Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Outlook Therapeutics, Inc. | tm2123933d1_ex99-1.htm |

| 8-K - FORM 8-K - Outlook Therapeutics, Inc. | tm2123933d1_8k.htm |

Exhibit 99.2

ONS - 5010: NORSE TWO Top - Line Results August 3, 2021 NASDAQ: OTLK outlooktherapeutics.com

This presentation contains forward - looking statements about Outlook Therapeutics, Inc . (“Outlook Therapeutics” or the “Company”) based on management’s current expectations, which are subject to known and unknown uncertainties and risks . Words such as “anticipated,” “initiate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “may,” “will,” and variations of these words or similar expressions are intended to identify forward - looking statements . These forward - looking statements include, among others, statements about ONS - 5010 ’s potential as the first FDA - approved ophthalmic formulation of bevacizumab - vikg , our expectations for ONS - 5010 market exclusivity, the timing of BLA submission and commercial launch of ONS - 5010 , ONS - 5010 ’s ability to replace and address issues with off - label use of Avastin, other drug candidates in development, commercial drivers for ONS - 5010 and its potential, as well as the success of ongoing ONS - 5010 trials for wet AMD and regarding planned trials for ONS - 5010 for DME and BRVO . Our actual results could differ materially from those discussed due to a number of factors, including, but not limited to, the risks inherent in developing pharmaceutical product candidates, conducting successful clinical trials, and obtaining regulatory approvals, as well as our ability to raise additional equity and debt financing on favorable terms, among other risk factors . These risks are described in more detail under the caption “Risk Factors” in our Annual Report on Form 10 - K and other filings with the Securities and Exchange Commission (“SEC”) . Moreover, Outlook Therapeutics operates in a very competitive and rapidly changing environment . New risks emerge from time to time . It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statement . In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied . Except as required by law, neither Outlook Therapeutics nor any other person assumes responsibility for the accuracy and completeness of the forward - looking statements . We are providing this information as of the date of this presentation and do not undertake any obligation to update any forward - looking statements contained in this presentation as a result of new information, future events or otherwise . This presentation contains trademarks, registered marks and trade names of Outlook Therapeutics and of other companies . All such trademarks, registered marks and trade names are the property of their respective holders . 2 Disclaimer

Call Agenda • Introduction and Opening Remarks • NORSE TWO: Study Design and Demographics • NORSE TWO Top - line Efficacy and Safety Results • Wet AMD Market Overview • Commercial Strategy • Next Steps 3

Executing on Pathway Towards Potential FDA Approval in Wet AMD 4 Open - Label Safety Study Supports BLA Requirements x Completed Clinical Experience Trial 1 st Registration Trial x Positive Results U.S. BLA Filing Targeted Calendar Q1 2022 Pivotal Trial 2 nd Registration Trial x Positive Top - line Data

5 Pivotal Trial 2 nd Registration Trial Trial Highlights: • Randomized masked controlled trial • ONS - 5010 (bevacizumab - vikg ) vs LUCENTIS® (ranibizumab) • 228 patients enrolled • Trial conducted in the United States • Trial arms included >95% treatment - naïve patients • Safety & efficacy data support planned U.S. BLA submission in calendar Q1 2022

Terry Dagnon Chief Operating Officer 6

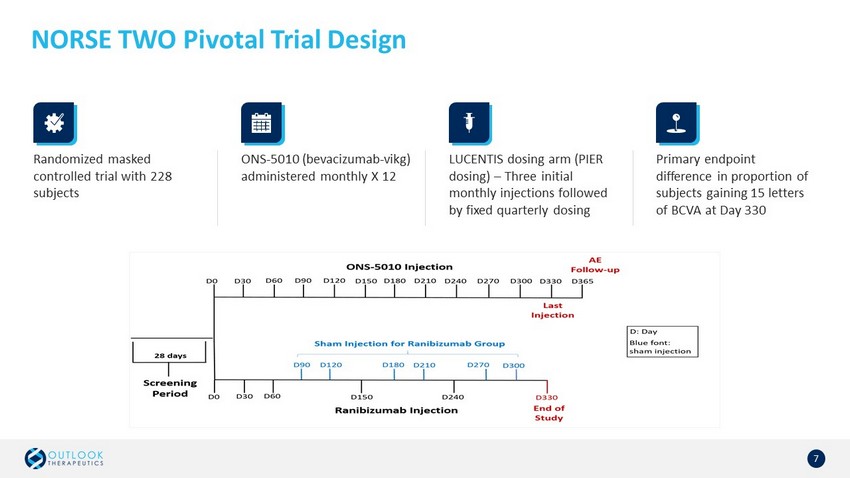

NORSE TWO Pivotal Trial Design 7 ONS - 5010 (bevacizumab - vikg ) administered monthly X 12 LUCENTIS dosing arm (PIER dosing) – Three initial monthly injections followed by fixed quarterly dosing Primary endpoint difference in proportion of subjects gaining 15 letters of BCVA at Day 330 Randomized masked controlled trial with 228 subjects

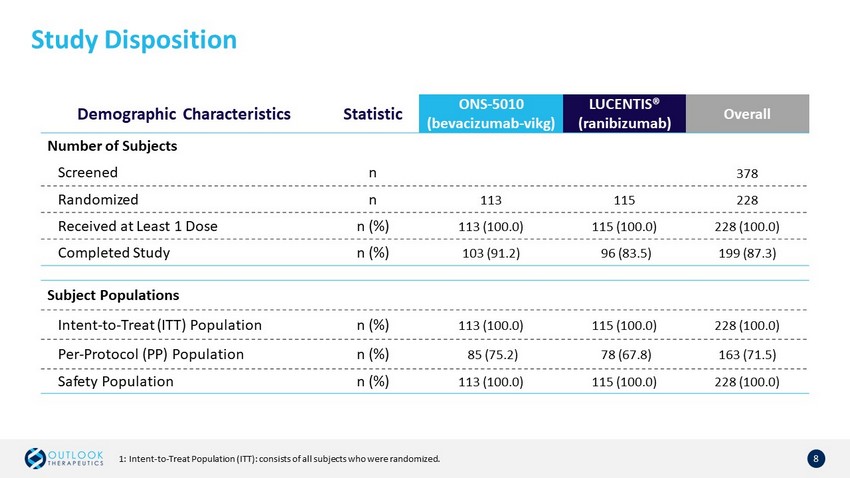

Study Disposition 8 Demographic Characteristics Statistic ONS - 5010 (bevacizumab - vikg ) LUCENTIS® ( ranibizumab) Overall Number of Subjects Screened n 378 Randomized n 113 115 228 Received at Least 1 Dose n (%) 113 (100.0) 115 (100.0) 228 (100.0) Completed Study n (%) 103 (91.2) 96 (83.5) 199 (87.3) Subject Populations Intent - to - Treat (ITT) Population n (%) 113 (100.0) 115 (100.0) 228 (100.0) Per - Protocol (PP) Population n (%) 85 (75.2) 78 (67.8) 163 (71.5) Safety Population n (%) 113 (100.0) 115 (100.0) 228 (100.0) 1: Intent - to - Treat Population (ITT): consists of all subjects who were randomized.

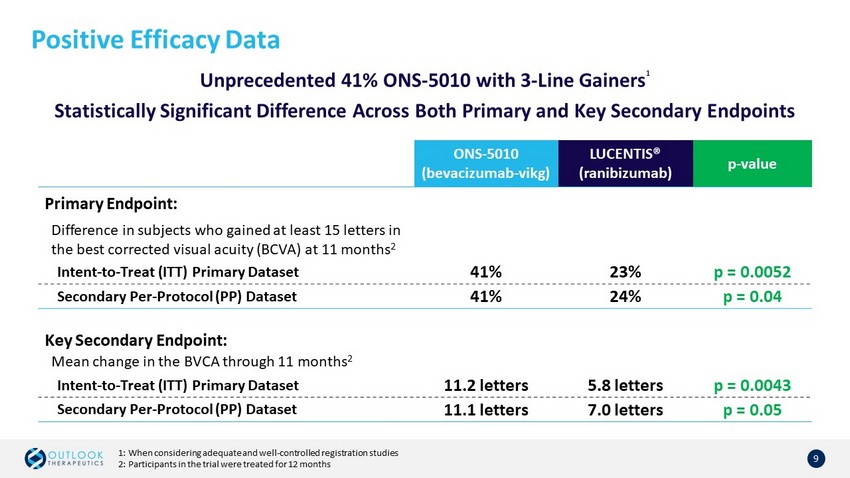

Positive Efficacy Data 9 Unprecedented 41% ONS - 5010 with 3 - Line Gainers 1 Statistically Significant Difference Across Both Primary and Key Secondary Endpoints ONS - 5010 (bevacizumab - vikg ) LUCENTIS® ( ranibizumab) p - value Primary Endpoint: Difference in subjects who gained at least 15 letters in the best corrected visual acuity (BCVA) at 11 months 2 Intent - to - Treat (ITT) Primary Dataset 41% 23% p = 0.0052 Secondary Per - Protocol (PP) Dataset 41% 24% p = 0.04 Key Secondary Endpoint: Mean change in the BVCA through 11 months 2 Intent - to - Treat (ITT) Primary Dataset 11.2 letters 5.8 letters p = 0.0043 Secondary Per - Protocol (PP) Dataset 11.1 letters 7.0 letters p = 0.05 1: When considering adequate and well - controlled registration studies 2: Participants in the trial were treated for 12 months

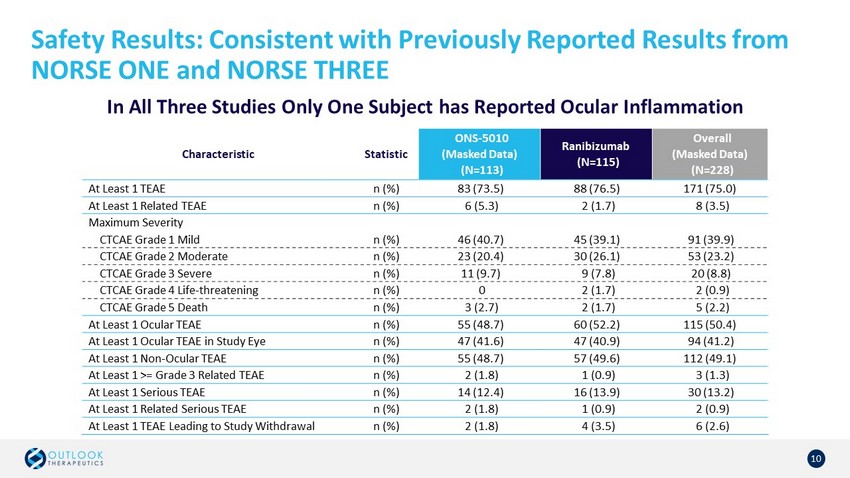

Safety Results: Consistent with Previously Reported Results from NORSE ONE and NORSE THREE 10 In All Three Studies Only One Subject has Reported Ocular Inflammation Characteristic Statistic ONS - 5010 (Masked Data) (N=113) Ranibizumab (N=115) Overall (Masked Data) (N=228) At Least 1 TEAE n (%) 83 (73.5) 88 (76.5) 171 (75.0) At Least 1 Related TEAE n (%) 6 (5.3) 2 (1.7) 8 (3.5) Maximum Severity CTCAE Grade 1 Mild n (%) 46 (40.7) 45 (39.1) 91 (39.9) CTCAE Grade 2 Moderate n (%) 23 (20.4) 30 (26.1) 53 (23.2) CTCAE Grade 3 Severe n (%) 11 (9.7) 9 (7.8) 20 (8.8) CTCAE Grade 4 Life - threatening n (%) 0 2 (1.7) 2 (0.9) CTCAE Grade 5 Death n (%) 3 (2.7) 2 (1.7) 5 (2.2) At Least 1 Ocular TEAE n (%) 55 (48.7) 60 (52.2) 115 (50.4) At Least 1 Ocular TEAE in Study Eye n (%) 47 (41.6) 47 (40.9) 94 (41.2) At Least 1 Non - Ocular TEAE n (%) 55 (48.7) 57 (49.6) 112 (49.1) At Least 1 >= Grade 3 Related TEAE n (%) 2 (1.8) 1 (0.9) 3 (1.3) At Least 1 Serious TEAE n (%) 14 (12.4) 16 (13.9) 30 (13.2) At Least 1 Related Serious TEAE n (%) 2 (1.8) 1 (0.9) 2 (0.9) At Least 1 TEAE Leading to Study Withdrawal n (%) 2 (1.8) 4 (3.5) 6 (2.6)

11 C. Russell Trenary III President & Chief Executive Officer

Summary of NORSE TWO Results x NORSE TWO demonstrated statistical significance across primary and key secondary endpoints x In NORSE TWO ONS - 5010 was demonstrated to be safe and well tolerated x NORSE TWO is the final step needed in clinical evaluation of ONS - 5010 x Confidence as we move forward with U.S. FDA BLA preparation and submission targeted for calendar Q1 2022 12

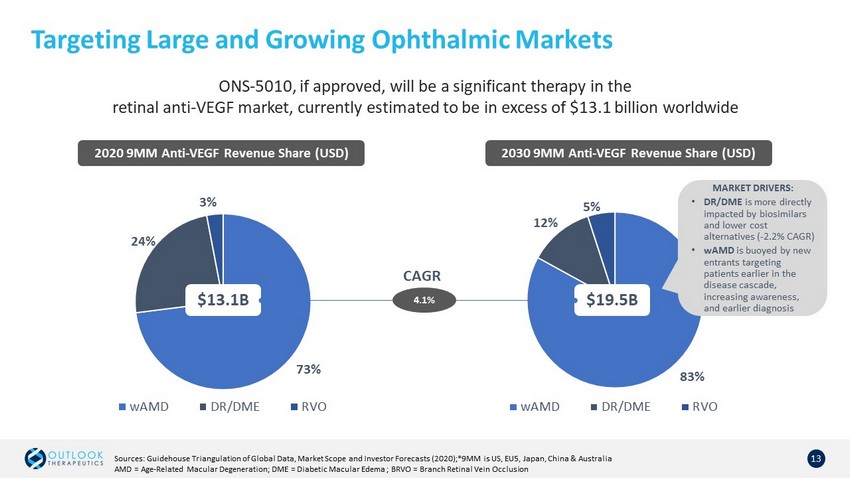

Targeting Large and Growing Ophthalmic Markets 13 83% 12% 5% wAMD DR/DME RVO 73% 24% 3% wAMD DR/DME RVO 2020 9MM Anti - VEGF Revenue Share (USD) $13.1B 2030 9MM Anti - VEGF Revenue Share (USD) Sources: Guidehouse Triangulation of Global Data, Market Scope and Investor Forecasts (2020);*9MM is US, EU5, Japan, China & Australia AMD = Age - Related Macular Degeneration; DME = Diabetic Macular Edema ; BRVO = Branch Retinal Vein Occlusion $19.5B 4.1% CAGR MARKET DRIVERS: • DR/DME is more directly impacted by biosimilars and lower cost alternatives ( - 2.2% CAGR) • wAMD is buoyed by new entrants targeting patients earlier in the disease cascade, increasing awareness, and earlier diagnosis ONS - 5010, if approved, will be a significant therapy in the retinal anti - VEGF market, currently estimated to be in excess of $13.1 billion worldwide

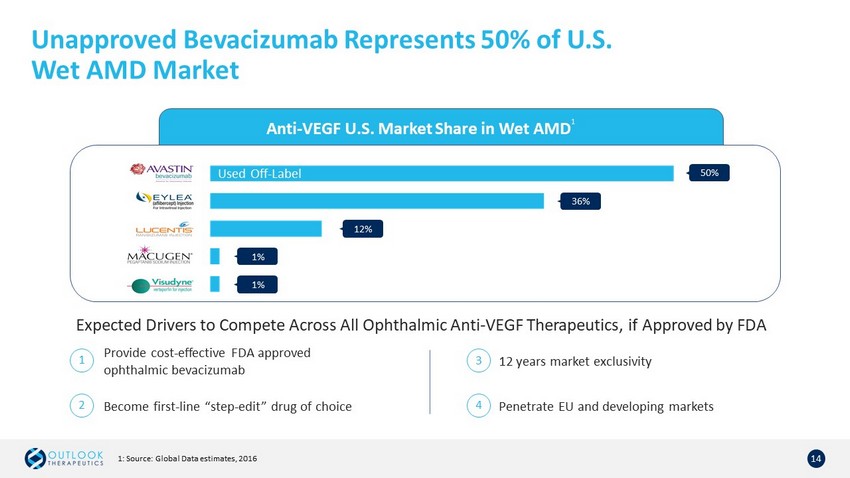

Unapproved Bevacizumab Represents 50% of U.S. Wet AMD Market 14 Anti - VEGF U.S. Market Share in Wet AMD 1 50% 12% 1% 1% 36% Used Off - Label Expected Drivers to Compete Across All Ophthalmic Anti - VEGF Therapeutics, if Approved by FDA 1 2 Provide cost - effective FDA approved ophthalmic bevacizumab Become first - line “step - edit” drug of choice 3 12 years market exclusivity 4 Penetrate EU and developing markets 1: Source: Global Data estimates, 2016

Commercial Planning Activities Underway 15 If ONS - 5010 (bevacizumab - vikg ) is FDA approved and has a cost - effective profile, Outlook Therapeutics expects ONS - 5010 to be widely adopted by payors and clinicians worldwide and to become the first - line drug of choice for payor - mandated “step - edit” in the United States for retinal indications Physician and Patient Outreach Aligning Key Opinion Leaders Payor Community Engagement

Manufacturing and Regulatory Progress Towards Commercialization 16 Manufacturing Best - in - class cGMP manufacturing partners Pre - Filled Syringes Supply agreement for a best - in - class pre - filled ophthalmic syringe Regulatory Achieved requirements agreed upon with the FDA

Next Steps • On target for U.S. FDA BLA submission in calendar Q1 2022 • Accelerate pre - commercial activities to support potential launch - Manufacturing - Distribution - Sales force planning - Physician and payor advisory boards - Key opinion leader support 17

Goal: 18 Enhance the Standard of Care in Treating Retinal Disorders

19 Q&A

Thank you! 20 Employees Patients Investigators Partners Investors CROs

Thank you! NASDAQ: OTLK outlooktherapeutics.com Investor Relations JTC Team 833.475.8247 otlk@jtcir.com