 H21R-5593 335.3 382.5 47.2 0.54 18.53 0.787 0.016 0.541 0.023

20HYMC: Nasdaq Hycroft Claim Map Source: Hycroft Mining Management • Large, unexplored land position • The Reserve Pit outline only encompasses 1,570 acres (~approx. 2%) of the claim package • The Hycroft resource covers an area of approx. 3 miles long (north to south) and 1.5 miles wide (east to west) within a land package of approximately 12 miles long by 8 miles wide • Historical drilling: • Aggressive drill campaigns from 2006 to 2013, no exploration drilling since 2013 • Original oxide drilling only assayed for cyanide soluble gold • Silver was rarely assayed due to low silver heap leach recovery and prices. Approx. 56% of drilling was not assayed for silver. • Additional exploration targets on land held by Hycroft outside existing plan of operations • Known mineralization proximal to existing facilities • Near surface oxide leach targets and expansion potential for deeper sulfides • Mineralization is limited by drilling and remains open in all directions and at depth (not owned by Hycroft)

21HYMC: Nasdaq Hycroft Exploration Targets – Expansion Potential Vortex Zone All Hycroft Claims Active Mining Exploration Targets Rosebud Claims (not owned by Hycroft) LEGEND Hades Area Gap Gravity High Diatreme Float Anomaly Ponds Gravity High Chance Prospect – drill intercept of 140 feet of 0.012 opt

22HYMC: Nasdaq Capital StructureOwnership Summary (1)(2) Mudrick 24.4 mm 41% Whitebox 11.8 mm 20% Highbridge 6.2 mm 10% Sprott Resource Lending Corp. 0.5 mm 1% Other 17.1 mm 28% Capitalization and Major Supporters Share Price - HYMC(1) $2.15 Shares Outstanding 60.3 mm Market Capitalization $129.6 mm 5-year Warrants issued 5/2021 - HYMCW (exercise price of $11.50) 34.3 mm 5-year Warrants issued 10/2021 - HYMCL (exercise price of $10.50) 9.6 mm Basic Shares + 5-year Warrants(3) 103.8 mm Unrestricted Cash on Hand (At June 30, 2021) $30.2 mm Debt(4) $147.9 mm 1. As of close on September 1, 2021, unless otherwise noted. 2. Reflects holdings of common stock and includes affiliated entities. 3. Does not include 12.7 mm of Seller warrants which have an exercise price of $40.31/share and would convert to 3.6 million shares. 4. Carrying value as of June 30, 2021, includes debt issuance costs and discounts.

HYMC: Nasdaq Hycroft Investment Highlights

24HYMC: Nasdaq One of the World’s Largest Precious Metals Deposits Proven & Probable Mineral Reserves –11.9 mm ozs gold / 478.5 mm ozs silver(1) Measured & Indicated Mineral Resources – 3.6 mm ozs gold / 106.4 mm ozs silver (exclusive of reserves)(1) Inferred Mineral Resources – 5.7 mm ozs gold / 127.9 mm ozs silver(1) Flexible processing options Strong Board, Management and Technical Team with Proven Track Record Combined experience of over 200 years in heap leach and milling operations, oxidation processes, engineering, geology, metallurgy, finance and capital markets Supported by a world class technical team comprised of Hycroft technical staff and world-renowned consultants including John Marsden, Hazen Research, Ausenco and IMC Highly Leveraged to Metal Prices Fully Permitted for Commercial Scale Operations; Enviable Jurisdiction Nevada ranks at the top of the best places in the world for mining(2) Permitted for current mine plan, EIS approved in 2019 for expanded pits and potential milling infrastructure Value Proposition(3) Median Junior Producer Trading P/NAV Multiple 0.8x Current trading P/NAV of 0.1x 2 1 3 4 5 Key Investment Highlights 1. Mineral Reserves and Resources are estimated at 12/31/20 and are based on $1,300/oz Au and $17.33/oz Ag. See “Cautionary Note to US Investors Regarding Mineral Reserves and Mineral Resources.” 2. Fraser Institute – Annual Survey of Mining Companies (02/23/21) 3. Source: BMO GoldPages for the week ended August 18, 2021

HYMC: Nasdaq QUESTIONS?

HYMC: Nasdaq APPENDIX

27HYMC: Nasdaq Cautionary Note to U.S. Investors Regarding Mineral Reserves and Mineral Resources The Mineral Resource and Mineral Reserve estimates contained in this presentation have been prepared in accordance with the requirements of the Modernization of Property Disclosures for Mining Registrants (the “SEC Modernization Rules”) set forth in subpart 1300 of Regulation S-K, as promulgated by the United States Securities and Exchange Commission (“SEC”). These disclosures differ in material respects from the requirements set forth in the SEC’s Industry Guide 7, which remained applicable until January 1, 2021 to U.S. companies subject to the reporting and disclosure requirements of the SEC. These standards differ significantly from the disclosure requirements of the SEC’s Industry Guide 7 in that mineral resource information contained herein may not be comparable to similar information disclosed by U.S. companies that have not early adopted and implemented the SEC Modernization Rules. Under SEC standards, mineralization, such are mineral resources, may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produce or extracted at the time of the reserve determination. The term “economically,” as used in the SEC’s Industry Guide 7 definition of reserves, means that profitable extraction or production has been established or analytically demonstrated in a feasibility study to be viable and justifiable under reasonable investment and market assumptions. The term “legally” as used in the SEC’s Industry Guide 7 definition of reserves, does not imply that all permits needed for mining and processing have been obtained or that other legal issues have been completely resolved. However, for a reserve to exist, we must have a justifiable expectation, based on applicable laws and regulations, that issuance of permits or resolution of legal issues necessary for mining and processing at a particular deposit will be accomplished in the ordinary course and in a timeframe consistent with our current mine plans. As used in this presentation, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined and used in accordance with the SEC Modernization Rules set forth in subpart 1300 of Regulation S-K, even though such terms were not recognized under the SEC’s Industry Guide 7 which the SEC Modernization Rules have replaced beginning January 1, 2021. You are specifically cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves, as defined by the SEC. You are cautioned that mineral resources do not have demonstrated economic value. Inferred mineral resources have a high degree of uncertainty as to their existence as to whether they can be economically or legally mined. Under the SEC Modernization Rules, estimates of inferred mineral resources may not form the basis of an economic analysis. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. A significant amount of exploration must be completed in order to determine whether an inferred mineral resource may be upgraded to a higher category. Therefore, you are cautioned not to assume that all or any part of an inferred mineral resource exists, that it can be economically or legally mined, or that it will ever be upgraded to a higher category. Likewise, you are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be upgraded to mineral reserves.

28HYMC: Nasdaq Mineral Reserves and Resources (12/31/20) Tons Grades (oz/t) Contained Ounces (000s) (Mt) Au Ag Au Ag Au Eq(1) Total Proven & Probable Reserves 1,123 0.011 0.426 11,865 478,513 18,445 Measured & Indicated 387 0.009 0.277 3,589 106,389 5,152 Inferred 599 0.010 0.217 5,688 127,949 7,499 Total Resources(2) 993 0.010 0.240 9,321 235,987 12,355 1. AuEq. calculated as revenue from gold and silver divided by gold price based on feasibility study commodity pricing of $1,300/oz Au and $17.33/oz Ag; includes stockpiled sulfide ore. 2. Resources shown exclusive of reserves. 4% 13% 83% Proven & Probable Oxide Transitional Sulfide 1% 6% 93% Measured, Indicated & Inferred Oxide Transitional Sulfide

29HYMC: Nasdaq Board of Directors David Kirsch Chairman, C, NG David Kirsch is a Managing Director and Senior Analyst at Mudrick Capital Management, L.P., where he is responsible for analyzing distressed credit and equity opportunities across a diverse range of industries. Prior to joining Mudrick Capital Management, LP, David was a Senior Analyst and Managing Director at Miura Global Management, a multi-billion dollar global long-short equity hedge fund. David received his B.S. Magna Cum Laude in Economics from the Wharton School at the University of Pennsylvania. Diane Garrett Director Michael Harrison Director, SST Eugene Davis Lead Director, A, NG A = Audit Committee | NG = Nominating & Governance Committee | C = Compensation Committee | SST = Safety, Sustainability & Technical Diane Garrett has over 20 years of senior executive management experience in the mining industry and an exceptional track record for developing projects and building companies. Dr. Garrett was President, CEO and Director of Romarco Minerals Inc. where she built and led the team that developed the multi-million ounce Haile Gold Mine from discovery through to final feasibility, permitting and construction. Diane received her Ph.D. in Engineering and her Masters in Mineral Economics from the University of Texas at Austin. Eugene Davis currently serves as the Chairman and Chief Executive Officer of PIRINATE Consulting Group, LLC (“PIRINATE”), a privately held consulting firm specializing in turnaround management, merger and acquisition consulting, strategic planning advisory services for domestic and international public and private business entities. Since forming PIRINATE in 1997, Mr. Davis has advised, managed, sold, liquidated and served as a chief executive officer, chief restructuring officer, director, chairman or committee chairman of several businesses operating in diverse sectors. Michael Harrison has over 25 years of executive, financial and technical experience in the mining industry. Michael is currently Managing Partner of Sprott Streaming and Royalty Fund, and previously served as Managing Director and Interim CEO of Sprott Resource Holdings Inc. Michael held the position of President and CEO of Adriana Resources Inc., and Vice President, Corporate Development for Coeur Mining Inc. Mr. Harrison holds a B.Sc.E Geophysics from Queen’s University and an MBA from the University of Western Ontario.

30HYMC: Nasdaq Board of Directors cont. Stephen Lang Director Steve Lang has over 40 years of experience in the mining industry, including engineering, development and production at gold, coal, base metals and PGM operations. He was Chief Executive Officer of Centerra Gold Inc., a publicly traded mining company, from 2008 to 2012 and served as Centerra’s Board Chair from 2012 to 2019. Prior to that, he served in Senior Executive roles at Stillwater Mining Company, Barrick Goldstrike, Rio Algom Ltd, Kinross Gold/Amax Gold, and Santa Fe Pacific Gold. Mr. Lang holds a BS and MS in Mining Engineering from the Missouri University of Science and Technology. Marni Wieshofer Director, A, C Thomas Weng Director, A, NG David Naccarati Director A = Audit Committee | NG = Nominating & Governance Committee | C = Compensation Committee | SST = Safety, Sustainability & Technical David Naccarati has more than 45 years of experience in, and is currently serving as an independent consultant to, the mining industry. He was a founding partner and board member of Cupric Canyon Capital, LLC, a private equity firm focused on acquiring and developing mining properties. Mr. Naccarati was a member of the senior management team for Phelps Dodge Corporation, including serving as president of the Phelps Dodge Mining Company. Mr. Naccarati also served as an adjunct professor in the department of Mining and Geological Engineering at the University of Arizona from 2009 to 2011. Mr. Naccarati received a degree in Mining Engineering from the University of Arizona and an MBA from Sloan School of Management (MIT). Marni Wieshofer’s professional background includes Head of Media and Managing Director in Houlihan Lokey’s TMT Corporate Finance Group, providing mergers and acquisitions, capital markets and financial advisory services and Chief Financial Officer and EVP of Corporate Development at Lionsgate Entertainment where she oversaw the company’s mergers, acquisitions, and other strategic financial initiatives. She holds a BA from Western University, an MBA from the Rotman School of Management, is a Canadian Chartered Accountant and obtained the ICD.D designation in 2018. Mr. Weng has more than 22 years of experience in the financial services sector. Mr. Weng is currently Co-Founding Partner with Alta Capital Partners, a provider of financial advisory services (since February 2011). From February 2007 to January 2011, Mr. Weng was a Managing Director at Deutsche Bank and Head of Equity Capital Markets for Metals and Mining throughout the Americas and Latin America, across all industry segments. Mr. Weng graduated from Boston University with a Bachelor of Arts in Economics.

31HYMC: Nasdaq • The primary crusher was reconditioned and brought into operation in late March 2019 • The secondary and tertiary crushers were recommissioned and placed online in March 2019 • Crusher will be maintained and ready for when sulfide processing begins Coarse Ore Stockpile Fine Ore Stockpile Fine Ore Stockpile Processing Infrastructure

32HYMC: Nasdaq Processing Infrastructure cont. • Gold and silver recovery is currently achieved through the 5,000 gallon per minute Brimstone Merrill-Crowe plant • CIC circuit (~4,500 gpm capacity) available as extra solution processing capacity as needed • Doré created onsite through Brimstone refinery • 21,500 gallon per minute North Merrill-Crowe plant is constructed • Shut down in 2017; solution flow from pad decreased with cessation of mining in 2015 • Requires some refurbishment prior to restart • All equipment on-site for a larger refinery

33HYMC: Nasdaq Sufficient capacity on existing leach pads to treat run-of-mine ore using traditional heap leach New Leach Pad • New fully permitted leach pad constructed (Stage 1A) • Intended for two-stage heap oxidation and leach process • Stage 1 – 8.6 M square feet; 26.5 M ton capacity • Ultimate pad capacity - 550 M ton capacity Process Improvements – in progress • Recent review of the new leach pad and process flow sheet identified operating improvement opportunities that will be incorporated into the final leach pad design • Air injection versus passive air flow to ensure adequate oxygen distribution to all areas • Improved piping and pond infrastructure to ensure no comingling of solutions Leach Pad & Projects Reviewing Options for Ultimate Flowsheet • Metal prices are up 35% and 50% for gold and silver, respectively, compared with prices used in the July 31, 2019 feasibility study economic analysis • Looking at potential benefits of constructing a small flotation and AAO circuit for higher grade portions of ore body as additional process stream

34HYMC: Nasdaq • Large, epithermal, low sulfidation, hot springs deposit • Gold and silver mineralization occurs as both disseminated and vein- controlled • Gold values ranging from detection to 8.8 ounces per ton; and Silver from detection to 647.5 ounces per ton 34 Deposit Type

35HYMC: Nasdaq Geologic Setting and Mineralization • The Hycroft mine is located on the western flank of the Kamma Mountains • Large, epithermal, low sulfidation, hot springs deposit • Gold and silver mineralization occurs as both disseminated and vein-controlled Simplified East-West Cross Section Through the Hycroft Mine (Section 40000 N)

36HYMC: Nasdaq Senior-Scale Gold Mine in Nevada Source: July 31, 2019 Summary Technical Report 4 1 0 0 0 N A u F a B lo c k G ra d e s ( L o o k in g N o rt h ) 4 1 0 0 0 N A g F a B lo c k G ra d e s ( L o o k in g N o rt h )

37HYMC: Nasdaq Drilling History • Exploration drilling started in 1975 • 5,520* drill holes within model footprint, representing 2,446,162 feet of drilling • Strong knowledge of the ore body through extensive drilling campaigns, individual assays and over 260 million tons of ore mined to date • 86% of holes drilled greater than 1,000 ft are downhole surveyed Drill Type Number Footage % of Total Diamond Drill 490 535,391 22 RC 4,760 1,874,402 77 Rotary 163 28,986 1 Blast 67 3,670 0.2 Sonic 40 3,713 0.2 Total 5,520 2,446,162 Angle 1,996 1,166,022 48 Vertical 3,524 1,280,140 52 Downhole Surveyed 1,013 1,033,476 42 1,000 ft with Downhole Survey 563 782,703 86 Analysis type Number of individual assays AuFA 437,568 AuCN 325,933 AgFA 276,758 AgCN 310,471 LECO (S%) 3,526 ICP (multi element) 56,885 Source: Hycroft Mining Management * Total holes included in the database of 5,520, however, it is estimated that 820 holes have been mined out

38HYMC: Nasdaq Hycroft Regional Mines Source: Hycroft Mining Management • Several neighboring world class deposits • Property position covers Sleeper-Rosebud high grade trend • Large under explored property position

39HYMC: Nasdaq Permitting • Received Record of Decision from Bureau of Land Management for EIS (10-22-19) • Current operating plan is fully permitted • Existing operating permits will be amended as new facilities/infrastructure are required • EIS includes flexibility: • Expanded pits • Construction of milling facilities and associated infrastructure • Construction of rail siding, if needed (from 2014 Rail Spur EA) • Construction of a tailings management facility to the south of the property, if needed • Phase 1 of the new leach pad is permitted • Phase 1A constructed and will complete electrical when needed, but not expected before late 2022 or later • Phase 1B and future phases will be planned for construction from cash flows when needed Permitted Disturbance – Oct. 2019 Record of Decision

40HYMC: Nasdaq 2020: Key Findings of Novel Two-stage Process FINDING SOLUTION IN PROGRESS Forced air injection Forced air injection system is a key component of the leach pad for effective oxygen distribution throughout pad Working with third-party engineering firm to design and integrate system into the flowsheet and leach pad Solution management Segregation of solution flows to and from the leach pad is required to ensure no comingling of solution in the leach pad system Additional engineering of the leach pad piping and pond system is underway and will be integrated with the final construction of the leach pad Agglomeration Finer crushed material requires agglomeration in order to achieve optimal permeability and gold/silver recoveries Working with a consulting firm to design and build an agglomeration system Reagent requirements Higher soda ash, caustic soda and cyanide consumption was observed in pre-commercial test pads and recent review of the test work Adjusting flow sheet and process plan to ensure proper reagent requirements are accounted for Transitional ore Any additional recovery from applying the novel process to certain transitional ores is offset by the additional crushing and processing cost These transitional ores are being routed as run-of-mine, direct leach material on existing leach pads Variability/ore definition Upon review of historical work, it was determined that additional variability test work and compositing is required to fully understand the geo-metallurgy of each domain Board approved ~$10mm program to drill and test additional material and conducted mineralogical and metallurgical studies in 2021. Drilling began in March 2021. • Hycroft, alongside its industry leading consultants, reviewed the novel two-stage process looking for opportunities for improvements in operating parameters which resulted in the identification of several gaps in the original plan and design but are critical to the success of this process. These findings included:

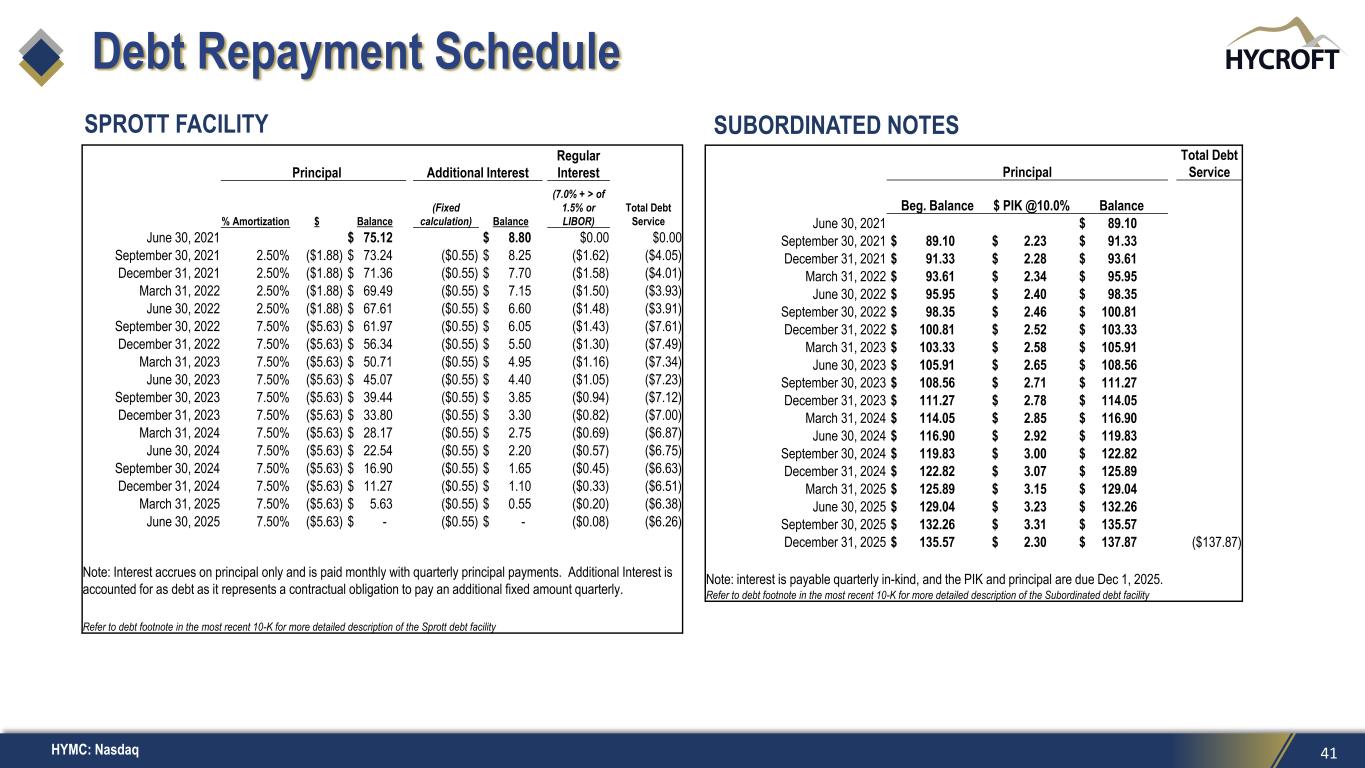

41HYMC: Nasdaq Debt Repayment Schedule SPROTT FACILITY SUBORDINATED NOTES Principal Additional Interest Regular Interest % Amortization $ Balance (Fixed calculation) Balance (7.0% + > of 1.5% or LIBOR) Total Debt Service June 30, 2021 $ 75.12 $ 8.80 $0.00 $0.00 September 30, 2021 2.50% ($1.88) $ 73.24 ($0.55) $ 8.25 ($1.62) ($4.05) December 31, 2021 2.50% ($1.88) $ 71.36 ($0.55) $ 7.70 ($1.58) ($4.01) March 31, 2022 2.50% ($1.88) $ 69.49 ($0.55) $ 7.15 ($1.50) ($3.93) June 30, 2022 2.50% ($1.88) $ 67.61 ($0.55) $ 6.60 ($1.48) ($3.91) September 30, 2022 7.50% ($5.63) $ 61.97 ($0.55) $ 6.05 ($1.43) ($7.61) December 31, 2022 7.50% ($5.63) $ 56.34 ($0.55) $ 5.50 ($1.30) ($7.49) March 31, 2023 7.50% ($5.63) $ 50.71 ($0.55) $ 4.95 ($1.16) ($7.34) June 30, 2023 7.50% ($5.63) $ 45.07 ($0.55) $ 4.40 ($1.05) ($7.23) September 30, 2023 7.50% ($5.63) $ 39.44 ($0.55) $ 3.85 ($0.94) ($7.12) December 31, 2023 7.50% ($5.63) $ 33.80 ($0.55) $ 3.30 ($0.82) ($7.00) March 31, 2024 7.50% ($5.63) $ 28.17 ($0.55) $ 2.75 ($0.69) ($6.87) June 30, 2024 7.50% ($5.63) $ 22.54 ($0.55) $ 2.20 ($0.57) ($6.75) September 30, 2024 7.50% ($5.63) $ 16.90 ($0.55) $ 1.65 ($0.45) ($6.63) December 31, 2024 7.50% ($5.63) $ 11.27 ($0.55) $ 1.10 ($0.33) ($6.51) March 31, 2025 7.50% ($5.63) $ 5.63 ($0.55) $ 0.55 ($0.20) ($6.38) June 30, 2025 7.50% ($5.63) $ - ($0.55) $ - ($0.08) ($6.26) Note: Interest accrues on principal only and is paid monthly with quarterly principal payments. Additional Interest is accounted for as debt as it represents a contractual obligation to pay an additional fixed amount quarterly. Refer to debt footnote in the most recent 10-K for more detailed description of the Sprott debt facility Principal Total Debt Service Beg. Balance $ PIK @10.0% Balance June 30, 2021 $ 89.10 September 30, 2021 $ 89.10 $ 2.23 $ 91.33 December 31, 2021 $ 91.33 $ 2.28 $ 93.61 March 31, 2022 $ 93.61 $ 2.34 $ 95.95 June 30, 2022 $ 95.95 $ 2.40 $ 98.35 September 30, 2022 $ 98.35 $ 2.46 $ 100.81 December 31, 2022 $ 100.81 $ 2.52 $ 103.33 March 31, 2023 $ 103.33 $ 2.58 $ 105.91 June 30, 2023 $ 105.91 $ 2.65 $ 108.56 September 30, 2023 $ 108.56 $ 2.71 $ 111.27 December 31, 2023 $ 111.27 $ 2.78 $ 114.05 March 31, 2024 $ 114.05 $ 2.85 $ 116.90 June 30, 2024 $ 116.90 $ 2.92 $ 119.83 September 30, 2024 $ 119.83 $ 3.00 $ 122.82 December 31, 2024 $ 122.82 $ 3.07 $ 125.89 March 31, 2025 $ 125.89 $ 3.15 $ 129.04 June 30, 2025 $ 129.04 $ 3.23 $ 132.26 September 30, 2025 $ 132.26 $ 3.31 $ 135.57 December 31, 2025 $ 135.57 $ 2.30 $ 137.87 ($137.87) Note: interest is payable quarterly in-kind, and the PIK and principal are due Dec 1, 2025. Refer to debt footnote in the most recent 10-K for more detailed description of the Subordinated debt facility