Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GERMAN AMERICAN BANCORP, INC. | gabc-20210803.htm |

German American Symbol: GABC August 3 – 5, 2021 KBW Community Bank Investor Conference

Presented By 2 Mark A. Schroeder, Chairman and CEO (812) 482-0701 mark.schroeder@germanamerican.com D. Neil Dauby, President and Chief Operating Officer (812) 482-0707 neil.dauby@germanamerican.com Bradley M. Rust, Senior Executive Vice President and CFO (812) 482-0718 brad.rust@germanamerican.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS When used in this presentation and our oral statements, the words or phrases “believe,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation, and we do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2020 as updated and supplemented by our other SEC reports filed from time to time. 3

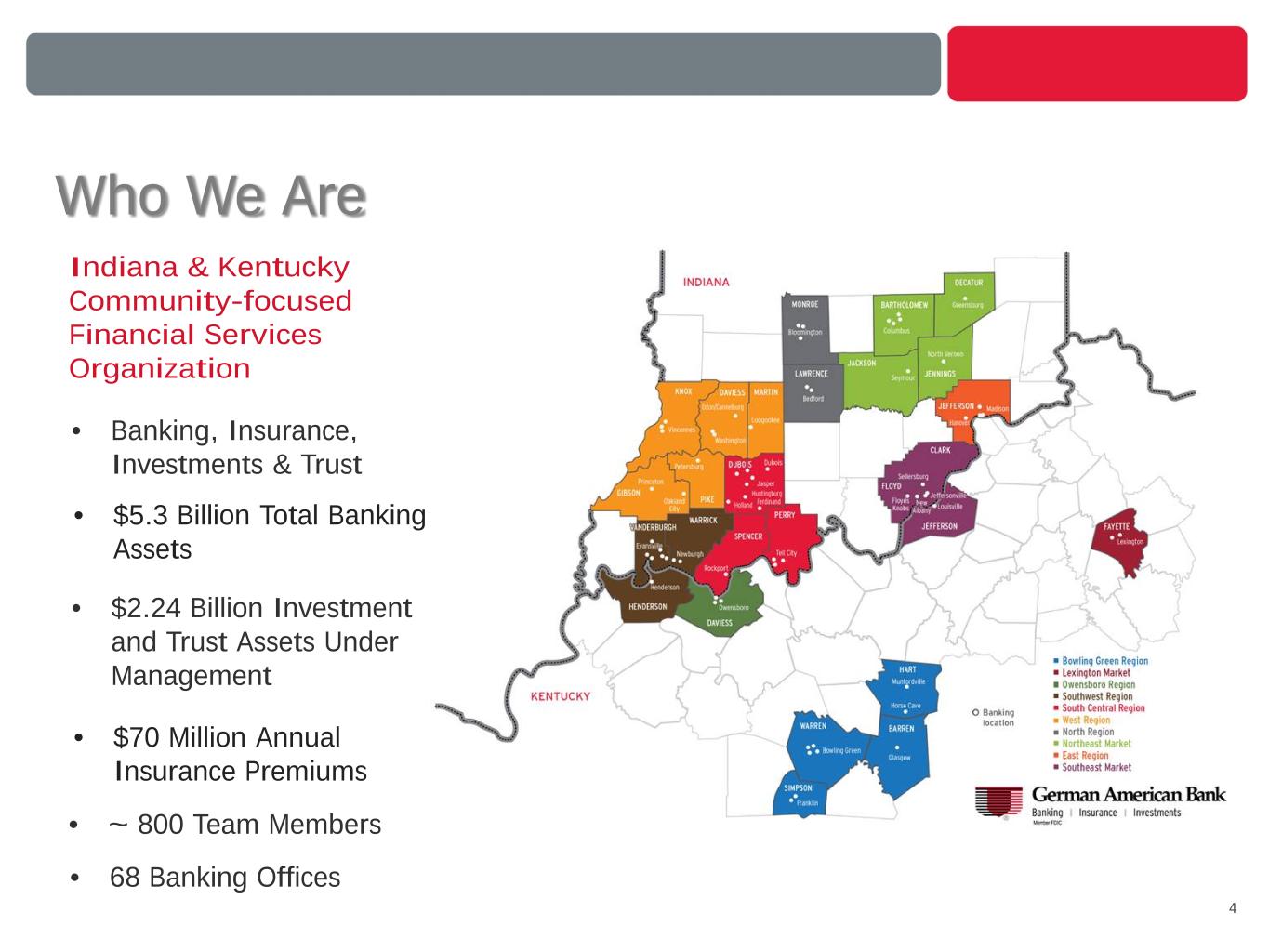

Who We Are Indiana & Kentucky Community-focused Financial Services Organization • Banking, Insurance, Investments & Trust • $5.3 Billion Total Banking Assets • $2.24 Billion Investment and Trust Assets Under Management • $70 Million Annual Insurance Premiums • ~ 800 Team Members • 68 Banking Offices 4

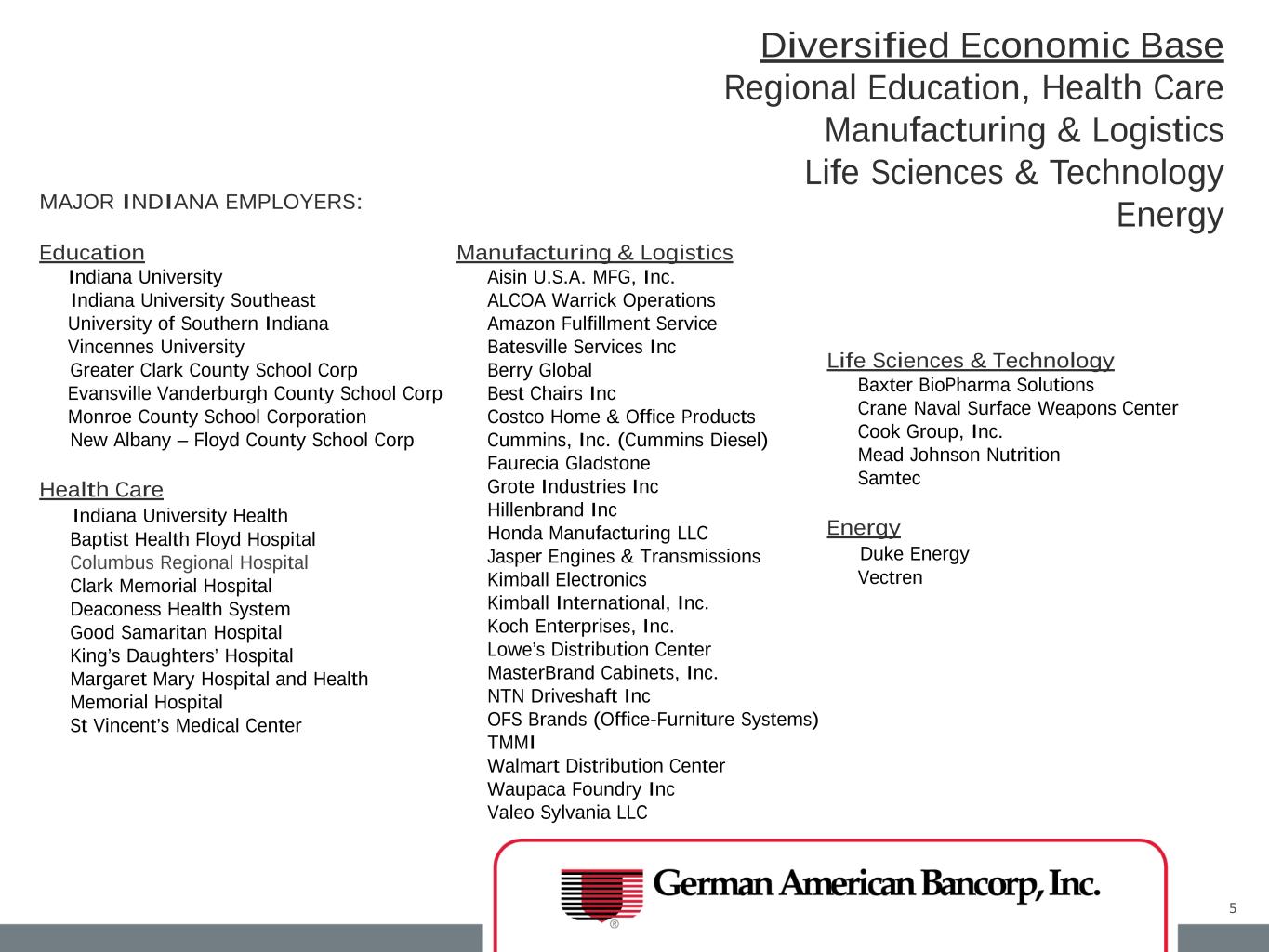

5 Diversified Economic Base Regional Education, Health Care Manufacturing & Logistics Life Sciences & Technology EnergyMAJOR INDIANA EMPLOYERS: Education Indiana University Indiana University Southeast University of Southern Indiana Vincennes University Greater Clark County School Corp Evansville Vanderburgh County School Corp Monroe County School Corporation New Albany – Floyd County School Corp Health Care Indiana University Health Baptist Health Floyd Hospital Columbus Regional Hospital Clark Memorial Hospital Deaconess Health System Good Samaritan Hospital King’s Daughters’ Hospital Margaret Mary Hospital and Health Memorial Hospital St Vincent’s Medical Center Manufacturing & Logistics Aisin U.S.A. MFG, Inc. ALCOA Warrick Operations Amazon Fulfillment Service Batesville Services Inc Berry Global Best Chairs Inc Costco Home & Office Products Cummins, Inc. (Cummins Diesel) Faurecia Gladstone Grote Industries Inc Hillenbrand Inc Honda Manufacturing LLC Jasper Engines & Transmissions Kimball Electronics Kimball International, Inc. Koch Enterprises, Inc. Lowe’s Distribution Center MasterBrand Cabinets, Inc. NTN Driveshaft Inc OFS Brands (Office-Furniture Systems) TMMI Walmart Distribution Center Waupaca Foundry Inc Valeo Sylvania LLC Life Sciences & Technology Baxter BioPharma Solutions Crane Naval Surface Weapons Center Cook Group, Inc. Mead Johnson Nutrition Samtec Energy Duke Energy Vectren

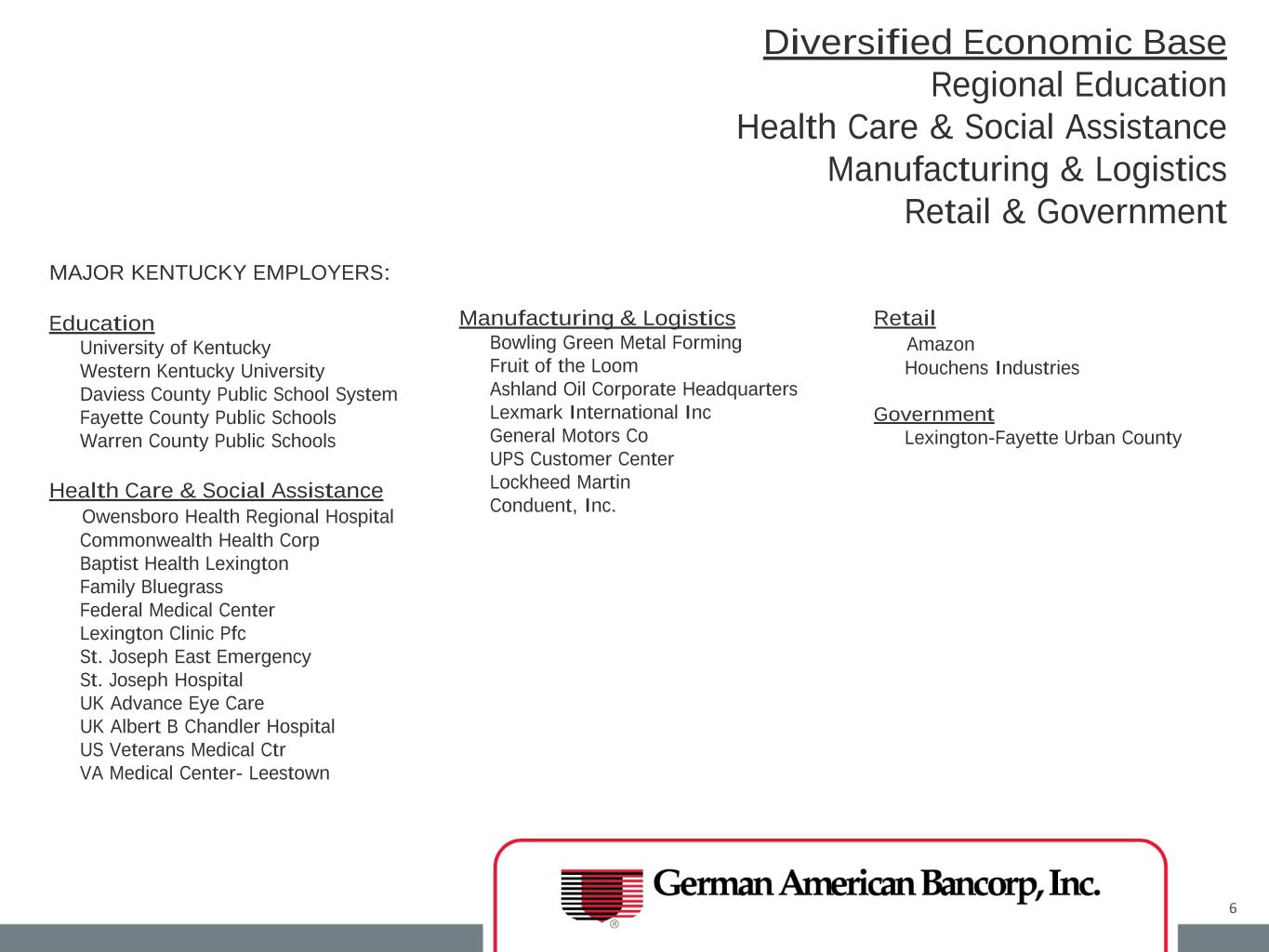

6 Diversified Economic Base Regional Education Health Care & Social Assistance Manufacturing & Logistics Retail & Government MAJOR KENTUCKY EMPLOYERS: Education University of Kentucky Western Kentucky University Daviess County Public School System Fayette County Public Schools Warren County Public Schools Health Care & Social Assistance Owensboro Health Regional Hospital Commonwealth Health Corp Baptist Health Lexington Family Bluegrass Federal Medical Center Lexington Clinic Pfc St. Joseph East Emergency St. Joseph Hospital UK Advance Eye Care UK Albert B Chandler Hospital US Veterans Medical Ctr VA Medical Center- Leestown Manufacturing & Logistics Bowling Green Metal Forming Fruit of the Loom Ashland Oil Corporate Headquarters Lexmark International Inc General Motors Co UPS Customer Center Lockheed Martin Conduent, Inc. Retail Amazon Houchens Industries Government Lexington-Fayette Urban County

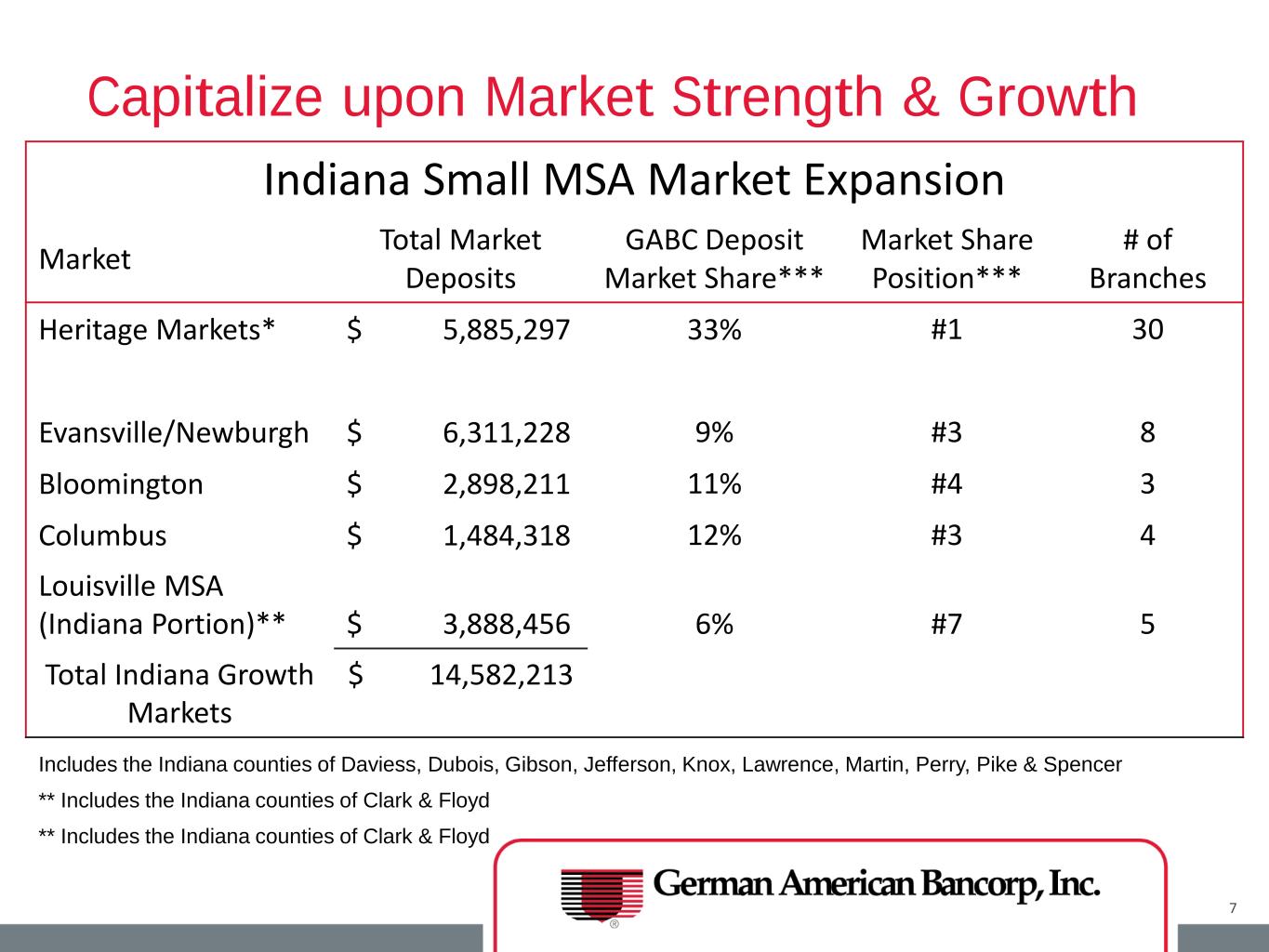

7 Capitalize upon Market Strength & Growth Indiana Small MSA Market Expansion Market Total Market Deposits GABC Deposit Market Share*** Market Share Position*** # of Branches Heritage Markets* $ 5,885,297 33% #1 30 Evansville/Newburgh $ 6,311,228 9% #3 8 Bloomington $ 2,898,211 11% #4 3 Columbus $ 1,484,318 12% #3 4 Louisville MSA (Indiana Portion)** $ 3,888,456 6% #7 5 Total Indiana Growth Markets $ 14,582,213 Includes the Indiana counties of Daviess, Dubois, Gibson, Jefferson, Knox, Lawrence, Martin, Perry, Pike & Spencer ** Includes the Indiana counties of Clark & Floyd ** Includes the Indiana counties of Clark & Floyd

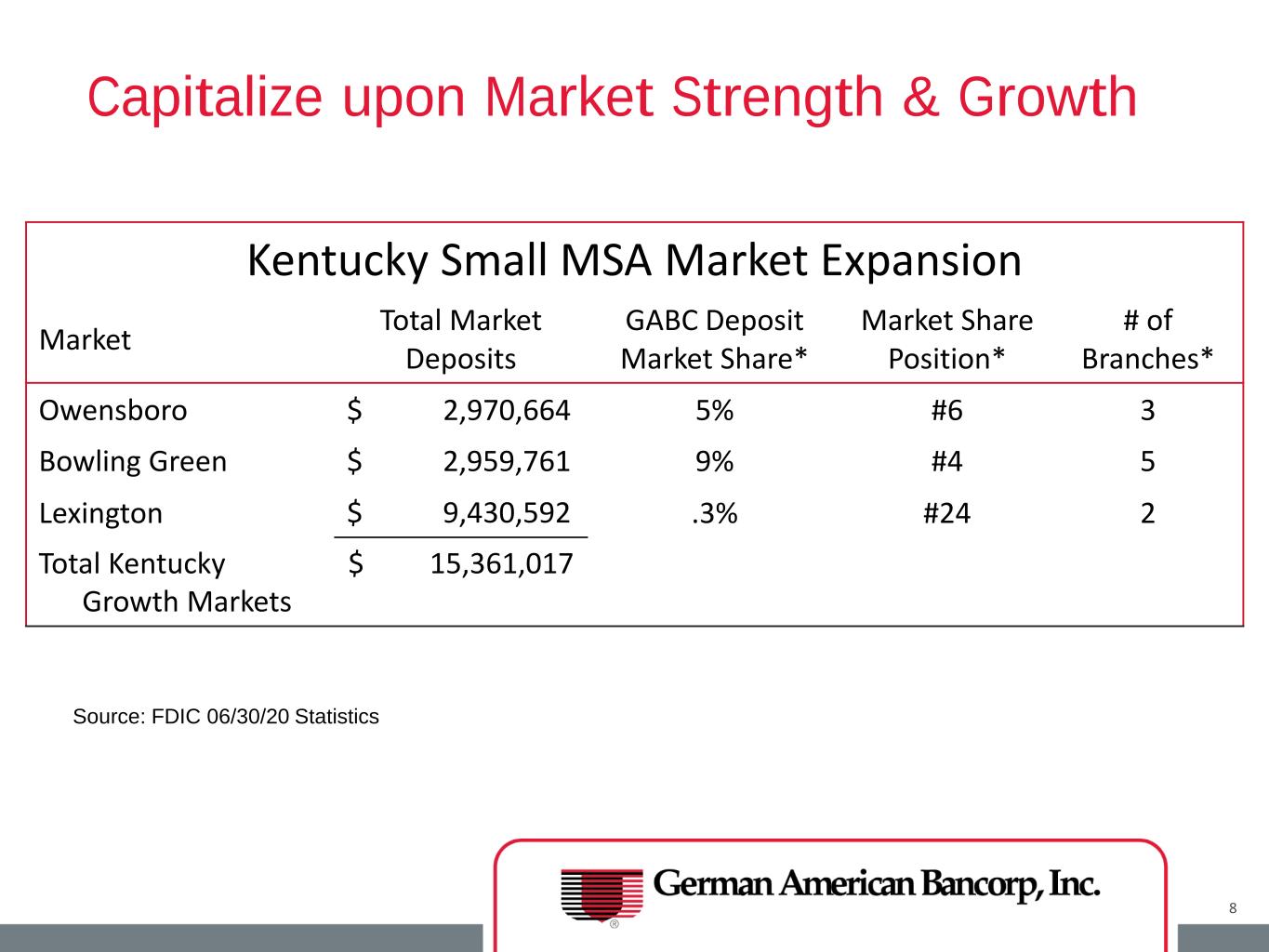

8 Capitalize upon Market Strength & Growth Kentucky Small MSA Market Expansion Market Total Market Deposits GABC Deposit Market Share* Market Share Position* # of Branches* Owensboro $ 2,970,664 5% #6 3 Bowling Green $ 2,959,761 9% #4 5 Lexington $ 9,430,592 .3% #24 2 Total Kentucky Growth Markets $ 15,361,017 Source: FDIC 06/30/20 Statistics

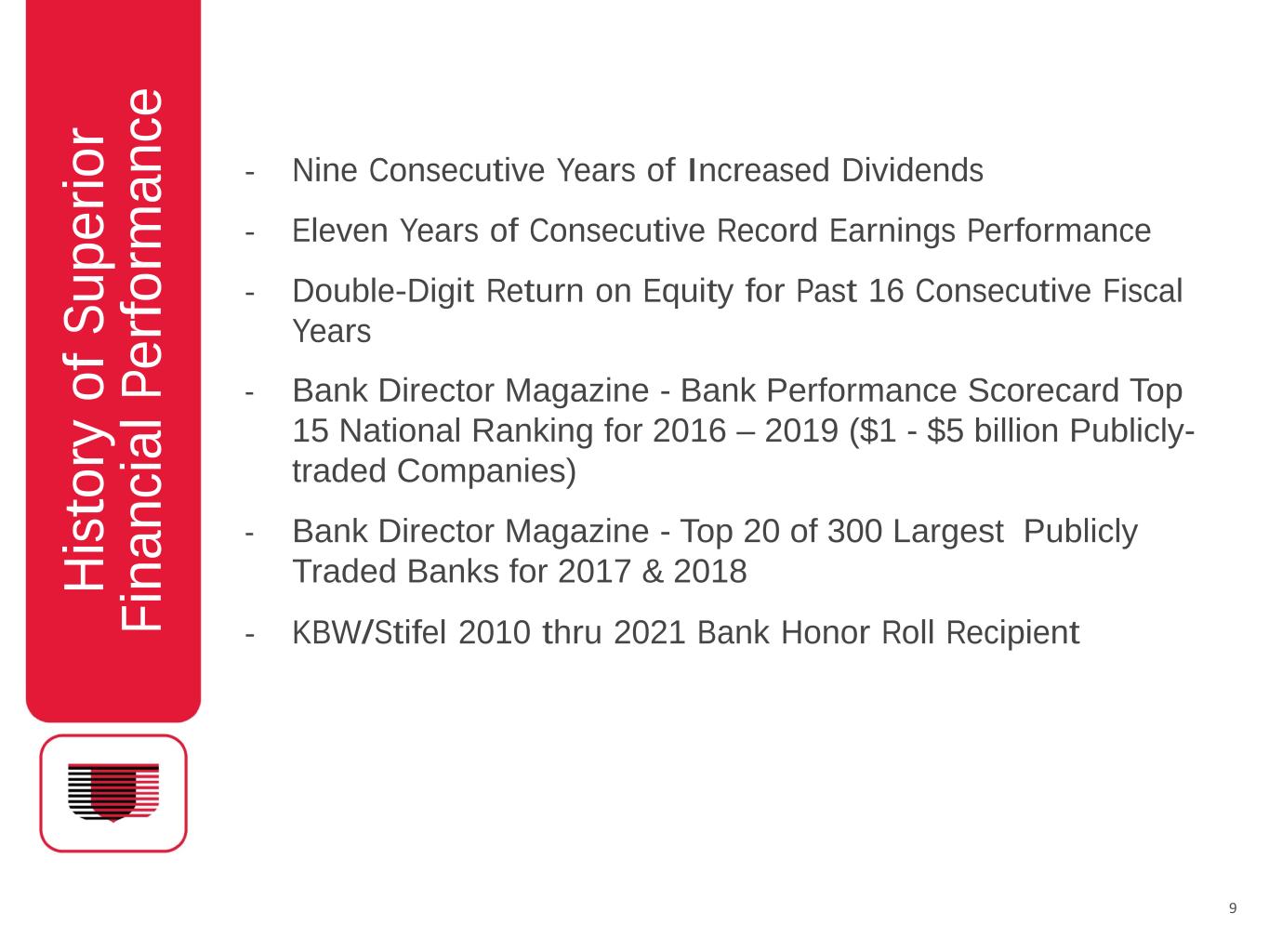

Hi st or y of S up er io r Fi na nc ia l P er fo rm an ce - Nine Consecutive Years of Increased Dividends - Eleven Years of Consecutive Record Earnings Performance - Double-Digit Return on Equity for Past 16 Consecutive Fiscal Years - Bank Director Magazine - Bank Performance Scorecard Top 15 National Ranking for 2016 – 2019 ($1 - $5 billion Publicly- traded Companies) - Bank Director Magazine - Top 20 of 300 Largest Publicly Traded Banks for 2017 & 2018 - KBW/Stifel 2010 thru 2021 Bank Honor Roll Recipient 9

FINANCIAL TRENDS 10

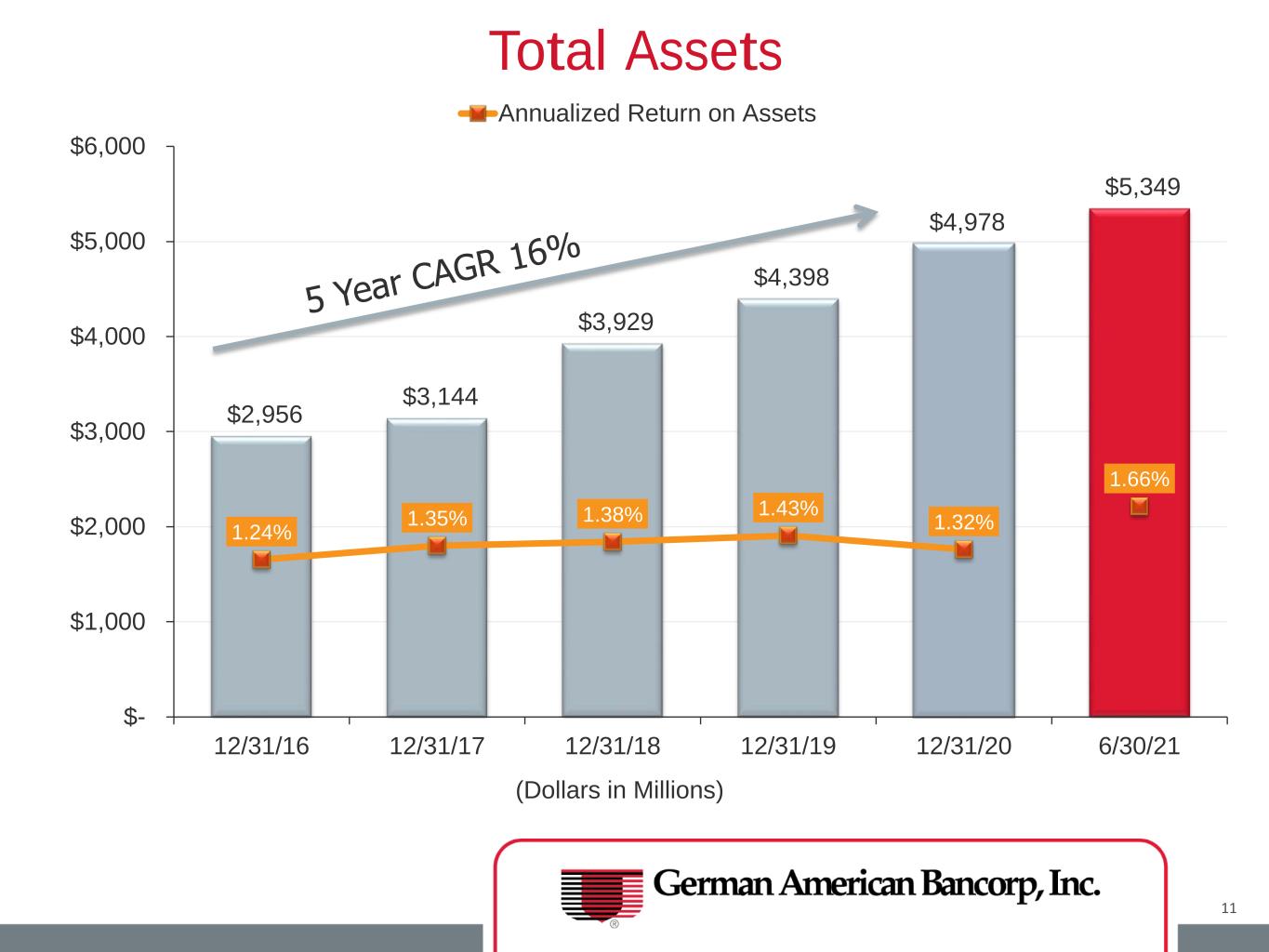

$2,956 $3,144 $3,929 $4,398 $4,978 $5,349 1.24% 1.35% 1.38% 1.43% 1.32% 1.66% $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/21 (Dollars in Millions) Total Assets Annualized Return on Assets 11

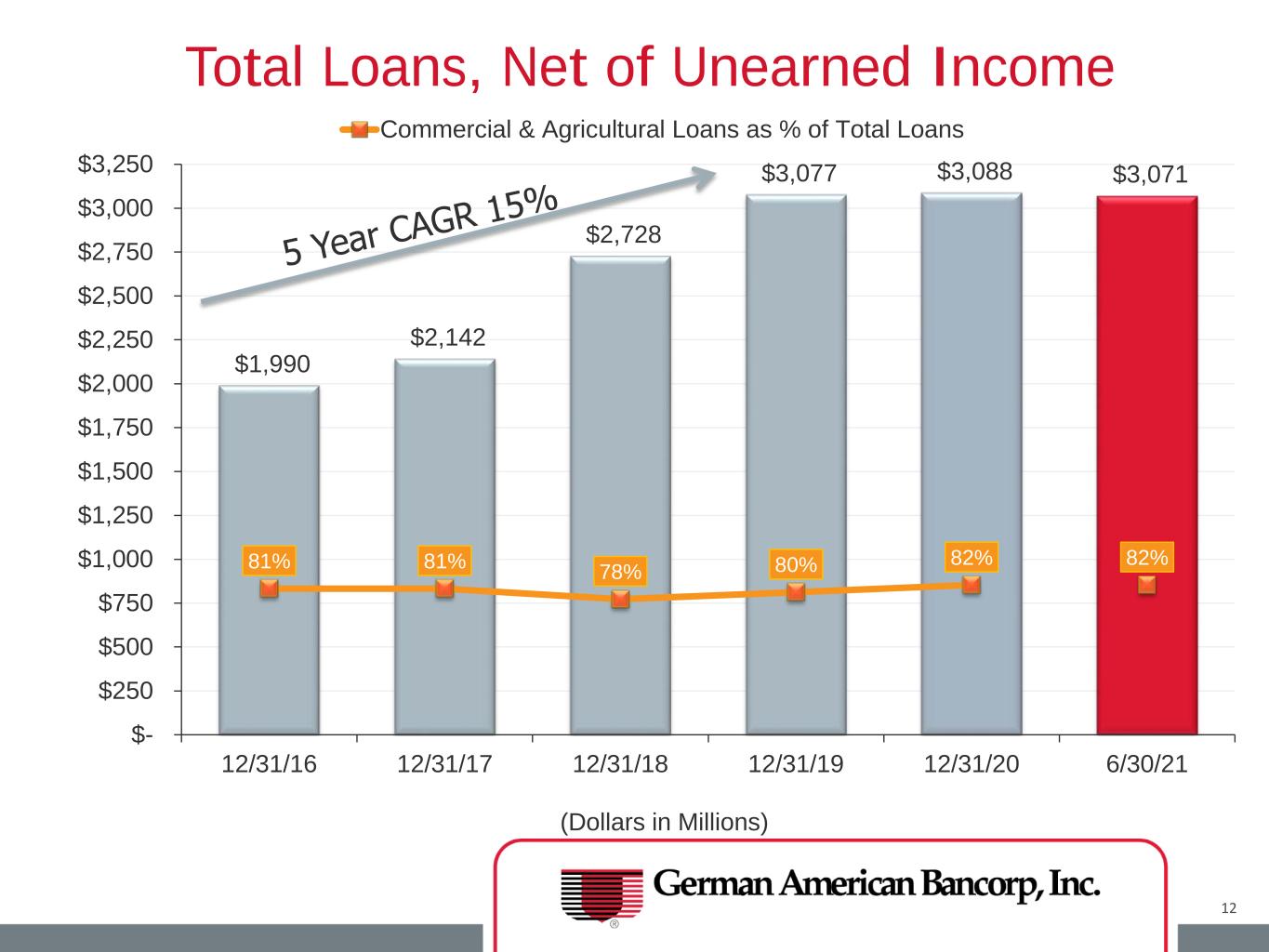

$1,990 $2,142 $2,728 $3,077 $3,088 $3,071 81% 81% 78% 80% 82% 82% $- $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 $3,000 $3,250 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/21 (Dollars in Millions) Total Loans, Net of Unearned Income Commercial & Agricultural Loans as % of Total Loans 12

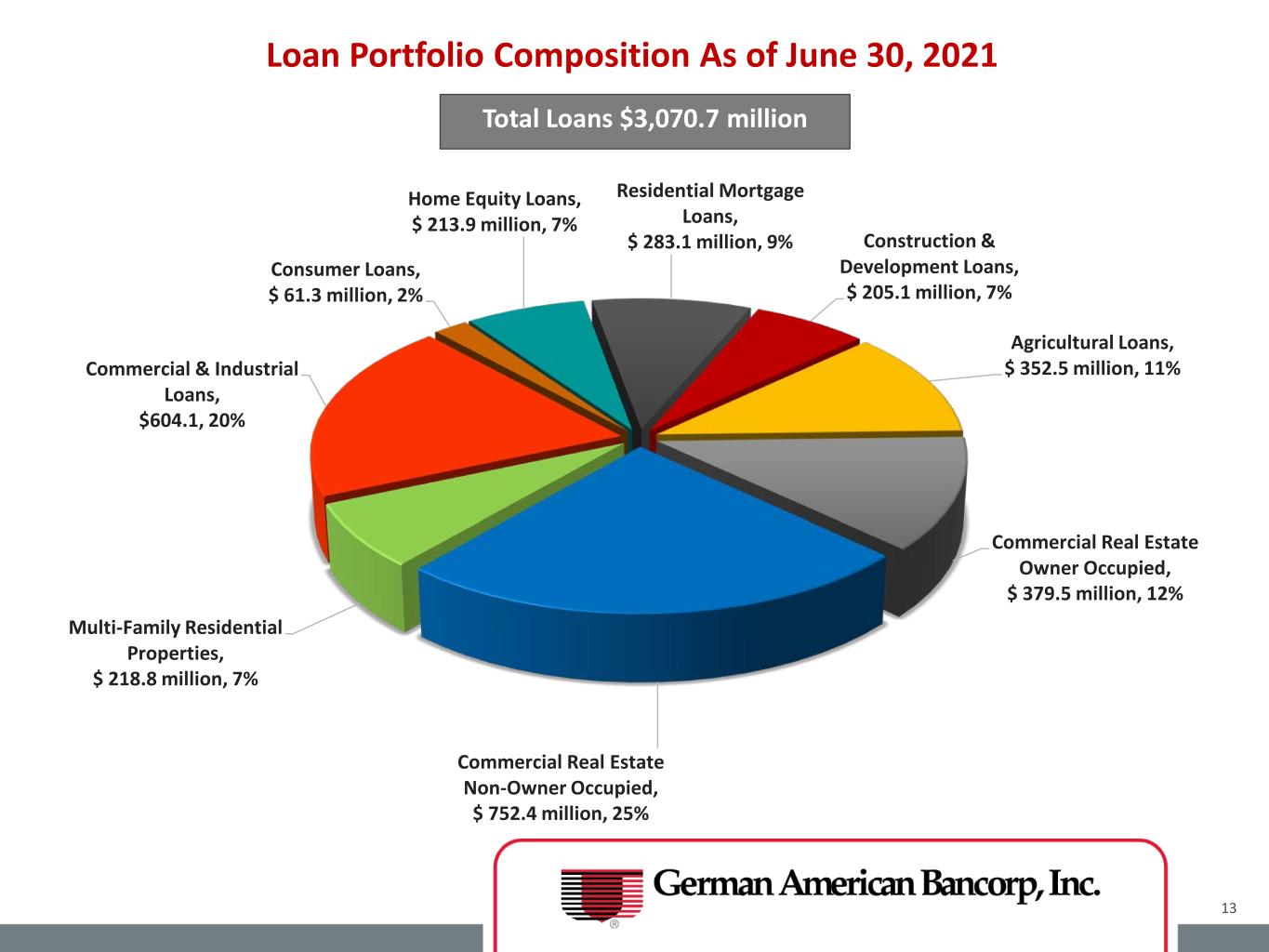

Construction & Development Loans, $ 205.1 million, 7% Agricultural Loans, $ 352.5 million, 11% Commercial Real Estate Owner Occupied, $ 379.5 million, 12% Commercial Real Estate Non-Owner Occupied, $ 752.4 million, 25% Multi-Family Residential Properties, $ 218.8 million, 7% Commercial & Industrial Loans, $604.1, 20% Consumer Loans, $ 61.3 million, 2% Home Equity Loans, $ 213.9 million, 7% Residential Mortgage Loans, $ 283.1 million, 9% Loan Portfolio Composition As of June 30, 2021 Total Loans $3,070.7 million 13

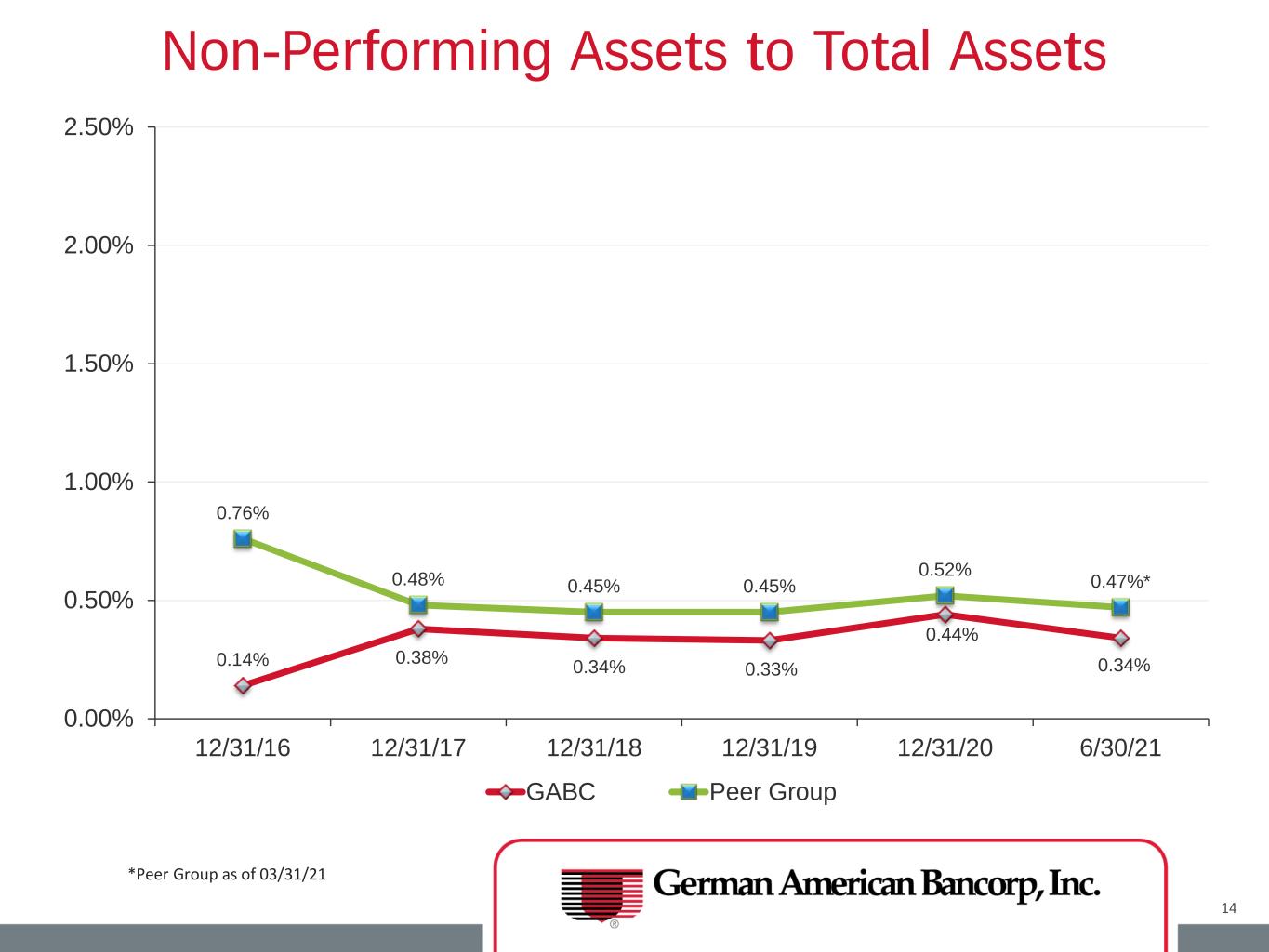

0.14% 0.38% 0.34% 0.33% 0.44% 0.34% 0.76% 0.48% 0.45% 0.45% 0.52% 0.47%* 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/21 Non-Performing Assets to Total Assets GABC Peer Group 14 *Peer Group as of 03/31/21

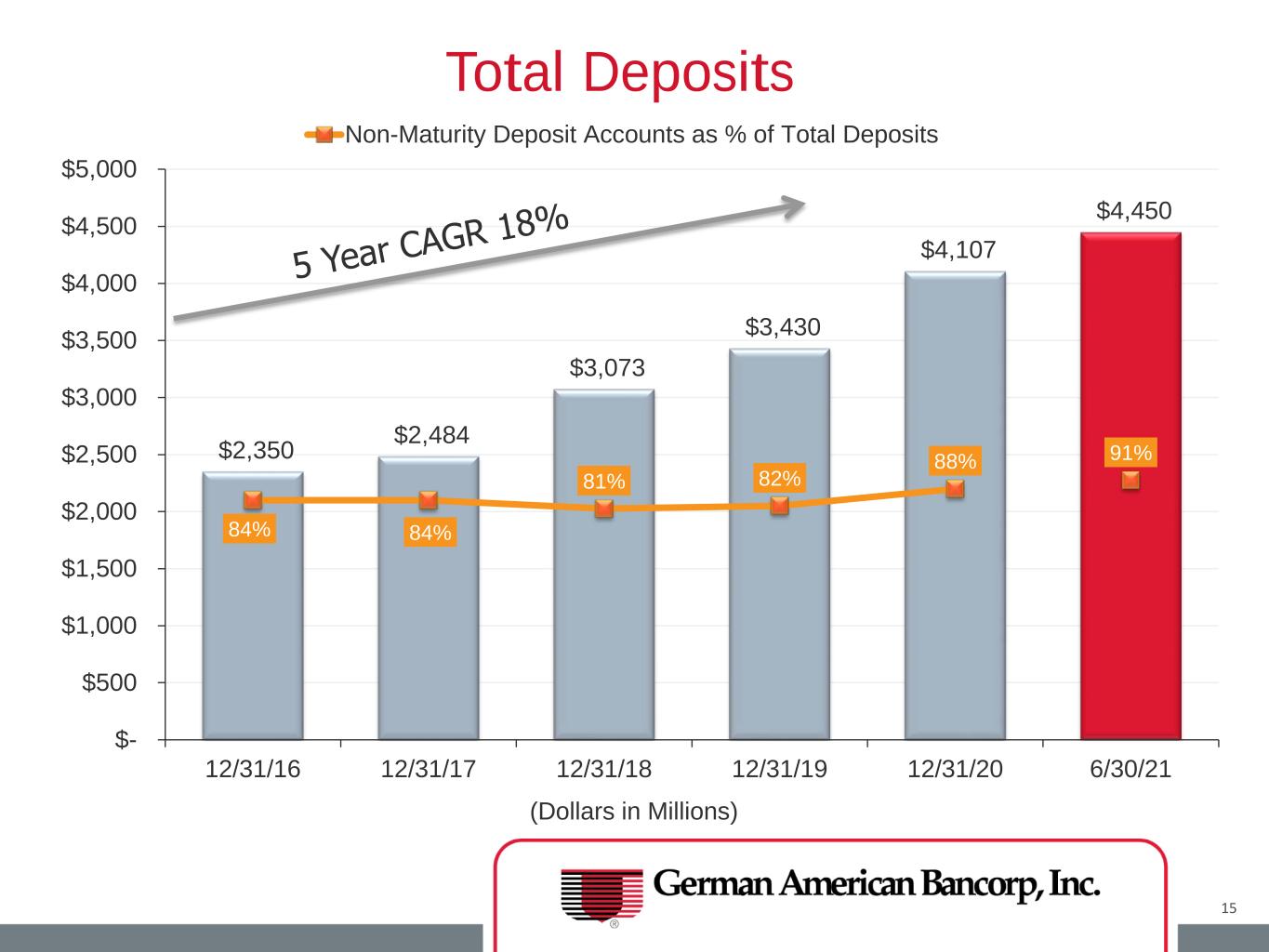

$2,350 $2,484 $3,073 $3,430 $4,107 $4,450 84% 84% 81% 82% 88% 91% $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/21 (Dollars in Millions) Total Deposits Non-Maturity Deposit Accounts as % of Total Deposits 15

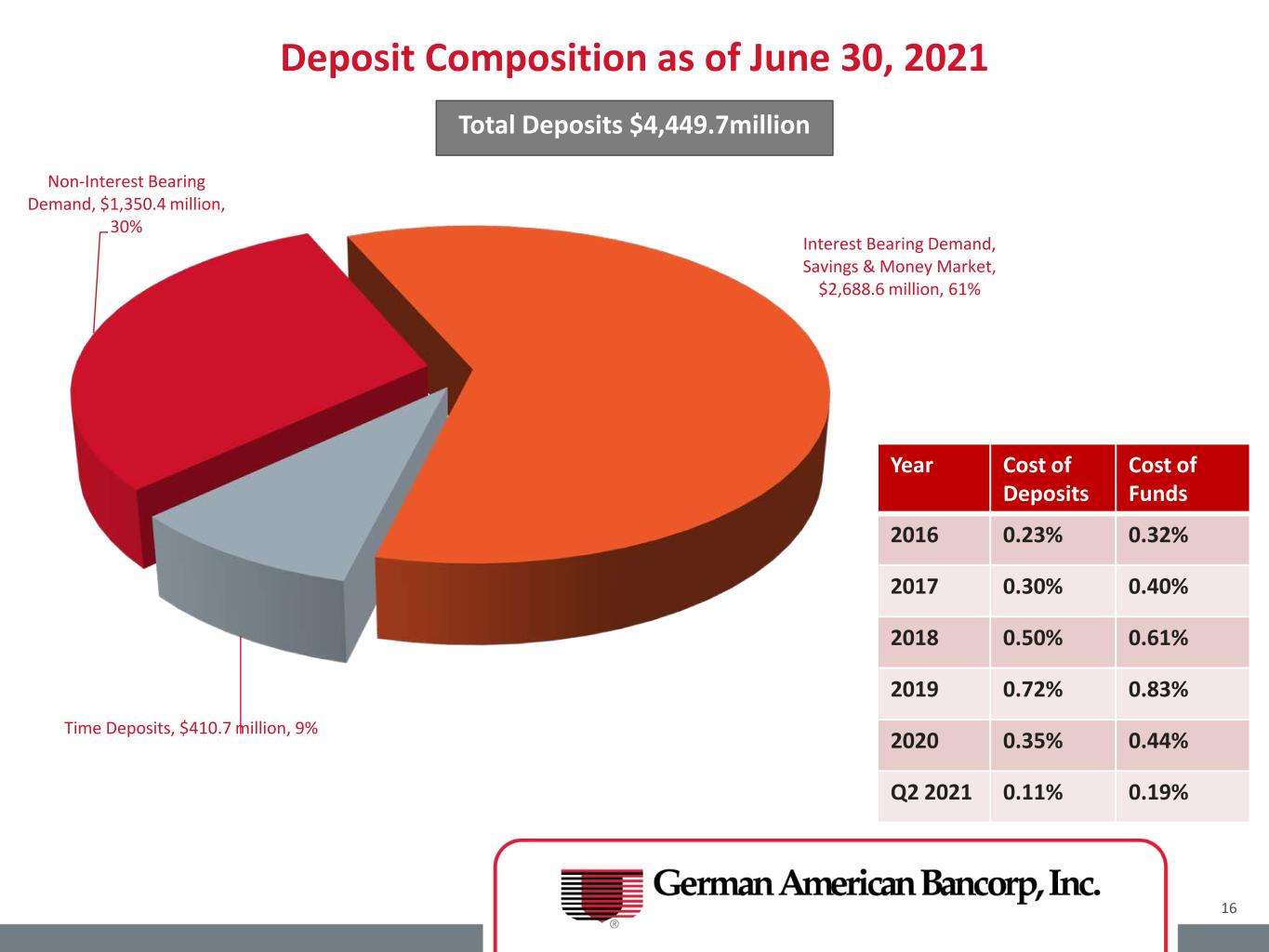

Non-Interest Bearing Demand, $1,350.4 million, 30% Interest Bearing Demand, Savings & Money Market, $2,688.6 million, 61% Time Deposits, $410.7 million, 9% Deposit Composition as of June 30, 2021 Total Deposits $4,449.7million 16 Year Cost of Deposits Cost of Funds 2016 0.23% 0.32% 2017 0.30% 0.40% 2018 0.50% 0.61% 2019 0.72% 0.83% 2020 0.35% 0.44% Q2 2021 0.11% 0.19%

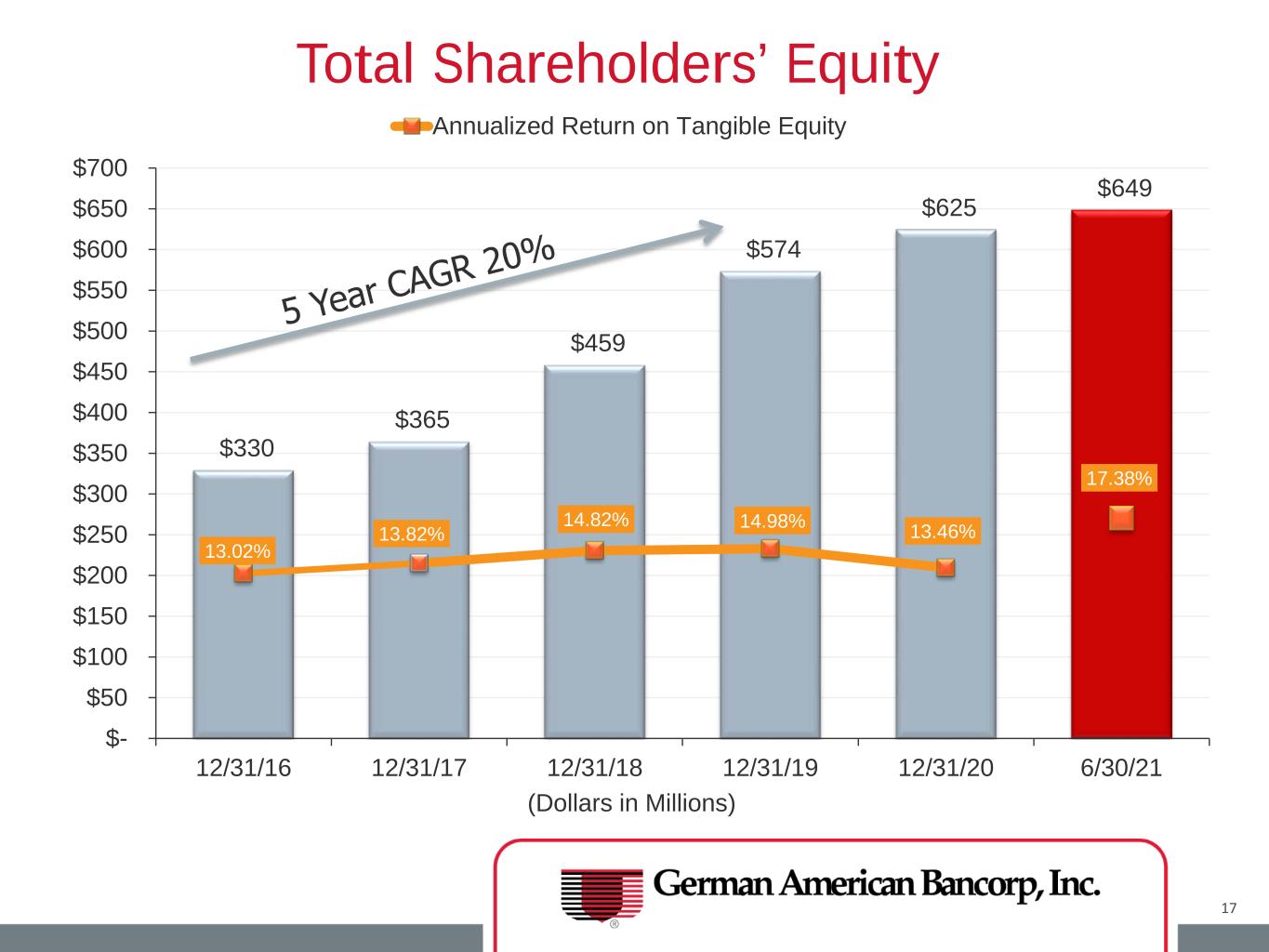

$330 $365 $459 $574 $625 $649 13.02% 13.82% 14.82% 14.98% 13.46% 17.38% $- $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 $600 $650 $700 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/21 (Dollars in Millions) Total Shareholders’ Equity Annualized Return on Tangible Equity 17

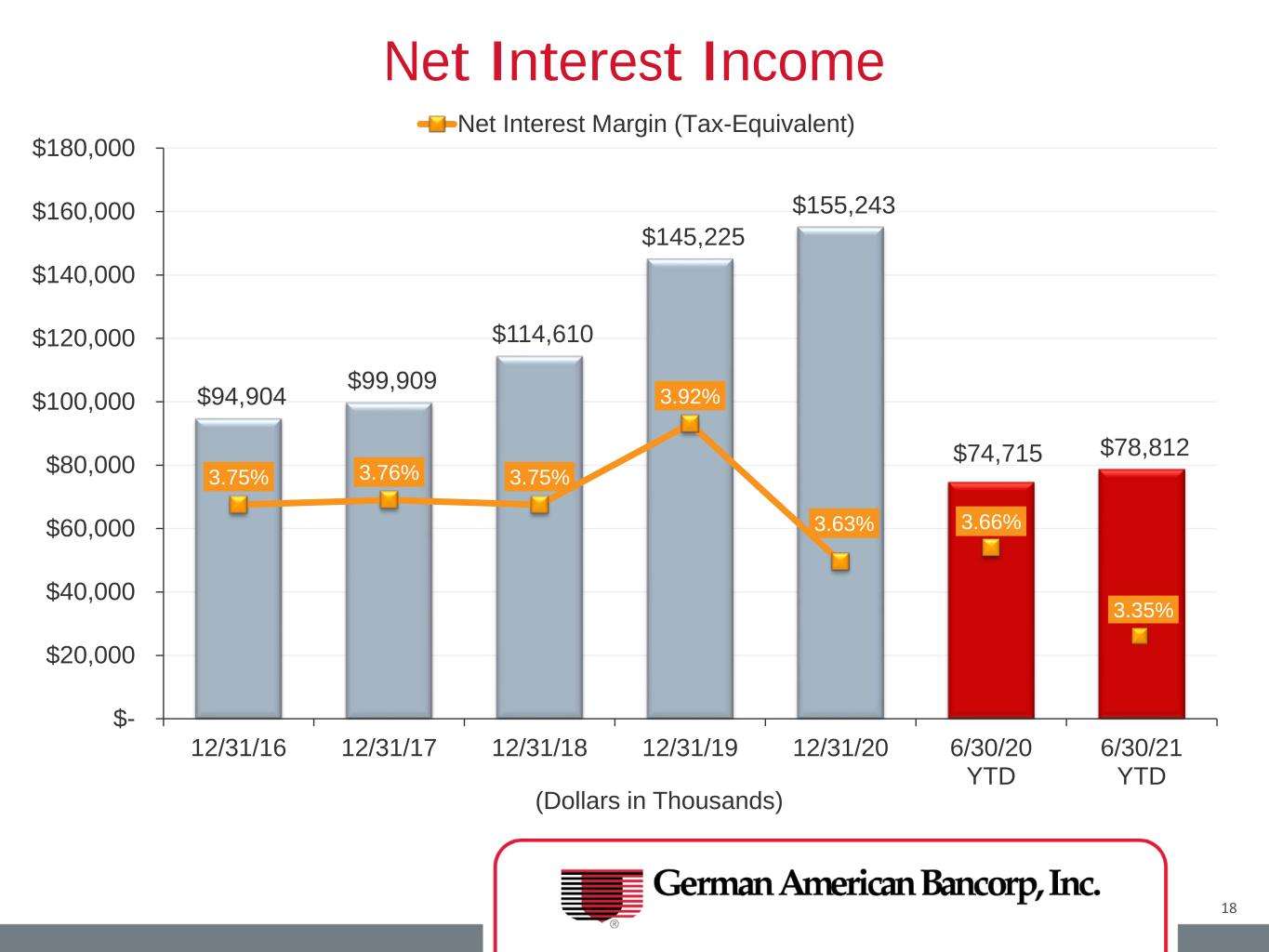

$94,904 $99,909 $114,610 $145,225 $155,243 $74,715 $78,812 3.75% 3.76% 3.75% 3.92% 3.63% 3.66% 3.35% $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/20 YTD 6/30/21 YTD (Dollars in Thousands) Net Interest Income Net Interest Margin (Tax-Equivalent) 18

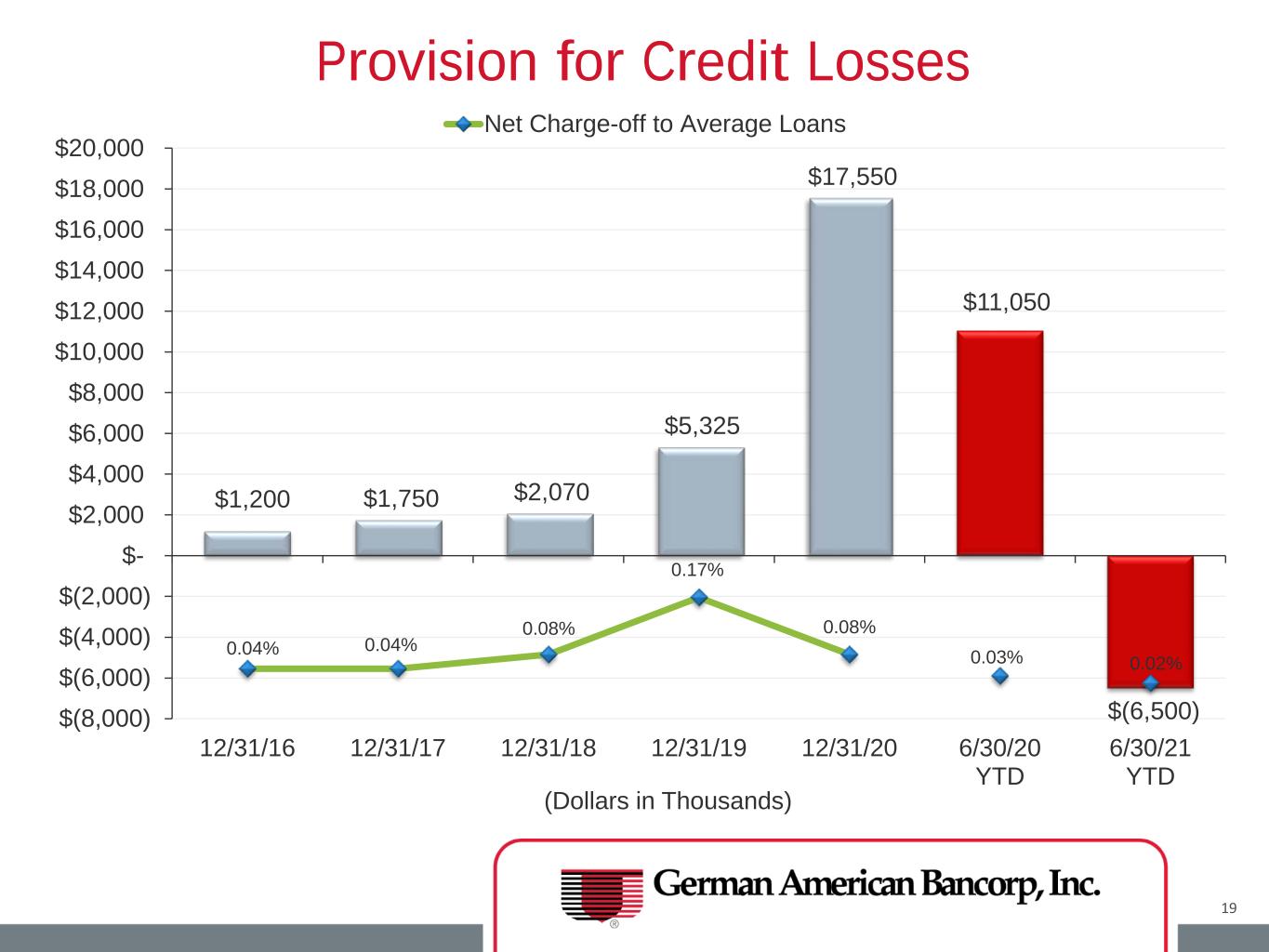

$1,200 $1,750 $2,070 $5,325 $17,550 $11,050 $(6,500) 0.04% 0.04% 0.08% 0.17% 0.08% 0.03% 0.02% $(8,000) $(6,000) $(4,000) $(2,000) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/20 YTD 6/30/21 YTD (Dollars in Thousands) Provision for Credit Losses Net Charge-off to Average Loans 19

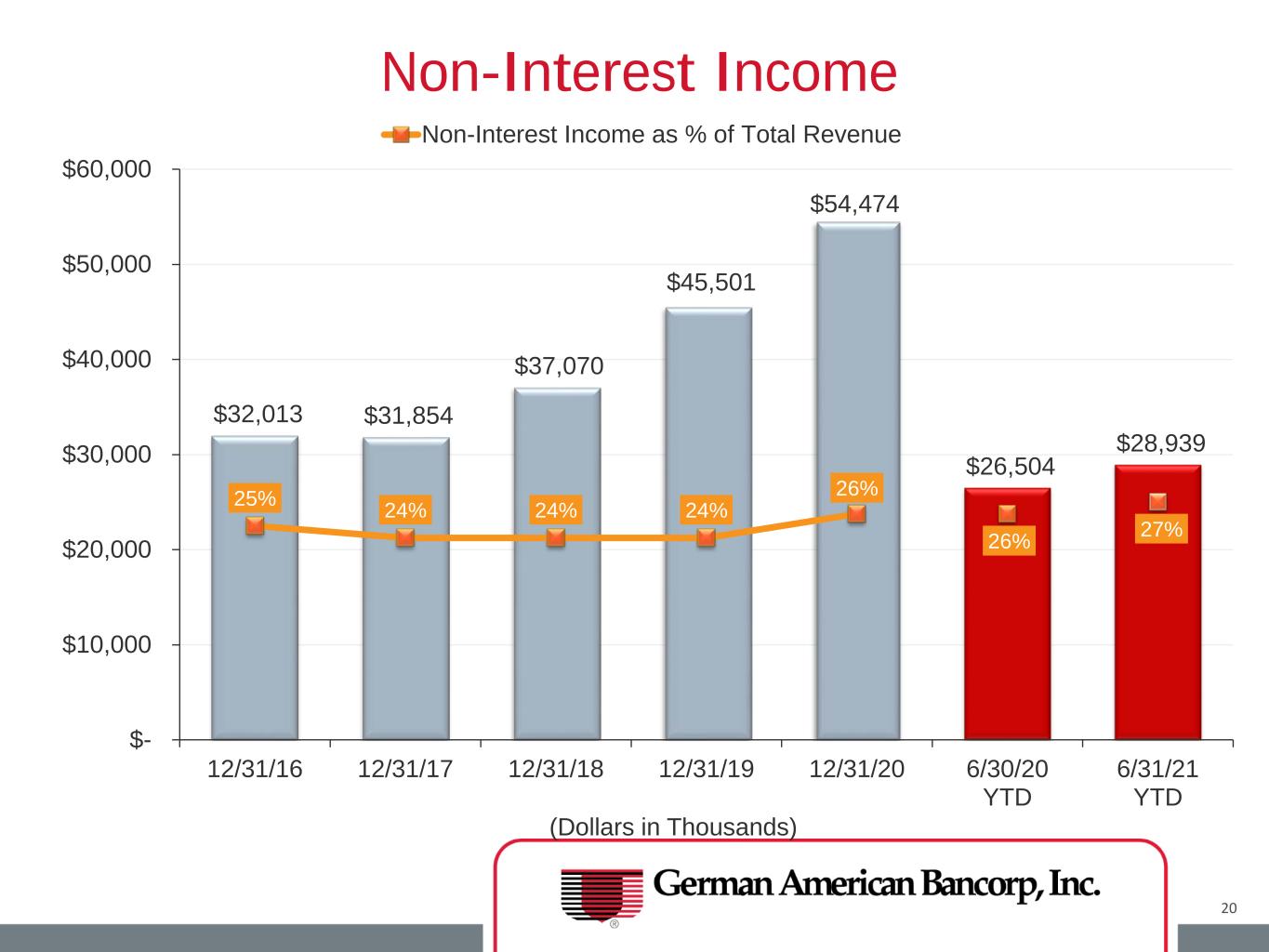

$32,013 $31,854 $37,070 $45,501 $54,474 $26,504 $28,939 25% 24% 24% 24% 26% 26% 27% $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/20 YTD 6/31/21 YTD (Dollars in Thousands) Non-Interest Income Non-Interest Income as % of Total Revenue 20

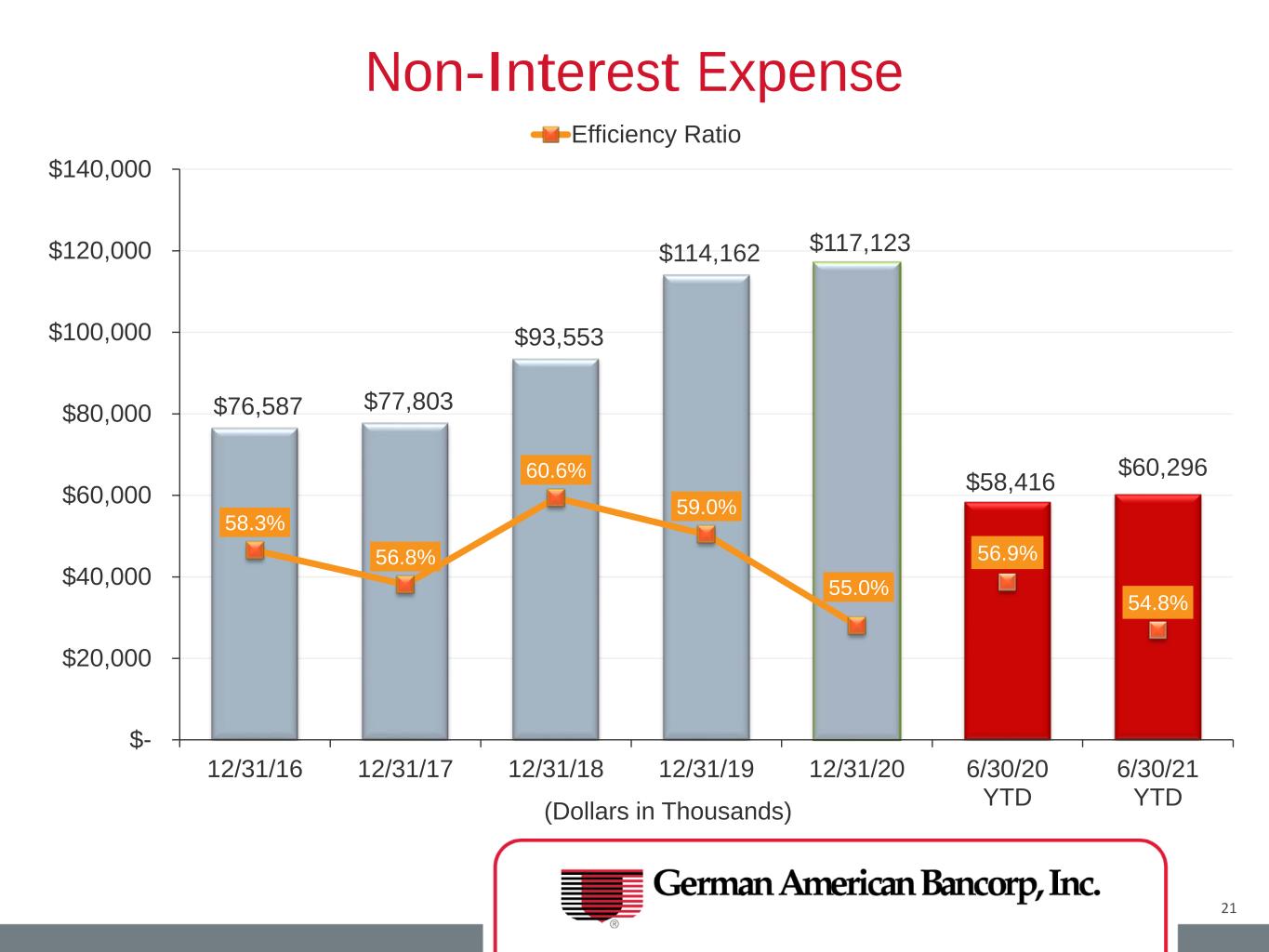

$76,587 $77,803 $93,553 $114,162 $117,123 $58,416 $60,296 58.3% 56.8% 60.6% 59.0% 55.0% 56.9% 54.8% $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/20 YTD 6/30/21 YTD(Dollars in Thousands) Non-Interest Expense Efficiency Ratio 21

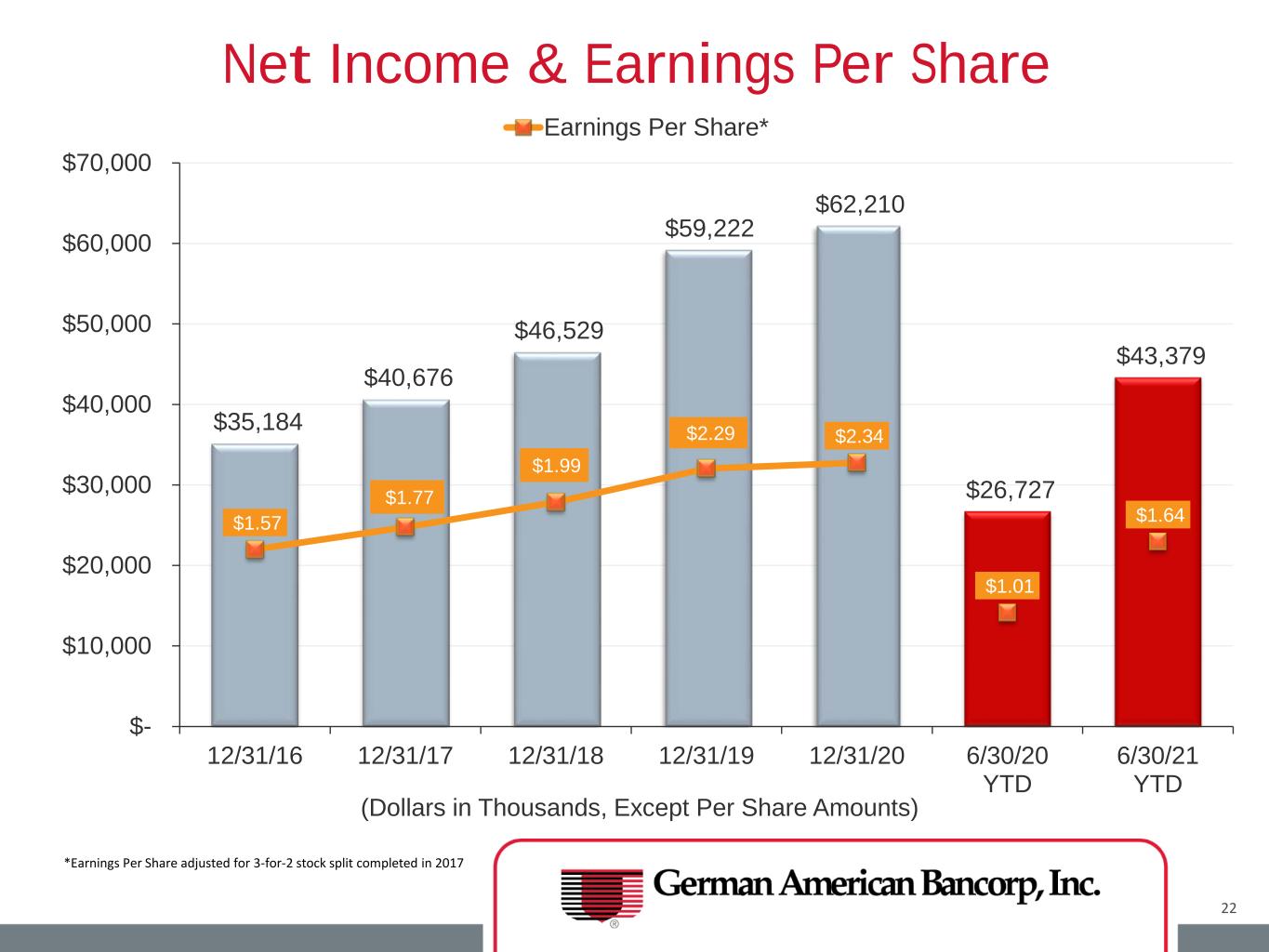

$35,184 $40,676 $46,529 $59,222 $62,210 $26,727 $43,379 $1.57 $1.77 $1.99 $2.29 $2.34 $1.01 $1.64 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 6/30/20 YTD 6/30/21 YTD (Dollars in Thousands, Except Per Share Amounts) Net Income & Earnings Per Share Earnings Per Share* *Earnings Per Share adjusted for 3-for-2 stock split completed in 2017 22

WHY INVEST IN GABC? 23

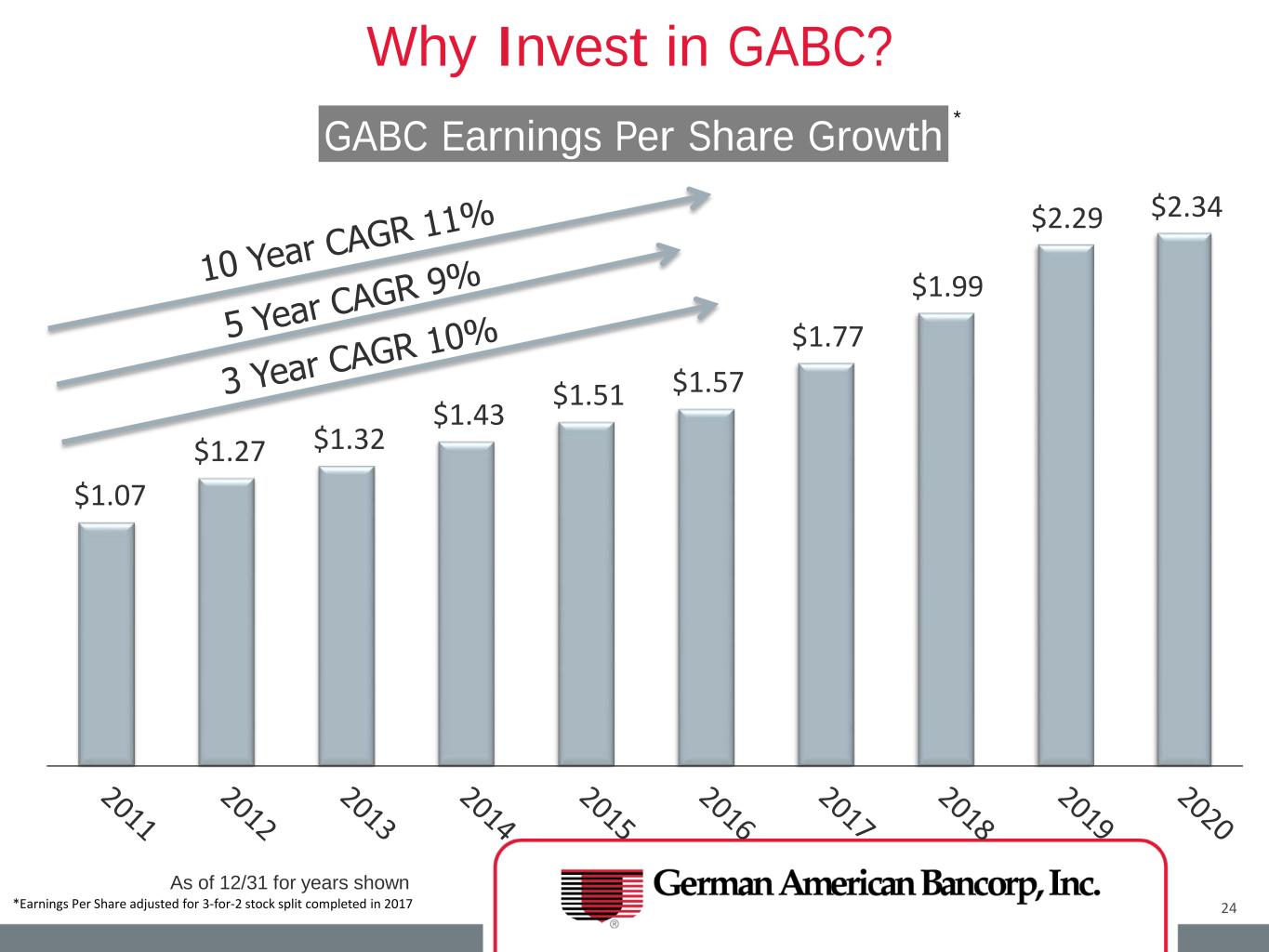

24 Why Invest in GABC? $1.07 $1.27 $1.32 $1.43 $1.51 $1.57 $1.77 $1.99 $2.29 $2.34 GABC Earnings Per Share Growth * As of 12/31 for years shown *Earnings Per Share adjusted for 3-for-2 stock split completed in 2017

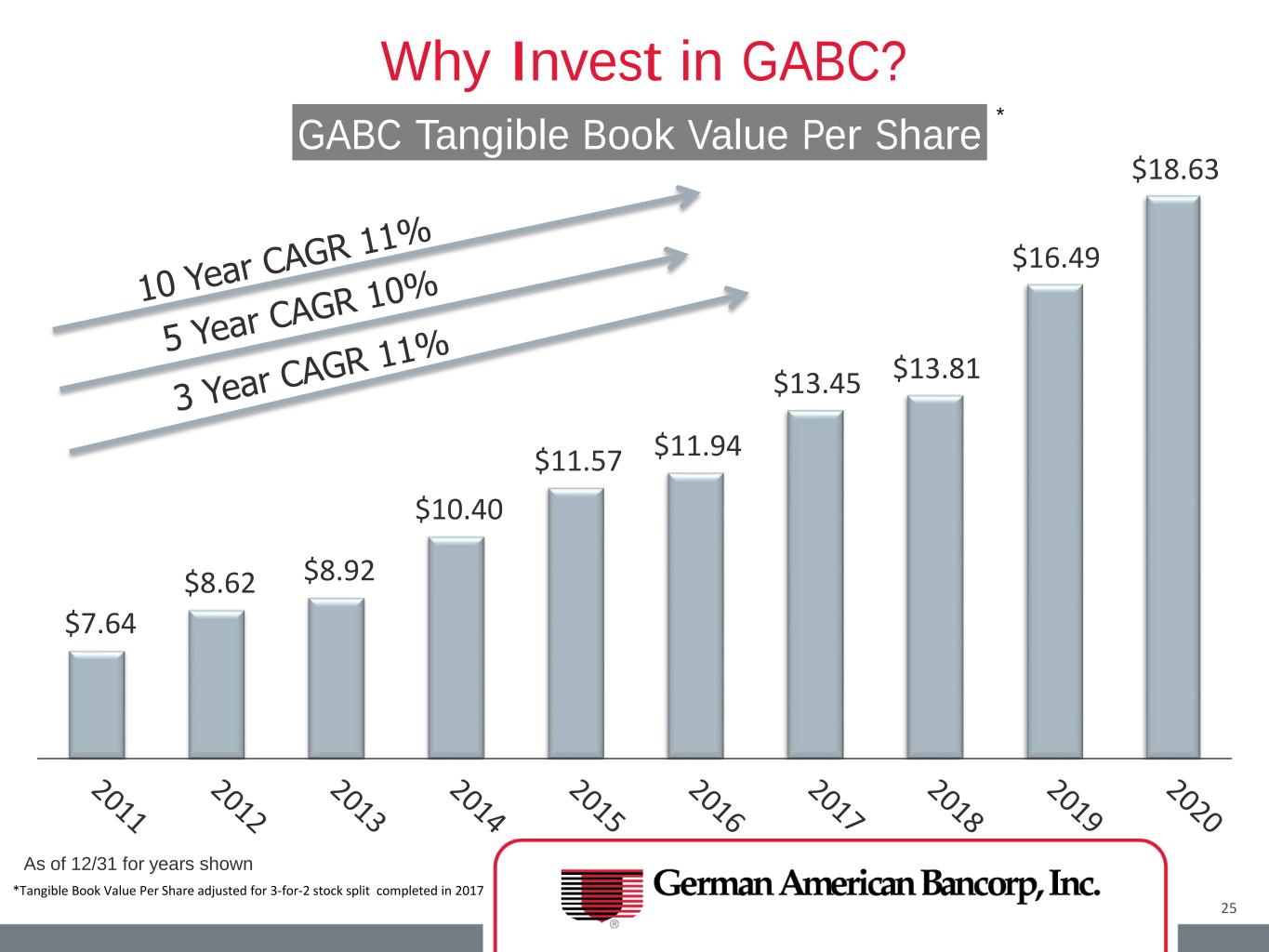

25 $7.64 $8.62 $8.92 $10.40 $11.57 $11.94 $13.45 $13.81 $16.49 $18.63 GABC Tangible Book Value Per Share Why Invest in GABC? * As of 12/31 for years shown *Tangible Book Value Per Share adjusted for 3-for-2 stock split completed in 2017

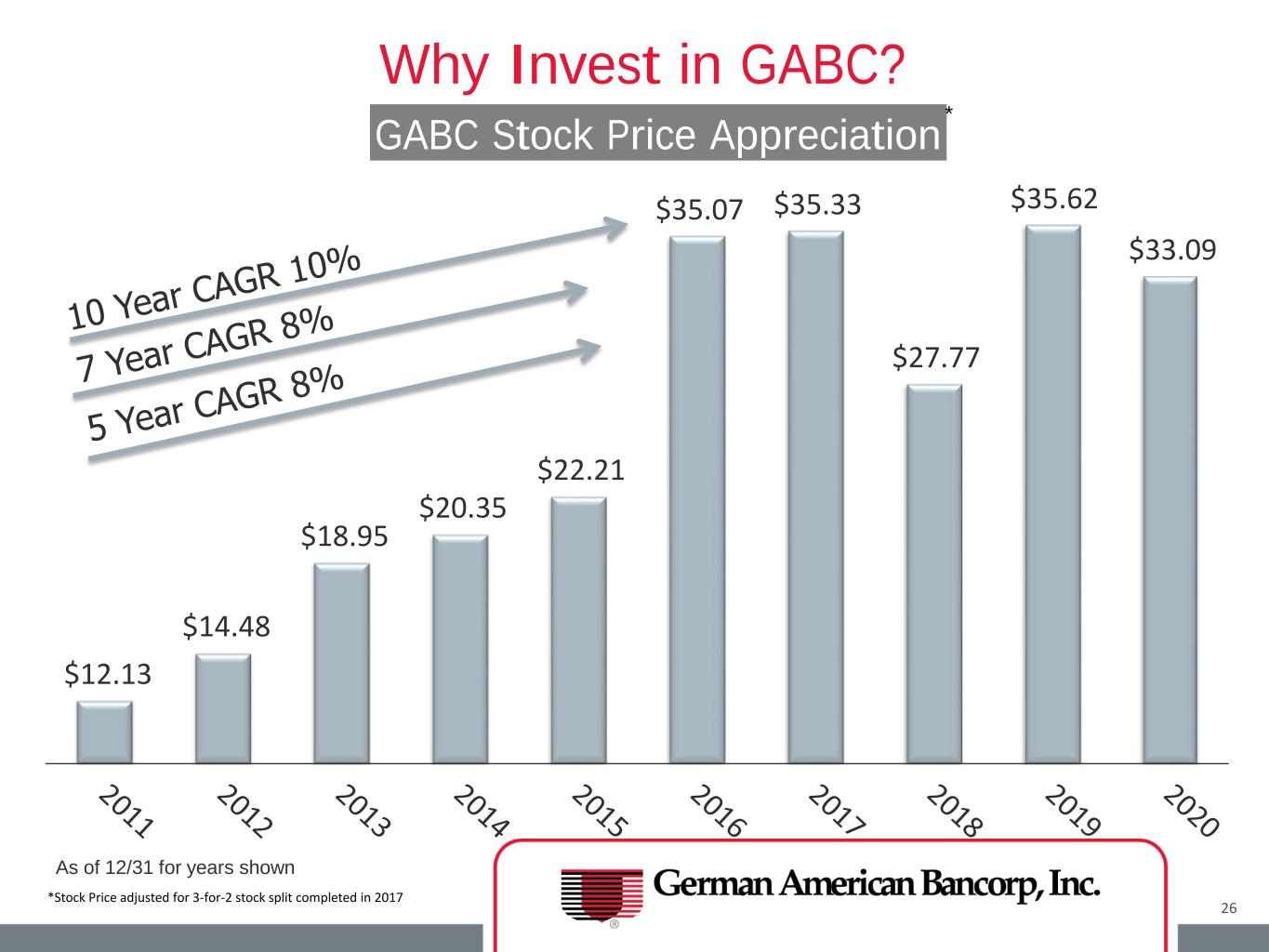

26 $12.13 $14.48 $18.95 $20.35 $22.21 $35.07 $35.33 $27.77 $35.62 $33.09 GABC Stock Price Appreciation Why Invest in GABC? As of 12/31 for years shown * *Stock Price adjusted for 3-for-2 stock split completed in 2017

Why Invest in GABC 27 • Proven Executive Management Team • Track Record of Consistent Top Quartile Financial Performance • Experienced in Operating Plan Execution and M & A Transitions • Potential Growth within New Market Areas – Small MSA Focus • Existing Platform for Operating Efficiency • Infrastructure in Place for Perpetuating Ongoing EPS Growth • Consistent Strong Dividend Yield and Dividend Pay-out Capacity

German American Bancorp, Inc. 28 Mark A. Schroeder, Chairman and CEO (812) 482-0701 mark.schroeder@germanamerican.com D. Neil Dauby, President and Chief Operating Officer (812) 482-0707 neil.dauby@germanamerican.com Bradley M. Rust, Senior Executive Vice President and CFO (812) 482-0718 brad.rust@germanamerican.com

29