Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Pony Group Inc. | f10k2020ex32-2_pony.htm |

| EX-32.1 - CERTIFICATION - Pony Group Inc. | f10k2020ex32-1_pony.htm |

| EX-31.2 - CERTIFICATION - Pony Group Inc. | f10k2020ex31-2_pony.htm |

| EX-31.1 - CERTIFICATION - Pony Group Inc. | f10k2020ex31-1_pony.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - Pony Group Inc. | f10k2020ex21-1_pony.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: [ ]

PONY GROUP INC.

(Exact name of registrant as specified in its charter)

| Delaware | 83-3532241 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

Engineer Experiment Building, A202 7 Gaoxin South Avenue, Nanshan District Shenzhen, Guangdong Province People’s Republic of China |

518000 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number: +86 0755 86665622

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Trading Symbol | Name of Each Exchange on Which Registered: | ||

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Common stock held by each officer and director and by each person known to the registrant who owned 10% or more of the outstanding voting and non-voting common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of December 31, 2020, there were 11,500,000 shares of common stock, par value $0.001 per share, of the registrant issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

If the following documents are incorporated by reference, briefly describe them and identify the part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (i) any annual report to security holders; (ii) any proxy or information statement; and (iii) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933 (the “Securities Act”). The listed documents should be clearly described for identification purposes (e.g. annual reports to security holders for fiscal year ended December 24, 1980): None

PONY GROUP INC.

TABLE OF CONTENTS

i

Unless otherwise stated in this Annual Report on Form 10-K (“Report”), references to:

| ● | “China” or the “PRC” refers to the People's Republic of China, excluding, for the purposes of this Report only, Hong Kong, Macau and Taiwan; |

| ● | “RMB” and “Renminbi” refer to the legal currency of China; |

| ● | “US$,” “U.S. dollars,” “$,” and “dollars” refer to the legal currency of the United States; |

| ● | “Pony,” “we,” “us,” “our company” and “our” refer to Pony Group Inc., its subsidiaries. |

| ● | “PonyHK” refer to Pony Limousine Services Limited., our wholly owned subsidiary in Hong Kong; and |

| ● | “Universe Travel” refers to Universe Travel Culture & Technology Ltd., a wholly-owned PRC subsidiary of Pony HK. |

We use U.S. dollars as reporting currency in our financial statements and in this Report. Monetary assets and liabilities denominated in Renminbi are translated into U.S. dollars at the rates of exchange as of the balance sheet date, equity accounts are translated at historical exchange rates, and revenues, expenses, gains and losses are translated using the average rate for the period. In other parts of this Report, any Renminbi denominated amounts are accompanied by translations. We make no representation that the Renminbi or U.S. dollar amounts referred to in this Report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. The PRC government restricts or prohibits the conversion of Renminbi into foreign currency and foreign currency into Renminbi for certain types of transactions.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report, including, without limitation, statements under the heading “Management's Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continues,” or “should,” or, in each case, their negative or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our ability to consummate any acquisition or other business combination and any other statements that are not statements of current or historical facts. These statements are based on management's current expectations, but actual results may differ materially due to various factors, including, but not limited to:

| ● | our goals and strategies; |

| ● | our future business development, financial condition and results of operations; |

| ● | the expected growth and heavy regulation of the credit industry, and marketplace lending in particular, in China; |

| ● | the growth in China of disposable household income and the availability and cost of credit available to finance car purchases; |

| ● | the growth of China's ride-hailing, automobile financing and leasing industries; |

| ● | taxes and other incentives or disincentives related to car purchases and ownership; |

| ● | fluctuations in the sales and price of new and used cars and consumer acceptance of financing car purchases; |

| ● | ride-hailing, transportation networks, and other fundamental changes in transportation pattern; |

| ● | our expectations regarding demand for and market acceptance of our products and services; |

| ● | our expectations regarding our customer base; |

| ● | our plans to invest in our automobile transaction and related services business; |

| ● | our relationships with our business partners; |

| ● | competition in our industries; |

| ● | macro-economic and political conditions affecting the global economy generally and the market in China specifically; and |

| ● | relevant government policies and regulations relating to our industries. |

The forward-looking statements contained in this Report are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated or over which we may not have any control. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those that are expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors” in this report and our other periodic reports filed by us with the SEC. Should one or more of these risks or unanticipated risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described in our periodic reports are not exhaustive.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this Report. In addition, even if our results or operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in this Report, those results or developments may not be indicative of results or developments in subsequent periods.

iii

Overview

Pony Group Inc., (The “Company” or “Pony”) was incorporated on January 7, 2019 in the state of Delaware.

Our Corporate History

On March 7, 2019, Pony Group Inc (the “Purchaser”), and Wenxian Fan, the sole owner of Pony Limousine Services Limited, entered into a Stock Purchase Agreement (the “Purchase Agreement”), pursuant to which Wenxian Fan (the “Seller”) would sell to the Purchaser, and the Purchaser will purchase from the Seller, 10,000 shares of the Pony Limousine Services Limited (“PonyHK”), which represented 100% of the shares. On March 07, 2019, this transaction was completed.

Pony Limousine Services Limited is a limited liability company formed under the laws of Hong Kong on April 28, 2016, which was formed by Wenxian Fan. Its registered office is located at Flat/Rm 01 11/F, Lucky Comm Bldg, 103 Des Voeux Rd West, Sheung Wan, Hong Kong. On February 2, 2019, Universe Travel Culture & Technology Ltd. (“Universe Travel”) was incorporated as a wholly-owned PRC subsidiary of Pony HK.

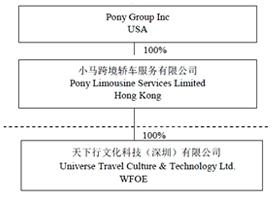

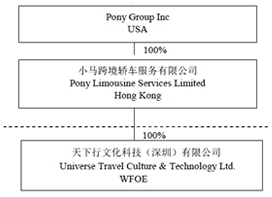

Our Corporate Structure

The following diagram illustrates our corporate structure, including our subsidiaries as of the date of this Report:

Our Services

The business nature of the Company is to provide carpooling, airport pick-up and drop-off, and personal drivers services for travelers between Guangdong Province and Hong Kong.

We offer our customers seamless, customized and on-demand access to a variety of transportation options. Currently, most of our customers are entities such as business companies, travel agencies or societal associations. To be as flexible and convenience as possible to our customers, we take orders from customers any time through WeChat, Tencent QQ, email and phone call, upon which we obtain a quote from our car fleet companies and forward it to the customer. Once the order is confirmed, the accepted car fleet company will perform the service by sending a driver to pick up the customer at the scheduled time. We charge the car fleet company a 5-15% service fee on each completed order. We completed 400 orders in 2017 and 460 in 2018 and generated $2,805 and $3,229 in 2017 and 2018, respectively.

Sales and Marketing

We market our services to users directly through word-of-mouth referrals, brand advertising. We plan to attract consumers and promote offerings on our “Let’s Go” application through sponsored events, social networking sites including Facebook, Twitter and Instagram and other similar initiatives.

1

Seasonality

Our current operations experience seasonality. We see high demands of our services during the golden weeks in China which was intended to help expand the domestic tourism market. Our business slows down during February to April.

Intellectual Property

We currently do not have any intellectual property. In July 2019, we started the process of registering our trademark with the Trade Marks Registry in Hong Kong.

Competition

Competition in the car service industry is intense and evolving. Our primary competitors are Shenzhen Anxun Automobile Rental Co., Ltd, The Motor Transport Company of Guangdong and Hong Kong Limited and China Comfort (Shenzhen) Travel Services Co. Ltd. We believe the primary competitive factors in our markets include pricing, user experience, brand, technological innovation, safety and reliability. We believe we compete favorably across these factors. We are strategically positioned in the Guangdong-Hong Kong market where the demand for traveling between these two places is high. However, many of our competitors and potential competitors are larger and have greater brand name recognition, longer operating histories, larger marketing budgets and established marketing relationships, access to larger customer bases and significantly greater resources for the development of their offerings. For additional information about the risks to our business related to competition, see the section titled “Risk Factors— We face intense competition and could lose market share to our competitors, which could adversely affect our business, financial condition and results of operations.”

Employees

As of the date of this Report, we have a total of 3 full-time employees and 1 part-time employee working for customer services. The following table sets forth the number of our employees categorized by function as of that date:

| Function | Total Number of Employees | |

| Technology & Product Development | 2 | |

| Human Resource & Administration | 1 | |

| Customer Services | 1 | |

| Total | 4 |

Facilities

We lease an office at Engineer Experiment Building, A202, 7 Gaoxin South Avenue, Nanshan District, Shenzhen, Guangdong Province, China, encompassing approximately 205 square meters of space for a monthly rent of RMB 10,000 (approximately $1,412). The lease for this facility expires on February 28, 2022. We believe the rented space is sufficient for our current operations. We believe our facilities are sufficient for our current needs.

Insurance

We currently do not have any insurance coverage other than participation in various government statutory social security plans, including a pension contribution plan, a medical insurance plan, an unemployment insurance plan, a work-related injury insurance plan, a maternity insurance plan and a housing provident fund.

Legal Proceedings

From time to time, we may in the future become a party to various legal or administrative proceedings arising in the ordinary course of our business, including actions with respect to intellectual property infringement, violation of third-party licenses or other rights, breach of contract and labor and employment claims. We are currently not a party to, and we are not aware of any threat of, any legal or administrative proceedings that, in the opinion of our management, are likely to have any material and adverse effect on our business, financial condition, cash-flow or results of operations.

2

Regulations

This section sets forth a summary of the most significant laws, rules and regulations that affect our business and operations in China. We provide our service through third-party transportation companies and do not own the vehicle ourselves for their operations, therefore we believe we do not need the qualifications related to vehicle transportation operations.

Regulations Relating to Foreign Investment

The Guidance Catalog of Industries for Foreign Investment

Investment activities in the PRC by foreign investors shall comply with the Guidance Catalog of Industries for Foreign Investment, or the Catalog, which was promulgated and is amended continuously by MOFCOM, and the National Development and Reform Commission, or NDRC. According to the Catalog, industries are classified as three categories: encouraged foreign invested industries, restricted foreign invested industries and prohibited foreign invested industries. Any industry not listed in the Catalog or any encouraged foreign invested industry listed in the Catalog is a permitted industry. Some restricted industries are limited to equity or contractual joint ventures, while in some cases Chinese partners are required to hold the majority interests in such joint ventures. Foreign investors are not allowed to invest in industries within the prohibited category. Industries not listed in the Catalogue are generally open to foreign investment unless specifically restricted by other PRC regulations.

In June 2018, the MOFCOM and the NDRC promulgated the Special Administrative Measures for the Access of Foreign Investment (Negative List), or the Negative List (2018), effective in July 2018. The Negative List (2018) expands the scope of permitted industries by foreign investment by reducing the number of industries that fall within the Negative List (2018) where restrictions on the shareholding percentage or requirements on the composition of board or senior management still exists. In June 2019, the MOFCOM and the NDRC promulgated the Special Administrative Measures for the Access of Foreign Investment (Negative List) (2019 Edition), or the Negative List (2019) to replace the Negative List (2018), effective in July 2019. The Negative List (2019) has reduced 8 special management measures in the Negative List (2018). We believe that our current business is to provide travel services and therefore falls in neither the Negative List (2018) nor the Negative List (2019).

Foreign Investment Law

On March 15, 2019, the National People’s Congress promulgated the Foreign Investment Law, which will become effective on January 1, 2020 and replace three existing laws on foreign investments in China, namely, the Sino-Foreign Equity Joint Venture Enterprise Law and the Foreign Owned Enterprise Law, together with their implementations and ancillary regulations to become the legal foundation for foreign investment in the PRC.

According to the Foreign Investment Law, the State Council will publish or approve to publish a catalogue for special administrative measures, or the “negative list.” The Foreign Investment Law grants national treatment to foreign invested entities, except for those foreign invested entities that operate in industries deemed to be either “restricted” or “prohibited” in the “negative list.” Because the “negative list” has yet to be published, it is unclear whether it will differ from the current Negative List. The Foreign Investment Law provides that foreign invested entities operating in foreign restricted or prohibited industries will require market entry clearance and other approvals from relevant PRC governmental authorities. Furthermore, the Foreign Investment Law provides that foreign invested enterprises established according to the existing laws regulating foreign investment may maintain their structure and corporate governance within five years after the implementing of the Foreign Investment Law.

Interim Administrative Measures for the Record-filing of the Incorporation and Change of Foreign-invested Enterprises

On September 3, 2016, the Standing Committee of the National People’s Congress promulgated the Order of the Standing Committee of the National People’s Congress on Amending Four Laws Including the Law of the People’s Republic of China on Wholly Foreign-owned Enterprises (the “Order”), which provides record-filing in lieu of administrative approval for the establishments and alterations of foreign invested enterprises (the “FIEs”) not subject to special administrative measures. In order to provide more guidance for foreign-invested Enterprises, the MOFCOM issued the Interim Administrative Measures for the Record-filing for the Establishment and Alteration of Foreign-invested Enterprises (the “Interim Measure”) on October 8, 2016 (Revised in July 30, 2017 and June 29, 2018), or the Measures. The Measures provided detail instructions for foreign-invested enterprise to carry out record filing in terms of the change of the enterprise in China.

3

The M&A Rules

The Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, was jointly promulgated by MOFCOM, China Securities Regulatory Commission, or CSRC, the State-owned Assets Supervision and Administration Commission of the State Council, State Administration of Taxation, State Administration of Industry and Commerce and State Administration of Foreign Exchange, or SAFE, on August 8, 2006 and became effective as of September 8, 2006, and were later amended on June 22, 2009. This M&A Rules governs among other things, the purchase and subscription by foreign investors of equity interests in a domestic enterprise, and the purchase and operation by foreign investors of the assets and business of a domestic enterprise. An offshore special purpose vehicle, or SPV, is defined under the M&A Rules as an offshore entity directly or indirectly controlled by Chinese individuals or enterprises for the purpose of an overseas listing, and the main assets of which are the rights and interests in affiliated domestic enterprises. Under the M&A Rules, if a SPV intends to merge with or acquire any domestic enterprise affiliated from the Chinese individuals or enterprises that control the SPV, such proposed merger for approval. The M&A Rules also require that a SPV shall obtain an approval from the CSRC prior to the listing and trading of its securities on an overseas stock exchange.

Regulations Relating to Intellectual Property Rights

Software Copyright

The Copyright Law of the PRC, promulgated in 1990 and amended it in 2001 and 2010, and the Regulations on Computer Software Protection, promulgated by the State Council of the PRC on December 20, 2001 and revised on January 8, 2011 and January 1, 2013, provide protection to the rights and interests of computer software copyright holders. Pursuant to the Regulations on Computer Software Protection, software developed by PRC citizens, legal entities or other organizations is automatically protected immediately after its development, regardless of whether the software was published. A software copyright owner may register with the designated registration authorities and obtain a registration certificate, which serves as preliminary proof of ownership of the copyright and other registered matters. The operational procedures for the registration of software copyright and the registration of software copyright license and transfer agreements are set forth in the Measures on Computer Software Copyright Registration promulgated by the National Copyright Administration on February 20, 2002.

Patents

The NPCSC adopted the Patent Law of the PRC in 1984 and amended it in 1992, 2000 and 2008, respectively. A patentable invention, utility model or design must meet three conditions: novelty, inventiveness and practical applicability. Patents cannot be granted for scientific discoveries, rules and methods for intellectual activities, methods used to diagnose or treat diseases, animal and plant breeds or substances obtained by means of nuclear transformation. The Patent Office under the State Intellectual Property Office is responsible for receiving, examining and approving patent applications. A patent is valid for a twenty-year term for an invention and a ten-year term for a utility model or design, starting from the application date. Except under certain specific circumstances provided by law, any third party user must obtain consent or a proper license from the patent owner to use the patent, otherwise the use will constitute an infringement of the rights of the patent holder.

Domain Name

On November 5, 2004, the MIIT promulgated the Measures for Administration of Domain Names for the Chinese Internet, or the Domain Name Measures. According to the Domain Name Measures, “domain name” shall refer to the character identifier for identifying and locating the hierarchical structure of a computer on the Internet, which corresponds to the Internet protocol (IP) address of the computer concerned. A domain name registration service shall observe the principle of “first apply, first register”. Where the domain name is completed, the applicant for the domain name registration shall be the holder of the domain name.

Trademark

The PRC Trademark Law, adopted in 1982 and revised in 2001 and 2013, respectively, with its implementation rules adopted in 2002 and revised in 2014, protects registered trademarks. The Trademark Office handles trademark registrations and grants a protection term of ten years to registered trademarks.

4

Regulations on Foreign Exchange

Foreign Exchange Settlement

The Circular of the State Administration of Foreign Exchange on Reforming the Management Approach regarding the Settlement of Foreign Exchange Capital of Foreign-invested Enterprises, which was promulgated by the SAFE on March 30, 2015 and became effective as of June 1, 2015, adopts the approach of discretional foreign exchange settlement, under which the foreign exchange capital in the capital account of a foreign-invested enterprise for which the foreign-invested enterprise has obtained confirmation by the local SAFE branches regarding the rights and interests of monetary contribution (or the book-entry registration of monetary contribution by the banks) can be settled at the banks based on the actual operation needs of such foreign-invested enterprise. The capital in Renminbi obtained by the foreign-invested enterprise from the discretionary settlement of foreign exchange capital shall be managed under the account pending for foreign exchange settlement payment. The proportion of discretionary settlement of foreign exchange capital is temporarily determined as 100%, subject to the adjustment of the SAFE.

Regulations Relating to Foreign Exchange Registration of Overseas Investment by PRC Residents

SAFE Circular 37 promulgated by the SAFE in July 2014, requires PRC residents or entities to register with the SAFE or its local branch their establishment or control of an offshore entity established for the purpose of overseas investment or financing. In addition, such PRC residents or entities must update their SAFE registrations when the offshore special purpose vehicle undergoes material events relating to any change of its basic information (including change of such PRC citizens or residents, name and operation term, and etc.) increases or decreases in investment amount, transfers or exchanges of shares, or mergers or divisions, etc.

SAFE further enacted the Notice of the SAFE on Further Simplifying and Improving the Foreign Exchange Management Policies for Direct Investment, or the SAFE Notice 13, on February 13, 2015, which allows PRC residents or entities to register with qualified banks their establishment or control of an offshore entity established for the purpose of overseas investment or financing. However, remedial registration applications made by PRC residents that previously failed to comply with the SAFE Circular 37 will continue to fall under the jurisdiction of the relevant local branch of the SAFE. In the event that a PRC shareholder holding interests in a special purpose vehicle fails to fulfill the required SAFE registration, the PRC subsidiaries of that special purpose vehicle may be prohibited from distributing profits to the offshore parent and from carrying out subsequent cross-border foreign exchange activities. Further, the special purpose vehicle may be restricted in its ability to contribute additional capital into its PRC subsidiary.

Regulations Relating to Dividend Distribution

The principal laws and regulations regulating the distribution of dividends by FIEs in the PRC include the Company Law of the PRC, as amended in 1999, 2004, 2005, 2013 and 2018, the Wholly Foreign-owned Enterprise Law of the PRC promulgated in 1986 and last amended in 2016 and its implementation regulations promulgated in 1990 and subsequently amended in 2001 and 2014, the Equity Joint Venture Law of the PRC promulgated in 1979 and last amended in 2016 and its implementation regulations promulgated in 1983 and last amended in 2014, and the Cooperative Joint Venture Law of the PRC promulgated in 1988 and last amended in 2017 and its implementation regulations promulgated in 1995 and last amended in 2017. Under the current regulatory regime in the PRC, FIEs in the PRC may pay dividends only out of their accumulated profit, if any, determined in accordance with PRC accounting standards and regulations. Except otherwise provided by the laws regarding foreign investment, a PRC company is required to set aside at least 10% of its after-tax profit as general reserves until the cumulative amount of such reserves reaches 50% of the company’s registered capital. A PRC company shall not distribute any profits until any losses from prior fiscal years have been offset. Profits retained from prior fiscal years may be distributed together with distributable profits from the current fiscal year.

Regulations Relating to Foreign Debts

Considering that certain foreign debts may be generated during the oversea or domestic investment from PRC residents, the State Administration of Foreign Exchange promulgated the Administrative Measures for Registration of Foreign Debts, or the Measures, on April 28, 2013 and became effective on May 13, 2013. This Measures require the entity to complete several regulatory procedures in terms of foreign debts. For example, after borrowed the foreign debts, debtors shall carry out registration on local SAFE in relation to the execution of the contract, the drawdown, the prepayment or the foreign exchange settlement and sales within a specific period. For any change of the foreign debts contract, an amendment registration shall be carried out with the local SAFE.

5

Regulations Relating to Employment and Social Insurance

Pursuant to the PRC Labor Law effective as of January 1, 1995 (as amended on August 27, 2009), and the PRC Labor Contract Law effective as of January 1, 2008 (as amended on December 28, 2012), a written labor contract shall be executed by employer and an employee when the employment relationship is established, and an employer is under an obligation to sign an unlimited- term labor contract with any employee who has worked for the employer for ten consecutive years. In addition, if an employee requests or agrees to renew a fixed-term labor contract that has already been entered into twice consecutively, the resulting contract must include an unlimited term, with certain exceptions. All employers are required to establish a system for labor safety and sanitation, strictly abide by state rules and standards and provide employees with appropriate workplace safety training. Moreover, all PRC enterprises are generally required to implement a standard working time system of eight hours a day and forty hours a week, and if the implementation of such standard working time system is not appropriate due to the nature of the job or the on, the enterprise may implement a flexible working time system or comprehensive working time system after obtaining approvals from the relevant authorities.

According to the Social Insurance Law of China effective from July 1, 2011, and the Housing Fund Regulation which was amended and became effective on March 24, 2002, employers in China shall pay contributions to the social insurance plan and the housing fund plan for their employees, and such contribution amount payable shall be calculated based on the employee actual salary in accordance with the relevant regulations.

Regulations on Tax

PRC Enterprise Income Tax Law

On March 16, 2007, the National People’s Congress promulgated the Law of the PRC on Enterprise Income Tax, which was amended on February 24, 2017 and December 29, 2018, and on December 6, 2007, the State Council of the PRC enacted The Regulations for the Implementation of the Law on Enterprise Income Tax, or collectively, the EIT Law. According to the EIT Law, taxpayers consist of resident enterprises and non-resident enterprises. Resident enterprises are defined as enterprises that are established in China in accordance with PRC laws, or that are established in accordance with the laws of foreign countries but whose “de facto management body” is located in the PRC. Non-resident enterprises are defined as enterprises that are set up in accordance with the laws of foreign countries and whose de facto management body is located outside the PRC, but have either established institutions or premises in the PRC or have income generated from inside the PRC. Under the EIT Law and relevant implementing regulations, enterprises are subject to a uniform corporate income tax rate of 25%. However, if non-resident enterprises have not formed permanent establishments or premises in the PRC, or if they have formed permanent establishments or premises in the PRC but their relevant income derived in the PRC is not related to those establishments, then their enterprise income tax would be set at a rate of 10% for their income sourced from inside the PRC.

As noted, the EIT Law provides that an income tax rate of 10% will be applicable to dividends or other gains received by investors who are “non-resident enterprises” and who meet the requirements for the lower enterprise income tax rate. Such income tax on dividends may be reduced further by the tax treaties between China and the jurisdictions in which our non-PRC shareholders reside. Specifically, pursuant to an Arrangement between the PRC and the Hong Kong Special Administrative Region on the Avoidance of Double Taxation and Prevention of Fiscal Evasion, or the Double Tax Avoidance Arrangement, and other applicable PRC laws, if a Hong Kong enterprise (being the beneficial owner of dividends from a PRC enterprise) is determined by the competent PRC tax authority to have satisfied the relevant conditions and requirements under such Double Tax Avoidance Arrangement and other applicable laws, the 10% withholding tax on the dividends that the Hong Kong enterprise receives from the PRC enterprise may be reduced to 5% subject to approval from the relevant tax authority. However, based on the Notice on Certain Issues with Respect to the Enforcement of Dividend Provisions in Tax Treaties, or Notice No. 81, issued on February 20, 2009 by the State Tax Administration, if the relevant PRC tax authorities determine, in their discretion, that a company benefits from such reduced income tax rate due to a corporate structure or arrangement that is primarily tax-driven, such PRC tax authorities may adjust the preferential tax treatment. Moreover, based on the Announcement on Certain Issues Concerning the Recognition of Beneficial Owners in Tax Treaties, which was issued on February 3, 2018 by the State Tax Administration, conduit companies, which are established for the purpose of evading or reducing tax, or transferring or accumulating profits, shall not be recognized as beneficial owners and are thus not entitled to the above tax benefits.

PRC Value-added Tax Law

The Provisional Regulations of the PRC on Value-added Tax were promulgated by the State Council of the PRC on December 13,1993 and subsequently amended on November 10, 2008, February 6, 2016 and November 19, 2017. The Detailed Rules for the Implementation of the Provisional Regulations of the PRC on Value-added Tax (Revised in 2011) was promulgated by the Ministry of Finance and the SAT on December 15, 2008 and subsequently amended on October 28, 2011 (collectively, the “VAT Law”). According to the VAT Law, all enterprises and individuals engaged in the sale of goods, provision of processing, repair and replacement services, and importation of goods within the territory of the PRC must pay value-added tax, or VAT. Other than exports (subject to 0% VAT rate) and certain products listed in the VAT Law (subject to 11% VAT rate), the sale and importation of goods were generally subject to a VAT rate of 17%. Pursuant to the Circular of the Ministry of Finance and the State Administration of Taxation on Adjusting Value-added Tax Rates, which became effective on May 1, 2018, the previous applicable VAT rate of 17% and 11% are adjusted to 16% and 10%, respectively.

6

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding other statements in this Report. The following information should be read in conjunction with Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes in Part II, Item 8, “Financial Statements and Supplementary Data” of this Form 10-K.

The business, financial condition and operating results of the Company can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below, any one or more of which could, directly or indirectly, cause the Company’s actual financial condition and operating results to vary materially from past, or from anticipated future, financial condition and operating results. Any of these factors, in whole or in part, could materially and adversely affect the Company’s business, financial condition, operating results and stock price.

Because of the following factors, as well as other factors affecting the Company’s financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Risks Related to Our Business

We are an early stage company with a limited operating history. Our limited operating history may not provide an adequate basis to judge our future prospects and results of operations.

We have a limited operating history. Our first operating subsidiary, Pony Limousine Services Limited was established in Hong Kong on April 28, 2018 to engage in providing car services to travelers between Guangdong Province and Hong Kong. Pony Group Inc. was established in the State of Delaware on January 7, 2019. We have limited experience and operating history in the travel industry. Our limited history may not provide a meaningful basis for investors to evaluate our business, financial performance and prospects.

We face intense competition and could lose market share to our competitors, which could adversely affect our business, financial condition and results of operations.

The market for car services is intensely competitive and characterized by rapid changes in technology, shifting rider needs and frequent introductions of new services and offerings. We expect competition to continue, both from current competitors and new entrants in the market that may be well-established and enjoy greater resources or other strategic advantages. If we are unable to anticipate or react to these competitive challenges, our competitive position could weaken, or fail to improve, and we could experience a decline in revenue or growth stagnation that could adversely affect our business, financial condition and results of operations.

Our main competitors in mainland China and Hong Kong include Shenzhen Anxun Automobile Rental Co., Ltd., The Motor Transport Company of Guangdong and Hong Kong Limited and China Comfort (Shenzhen) Travel Services Co., Ltd.

Certain of our competitors have greater financial, technical, marketing, research and development, manufacturing and other resources, greater name recognition, longer operating histories or a larger user base than we do. They may be able to devote greater resources to the development, promotion and sale of offerings and offer lower prices than we do, which could adversely affect our results of operations. Further, they may have greater resources to deploy towards the research, development and commercialization of new technologies, or they may have other financial, technical or resource advantages. These factors may allow our competitors to derive greater revenue and profits from their existing user bases, attract and retain new qualified drivers and new riders at lower costs or respond more quickly to new and emerging technologies and trends. Our current and potential competitors may also establish cooperative or strategic relationships amongst themselves or with third parties that may further enhance their resources and offerings.

We believe that our ability to compete effectively depends upon many factors both within and beyond our control, including:

| ● | the popularity, utility, ease of use, performance and reliability of our offerings compared to those of our competitors; |

| ● | our reputation and brand strength relative to our competitors; |

| ● | the prices of our offerings and the fees we charge drivers on our platform; |

| ● | our ability to attract and retain qualified drivers and riders; |

| ● | our ability, and the ability of our competitors, to develop new offerings; |

7

| ● | our ability to establish and maintain relationships with partners; |

| ● | changes mandated by, or that we elect to make, to address, legislation, regulatory authorities or litigation, including settlements, judgments, injunctions and consent decrees; |

| ● | our ability to attract, retain and motivate talented employees; |

| ● | our ability to raise additional capital; and |

| ● | acquisitions or consolidation within our industry. |

If we are unable to compete successfully, our business, financial condition and results of operations could be adversely affected.

We could be subject to claims from riders, drivers or third parties that are harmed whether or not our service or platform is in use, which could adversely affect our business, brand, financial condition and results of operations.

We could be subject to claims, lawsuits, investigations and other legal proceedings relating to injuries to, or deaths of, riders, drivers or third parties that are attributed to us through our offerings. We may also be subject to claims alleging that we are directly or vicariously liable for the acts of the drivers from the car fleet companies that we collaborated with. We may be subject to personal injury claims whether or not such injury actually occurred as a result of activity on our platform. Regardless of the outcome of any legal proceeding, any injuries to, or deaths of, any riders, drivers or third parties could result in negative publicity and harm to our brand, reputation, business, financial condition and results of operations. Any of the foregoing risks could adversely affect our business, financial condition and results of operations.

We rely on other third-party service providers and if such third parties do not perform adequately or terminate their relationships with us, our costs may increase and our business, financial condition and results of operations could be adversely affected.

Our success depends in part on our relationships with other third-party service providers, such as Hong Kong Wanjin Industry Co., Limited and Yahong Business Limited. Further, from time to time, we enter into collaboration arrangement in connection with car fleets and drivers. If any of our partners terminates its relationship with us or refuses to renew its agreement with us on commercially reasonable terms, we would need to find an alternate provider, and may not be able to secure similar terms or replace such providers in an acceptable timeframe. We also rely on other software and services supplied by third parties, such as communications and internal software, and our business may be adversely affected to the extent such software and services do not meet our expectations, contain errors or vulnerabilities, are compromised or experience outages. Any of these risks could increase our costs and adversely affect our business, financial condition and results of operations. Further, any negative publicity related to any of our third-party partners, including any publicity related to quality standards or safety concerns, could adversely affect our reputation and brand, and could potentially lead to increased regulatory or litigation exposure.

If we are not able to successfully develop new offerings and enhance our existing offerings, our business, financial condition and results of operations could be adversely affected.

Our ability to attract new riders, retain existing riders and increase utilization of our offerings will depend in part on our ability to successfully create and introduce new offerings and to improve upon and enhance our existing offerings. As a result, we may introduce significant changes to our existing offerings or develop and introduce new and unproven offerings. Furthermore, new rider demands regarding service, the availability of superior competitive offerings or a deterioration in the quality of our offerings or our ability to bring new or enhanced offerings to market quickly and efficiently could negatively affect the attractiveness of our service and the economics of our business and require us to make substantial changes to and additional investments in our offerings or our business model. In addition, we frequently experiment with and test different offerings and marketing strategies. If these experiments and tests are unsuccessful, or if the offerings and strategies we introduce based on the results of such experiments and tests do not perform as expected, our ability to attract new qualified drivers and new riders, retain existing qualified drivers and existing riders and maintain or increase utilization of our offerings may be adversely affected.

Developing and launching new offerings or enhancements to the existing offerings involves significant risks and uncertainties, including risks related to the reception of such offerings by existing and potential future riders, increases in operational complexity, unanticipated delays or challenges in implementing such offerings or enhancements, increased strain on our operational and internal resources (including an impairment of our ability to accurately forecast rider demand) and negative publicity in the event such new or enhanced offerings are perceived to be unsuccessful. We have scaled our business rapidly, and significant new initiatives have in the past resulted in, and in the future may result in, operational challenges affecting our business. In addition, developing and launching new offerings and enhancements to our existing offerings may involve significant upfront capital investments and such investments may not generate return on investment. Any of the foregoing risks and challenges could negatively impact our ability to attract and retain qualified drivers and riders, our ability to increase utilization of our offerings and our visibility into expected results of operations, and could adversely affect our business, financial condition and results of operations. Additionally, since we are focused on building our community and ecosystems for the long-term, our near-term results of operations may be impacted by our investments in the future.

8

Any failure to offer high-quality user support may harm our relationships with users and could adversely affect our reputation, brand, business, financial condition and results of operations.

Our ability to attract and retain riders is dependent in part on the ease and reliability of our offerings, including our ability to provide high-quality support. Our customers depend on our support organization to resolve any issues relating to our offerings, such as being overcharged for a ride, leaving something in a driver’s vehicle or reporting a safety incident. Our ability to provide effective and timely support is largely dependent on our ability to attract and retain service providers who are qualified to support users and sufficiently knowledgeable regarding our offerings. As we continue to grow our business and improve our offerings, we will face challenges related to providing quality support services at scale. If we grow our international rider base, our support organization will face additional challenges, including those associated with delivering support in languages other than Chinese. Any failure to provide efficient user support, or a market perception that we do not maintain high-quality support, could adversely affect our reputation, brand, business, financial condition and results of operations.

Systems failures and resulting interruptions in the availability of our website, applications, platform or offerings could adversely affect our business, financial condition and results of operations.

Our systems, or those of third parties upon which we rely, may experience service interruptions or degradation because of hardware and software defects or malfunctions, distributed denial-of-service and other cyberattacks, human error, earthquakes, hurricanes, floods, fires, natural disasters, power losses, disruptions in telecommunications services, fraud, military or political conflicts, terrorist attacks, computer viruses, ransomware, malware or other events. Our systems also may be subject to break-ins, sabotage, theft and intentional acts of vandalism, including by our own employees. Some of our systems are not fully redundant and our disaster recovery planning may not be sufficient for all eventualities. Our business interruption insurance may not be sufficient to cover all of our losses that may result from interruptions in our service as a result of systems failures and similar events.

We will likely continue to experience system failures and other events or conditions from time to time that interrupt the availability or reduce or affect the speed or functionality of our offerings. These events have resulted in, and similar future events could result in, losses of revenue. A prolonged interruption in the availability or reduction in the availability, speed or other functionality of our offerings could adversely affect our business and reputation and could result in the loss of users. Moreover, to the extent that any system failure or similar event results in harm or losses to the users using our platform, we may make voluntary payments to compensate for such harm or the affected users could seek monetary recourse or contractual remedies from us for their losses and such claims, even if unsuccessful, would likely be time-consuming and costly for us to address.

Our business could be adversely impacted by changes in the Internet and mobile device accessibility of users and unfavorable changes in or our failure to comply with existing or future laws governing the Internet and mobile devices.

Our business depends on users’ access to our platform via a mobile device and the Internet. We may operate in jurisdictions that provide limited Internet connectivity, particularly as we expand internationally. Internet access and access to a mobile device are frequently provided by companies with significant market power that could take actions that degrade, disrupt or increase the cost of users’ ability to access our platform. In addition, the Internet infrastructure that we and users of our platform rely on in any particular geographic area may be unable to support the demands placed upon it. Any such failure in Internet or mobile device accessibility, even for a short period of time, could adversely affect our results of operations.

The impact of any kind of epidemic, such as the coronavirus, on our operations, and the operations of the car fleet companies, may harm our business.

Our business could be adversely affected by the outbreaks of epidemics in China and globally, such as the Corona Virus Disease 2019, or COVID-19 originated in Wuhan, China, Ebola virus disease, H1N1 flu, H7N9 flu, avian flu, Severe Acute Respiratory Syndrome, or SARS, or other epidemics. Past occurrences of epidemics have caused different degrees of damage to the national and local economies. A recurrence of an outbreak of any kind of epidemic could cause a slowdown in the levels of economic activity generally, which may adversely affect our business, financial condition and results of operations. Should major public health issues, including pandemics, arise, we could be adversely affected by more stringent travel restrictions, additional limitations in car services and governmental actions limiting the movement of people between regions.

9

Moreover, we are subject to a number of laws and regulations specifically governing the Internet and mobile devices that are constantly evolving. Existing and future laws and regulations, or changes thereto, may impede the growth and availability of the Internet and online offerings, require us to change our business practices or raise compliance costs or other costs of doing business. These laws and regulations, which continue to evolve, cover taxation, privacy and data protection, pricing, copyrights, distribution, mobile and other communications, advertising practices, consumer protections, the provision of online payment services, unencumbered Internet access to our offerings and the characteristics and quality of online offerings, among other things. Any failure, or perceived failure, by us to comply with any of these laws or regulations could result in damage to our reputation and brand a loss in business and proceedings or actions against us by governmental entities or others, which could adversely impact our results of operations.

We rely on mobile operating systems and application marketplaces to make our apps available to the drivers and riders on our platform, and if we do not effectively operate with or receive favorable placements within such application marketplaces and maintain high rider reviews, our usage or brand recognition could decline and our business, financial results and results of operations could be adversely affected.

We depend in part on mobile operating systems, such as Android and iOS, and their respective application marketplaces to make our apps available to the drivers and riders on our platform. Any changes in such systems and application marketplaces that degrade the functionality of our apps or give preferential treatment to our competitors’ apps could adversely affect our platform’s usage on mobile devices. If such mobile operating systems or application marketplaces limit or prohibit us from making our apps available to drivers and riders, make changes that degrade the functionality of our apps, increase the cost of using our apps, impose terms of use unsatisfactory to us or modify their search or ratings algorithms in ways that are detrimental to us, or if our competitors’ placement in such mobile operating systems’ application marketplace is more prominent than the placement of our apps, overall growth in our rider or driver base could slow. Our apps have experienced fluctuations in number of downloads in the past, and we anticipate similar fluctuations in the future. Any of the foregoing risks could adversely affect our business, financial condition and results of operations.

As new mobile devices and mobile platforms are released, there is no guarantee that certain mobile devices will continue to support our platform or effectively roll out updates to our apps. Additionally, in order to deliver high-quality apps, we need to ensure that our offerings are designed to work effectively with a range of mobile technologies, systems, networks and standards. We may not be successful in developing or maintaining relationships with key participants in the mobile industry that enhance drivers’ and riders’ experience. If drivers or riders on our platform encounter any difficulty accessing or using our apps on their mobile devices or if we are unable to adapt to changes in popular mobile operating systems, our business, financial condition and results of operations could be adversely affected.

We depend on the interoperability of our platform across third-party applications and services that we do not control.

We have integrations with AutoNavi Maps (also known as Gaode Maps) and a variety of other productivity, collaboration, travel, data management and security vendors. As our offerings expand and evolve, including as we develop autonomous technology, we may have an increasing number of integrations with other third-party applications, products and services. Third-party applications, products and services are constantly evolving, and we may not be able to maintain or modify our platform to ensure its compatibility with third-party offerings following development changes. As our mobile application and respective products evolve, we expect the types and levels of competition to increase. Should any of our competitors or technology partners modify their products, standards or terms of use in a manner that degrades the functionality or performance of our platform or is otherwise unsatisfactory to us or gives preferential treatment to competitive products or services, our products, platform, business, financial condition and results of operations could be adversely affected.

10

Failure to protect or enforce our intellectual property rights could harm our business, financial condition and results of operations.

Our success is dependent in part upon protecting our intellectual property rights and technology (such as code, information, data, processes and other forms of information, knowhow and technology), or intellectual property. We rely on a combination of patents, copyrights, trademarks, service marks, trade secret laws and contractual restrictions to establish and protect our intellectual property. However, the steps we take to protect our intellectual property may not be sufficient or effective. Even if we do detect violations, we may need to engage in litigation to enforce our rights. Any enforcement efforts we undertake, including litigation, could be time-consuming and expensive and could divert management attention. While we take precautions designed to protect our intellectual property, it may still be possible for competitors and other unauthorized third parties to copy our technology and use our proprietary information to create or enhance competing solutions and services, which could adversely affect our position in our rapidly evolving and highly competitive industry.

We may be required to spend significant resources in order to monitor and protect our intellectual property rights, and some violations may be difficult or impossible to detect. Litigation to protect and enforce our intellectual property rights could be costly, time-consuming and distracting to management and could result in the impairment or loss of portions of our intellectual property. Our efforts to enforce our intellectual property rights may be met with defenses, counterclaims and countersuits attacking the validity and enforceability of our intellectual property rights. Our inability to protect our proprietary technology against unauthorized copying or use, as well as any costly litigation or diversion of our management’s attention and resources, could impair the functionality of our platform, delay introductions of enhancements to our platform, result in our substituting inferior or more costly technologies into our platform or harm our reputation or brand. In addition, we may be required to license additional technology from third parties to develop and market new offerings or platform features, which may not be on commercially reasonable terms or at all and could adversely affect our ability to compete.

Our industry has also been subject to attempts to steal intellectual property, particularly regarding autonomous vehicle development, including by foreign actors. We, along with others in our industry, have been the target of attempted thefts of our intellectual property and may be subject to such attempts in the future. Although we take measures to protect our property, if we are unable to prevent the theft of our intellectual property or its exploitation, the value of our investments may be undermined and our business, financial condition and results of operations may be negatively impacted.

Our platform contains third-party open source software components, and failure to comply with the terms of the underlying open source software licenses could restrict our ability to provide our offerings.

Our platform contains software modules licensed to us by third-party authors under “open source” licenses. Use and distribution of open source software may entail greater risks than use of third-party commercial software, as open source licensors generally do not provide support, warranties, indemnification or other contractual protections regarding infringement claims or the quality of the code. In addition, the public availability of such software may make it easier for others to compromise our platform.

Some open source licenses contain requirements that we make available source code for modifications or derivative works we create based upon the type of open source software we use, or grant other licenses to our intellectual property. If we combine our proprietary software with open source software in a certain manner, we could, under certain open source licenses, be required to release the source code of our proprietary software to the public. This would allow our competitors to create similar offerings with lower development effort and time and ultimately could result in a loss of our competitive advantages. Alternatively, to avoid the public release of the affected portions of our source code, we could be required to expend substantial time and resources to re-engineer some or all of our software. If we are held by the court to have breached or failed to fully comply with all the terms and conditions of an open source software license, we could face infringement or other liability, or be required to seek costly licenses from third parties to continue providing our offerings on terms that are not economically feasible, to re-engineer our platform, to discontinue or delay the provision of our offerings if re-engineering could not be accomplished on a timely basis or to make generally available, in source code form, our proprietary code, any of which could adversely affect our business, financial condition and results of operations.

11

Our business and results of operations are also subject to global economic conditions, including any resulting effect on spending by us or our riders. If general economic conditions deteriorate in China or in other markets where we operate, discretionary spending may decline and demand for ridesharing may be reduced. An economic downturn resulting in a prolonged recessionary period may have a further adverse effect on our revenue.

Failure to maintain our reputation and brand image could negatively impact our business.

Our brand has received a certain level of recognition in mainland China, Hong Kong. Our success depends on our ability to maintain and enhance our brand image and reputation. We could be adversely affected if our brand is tarnished or receives negative publicity. In addition, adverse publicity about regulatory or legal action against us could damage our reputation and brand image, undermine consumer confidence in us, and reduce long-term demand for our products, even if the regulatory or legal action is unfounded or not material to our operations.

In addition, our success in maintaining, extending and expanding our brand image depends on our ability to adapt to a rapidly changing media and internet environment, including our reliance on online advertising. Negative posts or comments about us on social networking websites could seriously damage our reputation and brand image. If we do not maintain, extend and expand our brand image, our product sales, financial condition or results of operations could be materially and adversely affected.

Our success is dependent on retaining key personnel who would be difficult to replace.

Our success depends largely on the continued services of our key management members. In particular, our success depends on the continued efforts of Ms. Wenxian Fan, our founder and Chief Executive Officer, President and Director. There can be no assurance that Ms. Fan will continue in her present capacities for any particular period of time. The loss of the services of Ms. Fan could materially and adversely affect our business development and our ability to expand and grow.

The legal requirements associated with being a public company, including those contained in and issued under the Sarbanes-Oxley Act, may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain listing of our common stock.

We may be unable to attract and retain qualified officers and directors necessary to provide for our effective management because of the rules and regulations that govern publicly listed companies, including, but not limited to, certifications by principal executive officers. Currently, our Chief Executive Officer does not have extensive experience in operating a U.S. public company. Moreover, the actual and perceived personal risks associated with compliance with the Sarbanes-Oxley Act and other public company requirements may deter qualified individuals from accepting roles as directors and executive officers. At present, we do not maintain an independent board of directors. Further, the requirements for board or committee membership, particularly with respect to an individual’s independence and level of experience in finance and accounting matters, may make it difficult to attract and retain qualified board members going forward. If we are unable to attract and retain qualified officers and directors, the management of our business and our ability to obtain or retain the listing of our common stock on any stock exchange (assuming we are able to obtain such listing) could be adversely affected.

If we fail to establish and maintain an effective system of internal controls, we may not be able to report our financial results accurately or prevent fraud. Any inability to report and file our financial results accurately and timely could harm our business and adversely impact the trading price of our common stock.

We are required to establish and maintain internal controls over financial reporting, disclosure controls and to comply with other requirements of the Sarbanes-Oxley Act and the rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”) thereunder. Our senior management, which currently consists of Ms. Fan, cannot guarantee that our internal controls and disclosure procedures will prevent all possible errors or all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a control system must reflect the fact that there are resource constraints and the benefit of controls must be relative to their costs. Because of the inherent limitations in all control systems, no system of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. Further, controls can be circumvented by individual acts of some persons, by collusion of two or more persons, or by management’s override of the controls. The design of any system of controls is also based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, a control may become inadequate because of changes in conditions or the degree of compliance with policies or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected.

12

Operating as a public company requires us to incur substantial costs and requires substantial management attention. In addition, key members of our management team have limited experience managing a public company.

As a public company, we will incur substantial legal, accounting and other expenses that we did not incur as a private company. For example, we are subject to the reporting requirements of the Exchange Act, the applicable requirements of the Sarbanes-Oxley Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, the rules and regulations of the SEC and the listing standards of the Nasdaq Global Select Market. For example, the Exchange Act requires, among other things, we file annual, quarterly and current reports with respect to our business, financial condition and results of operations. Compliance with these rules and regulations will increase our legal and financial compliance costs, and increase demand on our systems, particularly after we are no longer an emerging growth company. In addition, as a public company, we may be subject to stockholder activism, which can lead to additional substantial costs, distract management and impact the manner in which we operate our business in ways we cannot currently anticipate. As a result of disclosure of information in this prospectus and in filings required of a public company, our business and financial condition will become more visible, which may result in threatened or actual litigation, including by competitors.

Our current management has limited experience managing a publicly traded company, interacting with public company investors and complying with the increasingly complex laws pertaining to public companies. Our management team may not successfully or efficiently manage our transition to being a public company subject to significant regulatory oversight and reporting obligations under the federal securities laws and the continuous scrutiny of securities analysts and investors. These new obligations and constituents will require significant attention from our senior management and could divert their attention away from the day-to-day management of our business, which could adversely affect our business, financial condition and results of operations.

As an “emerging growth company” under applicable law, we will be subject to lessened disclosure requirements, which could leave our shareholders without information or rights available to shareholders of more mature companies.

For as long as we remain an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (which we refer to herein as the JOBS Act), we have elected to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| ● | taking advantage of an extension of time to comply with new or revised financial accounting standards; |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We expect to take advantage of these reporting exemptions until we are no longer an “emerging growth company.” Because of these lessened regulatory requirements, our shareholders would be left without information or rights available to shareholders of more mature companies.

Because we have elected to use the extended transition period for complying with new or revised accounting standards for an “emerging growth company,” our financial statements may not be comparable to companies that comply with public company effective dates.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates. Consequently, our financial statements may not be comparable to companies that comply with public company effective dates. As such, investors may have difficulty evaluating or comparing our business, performance or prospects in comparison to other public companies, which may have a negative impact on the value and liquidity of shares of our common stock.

13

Risks Related to Doing Business in China

Changes in the political and economic policies of the PRC government may materially and adversely affect our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies.

Most of our operations are conducted in the PRC and a significant percentage of our revenue is sourced from the PRC. Accordingly, our financial condition and results of operations are affected to a significant extent by economic, political and legal developments in the PRC.

The PRC economy differs from the economies of most developed countries in many respects, including the extent of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth by allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, regulating financial services and institutions and providing preferential treatment to particular industries or companies.

While the PRC economy has experienced significant growth in the past three decades, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall PRC economy, but may also have a negative effect on us. Our financial condition and results of operation could be materially and adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. In addition, the PRC government has implemented in the past certain measures, including interest rate increases, to control the pace of economic growth. These measures may cause decreased economic activity, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our businesses, financial condition and results of operations.

We must remit the offering proceeds to China before they may be used to benefit our business in China, and we cannot assure that we can finish all necessary governmental registration processes in a timely manner.