Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Atlas Crest Investment Corp. | tm2125835d11_8k.htm |

Exhibit 99.1

| ARCHER INVESTOR DECK SEPTEMBER 2021 1 ARCHER INVESTOR DECK SEPTEMBER 2021 |

| ARCHER INVESTOR DECK SEPTEMBER 2021 2 Archer Aviation Inc. (“Archer” or the “Company”) disclaims all warranties, whether express, implied or statutory, including, without limitation, any implied warranties of title, non- infringement of third-party rights, merchantability, or fitness for a particular purpose. The information pack (the “Pack”) discusses trends and markets that the leadership team of the Company believes will impact the development and success of the Company based on its current understanding of the marketplace. Industry and market data used in the Pack have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. The Company has not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Nothing in this agreement imposes on the Company, Atlas Crest Investment Corp. (“Atlas Crest”) or their advisors or representatives any obligation to provide further Packs or update or correct any inaccuracies in the Pack. Forward-Looking Statements The Pack includes “forward-looking statements” within the meaning of the “safe harbor” provisions under The Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “would,” “should,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. “Forward-looking statements” include all statements about the combined company’s plans and performance, regardless of whether the foregoing expressions are used to identify them. In addition, these forward-looking statements include, but are not limited to: statements regarding: estimates and forecasts of financial and performance metrics; projections of market opportunity and market share, expectations and timing related to commercial product launches; the potential success of the Company's go-to-market strategy; the Company’s research and development efforts; and the Company’s proposed manufacturing plans and expectations, including statements regarding the effectiveness and efficiency of its future manufacturing processes. These statements are based on various assumptions, whether or not identified in the Pack, and on the current expectations of Atlas Crest and Archer management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Atlas Crest and Archer. These forward-looking statements are subject to several risks and uncertainties regarding Atlas Crest’s businesses and the proposed business combination, and actual results may differ materially. These risks and uncertainties include, but are not limited to: the early stage nature of Archer’s business and its past and projected future losses; Archer’s ability to manufacture and deliver its aircraft; Archer’s ability to effectively market and sell air transportation as a substitute for conventional methods of transportation; the receipt of all required certifications, licenses, approvals, and authorizations from transportation authorities; Archer’s ability to achieve its business milestones and launch products on anticipated timelines; Archer’s dependence on suppliers and service partners for the parts and components in its aircraft; Archer’s ability to develop commercial-scale manufacturing capabilities; regulatory requirements and other obstacles outside of Archer’s control that slow market adoption of electric aircraft; regulatory risks related to evolving laws and regulations in Archer’s industries, including data privacy and security laws; Archer’s ability to facilitate necessary changes to Vertiport infrastructure to enable adoption; risks related to Archer’s Aerial Ride Sharing Business operating in densely populated metropolitan areas and heavily regulated airports; impact of the COVID-19 pandemic on Archer’s business and the global economy; the inability of the parties to successfully or timely consummate the proposed business combination; a decline in Archer’s securities following the business combination if it fails to meet the expectations of investors or securities analysts; Archer’s inability to protect its intellectual property rights from unauthorized use by third parties; Archer’s ability to defend third-party claims of intellectual property infringement against Archer; Archer’s need for and the availability of additional capital; risks related to the dual class structure of Archer’s common stock; the amount of redemption requests made by Atlas Crest’s public stockholders; and the ability of Atlas Crest or the combined company to issue equity or equity-linked securities in connection with the proposed business combination or in the future. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties and those factors discussed in Atlas Crest’s Registration Statement on Form S-4, filed with the Securities and Exchange Commission (“SEC”) on March 8, 2021 (as amended, the “Registration Statement”) under the heading “Risk Factors,” and other documents of Atlas filed, or to be filed, with the SEC. If any of these risks materialize or if assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Atlas Crest nor Archer presently know or that Atlas Crest and Archer currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Atlas Crest’s and Archer’s expectations, plans or forecasts of future events and views as of the date of the Pack. Atlas Crest and Archer anticipate that subsequent events and developments will cause Atlas Crest's and Archer’s assessments to change. However, while Atlas Crest and Archer may elect to update these forward-looking statements at some point in the future, Atlas Crest and Archer specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Atlas Crest’s or Archer’s assessments as of any date subsequent to the date of the Pack. Accordingly, undue reliance should not be placed upon the forward-looking statements. Additional Information about the Business Combination and Where to Find It In connection with the proposed business combination between Archer and Atlas Crest, Atlas Crest has filed with the SEC a definitive proxy statement/prospectus and has mailed a copy of such proxy statement/prospectus, together with other relevant documentation, to Atlas Crest stockholders. This Pack does not contain all the information that should be considered concerning the proposed business combination. It is not intended to form the basis of any investment decision or any other decision in respect to the proposed business combination. Atlas Crest stockholders and other interested persons are advised to read the definitive proxy statement/prospectus filed in connection with Atlas Crest’s solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed business combination because these materials will contain important information about Archer, Atlas Crest and the proposed transactions. The definitive proxy statement / prospectus was mailed to Atlas Crest stockholders on August 12, 2021. Atlas Crest stockholders will also be able to obtain copies of the definitive proxy statement/prospectus, as well as other filings containing information about Atlas Crest, without charge, at the SEC’s website at www.sec.gov, or by directing a request to: Atlas Crest Investment Corp., 399 Park Avenue, New York, NY 10022, or (212) 883-3800. These documents, once available, can also be obtained, without charge, at the SEC’s web site (http://www.sec.gov). INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE PROPOSED BUSINESS COMBINATION OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. Use of Projections and Description of Key Partnerships The Pack contains projected financial information with respect to the Company, namely revenue, gross profit, operating capital expenditures, EBITDA and EBITDA margin for 2024 – 2030. Such projected financial information constitutes forward-looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward-Looking Statements” above. Actual results may differ materially from the results contemplated by the projected financial information contained in the Pack, and the inclusion of such information in the Pack should not be regarded as a representation by any person that the results reflected in such projections will be achieved. The independent registered public accounting firm of the Company has not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in the Pack, and accordingly, does not express an opinion or provided any other form of assurance with respect thereto for the purpose of the Pack. The Pack contains descriptions of certain key business partnerships of the Company. These descriptions are based on the Company’s management team’s discussions with such counterparties and the latest available information and estimates as of the date of the Pack. In certain cases, such descriptions are subject to negotiation and execution of definitive agreements with such counterparties which have not been completed as of the date of the Pack and, as a result, such descriptions of key business partnerships of the Company, remain subject to change. Financial Information; Non-GAAP Financial Measures The financial information and data contained in the Pack is unaudited and does not conform to Regulation S-X. Some of the financial information and data contained in the Pack, such as EBITDA and EBITDA margin, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). EBITDA is defined as net income (loss) before interest, taxes, depreciation and amortization. Net income (loss) includes research and development expenses. The Company believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. The Company is not providing a reconciliation of projected EBITDA for full years 2024 – 2030 to the most directly comparable measure prepared in accordance with GAAP because the Company is unable to provide this reconciliation without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence, the financial impact, and the periods in which the adjustments may be recognized. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. No Offer or Solicitation This Pack does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Participants in the Solicitation Atlas Crest, Archer, and their respective directors, officers and employees may be deemed participants in the solicitation of proxies of Atlas Crest’s stockholders in connection with the proposed business combination. Atlas Crest stockholders and other interested persons may obtain, without charge, more detailed information regarding the names, affiliations and interests of certain directors, officers and employees of Atlas Crest and of Archer in Atlas Crest’s definitive proxy statement/prospectus. Information concerning the interests of Atlas Crest's and Archer’s participants in the solicitation, which may, in some cases, be different than those of Atlas Crest’s stockholders generally, is set forth in the definitive proxy statement/prospectus. Trademarks The Pack contains trademarks, service marks, trade names and copyrights of the Company and other companies, which are the property of their respective owners. Placement Agent Moelis & Company acted as a placement agent in connection with the PIPE financing and is receiving a fee in connection with such role. In addition, Moelis & Company LLC will receive a business combination marketing fee upon completion of the proposed transaction. Affiliates of Moelis & Company hold interests in the securities of Atlas Crest which do not have any value unless a business combination is consummated. Neither Atlas Crest nor Moelis has assumed any responsibility for independently verifying such information and expressly disclaims any liability to any purchaser in connection with such information or any transaction with the Company. Neither Atlas Crest nor Moelis make any representation or warranty, express or implied, or accept any responsibility or liability for the accuracy or completeness of the information contained herein or any other written or oral information that the Company makes available to any recipient. Neither Atlas Crest nor Moelis makes any representation or warranty as to the achievement or reasonableness of any projections, management estimates, prospects or returns. Certain images of aircraft and vertiport structures depicted in this presentation have been rendered utilizing computer graphics. Disclaimer |

| ARCHER INVESTOR DECK SEPTEMBER 2021 3 Certain Risks Related to Archer Aviation Inc. All references to the “Company,” “Archer,” “we,” “us” or “our” in Pack refer to the business of Archer Aviation Inc. The risks presented below are certain of the general risks related to the Company’s business, industry and ownership structure and are not exhaustive. The list below is qualified in its entirety by disclosures contained in the definitive proxy statement/prospectus and such future filings by the Company, or by third parties (including Atlas Crest) with respect to the Company, with the SEC. These risks speak only as of the date of the Pack and Atlas Crest and Archer make no commitment to update such disclosure. Some factors that could cause actual results to differ include: ● the early-stage nature of Archer’s business and its past and projected future losses; ● Archer’s ability to manufacture and deliver its aircraft, including doing so within its current estimated budget, including risks associated with Archer’s reliance on its relationships with its suppliers and service providers for the parts and components in its aircraft and its ability to successfully develop commercial-scale manufacturing capabilities; ● risks associated with the United Airlines order constituting all of the current orders for Archer aircraft and that the order is subject to conditions, further negotiation and reaching mutual agreement on certain material terms; ● risks relating to the uncertainty of the projections included in the Archer Financial Model (as defined in the definitive proxy statement/prospectus); ● Archer’s ability to effectively market and sell air transportation as a substitute for conventional methods of transportation, following receipt of governmental operating authority, including successfully addressing any obstacles outside of its control that may slow market adoption of eVTOL aircraft; ● Archer’s ability to compete in the competitive urban air mobility and eVTOL industries; ● Archer’s ability to obtain expected or required certifications, licenses, approvals, and authorizations from transportation authorities; ● Archer’s ability to achieve its business milestones and launch products on anticipated timelines; ● Archer’s dependence on suppliers and service partners for the parts and components in its aircraft; ● Archer’s ability to develop commercial-scale manufacturing capabilities; ● regulatory requirements and other obstacles outside of Archer’s control that slow market adoption of electric aircraft; ● Archer’s ability to facilitate necessary changes to Vertiport infrastructure to enable adoption, including installation of necessary charging equipment; ● Archer’s ability to establish and expand its presence within international markets and into the market segments of defense or logistics/cargo; ● Archer’s ability to hire, train and retain qualified senior management personnel or other key employees; ● risks related to natural disasters, outbreaks and pandemics, economic, social, weather, growth constraints and regulatory conditions or other circumstances affecting metropolitan areas; risks related to Archer’s aerial ride sharing business operating in densely populated metropolitan areas and heavily regulated airports; ● adverse publicity from accidents involving aircraft, helicopters or lithium-ion battery cells; ● the impact of labor and union activities on Archer’s workforce; losses resulting from indexed price escalation clauses in purchase orders and cost overruns; ● regulatory risks related to evolving laws and regulations in Archer’s industries, including data privacy and security laws; ● impact of the COVID-19 pandemic on Archer’s business and the global economy; ● the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination or that the approval of the stockholders of Atlas Crest is not obtained; ● a decline in Archer’s securities following the business combination if it fails to meet the expectations of investors or securities analysts; ● Archer’s inability to protect its intellectual property rights from unauthorized use by third parties; ● Archer’s ability to defend third-party claims of intellectual property infringement against Archer; ● Archer’s need for and the availability of additional capital to pursue its business objectives and respond to business opportunities, challenges or unforeseen circumstances; cybersecurity risks; ● risks and costs associated with the ongoing litigation with Wisk; ● risks related to the dual class structure of Archer’s common stock, which will limit other investors’ ability to influence corporate matters; the amount of redemption requests made by Atlas Crest’s public stockholders; To be listed in order of priority from most significant to least. |

| ARCHER INVESTOR DECK SEPTEMBER 2021 4 Today’s Reality POLLUTION CONGESTION MOBILITY LIMITATIONS UNPRECEDENTED TRAFFIC |

| ARCHER INVESTOR DECK SEPTEMBER 2021 5 Morgan Stanley predicts Urban Air Mobility to be a $1+ Trillion market by 2040 ARCHER INVESTOR DECK SEPTEMBER 2021 5 MASSIVE TAM Images in this presentation of the Maker Aircraft in flight are computer-generated simulations. |

| ARCHER INVESTOR DECK SEPTEMBER 2021 PRIVATE AND CONFIDENTIAL 6 1 ARCHER INVESTOR DECK SEPTEMBER 2021 6 |

| ARCHER INVESTOR DECK SEPTEMBER 2021 7 Aircraft design and technology facilitates an industry-leading certification timeline with the FAA ARCHER INVESTOR DECK SEPTEMBER 2021 7 1 ARCHER Positioning to be First to Market Key technology development led to Maker unveil in 2Q21. Targeting full-scale flight tests by end of year Manufacturing and supply chain partnership with Stellantis to accelerate speed-to-market Support from L.A. and Miami to facilitate build out of UAM infrastructure Leading team of eVTOL engineers and successful commercial aviation executives Commercial partnership with United for up to $1.5 billion in aircraft sales and go-to-market operating support |

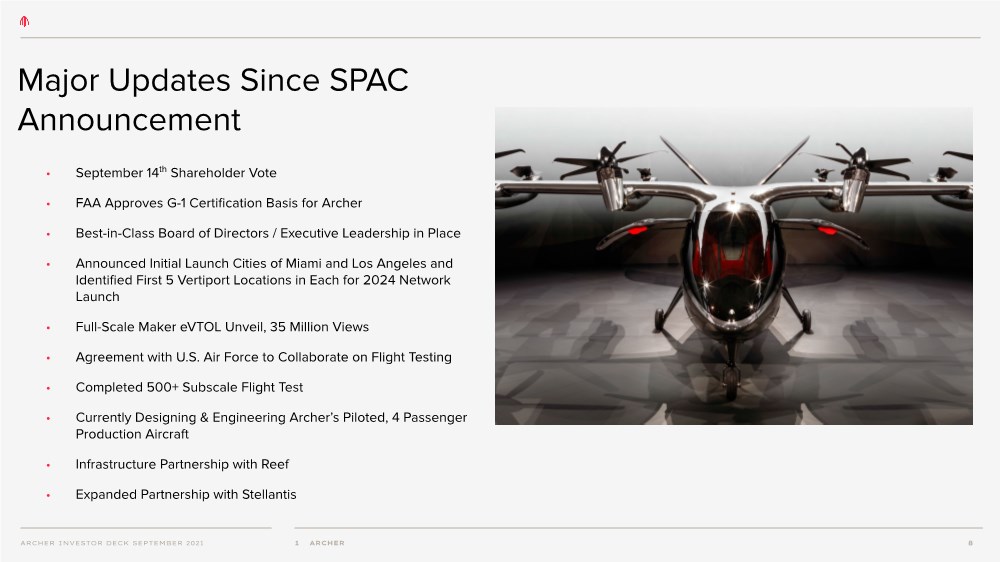

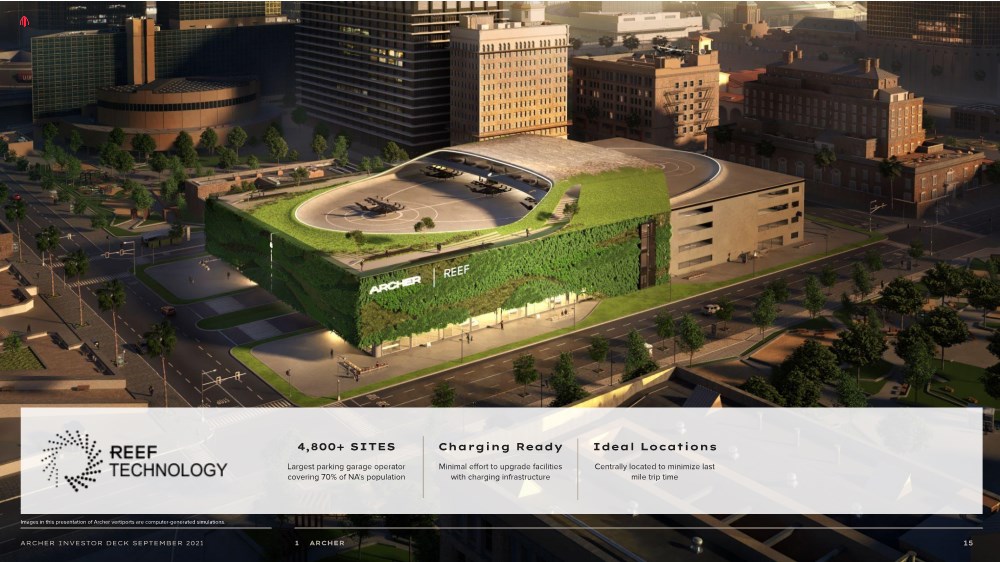

| ARCHER INVESTOR DECK SEPTEMBER 2021 8 • September 14th Shareholder Vote • FAA Approves G-1 Certification Basis for Archer • Best-in-Class Board of Directors / Executive Leadership in Place • Announced Initial Launch Cities of Miami and Los Angeles and Identified First 5 Vertiport Locations in Each for 2024 Network Launch • Full-Scale Maker eVTOL Unveil, 35 Million Views • Agreement with U.S. Air Force to Collaborate on Flight Testing • Completed 500+ Subscale Flight Test • Currently Designing & Engineering Archer’s Piloted, 4 Passenger Production Aircraft • Infrastructure Partnership with Reef • Expanded Partnership with Stellantis 1 ARCHER Major Updates Since SPAC Announcement |

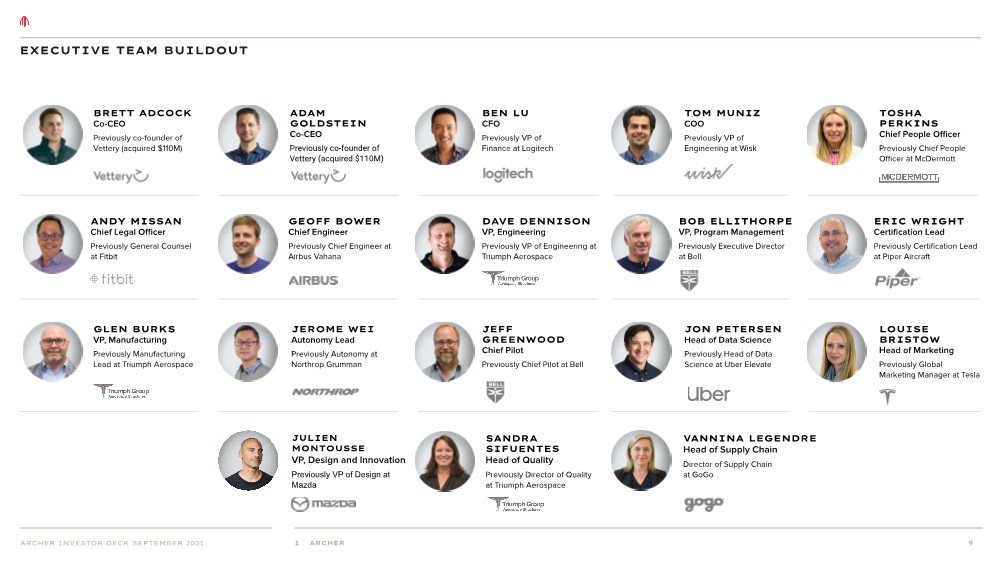

| ARCHER INVESTOR DECK SEPTEMBER 2021 9 EXECUTIVE TEAM BUILDOUT 1 ARCHER ADAM GOLDSTEIN Co-CEO Previously co-founder of Vettery (acquired $110M) VANNINA LEGENDRE Head of Supply Chain Director of Supply Chain at GoGo JULIEN MONTOUSSE VP, Design and Innovation Previously VP of Design at Mazda SANDRA SIFUENTES Head of Quality Previously Director of Quality at Triumph Aerospace GLEN BURKS VP, Manufacturing Previously Manufacturing Lead at Triumph Aerospace JEROME WEI Autonomy Lead Previously Autonomy at Northrop Grumman JEFF GREENWOOD Chief Pilot Previously Chief Pilot at Bell JON PETERSEN Head of Data Science Previously Head of Data Science at Uber Elevate LOUISE BRISTOW Head of Marketing Previously Global Marketing Manager at Tesla BRETT ADCOCK Co-CEO Previously co-founder of Vettery (acquired $110M) BEN LU CFO Previously VP of Finance at Logitech TOM MUNIZ COO Previously VP of Engineering at Wisk TOSHA PERKINS Chief People Officer Previously Chief People Officer at McDermott ANDY MISSAN Chief Legal Officer Previously General Counsel at Fitbit GEOFF BOWER Chief Engineer Previously Chief Engineer at Airbus Vahana DAVE DENNISON VP, Engineering Previously VP of Engineering at Triumph Aerospace BOB ELLITHORPE VP, Program Management Previously Executive Director at Bell ERIC WRIGHT Certification Lead Previously Certification Lead at Piper Aircraft |

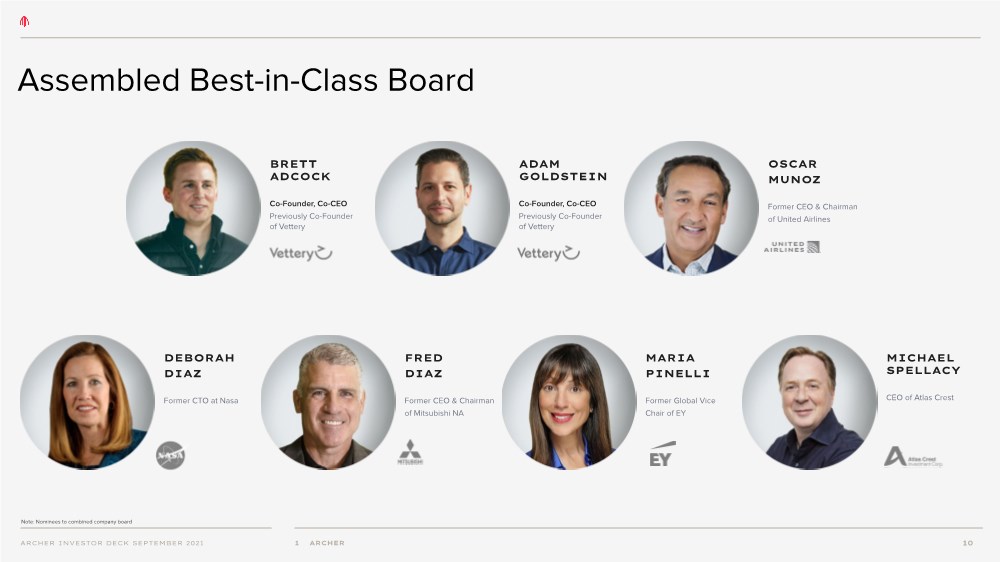

| ARCHER INVESTOR DECK SEPTEMBER 2021 10 Assembled Best-in-Class Board 1 ARCHER BRETT ADCOCK Co-Founder, Co-CEO Previously Co-Founder of Vettery ADAM GOLDSTEIN Co-Founder, Co-CEO Previously Co-Founder of Vettery OSCAR MUNOZ Former CEO & Chairman of United Airlines DEBORAH DIAZ Former CTO at Nasa FRED DIAZ Former CEO & Chairman of Mitsubishi NA MARIA PINELLI Former Global Vice Chair of EY MICHAEL SPELLACY CEO of Atlas Crest Note: Nominees to combined company board |

| ARCHER INVESTOR DECK SEPTEMBER 2021 11 AGREEMENT WITH UNITED STATES AIR FORCE TARGETING 4Q21 FLIGHT TEST MAKER UNVEILED JUNE 2021 (35M views) FULL-SCALE eVTOL AIRCRAFT KEY TECH DEVELOPED ARCHER INVESTOR DECK SEPTEMBER 2021 11 1 ARCHER |

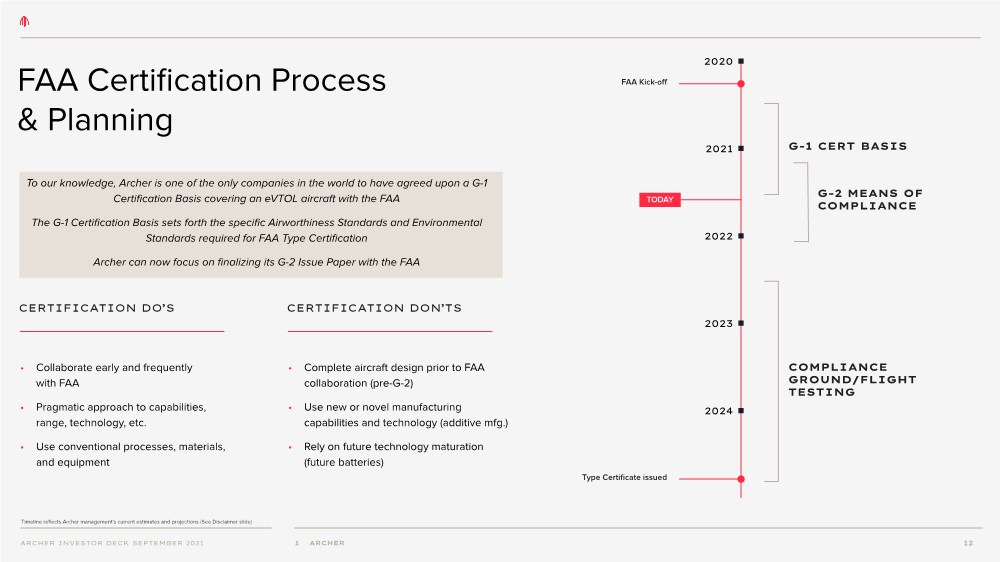

| ARCHER INVESTOR DECK SEPTEMBER 2021 12 1 ARCHER FAA Certification Process & Planning • Collaborate early and frequently with FAA • Pragmatic approach to capabilities, range, technology, etc. • Use conventional processes, materials, and equipment CERTIFICATION DO’S • Complete aircraft design prior to FAA collaboration (pre-G-2) • Use new or novel manufacturing capabilities and technology (additive mfg.) • Rely on future technology maturation (future batteries) CERTIFICATION DON’TS 2020 2021 2022 2023 2024 G-1 CERT BASIS FAA Kick-off Type Certificate issued G-2 MEANS OF COMPLIANCE COMPLIANCE GROUND/FLIGHT TESTING TODAY Timeline reflects Archer management’s current estimates and projections (See Disclaimer slide) To our knowledge, Archer is one of the only companies in the world to have agreed upon a G-1 Certification Basis covering an eVTOL aircraft with the FAA The G-1 Certification Basis sets forth the specific Airworthiness Standards and Environmental Standards required for FAA Type Certification Archer can now focus on finalizing its G-2 Issue Paper with the FAA |

| ARCHER INVESTOR DECK SEPTEMBER 2021 13 • High-volume composite manufacturing • Supporting Archer on composite material selection, NVH design • Access to low-cost automotive grade supply chain Partnership for Long-Term Manufacturing & Supply Chain 1 ARCHER STRATEGIC AUTOMOTIVE OEM PARTNER WITH A MULTI-YEAR COLLABORATION AGREEMENT EXPANDED PARTNERSHIP • Manufacturing consulting for site selection & operations • Supply chain and quality best practice sharing for high volume output • Early stage collaboration on battery fast charging, light weighting, and management systems |

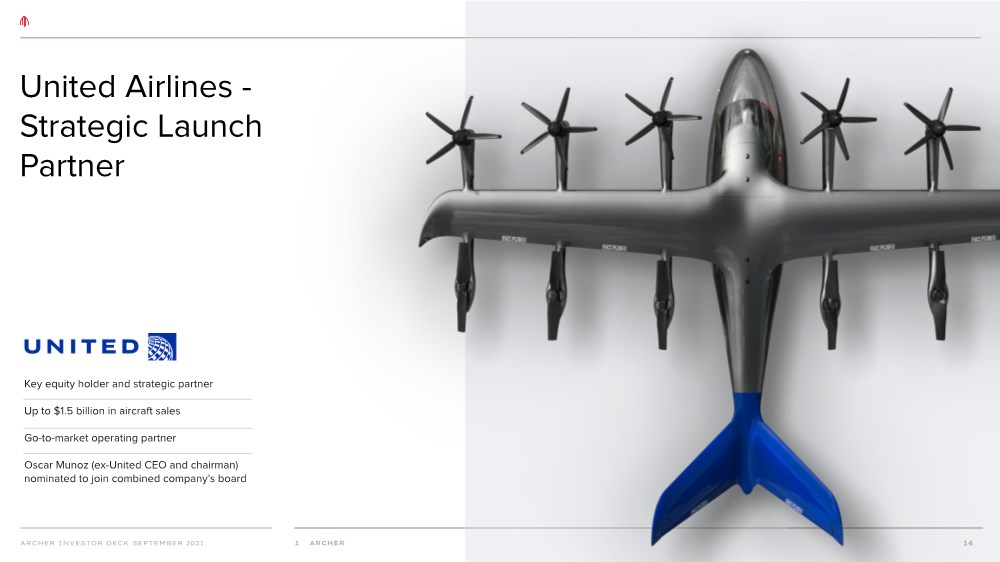

| ARCHER INVESTOR DECK SEPTEMBER 2021 14 United Airlines - Strategic Launch Partner 14 1 ARCHER Key equity holder and strategic partner Up to $1.5 billion in aircraft sales Go-to-market operating partner Oscar Munoz (ex-United CEO and chairman) nominated to join combined company’s board |

| ARCHER INVESTOR DECK SEPTEMBER 2021 15 ARCHER INVESTOR DECK SEPTEMBER 2021 15 1 ARCHER 4,800+ SITES Largest parking garage operator covering 70% of NA’s population Charging Ready Minimal effort to upgrade facilities with charging infrastructure Ideal Locations Centrally located to minimize last mile trip time Images in this presentation of Archer vertiports are computer-generated simulations. |

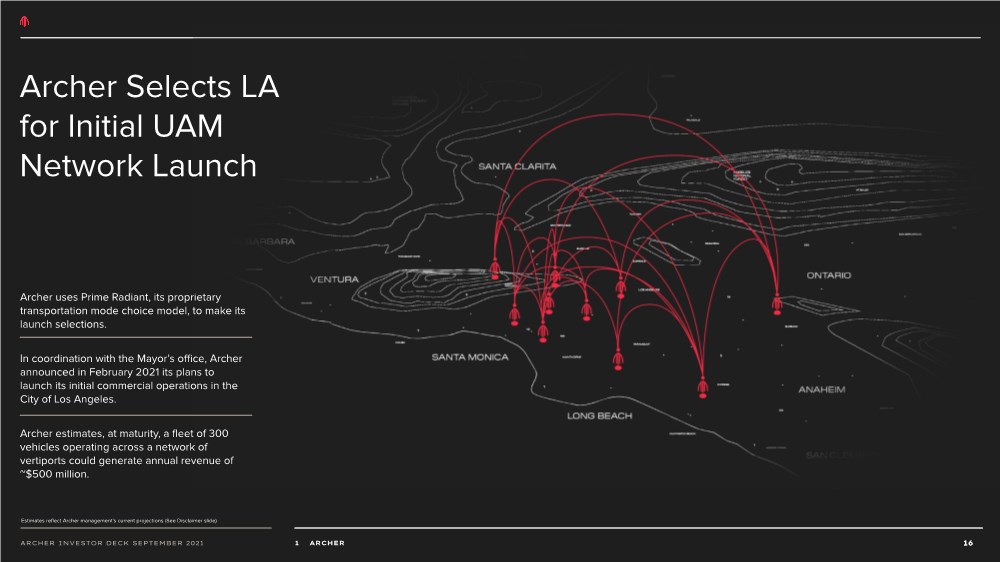

| ARCHER INVESTOR DECK SEPTEMBER 2021 16 16 1 ARCHER Archer uses Prime Radiant, its proprietary transportation mode choice model, to make its launch selections. In coordination with the Mayor’s office, Archer announced in February 2021 its plans to launch its initial commercial operations in the City of Los Angeles. Archer estimates, at maturity, a fleet of 300 vehicles operating across a network of vertiports could generate annual revenue of ~$500 million. Archer Selects LA for Initial UAM Network Launch Estimates reflect Archer management’s current projections (See Disclaimer slide) |

| ARCHER INVESTOR DECK 2021 PRIVATE AND CONFIDENTIAL 17 2 ARCHER INVESTOR DECK SEPTEMBER 2021 17 |

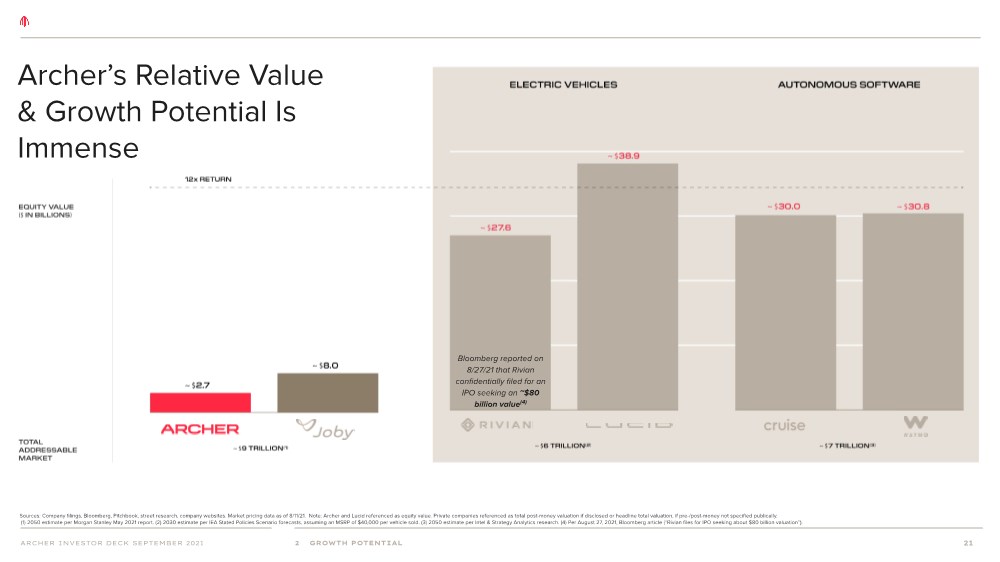

| ARCHER INVESTOR DECK SEPTEMBER 2021 18 High barriers to entry due to specialized engineering expertise, technology development, commercial partners, and capital needs Attractive short-term and long-term value creation with pre-market Electric Vehicle & Autonomous Vehicle peers ~12x Archer’s current valuation ARCHER INVESTOR DECK SEPTEMBER 2021 18 2 GROWTH POTENTIAL Key Investor Highlights |

| ARCHER INVESTOR DECK SEPTEMBER 2021 19 EV CHARGING RIDE SHARING ELECTRIC VEHICLES eVTOL AUTONOMOUS VEHICLES START-TO-MARKET <1 YEAR <2 YEARS 3-5 YEARS 6+ YEARS 6+ YEARS ENGINEERING TALENT SPECIALIZATION COMMODITY COMMODITY MEDIUM TALENT SPECIALIZATION SPECIALIZED TALENT NEEDED SPECIALIZED TALENT NEEDED REGULATION USING EXISTING REGULATIONS USING EXISTING REGULATIONS USING EXISTING REGULATIONS USING EXISTING REGULATIONS NEW REGULATIONS NEEDED TECHNOLOGY ACCESS MINIMAL TO NO TECHNOLOGY COMMODITY TECHNOLOGY WELL-UNDERSTOOD TECHNOLOGY WELL-UNDERSTOOD TECHNOLOGY ADVANCED TECHNOLOGY NEEDED LOW BARRIERS TO ENTRY HIGH BARRIERS TO ENTRY Urban Air Mobility Is A Highly Attractive “Hard-tech” Segment 2 GROWTH POTENTIAL |

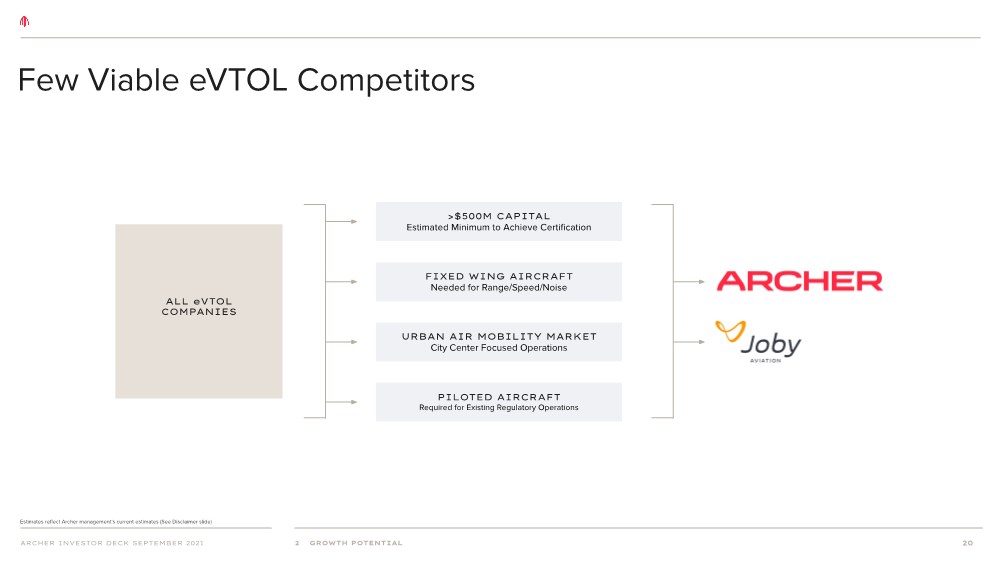

| ARCHER INVESTOR DECK SEPTEMBER 2021 20 Few Viable eVTOL Competitors 2 GROWTH POTENTIAL ALL eVTOL COMPANIES >$500M CAPITAL Estimated Minimum to Achieve Certification FIXED WING AIRCRAFT Needed for Range/Speed/Noise URBAN AIR MOBILITY MARKET City Center Focused Operations PILOTED AIRCRAFT Required for Existing Regulatory Operations Estimates reflect Archer management’s current estimates (See Disclaimer slide) |

| ARCHER INVESTOR DECK SEPTEMBER 2021 21 GROWTH POTENTIAL 5 2 Archer’s Relative Value & Growth Potential Is Immense Sources: Company filings, Bloomberg, Pitchbook, street research, company websites. Market pricing data as of 8/11/21. Note: Archer and Lucid referenced as equity value. Private companies referenced as total post-money valuation if disclosed or headline total valuation, if pre-/post-money not specified publically. (1) 2050 estimate per Morgan Stanley May 2021 report. (2) 2030 estimate per IEA Stated Policies Scenario forecasts, assuming an MSRP of $40,000 per vehicle sold. (3) 2050 estimate per Intel & Strategy Analytics research. (4) Per August 27, 2021, Bloomberg article (“Rivian files for IPO seeking about $80 billion valuation”). Bloomberg reported on 8/27/21 that Rivian confidentially filed for an IPO seeking an ~$80 billion value(4) |

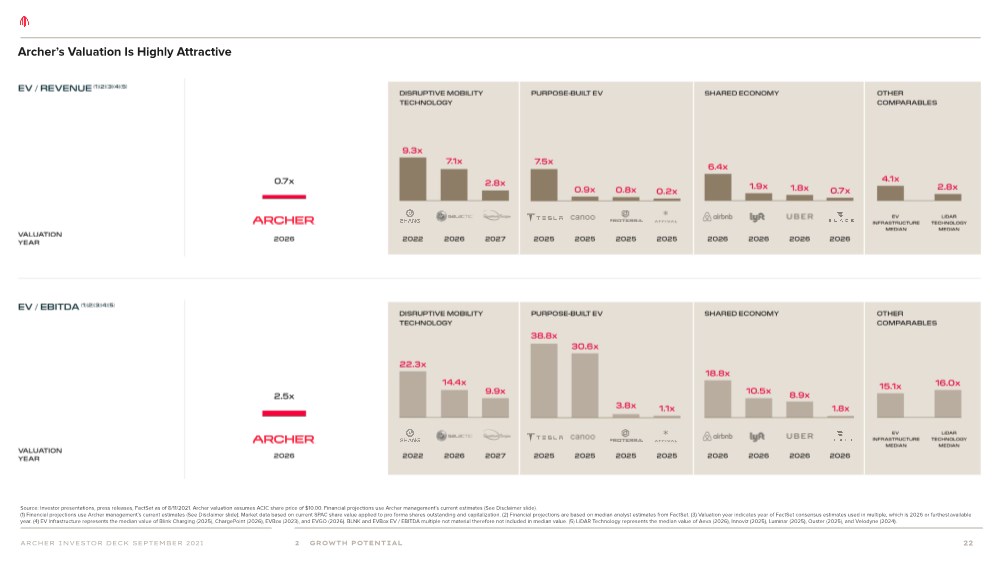

| ARCHER INVESTOR DECK SEPTEMBER 2021 22 Archer’s Valuation Is Highly Attractive Source: Investor presentations, press releases, FactSet as of 8/11/2021. Archer valuation assumes ACIC share price of $10.00. Financial projections use Archer management’s current estimates (See Disclaimer slide). (1) Financial projections use Archer management’s current estimates (See Disclaimer slide); Market data based on current SPAC share value applied to pro forma shares outstanding and capitalization. (2) Financial projections are based on median analyst estimates from FactSet. (3) Valuation year indicates year of FactSet consensus estimates used in multiple, which is 2026 or furthest available year. (4) EV Infrastructure represents the median value of Blink Charging (2025), ChargePoint (2026), EVBox (2023), and EVGO (2026). BLNK and EVBox EV / EBITDA multiple not material therefore not included in median value. (5) LiDAR Technology represents the median value of Aeva (2026), Innoviz (2025), Luminar (2025), Ouster (2025), and Velodyne (2024). 2 GROWTH POTENTIAL |

| ARCHER INVESTOR DECK AUGUST 2021 23 3 ARCHER INVESTOR DECK SEPTEMBER 2021 23 |

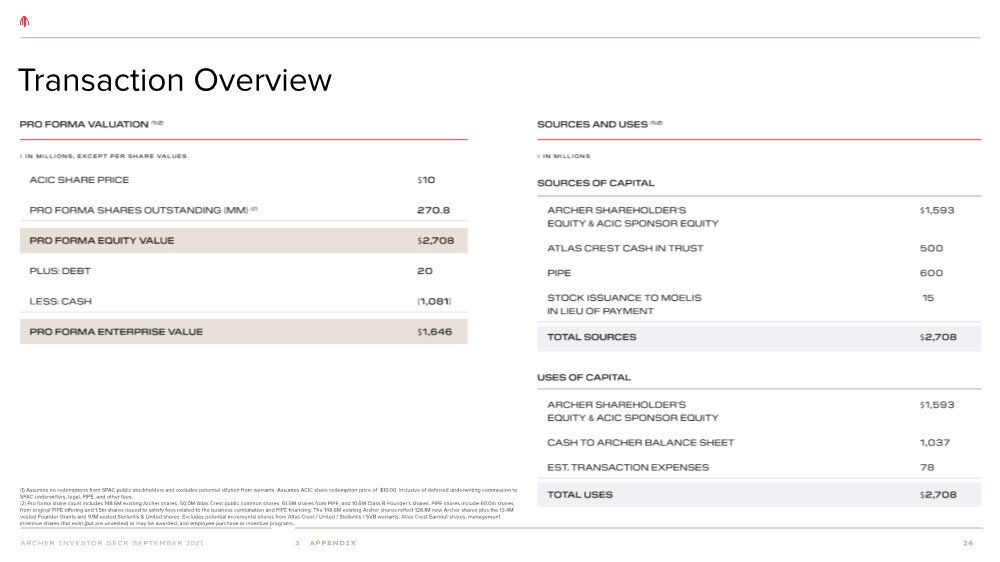

| ARCHER INVESTOR DECK SEPTEMBER 2021 24 (1) Assumes no redemptions from SPAC public stockholders and excludes potential dilution from warrants. Assumes ACIC share redemption price of $10.00. Inclusive of deferred underwriting commission to SPAC underwriters, legal, PIPE, and other fees. (2) Pro forma share count includes 148.6M existing Archer shares, 50.0M Atlas Crest public common shares, 61.5M shares from PIPE, and 10.6M Class B Founder’s shares. PIPE shares include 60.0m shares from original PIPE offering and 1.5m shares issued to satisfy fees related to the business combination and PIPE financing. The 148.6M existing Archer shares reflect 126.1M new Archer shares plus the 13.4M vested Founder Grants and 9.1M vested Stellantis & United shares. Excludes potential incremental shares from Atlas Crest / United / Stellantis / SVB warrants, Atlas Crest Earnout shares, management incentive shares that exist (but are unvested) or may be awarded, and employee purchase or incentive programs. Transaction Overview 3 APPENDIX |

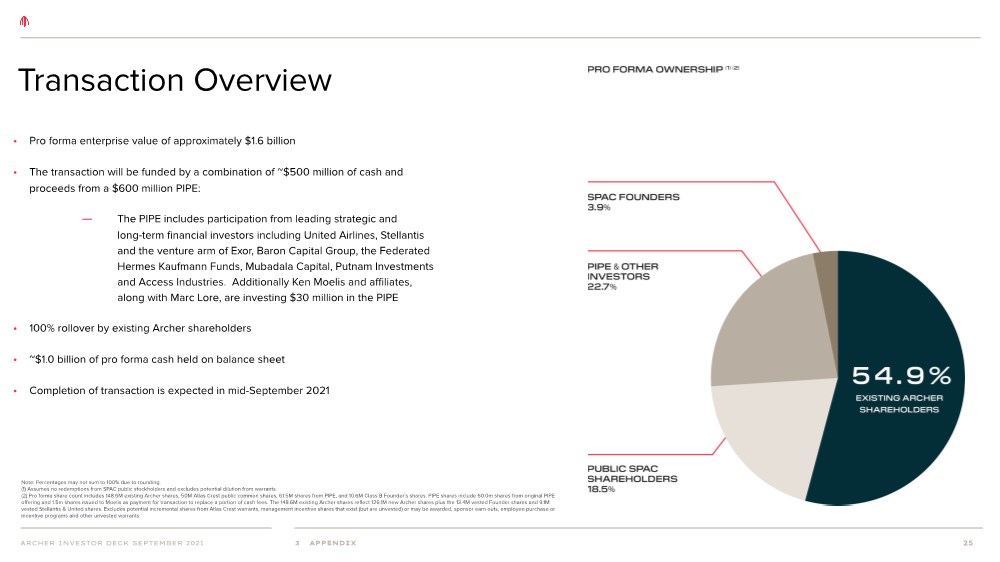

| ARCHER INVESTOR DECK SEPTEMBER 2021 25 • Pro forma enterprise value of approximately $1.6 billion • The transaction will be funded by a combination of ~$500 million of cash and proceeds from a $600 million PIPE: — The PIPE includes participation from leading strategic and long-term financial investors including United Airlines, Stellantis and the venture arm of Exor, Baron Capital Group, the Federated Hermes Kaufmann Funds, Mubadala Capital, Putnam Investments and Access Industries. Additionally Ken Moelis and affiliates, along with Marc Lore, are investing $30 million in the PIPE • 100% rollover by existing Archer shareholders • ~$1.0 billion of pro forma cash held on balance sheet • Completion of transaction is expected in mid-September 2021 3 APPENDIX Note: Percentages may not sum to 100% due to rounding. (1) Assumes no redemptions from SPAC public stockholders and excludes potential dilution from warrants. (2) Pro forma share count includes 148.6M existing Archer shares, 50M Atlas Crest public common shares, 61.5M shares from PIPE, and 10.6M Class B Founder’s shares. PIPE shares include 60.0m shares from original PIPE offering and 1.5m shares issued to Moelis as payment for transaction to replace a portion of cash fees. The 148.6M existing Archer shares reflect 126.1M new Archer shares plus the 13.4M vested Founder shares and 9.1M vested Stellantis & United shares. Excludes potential incremental shares from Atlas Crest warrants, management incentive shares that exist (but are unvested) or may be awarded, sponsor earn outs, employee purchase or incentive programs and other unvested warrants. Transaction Overview |

| ARCHER INVESTOR DECK AUGUST 2021 26 ARCHER INVESTOR DECK SEPTEMBER 2021 26 ARCHER AVIATION INC. PALO ALTO, CALIFORNIA 1880 Embarcadero Rd Palo Alto, CA 94303 ARCHER.COM |