Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Walmart Inc. | wmt-20210817.htm |

| EX-99.1 - PRESS RELEASE - Walmart Inc. | earningsreleasefy22q2.htm |

Q2 FY2022 Financial presentation to accompany management commentary

This presentation contains statements or may include or may incorporate by reference, statements that may be deemed to be "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Act"), that are intended to enjoy the protection of the safe harbor for forward-looking statements provided by the Act as well as protections afforded by other federal securities laws. Assumptions on which such forward-looking statements are based are also forward-looking statements. Such forward-looking statements are not statements of historical facts, but instead express our estimates or expectations for our consolidated, or one of our segment's or business’, economic performance or results of operations for future periods or as of future dates or events or developments that may occur in the future or discuss our plans, objectives or goals. Our actual results may differ materially from those expressed in or implied by any of these forward-looking statements as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and factors including: the impact of the COVID-19 pandemic on our business and the global economy; economic, capital markets and business conditions; trends and events around the world and in the markets in which we operate; currency exchange rate fluctuations, changes in market interest rates and market levels of wages; changes in the size of various markets, including eCommerce markets; unemployment levels; inflation or deflation, generally and in particular product categories; consumer confidence, disposable income, credit availability, spending levels, shopping patterns, debt levels and demand for certain merchandise; the effectiveness of the implementation and operation of our strategies, plans, programs and initiatives; unexpected changes in our objectives and plans; the impact of acquisitions, investments, divestitures, and other strategic decisions; our ability to successfully integrate acquired businesses; changes in the trading prices of certain equity investments we hold; initiatives of competitors, competitors' entry into and expansion in our markets, and competitive pressures; customer traffic and average transactions in our stores and clubs and on our eCommerce websites; the mix of merchandise we sell, the cost of goods we sell and the shrinkage we experience; our gross profit margins; the financial performance of Walmart and each of its segments, including the amounts of our cash flow during various periods; the amount of our net sales and operating expenses denominated in the U.S. dollar and various foreign currencies; commodity prices and the price of gasoline and diesel fuel; supply chain disruptions and disruptions in seasonal buying patterns; the availability of goods from suppliers and the cost of goods acquired from suppliers; our ability to respond to changing trends in consumer shopping habits; consumer acceptance of and response to our stores, clubs, eCommerce platforms, programs, merchandise offerings and delivery methods; cyber security events affecting us and related costs and impact to the business; developments in, outcomes of, and costs incurred in legal or regulatory proceedings to which we are a party or are subject, and the liabilities, obligations and expenses, if any, that we may incur in connection therewith; casualty and accident-related costs and insurance costs; the turnover in our workforce and labor costs, including healthcare and other benefit costs; our effective tax rate and the factors affecting our effective tax rate, including assessments of certain tax contingencies, valuation allowances, changes in law, administrative audit outcomes, impact of discrete items and the mix of earnings between the U.S. and Walmart's international operations; changes in existing tax, labor and other laws and regulations and changes in tax rates including the enactment of laws and the adoption and interpretation of administrative rules and regulations; the imposition of new taxes on imports, new tariffs and changes in existing tariff rates; the imposition of new trade restrictions and changes in existing trade restrictions; adoption or creation of new, and modification of existing, governmental policies, programs, initiatives and actions in the markets in which Walmart operates and elsewhere and actions with respect to such policies, programs and initiatives; changes in accounting estimates or judgments; the level of public assistance payments; natural disasters, changes in climate, geopolitical events, global health epidemics or pandemics and catastrophic events; and changes in generally accepted accounting principles in the United States. Our most recent annual report on Form 10-K and subsequent quarterly report on Form 10-Q filed with the SEC discuss other risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in the presentation. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this presentation. Walmart cannot assure you that the results reflected in or implied by any forward-looking statement will be realized or, even if substantially realized, that those results will have the forecasted or expected consequences and effects for or on our operations or financial performance. The forward-looking statements made today are as of the date of this presentation. Walmart undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances. This presentation includes certain non-GAAP measures as defined under SEC rules, including net sales, revenue, and operating income on a constant currency basis, adjusted operating income, adjusted operating income in constant currency, adjusted EPS, free cash flow and return on investment. Refer to information about the non-GAAP measures contained in this presentation. Additional information as required by Regulation G and Item 10(e) of Regulation S-K regarding non-GAAP measures can be found in our most recent Form 10-K and our Form 8-K furnished as of the date of this presentation with the SEC, which are available at www.stock.walmart.com. 2 Safe harbor and non-GAAP measures

3 Metric FY22 Guidance at 5.18.21 New FY22 Guidance Consolidated net sales Decline low single-digits in constant currency • Excluding divestitures1, consolidated net sales growth up low- to-mid single-digits Slightly positive in constant currency • Excluding divestitures1, consolidated net sales growth up 6% to 7%, or more than $30 billion Comp sales growth • Walmart U.S., up low single-digits, ex. fuel • Sam’s Club, up low single-digits, ex. fuel and tobacco • Walmart U.S., up 5% to 6%, ex. fuel • Sam’s Club, up 7.5% to 8.5%, ex. fuel and tobacco Walmart International net sales Decline 20%-25% in constant currency due to divestitures1 • Increase mid single-digits, excluding divestitures1 Decline 21.5% to 22.5% in constant currency due to divestitures1 • Increase 7% to 8%, excluding divestitures1 Consolidated expense leverage Maintain rate, or slightly leverage Slightly leverage Consolidated operating income Increase mid single-digits in constant currency • Increase high single-digits, excluding divestitures1, in constant currency Increase 9% to 11.5% in constant currency • Increase 11.5% to 14%, excluding divestitures1, in constant currency Walmart U.S. operating income Increase high single-digits Increase 11% to 13.5% Effective tax rate 24.5% to 25.5% No change EPS Increase high single-digits • Increase low double-digits, excluding divestitures1 $6.20 to $6.35 Capital expenditures Around $14 billion No change 1 We completed the sales of Walmart Argentina in November 2020, Asda in February 2021 and Seiyu in March 2021. Fiscal 2022 Q3 and full-year guidance The following guidance reflects the company’s updated expectations for Q3 and fiscal year 2022 and is provided on a non-GAAP basis as the company cannot predict certain elements which are included in reported GAAP results, including the impact of foreign exchange translation and externally adjusted items. Prior year results are on an adjusted basis. The company’s updated guidance assumes continued strength in the U.S. economy and no significant additional government stimulus for the remainder of the year. Metric Q3 FY22 Guidance Comp sales growth Walmart U.S., up 6% - 7%, ex. fuel EPS $1.30 to $1.40

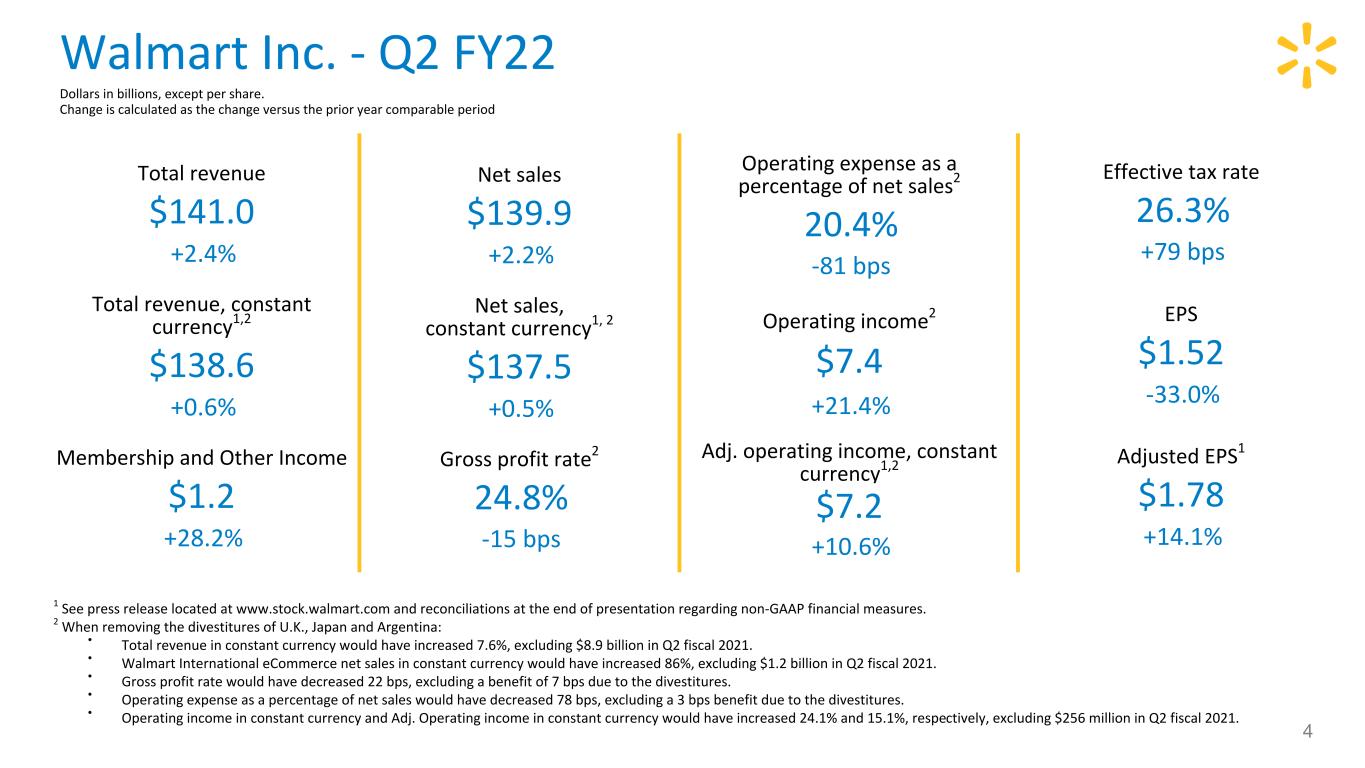

4 Total revenue $141.0 +2.4% Total revenue, constant currency1,2 $138.6 +0.6% Membership and Other Income $1.2 +28.2% Net sales $139.9 +2.2% Net sales, constant currency1, 2 $137.5 +0.5% Gross profit rate2 24.8% -15 bps Operating expense as a percentage of net sales2 20.4% -81 bps Operating income2 $7.4 +21.4% Adj. operating income, constant currency1,2 $7.2 +10.6% Effective tax rate 26.3% +79 bps EPS $1.52 -33.0% Adjusted EPS1 $1.78 +14.1% Walmart Inc. - Q2 FY22 Dollars in billions, except per share. Change is calculated as the change versus the prior year comparable period 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 2 When removing the divestitures of U.K., Japan and Argentina: • Total revenue in constant currency would have increased 7.6%, excluding $8.9 billion in Q2 fiscal 2021. • Walmart International eCommerce net sales in constant currency would have increased 86%, excluding $1.2 billion in Q2 fiscal 2021. • Gross profit rate would have decreased 22 bps, excluding a benefit of 7 bps due to the divestitures. • Operating expense as a percentage of net sales would have decreased 78 bps, excluding a 3 bps benefit due to the divestitures. • Operating income in constant currency and Adj. Operating income in constant currency would have increased 24.1% and 15.1%, respectively, excluding $256 million in Q2 fiscal 2021. Adj. operating income, constant currency1,2 $7.2 +10.6%

1 Debt to total capitalization calculated as of July 31, 2021. Debt includes short-term borrowings, long-term debt due within one year, finance lease obligations due within one year, long- term debt and long-term finance lease obligations. Total capitalization includes debt and total Walmart shareholders' equity. 2 Calculated for the trailing 12 months ended July 31, 2021. For ROI, see reconciliations at the end of presentation regarding non-GAAP financial measures. 5 Receivables, net Debt to capitalization1 $6.1 36.5% +19.4% -440 bps Inventories Return on assets2 $47.8 4.4% +16.2% -330 bps Accounts payable Return on investment2 $49.6 14.8% +7.1% +130 bps Walmart Inc. - Q2 FY22 Dollars in billions. Change is calculated as the change versus the prior year comparable period

1 See press release located at www.stock.walmart.com and reconciliations at the end of this presentation regarding non-GAAP financial measures. 2$15.2 billion remaining of $20 billion authorization approved in February 2021. The company repurchased approximately 17 million shares in Q2 fiscal 2022. 6 Operating cash flow Dividends $12.4 $3.1 -$6.5 ($1.5 in 2Q22) Capital expenditures Share repurchases2 $5.0 $5.2 +$1.5 ($2.4 in 2Q22) Free cash flow1 Total shareholder returns $7.4 $8.3 -$8.0 ($3.9 in 2Q22) Walmart Inc. - YTD Q2 FY22 Dollars in billions. Dollar changes may not recalculate due to rounding. Change is calculated as the change versus the prior year comparable period

7 Net Sales $98.2 +5.3% eCommerce net sales growth +6% eCommerce contribution to comp1, 2 ~20 bps Inventory Total: +20% Comparable sales1, 2 5.2% Comparable transactions 6.1% Comparable average ticket -0.8% • eCommerce sales more than doubled, up 103%, over the past two years • Walmart Connect advertising sales increased 95%; ramping new advertisers • Comp sales better than expected reflecting strong underlying business trends, a robust U.S. economy and stimulus spending • Comp sales up 14.5% on two-year stack • Comp sales gains increased each month through quarter, with July the strongest • In-store transactions accelerated in Q2 • Comp ticket increased ~26% on two-year stack Remodels: 187 stores Pickup: ~3,900 locations Same-day delivery: ~3,250 stores • Increase includes lapping last year's COVID- related effects on inventory as well as strong sales growth this year 1 Comp sales for the 13-week period ended July 30, 2021 compared to the 13-week period ended July 31, 2020, and excludes fuel. 2 The results of new acquisitions are included in our comp sales metrics in the 13th month after acquisition. Walmart U.S. - Q2 FY22 Dollars in billions. Change is calculated as the change versus the prior year comparable period

8 Gross profit rate +20 bps Operating income $6.1 +20.4% Operating expense rate -49 bps • Benefited from COVID vaccines this year and lapping last year's COVID- related closures of Auto Care Centers and Vision Centers • Also benefited from lower markdowns and Walmart Connect advertising sales • Partially offset by increased supply chain costs • Expense leverage reflects strong sales, lower COVID costs and lapping last year's business restructuring charge (~40 bps); partially offset by investments in wages, marketing and technology expenses • COVID costs were lower by ~$1 billion; benefited leverage by ~100 bps Adj. operating income1 $6.1 +12.0% Walmart U.S. - Q2 FY22 Dollars in billions. Change is calculated as the change versus the prior year comparable period 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures.

Walmart U.S. - quarterly merchandise highlights 9 Category Comp sales Details Grocery + mid single-digit • Sales growth of 6% reflected strong market share gains (according to Nielsen) and modest ticket inflation; sales accelerated through the quarter and increased low double- digits on a two-year stacked basis • Food categories saw broad-based strength with low-teens growth on a two-year stack; aided by strong price positioning, an elevated fresh offering and better in-stocks • Consumables categories reflected strength in pets, beauty and baby products Health & wellness + mid-teens • Strong sales reflected lapping last year's COVID-related closures of Vision Centers, this year's vaccine administration and branded drug inflation General merchandise + low single-digit • Lapping last year's stimulus-driven growth; Q2 sales increased mid-teens percentage on a two-year stacked basis • Strength in apparel and travel-related categories as customers increase socialization • Automotive categories benefited from lapping last year's COVID-related closures of Auto Care Centers • Solid start in Back-to-School categories

• Positively affected by 20 bps from divestitures • Retained market operating expense rate leveraged 65 bps from strong sales growth and lapping last year's discrete tax item. Offset by impact of COVID- related sales restrictions • Retained market COVID-related costs were lower by ~$36 mil. and benefited leverage by ~24 bps • Divestitures accounted for a reduction of $1.7 billion YoY • Increase includes strong sales growth this year and lapping last year's COVID-related effects on inventory 10 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. Inventory $9.3 +5.5% Gross profit rate -76 bps Operating income $0.9 +6.0% Net sales, constant currency1 $20.6 -24.0% Operating expense rate -85 bps Operating income, constant currency1 $0.7 -12.4% • Negatively affected by 35 bps from divestitures • Retained market gross profit rate decreased 41 bps due to mix shift to lower margin formats, partially offset by markdown optimization Net sales $23.0 -15.2% Walmart International - Q2 FY22 Dollars in billions. Dollar changes may not recalculate due to rounding. Change is calculated as the change versus the prior year comparable period • Divestitures accounted for a reduction of $8.9 billion YoY • Retained market growth of 25.8% • Divestitures accounted for a reduction of $256 million YoY • Retained market growth of 54.9% • Divestitures accounted for a reduction of $256 million YoY • Retained market growth of 27.9% Adj. operating income1 $0.9 -3.1% Adj. operating income, constant currency1 $0.7 -20.0% • Divestitures accounted for a reduction of $8.9 billion YoY • Retained market growth of 12.7%: ◦ Strong sales growth in Flipkart, Mexico and China ◦ Lapping tighter government- mandated restrictions last year, largely in India ◦ eCommerce net sales contributed 19% of total net sales • Retained market growth of 12.3%

• Sales of general merchandise limited by COVID-related restrictions on non-essential categories; two-year stack comp sales +10.4% • As restrictions lifted, Q2 ended with positive YoY sales growth • eCommerce net sales +41% 1 Walmex includes the consolidated results of Mexico and Central America 2 ANTAD - Asociacion Nacional de Tiendas de Autoservicio y Departamentales; The National Association of Supermarkets and Department Stores 11 Walmex1 China Canada Net sales growth +6.7% +6.0% -3.7% Comparable sales +5.4% +2.9% -3.6% Comparable transactions +7.6% +0.1% +5.2% Comparable ticket -2.1% +2.7% -8.4% • Growth in apparel and general merchandise, while food and consumables were softer • In Mexico, comp sales increased +4.7% • Comp sales outpaced ANTAD2 self- service and club • Mexico eCommerce net sales +13% • Strong sales in Sam's Club, partially offset by softer traffic in Hypermarkets • Sam's Club delivered double-digit comp sales growth with new member sign-ups more than doubling YoY • eCommerce net sales +75% Walmart International - Q2 FY22 Results are presented on a constant currency basis. Net sales and comp sales are presented on a nominal, calendar basis and include eCommerce results. Change is calculated as the change versus the prior year comparable period.

• COVID-related restrictions resulted in negative sales growth, impacting operating costs, along with investments in eCommerce • Higher penetration of Sam's Club lower operating expense format and cost discipline • Soft general merchandise sales affected by COVID-related restrictions 1 Walmex includes the consolidated results of Mexico and Central America. 12 Walmex1 China Canada Gross profit rate Slight Increase Decrease Decrease • Change in mix to higher margin categories along with cost of goods savings initiatives • Change in mix to lower margin formats of Sam's Club and eCommerce Operating expense rate Slight Increase Decrease Increase Operating income $ Increase Increase Decrease Walmart International - Q2 FY22 Results are presented on a constant currency basis. Change is calculated as the change versus the prior year comparable period • Investments in associates' value proposition, technology, and eCommerce expansion, partially offset by lapping last year's discrete tax item

13 +7.7% Comparable sales +5.1% Comparable transactions +2.5% Average comparable ticket ~180 bps eCommerce contribution $16,437 +8% Net sales +12.2% Membership income -29.9999999999998 bps Gross profit rate -21.9999999999999 bps Operating expense rate $575 9.1% Operating income With Fuel Without Fuel Comparable sales1 +13.9% Net sales $18.6 +13.9% eCommerce net sales growth +27% Comparable sales +13.9% Membership income +12.2% Gross profit rate -88 bps Operating expense rate -82 bps Inventory $4.8 +14.0% Operating income $0.7 +11.5% • Strong membership trends with record total member count • Renewal rates increased almost 260 bps with Plus member renewal rate increasing over 455 bps • Plus penetration increased over 755 bps, reaching an all-time high • First year member renewals remain solid • Higher fuel sales positively affected operating expense leverage • Wage investments and lower tobacco sales somewhat offset that tailwind • COVID-related costs were lower by ~$80 mil. and benefited expense leverage by ~50 bps • Unfavorable fuel mix and lower fuel rate negatively impacted gross profit • Excluding fuel, cost inflation and strategic investments in price were partially offset by favorable changes in mix • Strong curbside performance and solid direct-to-home contribution • Strong comp sales growth with contribution from both transactions and ticket and a benefit from stimulus spending • On a two-year stack, comp sales increased 22.6% • Broad strength across categories, led by food • Tobacco negatively affected comp sales 1 Comp sales for the 13-week period ended July 30, 2021 compared to the 13-week period ended July 31, 2020. • Increase reflects inventory build to support higher sales trends and lapping last year's COVID-related effects on inventory Sam's Club - Q2 FY22 Dollars in billions. Change is calculated as the change versus the prior year comparable period

14 $18,644 +13.9% Net Sales +33% eCommerce net sales growth +13.9% Comparable sales -87.9999999999999 bps Gross profit rate -82 bps Operating expense rate $660 11.5% Operating income Without Fuel Net sales $16.4 +7.7% Operating expense rate -22 bps Gross profit rate -30 bps Operating income $0.6 +9.1% Comparable transactions +5.1% Comparable sales1, 2 +7.7% eCommerce contribution ~180 bps Average comparable ticket +2.5% 1 Comp sales for the 13-week period ended July 30, 2021 compared to the 13-week period ended July 31, 2020, and excludes fuel. 2 Tobacco negatively affected comp sales for the 13-week period ended July 30, 2021 by 290 basis points. On a two-year stack, tobacco negatively affected comp sales by 680 basis points. Sam's Club - Q2 FY22 Dollars in billions. Change is calculated as the change versus the prior year comparable period • On a two-year stack, average comp ticket increased 6.8% • On a two-year stack, comp sales increased 21.0% • On a two-year stack, comp transactions increased 13.8%

15 Category Comp sales Details Fresh / Freezer / Cooler + low double-digit • Fresh meat, prepared foods, produce and floral performed well Grocery and beverage + mid-teens • Drinks, snacks, candy and adult beverage showed strength Consumables + high single-digit • Tabletop, laundry & home care, pet supplies and baby care performed well Home and apparel + low double-digit • Strength in tires, apparel, jewelry and furniture Technology, office and entertainment - mid single-digit • TVs performed well but were more than offset by reduced mobile phone sales • Sam's entered into a new strategic arrangement in its mobile phone business and no longer recognizes the full transaction value; instead, it receives a commission on each sale • Aside from the mobile phone business, comp sales were slightly positive Health and wellness + mid single-digit • Optical and pharmacy were strong Sam's Club - quarterly financial highlights

We include Return on Assets ("ROA"), which is calculated in accordance with U.S. generally accepted accounting principles ("GAAP") as well as Return on Investment ("ROI") as measures to assess returns on assets. Management believes ROI is a meaningful measure to share with investors because it helps investors assess how effectively Walmart is deploying its assets. Trends in ROI can fluctuate over time as management balances long-term strategic initiatives with possible short-term impacts. We consider ROA to be the financial measure computed in accordance with GAAP that is the most directly comparable financial measure to our calculation of ROI. ROA was 4.4 percent and 7.7 percent for the trailing 12 months ended July 31, 2021 and 2020, respectively. The decrease in ROA was primarily due to the losses on divestiture of our operations in the U.K., Japan and Argentina as well as net fair value changes in our equity instruments, partially offset by the increase in operating income. ROI was 14.8 percent and 13.5 percent for the trailing twelve months ended July 31, 2021 and 2020. The increase in ROI was primarily due to the increase in operating income. We define ROI as adjusted operating income (operating income plus interest income, depreciation and amortization, and rent expense) for the trailing twelve months divided by average invested capital during that period. We consider average invested capital to be the average of our beginning and ending total assets, plus average accumulated depreciation and average amortization, less average accounts payable and average accrued liabilities for that period. Our calculation of ROI is considered a non-GAAP financial measure because we calculate ROI using financial measures that exclude and include amounts that are included and excluded in the most directly comparable GAAP financial measure. For example, we exclude the impact of depreciation and amortization from our reported operating income in calculating the numerator of our calculation of ROI. As mentioned above, we consider ROA to be the financial measure computed in accordance with generally accepted accounting principles most directly comparable to our calculation of ROI. ROI differs from ROA (which is consolidated net income for the period divided by average total assets for the period) because ROI: adjusts operating income to exclude certain expense items and adds interest income; adjusts total assets for the impact of accumulated depreciation and amortization, accounts payable and accrued liabilities to arrive at total invested capital. Because of the adjustments mentioned above, we believe ROI more accurately measures how we are deploying our key assets and is more meaningful to investors than ROA. Although ROI is a standard financial measure, numerous methods exist for calculating a company's ROI. As a result, the method used by management to calculate our ROI may differ from the methods used by other companies to calculate their ROI. 16 Non-GAAP measures - ROI

The calculation of ROA and ROI, along with a reconciliation of ROI to the calculation of ROA, is as follows: 17 3 Upon adoption of ASU 2016-02, Leases, a factor of eight times rent is no longer included in the calculation of ROI on a prospective basis as operating lease assets are now recorded on the Consolidated Balance Sheet. 1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the prior period and dividing by 2. 2 The average is based on the addition of 'total assets without leased assets, net' at the end of the current period to 'total assets without leased assets, net' at the end of the prior period and dividing by 2, plus 'leased assets, net' at the end of the current period. 3 The average is based on the addition of 'accumulated depreciation and amortization, without leased assets' at the end of the current period to 'accumulated depreciation and amortization, without leased assets' at the end of the prior period and dividing by 2, plus 'accumulated amortization on leased assets' at the end of the current period. NP = not provided CALCULATION OF RETURN ON ASSETS CALCULATION OF RETURN ON INVESTMENT Trailing Twelve Months Trailing Twelve Months Ended July 31, Ended July 31, (Dollars in millions) 2021 2020 (Dollars in millions) 2021 2020 Numerator Numerator Consolidated net income $ 10,368 $ 18,128 Operating income $ 25,528 $ 21,323 Denominator + Interest income 122 151 Average total assets1 $ 237,967 $ 236,122 + Depreciation and amortization 10,892 11,113 Return on assets (ROA) 4.4 % 7.7 % + Rent 2,451 2,679 ROI operating income $ 38,993 $ 35,266 July 31, Denominator Certain Balance Sheet Data 2021 2020 2019 Average total assets1 $ 237,967 $ 236,122 Total assets $ 238,552 $ 237,382 $ 234,861 '+ Average accumulated depreciation and amortization1 97,685 93,418 Accumulated depreciation and amortization 98,346 97,023 89,813 '- Average accounts payable1 47,964 46,099 Accounts payable 49,601 46,326 45,871 '- Average accrued liabilities1 23,842 22,230 Accrued liabilities 23,915 23,768 20,691 Average invested capital $ 263,846 $ 261,211 Return on investment (ROI) 14.8 % 13.5 % 1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the prior period and dividing by 2. Non-GAAP measures - ROI (cont.)

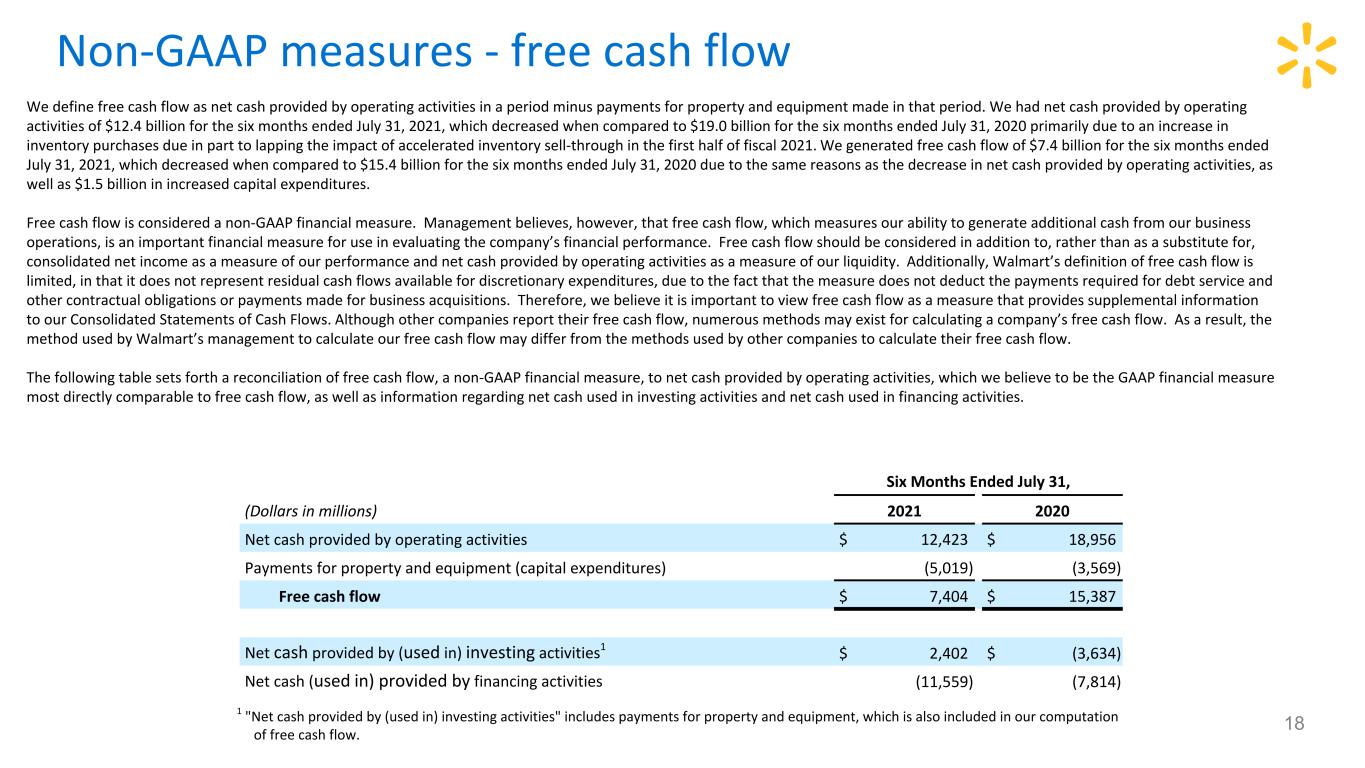

1 "Net cash provided by (used in) investing activities" includes payments for property and equipment, which is also included in our computation of free cash flow. 18 We define free cash flow as net cash provided by operating activities in a period minus payments for property and equipment made in that period. We had net cash provided by operating activities of $12.4 billion for the six months ended July 31, 2021, which decreased when compared to $19.0 billion for the six months ended July 31, 2020 primarily due to an increase in inventory purchases due in part to lapping the impact of accelerated inventory sell-through in the first half of fiscal 2021. We generated free cash flow of $7.4 billion for the six months ended July 31, 2021, which decreased when compared to $15.4 billion for the six months ended July 31, 2020 due to the same reasons as the decrease in net cash provided by operating activities, as well as $1.5 billion in increased capital expenditures. Free cash flow is considered a non-GAAP financial measure. Management believes, however, that free cash flow, which measures our ability to generate additional cash from our business operations, is an important financial measure for use in evaluating the company’s financial performance. Free cash flow should be considered in addition to, rather than as a substitute for, consolidated net income as a measure of our performance and net cash provided by operating activities as a measure of our liquidity. Additionally, Walmart’s definition of free cash flow is limited, in that it does not represent residual cash flows available for discretionary expenditures, due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow as a measure that provides supplemental information to our Consolidated Statements of Cash Flows. Although other companies report their free cash flow, numerous methods may exist for calculating a company’s free cash flow. As a result, the method used by Walmart’s management to calculate our free cash flow may differ from the methods used by other companies to calculate their free cash flow. The following table sets forth a reconciliation of free cash flow, a non-GAAP financial measure, to net cash provided by operating activities, which we believe to be the GAAP financial measure most directly comparable to free cash flow, as well as information regarding net cash used in investing activities and net cash used in financing activities. Six Months Ended July 31, (Dollars in millions) 2021 2020 Net cash provided by operating activities $ 12,423 $ 18,956 Payments for property and equipment (capital expenditures) (5,019) (3,569) Free cash flow $ 7,404 $ 15,387 Net cash provided by (used in) investing activities1 $ 2,402 $ (3,634) Net cash (used in) provided by financing activities (11,559) (7,814) Non-GAAP measures - free cash flow

1 Change versus prior year comparable period. 2 Walmart International eCommerce net sales were $4.1 billion and $8.4 billion for the three and six months ended July 31, 2021, and were positively impacted by $258 million and $375 million of currency exchange rate fluctuations, respectively. Walmart International eCommerce net sales were $3.3 billion and $6.2 billion for the three and six months ended July 31, 2020, respectively. 3 Walmart International eCommerce net sales increased 26% on a reported basis and 16% in constant currency and increased 37% on a reported basis and 30% in constant currency for the three and six months ending July 31, 2021, respectively. 19 In discussing our operating results, the term currency exchange rates refers to the currency exchange rates we use to convert the operating results for countries where the functional currency is not the U.S. dollar into U.S. dollars. We calculate the effect of changes in currency exchange rates as the difference between current period activity translated using the current period’s currency exchange rates and the comparable prior year period’s currency exchange rates. Additionally, no currency exchange rate fluctuations are calculated for non- USD acquisitions until owned for 12 months. Throughout our discussion, we refer to the results of this calculation as the impact of currency exchange rate fluctuations. When we refer to constant currency operating results, this means operating results without the impact of the currency exchange rate fluctuations. The disclosure of constant currency amounts or results permits investors to better understand Walmart’s underlying performance without the effects of currency exchange rate fluctuations. The table below reflects the calculation of constant currency for total revenues, net sales and operating income for the three and six months ended July 31, 2021. Three Months Ended July 31, 2021 Six Months Ended July 31, 2021 2021 Percent Change1 2021 Percent Change1 2021 Percent Change1 2021 Percent Change1 (Dollars in millions) Walmart International Consolidated Walmart International Consolidated Total revenues: As reported $ 23,389 -14.7 % $ 141,048 2.4 % $ 51,058 -11.1 % $ 279,358 2.6 % Currency exchange rate fluctuations (2,426) N/A (2,426) N/A -3,353 N/A -3,353 N/A Constant currency total revenues $ 20,963 -23.5 % $ 138,622 0.6 % $ 47,705 -17.0 % $ 276,005 1.3 % Net sales2,3: As reported $ 23,035 -15.2 % $ 139,871 2.2 % $ 50,335 -11.6 % $ 277,030 2.4 % Currency exchange rate fluctuations (2,397) N/A (2,397) N/A -3,310 N/A -3,310 N/A Constant currency net sales $ 20,638 -24.0 % $ 137,474 0.5 % $ 47,025 -17.4 % $ 273,720 1.2 % Operating income: As reported $ 861 6.0 % $ 7,354 21.4 % $ 2,055 27.0 % $ 14,263 26.4 % Currency exchange rate fluctuations (150) N/A (150) N/A -201 N/A -201 N/A Constant currency operating income $ 711 -12.4 % $ 7,204 18.9 % $ 1,854 14.6 % $ 14,062 24.6 % Non-GAAP measures - constant currency

1 Reflects a business restructuring charge resulting from changes to Walmart U.S. support teams to better support its omni-channel strategy recorded in the second quarter of fiscal 2021. 2 Change versus prior year comparable period. NP - not provided 20 Adjusted operating income is considered a non-GAAP financial measure under the SEC’s rules because it excludes certain charges included in operating income calculated in accordance with GAAP. Management believes that adjusted operating income is a meaningful measure to share with investors because it best allows comparison of the performance with that of the comparable period. In addition, adjusted operating income affords investors a view of what management considers Walmart’s core earnings performance and the ability to make a more informed assessment of such core earnings performance as compared with that of the prior year. When we refer to adjusted operating income in constant currency this means adjusted operating results without the impact of the currency exchange rate fluctuations. The disclosure of constant currency amounts or results permits investors to better understand Walmart’s underlying performance without the effects of currency exchange rate fluctuations. The tables below reflect the calculation of adjusted operating income and adjusted operating income in constant currency for the three and six months ended July 31, 2021 and 2020. Three Months Ended July 31, Six Months Ended July 31, Walmart US Walmart International Consolidated Walmart US Walmart International Consolidated 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 2021 2020 Operating income: Operating income, as reported 6,089 5,057 861 812 7,354 6,059 11,544 9,359 2,055 1,618 14,263 11,283 Business restructuring charge1 — 380 — — — 380 380 — — — 380 Discrete tax item — — — 77 — 77 — — 77 — 77 Adjusted operating income 6,089 5,437 861 889 7,354 6,516 11,544 9,739 2,055 1,695 14,263 11,740 Percent change2 12.0 % NP -3.1 % NP 12.9 % NP 18.5 % NP 21.2 % NP 21.5 % NP Currency exchange rate fluctuations — — (150) — (150) — — — (201) — (201) — Adjusted operating income, constant currency 6,089 5,437 711 889 7,204 6,516 11,544 9,739 1,854 1,695 14,062 11,740 Percent change2 12.0 % NP -20.0 % NP 10.6 % NP 18.5 % NP 9.4 % NP 19.8 % NP Non-GAAP measures - adjusted operating income

21 Adjusted diluted earnings per share attributable to Walmart (Adjusted EPS) is considered a non-GAAP financial measure under the SEC’s rules because it excludes certain amounts included in the diluted earnings per share attributable to Walmart calculated in accordance with GAAP (EPS), the most directly comparable financial measure calculated in accordance with GAAP. Management believes that Adjusted EPS is a meaningful measure to share with investors because it best allows comparison of the performance with that of the comparable period. In addition, Adjusted EPS affords investors a view of what management considers Walmart’s core earnings performance and the ability to make a more informed assessment of such core earnings performance with that of the prior year. We adjust for the unrealized and realized gains and losses on our equity investments each quarter because although the investments are strategic decisions for the company’s retail operations, management’s measurement of each strategy is primarily focused on the operational results rather than the fair value of such investments. Additionally, management does not forecast changes in the fair value of its equity investments. Accordingly, management adjusts EPS each quarter for the realized and unrealized gains and losses related to those equity investments. We have calculated Adjusted EPS for the three and six months ended July 31, 2021 by adjusting EPS for the following: 1. unrealized and realized gains and losses on the company’s equity investments; and 2. the incremental loss on sale of our operations in the U.K and Japan recorded during the first quarter of fiscal 2022. Non-GAAP measures - adjusted EPS

22 1 Change versus prior year comparable period. 2 Calculated based on nature of item, including any realizable deductions, and statutory rate in effect for relevant jurisdictions. Minimal realizable tax benefit was provided in connection with the incremental loss on sale. 3 The reported effective tax rate was 26.3% and 26.5% for the three and six months ended July 31, 2021, respectively. Adjusted for the above items, the effective tax rate was 25.6% and 24.5% for the three and six months ended July 31, 2021, respectively. 4 Quarterly adjustments or adjusted EPS may not sum to YTD adjustments or YTD adjusted EPS due to rounding. Three Months Ended July 31, 2021 Percent Change1 Six Months Ended July 31, 20214 Percent Change1 Diluted earnings per share: Reported EPS $ 1.52 -33.0% $ 2.48 -32.4% Adjustments: Pre-Tax Impact Tax Impact2,3 Net Impact Pre-Tax Impact Tax Impact2,3 Net Impact Unrealized and realized (gains) and losses on equity investments $ 0.34 $ (0.08) $ 0.26 $ 1.07 $ (0.22) $ 0.85 Incremental loss on sale of our operations in the U.K. and Japan — — — 0.15 — 0.15 Net adjustments $ 0.26 $ 1.00 Adjusted EPS $ 1.78 14.1% $ 3.48 27.0% Non-GAAP measures - adjusted EPS (cont.)

23 As previously disclosed in our second quarter ended July 31, 2020 press release, we have calculated Adjusted EPS for the three and six months ended July 31, 2020 by adjusting EPS for the following: (1) unrealized gains and losses on the Company’s equity investments; (2) a business restructuring charge resulting from changes to corporate support teams to better support the Walmart U.S. omnichannel strategy; and (3) a discrete tax item. Three Months Ended July 31, 2020 Six Months Ended July 31, 20204 Diluted earnings per share: Reported EPS $ 2.27 $ 3.67 Adjustments: Pre-Tax Impact Tax Impact1,2 NCI Impact3 Net Impact Pre-Tax Impact Tax Impact1,2 NCI Impact3 Net Impact Unrealized (gains) and losses on equity investments $ (1.13) $ 0.24 $ — $ (0.89) $ (1.41) $ 0.30 $ — $ (1.11) Business restructuring charge 0.13 (0.03) — 0.10 0.13 (0.03) — 0.10 Discrete tax item 0.06 0.05 (0.03) 0.08 0.06 0.05 (0.03) 0.08 Net adjustments $ (0.71) $ (0.93) Adjusted EPS $ 1.56 $ 2.74 Non-GAAP measures - adjusted EPS (cont.) 1 Calculated based on nature of item, including any realizable deductions, and statutory rate in effect for relevant jurisdictions. 2 The reported effective tax rate was 25.5% and 25.1% for the three and six months ended July 31, 2020, respectively. When adjusted for the above items, the effective tax rate was 24.8% and 24.9% for the three and six months ended July 31, 2020, respectively. 3 Calculated based on the ownership percentages of our noncontrolling interests. 4 Quarterly adjustments or adjusted EPS may not sum to YTD adjustments or YTD adjusted EPS due to rounding.

• Unit counts & square footage • Comparable store sales, including and excluding fuel • Terminology 24 Additional resources at stock.walmart.com