Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - BayCom Corp | tm2126906d1_ex99-2.htm |

| EX-2.1 - EXHIBIT 2.1 - BayCom Corp | tm2126906d1_ex2-1.htm |

| 8-K - FORM 8-K - BayCom Corp | tm2126906d1_8k.htm |

Exhibit 99.1

September 2021 Announces Expansion in Southern California Pacific Enterprise Bancorp Holding Company for

2 Forward Looking Statements This presentation contains "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts . They often include the words or phrases "may," "believe," "will," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," "plans," "potential," or similar expressions . Investors and security holders are cautioned not to place undue reliance on any forward - looking statements, which speak only as of the date such statements are made . These statements may relate to future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial information . By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements . Statements about the expected timing, completion and effects of the proposed merger and all other statements in this communication other than historical facts constitute forward - looking statements . In addition to factors disclosed in BayCom Corp’s (“BayCom”) reports filed with or furnished to the Securities and Exchange Commission (“SEC”), important factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following : expected revenues, cost savings, synergies and other benefits from the proposed merger (the “Merger”) between BayCom and Pacific Enterprise Bancorp (“PEB”) not be realized within the expected time frames or at all including but not limited to customer and employee retention, and costs or difficulties relating to integration matters, might be greater than expected including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which BayCom and PEB operate ; the possibility that the Merger does not close when expected or at all because required regulatory, shareholder or other approvals, financial tests or other conditions to closing are not received or satisfied on a timely basis or at all ; the risk that the benefits from the Merger may not be fully realized or may take longer to realize than expected or be more costly to achieve ; the failure to attract new customers and retain existing customers in the manner anticipated ; reputational risks and the potential adverse reactions or changes to business, customer or employee relationships, including those resulting from the announcement or completion of the Merger ; BayCom’s or PEB’s businesses may experience disruptions due to transaction - related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities ; deposit attrition, operating costs, customer loss and business disruption following the transaction, including difficulties in maintaining relationships with employees, may be greater than expected ; the diversion of managements' attention from ongoing business operations and opportunities as a result of the Merger or otherwise ; changes in BayCom’s or PEB’s stock price before closing, including as a result of its financial performance prior to closing or transaction - related uncertainty, or more generally due to broader stock market movements, and the performance of financial companies and peer group companies ; the occurrence of any event, change or other circumstance that could give risk to the right of one or both of the parties to terminate the Merger ; the outcome of pending or threatened litigation, or of matters before regulatory agencies, whether currently existing or commencing in the future, including litigation related to the Merger ; changes in interest rates which may affect BayCom’s and PEB’s expected revenues, credit quality deterioration, reductions in real estate values, or reductions in BayCom’s and PEB’s net income, cash flows or the market value of assets, including its investment securities ; each of BayCom’s and PEB’s potential exposure to unknown or contingent liabilities of the other party ; dilution caused by BayCom’s issuance of additional shares of BayCom common stock in connection with the Merger ; the possibility that the Merger is more expensive to complete than anticipated, including as a result of unexpected factors or events ; future acquisitions by BayCom of other depository institutions or lines of business ; and that the novel coronavirus of 2019 (“COVID - 19 ”) pandemic, including uncertainty and volatility in financial, commodities and other markets, and disruptions to banking and other financial activity, could harm BayCom’s or PEB’s business, financial position and results of operations, and could adversely affect the timing and anticipated benefits of the Merger . Additional factors which could affect the forward - looking statements can be found in the cautionary language included under the headings “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in BayCom’s Annual Report on Form 10 - K filed with the SEC for the year ended December 31 , 2020 , and other documents subsequently filed by BayCom with the SEC . Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results . You should not place undue reliance on forward - looking statements and BayCom and PEB undertake no obligation to update or revise any such statements to reflect circumstances or events that occur after the date on which the forward - looking statement is made, whether as a result of new information, future events or otherwise .

3 Additional Information Additional Information about the Merger and Where to Find It . In connection with the Merger, BayCom will file with the SEC a registration statement on Form S - 4 that will include a joint proxy statement of BayCom and PEB and a prospectus of BayCom, as well as other relevant documents concerning the Merger . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S - 4 , THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S - 4 AND ANY OTHER RELEVANT DOCUMENTS WHEN FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BAYCOM, PEB AND THE MERGER . The joint proxy statement/prospectus will be sent to the shareholders of PEB and BayCom seeking the required shareholder approvals . Investors and security holders will be able to obtain free copies of the registration statement on Form S - 4 and the related joint proxy statement/prospectus, when filed, as well as other documents filed with the SEC by BayCom through the web site maintained by the SEC at www . sec . gov . These documents, when available, also can be obtained free of charge by accessing BayCom’s website at www . unitedbusinessbank . com under the tab “Investor Information” and then under “Documents” . Alternatively, these documents, when filed with the SEC by BayCom, can be obtained free of charge by directing a written request to either BayCom Corp . , 500 Ygnacio Valley Road, Suite 200 , Walnut Creek, California, 94596 , Attn : Agnes Chiu or by calling ( 925 ) 476 - 1843 , or to Pacific Enterprise Bancorp, 17748 Skypark Circle, Suite 100 , Irvine, CA 92614 , Attn : Jerro Otsuki , or by calling ( 949 ) 623 - 7592 . Participants in this Transaction . BayCom, PEB and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of BayCom and PEB in connection with the Merger . Information about BayCom’s participants may be found in the definitive proxy statement of BayCom filed with the SEC on April 29 , 2021 , and information about PEB’s participants and additional information regarding the interests of these participants will be included in the joint proxy statement/prospectus regarding the proposed transaction when it becomes available . The definitive proxy statement can be obtained free of charge from the sources described above .

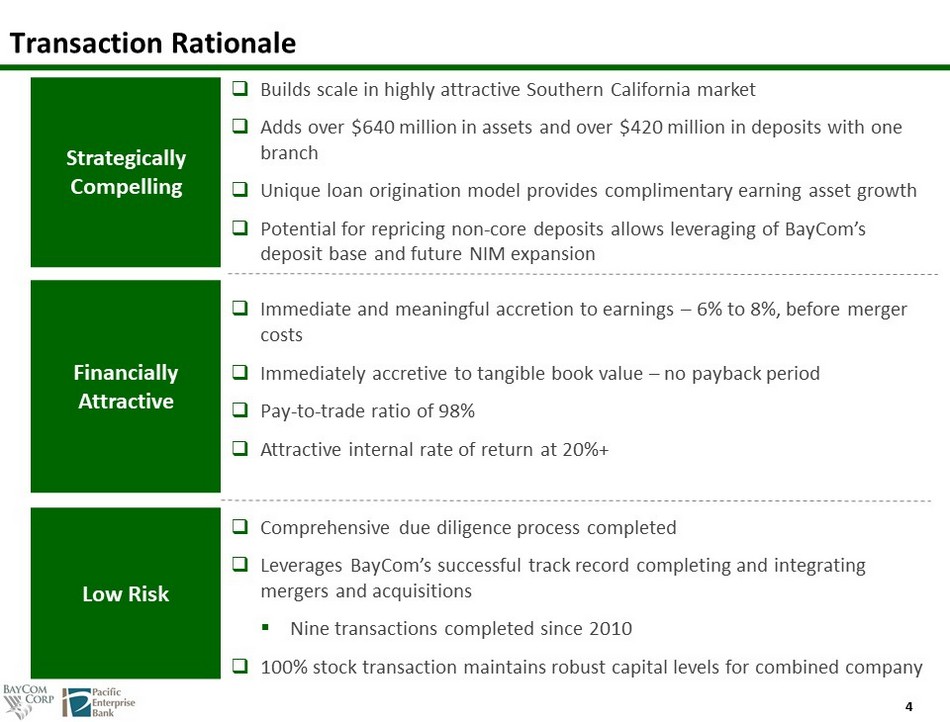

4 Transaction Rationale Strategically Compelling Financially Attractive Low Risk □ Comprehensive due diligence process completed □ Leverages BayCom’s successful track record completing and integrating mergers and acquisitions ▪ Nine transactions completed since 2010 □ 100% stock transaction maintains robust capital levels for combined company □ Builds scale in highly attractive Southern California market □ Adds over $640 million in assets and over $420 million in deposits with one branch □ Unique loan origination model provides complimentary earning asset growth □ Potential for repricing non - core deposits allows leveraging of BayCom’s deposit base and future NIM expansion □ Immediate and meaningful accretion to earnings – 6% to 8%, before merger costs □ Immediately accretive to tangible book value – no payback period □ Pay - to - trade ratio of 98% □ Attractive internal rate of return at 20%+

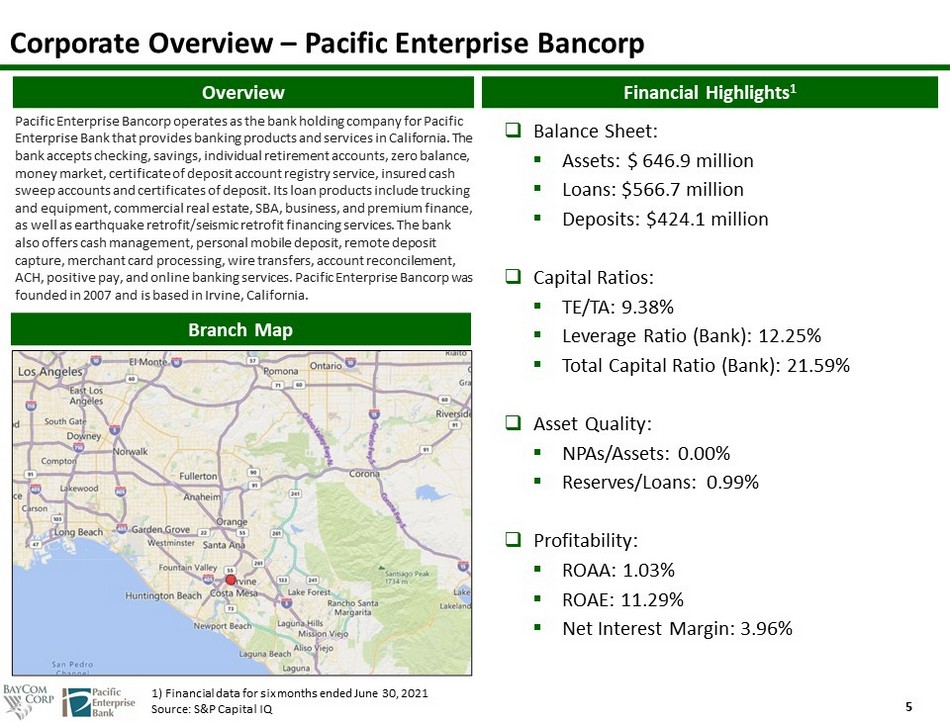

5 □ Balance Sheet: ▪ Assets: $ 646.9 million ▪ Loans: $566.7 million ▪ Deposits: $424.1 million □ Capital Ratios: ▪ TE/TA: 9.38% ▪ Leverage Ratio (Bank): 12.25% ▪ Total Capital Ratio (Bank): 21.59% □ Asset Quality: ▪ NPAs/Assets: 0.00% ▪ Reserves/Loans: 0.99% □ Profitability: ▪ ROAA: 1.03% ▪ ROAE: 11.29% ▪ Net Interest Margin : 3.96% 1) Financial data for six months ended June 30, 2021 Source: S&P Capital IQ Corporate Overview – Pacific Enterprise Bancorp Overview Branch Map Financial Highlights 1 Pacific Enterprise Bancorp operates as the bank holding company for Pacific Enterprise Bank that provides banking products and services in California. The bank accepts checking, savings, individual retirement accounts, zero balance, money market, certificate of deposit account registry service, insured cash sweep accounts and certificates of deposit. Its loan products include trucking and equipment, commercial real estate, SBA, business, and premium finance, as well as earthquake retrofit/seismic retrofit financing services. The bank also offers cash management, personal mobile deposit, remote deposit capture, merchant card processing, wire transfers, account reconcilement, ACH, positive pay, and online banking services. Pacific Enterprise Bancorp was founded in 2007 and is based in Irvine, California.

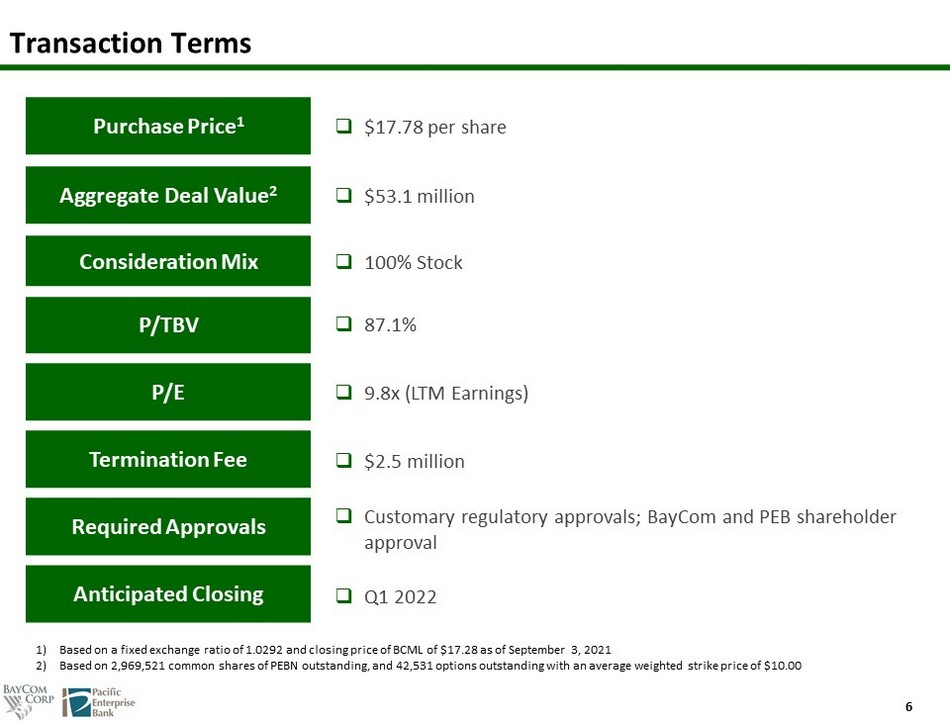

6 Transaction Terms Aggregate Deal Value 2 Termination Fee Anticipated Closing □ Q1 2022 □ $53.1 million □ 9.8x (LTM Earnings) Purchase Price 1 Consideration Mix P/TBV Required Approvals □ $17.78 per share □ 100% Stock □ $2.5 million □ Customary regulatory approvals; BayCom and PEB shareholder approval 1) Based on a fixed exchange ratio of 1.0292 and closing price of BCML of $17.28 as of September 3, 2021 2) Based on 2,969,521 common shares of PEBN outstanding, and 42,531 options outstanding with an average weighted strike price of $10.00 P/E □ 87.1%

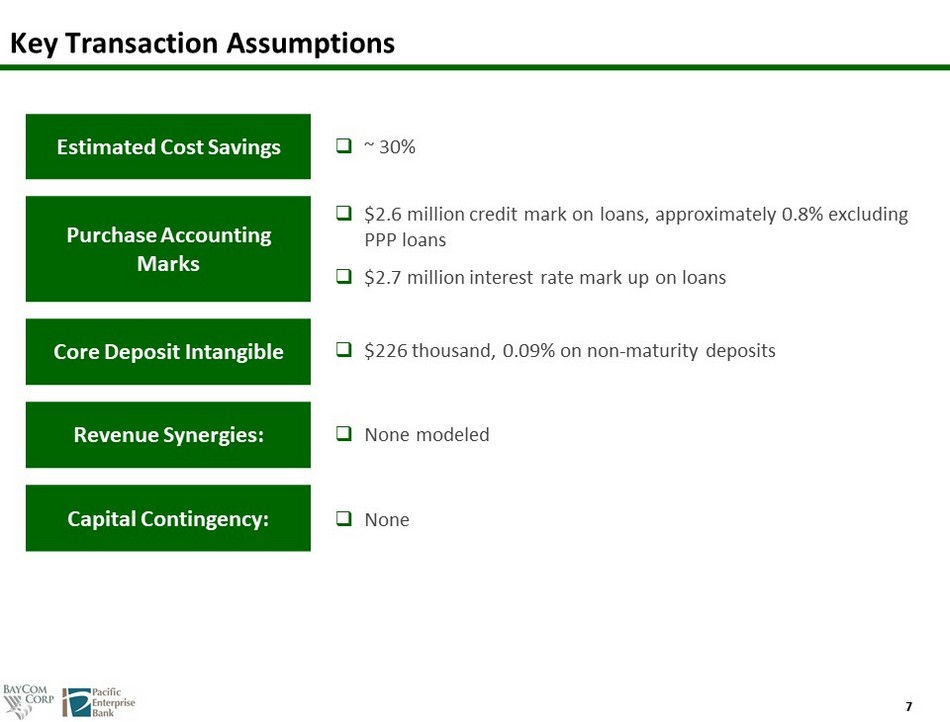

7 Key Transaction Assumptions Estimated Cost Savings Capital Contingency: □ ~ 30% □ None modeled Purchase Accounting Marks Core Deposit Intangible Revenue Synergies: □ $2.6 million credit mark on loans, approximately 0.8% excluding PPP loans □ $2.7 million interest rate mark up on loans □ $226 thousand, 0.09% on non - maturity deposits □ None

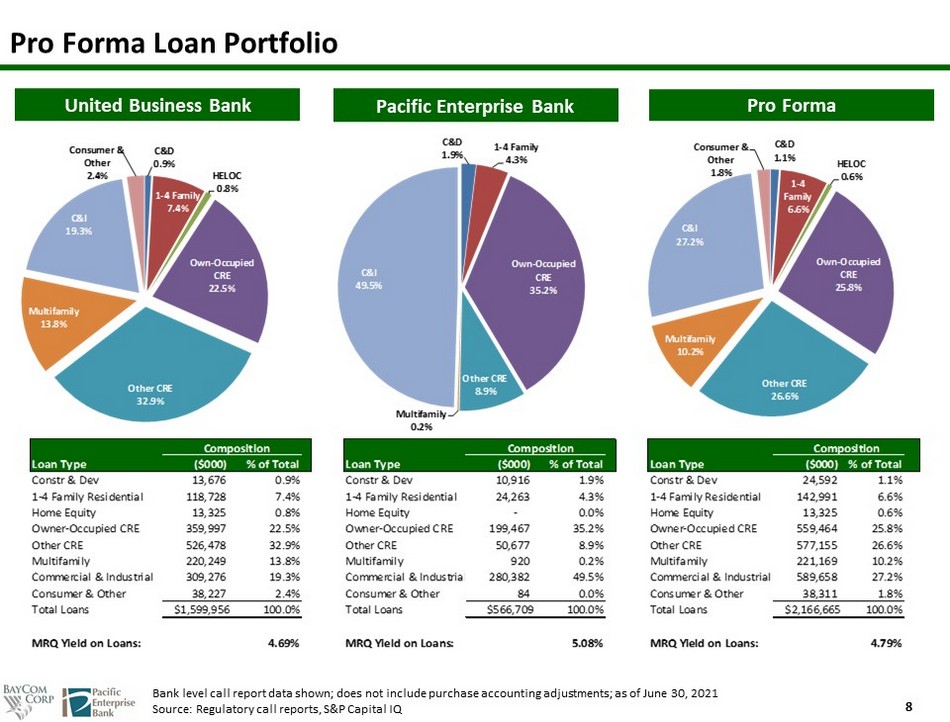

8 Pro Forma Loan Portfolio United Business Bank Pacific Enterprise Bank Pro Forma Bank level call report data shown; does not include purchase accounting adjustments; as of June 30, 2021 Source : Regulatory call reports, S&P Capital IQ Composition Composition Composition Loan Type ($000) % of Total Loan Type ($000) % of Total Loan Type ($000) % of Total Constr & Dev 13,676 0.9% Constr & Dev 10,916 1.9% Constr & Dev 24,592 1.1% 1-4 Family Residential 118,728 7.4% 1-4 Family Residential 24,263 4.3% 1-4 Family Residential 142,991 6.6% Home Equity 13,325 0.8% Home Equity - 0.0% Home Equity 13,325 0.6% Owner-Occupied CRE 359,997 22.5% Owner-Occupied CRE 199,467 35.2% Owner-Occupied CRE 559,464 25.8% Other CRE 526,478 32.9% Other CRE 50,677 8.9% Other CRE 577,155 26.6% Multifamily 220,249 13.8% Multifamily 920 0.2% Multifamily 221,169 10.2% Commercial & Industrial 309,276 19.3% Commercial & Industrial 280,382 49.5% Commercial & Industrial 589,658 27.2% Consumer & Other 38,227 2.4% Consumer & Other 84 0.0% Consumer & Other 38,311 1.8% Total Loans $1,599,956 100.0% Total Loans $566,709 100.0% Total Loans $2,166,665 100.0% MRQ Yield on Loans: 4.69% MRQ Yield on Loans: 5.08% MRQ Yield on Loans: 4.79% C&D 0.9% 1 - 4 Family 7.4% HELOC 0.8% Own - Occupied CRE 22.5% Other CRE 32.9% Multifamily 13.8% C&I 19.3% Consumer & Other 2.4% C&D 1.9% 1 - 4 Family 4.3% Own - Occupied CRE 35.2% Other CRE 8.9% Multifamily 0.2% C&I 49.5% C&D 1.1% 1 - 4 Family 6.6% HELOC 0.6% Own - Occupied CRE 25.8% Other CRE 26.6% Multifamily 10.2% C&I 27.2% Consumer & Other 1.8%

9 Pro Forma Deposit Composition United Business Bank Pacific Enterprise Bank Pro Forma Bank level call report data shown; does not include purchase accounting adjustments; as of June 30, 2021 Source : Regulatory call reports, S&P Capital IQ Composition Composition Composition Deposit Type ($000) % of Total Deposit Type ($000) % of Total Deposit Type ($000) % of Total Non Interest Bearing 730,180 36.6% Non Interest Bearing 73,252 17.2% Non Interest Bearing 803,432 33.2% NOW & Other Trans 327,530 16.4% NOW & Other Trans 37,095 8.7% NOW & Other Trans 364,625 15.0% MMDA & Sav 711,924 35.6% MMDA & Sav 142,892 33.6% MMDA & Sav 854,816 35.3% Time Deposits < $100k 40,854 2.0% Time Deposits < $100k 382 0.1% Time Deposits < $100k 41,236 1.7% Time Deposits > $100k 186,873 9.4% Time Deposits > $100k 171,858 40.4% Time Deposits > $100k 358,731 14.8% Total Deposits $1,997,361 100.0% Total Deposits $425,479 100.0% Total Deposits $2,422,840 100.0% MRQ Cost of Deposits: 0.25% MRQ Cost of Deposits: 0.68% MRQ Cost of Deposits: 0.33% Loans / Deposits: 80.10% Loans / Deposits: 133.19% Loans / Deposits: 89.43% Non - Interest Bearing 36.6% NOW Accts 16.4% MMDA & Savings 35.6% Time Deposits < $100k 2.0% Time Deposits > $100k 9.4% Non - Interest Bearing 17.2% NOW Accts 8.7% MMDA & Savings 33.6% Time Deposits < $100k 0.1% Time Deposits > $100k 40.4% Non - Interest Bearing 33.2% NOW Accts 15.0% MMDA & Savings 35.3% Time Deposits < $100k 1.7% Time Deposits > $100k 14.8%

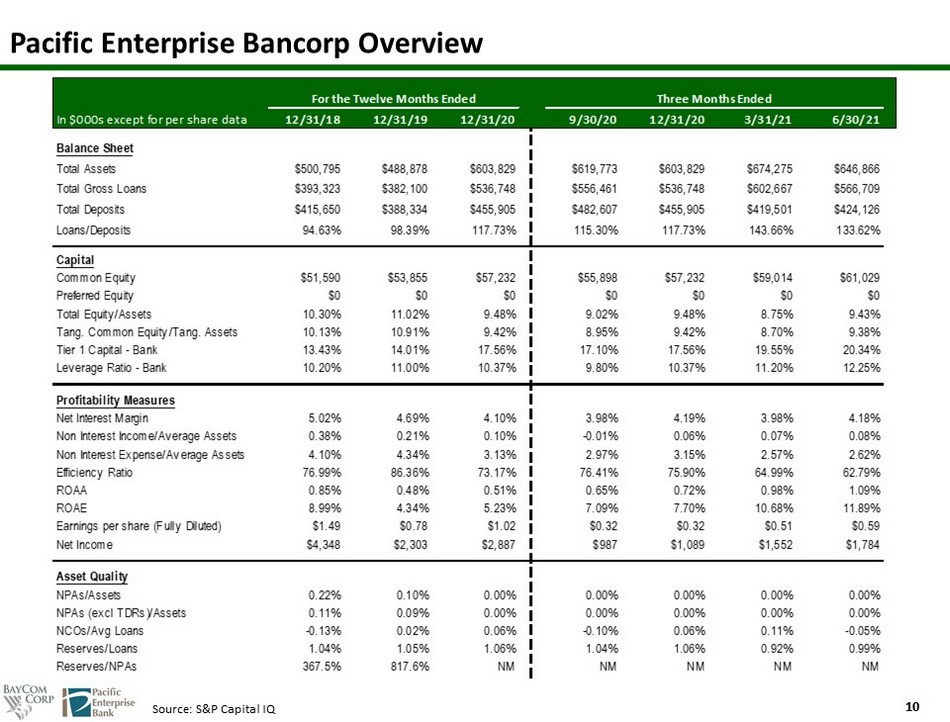

10 Pacific Enterprise Bancorp Overview Source : S&P Capital IQ For the Twelve Months Ended In $000s except for per share data 12/31/18 12/31/19 12/31/20 9/30/20 12/31/20 3/31/21 6/30/21 Balance Sheet Total Assets $500,795 $488,878 $603,829 $619,773 $603,829 $674,275 $646,866 Total Gross Loans $393,323 $382,100 $536,748 $556,461 $536,748 $602,667 $566,709 Total Deposits $415,650 $388,334 $455,905 $482,607 $455,905 $419,501 $424,126 Loans/Deposits 94.63% 98.39% 117.73% 115.30% 117.73% 143.66% 133.62% Capital Common Equity $51,590 $53,855 $57,232 $55,898 $57,232 $59,014 $61,029 Preferred Equity $0 $0 $0 $0 $0 $0 $0 Total Equity/Assets 10.30% 11.02% 9.48% 9.02% 9.48% 8.75% 9.43% Tang. Common Equity/Tang. Assets 10.13% 10.91% 9.42% 8.95% 9.42% 8.70% 9.38% Tier 1 Capital - Bank 13.43% 14.01% 17.56% 17.10% 17.56% 19.55% 20.34% Leverage Ratio - Bank 10.20% 11.00% 10.37% 9.80% 10.37% 11.20% 12.25% Profitability Measures Net Interest Margin 5.02% 4.69% 4.10% 3.98% 4.19% 3.98% 4.18% Non Interest Income/Average Assets 0.38% 0.21% 0.10% -0.01% 0.06% 0.07% 0.08% Non Interest Expense/Average Assets 4.10% 4.34% 3.13% 2.97% 3.15% 2.57% 2.62% Efficiency Ratio 76.99% 86.36% 73.17% 76.41% 75.90% 64.99% 62.79% ROAA 0.85% 0.48% 0.51% 0.65% 0.72% 0.98% 1.09% ROAE 8.99% 4.34% 5.23% 7.09% 7.70% 10.68% 11.89% Earnings per share (Fully Diluted) $1.49 $0.78 $1.02 $0.32 $0.32 $0.51 $0.59 Net Income $4,348 $2,303 $2,887 $987 $1,089 $1,552 $1,784 Asset Quality NPAs/Assets 0.22% 0.10% 0.00% 0.00% 0.00% 0.00% 0.00% NPAs (excl TDRs)/Assets 0.11% 0.09% 0.00% 0.00% 0.00% 0.00% 0.00% NCOs/Avg Loans -0.13% 0.02% 0.06% -0.10% 0.06% 0.11% -0.05% Reserves/Loans 1.04% 1.05% 1.06% 1.04% 1.06% 0.92% 0.99% Reserves/NPAs 367.5% 817.6% NM NM NM NM NM Three Months Ended