Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Stock Yards Bancorp, Inc. | exh_991.htm |

| 8-K - FORM 8-K - Stock Yards Bancorp, Inc. | f8k_080221.htm |

EXHIBIT 99.2

Merger with Commonwealth Bancshares, Inc. August 3, 2021

Page 2 Forward - Looking Statements Forward - Looking Statements Certain statements contained in this communication, which are not statements of historical fact, constitute forward - looking stat ements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, certain plans, expectations, goals, projections, and ben efi ts relating to the proposed merger transaction between Stock Yards Bancorp, Inc. (“Stock Yards”) and Commonwealth Bancshares, Inc. (“Commonwealth”) which are subject to numerous assumpti ons , risks and uncertainties. Words or phrases such as “anticipate,” “believe,” “aim,” “can,” “conclude,” “continue,” “could,” “estimate,” “expect,” “foresee,” “goal,” “intend,” “m ay,” “might,” “outlook,” “possible,” “plan,” “predict,” “project,” “potential,” “seek,” “should,” “target,” “will,” “will likely,” “would,” or the negative of these terms or other comparable t erm inology, as well as similar expressions, are intended to identify forward - looking statements but are not the exclusive means of identifying such statements. Please refer to Stock Yards’ Annual R eport on Form 10 - K for the year ended December 31, 2020, and its Quarterly Report on Form 10 - Q for the three months ended March 31, 2021, as well as its other filings with the SEC for a more detailed discussion of risks, uncertainties and factors that could cause actual results to differ from those discussed in the forward - looking statements. Forward - looking statements are not historical facts but instead express only management’s beliefs regarding future results or ev ents, many of which, by their nature, are inherently uncertain and outside of the management’s control. It is possible that actual results and outcomes may differ, possibly mater ial ly, from the anticipated results or outcomes indicated in these forward - looking statements. In addition to factors disclosed in reports filed by Stock Yards with the SEC, risks and uncertainti es for Stock Yards, Commonwealth and the combined company include, but are not limited to: the possibility that some or all of the anticipated benefits of the proposed merger wil l not be realized or will not be realized within the expected time period; the risk that integration of Commonwealth’s operations with those of Stock Yards will be materially delayed or will b e m ore costly or difficult than expected; the parties’ inability to meet expectations regarding the timing, completion and accounting and tax treatments of the merger; the inability to complete th e merger due to the failure of Commonwealth’s shareholders to adopt the merger agreement; the failure to satisfy other conditions to completion of the merger, including re cei pt of required regulatory and other approvals; the failure of the proposed transaction to close for any other reason; diversion of management's attention from ongoing business operations and opp ortunities due to the merger; the challenges of integrating and retaining key employees; the effect of the announcement of the merger on Stock Yards’, Commonwealth’s or the com bined company’s respective customer and employee relationships and operating results; the possibility that the merger may be more expensive to complete than anticipated, incl udi ng as a result of unexpected factors or events; dilution caused by Stock Yards’ issuance of additional shares of Stock Yards common stock in connection with the merger; the magnitude an d duration of the COVID - 19 pandemic and its impact on the global economy and financial market conditions and the business, results of operations and financial condition of Stoc k Y ards, Commonwealth and the combined company; and general competitive, economic, political and market conditions and fluctuations. All forward - looking statements included in this communication are made as of the date hereof and are based on information available at that time. Except as required by law, neither Stock Yards nor Commonwealth assumes any obligation to update any forward - looking statement to reflect events or circumstances that occur after the date the forward - looking statements were made.

Page 3 Important Additional Information Additional Information Regarding the Proposed Transaction This communication in respect of the proposed merger transaction between Stock Yards and Commonwealth is for informational pu rpo ses only and is neither an offer to purchase nor a solicitation of an offer to sell any securities. In connection with the proposed transaction, Stock Yards and Commonwealth wi ll prepare a proxy statement of Commonwealth that also constitutes an offering circular of Stock Yards which, when finalized, will be sent to the shareholders of Commonwealth seeki ng their approval of the merger - related proposals. The shares of Stock Yards common stock to be issued to Commonwealth shareholders in the proposed merger will not be registered under the Se curities Act of 1933, as amended, or under any state securities laws, and those shares may not be offered or sold absent registration or an applicable exemption from the registra tio n requirements of the Securities Act, which will be more fully described in the proxy statement/offering circular. The proxy statement/offering circular will be delivered to Commonwealth s har eholders when available. This communication is not a substitute for the proxy statement/offering circular or any other document that Stock Yards may file with the SEC. COMMONWEAL TH SHAREHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT/OFFERING CIRCULAR, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMEN TS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IM PORTANT INFORMATION ABOUT STOCK YARDS, COMMONWEALTH AND THE PROPOSED TRANSACTION. Other documents relating to the merger transaction fil ed by Stock Yards can be obtained free of charge from the SEC’s website at www.sec.gov. Documents filed by Stock Yards also can be obtained free of ch arg e by accessing Stock Yards’ website at www.syb.com under the tab “Investors Relations” and then under “SEC Filings.” Alternatively, these documents and the proxy statement/offe rin g circular, when available, can be obtained free of charge from Stock Yards upon written request to Stock Yards, Attention: Chief Financial Officer, 1040 East Main Street, Louisville, Ken tucky 40206 or by calling (502) 582 - 2571, or to Commonwealth, Attention: Chief Financial Officer, 4350 Brownsboro Road Ste 310, Louisville, Kentucky 40207 or by calling (502 ) 2 59 - 2200. Participants in the Solicitation Stock Yards, Commonwealth and their respective directors and executive officers may be deemed to be participants in the solic ita tion of proxies from Commonwealth’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of Stock Yards and their own ers hip of Stock Yards common stock is set forth in the definitive proxy statement for Stock Yards’ 2021 annual meeting of shareholders, as previously filed with the SEC on March 12 , 2 021, and Stock Yards’ Annual Report on Form 10 - K for the year ended December 31, 2020, as previously filed with the SEC on February 26, 2021, as well as other documents filed with th e S EC. Information about the directors and executive officers of Commonwealth and their ownership of Commonwealth common stock, as well as additional information regarding the pa rti cipants in the proxy solicitation and a description of their direct and indirect interests, by securities holdings or otherwise, will be included in the proxy statement/offering ci rcu lar when it becomes available. You may obtain free copies of these documents from Stock Yards or Commonwealth using the sources indicated above. No Offer or Solicitation This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to buy securi tie s nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of suc h jurisdiction. This communication is also not a solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise. No offer of securities or solicitation will be m ade except by means of the proxy statement/offering circular described in the preceding paragraphs. Non - GAAP Measures This communication contains certain non - GAAP financial measures of Stock Yards and Commonwealth determined by methods other than in accordance with generally accepted accounting principles. We use non - GAAP financial measures to provide meaningful supplemental information regarding our performan ce. We believe these non - GAAP measures are beneficial in assessing our operating results and related trends, and when planning and forecasting future periods. These non - GA AP disclosures should be considered in addition to, and not as a substitute for or preferable to, financial results determined in accordance with GAAP. The non - GAAP financial measures we use may differ from the non - GAAP financial measures other financial institutions use to measure their results of operations.

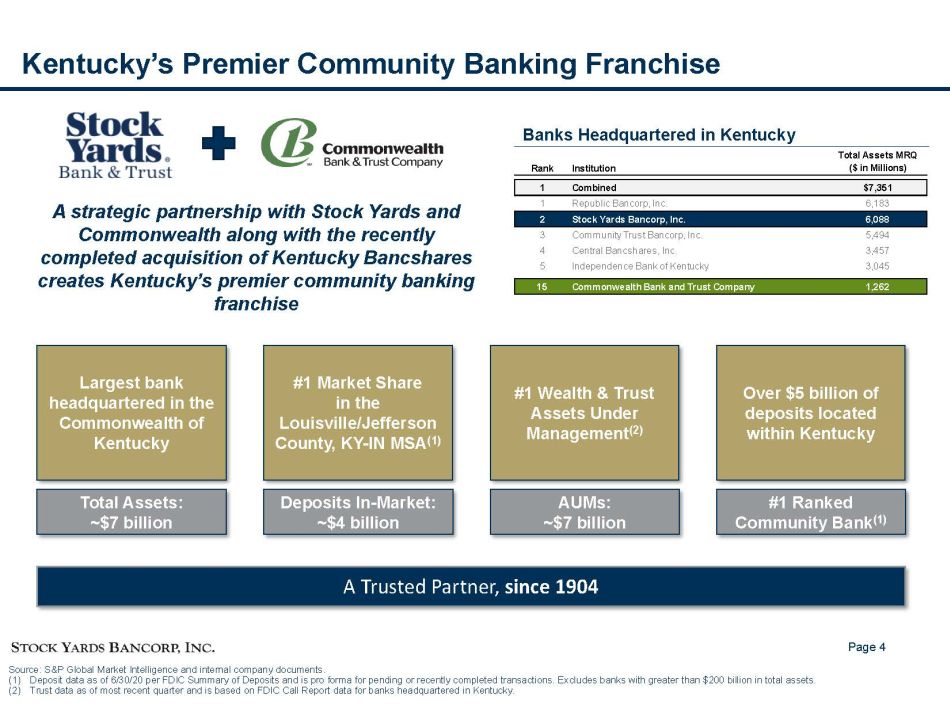

Page 4 Kentucky’s Premier Community Banking Franchise Rank Institution Total Assets MRQ ($ in Millions) 1 Combined $7,351 1 Republic Bancorp, Inc. 6,183 2 Stock Yards Bancorp, Inc. 6,088 3 Community Trust Bancorp, Inc. 5,494 4 Central Bancshares, Inc. 3,457 5 Independence Bank of Kentucky 3,045 15 Commonwealth Bank and Trust Company 1,262 A strategic partnership with Stock Yards and Commonwealth along with the recently completed acquisition of Kentucky Bancshares creates Kentucky’s premier community banking franchise Largest bank headquartered in the Commonwealth of Kentucky #1 Market Share in the Louisville/Jefferson County, KY - IN MSA (1) #1 Wealth & Trust Assets Under Management (2) Over $5 billion of deposits located within Kentucky A Trusted Partner, since 1904 Source: S&P Global Market Intelligence and internal company documents. (1) Deposit data as of 6/30/20 per FDIC Summary of Deposits and is pro forma for pending or recently completed transactions. Excl ude s banks with greater than $200 billion in total assets. (2) Trust data as of most recent quarter and is based on FDIC Call Report data for banks headquartered in Kentucky. Banks Headquartered in Kentucky Total Assets: ~$7 billion Deposits In - Market: ~$4 billion AUMs: ~$7 billion #1 Ranked Community Bank (1)

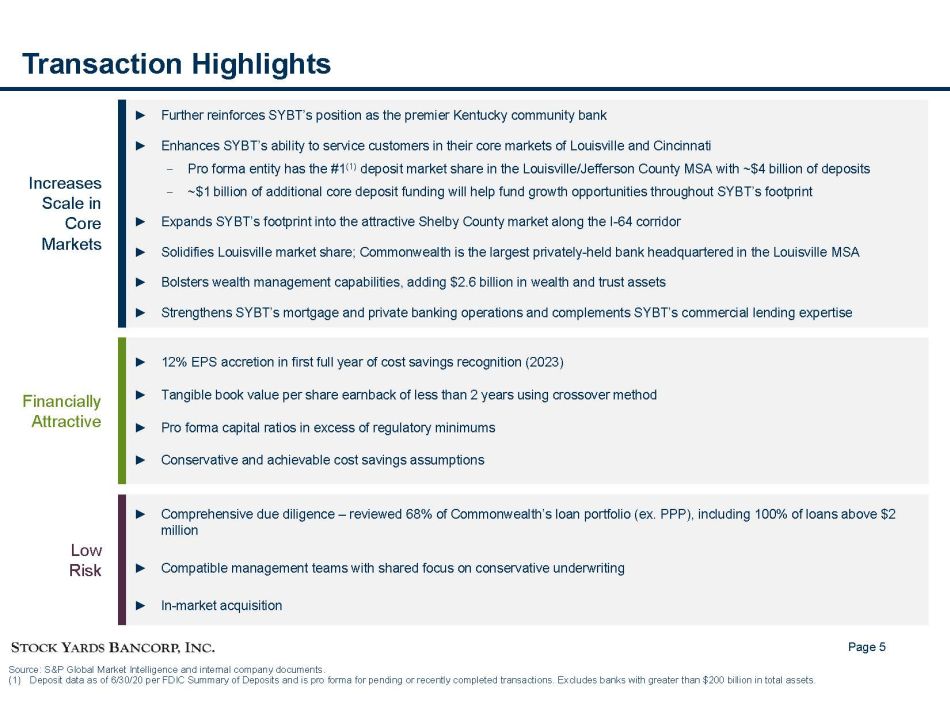

Page 5 Transaction Highlights ► Further reinforces SYBT’s position as the premier Kentucky community bank ► Enhances SYBT’s ability to service customers in their core markets of Louisville and Cincinnati − Pro forma entity has the #1 (1) deposit market share in the Louisville/Jefferson County MSA with ~$4 billion of deposits − ~$1 billion of additional core deposit funding will help fund growth opportunities throughout SYBT’s footprint ► Expands SYBT’s footprint into the attractive Shelby County market along the I - 64 corridor ► Solidifies Louisville market share; Commonwealth is the largest privately - held bank headquartered in the Louisville MSA ► Bolsters wealth management capabilities, adding $2.6 billion in wealth and trust assets ► Strengthens SYBT’s mortgage and private banking operations and complements SYBT’s commercial lending expertise Source: S&P Global Market Intelligence and internal company documents. (1) Deposit data as of 6/30/20 per FDIC Summary of Deposits and is pro forma for pending or recently completed transactions. Excl ude s banks with greater than $200 billion in total assets. ► 12% EPS accretion in first full year of cost savings recognition (2023) ► Tangible book value per share earnback of less than 2 years using crossover method ► Pro forma capital ratios in excess of regulatory minimums ► Conservative and achievable cost savings assumptions ► Comprehensive due diligence – reviewed 68% of Commonwealth’s loan portfolio (ex. PPP), including 100% of loans above $2 million ► Compatible management teams with shared focus on conservative underwriting ► In - market acquisition Increases Scale in Core Markets Financially Attractive Low Risk

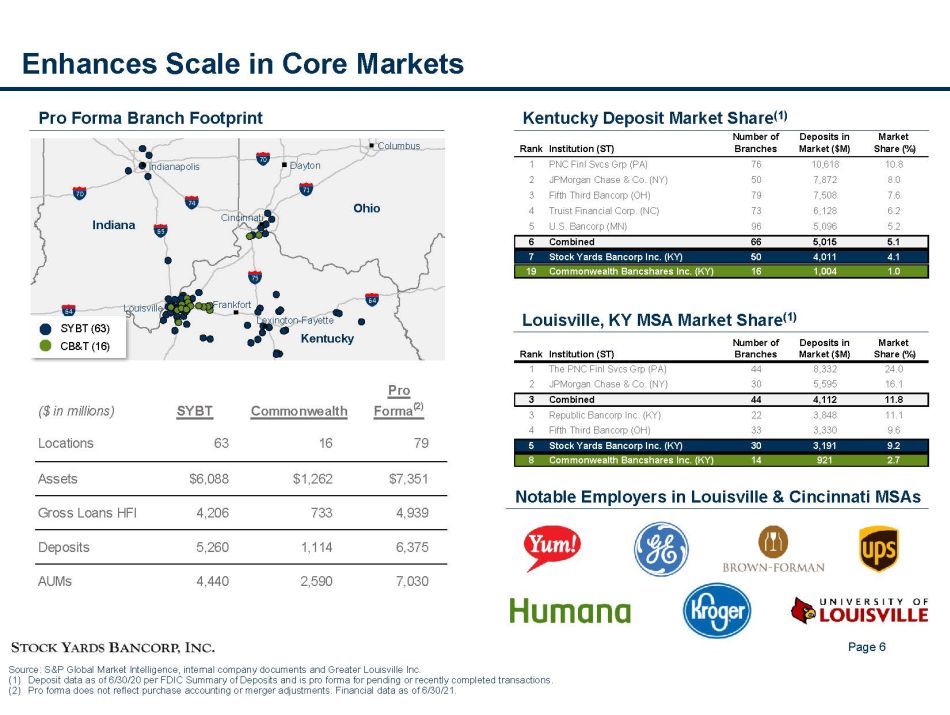

Page 6 ($ in millions) SYBT Commonwealth Pro Forma (2) Locations 63 16 79 Assets $6,088 $1,262 $7,351 Gross Loans HFI 4,206 733 4,939 Deposits 5,260 1,114 6,375 AUMs 4,440 2,590 7,030 64 Enhances Scale in Core Markets Source: S&P Global Market Intelligence, internal company documents and Greater Louisville Inc. (1) Deposit data as of 6/30/20 per FDIC Summary of Deposits and is pro forma for pending or recently completed transactions . (2) Pro forma does not reflect purchase accounting or merger adjustments. Financial data as of 6/30/21. Louisville Indianapolis Lexington - Fayette Frankfort Cincinnati Columbus Dayton 70 65 75 71 74 70 64 Indiana Ohio Kentucky Pro Forma Branch Footprint Notable Employers in Louisville & Cincinnati MSAs Kentucky Deposit Market Share (1) Louisville, KY MSA Market Share (1) SYBT ( 63 ) CB&T ( 16 ) Rank Institution (ST) Number of Branches Deposits in Market ($M) Market Share (%) 1 PNC Finl Svcs Grp (PA) 76 10,618 10.8 2 JPMorgan Chase & Co. (NY) 50 7,872 8.0 3 Fifth Third Bancorp (OH) 79 7,508 7.6 4 Truist Financial Corp. (NC) 73 6,128 6.2 5 U.S. Bancorp (MN) 96 5,096 5.2 6 Combined 66 5,015 5.1 7 Stock Yards Bancorp Inc. (KY) 50 4,011 4.1 19 Commonwealth Bancshares Inc. (KY) 16 1,004 1.0 Rank Institution (ST) Number of Branches Deposits in Market ($M) Market Share (%) 1 The PNC Finl Svcs Grp (PA) 44 8,332 24.0 2 JPMorgan Chase & Co. (NY) 30 5,595 16.1 3 Combined 44 4,112 11.8 3 Republic Bancorp Inc. (KY) 22 3,848 11.1 4 Fifth Third Bancorp (OH) 33 3,330 9.6 5 Stock Yards Bancorp Inc. (KY) 30 3,191 9.2 8 Commonwealth Bancshares Inc. (KY) 14 921 2.7

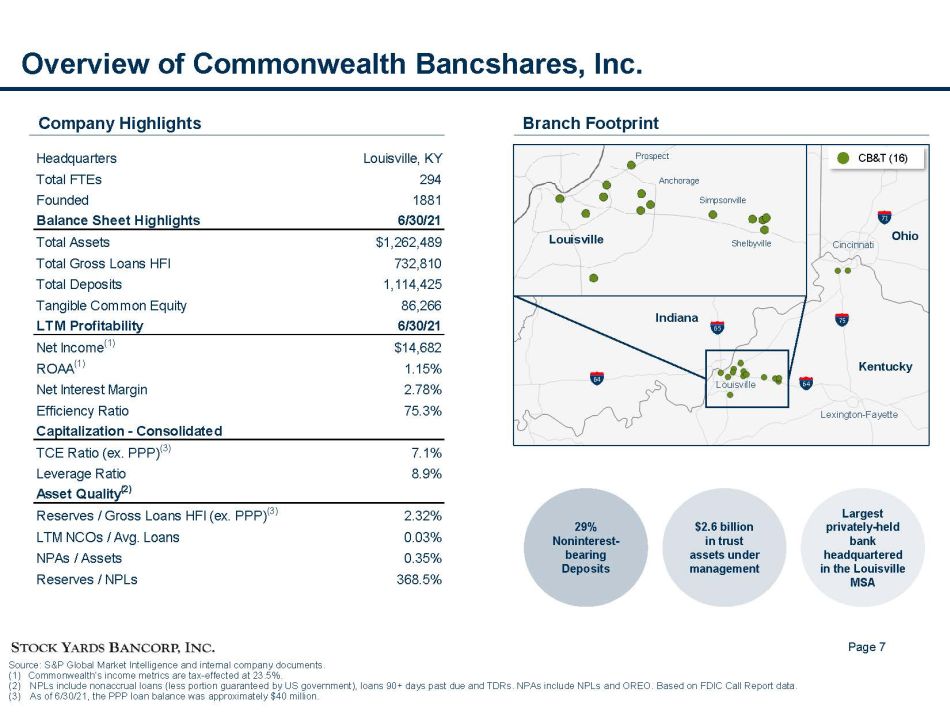

Page 7 Headquarters Louisville, KY Total FTEs 294 Founded 1881 Balance Sheet Highlights 6/30/21 Total Assets $1,262,489 Total Gross Loans HFI 732,810 Total Deposits 1,114,425 Tangible Common Equity 86,266 LTM Profitability 6/30/21 Net Income (1) $14,682 ROAA (1) 1.15% Net Interest Margin 2.78% Efficiency Ratio 75.3% Capitalization - Consolidated TCE Ratio (ex. PPP) (3) 7.1% Leverage Ratio 8.9% Asset Quality (2) Reserves / Gross Loans HFI (ex. PPP) (3) 2.32% LTM NCOs / Avg. Loans 0.03% NPAs / Assets 0.35% Reserves / NPLs 368.5% Overview of Commonwealth Bancshares, Inc. Source: S&P Global Market Intelligence and internal company documents. (1) Commonwealth’s income metrics are tax - effected at 23.5%. (2) NPLs include nonaccrual loans (less portion guaranteed by US government), loans 90+ days past due and TDRs. NPAs include NPLs an d OREO. Based on FDIC Call Report data. (3) As of 6/30/21, the PPP loan balance was approximately $40 million. Company Highlights Branch Footprint 29 % Noninterest - bearing Deposits $2.6 billion in trust assets under management Largest privately - held bank headquartered in the Louisville MSA Indiana Ohio Kentucky Louisville Lexington - Fayette Cincinnati 64 65 75 71 64 CB&T ( 16 ) Shelbyville Simpsonville Prospect Anchorage Louisville Shelbyville Simpsonville Prospect Anchorage Louisville

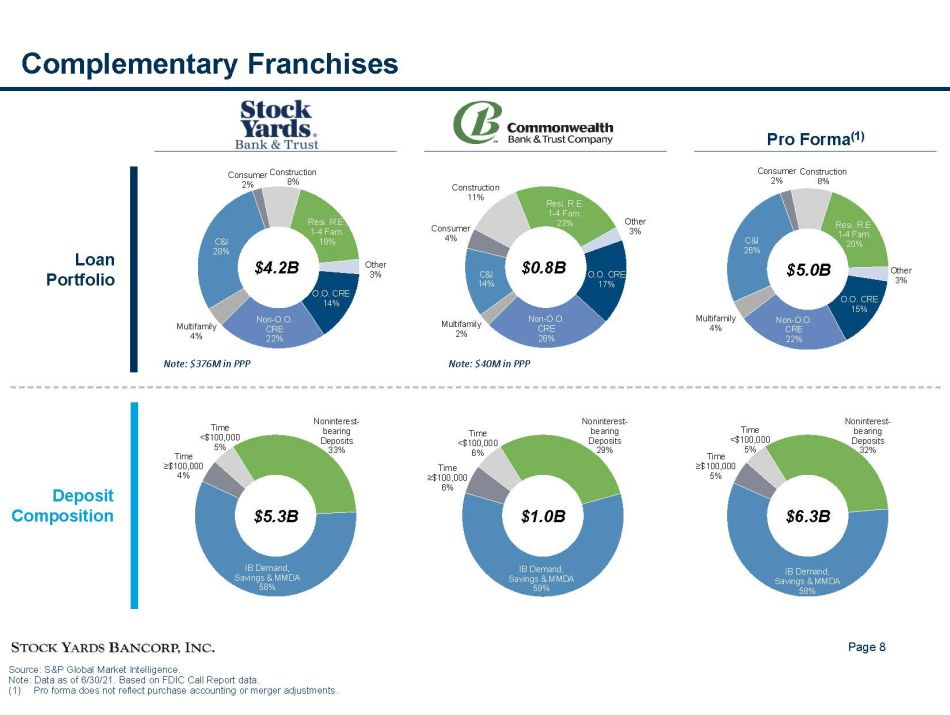

Page 8 Noninterest - bearing Deposits 32% IB Demand, Savings & MMDA 58% Time <$100,000 5% Time ≥$100,000 5% Noninterest - bearing Deposits 29% IB Demand, Savings & MMDA 59% Time <$100,000 6% Time ≥$100,000 6% Noninterest - bearing Deposits 33% IB Demand, Savings & MMDA 58% Time <$100,000 5% Time ≥$100,000 4% Construction 8% Resi. R.E. 1 - 4 Fam. 20% Other 3% O.O. CRE 15% Non - O.O. CRE 22% Multifamily 4% C&I 26% Consumer 2% Construction 11% Resi. R.E. 1 - 4 Fam. 23% Other 3% O.O. CRE 17% Non - O.O. CRE 26% Multifamily 2% C&I 14% Consumer 4% Construction 8% Resi. R.E. 1 - 4 Fam. 19% Other 3% O.O. CRE 14% Non - O.O. CRE 22% Multifamily 4% C&I 28% Consumer 2% Complementary Franchises $4.2B $0.8B $ 5 .0B $5.3B $ 1.0 B $6.3B Source: S&P Global Market Intelligence. Note: Data as of 6/30/21. Based on FDIC Call Report data. (1) Pro forma does not reflect purchase accounting or merger adjustments. Pro Forma (1) Loan Portfolio Deposit Composition Note: $376M in PPP Note: $40M in PPP

Page 9 Transaction Overview (1) Based on SYBT closing common stock price of $47.64 as of 7/30/21. (2) Based on Commonwealth financials as of 6/30/21. (3) Commonwealth’s net income figures are tax - effected at 23.5%. Consideration Key Pricing Multiples (1)(2) Pro Forma Ownership Management & Board of Directors Timing and Approvals ► Approximately $153 million deal value, or $55.35 per Commonwealth share (1) ► 0.9267 shares of SYBT common stock and $11.20 per share in cash for each Commonwealth share ► Stock / cash mix ~80% / ~20% ► Price / Tangible Book Value Per Share: 1.78x ► Price / LTM Net Income (3) : 10.4x ► Price / 2022E Net Income (3) + Fully Phased Cost Savings: 8.2x ► ~91% SYBT existing shareholders ► ~9% Commonwealth current shareholders – The Wells family will beneficially own ~6% and will be subject to the terms of the agreed upon Investor Agreement ► John W. Key, President and CEO of Commonwealth Bank, will join Stock Yards Bank in a senior management position as Director of Strategic Initiatives and will serve as a voting member of the bank’s senior credit, strategy and operations committees ► One current Commonwealth Bancshares board member, Laura Wells, to join the Board of Directors of SYBT following completion of the transaction ► Targeted closing date in fourth quarter of 2021 ► Customary regulatory approvals and closing conditions ► Approval of Commonwealth shareholders

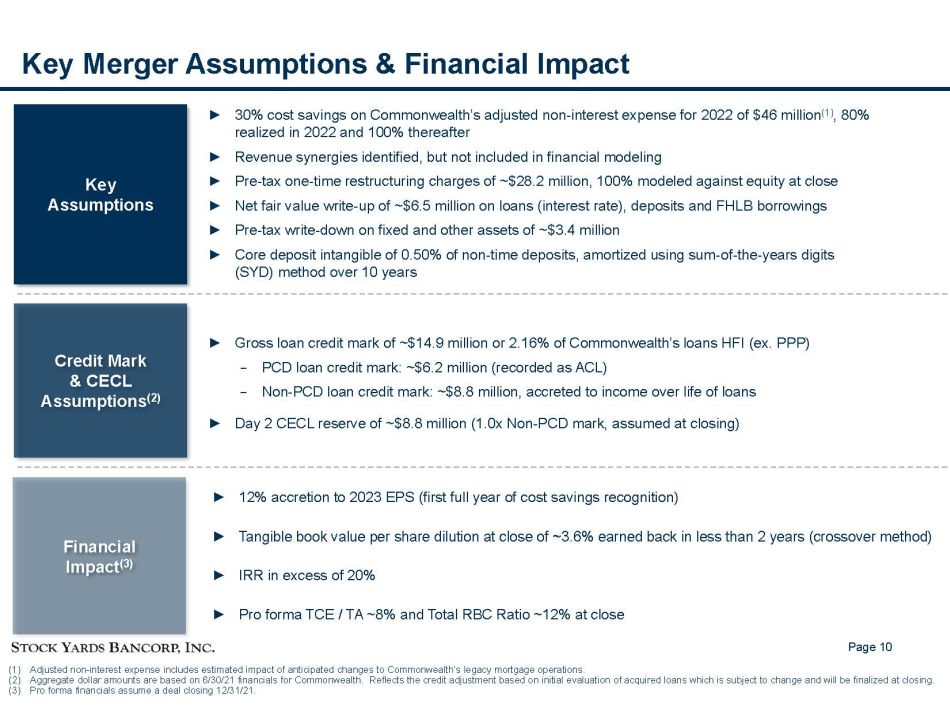

Page 10 Key Merger Assumptions & Financial Impact (1) Adjusted non - interest expense includes estimated impact of anticipated changes to Commonwealth’s legacy mortgage operations. (2) Aggregate dollar amounts are based on 6/30/21 financials for Commonwealth. Reflects the credit adjustment based on initial e val uation of acquired loans which is subject to change and will be finalized at closing. (3) Pro forma financials assume a deal closing 12/31/21. ► 30% cost savings on Commonwealth’s adjusted non - interest expense for 2022 of $46 million (1) , 80% realized in 2022 and 100% thereafter ► Revenue synergies identified, but not included in financial modeling ► Pre - tax one - time restructuring charges of ~$28.2 million, 100% modeled against equity at close ► Net fair value write - up of ~$6.5 million on loans (interest rate), deposits and FHLB borrowings ► Pre - tax write - down on fixed and other assets of ~$3.4 million ► Core deposit intangible of 0.50% of non - time deposits, amortized using sum - of - the - years digits (SYD) method over 10 years ► Gross loan credit mark of ~$14.9 million or 2.16% of Commonwealth’s loans HFI (ex. PPP) − PCD loan credit mark: ~$6.2 million (recorded as ACL) − Non - PCD loan credit mark: ~$8.8 million, accreted to income over life of loans ► Day 2 CECL reserve of ~$8.8 million (1.0x Non - PCD mark, assumed at closing) ► 12% accretion to 2023 EPS (first full year of cost savings recognition) ► Tangible book value per share dilution at close of ~3.6% earned back in less than 2 years (crossover method) ► IRR in excess of 20% ► Pro forma TCE / TA ~8% and Total RBC Ratio ~12% at close Key Assumptions Credit Mark & CECL Assumptions (2) Financial Impact (3)

Page 11 Comprehensive Due Diligence Disciplined Acquiror ► SYBT is an experienced acquirer; fourth transaction since 2012, second transaction in 2021 ► Long track record of growing earnings and tangible book value Conservative Diligence Approach ► Comprehensive and collaborative process including business, operational, credit, financial, legal, HR and regulatory ► Detailed review of revenue and expense structure to determine potential synergies ► Heightened focus on credit and interest rate risk, in light of the pandemic ► SYBT’s most experienced credit team reviewed a significant portion of the loan portfolio: − Reviewed 68 % of the loan portfolio, excluding PPP balances − Reviewed 100% of loans with balances above $2 million ► Complementary bank cultures and community banking philosophies ► SYBT has a deep understanding of the markets Commonwealth operates in; SYBT has been operating in and serving the Louisville market for over 100 years

Page 12 Transaction Highlights x Creates the largest bank headquartered in the Commonwealth of Kentucky x Increases scale in two of SYBT’s core operating markets x Expands SYBT’s footprint into the attractive Shelby County market x Builds upon strengths and enhances scale, profitability and performance x Attractive financial returns with strong EPS accretion, IRR and short tangible book value earnback x Further diversifies combined loan portfolio across asset classes and markets x Expands wealth and trust assets by $2.6 billion x Adds an additional ~$1 billion in low - cost deposit funding x Detailed and robust due diligence process x Shared values – culture, leadership and strategic familiarity x Lower risk, in - market transaction with significant cost savings opportunities