Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE OF THE COMPANY, DATED AUGUST 16, 2021 - Sezzle Inc. | ea145953ex99-1_sezzleinc.htm |

| 8-K - CURRENT REPORT - Sezzle Inc. | ea145953-8k_sezzleinc.htm |

Exhibit 99.2

The way forward. 2Q21 Presentation 17 AUGUST 2021 This presentation is authorised for release by the Board 16 August 2021

DISCLAIMER This Presentation contains summary information about the current activities of Sezzle as at the date of this Presentation . The information in this Presentation is of a general nature and does not purport to be complete and the information in the Presentation remains subject to change without notice . Also, it is not intended that it be relied upon as advice to investors or potential investors . This Presentation has been prepared without taking into account the objectives, financial situation or needs of any particular investor . Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial situation and needs and seek appropriate advice, including financial, legal and taxation advice appropriate to their jurisdiction . The material contained in this Presentation may include information derived from publicly available sources that have not been independently verified . This Presentation is not a disclosure document under Australian law or under any other law . Accordingly, this Presentation is not intended to be relied upon as advice to current shareholders, investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular shareholder or investor . The information in this presentation includes “forward - looking statements” within the meaning of the Securities Exchange Act of 1934 , as amended . All statements regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward - looking statements . When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward - looking statements . When considering forward - looking statements, you should consider the risk factors described in our Form 10 - Q filed with the SEC on August 16 , 2021 . These forward - looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events . Nevertheless, and despite the fact that management’s expectations and estimates are based on assumptions management believes to be reasonable and data management believes to be reliable, our actual results, performance or achievements are subject to future risks and uncertainties, any of which could materially affect our actual performance . Except as otherwise required by applicable law, we disclaim any duty to update any forward - looking statements to reflect events or circumstances after the date of this presentation . This Presentation has been prepared in good faith, but no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, correctness, reliability or adequacy of any statements, estimates, opinions or other information, or the reasonableness of any assumption or other statement, contained in the Presentation (any of which may change without notice) . All financial figures are expressed in U . S . dollars unless otherwise stated . SEZZLE INC 2Q21 PRESENTATION | 2

OUR MISSION Financially Empower the Next Generation SEZZLE INC 2Q21 PRESENTATION | 3

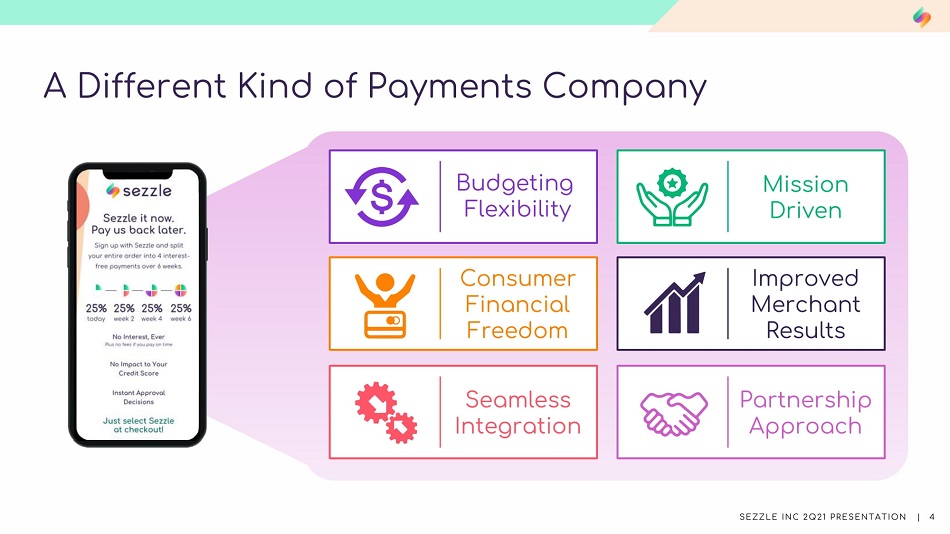

A Different Kind of Payments Company Budgeting Flexibility Mission Driven Consumer Financial Freedom Improved Merchant Results Seamless Integration Partnership Approach SEZZLE INC 2Q21 PRESENTATION | 4

Two - sided Network for Merchants and Consumers For Merchants For Consumers Consumer insights and marketing Daily settlement and no credit or fraud risk Increased AOV and lower product returns Higher Purchase Frequency No interest 1 Payment flexibility Tap and build credit Access new brands Fully Digital Experience High Approval Rates Easy integration Improved customer satisfaction 1 Not including long - term installment payment plans with Ally Financial . SEZZLE INC 2Q21 PRESENTATION | 5

Scaled Platform $1.4 billion LTM UMS 1,4 2.2 million+ Cumulative App Downloads 5 41,800 Active Merchants 3,4 4.8 / 5.0 Trustpilot Rating 7 3.0 million Active Consumers 2,4 49x Average Annual Transactions for Top 10% of Consumers 6 1 UMS defined as total value of sales made by merchants based on the purchase price of each confirmed sale through the Sezzle Platform with LTM representing the Last Twelve Months. July 2021 UMS was US$150.6M, up 109.7% YoY. 2 Active Consumers is defined as unique end users who have purchased through the Sezzle Platform within the last twelve months. 3 Active Merchants is defined as merchants who have had transactions through the Sezzle Platform in the last twelve months, and there is no minimum required number of transactions to meet the Active Merchant criteria. 4 As of 31 - July - 2021. 5 As of 30 - Jun - 2021 6 Based on UMS over rolling 12 - month period ended 30 - June - 2021. 7 As of 14 - July - 2021. SEZZLE INC 2Q21 PRESENTATION | 6

We’re Just Getting Started With Our Growth Plans Market Penetration x Large upside potential given low BNPL p enetration of e - commerce (1.6% in North America 1 ) x New product verticals seeing increased user and merchant demand for BNPL offerings Product Innovation x Long - term installment offering through bank partnerships (with Ally Financial) x In - store capabilities with Sezzle Virtual Card x Credit - building through Sezzle Up offering Geographic Expansion x Launched in Canada in Spring 2019 x Positive trends in India, favorable cross - border discussions in Europe, and in the early stages of entering Brazil Growth in New Verticals x Expansion into new categories including health, electronics, and travel x Themed categorization to allow consumers to shop their values, including black - owned, sustained, location - specific, and other designations Diversified Merchant Partners x Continued buildout of omnichannel offering with scale retailers including Target, GameStop, and Pure Hockey x Actively onboarding established direct to consumer (DTC) and enterprise retailers while expanding in - store offerings to SMBs Source: WorldPay 2021 Global Payments Report, Statista. ¹ Based on size of U.S. and Canada retail e - Commerce markets . SEZZLE INC 2Q21 PRESENTATION | 7

Tapping into a Global Market. SEZZLE INC 2Q21 PRESENTATION | 8 Canada • Launched in Spring 2019 • UMS run - rate > US$100M (based on May 2021 UMS) • 2Q21 Active Consumers rose 320% to > 150k • 2Q21 Active Merchants up 290% to > 2,600 Europe • Pilot/Market Development began at the end of 2020 • Step up on cross - border discussions with merchants and merchant acquisition platforms • 2Q21 signed THG PLC (The Hut Group) and Valencia CF United States • Primary Market Brazil • Launched in April 2021 and on track India • Launched in July 2020 • Tracking similarly to Sezzle US at the same stage in terms of consumer growth • Favorable trends in processing costs and loss rates • Further improvement needed in unit economics before making larger scale investment

` Building Network of Omnichannel Solutions The Sezzle Network Payment Related E - Commerce Platforms Other Institutions Card Networks Banks Credit Reporting Agencies Note: Graphic not indicative of partner size. SEZZLE INC 2Q21 PRESENTATION | 9

Partnership with • 19 July 2021, Sezzle issued Discover Financial Services (“Discover”) 4,559,270 shares of the Company’s common stock for US$30.0 million. • Sezzle and Discover are finalizing a definitive commercial agreement, including: • Plans for a buy now, pay later network solution on the Discover Global Network. • Dedicated referral program introducing Discover credit and debit products to Sezzle’s consumer base. DISCOVER FAST FACTS • One of the largest digital banks in the United States with total assets in excess of US$110.0 billion as of 31 December 2020. • Discover accepted at over 50 million locations in 2020 through its Discover Global Network (Discover Network, PULSE Debit Network, and Diners Club International). • In 2020, the Discover Global Network had US$417 billion in volume. SEZZLE INC 2Q21 Presentation | 10

• 03 August 2021, BigCommerce announced Sezzle , as a new preferred buy now, pay later partner. • As of 30 June 2021, BigCommerce served ~58,000 online stores across industries in ~147 countries. • Natively integrated as a payment gateway in the BigCommerce Control Panel, merchants can enable the Sezzle payment option with a single click to display a Sezzle widget at checkout. • BigCommerce (Nasdaq: BIGC) is a leading SaaS ecommerce platform that empowers merchants of all sizes to build, innovate and grow their businesses online. “There are a number of BNPL providers in the market right now, but Sezzle’s commitment to giving consumers a responsible way to slowly build credit without taking on large amounts of debt was a key differentiator in deciding to make them a preferred BNPL partner.” Mark Rosales, Vice President of Payments at BigCommerce SEZZLE INC 2Q21 PRESENTATION | 11 Preferred BNPL Partner for

From Start - ups to Large Retail Enterprises SEZZLE INC 2Q21 PRESENTATION | 12

Key Digital Payments Platform Leading recognition across the industry 4. 8 6,252 Reviews 4. 8 14,000 Reviews 4. 7 14,392 Reviews Best Buy - Now - Pay - Later App for Students Top 10 Payment and Card Solution Providers Top Installment Platform 4.9 28,000 Reviews SEZZLE INC 2Q21 PRESENTATION | 13

Note: Repeat Usage defined as cumulative orders made by returning end - customers to date relative to total cumulative orders to date. Top 10% of consumers measured by UMS over rolling 12 - month period ended 30 June 2021. Strong Underlying Merchant Sales and Healthy Income Levels Key drivers of growth include: • Active Consumers, Active Merchants, and Repeat Usage. • Active Consumer repeat usage grew to 91.6% in June 2021 (30 th consecutive month). • Top 10% of Sezzle’s consumers based on UMS, transact 49 times per year (~4 times per month). • Continued headway with larger enterprise merchant partners evidenced by recent additions of Target, Lamps Plus, and Market America Worldwide. UMS and Total Income as % of UMS Commentary SEZZLE INC 2Q21 PRESENTATION | 14 UMS CAGR : 350%

Transaction and Net Interest Expense Favorable trends in transaction and net interest expense from ACH, higher AOVs and new credit facility SEZZLE INC 2Q21 PRESENTATION | 15 US$M 31/03/20 30/06/20 31/03/21 30/06/21 Net interest expense 0.8$ 1.0$ 1.4$ 1.2$ As % of UMS Net interest expense 0.7% 0.6% 0.4% 0.3% Quarter ended US$M 31/03/20 30/06/20 31/03/21 30/06/21 Payment processing costs 2.7$ 3.9$ 6.5$ 7.0$ Other transaction expenses 1 0.8 1.3 2.4 2.6 Total transaction expense 3.5$ 5.2$ 8.9$ 9.6$ As % of UMS Payment processing costs 2.2% 2.1% 1.7% 1.7% Other transaction expenses 0.7% 0.7% 0.7% 0.6% Total transaction expense 2.9% 2.8% 2.4% 2.3% 1Other transaction costs include items such as merchant affiliate and partnership fees and consumer communication costs. Quarter ended

Provision for Uncollectible Accounts Provision for uncollectible accounts as a % of UMS Pr ovision for uncollectible accounts affected by: • Expansion testing with large enterprise merchants • Non - integrated product offerings • COVID - 19 and resulting stimulus SEZZLE INC 2Q21 PRESENTATION | 16 US$M 31/03/20 30/06/20 31/03/21 30/06/21 Provision for uncollectible accounts 2.8$ 2.3$ 8.6$ 13.8$ As % of UMS Provision for uncollectible accounts 2.4% 1.2% 2.3% 3.4% Quarter ended

Other Operating E xpenses • Other operating expenses growth is mostly driven by personnel and related compensation costs which represent over 65% of other operating expenses. About 47% of personnel and related compensation costs are non - cash in the form of equity and incentive - based compensation. • General and administrative costs were the second highest category after personnel and related compensation. The YoY increase in 2Q G&A was driven by third - party implementation costs, legal fees associated with filing with the SEC, and other public company reporting costs in connection with our listing on the ASX. SEZZLE INC 2Q21 PRESENTATION | 17 Other operating expenses (US$M) 31/03/20 30/06/20 2H20 FY 2020 31/03/21 30/06/21 Personnel $3.2 $3.4 $10.5 $17.1 $7.0 $7.5 Equity and incentive-based compensation 0.6 2.6 10.4 13.6 5.3 6.9 Third-party technology and data 0.4 0.5 1.6 2.5 1.2 1.1 Marketing, advertising, and tradeshows 0.3 0.5 3.5 4.3 1.5 1.9 General and administrative 0.9 0.8 5.5 7.2 2.4 3.9 Total other operating expenses $5.3 $7.9 $31.4 $44.6 $17.4 $21.3 Quarter ended Quarter ended

• Subsequent to quarter end, Sezzle received a US$30M investment from Discover. • In February 2021, refinanced receivables funding facility with a new 28 - month US$250M facility. x Lowered borrowing costs, x Extended maturity, and x Increased capacity. • Certain merchants elect not to receive transaction proceeds up front and leave cash with Sezzle , which totaled US$79.0M as 30 June 2021. Well - Capitalized for the Future Source : Company reports.. SEZZLE INC 2Q21 PRESENTATION | 18 Audited Unaudited (US$M) 31-Dec-2020 30-Jun-2021 Cash and cash equivalents $84.3 $58.2 Restricted cash $4.8 $1.8 Total cash $89.1 $60.0 Drawn on line of credit $40.0 $21.0 Unused borrowing capacity $23.9 $56.8 Total line of credit $100.0 $250.0

Thank You