Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SYNAPTICS Inc | d170249dex991.htm |

| 8-K - 8-K - SYNAPTICS Inc | d170249d8k.htm |

Synaptics to Acquire DSP Group Accelerates leadership in Low Power Edge AI August 30, 2021 Exhibit 99.2

Safe Harbor Statement This presentation contains forward-looking statements that are subject to the safe harbors created under the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business, including our expectations regarding the proposed transaction between Synaptics and DSP Group, the expected timetable for completing the transaction and the potential benefits of the transaction including expected synergies, and potential impacts on our business of the COVID-19 pandemic, and can be identified by the fact that they do not relate strictly to historical or current facts. Such forward-looking statements may include words such as “expect,” “anticipate,” “intend,” “believe,” “estimate,” “plan,” “target,” “strategy,” “continue,” “may,” “will,” “should,” variations of such words, or other words and terms of similar meaning. All forward-looking statements reflect our best judgment and are based on several factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Such factors include, but are not limited to, the possibility that various conditions to the consummation of the proposed transaction between Synaptics and DSP Group will not be satisfied or waived, the ability to successfully integrate the acquired business into our portfolio, the failure to realize the anticipated benefits of the transaction and expected synergies related thereto, the risk that our business, results of operations and financial condition and prospects may be materially and adversely affected by the COVID-19 pandemic and that significant uncertainties remain related to the impact of COVID-19 on our business operations and future results; global supply chain disruptions and component shortages that are currently affecting the semiconductor industry as a whole; the risks as identified in the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” sections of our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q (including that the impact of the COVID-19 pandemic may also exacerbate the risks discussed therein); and other risks as identified from time to time in our Securities and Exchange Commission reports. Forward-looking statements are based on information available to us on the date hereof, and we do not have, and expressly disclaim, any obligation to publicly release any updates or any changes in our expectations, or any change in events, conditions, or circumstances on which any forward-looking statement is based. Our actual results and the timing of certain events could differ materially from the forward-looking statements. Except as specifically identified related to the proposed transaction with DSP Group, these forward-looking statements do not reflect the potential impact of any mergers, acquisitions, or other business combinations that had not been completed as of the date of this presentation.

Disclaimer Regarding Non-GAAP Financial Measures In this presentation, we discuss certain financial measures that are not calculated in accordance with generally accepted accounting principles, including Adjusted EBITDA, non-GAAP gross margin, non-GAAP operating margin and non-GAAP EPS. We have not provided a reconciliation of these non-GAAP financial measures to their respective comparable GAAP financial measures because, without unreasonable efforts, we are unable to predict with reasonable certainty the amount and timing of adjustments that are used to calculate these non-GAAP financial measures. These adjustments are uncertain, depend on various factors that are beyond our control and could have a material impact on, in each case, the most directly comparable GAAP financial measure. Additional Information and Where to Find It In connection with the transaction, DSP Group, Inc. (“DSP”) will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a proxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, DSP will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting related to the transaction. STOCKHOLDERS OF DSP ARE URGED TO READ THESE MATERIALS, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT DSP WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DSP AND THE TRANSACTION. The preliminary proxy statement, the definitive proxy statement and other relevant materials for DSP stockholders in connection with the transaction (when they become available), and any other documents filed by DSP with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov) or at DSP’s website (http://www.dspg.com) or by writing to DSP at 2055 Gateway Place, San Jose, California 95110, attention Investor Relations. DSP and certain of its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from DSP’s stockholders with respect to the transaction. Information about DSP’s directors and executive officers and their ownership of DSP’s common stock is set forth in DSP’s proxy statement on Schedule 14A filed with the SEC on April 30, 2021 and subsequent changes made by such persons on Statements of Changes in Ownership on Form 4 filed with the SEC. Information regarding the identity of the participants and their direct and indirect interests in the transaction will be set forth in the proxy statement and other materials to be filed by DSP in connection with the transaction.

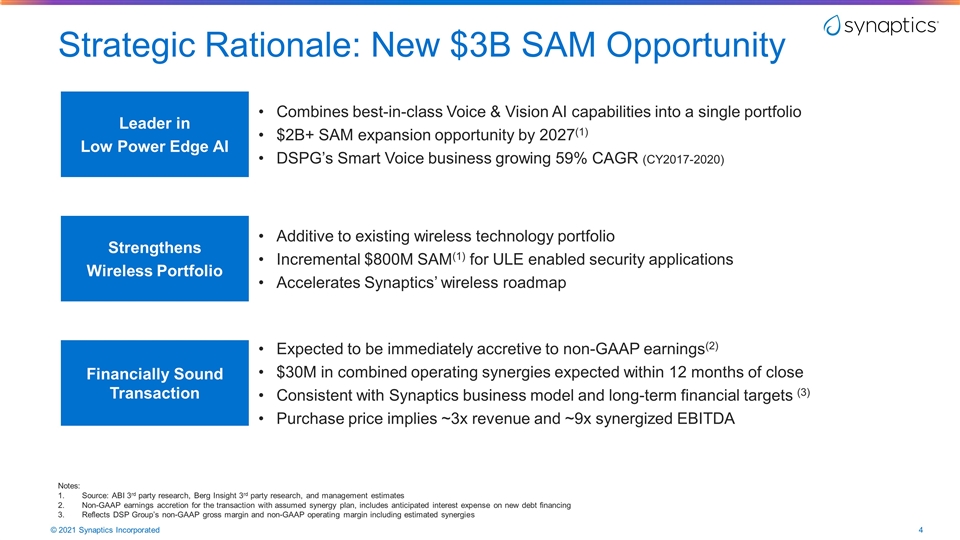

Strategic Rationale: New $3B SAM Opportunity Financially Sound Transaction Leader in Low Power Edge AI Expected to be immediately accretive to non-GAAP earnings(2) $30M in combined operating synergies expected within 12 months of close Consistent with Synaptics business model and long-term financial targets (3) Purchase price implies ~3x revenue and ~9x synergized EBITDA Combines best-in-class Voice & Vision AI capabilities into a single portfolio $2B+ SAM expansion opportunity by 2027(1) DSPG’s Smart Voice business growing 59% CAGR (CY2017-2020) Strengthens Wireless Portfolio Additive to existing wireless technology portfolio Incremental $800M SAM(1) for ULE enabled security applications Accelerates Synaptics’ wireless roadmap Notes: Source: ABI 3rd party research, Berg Insight 3rd party research, and management estimates Non-GAAP earnings accretion for the transaction with assumed synergy plan, includes anticipated interest expense on new debt financing Reflects DSP Group’s non-GAAP gross margin and non-GAAP operating margin including estimated synergies

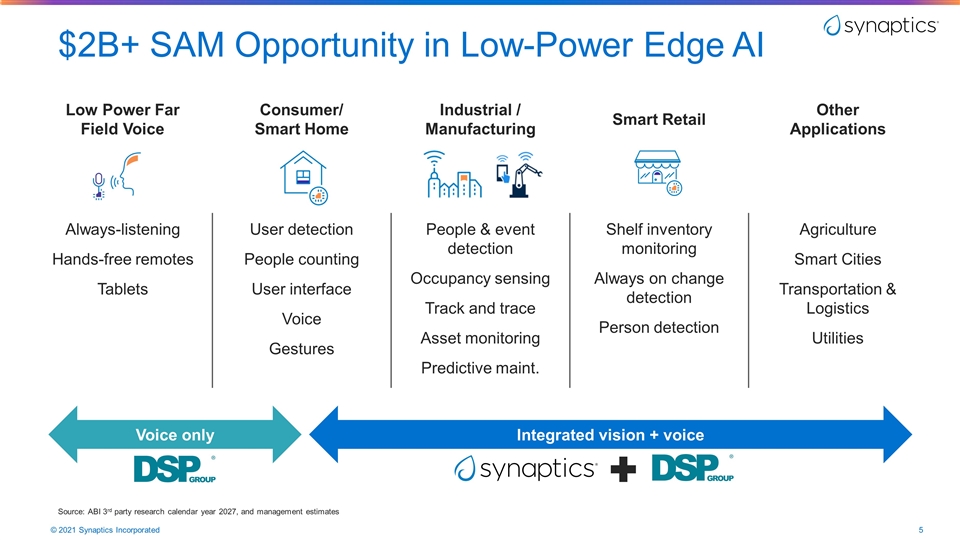

$2B+ SAM Opportunity in Low-Power Edge AI Consumer/ Smart Home Industrial / Manufacturing Smart Retail Other Applications User detection People counting User interface Voice Gestures People & event detection Occupancy sensing Track and trace Asset monitoring Predictive maint. Shelf inventory monitoring Always on change detection Person detection Agriculture Smart Cities Transportation & Logistics Utilities Always-listening Hands-free remotes Tablets Low Power Far Field Voice Voice only Integrated vision + voice Source: ABI 3rd party research calendar year 2027, and management estimates

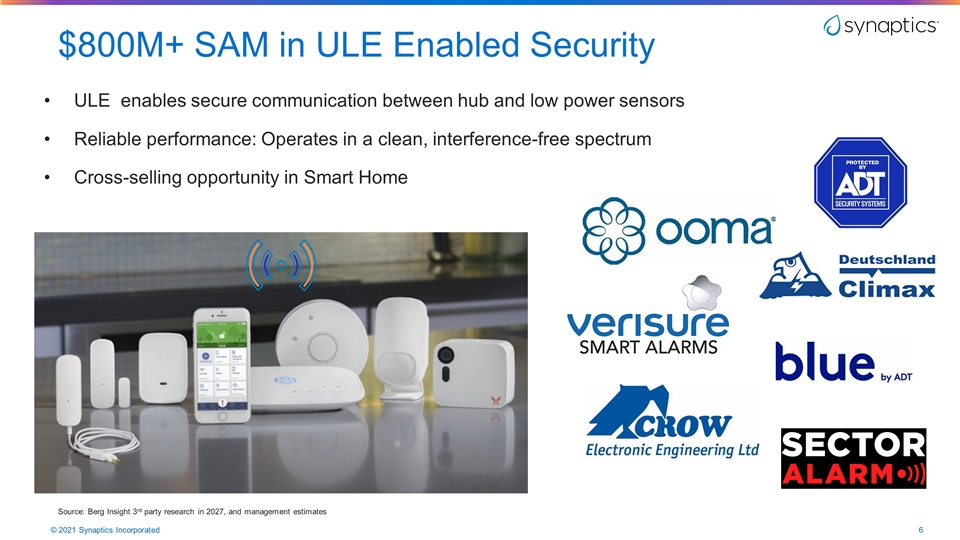

$800M+ SAM in ULE Enabled Security ULE enables secure communication between hub and low power sensors Reliable performance: Operates in a clean, interference-free spectrum Cross-selling opportunity in Smart Home Source: Berg Insight 3rd party research in 2027, and management estimates

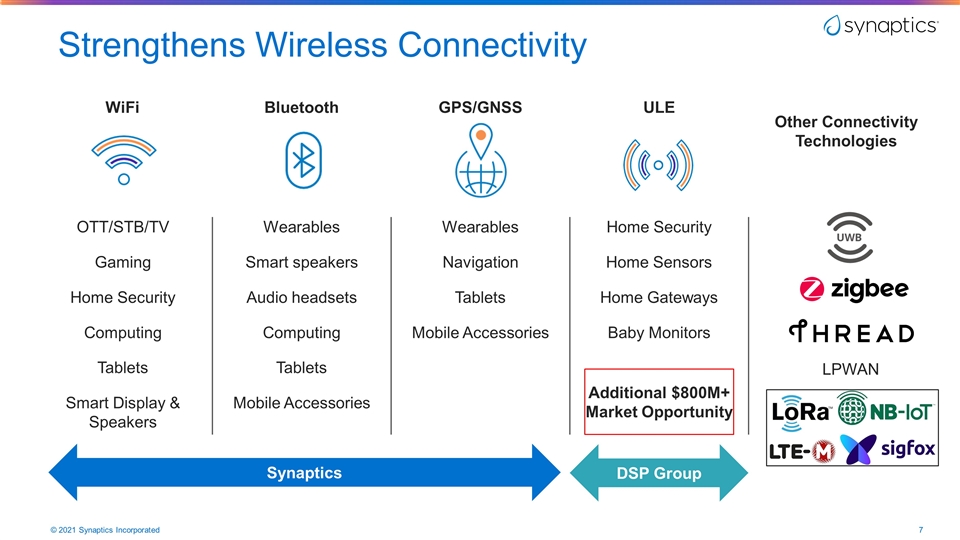

Strengthens Wireless Connectivity Bluetooth GPS/GNSS ULE Other Connectivity Technologies Wearables Smart speakers Audio headsets Computing Tablets Mobile Accessories Wearables Navigation Tablets Mobile Accessories Home Security Home Sensors Home Gateways Baby Monitors LPWAN OTT/STB/TV Gaming Home Security Computing Tablets Smart Display & Speakers WiFi Additional $800M+ Market Opportunity Synaptics DSP Group

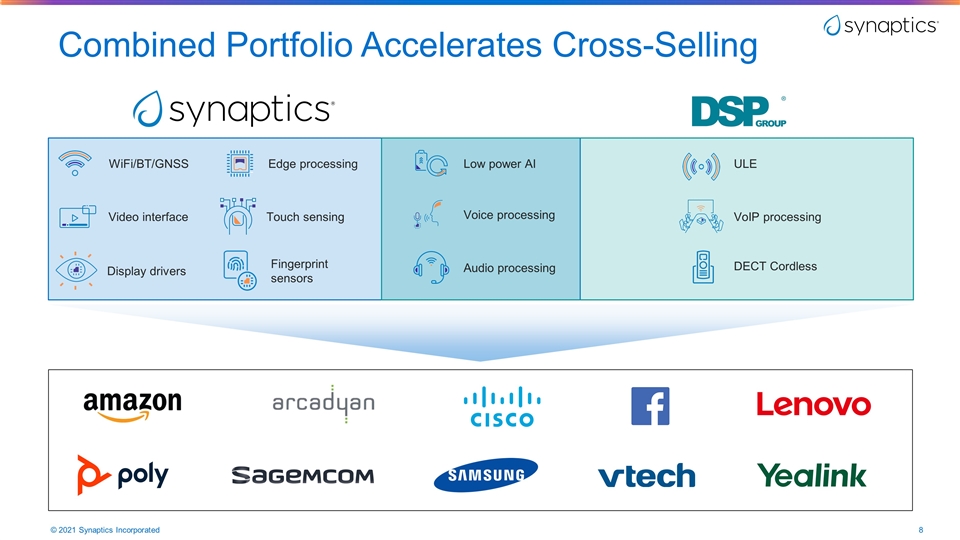

Combined Portfolio Accelerates Cross-Selling ULE Touch sensing Display drivers Fingerprint sensors Video interface Low power AI Audio processing Edge processing VoIP processing DECT Cordless WiFi/BT/GNSS Voice processing

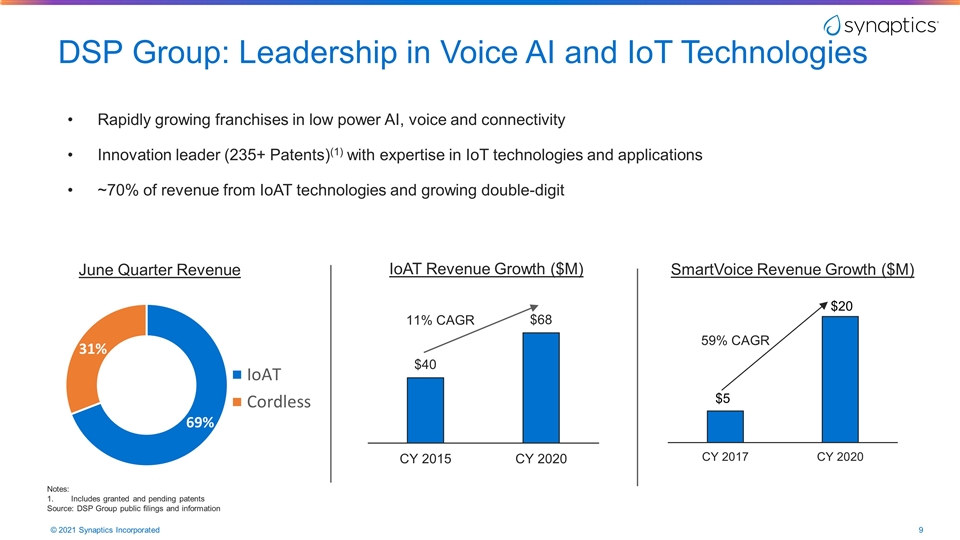

DSP Group: Leadership in Voice AI and IoT Technologies Rapidly growing franchises in low power AI, voice and connectivity Innovation leader (235+ Patents)(1) with expertise in IoT technologies and applications ~70% of revenue from IoAT technologies and growing double-digit Notes: Includes granted and pending patents Source: DSP Group public filings and information SmartVoice Revenue Growth ($M) IoAT Revenue Growth ($M) June Quarter Revenue

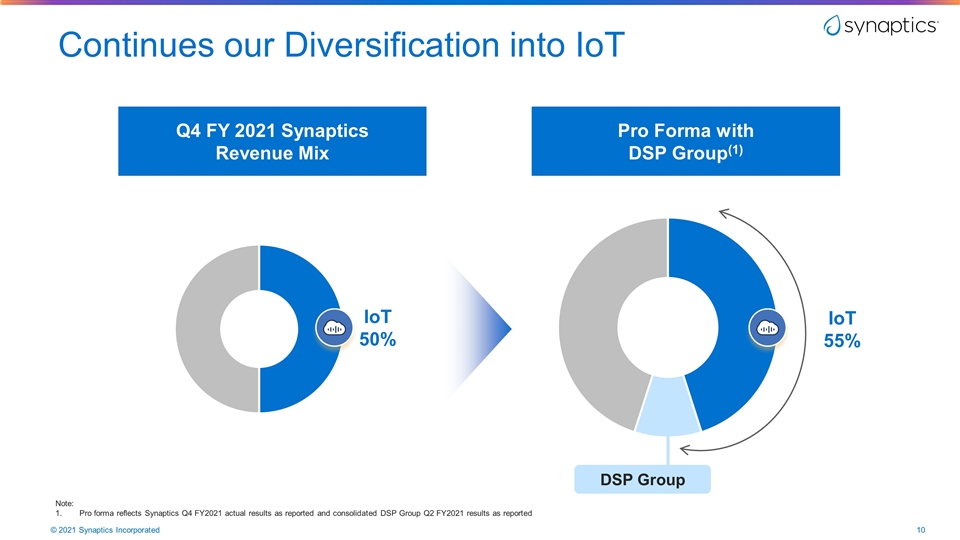

Continues our Diversification into IoT Q4 FY 2021 Synaptics Revenue Mix Pro Forma with DSP Group(1) IoT 50% IoT 55% Note: Pro forma reflects Synaptics Q4 FY2021 actual results as reported and consolidated DSP Group Q2 FY2021 results as reported DSP Group

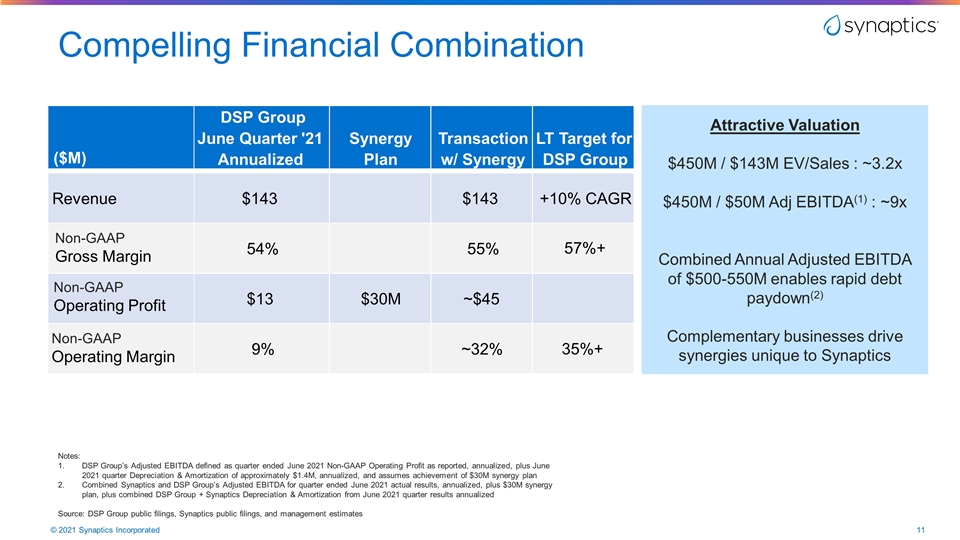

Compelling Financial Combination Notes: DSP Group’s Adjusted EBITDA defined as quarter ended June 2021 Non-GAAP Operating Profit as reported, annualized, plus June 2021 quarter Depreciation & Amortization of approximately $1.4M, annualized, and assumes achievement of $30M synergy plan Combined Synaptics and DSP Group’s Adjusted EBITDA for quarter ended June 2021 actual results, annualized, plus $30M synergy plan, plus combined DSP Group + Synaptics Depreciation & Amortization from June 2021 quarter results annualized Source: DSP Group public filings, Synaptics public filings, and management estimates ($M) DSP Group June Quarter '21 Annualized Synergy Plan Transaction w/ Synergy LT Target for DSP Group Revenue $143 $143 +10% CAGR Non-GAAP Gross Margin 54% 55% 57%+ Non-GAAP Operating Profit $13 $30M ~$45 Non-GAAP Operating Margin 9% ~32% 35%+ Attractive Valuation $450M / $143M EV/Sales : ~3.2x $450M / $50M Adj EBITDA(1) : ~9x Combined Annual Adjusted EBITDA of $500-550M enables rapid debt paydown(2) Complementary businesses drive synergies unique to Synaptics

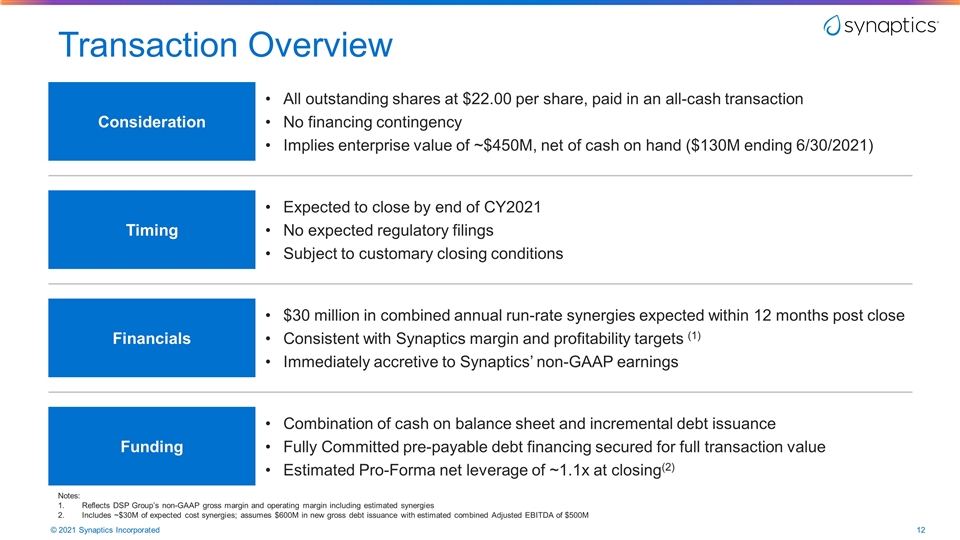

Transaction Overview Consideration Timing Financials All outstanding shares at $22.00 per share, paid in an all-cash transaction No financing contingency Implies enterprise value of ~$450M, net of cash on hand ($130M ending 6/30/2021) Expected to close by end of CY2021 No expected regulatory filings Subject to customary closing conditions $30 million in combined annual run-rate synergies expected within 12 months post close Consistent with Synaptics margin and profitability targets (1) Immediately accretive to Synaptics’ non-GAAP earnings Funding Combination of cash on balance sheet and incremental debt issuance Fully Committed pre-payable debt financing secured for full transaction value Estimated Pro-Forma net leverage of ~1.1x at closing(2) Notes: Reflects DSP Group’s non-GAAP gross margin and operating margin including estimated synergies Includes ~$30M of expected cost synergies; assumes $600M in new gross debt issuance with estimated combined Adjusted EBITDA of $500M

Summary Highly complementary business which expands IoT market reach Accelerates low power AI strategy targeting a $2B+ market opportunity Strengthens wireless connectivity with the addition of ULE to the portfolio Expected to be immediately accretive to non-GAAP Earnings & EPS

Q&A